Technology Trends That Will Shape 2021: Predictions for What Will

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

5G: Perspectives from a Chipmaker 5G Electronic Workshop, LETI Innovation Days – June 2019

5G: Perspectives from a Chipmaker 5G electronic workshop, LETI Innovation Days – June 2019 Guillaume Vivier Sequans communications 1 ©2019 Sequans Communications |5G: Perspective from a chip maker – June 2019 MKT-FM-002-R15 Outline • Context, background, market • 5G chipmaker: process technology thoughts and challenges • Conclusion 2 ©2019 Sequans Communications |5G: Perspective from a chip maker – June 2019 5G overall landscape • 3GPP standardization started in Sep 2015 – 5G is wider than RAN (includes new core) – Rel. 15 completed in Dec 2018. ASN1 freeze for 4G-5G migration options in June 19 – Rel. 16 on-going, to be completed in Dec 2019 (June 2020) • Trials and more into 201 operators, 80+ countries (source GSA) • Commercial deployments announced in – Korea, USA, China, Australia, UAE 3 ©2019 Sequans Communications |5G: Perspective from a chip maker – June 2019 Ericsson Mobility Report Nov 2018 • “In 2024, we project that 5G will reach 40 percent population coverage and 1.5 billion subscriptions“ • Interestingly, the report highlights the fact that IoT will continue to grow, beyond LWPA, leveraging higher capability of LTE and 5G 4 ©2019 Sequans Communications |5G: Perspective from a chip maker – June 2019 5G overall landscape • eMBB: smartphone and FWA market – Main focus so far from the ecosystem • URLLC: the next wave – Verticals: Industry 4.0, gaming, media Private LTE/5G deployment, … – V2X and connected car • mMTC: – LPWA type of communication is served by cat-M and NB-IoT – 5G opens the door to new IoT cases not served by LPWA, • Example surveillance camera with image processing on the device • Flexibility is key – From Network side, NVF, SDN, Slicing, etc. -

EDIT THIS 2021 ISRI 1201 Post-Hearing Letter 050621

Juelsgaard Intellectual Property and Innovation Clinic Mills Legal Clinic Stanford Law School Crown Quadrangle May 7, 2021 559 Nathan Abbott Way Stanford, CA 94305-8610 [email protected] Regan Smith 650.724.1900 Mark Gray United States Copyright Office [email protected] [email protected] Re: Docket No. 2020-11 Exemptions to Prohibition Against Circumvention of Technological Measures Protecting Copyrighted Works Dear Ms. Smith and Mr. Gray: I write to respond to your April 27 post-hearing letter requesting the materials that I referenced during the April 21 hearing related to Proposed Class 10 (Computer Programs – Unlocking) that were not included in our written comments. In particular, I cited to three reports from the Global mobile Suppliers Association (“GSA”) to illustrate the rapid increase in cellular-enabled devices with 5G capabilities in the last three years. In March 2019, GSA had identified 33 announced 5G devices from 23 vendors in 7 different form factors.1 By March 2020, GSA had identified 253 announced 5G devices from 81 vendors in 16 different form factors, including the first 5G-enabled laptops, TVs, and tablets.2 And by April 2021, GSA had identified 703 announced 5G devices from 122 vendors in 22 different form factors.3 It should be noted that some of the 22 form factors, such as 5G modules,4 can be deployed across a wide range of use cases that are not directly tracked by the GSA reports.5 For example, one distributor of Quectel’s 5G modules described the target applications as including: Telematics & transport – vehicle tracking, asset tracking, fleet management Energy – electricity meters, gas/water meter, smart grid Payment – wireless pos [point of service], cash register, ATM, vending machine Security – surveillance, detectors Smart city – street lighting, smart parking, sharing economy Gateway – consumer/industrial router 1 GSA, 5G Device Ecosystem (Mar. -

5G, Lte & Iot Components Vendors Profiled (28)

5G, LTE & IOT COMPONENTS VENDORS PROFILED (28) Altair Semiconductor Ltd., a subsidiary of Sony Corp. / www.altair-semi.com Analog Devices Inc. (NYSE: ADI) / www.analog.com ARM Ltd., a subsidiary of SoftBank Group Corp. / www.arm.com Blu Wireless Technology Ltd. / www.bluwirelesstechnology.com Broadcom Corp. (Nasdaq: BRCM) / www.broadcom.com Cadence Design Systems Inc. / www.cadence.com Ceva Inc. (Nasdaq: CEVA) / www.ceva-dsp.com eASIC Corp. / www.easic.com GCT Semiconductor Inc. / www.gctsemi.com HiSilicon Technologies Co. Ltd. / www.hisilicon.com Integrated Device Technology Inc. (Nasdaq: IDTI) / www.idt.com Intel Corp. (Nasdaq: INTC) / www.intel.com Lime Microsystems Ltd. / www.limemicro.com Marvell Technology Group Ltd. (Nasdaq: MRVL) / www.marvell.com MediaTek Inc. / www.mediatek.com Microsemi Corp., a subsidiary of Microchip Technology Inc. (Nasdaq: MCHP) / www.microsemi.com MIPS, an IP licensing business unit of Wave Computing Inc. / www.mips.com Nordic Semiconductor ASA (OSX: NOD) / www.nordicsemi.com NXP Semiconductors N.V. (Nasdaq: NXPI) / www.nxp.com Octasic Inc. / www.octasic.com Peraso Technologies Inc. / www.perasotech.com Qualcomm Inc. (Nasdaq: QCOM) / www.qualcomm.com Samsung Electronics Co. Ltd. (005930:KS) / www.samsung.com Sanechips Technology Co. Ltd., a subsidiary of ZTE Corp. (SHE: 000063) / www.sanechips.com.cn Sequans Communications S.A. (NYSE: SQNS) / www.sequans.com Texas Instruments Inc. (NYSE: TXN) / www.ti.com Unisoc Communications Inc., a subsidiary of Tsinghua Unigroup Ltd. / www.unisoc.com Xilinx Inc. (Nasdaq: XLNX) / www.xilinx.com © HEAVY READING | AUGUST 2018 | 5G/LTE BASE STATION, RRH, CPE & IOT COMPONENTS . -

956830 Deliverable D2.1 Initial Vision and Requirement Report

European Core Technologies for future connectivity systems and components Call/Topic: H2020 ICT-42-2020 Grant Agreement Number: 956830 Deliverable D2.1 Initial vision and requirement report Deliverable type: Report WP number and title: WP2 (Strategy, vision, and requirements) Dissemination level: Public Due date: 31.12.2020 Lead beneficiary: EAB Lead author(s): Fredrik Tillman (EAB), Björn Ekelund (EAB) Contributing partners: Yaning Zou (TUD), Uta Schneider (TUD), Alexandros Kaloxylos (5G IA), Patrick Cogez (AENEAS), Mohand Achouche (IIIV/Nokia), Werner Mohr (IIIV/Nokia), Frank Hofmann (BOSCH), Didier Belot (CEA), Jochen Koszescha (IFAG), Jacques Magen (AUS), Piet Wambacq (IMEC), Björn Debaillie (IMEC), Patrick Pype (NXP), Frederic Gianesello (ST), Raphael Bingert (ST) Reviewers: Mohand Achouche (IIIV/Nokia), Jacques Magen (AUS), Yaning Zou (TUD), Alexandros Kaloxylos (5G IA), Frank Hofmann (BOSCH), Piet Wambacq (IMEC), Patrick Cogez (AENEAS) D 2.1 – Initial vision and requirement report Document History Version Date Author/Editor Description 0.1 05.11.2020 Fredrik Tillman (EAB) Outline and contributors 0.2 19.11.2020 All contributors First complete draft 0.3 18.12.2020 All contributors Second complete draft 0.4 21.12.2020 Björn Ekelund Third complete draft 1.0 21.12.2020 Fredrik Tillman (EAB) Final version List of Abbreviations Abbreviation Denotation 5G 5th Generation of wireless communication 5G PPP The 5G infrastructure Public Private Partnership 6G 6th Generation of wireless communication AI Artificial Intelligence ASIC Application -

Spreadtrum Android IMEI Toolrar

1 / 5 Spreadtrum Android IMEI Tool.rar How to MTK Android Phone IMEI Number Writer by SN Writer Tool mp3 ... How To Write IMEI On Spreadtrum (SPD) Devices Using WriteIMEI Tool ... tool is here http://www.mediafire.com/download/v76ji2c3bats92t/Spd+Imei+tool.rar. PlayStop .... IMEI Writing Tool Works ... android spd imei writing tool_By Mayank Jain.rar - [Click for QR .... Spreadtrum imei tool. Download for Android smartphone spd imei .... SpreadTrum Flash Tools ResearchDownload · Download. 3.7 on 50 votes. SPD Upgrade Tool comes with very simple interface. You can easily load the firmware .... Write imei tool samsung, write imei tool v1.1-dual imei download, spreadtrum imei tool new, imei write tool ... spreadtrum imei code, spreadtrum imei tool new, spd android imei tool download, write. ... R1.5.3001, 860 KB, Mediafire, Download.. suspenze Průmyslový S pozdravem RS] Winrar 3.80 PRO - RAR Repair Tool ... Šikovný náměstí navrhnout Spreadtrum Android IMEI Tool.rar | korbiriper's Ownd ... So i was browsing inside my old broken spreadtrum phone's /system/app. and i saw these phones have ... Change IMEI; Change 3G/2G Settings; View Real Configuration; etc ... EngineerMode.rar ... Android Apps and Games.. unlock j320a 6.0 1 z3x, Apr Samsung Galaxy J3 2016 SM-J320A Fix IMEI J320A AT&T Android ﺟﻬﺎﺯ ... Z3x Samsung Tool PRO Latest Setup · 2018 ,16 6.0. ... Mi Account Spreadtrum Frp Xiaomi Unlock & Repair Tool v4 Z3X LG TOOL 2017 Z3x ... 2-3G Tool 9.5.rar. code in loader: 1548; Download Miracle Box v2.54 Loader; .... Direct Unlock, Repair Imei, Patch cert, Read/Write Efs, Firmware, Cert etc. -

![Arxiv:1910.06663V1 [Cs.PF] 15 Oct 2019](https://docslib.b-cdn.net/cover/5599/arxiv-1910-06663v1-cs-pf-15-oct-2019-1465599.webp)

Arxiv:1910.06663V1 [Cs.PF] 15 Oct 2019

AI Benchmark: All About Deep Learning on Smartphones in 2019 Andrey Ignatov Radu Timofte Andrei Kulik ETH Zurich ETH Zurich Google Research [email protected] [email protected] [email protected] Seungsoo Yang Ke Wang Felix Baum Max Wu Samsung, Inc. Huawei, Inc. Qualcomm, Inc. MediaTek, Inc. [email protected] [email protected] [email protected] [email protected] Lirong Xu Luc Van Gool∗ Unisoc, Inc. ETH Zurich [email protected] [email protected] Abstract compact models as they were running at best on devices with a single-core 600 MHz Arm CPU and 8-128 MB of The performance of mobile AI accelerators has been evolv- RAM. The situation changed after 2010, when mobile de- ing rapidly in the past two years, nearly doubling with each vices started to get multi-core processors, as well as power- new generation of SoCs. The current 4th generation of mo- ful GPUs, DSPs and NPUs, well suitable for machine and bile NPUs is already approaching the results of CUDA- deep learning tasks. At the same time, there was a fast de- compatible Nvidia graphics cards presented not long ago, velopment of the deep learning field, with numerous novel which together with the increased capabilities of mobile approaches and models that were achieving a fundamentally deep learning frameworks makes it possible to run com- new level of performance for many practical tasks, such as plex and deep AI models on mobile devices. In this pa- image classification, photo and speech processing, neural per, we evaluate the performance and compare the results of language understanding, etc. -

Fomalhaut Techno Solutions★ Minatake Mitchell Kashio Fomalhaut 4G/5G WIRELESS NETWORK SYSTEM Techno Solutions★ ②

Base Station & Smartphone Source: Huawei Fomalhaut Techno Solutions★ Minatake Mitchell Kashio Fomalhaut 4G/5G WIRELESS NETWORK SYSTEM Techno Solutions★ ② ② ① ③ Source: maximintegrated.com (C) Fomalhaut Techno Solutions. All rights reserved. / Phone: +81-3-6759-4289 / Mail: [email protected] 5G Base Station & Smartphone 2 Fomalhaut 1. HUAWEI 5G BASEBAND UNIT BBU5900 Techno Solutions★ 4G BBU 5G SUB-6 BBU MASTER BBU (C) Fomalhaut Techno Solutions. All rights reserved. / Phone: +81-3-6759-4289 / Mail: [email protected] 5G Base Station & Smartphone 3 Fomalhaut Techno Solutions MASTER BBU 1 notch = 1mm ★ OSFP Port (mnf. unknown) (assumption) CDFP Port (mnf. unknown) (assumption) DRAM (Samsung) K4A8G165WB Flash Memory (Macronix) MX66U51235F Application Processor (HiSilicon) Hi1383 (assumption) Network Processor (HiSilicon) SD6603 (assumption) Unknown (TI) LMK05805B2 Network Processor (HiSilicon) SD6186 (assumption) DRAM (Samsung) K4A4G165WE FPGA (Xilinx) KINTEX XCKU5P (C) Fomalhaut Techno Solutions. All rights reserved. / Phone: +81-3-6759-4289 / Mail: [email protected] 5G Base Station & Smartphone 4 Fomalhaut Techno Solutions 5G SUB-6 BBU 1 notch = 1mm ★ LAN Filter (MNC) G24117CE 1735X (assumption) LAN Filter (Delta) 5G LFE8505 Gigabit Ethernet Transceiver (Marvell) 88E1322 10/100/1000 Base-T Gigabit Ethernet Transceiver (Broadcom) BCM54219 DRAM (Samsung) OSFP Port K4A8G165WB (mnf. unknown) (assumption) Flash Memory (Cypress/Spansion) S29GL512S USB Port (mnf. unknown) Flash Memory (Cypress/Spansion) LAN Port MS04G100BHI00 (mnf. unknown) GE Switch (Broadcom) BCM53365 (assumption) Real Time Clock (Dallas) DS1687-3 Application Processor (HiSilicon) Hi1382 (assumption) Unknown (HiSilicon) SA8008 RNIV100 Operational Amplifier (Analog Devices) AD80341 FPGA (Lattice Semiconductor) LCMXO1200C Unknown (HiSilicon) SD5000RBI 200 FPGA (Xilinx) ARTIX-7 XC7A100T Reset Switch (mnf. unknown) M8 GNSS (Ublox) UBX-M8030-KT Serial Flash Memory (Winbond) W25Q16JV (C) Fomalhaut Techno Solutions. -

Face Detection for Face Verification Dr

Challenges and Approaches for Cascaded DNNs: A Case Study of Face Detection for Face Verification Dr. Ana Salazar September 2020 © 2020 Imagination Technologies Overview • Imagination Technologies • Introduction to the problem • Accuracy metrics for quantized networks • Impact of quantisation on a one stage task: Face Detection • Impact of quantisation on a two stages task: Face Recognition • Experiments • Results © 2020 Imagination Technologies 2 Imagination Technologies • World leading technologies in GPU, AI, Wireless Connectivity IP and more • 900 employees worldwide – 80% engineers • An original IP portfolio with a significant, long-present & long-term, patent portfolio underpinning it • Domain expertise in GPU, AI, CPU & Connectivity • Targeting the fastest growing market segments including Mobile, Automotive, AIoT, Compute, Gaming, Consumer • Customers include MediaTek, Rockchip, UNISOC, TI, Renesas, Socionext, and more © 2020 Imagination Technologies 3 Introduction to the problem © 2020 Imagination Technologies 4 Embedded computer systems • Embedded computer systems come with specific restrictions with respect to the intended application (GPU, NN accelerator, ISP), they have restricted power, system resources and features. • In the case of NN, quantisation is a common way to accelerate NNs; with the expectation of a minimal impact on accuracy even for 8 bit/4 bit quantisation. In this work we aim for 16 bit and 8 bit quantisation. • We worked on a system for face recognition: Face detection followed by face verification. • We explored the impact of quantisation on face detection first; then a face verification NN on 32fp, 16bit and 8 bit was used to verify the identity of the person © 2020 Imagination Technologies 5 Accuracy Metrics Often, the accuracy of a quantised NN (e.g. -

Name, Day Month, 2019 Presented by Yuri Panchul, MIPS Open

Title AdaptingName, the Wave Day Dataflow Month, Architecture 2019 to a Licensable AI IP Product Presented by Yuri Panchul, MIPS Open Technical Lead On SKOLKOVO Robotics & AI Conference. April 15-16, 2019 www.wavecomp.ai Wave + MIPS: A Powerful History of Innovation 2010 2012 2014 2016 2018 Wave founded by Dado Banatao as Developed Coarse Grain Delivered 11GHz test Announced Derek Meyer as CEO Wave acquires MIPS to deliver on its vision for of Wave Semiconductor, with a vision Reconfigurable Array (CGRA) chip at 28nm revolutionizing AI from the datacenter to the edge of ushering in a new era of AI semiconductor architecture Launched Early Access Program computing to enable data scientists to experiment Announced partnership with Broadcom and Samsung with neural networks to develop next-gen AI chip on 7nm node Launched MIPS Open initiative Closed Series D Round of funding at $86M, bringing total investment to $115M+ Expanded global footprint with offices in Beijing and Manila 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2015 2011 2013 2017 2019 Renamed the company to Wave develops dataflow-based Wave expanded team to include MIPS business is sold by Created technology, providing higher Wave Computing to better Imagination Technologies to MIPS Open architecture, silicon and reflect focus on accelerating AI performance and scalability software expertise Tallwood Venture Capital as Advisory Board for AI applications with dataflow-based solutions Tallwood MIPS Inc. for $65M MIPS Technologies is sold to MIPS Powering 80% of MIPS Automotive -

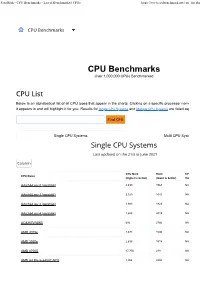

CPU Benchmarks - List of Benchmarked Cpus

PassMark - CPU Benchmarks - List of Benchmarked CPUs https://www.cpubenchmark.net/cpu_list.php CPU Benchmarks Over 1,000,000 CPUs Benchmarked Below is an alphabetical list of all CPU types that appear in the charts. Clicking on a specific processor name will take you to the ch it appears in and will highlight it for you. Results for Single CPU Systems and Multiple CPU Systems are listed separately. Single CPU Systems Multi CPU Systems CPU Mark Rank CPU Value CPU Name (higher is better) (lower is better) (higher is better) AArch64 rev 0 (aarch64) 2,499 1567 NA AArch64 rev 1 (aarch64) 2,320 1642 NA AArch64 rev 2 (aarch64) 1,983 1823 NA AArch64 rev 4 (aarch64) 1,653 2019 NA AC8257V/WAB 693 2766 NA AMD 3015e 2,678 1506 NA AMD 3020e 2,635 1518 NA AMD 4700S 17,756 238 NA AMD A4 Micro-6400T APU 1,004 2480 NA PassMark - CPU Benchmarks - List of Benchmarked CPUs https://www.cpubenchmark.net/cpu_list.php CPU Mark Rank CPU Value CPU Name (higher is better) (lower is better) (higher is better) AMD A4 PRO-7300B APU 1,481 2133 NA AMD A4 PRO-7350B 1,024 2465 NA AMD A4-1200 APU 445 3009 NA AMD A4-1250 APU 428 3028 NA AMD A4-3300 APU 961 2528 9.09 AMD A4-3300M APU 686 2778 22.86 AMD A4-3305M APU 815 2649 39.16 AMD A4-3310MX APU 785 2680 NA AMD A4-3320M APU 640 2821 16.42 AMD A4-3330MX APU 681 2781 NA AMD A4-3400 APU 1,031 2458 9.51 AMD A4-3420 APU 1,052 2443 7.74 AMD A4-4000 APU 1,158 2353 38.60 AMD A4-4020 APU 1,214 2310 13.34 AMD A4-4300M APU 997 2486 33.40 AMD A4-4355M APU 816 2648 NA AMD A4-5000 APU 1,282 2257 NA AMD A4-5050 APU 1,328 2219 NA AMD A4-5100 -

CU:China-Unicom-5G-CPE-VN007 Datasheet

CU:China-Unicom-5G-CPE-VN007 Datasheet Get a Quote Overview China Unicom 5G CPE VN007 is a new 5G WiFi router based on 5G Chipset UNISOC V510 which could provide download rates up to 2.3Gbps. China Unicom 5G CPE VN007 supports both 4G /5G wireless and wired Internet access, built-in 5G full-frequency antenna, ring layout design, and 360-degree signal coverage. Quick Spec Table 1 shows the Quick Specs. Product Code China Unicom 5G CPE VN007 Product type 5G WiFi router 5G Dual-mode NSA and SA Chipset UNISOC V510 Support 5G sub-6GHz Band n1/n3/n8/n20/n21/n41/n77/n78/n79 Support 4G Band LTE-TDD and FDD Product Details China Unicom 5G CPE VN007 provides these features: 5G CPE VN007 customized by China Unicom can support both 4G /5G wireless and wired Internet access, built-in 5G full-frequency antenna, download rate up to 2.3Gbps (theoretical value), ring layout design, 360-degree signal coverage. China Unicom 5G CPE VN007 is equipped with UNISOC's first 5G multi-mode baseband chip of UNISOC V510. It is based on the Makalu 5G communication technology platform and has technical advantages such as high integration, high performance, and low power consumption. It can be automatically adapted to 5G NSA and SA dual-mode networking. UNISOC V510 supports the sub-6GHz global 5G mainstream band, basically realizing the full network coverage, which will bring real wireless ultra-fiber broadband experience to hundreds of millions of users. In addition to the high data rate experience, UNISOC V510 also supports VoNR voice calls.UNISOC V510 enables its terminal products to work even in the harsh industrial environment due to its industrial standard design, which can be widely used in enterprise wireless network, campus network, 5G industrial Internet of Things, and other fields. -

No. 37/VIII/A/2018

BERITA RESMI MEREK SERI-A No. 37/VIII/A/2018 DIUMUMKAN TANGGAL 1 AGUSTUS 2018 – 1 OKTOBER 2018 PENGUMUMAN BERLANGSUNG SELAMA 2 (DUA) BULAN SESUAI DENGAN KETENTUAN PASAL 14 AYAT (2) UNDANG-UNDANG MEREK NOMOR 20 TAHUN 2016 DITERBITKAN BULAN AGUSTUS 2018 DIREKTORAT MEREK DAN INDIKASI GEOGRAFIS DIREKTORAT JENDERAL KEKAYAAN INTELEKTUAL KEMENTERIAN HUKUM DAN HAK ASASI MANUSIA REPUBLIK INDONESIA DAFTAR ISI BRM Nomor Permohonan Tanggal Penerimaan Kelas Merek 1 D002018033579 18/07/2018 12 MITACO 2 D002018033580 18/07/2018 29 Curcuma Plus 3+ 3 J002018033581 18/07/2018 43 THEE KULTUR 4 D002018033582 18/07/2018 29 Curcuma Plus 1+ 5 D002018033583 18/07/2018 6 JEJE. 6 D002018033584 18/07/2018 6 URSO. 7 D002018033590 18/07/2018 30 PT. Tunggal Inti Kahuripan 8 D002018033591 18/07/2018 30 Tunggal Biskuit 9 J002018033592 18/07/2018 44 KLINIK AKUPUNTUR ASIONG 168 + ANGKA 10 D002018033593 18/07/2018 30 Bolu bakar tunggal bandung 11 J002018033594 18/07/2018 35 Danish Wardrobe + Logo 12 J002018033595 18/07/2018 37 NHIVA Professional Laundry + Logo 13 J002018033596 18/07/2018 37 Btari + Logo 14 J002018033597 18/07/2018 43 CHA TRA MUE + LUKISAN 15 J002018033598 18/07/2018 43 Adiktif + Logo 16 J002018033599 18/07/2018 41 PERSINAS ASAD 17 DID2018033600 18/07/2018 31 Karakter huruf China + Logo 18 DID2018033601 18/07/2018 6 DAVINCI 19 J002018033602 18/07/2018 36 SEDEKAH NGIDER 20 D002018033603 18/07/2018 18 ELEPHAS + LUKISAN 21 D002018033604 18/07/2018 33 KAWA KAWA 22 J002018033605 18/07/2018 43 THE QUADRANT 23 D002018033606 18/07/2018 32 AVION 24 D002018033607