Q4 2020 Point of View Downtown Office Market

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Eighth Avenue Place - West Tower [email protected]

Dan Lannon Senior Vice President | Partner 403 215 9865 [email protected] Todd Sutcliffe Senior Vice President | Partner +1 403 298 0414 [email protected] For Sublease | 585 - 8th Avenue SW Jim Rea Executive Vice President | Partner +1 403 215 7250 Eighth Avenue Place - West Tower [email protected] Eighth Avenue Place offers a range of top-of-the-line amenities for tenant use. From on-site retailers, to indoor bike room with attached shower facilities, to state-of-the-art fitness and conference centres and executive car wash, Eighth Colliers International Avenue Place boasts an extensive inventory of amenities that are unparalleled 900, 335 8th Avenue SW Calgary, AB T2P 1C9 in convenience and quality. www.colliers.com/calgary +1 403 266 5544 Eighth Avenue Place is connected to Centennial Parkade, Plains Midstream Plaza, HSBC Building and Watermark Tower via Calgary’s extensive +15 system. Accelerating success. For Sublease | 585 - 8th Avenue SW, Calgary, AB Property Overview Key Highlights Subease Information Fitness Facility on Plus 15 Suite 2500 - 24,818 SF Available Subpremises Suite 2400 - 24,818 SF Suite 1100 - 24,334 SF Sublandlord Pembina Pipeline Corporation Close to LTR Line Annual Net Rent Market Sublease Rates Operating Costs & Taxes $20.86 per SF (2021 estimate) Plus 15 Suite 2500 - Immediate Connected Suite 2400 - Immediate Suite 1100 - February 1, 2022* Gallery Occupancy Date *Available immediately forcollierscanada.com/2007055 sub-sublease as marketed by Real Estate Advisors Ltd. 6-Level Undergorund Term -

Jamieson Place 900, 335 8Th Avenue SW Calgary, AB T2P 1C9 This AA Class, 38 Storey, 810,000 Sq

JIM REA Executive Vice President | Partner 403 215 7250 [email protected] TODD SUTCLIFFE Vice President | Partner 403 298 0414 [email protected] CRAIG HULSMAN Associate Vice President 403 571 8829 [email protected] FOR SUBLEASE | 308 - 4th Avenue SW, Calgary, AB Colliers International Jamieson Place 900, 335 8th Avenue SW Calgary, AB T2P 1C9 www.colliers.com/calgary This AA Class, 38 storey, 810,000 sq. ft. building, includes a heated underground parking facility, +1 403 266 5544 a number of sky garden elements consisting of four two-storey atrium areas and features a spacious and an elegantly landscaped 26,000 sq. ft. indoor winter garden located on the +15 level. Jamieson Place is walking distance to Eau Claire Market, YMCA, Bow River Pathway System. LEED Gold accredited building for state of the art energy efficient building systems. Accelerating success. FOR SUBLEASE | 308 - 4th Avenue SW, Calgary, AB Sublease Information Available Subpremises Floor 24 - 9,861 square feet Sublandlord Peters & Co. Limited Annual Net Rent Market Sublease Rates Term of Sublease September 29, 2025 Operating Costs and Taxes $22.52 per square foot (2020 estimate) Parking Up to 6 spaces available Occupancy Date Immediate • High-end fitness and conference facilities for tenant use Amenities • Secure bicycle storage with showers, lockers, and changerooms Building Details Constructed 2010 Rentable Area 810,630 square feet Average Floorplate 23,400 square feet Number of Floors 38 Landlord bcIMC Realty Corporation Building Management QuadReal Property Group LP Monday - Friday | 6:00 am - 6:00 pm HVAC Saturday | 8:00 am - 1:00 pm Comments • MOSTLY FURNISHED • +15 connected to Calgary City Centre and BP Centre. -

Roslyn Building 400 - 5Th Avenue Sw Building Information

ROSLYN BUILDING 400 - 5TH AVENUE SW BUILDING INFORMATION Building Details Highlights Constructed 1968 > +15 connected to Calgary Place, Shell Centre and Chevron Plaza 130,373 square feet Rentable Area > One block from Calgary Petroleum Club and Westin Hotel Average Floorplate 13,109 square feet > Renovations recently completed to common areas Number of Floors 10 > 4 elevators including 1 combined passenger/freight Landlord SCREO I Calgary Office Inc. HVAC Monday - Friday | 6:00 am - 6:00 pm Bike Storage Saturday | 8:00 am - 5:00 pm > Bike rack located in the loading dock Security Monday - Friday | 6:00am - 4:00pm Saturday | 9:00am - 5:00pm > Non-reserved > Look to add additional bike racks in heated underground parkade > Total bike parking - 32 Lease Information AVAILABLE PREMISES Suite SQ/FT Availability Annual Net Rent Market Rates Operating Costs $14.90 (2020 estimate) Suite 400 - 13,892 SF Available Immediately and Taxes Suite 500 - 6,752 SF Available Immediately Parking 1:4,000 square feet @ $450.00/stall/month reserved underground Suite 620 - 12,327 SF Available Immediately FLOOR PLANS Floor 4 - 13,892 square feet Floor 5 - 6,752 square feet Suite 400 - 13,892 SF Suite 500 - 6,752 SF > 24 exterior offices > 13 exterior offices > open areas > 4 interior offices > 2 boardrooms > boardroom > 2 kitchens > meeting room > shower > kitchen > server room FLOOR PLANS BUILDING LOCATION 23 EAST TOWER40 23 PARK P 3 AVENUE SW 3 AVENUE SW 17 MCDOUGALL PAVILLIONS POTENTIAL EAU CLAIRE PARKADE OF EAU CLAIRE HOUSE CHURCHILL 615 PARKADE ESTATES BENTALL 3rd AVE PLACE I P THE WESTIN 200 CARS KENNEDY SITE P PARKADE SW3 II PLACE 7 WESTIN Floor 6 - 12,327 square feet CLAIRE EAU SHELL BP CENTRE P CENTRE 32 P 512-528 4 AVE SW BIRCHCLIFF THE WESTIN ALBERTA REGENCY (RETAIL) ALTIUS 30 MCFARLANE ENERGY HOTEL 16 38 SERVICES SUITES SW 1 STREET P TOWER P BUILDING 13 CENTER JAMIESON PLACE HOTEL LAND TITLES HOTEL OPTIMA 3 18 5 REST. -

Brookfield Place Calgary East Tower

BROOKFIELD PLACE CALGARY EAST TOWER UP TO 78,162 SF FOR SUBLEASE 225 - 6th Avenue SW CALGARY, ALBERTA ALEX BROUGH JAMES MCKENZIE CUSHMAN & WAKEFIELD ULC Executive Vice President Vice President 250 - 6th Avenue SW, Suite 2400 Calgary, Alberta T2P 3H7 403 261 1186 403 261 1140 403 261 1111 [email protected] [email protected] cushmanwakefield.com FOR SUBLEASE Brookfield Place Calgary - East Tower 225 - 6th Avenue SW | Calgary, AB Property Details Building Amenities Address 225 - 6th Avenue SW • +15 connected to Stephen Avenue Place & Year Built 2017 Bow Valley Square • Large urban plaza features a south facing Landlord Brookfield Place (Calgary) LP landscaped courtyard with extensive Property Management Brookfield Properties Canada seating and common areas Management LP • In-house Porter Service Total Building Size 1,417,577 SF • Bike storage facility/shower Number of Floors 56 • LEED GOLD Core & Shell Certification Average Floor Plate 26,300 SF - Low Rise 27,800 SF - Mid Rise Elevators 10 per rise Ceiling Height 9’ Parking Ratio 1:3,000 SF Leasing Particulars Sublandlord: Cenovus Energy Inc. Area Available: Fl 20: 26,477 SF SUBLEASED Fl 21: 26,474 SF SUBLEASED Fl 22: 26,473 SF SUBLEASED Fl 23: 25,755 SF SUBLEASED Fl 24: 26,412 SF Virtual Tour Fl 25: 25,704 SF Fl 26: 11,736 SF Fl 27: 27,521 SF SUBLEASED Fl 28: 14,310 SF Total: 78,162 SF Rental Rate: Market sublease rates Additional Rent: $19.35/SF (2021 LL estimate) Parking: 1 stall per 3,000 SF As at March 2020 Bike Facilities Plan FOR SUBLEASE Brookfield Place Calgary -

Entuitive Credentials

CREDENTIALS SIMPLIFYING THE COMPLEX Entuitive | Credentials FIRM PROFILE TABLE OF CONTENTS Firm Profile i) The Practice 1 ii) Approach 3 iii) Better Design Through Technology 6 Services i) Structural Engineering 8 ii) Building Envelope 10 iii) Building Restoration 12 iv) Special Projects and Renovations 14 Sectors 16 i) Leadership Team 18 ii) Commercial 19 iii) Cultural 26 iv) Institutional 33 SERVICES v) Healthcare 40 vi) Residential 46 vii) Sports and Recreation 53 viii) Retail 59 ix) Hospitality 65 x) Mission Critical Facilities/Data Centres 70 xi) Transportation 76 SECTORS Image: The Bow*, Calgary, Canada FIRM PROFILE: THE PRACTICE ENTUITIVE IS A CONSULTING ENGINEERING PRACTICE WITH A VISION OF BRINGING TOGETHER ENGINEERING AND INTUITION TO ENHANCE BUILDING PERFORMANCE. We created Entuitive with an entrepreneurial spirit, a blank canvas and a new approach. Our mission was to build a consulting engineering firm that revolves around our clients’ needs. What do our clients need most? Innovative ideas. So we created a practice environment with a single overriding goal – realizing your vision through innovative performance solutions. 1 Firm Profile | Entuitive Image: Ripley’s Aquarium of Canada, Toronto, Canada BACKED BY DECADES OF EXPERIENCE AS CONSULTING ENGINEERS, WE’VE ACCOMPLISHED A GREAT DEAL TAKING DESIGN PERFORMANCE TO NEW HEIGHTS. FIRM PROFILE COMPANY FACTS The practice encompasses structural, building envelope, restoration, and special projects and renovations consulting, serving clients NUMBER OF YEARS IN BUSINESS throughout North America and internationally. 4 years. Backed by decades of experience as Consulting Engineers. We’re pushing the envelope on behalf of – and in collaboration with OFFICE LOCATIONS – our clients. They are architects, developers, building owners and CALGARY managers, and construction professionals. -

Bankers Hall East

BANKERS HALL EAST Class AA SUBLEASE FLOOR 39: 12,326 SF Damon Harmon, CPA, CGA Josh Hamill Nicole Bennett 403.571.8221 403.539.0889 403.258.1872 [email protected] [email protected] [email protected] Features & AMENITIES Premises is in excellent, move-in condition Space is ideally suited for a highly collaborative team; several break- out rooms and large open area with unobstructed views to the North and West Some furniture potentially available Plus 15 connection to Bankers Court, Home Oil Tower, Royal Bank Building, The Core Shopping Centre Within walking distance to several public transit routes and CTrain stations 40,000-square-foot Bankers Hall Club, a private health club offering cardiovascular and weight training, fitness studios, 4 squash courts, lounge and pro shop Access to Bankers Hall Auditorium, a state-of-the-art facility designed to accommodate up to 175 people On-site management with 24/7 building access and security Space PROFILE Sublandlord: Bennett Jones Services Limited Partnership Subpremises: 39th Floor: 12,326 sf Availability: Immediately Term Expiry: Flexible up to May 30, 2027 Rental Rate: Market sublease rates T.I.A.: As is Op. Costs & Taxes: $21.75 per sf (est. 2019) Parking: 1 stall per 2,500 sf at market rates Building INFORMATION Exterior Address: 855 Second Street SW Year of Completion: 1988 Number of Floors: 52 Rentable Area: 820,221 sf Ave. Floor Plate: 20,500 sf Security: 7 days per week, 24 hours per day Manned security desk, card key access HVAC: 7:30 am - 6:00 pm After hours upon request Landlord/ View from Office Building Manager: Brookfield Office Properties Boardroom 39.368 ROBSON A 39.342 39-106 FLEX 39.332 39.102 39.372 39.374 39.340 39.100 39.376 39.378 39.366 39.334 BRYCE FLEX CONFERENCE CONFERENCE OPEN WORK AREA 39.338 39.336 39.104 39-134 39-386 39.370 COFFEE 39.364 39.118 ENCLAVE N. -

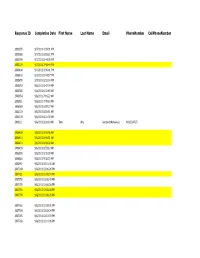

Appendix D-2 Reception Survey

Response ID Completion Date First Name Last Name Email PhoneNumber CellPhoneNumber 2001935 9/7/2011 4:39:31 PM 2002588 9/7/2011 6:08:11 PM 2002790 9/7/2011 6:44:06 PM 2003129 9/7/2011 7:48:44 PM 2003400 9/7/2011 8:36:41 PM 2003418 9/7/2011 8:44:57 PM 2003455 9/7/2011 8:52:34 PM 2005350 9/8/2011 6:47:04 AM 2005385 9/8/2011 6:52:43 AM 2005654 9/8/2011 7:16:22 AM 2005921 9/8/2011 7:45:18 AM 2006069 9/8/2011 8:09:37 AM 2006119 9/8/2011 8:19:11 AM 2006129 9/8/2011 8:22:00 AM 2006211 9/8/2011 8:28:10 AM Tom Alty [email protected] 4032524725 2006409 9/8/2011 8:48:48 AM 2006410 9/8/2011 8:48:51 AM 2006413 9/8/2011 8:49:00 AM 2006439 9/8/2011 8:53:12 AM 2006855 9/8/2011 9:55:00 AM 2006886 9/8/2011 9:58:33 AM 2006947 9/8/2011 10:15:01 AM 2007748 9/8/2011 12:06:26 PM 2007751 9/8/2011 12:06:54 PM 2007752 9/8/2011 12:06:45 PM 2007755 9/8/2011 12:08:08 PM 2007756 9/8/2011 12:08:08 PM 2007759 9/8/2011 12:08:28 PM 2007762 9/8/2011 12:09:01 PM 2007764 9/8/2011 12:09:24 PM 2007765 9/8/2011 12:10:03 PM 2007768 9/8/2011 12:10:06 PM 2007770 9/8/2011 12:10:16 PM 2007772 9/8/2011 12:10:40 PM 2007773 9/8/2011 12:10:49 PM 2007774 9/8/2011 12:10:56 PM 2007775 9/8/2011 12:11:51 PM 2007776 9/8/2011 12:11:11 PM 2007777 9/8/2011 12:11:11 PM 2007778 9/8/2011 12:11:13 PM 2007779 9/8/2011 12:11:18 PM 2007781 9/8/2011 12:11:54 PM 2007784 9/8/2011 12:11:27 PM 2007785 9/8/2011 12:13:17 PM 2007786 9/8/2011 12:11:35 PM 2007787 9/8/2011 12:11:39 PM 2007788 9/8/2011 12:11:46 PM 2007790 9/8/2011 12:11:57 PM 2007791 9/8/2011 12:12:03 PM 2007792 9/8/2011 12:13:06 PM 2007793 9/8/2011 -

Boma Building Guide – Calgary 1 2011-2012 Choosing a Security Provider Is One of the Most Important Decisions You Have to Make

BOMA BUILDING GUIDE – CALGARY 1 2011-2012 Choosing a security provider is one of the most important decisions you have to make. That doesn’t mean it can’t be easy. Protecting the safety and assets of your Key Solutions: property has many facets. Personal • Advanced Access Control, Intrusion security. Organizational liability. Maintaining Detection and Video Surveillance profitability. Guarding intellectual property, • 24/7 Monitoring and Remote Monitoring equipment and inventory. Fortunately, you • Call Centre Services can address all of these concerns with one • Comprehensive IP-Based Solutions simple decision. Choose ADT and Intercon • Long-Term and Short-Term Security Personnel Services Security. From cutting-edge access control • Mobile Alarm Response and 24/7 monitoring to security personnel • Locksmith Services and locksmith services, ADT and Intercon Security offer comprehensive security For more information, call 403.291.2868 or solutions and protection you can trust. visit www.ADT.ca or www.interconsecurity.com Drawing from a wide range of experience, products and services, we can offer specific solutions to help protect your employees, your assets and your business as a whole. Monitoring Access Control Video Surveillance IP Solutions Intrusion Detection Security Guards Locksmithing RBQ 3019-4070-50. © 2011 ADT. All rights reserved. ADT and the ADT logo are registered trademarks of ADT Services AG and are used under licence. Intercon Security is an affiliate of ADT Security Services Canada, Inc. 2011-2012 2 BOMA BUILDING GUIDE – CALGARY BOMA BUILDING GUIDE – CALGARY 3 2011-2012 PUBLISHER: BOMA Calgary 25th ANNUAL BOMA BUILDING GUIDE ASSOCIATE PUBLISHER: William G.R. Partridge, CAE BOMA COMMUNICATIONS COMMITTEE: CALGARY 2011–2012 Vicki Gibbs, Design Group Staffing Inc. -

CPLF Welcome Package 07/16 Page 2

OUR MISSION: To promote self-sufficiency and growth within individuals whom have a disAbility. This is achieved through Community Presence and Participation, Skill and Image Enhancement, Autonomy and Empowerment. CPLF Welcome Package Suite 140, 1935 32nd Avenue NE Calgary, Alberta T2E 7C8 Email: [email protected] www.cplf.ca Acknowledgement of package review Client Signature Date YY/MM/DD CPLF Welcome Package 07/16 Page 2 OUR MISSION: To promote self-sufficiency and growth within individuals whom have a disAbility. This is achieved through Community Presence and Participation, Skill and Image Enhancement, Autonomy and Empowerment. CPLF Welcome Package Suite 140, 1935 – 32nd Avenue NE Calgary, Alberta T2E-7C8 Email: [email protected] www.cplf.ca CPLF Welcome Package 07/16 Page 3 The aim of Calgary Progressive Lifestyles Foundation (CPLF) is to promote self-sufficiency and growth within adults who have a disability. This is achieved through Community Inclusion; Community Participation such as employment; Self Enhancement; Enhanced self image; and Empowerment. The Calgary Progressive Lifestyles Foundation has a strong commitment to a continued process of improvement by evaluating the outcomes of its activities. Established in 1989, CPLF uses an individualized client-centered approach where the needs of the individual are assessed and support services are developed around the identified needs. CPLF provides quality support services focused on developing and enhancing a person's potential and quality of life. Guiding us in the provision of these support service are the following beliefs and values: • Every person is a unique individual having worth, no matter what the degree of disability. • Every person has the need for self-determination to the greatest extent possible. -

FOR SUBLEASE WESTERN UNION BUILDING 640 - 8 AVENUE SW, Calgary, AB

FOR SUBLEASE WESTERN UNION BUILDING 640 - 8 AVENUE SW, Calgary, AB Partnership. Performance. PARTICULARS COMMENTS Sublandlord Amberg Corp. - Central location with numerous amenities within the immediate area (food courts, Available Suite 1100 - 1,100sf coffee shops, shopping, parks) (shared space) - Located in the heart of Theatre District Occupancy Immediate - Plus 15 connected Term Flexible - One block from LRT line Rental Rate Market Sublease rates - Covered parking @ $380.00/stall/month 2018 Operating - Lobby recently renovated and expanded Costs $17.50 psf - Bicycle path right by the building on 8th avenue Eighth Avenue Place West - Suite 1200, 585 - 8th Avenue SW, Calgary, AB T2P 1G1 | T 403.262.3082 F: 403.262.3325 | avisonyoung.com © 2018 Avison Young Real Estate Alberta Inc. All rights reserved. E. & O.E.: The information contained herein was obtained from sources that we deem reliable and, while thought to be correct, is not guaranteed by Avison Young. - CityCity ofof C Calalgagrayr y L E G E N D LEGEND 3 Number of Floors Downtown & Beltline Waterfront Light Rail Transit (C-Train) Downtown & Beltline Condos Anthem (C-Train) Properties Plus 15 Connections City of Calgary The Concord Proposed Plus 15 Connections Downtown Core One Way Indicator Central Business District CP Rail Future Future Development Development Site Site Q Haute Chinese Cuisine United Church P P Tower Millennium 36 AVISON YOUNG REAL ESTATE ALBERTA INC. Eau Claire Centennial Future City City Tower Place West Centre Eighth Avenue Place - West Tower Centre Phase I Centennial Devon Phase II 1200, 585 - 8th Avenue SW 24 Place East Tower Calgary, AB T2P 1G1 T. -

First Canadian Centre

FIRST CANADIAN CENTRE Class A SUBLEASE FLOOR 11 - APPROX. 6,000 SF Kendra Pinder John Stones 403.571.8085 403.571.8086 [email protected] [email protected] Features & AMENITIES Shared office scenario “Plug and play” option Mix of office and open area Shared reception area Furniture available Large conference facility available to tenants free of charge Building is centrally situated within walking distance to numerous amenities including retail, restaurants, banking, professional services and eateries Located directly on CTrain line Plus 15 connection to Intact Place, 444 Seventh, Dome Tower, Centrium Place Space PROFILE Sublandlord: Questfire Energy Corp. Subpremises: 11th Floor: Approx. 6,000 sf Availability: Immediately Elevator Lobby Term Expiry: July 30, 2019 Rental Rate: Market sublease rates T.I.A.: As is Op. Costs & Taxes: $22.10 per sf (est. 2017) Parking: 1 stall per 3,000 sf Building INFORMATION Address: 350 Seventh Avenue SW Reception Year of Completion: 1982 Number of Floors: 41 Rentable Area: 508,688 sf Ave. Floor Plate: 16,914 sf Security: Card Key Access HVAC: Mon-Fri: 8:00 a.m. - 6:00 p.m. Landlord/ Building Manager: GWL Realty Advisors Inc. Office Meeting Room Open Area N 11th Floor DETAILS 12 exterior offices 2 internal offices Open area Kitchenette Copy room File Storage APPROX. 6,000 SF Cresa Alberta Suite 1400, 606 - 4 Street SW 14 Prince’s Number of Floors Island Centre Street Bridge Plus 15 Connections Calgary, Alberta T2P 1T1 Estates Condo Proposed Plus 15 Connections Memorial Drive tel: 403.571.8080 Rest. One way Directions Condo Light Rail Transit cresa.com Condo Railway Princeton l & II Ea u The Waterfront Building / Future Development Claire Future Y.M.C.A. -

Calgary City Centre for SUBLEASE > 215 - 2Nd Street SW, Calgary, AB

Calgary City Centre FOR SUBLEASE > 215 - 2nd Street SW, Calgary, AB BUILDING DETAILS Constructed 2016 Rentable Area 811,046 square feet Average Floorplate 27,000 square feet Number of Floors 34 Landlord Cadillac Fairview Corporation Limited HVAC Monday - Friday | 7:00 am - 6:00 pm SUBLEASE INFORMATION Available Subpremises Floor 20 - 24,977 square feet *can be demised to suit numerous requirements Occupancy Date Immediate Sublandlord Canbriam Energy Inc. Annual Net Rent Market sublease rates Operating Costs $22.50 per square foot and Taxes [2016] Term of Sublease Up to five (5) years Parking Ratio 1 stall per 1,800 square feet HIGHLIGHTS • Certified Platinum building under the LEED Green Building Rating System • Calgary City Centre is connected to Calgary’s prominent office towers by two (2) +15 bridges to the east and south • Building features 125 hourly parking stalls and 250 bicycle stalls • 16 high speed passenger elevators which use destination dispatch technology • Manned lobby desk c/w security access control and monitoring • Conference centre and fitness centre available in the building for Tenant use • Space has been developed using the Stylwall System by BRC which is manufactured in Italy ALY LALANI BRETT TONER Senior Vice President/Partner Associate COLLIERS INTERNATIONAL 403 298 0410 403 298 0406 Royal Bank Building, Suite 900 [email protected] [email protected] 335, 8th Avenue SW, Calgary, AB Calgary City Centre AVAILABLE AREA Floor 20 - 24,977 square feet N • 52 exterior offices • reception area(s) • 11 interior