Calgary Assessment Review Board

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Boma Building Guide – Calgary 1 2011-2012 Choosing a Security Provider Is One of the Most Important Decisions You Have to Make

BOMA BUILDING GUIDE – CALGARY 1 2011-2012 Choosing a security provider is one of the most important decisions you have to make. That doesn’t mean it can’t be easy. Protecting the safety and assets of your Key Solutions: property has many facets. Personal • Advanced Access Control, Intrusion security. Organizational liability. Maintaining Detection and Video Surveillance profitability. Guarding intellectual property, • 24/7 Monitoring and Remote Monitoring equipment and inventory. Fortunately, you • Call Centre Services can address all of these concerns with one • Comprehensive IP-Based Solutions simple decision. Choose ADT and Intercon • Long-Term and Short-Term Security Personnel Services Security. From cutting-edge access control • Mobile Alarm Response and 24/7 monitoring to security personnel • Locksmith Services and locksmith services, ADT and Intercon Security offer comprehensive security For more information, call 403.291.2868 or solutions and protection you can trust. visit www.ADT.ca or www.interconsecurity.com Drawing from a wide range of experience, products and services, we can offer specific solutions to help protect your employees, your assets and your business as a whole. Monitoring Access Control Video Surveillance IP Solutions Intrusion Detection Security Guards Locksmithing RBQ 3019-4070-50. © 2011 ADT. All rights reserved. ADT and the ADT logo are registered trademarks of ADT Services AG and are used under licence. Intercon Security is an affiliate of ADT Security Services Canada, Inc. 2011-2012 2 BOMA BUILDING GUIDE – CALGARY BOMA BUILDING GUIDE – CALGARY 3 2011-2012 PUBLISHER: BOMA Calgary 25th ANNUAL BOMA BUILDING GUIDE ASSOCIATE PUBLISHER: William G.R. Partridge, CAE BOMA COMMUNICATIONS COMMITTEE: CALGARY 2011–2012 Vicki Gibbs, Design Group Staffing Inc. -

July and August We Are All Off on Holidays So I Hope You' Ll Take Along H Istory Noll' and Read the Articles

The membership newsletter of the Historical Society of Alberta Suite 325, The Lancaster Building, 304 8th Avenue SW, Calgary, AB. T2P IC2 No.3 Telephone : 403-26 1-3662 J uly 1996 Fax: 403-269-6ll29 Tour of Major Sites of the North In this issue West Rebellion an Unqualified Success Major Sites Tour 1 by Jim Mackie Past President The Alber ta Historical Society Members & Donors 2 President's Report 3 The Central Alberta Historical Society's mel at Fort Nomandcau, just west of Red Elise Corbet - A Tribute 3 "Tour of the Major Sites of the North- West Deer, for an orientation. The next morning, Editorial 4 Rebellion in Saskatchewan," was a great a bus load of keen history huffs departed AB Early Arts Clubs 5 success. On Sunday June 2, 1996, following from the Red Deer Museum at 7:00 am. My Carbon Mystery Weekend 5 a very successful Annual Genera l Meeting wife Ilelen and I were part of this group. Book Reviews 6&7 Satu rday Book Publishers 7 in Red Deer of the Historical Society of After a picnic lunch at Tomahawk Park, HSA Chapter Reports 8&9 Alberta and Conference sponsored by the in Cut Knife, we visited the Poundmaker Historic Calgary Week 10 & 11 Central Alberta and the Chinook Country Reserve. We c1imhed a high hill and which HSA Calendar of events & Historical Societies, memhers of the Tour was Ihe site of the Cut Knife Baltic where Crossword 12 on May 2, 1885, Chief Poundmaker and his r--------- ----------- ----, band defeated the forces of Colonel Otter, Chief Congratulations Poundmaker's grave is located on the top of this magnificen t site, which had Hu gh Dempsey a 360 degree view of the In May, his book The Golden Age of tile country side. -

Q4 2018 POV Appendices.Indd

Appendices Appendix A CLASS AA OFFICE VACANCY BUILDING NAME TOTAL AREA FLOOR PLATE HEADLEASE HEADLEASE SUBLEASE SUBLEASE (sf) (sf) (sf) (%) (sf) (%) 707 Fifth 564,350 20,889 261,066 46.26% 88,868 15.75% Bankers Court 243,240 20,900 - 0.00% - 0.00% Bankers Hall - East Tower 820,221 20,500 - 0.00% 12,326 1.50% Bankers Hall - West Tower 829,873 20,000 46,709 5.63% 142,467 17.17% Brookfi eld Place Calgary - East Tower 1,417,000 27,500 215,973 15.24% 320,869 22.64% Calgary City Centre 820,000 27,000 66,298 8.09% - 0.00% Centennial Place - East 811,024 21,600 - 0.00% 38,967 4.80% Centennial Place - West 443,870 23,000 - 0.00% 6,556 1.48% Devon Tower 806,191 19,519 67,568 8.38% 28,038 3.48% Eau Claire Tower 615,000 27,500 - 0.00% 40,351 6.56% Eighth Avenue Place - East 1,070,000 23,500 - 0.00% 71,611 6.69% Eighth Avenue Place - West 841,000 23,500 - 0.00% - 0.00% Jamieson Place 860,000 23,875 33,405 3.88% 97,247 11.31% Livingston Place - South 435,364 22,936 83,411 19.16% 22,666 5.21% Livingston Place - West 420,345 20,230 45,512 10.83% 102,238 24.32% Suncor Energy Centre - East 585,630 20,000 19,353 3.30% 220,311 37.62% Suncor Energy Centre - West 1,121,218 23,000 - 0.00% - 0.00% TD Canada Trust Tower 617,621 18,715 5,484 0.89% - 0.00% TELUS Sky 430,000 16,538 278,051 64.66% - 0.00% The Bow 1,700,000 32,000 - 0.00% 525,526 30.91% TransCanada PipeLines Tower 938,926 28,400 - 0.00% - 0.00% Total 21 Buildings 16,390,873 1,122,830 6.85% 1,718,041 10.48% Total Class AA Vacancy 2,840,871 17.33% Note: There was a net increase of 430,000 sf to Class AA inventory, due to the addition of Telus Sky. -

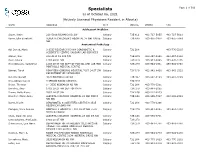

Specialists Page 1 of 509 As of October 06, 2021 (Actively Licensed Physicians Resident in Alberta)

Specialists Page 1 of 509 as of October 06, 2021 (Actively Licensed Physicians Resident in Alberta) NAME ADDRESS CITY POSTAL PHONE FAX Adolescent Medicine Soper, Katie 220-5010 RICHARD RD SW Calgary T3E 6L1 403-727-5055 403-727-5011 Vyver, Ellie Elizabeth ALBERTA CHILDREN'S HOSPITAL 28 OKI DRIVE Calgary T3B 6A8 403-955-2978 403-955-7649 NW Anatomical Pathology Abi Daoud, Marie 9-3535 RESEARCH RD NW DIAGNOSTIC & Calgary T2L 2K8 403-770-3295 SCIENTIFIC CENTRE CALGARY LAB SERVICES Alanen, Ken 242-4411 16 AVE NW Calgary T3B 0M3 403-457-1900 403-457-1904 Auer, Iwona 1403 29 ST NW Calgary T2N 2T9 403-944-8225 403-270-4135 Benediktsson, Hallgrimur 1403 29 ST NW DEPT OF PATHOL AND LAB MED Calgary T2N 2T9 403-944-1981 493-944-4748 FOOTHILLS MEDICAL CENTRE Bismar, Tarek ROKYVIEW GENERAL HOSPITAL 7007 14 ST SW Calgary T2V 1P9 403-943-8430 403-943-3333 DEPARTMENT OF PATHOLOGY Bol, Eric Gerald 4070 BOWNESS RD NW Calgary T3B 3R7 403-297-8123 403-297-3429 Box, Adrian Harold 3 SPRING RIDGE ESTATES Calgary T3Z 3M8 Brenn, Thomas 9 - 3535 RESEARCH RD NW Calgary T2L 2K8 403-770-3201 Bromley, Amy 1403 29 ST NW DEPT OF PATH Calgary T2N 2T9 403-944-5055 Brown, Holly Alexis 7007 14 ST SW Calgary T2V 1P9 403-212-8223 Brundler, Marie-Anne ALBERTA CHILDREN HOSPITAL 28 OKI DRIVE Calgary T3B 6A8 403-955-7387 403-955-2321 NW NW Bures, Nicole DIAGNOSTIC & SCIENTIFIC CENTRE 9 3535 Calgary T2L 2K8 403-770-3206 RESEARCH ROAD NW Caragea, Mara Andrea FOOTHILLS HOSPITAL 1403 29 ST NW 7576 Calgary T2N 2T9 403-944-6685 403-944-4748 MCCAIG TOWER Chan, Elaine So Ling ALBERTA CHILDREN HOSPITAL 28 OKI DR NW Calgary T3B 6A8 403-955-7761 Cota Schwarz, Ana Lucia 1403 29 ST NW Calgary T2N 2T9 DiFrancesco, Lisa Marie DEPARTMENT OF PATHOLOGY (CLS) MCCAIG Calgary T2N 2T9 403-944-4756 403-944-4748 TOWER 7TH FLOOR FOOTHILLS MEDICAL CENTRE 1403 29TH ST NW Duggan, Maire A. -

Q2 2020 Point of View Downtown Office Market

Q2 2020 Point of View Downtown Office Market An Insight into the Calgary Office Market Q2 2020 Point of View Table of Contents 1. Market Overview 2. Additional Graphs and Tables 3. Appendices A: Class AA Office Vacancy B: Class A Office Vacancy C: Class B Office Vacancy D: Class C Office Vacancy E: Beltline Office Vacancy F: Kensington Office Vacancy G: Inglewood Office Vacancy H: Mission Office Vacancy I: Class AA Parking & Operating Costs J: Class A Parking & Operating Costs K: Class B Parking & Operating Costs L: Class C Parking & Operating Costs M: Beltline Parking & Operating Costs Q2 2020 Point of View Market Overview Downtown Office Market “If plan A doesn’t work, the alphabet has 25 more letters — 204 if you’re in Japan.” Downtown Supply — Claire Cook 43,877,044 sf Ironically, Calgary’s real estate market, when as the second highest cost for a company looking strictly at the numbers, had an after salaries, the monthly rent for office almost forgettable second quarter. Instead space demanded a spotlight as corporate of seeing the typical market fluctuations executives digitally discussed the sudden and produced by the volume of tenants and drastic disparity between the price and value Downtown Vacancy landlords transacting on new leases, nearly all of their usual place of work. businesses have pressed the pause button, As we collectively respond to the financial 26.35% along with the rest of the world, while we sort and operational collateral damage caused out what to make of the first global pandemic by the pandemic, two real estate questions in a century. -

Historic Downtown Calgary Introduction

Stephen Avenue Timeline 1875 Inspector Brisebois and 50 members of the “F” Troop of the 1910 The Nielson Block is enlarged and two more storeys are added. North-West Mounted Police (NWMP) establish a fort on the 1911 The Dominion Bank Building is under construction on Stephen banks of the Bow and Elbow River. Avenue. The jewellery store in the Doll Block is robbed of Downtow� 1876 Fort Brisebois is renamed Fort Calgary by Colonel James $11,000 worth of diamonds. P.O. Box 2100 Station M, #8117 Macleod of the NWMP after the ancestral estate of his cousins 1912 The Molson’s Bank opens on Stephen Avenue. The Calgary Calgary, Alberta, Canada on the Isle of Mull, Scotland. Milling Company is sold to Robin Hood Milling. The build- T2P 2M5 Calgary 1883 The Canadian Pacific Railway arrives in town. A young lawyer, ing is sold to John Irwin who opens a fancy food grocery store. www.calgary.ca/heritage James Alexander Lougheed, purchases five lots from the CPR at 1913 The Burns Building opens as the head offices for Pat Burns’ cattle $300 each, on what became Stephen Avenue. operations. The Main Post office built in 1894 is torn down to 1884 Calgary is incorporated as a town. Calgary has its first make way for a newer and bigger building, The Calgary Public Including Calgary’s National Historic District newspaper, 30 major buildings and a population of over 1,000. Building, which is not constructed until 1930. Hudson’s Bay Stephen Avenue Stephen Avenue is named after George Stephen, President of opens store #4, the site of the present “Bay.” the CPR. -

Don't Let Fear, Lack of Planning, Inability Or Inertia Get in the Way of Seizing

BY Shelley Arnusch, Andrew Guilbert, Dylan Leeder, Käthe Lemon AND Victoria Lessard Don’t let fear, lack of planning, inability or inertia get in the way of seizing the moment and making the most of summer. Photograph by Jared Sych 33 AvenueCalgary.com It’s time to get over yourself, stop making excuses and do something that scares you. Mount Norquay's via ferrata. ost of us have one thing we’ve always thought about doing Norquay debuted via ferrata — a style of guided alpine climbing that uses but have held off on actually doing for any number of reasons, secured hand-holds, ropes and suspension bridges — in 2014. Last summer though one huge reason is more than likely because the thought the resort added two new routes to the program, building upon the 2.5-hour of actually going through with it scares off the proverbial pants. adventure and the four-hour adventure with five- and six-hour tours. MBut many experts would argue that’s precisely why you should Via ferrata adventures at Norquay start with a ride up the sightseeing do it. Aside from getting the feeling of being a total badass while you’re out chair lift to a staging area near the Cliffhouse Bistro, the historic eatery there dangling off a cliff or what have you, research has shown that taking perched at just below 7,000 feet. (It’s a popular gathering spot for post-via physical risks has positive psychological effects. Engaging in adventure activi- ferrata celebration beverages and the six-hour tour includes a packed lunch ties increases overall self-confidence and bolsters our ability to deal with the and Cliffhouse après.) Those who are really nervous about heights (like unforeseen situations we encounter in the course of an otherwise unremark- almost didn’t ride the chair lift nervous) can opt for the 2.5-hour Explorer able day. -

City of Calgary Partners

Index DEDICATION TO LOUELLA MAY CHANNELL ............................................................................. 5 INTRODUCTION .............................................................................................................................. 6 CROSS CULTURAL CONNECTIONS – UPDATE FORM ............................................................. 7 IMPORTANT TELEPHONE NUMBERS TO REMEMBER ............................................................. 8 ALBERTA HEALTH SERVICES ..................................................................................................... 8 HEALTHY DIVERSE POPULATIONS ................................................................................ 8 HEALTH LINK ALBERTA.................................................................................................... 9 CALGARY COMMUNITIES AGAINST SEXUAL ABUSE ................................................... 9 CITY OF CALGARY PARTNERS ................................................................................................... 9 TELUS SPARK SCIENCE CENTRE CALGARY ................................................................ 9 CALGARY ZOO – Botanical Garden and Prehistoric Park ............................................... 10 FORT CALGARY NATIONAL HISTORICAL PARK ......................................................... 10 HERITAGE PARK HISTORICAL VILLAGE ...................................................................... 10 TALISMAN CENTRE ....................................................................................................... -

Coolnet Alberta

COOLNet Alberta https://web1.infinitesource.ca/abca/planroom/forms/projectSearchResults/manage.do?method=b... 2017-Feb-24 10:05:51 Project Report BIDDING ADVANCE PROCUREMENT NOTICE BASE CONSTRUCTION PROGRAM FY16-17 ABlm-161360 Wainwright, AB Bid Closing: 2017-Mar-31 2:00 PM Plans Available: LMCA Planroom Bids To: Defence Construction Canada Wainwright Project Details: PURPOSE OF THIS ADVANCE PROCUREMENT NOTICE This is not a bid solicitation. This is an advance notice of potential projects with anticipated security requirements to provide interested Contractors and Consultants an opportunity to apply for security clearances. Note that there is no guarantee that these projects will proceed. DESCRIPTION OF THE PROJECT The Construction Program will consist of multi-trade and single trade, construction projects of varying sizes and complexity. The program may include, but is not limited to new construction, repair, renovations and maintenance of Department of National Defence (DND) infrastructure in support of Canadian Forces Operations. Additional technical services supporting the program may also include, but not limited to land surveying, materials testing, geological and environmental studies. Overall program value is estimated at $10,000,000.00, with the maximum value of any individual project $3,000,000.00. DESCRIPTION OF THE SERVICES The program will consist of design and construction projects that may include, but are not necessarily limited to the following: General construction services including design, repairs, expansions, and / or replacements of partial and complete facilities, including siding, roofing, flooring in various facilities and the construction of complete new facilities. Electrical and Control systems repair and / or replacements including electrical distribution systems, primary service installations, diesel generators, and other building related electrical components including fire detection, intrusion alarm, and security upgrades. -

Q2 2019 Point of View Downtown/Beltline Office Market

Q2 2019 Point of View Downtown/Beltline Office Market An Insight into the Calgary Office Market Q2 2019 Point of View Table of Contents 1. Market Overview 2. Market Forecast 3. New Developments 4. Additional Graphs and Tables 5. Appendices A: Class AA Office Vacancy B: Class A Office Vacancy C: Class B Office Vacancy D: Class C Office Vacancy E: Beltline Office Vacancy F: Kensington Office Vacancy G: Inglewood Office Vacancy H: Mission Office Vacancy I: Class AA Parking & Operating Costs J: Class A Parking & Operating Costs K: Class B Parking & Operating Costs L: Class C Parking & Operating Costs M: Beltline Parking & Operating Costs Devon’s premises in Devon Tower will be coming to market. Devon Tower Q2 2019 Point of View Market Overview Downtown Office Market Any substantial amount of space subleased will be offset by space coming back to the Downtown Supply market due to major asset dispositions. 43,940,238 sf It was an exceedingly neutral period for substantially all Devon Canada employees from absorption in the second quarter, with vacancy Devon Tower. To accommodate these new tilting downward to 24.18%. The mild, positive employees CNRL has subleased 60,000 square absorption marked the second straight positive feet in Bankers Hall West and leased 28,000 Downtown Vacancy quarter for the downtown market, as total square feet in Home Oil Tower. Given that it is absorption for 2019 has now reached 402,815 likely over 200,000 square feet of space is going 24.24% square feet. to be freed up in Devon Tower the transaction will lead to net negative absorption of office The largest block of individual leasing in the space. -

1 J Archaeological

HALBERTA 1 J ArchaeologicaNo. 43 ISSN 0701-1176 Fall 2005 l MBB1 tn* iittsiiysiyili*ps*ss!gs!»«ia ;':*yi»«;y:&:iy",':" ^ Contents 2 Provincial Society Officers 2004-2005 18 ASA 2004 Financial Statement News & Short Reports 3 Editor's Note Features 3 Recent Alberta Graduate Degrees in 12 Educational Programs on the Archaeology of Archaeology Alberta: Cypress Hills Archaeological Project 4 ASA President's Report Summer 2005 5 ASA Annual General meeting Minutes 13 The (New) Oldest Graffiti at Writing-On- 6 In Memory Stone Provincial Park 7 AGM Centre Reports 19 ASA Issued Permits, November 2004 - Octo 11 Alberta Archaeological Review ber 2005 Financial Statement ARCHAEOLOGICAL SOCIETY OF ALBERTA Charter #2805, registered under the Societies Act of Alberta on February 7, 1957 PROVINCIAL SOCIETY OFFICERS 2004-2005 RED DEER CENTRE: President: Karen Kehoe President Dr. Shawn Bubel 3706-43 Avenue Department of Geography Red Deer AB T2N 3B6 University of Lethbridge Phone:403-358-2391 Lethbridge AB T1K 3M4 soul_fire 19 @hotmail.com Phone:403-329-2531 Provincial Rep: Jean Kaufmann [email protected] SOUTHEASTERN ALBERTA Past-President Kate R. Chapman ARCHAEOLOGICAL SOCIETY: R.R.#2, Lacombe AB President: Janice Andreas T4L 2N2 46 Rossland Crescent SE Phone: 403-885-2924 Medicine Hat AB T1B 2B 6 [email protected] Phone: 403-526-3346 [email protected] Executive/ Jim McMurchy Provincial Rep: Ray Lusty Secretary/ 97 Eton Road West Treasurer Phone:403-381-2655 STRATHCONA CENTRE; [email protected] President: George Chalut 14716-65 Street Alberta Dr. John Dormaar Edmonton AB T5A 2E1 Archaeological Research Centre Phone:780-431-2329 Review: Agr. -

Calgary Assessment Review Board

Page 1 of 10 CARB 7 4659P-2014 Calgary Assessment Review Board DECISION WITH REASONS In the matter of the complaint against the property assessment as provided by the Municipal Government Act, Chapter M-26, Section 460, Revised Statutes of Alberta 2000 (the Act). between: Western Securities Limited (as represented by Altus Group Limited), COMPLAINANT and The City Of Calgary, RESPONDENT before: W. Kipp, PRESIDING OFFICER K. Bickford, BOARD MEMBER P. Grace, BOARD MEMBER This is a complaint to the Calgary Assessment Review Board in respect of a property assessment prepared by the Assessor of The City of Calgary and entered in the 2014 Assessment Roll as follows: ROLL NUMBER: 067050104 LOCATION ADDRESS: 600 - 6 Avenue SW, Calgary AB FILE NUMBER: 74659 ASSESSMENT: $28,660,000 Page 2 of 10 CARB 7 4659P-2014 1 This complaint was heard on the 24 h day of June, 2014 at the office of the Assessment Review Board located at Floor Number 4, 1212-31 Avenue NE, Calgary, Alberta, Boardroom 3. Appeared on behalf of the Complainant: • S. Meiklejohn (Agent, Altus Group Limited) Appeared on behalf of the Respondent: • C. Fox (Assessor, The City of Calgary) Board's Decision in Respect of Procedural or Jurisdictional Matters: [1] Due to similarities in issues, evidence and argument, the parties requested and the GARB consented to carrying forward Complainant disclosure C1 B (Capitalization Rate analysis), C2 (Complainant Rebuttal) and R1 (Respondent's disclosure) from file 74635 to files 74679, 75751, 74659, 75696 and 74676. Further, the Complainant requested, the Respondent agreed and the CARB consented to carrying forward exhibits C1 B and C2 to file 75345.