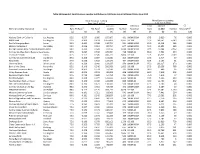

List of Minority Depository Institutions As of December 31, 2017

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

DBE Program 11.07.19

City of Springfield, Ohio Disadvantaged Business Enterprise Program for FTA-assisted Projects MEMORANDUM TO : BRYAN L. HECK, CITY MANAGER FROM: SHANNON L. MEADOWS, COMMUNITY DEVELOPMENT DIRECTOR DATE: NOVEMBER 6, 2019 RE: DISTRIBUTION OF DBE PROGRAM FOR FTA-ASSISTED PROJECTS The City of Springfield, through its Department of Community Development and in partnership with the Department of Finance, has drafted and submitted to the Federal Transit Administration a new Disadvantaged Business Enterprise Program FTA-assisted Projects document. This plan document is to be distributed, along with the City of Springfield’s Policy Statement, to the Springfield City Commission; Senior Staff of each department within the City organization; as well as DBE and non-DBE business communities that perform work for the City of FTA-assisted contracts. Additionally, the City’s Program and it’s associated DBE Policy shall be placed on the city’s website at www.springfieldohio.gov/SCAT . Within the Program and Policy document, you will find the stated objectives for the City’s DBE Program for FTA-assisted Projects: 1. To ensure nondiscrimination in the award and administration of FTA-assisted contracts; 2. To create a level playing field on which DBEs can compete fairly for FTA-assisted contracts; 3. To ensure that the DBE Program is narrowly tailored in accordance with applicable law; 4. To ensure that only firms that fully meet 49 CFR Part 26 eligibility standards are permitted to participate as DBEs; 5. To help remove barriers to the participation of DBEs in FTA-assisted contracts; 6. To assist the development of firms that can compete successfully in the market place outside the DBE Program; 7. -

Live Oak Banking Company 2605 Iron Gate Dr, Ste 100 2013 7(A) Jpmorgan Chase Bank, National 1111 Polaris Pkwy 2013 7(A) U.S

APPVFY MAJPGM L2Name L2Street 2013 7(A) Wells Fargo Bank, National Ass 101 N Philips Ave 2013 7(A) Live Oak Banking Company 2605 Iron Gate Dr, Ste 100 2013 7(A) JPMorgan Chase Bank, National 1111 Polaris Pkwy 2013 7(A) U.S. Bank National Association 425 Walnut St 2013 7(A) The Huntington National Bank 17 S High St 2013 7(A) Ridgestone Bank 13925 W North Ave 2013 7(A) Seacoast Commerce Bank 11939 Ranho Bernardo Rd 2013 7(A) Wilshire State Bank 3200 Wilshire Blvd, Ste 1400 2013 7(A) Compass Bank 15 S 20th St 2013 7(A) Hanmi Bank 3660 Wilshire Blvd PH-A 2013 7(A) Celtic Bank Corporation 268 S State St, Ste 300 2013 7(A) KeyBank National Association 127 Public Sq 2013 7(A) Noah Bank 7301 Old York Rd 2013 7(A) BBCN Bank 3731 Wilshire Blvd, Ste 1000 2013 7(A) TD Bank, National Association 2035 Limestone Rd 2013 7(A) Manufacturers and Traders Trus One M & T Plaza, 15th Fl 2013 7(A) Newtek Small Business Finance, 212 W. 35th Street 2013 7(A) SunTrust Bank 25 Park Place NE 2013 7(A) Hana Small Business Lending, I 1000 Wilshire Blvd 2013 7(A) First Bank Financial Centre 155 W Wisconsin Ave 2013 7(A) NewBank 146-01 Northern Blvd 2013 7(A) Open Bank 1000 Wilshire Blvd, Ste 100 2013 7(A) Bank of the West 180 Montgomery St 2013 7(A) CornerstoneBank 2060 Mt Paran Rd NW, Ste 100 2013 7(A) Synovus Bank 1148 Broadway 2013 7(A) Comerica Bank 1717 Main St 2013 7(A) Borrego Springs Bank, N.A. -

480357300.00

LOS ANGELES DISTRICT OFFICE Lender Ranking Report 7(a) and 504 Loan Programs Fiscal Year 2018 - 1st Quarter (YTD) (10/01/2017 - 12/31/2017) 7(a) Loan Program 1 WELLS FARGO BANK, N.A. 75 $46,434,400 60 Byline Bank 1 $3,400,000 2 JPMORGAN CHASE BANK, N.A. 65 $17,434,700 61 MidFirst Bank 1 $2,596,000 3 BANK OF HOPE 40 $25,544,400 62 Pacific Western Bank 1 $2,421,000 4 East West Bank 29 $9,327,000 63 Cathay Bank 1 $2,210,000 7(a) LOAN TOTALS 5 U.S. Bank, N.A. 28 $5,779,200 64 First-Citizens Bank & Trust Company 1 $1,980,000 591 Loans 6 First Home Bank 18 $3,998,000 65 Community Bank of the Bay 1 $1,866,000 7 Celtic Bank Corporation 18 $3,466,600 66 Partners Bank of California 1 $1,750,000 Valued at: $375,199,300 8 Live Oak Banking Company 14 $22,946,000 67 United Pacific Bank 1 $1,650,000 9 Uniti Bank 14 $15,405,000 68 Meadows Bank 1 $1,601,500 10 Seacoast Commerce Bank 13 $14,323,300 69 Citizens Business Bank 1 $1,600,000 11 Pacific City Bank 13 $13,189,000 70 T Bank, N.A. 1 $1,452,000 504 LOAN TOTALS 12 Bank of the West 13 $13,023,800 71 Community Valley Bank 1 $954,400 81 Loans 13 Commonwealth Business Bank 11 $14,453,000 72 Umpqua Bank 1 $823,000 14 Open Bank 10 $4,784,500 73 Commerce Bank of Temecula Valley 1 $655,000 Valued at: $105,158,000 15 Citibank, N.A. -

CHINESE AMERICAN MUSEUM CAM Honors History-Making Innovators

CHINESE AMERICAN MUSEUM 425 North Los Angeles Street Los Angeles, CA 90012 Tel 213 485-8484 Fax 213 485-0428 www.camla.org FOR IMMEDIATE RELEASE September 25, 2014 CAM Honors History-making Innovators, Pioneers, Leaders LOS ANGELES.—Innovators, pioneers, corporate and community leaders were recognized Thursday, Sept. 25 as the Chinese American Museum (CAM) raised the curtain on the 18th annual Historymakers Awards Gala and commemorated its 10th anniversary. In line with the gala’s theme, “CAM at 10: New Directions for the Next Decade,” Nissan North America served as title sponsor for the event and announced the launch of Project Future Star, a contest designed to celebrate visionaries and innovators. "We thank Nissan for joining with us as we expand our mission into the next decade," stated Dr. Gay Yuen, Friends of the Chinese American Museum (FCAM) president. Kin Hui, Chairman and CEO of the Singpoli Group, served as honorary dinner chair. The event took place at the Bonaventure Hotel in downtown Los Angeles. Awards were presented to the following individuals and organizations: Ming Hsieh (Judge Ronald S. W. Lew Visionary Award) is at the forefront of engineering medicine for cancer research and biometric identification. As the founder, Chairman, and Chief Executive Officer of 3M Cogent Inc., he has led the development of global identification systems. He has also served as the Chairman and CEO of Fulgent Therapeutics Inc., a cancer drug research and development company. Raised in Shenyang, northern China, he currently a trustee of the University of Southern California. David Fon Lee (Dr. Dan S. Louie, Jr., Lifetime Achievement Award), best known as proprietor of the iconic General Lee’s Man Jen Low Restaurant, led advocacy on behalf of Chinatown and U.S.-China relations as early as the 1970s. -

A Comparison of Korean and Chinese American Banks in California*

한국지역지리학회지 제12 권 제 1 호 (2006) 154-171 The Financial Development of Korean Americans: A Comparison of Korean and Chinese American Banks in California* Hyeon-Hyo Ahn**, Yun-Sun Chung*** 미국에서의 한인 금융: 캘리포니아에서 한국계와 중국계 은행의 비교* 안현효**․ 정연선 *** 요약:본 논문은 캘리포니아의 중국계와 한국계의 양 소수민족은행을 비교하여 한국계 민족은행과 한국계 이민사회의 경제적 관계를 해명하고자 한다. 통상 미국 내 소수민족경제권의 경제적 성과 차이는 문화적 차이 또는 비공식금융의 기여로 설명되는 경우가 많으나 우리는 공식금융제도의 적극적 역할에 주목하여 금융제도와 소수민족경제의 관련성을 강조한다.,, 동시에 한국계 미국은행은 성장 수익성 은행전략 면에서 중국계 소수민족은행과 구분된다는 점을 중시하여, 은행전략 측면에서, 중국계와 한국계가 고객과의 장기적 거래를 중시하는 유사한 관계은행전략을 구사하지만, 은행의 대출분포와 예금분포는 서로 다르다는 점을 지적하였다. 이는 각 소수민족은행이 다른 경영성과를 낳는 이유가 된다. 한국계은행의 경우 대출구조가 사업대출 중심이며, 이자 낳지 않는 예금의 비중이 중국계 민족은행보다 상대적으로 높 은 사실이 한국계 소수민족은행이 높은 성장을 하게 된 배경이다. 따라서 관계은행전략이라는 개념만으로는 다수의 소 수민족은행의 차이를 설명할 수 없으므로, 본 연구는 한국계와 중국계의 이민사회 그 자체의 특수성에 주목하였다. 중 국계 미국인의 경우 인구구성의 이질성과 해외자본의 영향이, 한국계 미국인의 경우 동질적 인구 및 사업구성과 착 한 국계 미국인 금융기관의 경쟁력이 특징적이다. 주요어:소수민족은행, 한국계 미국은행 , 중국계 미국은행 , 관계은행 Abstract :By comparing to Chinese American banks, this research shows the uniqueness of Korean American banks. This article argues that instead of the cultural attributes and/or informal financial institutions, formal financial institutions, such as the ethnic banks studied here, are responsible for the business success of Asians abroad. However, ethnic banks have different development trajectories depending on their respective ethnic communities. Korean American banks are notably different from Chinese American banks in terms of growth, profitability, and banking strategies. -

3A Expanded Small Business Lending

Table 3A Expanded. Small Business Lending Institutions in California Using Call Report Data, June 2012 Small Business Lending Micro Business Lending (less than $ million) (less than $ 100k) Total Amount Institution Total Amount CC Name of Lending Institution City Rank TA Ratio1 TBL Ratio1 (1,000) Number Asset Size Rank (1,000) Number Amount/TA1 (1) (2) (3) (4) (5) (6) (7) (8) (9) (10) National Bank of California Los Angeles 95.0 0.537 1.000 187,467 431 100M-500M 67.5 3,020 76 0.000 BBCN Bank Los Angeles 92.5 0.309 0.424 1,557,424 9,537 1B-10B 97.5 168,741 6,149 0.000 Pacific Enterprise Bank Irvine 92.5 0.405 0.549 110,755 591 100M-500M 95.0 11,314 249 0.000 Mission Valley Bank Sun Valley 90.0 0.356 0.564 87,754 647 100M-500M 95.0 12,892 365 0.000 Borrego Springs Bank, National AssociLa Mesa 90.0 0.435 0.628 65,123 3,020 100M-500M 97.5 10,544 2,562 0.000 Community West Bank, National Asso Goleta 87.5 0.227 0.542 129,084 718 500M-1B 85.0 7,591 234 0.000 Tri Counties Bank Chico 87.5 0.173 0.545 436,723 3,804 1B-10B 97.5 43,955 2,289 0.000 Community Commerce Bank Claremont 87.5 0.358 0.687 103,416 365 100M-500M 67.5 2,717 57 0.000 Plaza Bank Irvine 87.5 0.328 0.502 127,075 484 100M-500M 52.5 2,193 61 0.000 Universal Bank West Covina 85.0 0.329 1.000 133,617 170 100M-500M 95.0 133,617 170 0.000 Bank of the Sierra Porterville 85.0 0.148 0.546 206,583 1,602 1B-10B 97.5 20,356 768 0.000 Seacoast Commerce Bank San Diego 82.5 0.363 0.574 57,144 315 100M-500M 30.0 409 16 0.000 Valley Business Bank Visalia 82.5 0.259 0.531 89,428 408 100M-500M 90.0 -

The Large Bank Protection Act: Raising the CFPB’S Enforcement and Supervision Asset Threshold Would Place American Consumers at Risk Christopher L

The Large Bank Protection Act: Raising the CFPB’s Enforcement and Supervision Asset Threshold Would Place American Consumers at Risk Christopher L. Peterson May 3, 2018 1620 Eye Street, NW, Suite 200 | Washington, DC 20006 | (202) 387-6121 | consumerfed.org Executive Summary Congress is currently considering raising the total asset threshold for Consumer Financial Protection Bureau (CFPB) supervision and enforcement of banks from $10 billion to $50 billion. This report analyzes the effect of this change on the number of banks subject to CFPB oversight. Furthermore, this report looks at the CFPB’s enforcement track record in cases against banks within the $10-to-$50-billion-range, and highlights examples of enforcement actions previously taken by the CFPB that would have been impossible if the asset threshold were set at $50 billion under the original Dodd-Frank Act. Raising the CFPB supervision and enforcement threshold from ten to fifty billion dollars would: • Cut the number of banks subject to CFPB supervision and enforcement by 65% from 124 to 43. Currently, 124 out of 5,679 banks are subject to CFPB enforcement. Raising the CFPB oversight threshold to fifty billion dollars would place 81 of the nation’s largest banks beyond the supervisory and enforcement jurisdiction of the CFPB. • Eliminate CFPB oversight of nearly 50 of the largest banks bailed out during the financial crisis. Forty-nine of 81 large banks in the $10 to $50 billion asset range took TARP funds during the Great Recession. After bailing out these banks with taxpayer money, Congress is now considering removing them from the supervision and enforcement authority of the agency designed to prevent some of the same behavior that caused the crisis. -

Rank Total Assets Bank Name 1 $2138002000000

Rank Total Assets Bank Name 1 $2,138,002,000,000 JPMorgan Chase Bank 2 $1,749,176,000,000 Wells Fargo Bank 3 $1,707,215,000,000 Bank of America 4 $1,369,304,000,000 Citibank 5 $442,985,106,000 U.S. Bank 6 $360,348,645,000 PNC Bank 7 $282,071,109,000 Capital One 8 $274,106,659,000 TD Bank 9 $260,306,000,000 The Bank of New York Mellon 10 $233,542,890,000 State Street Bank and Trust Company 11 $214,562,871,000 Branch Banking and Trust Company 12 $201,282,949,000 SunTrust Bank 13 $200,405,288,000 HSBC Bank USA 14 $180,506,000,000 Charles Schwab Bank 15 $156,156,000,000 Goldman Sachs Bank USA 16 $137,903,926,000 Fifth Third Bank 17 $132,807,446,000 Chase Bank USA 18 $132,288,338,000 KeyBank 19 $127,377,000,000 Morgan Stanley Bank 20 $123,636,430,000 Regions Bank 21 $122,682,502,000 Manufacturers and Traders Trust Company 22 $122,313,000,000 Ally Bank 23 $121,086,840,000 The Northern Trust Company 24 $118,240,305,000 Citizens Bank 25 $116,115,695,000 MUFG Union Bank 26 $105,873,901,000 Capital One Bank (USA) 27 $105,498,391,000 BMO Harris Bank 28 $99,868,655,000 The Huntington National Bank 29 $93,651,365,000 Discover Bank 30 $83,988,195,000 Compass Bank 31 $83,695,723,000 Bank of the West 32 $81,283,142,000 USAA Federal Savings Bank 33 $80,375,731,000 Santander Bank, N.A. -

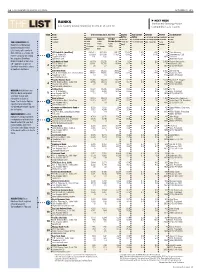

THELIST LA County Based

14 LOS ANGELES BUSINESS JOURNAL OCTOBER 31, 2016 NEXT WEEK BANKS The Fastest Growing Private THE LIST L.A. County based; ranked by assets as of June 30 Companies in L.A. County Rank Bank ($ in millions; as of June 30) Capital Non-Current Returns Profile Top Executive • name Ratios Ratios • on average assets • employees3 • name • address Assets Deposits YTD Net • tier one1 • % of total assets • on average equity • branches • title THE PACESETTER: CIT • website • 2016 • 2016 Income (Loss) • total risk- • % of total loans (Jan. 1-June 30) • year • phone • 2016 2 Bank N.A. is the largest • 2015 • 2015 based founded • % change • % change • 2015 bank headquartered in (loss) (loss) L.A. County with assets of $43.4 billion as of June 30. CIT Bank N.A. (OneWest)4 $43,413 $32,928 ($9.7) 12.6% 1.6% -0% 3,734 Ellen Alemany 888 E. Walnut St. $21,650 $14,889 $115.4 13.8% 2% -0.4% 71 Chairwoman, CEO, Parent company CIT Group 1 Pasadena 91101 101 121 1908 President Inc. acquired OneWest bankoncit.com (800) 669-2300 Bank in August of last year. City National Bank 41,979 37,576 (9.7) 9.2 0.1 0.6 3,809 Russell Goldsmith CIT continues to operate 2 555 S. Flower St. 33,491 29,703 119.4 11.1 0.2 7.7 81 Chairman, CEO OneWest-branded locations Los Angeles 90071 25 27 1954 (310) 888-6000 cnb.com in Southern California. East West Bank 32,897 28,333 209.2 11 0.6 1.3 2,801 Dominic Ng 135 N. -

1 1St Bank Yuma 1St Capital Bank 1St Financial Bank USA 1St Security

1st Bank Yuma 1st Capital Bank 1st Financial Bank USA 1st Security Bank of Washington 1st Source Bank 21st Century Bank Academy Bank, National Association ACNB Bank ACS Association Adams Bank & Trust Affiliated Bank, National Association Affinity FCU Alaska USA FCU Albany Bank and Trust Company, National Association Alerus Financial, National Association Allegiance Bank Alliance Bank Alliance Community Bank Ally Bank Alpine Bank Altabank Altra FCU Alva State Bank & Trust Company Amarillo National Bank Amerant Bank, National Association Amerasia Bank American AG Credit, ACA American Bank & Trust American Bank Center American Bank of Baxter Springs American Bank of Commerce American Bank of the North American Bank, National Association American Bank, National Association American Business Bank American Community Bank & Trust American Continental Bank American Exchange Bank American Momentum Bank American National Bank American National Bank American National Bank of Minnesota American Plus Bank, National Association American River Bank American Riviera Bank American Savings Bank, FSB 1 American State Bank American State Bank America's Christian CU Ameris Bank ANB Bank Anchor State Bank Andover State Bank Aquesta Bank Arbor Bank Arcata Economic Development Corporation Arizona FCU Arkansas Capital Corporation Armstrong Bank Arvest Bank Assemblies of God CU Associated Bank, National Association Atlantic Capital Bank, National Association Atlantic Union Bank Austin Bank, Texas National Association Avid bank Avidia Bank Axos Bank BAC Community -

FDIC Institution Listing ACTIVE AS of 3/25/2013

FDIC Institution Listing ACTIVE AS OF 3/25/2013 ‐ FOR UPDATES SEE SOURCE URL (below) Source: http://www2.fdic.gov/idasp/main.asp NAME ADDRESS CITY STATE ZIP WEBADDR 1st Advantage Bank 240 Salt Lick Road Saint Peters MO 63376 http://www.1stadvantagebank.com:80/ 1st Bank 120 Second Street, N.W. Sidney MT 59270 http://www.our1stbank.com:80/ 1st Bank & Trust 710 South Park Drive Broken Bow OK 74728 http://www.1stbankandtrust.com:80/ 1st Bank of Sea Isle City 4301 Landis Avenue Sea Isle City NJ 08243 http://www.1stbankseaisle.com:80/ 1st Bank of Troy 212 South Main Street Troy KS 66087 https://secure.fbtroyks.com 1st Bank Yuma 2799 South 4th Avenue Yuma AZ 85364 http://www.1stbankyuma.com:80/ 1st Cameron State Bank 124 South Walnut Cameron MO 64429 http://www.1stcameron.com:80/ 1st Capital Bank 5 Harris Court, Building N, Suite #3 Monterey CA 93940 http://www.1stcapitalbank.com:80/ 1st Century Bank, National Association 1875 Century Park East, Suite 1400 Los Angeles CA 90067 http://www.1cbank.com:80/ 1st Colonial Community Bank 1040 Haddon Avenue Collingswood NJ 08108 http://www.1stcolonial.com:80/ 1st Commerce Bank 5135 Camino Al Norte, Suite 4 North Las Vegas NV 89031 http://www.1stcommercebank.com:80/ 1st Community Bank 407 Third Street Sherrard IL 61281 http://www.1stcommunitybanks.com:80/ 1st Constitution Bank 2650 Route 130 Cranbury NJ 08512 http://www.1stconstitution.com:80/ 1st Enterprise Bank 818 West Seventh Street, Suite 220 Los Angeles CA 90017 http://www.1stenterprisebank.com:80/ 1st Equity Bank 3956 West Dempster Street Skokie IL 60076 1st Equity Bank Northwest 1330 Dundee Road Buffalo Grove IL 60089 1st Financial Bank USA 331 North Dakota Dunes Boulevard Dakota Dunes SD 57049 http://www.1fbusa.com:80/ 1st Manatee Bank 12215 Us Highway 301 N Parrish FL 34219 http://www.1stmanatee.com:80/ 1st National Bank 730 East Main Street Lebanon OH 45036 http://www.bankwith1st.com:80/ 1st National Bank of South Florida 1550 North Krome Avenue Homestead FL 33030 http://www.1stnatbank.com:80/ 1st National Community Bank 16924 St. -

1409549000.00

LOS ANGELES DISTRICT OFFICE Lender Ranking Report 7(a) and 504 Loan Programs Fiscal Year 2017 - 3rd Quarter (YTD) (10/01/2016 - 06/30/2017) 7(a) Loan Program 504 Loan Program 1 WELLS FARGO BANK, N.A. 318 $115,135,500 60 UNITED PACIFIC BANK 5 $10,465,000 1 CDC SMALL BUS. FINANCE CORP.* 77 $105,778,000 2 JPMORGAN CHASE BANK, N.A. 223 $53,315,600 61 BANNER BANK 5 $311,900 2 BFC FUNDING 58 $94,157,000 3 BANK OF HOPE 117 $74,575,000 62 PACIFIC WESTERN BANK 4 $7,787,000 3 CALIFORNIA STATEWIDE CDC 54 $57,020,000 4 U.S. BANK, N.A. 101 $17,389,200 63 BANK OF SANTA CLARITA 4 $5,205,000 4 MORTGAGE CAP. DEV. CORP.* 24 $34,934,000 5 EAST WEST BANK 81 $33,597,000 64 COMMERCIAL BANK OF CALIFORNIA 4 $4,767,000 5 PACIFIC WEST CDC 20 $23,808,000 6 PACIFIC CITY BANK 64 $57,539,400 65 UNITED BUSINESS BANK, F.S.B. 4 $3,943,500 6 SOUTHLAND ECONOMIC DEV. CORP. 11 $6,643,000 7 COMMONWEALTH BUSINESS BANK 56 $46,866,000 66 MISSION VALLEY BANK 4 $3,213,100 7 AMPAC TRI-STATE CDC, INC. 9 $9,315,000 8 OPEN BANK 45 $42,370,500 67 CAPITAL BANK 4 $3,190,000 8 SO CAL CDC 9 $8,710,000 9 CELTIC BANK CORPORATION 41 $12,517,800 68 OPUS BANK 4 $1,100,000 9 COASTAL BUSINESS FINANCE 5 $3,023,000 10 FIRST HOME BANK 40 $12,546,000 69 THE BANCORP BANK 4 $878,000 10 ENTERPRISE FUNDING CORPORATION 3 $2,202,000 11 SEACOAST COMMERCE BANK 38 $38,164,300 70 PCR SMALL BUSINESS DEVELOPMENT* 4 $495,000 11 SUPERIOR CA ECONOMIC DEV.