Annual Consolidated Financial Statements for 2011 And

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Voluntary Pension Funds Sector in Serbia

Supervision of Voluntary Pension Fund Management Companies VOLUNTARY PENSION FUNDS SECTOR IN SERBIA Second Quarter Report 2008 July 2008 Supervision of Voluntary Pension Fund Management Companies CONTENTS 1. INTRODUCTION......................................................................................................... 3 2. MANAGEMENT COMPANIES ................................................................................... 4 Market participants................................................................................................... 4 Ownership structure of management companies................................................. 5 Organizational network of management companies ............................................ 5 Fees charged by companies ................................................................................... 6 Transaction costs..................................................................................................... 7 3. VOLUNTARY PENSION FUNDS ............................................................................... 7 Net assets of voluntary pension funds .................................................................. 7 Composition of assets of voluntary pension funds.............................................. 9 Stock exchange trading by pension funds ..........................................................10 Number and structure users of VPF services .....................................................11 Contribution payments, disbursements and transfers among funds...............16 -

Minutes from the Regular Session of the General Meeting of Bank’S Shareholders Held on January 25Th 2017

MINUTES FROM THE REGULAR SESSION OF THE GENERAL MEETING OF BANK’S SHAREHOLDERS HELD ON JANUARY 25TH 2017 Belgrade, January 25th 2017 1 KOMERCIJALNA BANKA AD BEOGRAD GENERAL MEETING OF SHAREHOLDERS OF THE BANK No. 33462 Belgrade, January 25th 2017 MINUTES From the regular session of the General Meeting of Shareholders of Komercijalna Banka AD Beograd, held on January 25th 2017 in Belgrade – in the premises of the Bank, 14 Svetog Save St – with the beginning at 12.00 hours Shareholders – holders of ordinary shares specified on the List of Shareholders of the Bank composed on the Cut-off Date on January 15th 2017 with reference to the excerpt from the Central Registry of Securities – were attending the regular session of General Meeting of Shareholder of Komercijalna Banka AD Beograd that was held on January 25th 2017, as follows: 1. Republic of Serbia, proxy Jovanka Kosanović, Chair of the Bank's GMS 2. EBRD London – proxy k Mirjana Vujičić 3. Jugobanka in bankruptcy, Belgrade - proxy Jovanka Kosanović 4. Dunav osiguranje ado Beograd – proxy Mila Pavlović The shareholder IFC CAPITALIZATION FUND, WILMINGTON, USA delivered to the Bank duly completed and certified in absentia voting form. Representatives of the Bank who attended the session were: 1. Alexander Picker, President of the Executive Board, CEO of the Bank 2. Gabrijela Horvat, Director of Legal Affairs Division 3. Marija Tatomirov, Director of Normative Affairs Division 4. Vesna Velemir, Head of the Executive Board Support Unit The session of the General Meeting of Shareholders began at 12:00 hours. Chair of the GMS, Jovanka Kosanović, opened the GMS session by greeting the attending representatives of the shareholders and management of the Bank and informed the General Meeting of Bank's Shareholders that, pursuant to the Law on Bank and Law on Companies, in her capacity of the Chair of the General Meeting, she passed: 1. -

Dunav Re SAS Report 31Dec2020

kpmg KPMG d.o.o. Beograd Tel.: +381 (0)11 20 50 500 Milutina Milankovića 1J Fax: +381 (0)11 20 50 550 11070 Belgrade www.kpmg.com/rs Serbia T R A N S L A T I O N Independent Auditor's Report To the Shareholders of Dunav - Re a.d.o. Beograd Opinion We have audited the accompanying In our opinion, the accompanying financial financial statements of Dunav - Re a.d.o. statements give a true and fair view of the Beograd (the “Company”), which comprise: financial position of the Company as at 31 December 2020, and of its financial — the balance sheet as at performance and its cash flows for the year 31 December 2020; then ended in accordance with the and, for the period from 1 January to accounting regulations effective in the 31 December 2020: Republic of Serbia and other relevant laws and by-laws which regulate financial — the income statement; reporting of insurance companies in Republic of Serbia. — the statement of other comprehensive income; — the statement of changes in equity; — the cash flow statement; and — notes, comprising a summary of significant accounting policies and other explanatory information (the “financial statements”). © 2021 KPMG d.o.o. Beograd, a Serbian limited liability company and Registration Number:17148656 a member firm of the KPMG global organization of independent Tax identity number: 100058593 member firms affiliated with KPMG International Limited, a private Bank Acc.:: 265-1100310000190-61 English company limited by guarantee. All rights reserved. kpmg T R A N S L A T I O N Basis for Opinion We conducted our audit in accordance with the Accountants International Code of Ethics for Law on Auditing and the Law on Accounting of Professional Accountants (including the Republic of Serbia, the Decision on the International Independence Standards) (IESBA content of reports on the audit of financial Code) together with the ethical requirements statements of an insurance company and that are relevant to our audit of the financial applicable auditing standards in the Republic of statements in the Republic of Serbia and we Serbia. -

Serbian Equities Daily

Friday, June 14, 2013 SERBIAN EQUITIES DAILY 700 9 Market Comment: Belex rebounded slightly yesterday with solid volumes as 600 6 it appears that some investors are beginning to feel the market is up for a correction. Belex15 grew 0.54%, while 500 3 BELEXline grew 0.45% on volumes of €530k. Bonds contributed with €200k of the total. NIS traded heavily as 400 0 08/06/2012 08/10/2012 08/02/2013 08/06/2013 37 thousand shares exchanged hands. We hope the market will continue to recover today. Volume (€ m) BELEX15 BELEX15 Economy: Serbian Constructors to build heavily in Iraq Value 494.70 After the return of the delegation of Serbian construction and Daily Change% 0.54% infrastructure companies from Iraq, Serbian minister of YTD Change -29.19 construction and urbanism Velimir Ilic stated that projects worth €1.5bn could be signed by the end of the year. Up until now, YTD Change% -5.57% €120mn worth projects have been offered to Serbian companies. BELEXline Tenders for new projects will be announced shortly and a lot of our firms have a good history of project execution in Iraq, stated Value 978.67 Serbian minister. (Source: B92) Analyst: Ivan Radovic, Daily Change% 0.45% ([email protected], tel: +381 11 3027 533) YTD Change -26.89 YTD Change% -2.67% Market info MCap (€ bn) 6.6 MCap / GDP2013e 20% 2013e P/E* 5.6 2013e P/B* 0.6 2013e P/S* 0.7 Av. Daily Vol.YTD (€m) 0.5 *multiples refer to Eurobank Brokerage Universe FX rates YTD chg. -

Annual Report of Energoprojekt Holding Plc. for the Year 2017

Annual Report of Energoprojekt Holding Plc. for the year 2017 Belgrade, April 2018 Pursuant to Articles 50 and 51 of the Law on Capital Market (RS Official Gazette, No. 31/2011, 112/2015 and 108/2016) and pursuant to Article 3 of the Rulebook on Contents, Form and Method of Publication of Annual, Half-Yearly and Quarterly Reports of Public Companies (RS Official Gazette, No. 14/2012, 5/2015 and 24/2017), Energoprojekt Holding Plc. based in Belgrade, registration No.: 07023014 hereby publishes the following: ANNUAL REPORT FOR 2017 C O N T E N T S 1. FINANCIAL STATEMENTS OF ENERGOPROJEKT HOLDING Plc. FOR 2017 (Balance Sheet, Income Statement, Report on Other Income, Cash Flow Statement, Statement of Changes in Equity, Notes to the Financial Statements) 2. INDEPENDENT AUDITOR’S REPORT (complete report) 3. ANNUAL BUSINESS REPORT (Note: Annual Business Report and Consolidated Annual Business Report are presented as a single report and these contain information of significance for the economic entity) 4. STATEMENT BY PERSONS RESPONSIBLE FOR REPORT PREPARATION 5. DECISION OF COMPETENT COMPANY BODY ON THE ADOPTION OF ANNUAL FINANCIAL STATEMENTS* (Note) 6. DECISION ON DISTRIBUTION OF PROFIT OR COVERAGE OF LOSSES* (Note) 1. FINANCIAL STATEMENTS OF ENERGOPROJEKT HOLDING Plc. FOR THE YEAR 2017 (Balance Sheet, Income Statement, Report on Other Income, Cash Flow Statement, Statement of Changes in Equity, Notes to the Financial Statements) Energoprojekt Holding Plc. NOTES TO THE ANNUAL FINANCIAL STATEMENTS FOR THE YEAR 2017 Belgrade, 2018 Notes to the Financial Statements for 2017 Page 1/98 Energoprojekt Holding Plc. C O N T E N T S 1. -

Consolidated Annual Report of Energoprojekt Holding Plc. for the Year 2019

Consolidated Annual Report of Energoprojekt Holding Plc. for the year 2019 Belgrade, April 2020 Pursuant to Articles 50 and 51 of the Law on Capital Market (RS Official Gazette, No. 31/2011, 112/2015 and 108/2016) and pursuant to Article 3 of the Rulebook on the Content, Form and Method of Publication of Annual, Half-Yearly and Quarterly Reports of Public Companies (RS Official Gazette, No. 14/2012, 5/2015 and 24/2017), Energoprojekt Holding Plc. from Belgrade, registration No.: 07023014 hereby publishes the following: CONSOLIDATED ANNUAL REPORT OF ENERGOPROJEKT HOLDING PLC. FOR THE YEAR OF 2019 C O N T E N T S 1. CONSOLIDATED FINANCIAL STATEMENTS OF THE ENERGOPROJEKT HOLDING PLC. FOR THE YEAR 2019 (Balance Sheet, Income Statement, Report on Other Income, Cash Flow Statement, Statement of Changes in Equity, Notes to Financial Statements) 2. INDEPENDENT AUDITOR’S REPORT (complete report) 3. ANNUAL BUSINESS REPORT (Note: Annual Business Report and Consolidated Annual Business Report are presented as a single report and these contain information of significance for the economic entity) 4. STATEMENT BY THE PERSONS RESPONSIBLE FOR PREPARATION OF REPORTS 5. DECISION OF COMPETENT COMPANY BODY ON THE ADOPTION OF ANNUAL CONSOLIDATED FINANCIAL STATEMENTS* (Note) 6. DECISION ON DISTRIBUTION OF PROFIT OR COVERAGE OF LOSSES* (Note) 1. CONSOLIDATED FINANCIAL STATEMENTS OF THE ENERGOPROJEKT HOLDING PLC. FOR THE YEAR 2019 (Balance Sheet, Income Statement, Report on Other Income, Cash Flow Statement, Statement on Changes in Equity, Notes to Financial Statements) NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS ENERGOPROJEKT HOLDING PLC FOR 2019 Belgrade, April 2020 Energoprojekt Holding Plc. -

Weekly Report

INTERCITY BROKER JSC WEEKLY REPORT BROKER-DEALER COMPANY Member of Belgrade Stock Exchange t h n d Member of Central Securities Depository and Clearing house S ep tembe r 2 8 – Octo b er 2 , 2 009 52 Maksima Gorkog St., Belgrade, Serbia Tel: +381 (11) 3083-100, 3087-862; Fax: +381 (11) 3083-150 e-mail: [email protected]; www.icbbg.rs BSE Indices Sink in Lower Volumes Belgrade Stock Exchange (BSE) indices were closing in red all through the week and the greatest losses were recorded on Friday. Fluctuation of Stock Exchange Indices The avalanche of bad mood among investors anchored in latest data on unemployment in the USA has overflowed all markets in (%) in the Region (1-m Change) the world. Investors’ insecurity in the recovery of global economy 24 reflected on the domestic stock exchange as well, whose growth depends on foreign investors. Blue chip index Belex15 lost 9.32% and broader Belexline index 7.80%. Turnover has fallen about 46% 20 compared to the previous week. 16 Serbian Business Club founded in Slovenia. Joint Venture of U.S. Green Star and local Notos to construct wind farm in Northern 12 Serbia. Dun&Bradstreet: Economy stable, credit rating the same. Italy's Banca Intesa Serbian unit to launch investment fund in 2010. Zastava Arms launched new carbines for big game hunters 8 – first shipment for US company EEA. Belarus trade and industrial chamber opens in Serbia. August industrial output falls 10% Y/Y. 4 Sept retail prices rise 0.3% M/M, up 9.5% Y/Y. -

Mesečni Izveštaj / Monthly Report Avgust 2020. Indeksi / Indices

MESEČNI PROMET / MONTHLY TURNOVER Promet RSD / Promena % / Promet EUR / Promena % / Broj transakcija / TRŽIŠNI SEGMENT / MARKET SEGMENT Turnover RSD % Change (RSD)* Turnover EUR % Change (EUR)* No of Transactions PRIME LISTING-akcije 152,595,110 +428.04% 1,297,671 +428.01% 825 PRIME LISTING-obveznice Republike Srbije 359,690,687 -86.49% 3,058,986 -86.48% 16 STANDARD LISTING-akcije 257,695,813 +506.43% 2,191,479 +506.40% 117 OPEN MARKET—akcije 25,293,837 -24.16% 215,106 -24.16% 115 MTP—akcije 23,454,407 -19.65% 199,460 -19.66% 94 * mesečna promena / * monthly change Promet RSD / Promena % / Promet EUR / Promena % / Broj transakcija / METODE TRGOVANJA / TRADING METHODS Turnover RSD % Change (RSD)* Turnover EUR % Change (EUR)* No of Transactions Kontinuirano trgovanje / Continuous trading method 805,417,554 -71.19% 6,849,493 -71.19% 1,165 Blok trgovanja / Block trading 13,312,300 +100.00% 113,208 +100.00% 2 Ukupno / Total 818,729,854 -70.71% 6,962,701 -70.71% 1,167 * mesečna promena / * monthly change Učešće u ukupnom Učešće u ukupnom broju Učešće u prometu Učešće u broju transakcija STRUKTURA TRGOVANJA / prometu / Total transakcija / Total No. Of akcijama / Turnover - akcijama / No of Trades - TRADING STRUCTURE Turnover Trades Shares Shares Regulisano tržište / Regulated Market 97.14% 91.95% 94.89% 91.83% MTP 2.86% 8.05% 5.11% 8.17% METODE TRGOVANJA / TRADING METHODS Kontinuirano trgovanje / Continuous trading 98.37% 99.83% 97.10% 99.83% Blok trgovanja / Block trading 1.63% 0.17% 2.90% 0.17% VRSTE HOV / SECURITY TYPE Akcije / Shares 56.07% 98.63% - - Obveznice Republike Srbije / RS Bonds 43.93% 1.37% - - Korporativne obveznice / Corporate Bonds 0.00% 0.00% - - INDEKSI / INDICES BELEX15 52.08% 84.40% 92.90% 85.58% BELEXline 52.38% 87.49% 93.43% 88.71% PROMET U PRETHODNIH 12 MESECI / TURNOVER IN PREVIOUS 12 MONTHS Regulisano / Regulated Br. -

Tačka 5. VALJAONICA BAKRA SEVOJNO A.D. Predlog Odluke SKUPŠTINA Broj: 37/5 19.06.2018

Tačka 5. VALJAONICA BAKRA SEVOJNO a.d. predlog Odluke SKUPŠTINA Broj: 37/5 19.06.2018. godine S E V O J N O Na osnovu člana 329. stav 1. tačka 8. Zakona o privrednim društvima (Sl. glasnik RS br. 36/2011, 99/2011, 83/2014 – dr. zakon i 5/2015), člana 22. alineja 8. Statuta Akcionarskog društva Valjaonica bakra Sevojno (Sl. bilten Društva br.148-1 od 29.05.2015. godine) i Odluke Nadzornog odbora Broj 6/5-5 od 15.05.2018. godine, Skupština Društva na sednici održanoj dana 19.06.2018. godine, donosi sledeću: ODLUKU o usvajanju Godišnjeg konsolidovanog izveštaja o poslovanju i konsolidovanih godišnjih finansijskih izveštaja 1. Usvajaju se Godišnji konsolidovani izveštaj o poslovanju i konsolidovani godišnji finansijski izveštaji Akcionarskog društva Valjaonica bakra Sevojno za 2017. godinu. 2. Godišnji konsolidovani izveštaj o poslovanju i Konsolidovani godišnji finansijski izveštaji Akcionarskog društva Valjaonica bakra Sevojno za 2017. godinu, su sastavni deo ove Odluke. Obrazloženje Skupština akcionara Valjaonice bakra Sevojno a.d. je razmatrala Godišnji konsolidovani izveštaj o poslovanju i Konsolidovane godišnje finansijske izveštaje za 2017. godinu, pa je u skladu sa članom 329. stav 1. tačka 8. Zakona o privrednim društvima (Sl. glasnik RS br. 36/2011, 99/2011, 83/2014 – dr. zakon i 5/2015) i članom 22. alineja 8. Statuta Akcionarskog društva Valjaonica bakra Sevojno (Sl. bilten Društva br.148-1 od 29.06.2015. godine), odlučila kao u dispozitivu ove Odluke. PREDSEDNIK SKUPŠTINE ______________________________ VALJAONICA BAKRA SEVOJNO AD GODIŠNJI KONSOLIDOVANI IZVEŠTAJ DRUŠTVA ZA 2017.GODINU U skladu sa članom 50. i 51. Zakona o tržištu kapitala ("Službeni glasnik RS" broj 31/2011, 112/2015 i 108/16) i članom 3. -

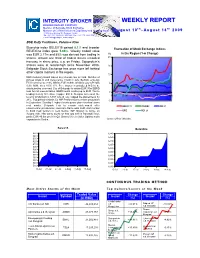

Weekly Report

INTERCITY BROKER JSC WEEKLY REPORT BROKER-DEALER COMPANY Member of Belgrade Stock Exchange t h t h Member of Central Securities Depository and Clearing house A u g u s t 1 0 – A u g u s t 1 4 2 0 0 9 52 Maksima Gorkog St., Belgrade, Serbia Tel: +381 (11) 3083-100, 3087-862; Fax: +381 (11) 3083-150 e-mail: [email protected]; www.icbbg.rs BSE Rally Continues, Volumes Rise Blue-chip index BELEX15 gained 8.1% and broader Fluctuation of Stock Exchange Indices BELEXline index grew 5.66%. Weekly traded value was EUR 2.71m and 85% was derived from trading in (%) in the Region (1-m Change) shares. Almost one third of traded issues recorded 20 increase in share price, e.g. on Friday, Sojaprotein’s shares were at record-high since November 2008. 15 Belgrade Stock Exchange has once more left behind other capital markets in the region. 10 NBS monetary board leaves key interest rate on hold. Number of jobless drops in 2nd consecutive month in July. Serbia's end-July FX Reserves rise 2.9% M/M to EUR 9.9bln. Serbia’s July CPI falls 5 0.9% M/M, rises 8.5% Y/Y. Free shares in privatized NIS to be distributed by year-end. City of Belgrade to obtain EUR 35m EBRD loan for rail modernization. EBRD mulls lending up to EUR 15m to 0 leading bakery firm Klas. Copper Mill in Sevojno increased the 14-Jul 20-Jul 26-Jul 1-Aug 7-Aug 13-Aug level of production to 3,651 tons in July, topped the planed level by 23%. -

Skupština Pks

SKUPŠTINA PKS RPK NIŠ YUMIS JAGODA NIKOLIĆ TIGAR TYRES MILENA TOŠIĆ PHILIP MORRIS JELENA PRERADOVIĆ STEVANOVIĆ LEONI WIRRING SYSTEMS ALEKSANDAR ANDRIĆ HARDER DIGITAL SOVA BRANISLAV BRANDIĆ RPK ZRENJANIN MLEKOPRODUKT ANDREJ BESLAĆ DRAXLMAIER BRANIMIR JOKSIMOVIĆ DIJAMANT DRAGAN ŽIVKOVIĆ FIRMA RPK UŽICE IMPOL SEVALA A.D. UŽICE NINKO TEŠIĆ MPP JEDINSTVA A.D. SEVOJNO MIĆA MIĆIĆ MATIS D.O.O. IVANJICA DRAGOMIR LAZOVIĆ RPK SREMSKA MITROVICA IGM AUTOMATIVE DALIBOR BERIĆ VIKTORIAOIL AD MARIJA VASILJEVIĆ NIKIĆ MITROS FLEISCHWAREN RAMO ADROVIĆ RPK POŽAREVAC DIS KRNJEVO BORKO STANOJEVIĆ BAMBI VUKAŠIN PETKOVIĆ ARRIVA LITAS DEJAN BOGUNOVIĆ 2 RPK PANČEVO UTVA SILOSI AD SAVA KRSTIĆ TEHNOMARKET MIROLJUB KRŠANIN HIP PETROHEMIJA NEGICA RAJAKOV FIRMA RPK NOVI SAD CARLSBERG SRBIJA DOO ĐORĐE KOPRIVICA SUNOKO DOO DANIJELA LAUŠEVIĆ NEOPLANTA DOO JELENA ŠOĆ DUJAKOVIĆ RT-RK DOO NOVI SAD PROF. DR NIKOLA TESLIĆ GLOBAL SEED DOO SAŠA VITOŠEVIĆ RPK LESKOVAC BAT VRANJE JELENA ALEKSIĆ SIMPO VRANJE SLAĐAN DISIĆ NEVENA COSMETIC MILJAN MILJKOVIĆ RPK KRUŠEVAC COOPER TIRE & RUBBER CO. SERBIA NENAD DOJČILOVIĆ HENKEL DUŠAN ANTONIJEVIĆ TRAJAL KORPORACIJA MILOŠ NENEZIĆ RPK KRALJEVO METALAC AD GORNJI MILANOVAC PETRAŠIN JAKOVLJEVIĆ AMIGA, KRALJEVO MIROSLAV TLAČINAC UNI PROMET, ČAČAK ZORAN BOJOVIĆ VODA VRNJCI, VRNJAČKA BANJA DRAGICA PETROVIĆ ATENIC COMMERCE, ČAČAK RODOLJUB PETROVIĆ 3 RPK KRAGUJEVAC KNJAZ MILOŠ ANDRIJANA DESPOTOVIĆ DIREKTNA BANKA DRAGAN PEJČINOVIĆ CRH POPOVAC ALEKSANDAR MILOŠEVIĆ PEŠTAN BUKOVIK LJILJANA BOŠKOVIĆ COMTRADE KRAGUJEVAC SRĐAN ATANASIJEVIĆ RPK SOMBOR APATINSKA -

Relevance of Dividend Policy for Food Industry Corporations in Serbia

RELEVANCE OF DIVIDEND POLICY FOR FOOD INDUSTRY CORPORATIONS IN SERBIA Review Article Economics of Agriculture 4/2012 UDC: 336.781.2:338.432(497.11) RELEVANCE OF DIVIDEND POLICY FOR FOOD INDUSTRY CORPORATIONS IN SERBIA Vladimir Zakić1, Zorica Vasiljević2, Vlade Zarić3 Summary The subject of this paper is to analyze dividend policy of ten representative companies in the food industry sector. In the conditions of limited and expensive sources of financing, as a significant alternative to borrowing stands the stock market. In business of domestic corporations, however, the issue of new shares represents a rare event. A very important factor for future development of the primary equity market is an increase in volume of trading on the „asleep“ secondary market. Lack of demand and falling trading volume prevents the growth of share prices, and thus the possibility of realizing capital gains from their sale. In such circumstances, the main reason of investment in shares can be dividend yield. The goal of this paper is to analyze the opportunities and to provide guidelines in formulating effective dividend policies in order to attract certain groups of shareholders, among which the most important are institutional investors, which in their portfolios do not usually hold more than a few percent of the shares of individual companies. Key words: dividend policy, corporations, food industry, institutional investors. JEL: G35 Introduction Corporations are the dominant and most important form of business organization in terms of assets and resources, as well as the scope and breadth of business activities. Because they can attract a large number of investors, corporations represent an ideal way to increase the equity.