Commercial List) in the Matter of the Companies’ Creditors Arrangement Act, R.S.C

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

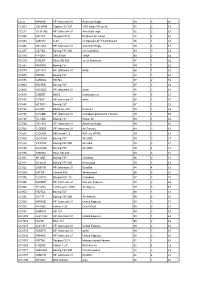

CC22 N848AE HP Jetstream 31 American Eagle 89 5 £1 CC203 OK

CC22 N848AE HP Jetstream 31 American Eagle 89 5 £1 CC203 OK-HFM Tupolev Tu-134 CSA -large OK on fin 91 2 £3 CC211 G-31-962 HP Jetstream 31 American eagle 92 2 £1 CC368 N4213X Douglas DC-6 Northern Air Cargo 88 4 £2 CC373 G-BFPV C-47 ex Spanish AF T3-45/744-45 78 1 £4 CC446 G31-862 HP Jetstream 31 American Eagle 89 3 £1 CC487 CS-TKC Boeing 737-300 Air Columbus 93 3 £2 CC489 PT-OKF DHC8/300 TABA 93 2 £2 CC510 G-BLRT Short SD-360 ex Air Business 87 1 £2 CC567 N400RG Boeing 727 89 1 £2 CC573 G31-813 HP Jetstream 31 white 88 1 £1 CC574 N5073L Boeing 727 84 1 £2 CC595 G-BEKG HS 748 87 2 £2 CC603 N727KS Boeing 727 87 1 £2 CC608 N331QQ HP Jetstream 31 white 88 2 £1 CC610 D-BERT DHC8 Contactair c/s 88 5 £1 CC636 C-FBIP HP Jetstream 31 white 88 3 £1 CC650 HZ-DG1 Boeing 727 87 1 £2 CC732 D-CDIC SAAB SF-340 Delta Air 89 1 £2 CC735 C-FAMK HP Jetstream 31 Canadian partner/Air Toronto 89 1 £2 CC738 TC-VAB Boeing 737 Sultan Air 93 1 £2 CC760 G31-841 HP Jetstream 31 American Eagle 89 3 £1 CC762 C-GDBR HP Jetstream 31 Air Toronto 89 3 £1 CC821 G-DVON DH Devon C.2 RAF c/s VP955 89 1 £1 CC824 G-OOOH Boeing 757 Air 2000 89 3 £1 CC826 VT-EPW Boeing 747-300 Air India 89 3 £1 CC834 G-OOOA Boeing 757 Air 2000 89 4 £1 CC876 G-BHHU Short SD-330 89 3 £1 CC901 9H-ABE Boeing 737 Air Malta 88 2 £1 CC911 EC-ECR Boeing 737-300 Air Europa 89 3 £1 CC922 G-BKTN HP Jetstream 31 Euroflite 84 4 £1 CC924 I-ATSA Cessna 650 Aerotaxisud 89 3 £1 CC936 C-GCPG Douglas DC-10 Canadian 87 3 £1 CC940 G-BSMY HP Jetstream 31 Pan Am Express 90 2 £2 CC945 7T-VHG Lockheed C-130H Air Algerie -

Signatory Visa Waiver Program (VWP) Carriers

Visa Waiver Program (VWP) Signatory Carriers As of May 1, 2019 Carriers that are highlighted in yellow hold expired Visa Waiver Program Agreements and therefore are no longer authorized to transport VWP eligible passengers to the United States pursuant to the Visa Waiver Program Agreement Paragraph 14. When encountered, please remind them of the need to re-apply. # 21st Century Fox America, Inc. (04/07/2015) 245 Pilot Services Company, Inc. (01/14/2015) 258131 Aviation LLC (09/18/2013) 26 North Aviation Inc. 4770RR, LLC (12/06/2016) 51 CL Corp. (06/23/2017) 51 LJ Corporation (02/01/2016) 620, Inc. 650534 Alberta, Inc. d/b/a Latitude Air Ambulance (01/09/2017) 711 CODY, Inc. (02/09/2018) A A OK Jets A&M Global Solutions, Inc. (09/03/2014) A.J. Walter Aviation, Inc. (01/17/2014) A.R. Aviation, Corp. (12/30/2015) Abbott Laboratories Inc. (09/26/2012) ABC Aerolineas, S.A. de C.V. (d/b/a Interjet) (08/24/2011) Abelag Aviation NV d/b/a Luxaviation Belgium (02/27/2019) ABS Jets A.S. (05/07/2018) ACASS Canada Ltd. (02/27/2019) Accent Airways LLC (01/12/2015) Ace Aviation Services Corporation (08/24/2011) Ace Flight Center Inc. (07/30/2012) ACE Flight Operations a/k/a ACE Group (09/20/2015) Ace Flight Support ACG Air Cargo Germany GmbH (03/28/2011) ACG Logistics LLC (02/25/2019) ACL ACM Air Charter Luftfahrtgesellschaft GmbH (02/22/2018) ACM Aviation, Inc. (09/16/2011) ACP Jet Charter, Inc. (09/12/2013) Acromas Shipping Ltd. -

Fields Listed in Part I. Group (8)

Chile Group (1) All fields listed in part I. Group (2) 28. Recognized Medical Specializations (including, but not limited to: Anesthesiology, AUdiology, Cardiography, Cardiology, Dermatology, Embryology, Epidemiology, Forensic Medicine, Gastroenterology, Hematology, Immunology, Internal Medicine, Neurological Surgery, Obstetrics and Gynecology, Oncology, Ophthalmology, Orthopedic Surgery, Otolaryngology, Pathology, Pediatrics, Pharmacology and Pharmaceutics, Physical Medicine and Rehabilitation, Physiology, Plastic Surgery, Preventive Medicine, Proctology, Psychiatry and Neurology, Radiology, Speech Pathology, Sports Medicine, Surgery, Thoracic Surgery, Toxicology, Urology and Virology) 2C. Veterinary Medicine 2D. Emergency Medicine 2E. Nuclear Medicine 2F. Geriatrics 2G. Nursing (including, but not limited to registered nurses, practical nurses, physician's receptionists and medical records clerks) 21. Dentistry 2M. Medical Cybernetics 2N. All Therapies, Prosthetics and Healing (except Medicine, Osteopathy or Osteopathic Medicine, Nursing, Dentistry, Chiropractic and Optometry) 20. Medical Statistics and Documentation 2P. Cancer Research 20. Medical Photography 2R. Environmental Health Group (3) All fields listed in part I. Group (4) All fields listed in part I. Group (5) All fields listed in part I. Group (6) 6A. Sociology (except Economics and including Criminology) 68. Psychology (including, but not limited to Child Psychology, Psychometrics and Psychobiology) 6C. History (including Art History) 60. Philosophy (including Humanities) -

The Airline Guide To

THE AIRLINE GUIDE TO PMA By David Doll & Ryan Aggergaard Welcome to the Profitable New World of PMA Airlines by their very nature combine huge, perpetual fixed costs with fickle demand. This makes them extremely vulnerable to any kind of disturbance. The years have seen a multitude of economic downturns, wars, acts of terrorism, diseases, aircraft crashes, and strikes suddenly shrink demand for air travel. Meanwhile, the costs of jet fuel and aircraft maintenance go up, up, and up. Survival demands that cost control must be a major ongoing effort for every airline in good times as well as bad. Over half the global profit in 2015 is expected to be generated by airlines based in North America ($15.7 billion). For North American airlines, the margin on earnings before interest and taxation (EBIT) is expected to exceed 12%, more than double that of the next best performing regions of Asia-Pacific and Europe. Many airlines try to save money by short building engines. They remain legal and safe, but they do not build in longevity. I call this strategy, “saving oneself into bankruptcy”. Maintenance is an investment that returns flying hours. A significant portion of a shop visit cost is fixed and is not reduced by short building the engine. Thus, an engine that returns to the shop early has a very high maintenance cost per flying hour. Within the space of a very few years the airline that short builds its engines is churning shop visits, operations are adversely affected, and maintenance costs are out of control. A far better way to control maintenance cost is to reduce the cost of maintenance materials. -

Court File No. CV-16-11359-00CL

Court File No. CV-16-11359-00CL ONTARIO SUPERIOR COURT OF JUSTICE (COMMERCIAL LIST) BETWEEN: BRIO FINANCE HOLDINGS B.V. Applicant and CARPATHIAN GOLD INC. Respondent APPLICATION UNDER SECTION 243(1) OF THE BANKRUPTCY AND INSOLVENCY ACT, R.S.C. 1985, C. B-3, AS AMENDED BOOK OF AUTHORITIES THE RECEIVER (Re Approval and Vesting Order and Discharge Order) (Returnable April 29, 2016) Dated: April 26, 2016 STIKEMAN ELLIOTT LLP Barristers & Solicitors 5300 Commerce Court West 199 Bay Street Toronto, Canada M5L 1B9 Elizabeth Pillon LSUC#: 35638M Tel: (416) 869-5623 Email: [email protected] C. Haddon Murray LSUC#: 61640P Tel: (416) 869-5239 Email: [email protected] Fax: (416) 947-0866 Lawyers for the Receiver 6553508 vl INDEX INDEX TAB 1. Royal Bank v. Soundair Corp. (1991), 7 C.B.R. (3d) 1 (Ont. C.A.) 2. Re Eddie Bauer of Canada Inc., [2009] O.J. No. 3784 (S.C.J. [Commercial List]). 3. Nelson Education Limited (Re), 2015 ONSC 5557 4. Tool-Plas Systems Inc. (Re), 2008 CanLII 54791 5. Target Canada Co. (Re), 2015 ONSC 7574 6553508 vl - .TAB 1 Royal Bank of Canada v. Soundair Corp., Canadian Pension Capital Ltd. and Canadian Insurers Capital Corp. Indexed as: Royal Bank of Canada v. Soundair Corp. (C.A.) 4 O.R. (3d) 1 ('() [1991] O.J. No. 1137 () Action No. 318/91 ONTARIO Court of Appeal for Ontario Goodman, McKinlay and Galligan JJ.A. July 3, 1991 Debtor and creditor -- Receivers -- Court-appointed receiver accepting offer to purchase assets against wishes of secured creditors Receiver acting properly and prudently -- Wishes of creditors not determinative -- Court approval of sale confirmed on appeal. -

Très Honorable Jean-Luc Pepin Mg 32 B 56

LIBRARY AND BIBLIOTHÈQUE ET ARCHIVES CANADA ARCHIVES CANADA Canadian Archives and Direction des archives Special Collections Branch canadiennes et collections spéciales Très Honorable Jean-Luc Pepin MG 32 B 56 Instrument de recherche no 1893 / Finding Aid No. 1893 Préparé en 1997 par le personnel de la Prepared in 1997 by the staff of the Section des archives politiques. Political Archives Section TABLE DES MATIÈRES/TABLE OF CONTENTS Introduction ................................................................. ii Scrapbooks (1942-1984, vol. 1-40) ...............................................1 Discours/Speeches (1963-1984, vol. 41-45) ....................................... 11 Ministre des Transports: dossiers sujets en ordre numérique Minister of Transport: numerical subject files (1980-1983, vol.46-110) .......................................................36 Ministre des Transports: dossiers sujets en ordre alphabétique Minister of Transport: alphabetical subject files p (1980-1983, vol. 111-113) ......................................................79 Ministre des Relations extérieures: dossiers sujets en ordre alphabétique Minister of External Relations: alphabetical subject files (1980-1984, vol. 114) ) ........................................................84 Dossiers sujets en ordre chronologique/Chronological subject files (1942-1996, vol. 115-122 ) .....................................................85 Notes sur différents sujets en ordre alphabétique Notes on various subjects in alphabetical order (n.d., 1967-1994, vol -

2009 Annual Report EMB MOVE RAA REG ANNUAL.Pdf 1 8/18/09 11:43 AM

2009 Annual Report EMB_MOVE_RAA_REG_ANNUAL.pdf 1 8/18/09 11:43 AM C M Y CM MY CY CMY K Report from the Chairman Rick Leach Dear RAA Members and Friends, 2009 has proven to be perhaps the most challenging year for the regional airline industry. Safety issues have been at the forefront, and as such, this year has stretched our bounds to make our industry even safer. The Regional Airline Association (RAA) plays a key role in the success of the industry. Over the past decade, the RAA has helped its 32 regional airlines form a seamless operation with their major partners, and the organization has played an integral role in our nation’s air system. Right now, more than 51 percent of daily flights are conducted by regional airlines, and we carry approximately one-quarter of our nation’s passengers. Without our service, 77 percent of US communities would cease to have any 2008-2009 air service at all. We have become a significant, and essential contributor to the airline industry and Board of Directors to the overall American economy. We employ some 60,000 professionals, and we greatly value their contribution to the regional airline industry. Chairman Scheduled passenger service has evolved to where regional and mainline airlines operate seamlessly to Rick Leach benefit the traveling public. The passenger buys one ticket and expects one level of service, so there can Trans States Holdings be only one industry safety standard. Vice Chairman Aviation safety, by its very nature, is a shared responsibility. I know all the regional airlines work closely Russell “Chip” Childs with other aviation stakeholders — our employees, our suppliers, other airlines and most importantly, SkyWest Airlines the FAA — to identify and inventory their best practices and share it collectively. -

ROYAL BANK of CANADA (Plaintiff/Respondent) V

Court File No.: CV-20-00639000-00CL ONTARIO SUPERIOR COURT OF JUSTICE (COMMERCIAL LIST) IN THE MATTER OF THE COMPANIES' CREDITORS ARRANGEMENT ACT, R.S.C. 1985, c. C-36, AS AMENDED AND IN THE MATTER OF A PLAN OF COMPROMISE OR ARRANGEMENT OF JAMES E. WAGNER CULTIVATION CORPORATION, JAMES E. WAGNER CULTIVATION LTD., JWC 1 LTD., JWC 2 LTD., JWC SUPPLY LTD. AND GROWTHSTORM INC. Applicants BOOK OF AUTHORITIES OF THE APPLICANTS (Returnable June 2, 2020) May 25, 2020 BENNETT JONES LLP 3400 One First Canadian Place P.O. Box 130 Toronto, ON M5X 1A4 Sean Zweig (LSO# 57307I) Email: [email protected] Mike Shakra (LSO# 64604K) Email: [email protected] Aiden Nelms (LSO# 74170S) Email: [email protected] Tel: (416) 863-1200 Fax: (416) 863-1716 Lawyers for the Applicants INDEX Court File No.: CV-20-00639000-00CL ONTARIO SUPERIOR COURT OF JUSTICE (COMMERCIAL LIST) IN THE MATTER OF THE COMPANIES' CREDITORS ARRANGEMENT ACT, R.S.C. 1985, c. C-36, AS AMENDED AND IN THE MATTER OF A PLAN OF COMPROMISE OR ARRANGEMENT OF JAMES E. WAGNER CULTIVATION CORPORATION, JAMES E. WAGNER CULTIVATION LTD., JWC 1 LTD., JWC 2 LTD., JWC SUPPLY LTD. AND GROWTHSTORM INC. Applicants INDEX TAB CASES 1. Target Canada Co, Re, 2015 ONSC 1487 2. Re Canwest Publishing Inc, 2010 ONSC 2870 3. Eddie Bauer of Canada Inc, Re (2009), OJ No. 3784 4. Royal Bank v Soundair Corp, [1991] 4 OR (3d) 1 5. Bloom Lake, g.p.l., Re, 2015 QCCS 1920 6. Canwest Global Communications Corp, (September 8, 2010), Toronto, CV-09-8396- 00CL (Approval and Vesting Order) 7. -

Beech 18 Production List Part 3

Last updated 10 March 2021 BEECH 18 PRODUCTION LIST Compiled by Geoff Goodall PART 3: BEECH C-45G & C-45H (Earlier military models remanufactured by Beech to USAF contract 1952-1954) A number of USAF Beech C-45Gs and Hs were transferred to the US Army. 52-10748 (c/n AF-678) was based in Europe 1959-1963 and is seen here at Gatwick in May 1963 Photo Geoff Goodall collection Civilianised C-45G N115V (AF-17) at Hawthorne Municipal, California in 1963. This aircraft has been fitted with Volpar trigear, wrap-around windscreen, enlarged windows and raised cabin roof. Photo by Eddie Coates In 1951-1952, the US Air Force placed a series of contracts with Beech Aircraft Corporation for a total of 900 modernised C-45 models, designated C-45G & C-45H. They were rebuilt from obsolete RC-45A, C-45B, C-45F, T-7 and T-11 airframes, remanufactured as zero-time airframes and assigned new Beech c/ns prefixed AF- : C-45G-BH: 372 AF-1 to 60, and AF-157 to 468: P&W R-985-AN-3 (450hp) TC-45G-BH: 96 AF-61 to 156: navigation trainer C-45H-BH: 432 AF-469 to 900: P&W R-985-AN-14BB (450hp), autopilot omitted Beech leased the disused Herington AFB, 75 miles north of Wichita KS for the contract. Hundreds of surplus military Beech 18s were flown to Herington, where an additional 385 arrived by rail boxcars from Air Materiel Command bases such as Hill AFB Utah and Ogden AFB California. At times up to 100 military Beech 18 models were lined up on the Herington ramp waiting remanufacture. -

American Airlines Pilot Recruiting & Development

What To Know At The 42nd Annual Convention Ribbon Cutting Ceremony Please join us Monday Afternoon for the ribbon cutting! Festivities begin at the entrance to the Exhibit Hall in the Convention Center at 4:30pm. Connect With #RAA17Attendees Join the conversation using #RAA17; follow us @RAAtweets Download The App For up-to-date content, guides and more, download the RAA app! Search “42nd RAA” and then enter password “palmbeach17” (case sensitive) for access. Feelin’ Lucky? Visit the following companies in the Exhibit Hall for special raffle prizes. Aero Parts Mart Booth 336 JD Aero Technical Inc. Booth 731 AeroShell Booth 708 Q1 Aviation Booth 744 Aviatron Booth 721 Skyservice Booth 712 Bose Booth 137 StandardAero Booth 326 Eagle Cap Booth 232 Vanguard Aerospace LLC Booth 135 eTT Aviation Booth 205 Wings Financial Credit Union Booth 216 2 3 4 5 REGIONAL AIRLINES ImportantB THE Regional StatsUBERS and Trends Over The Last Ten Years Regional Airlines Provide the Sole Link to Global Air Transportation for Many U.S. Communities Regional Airlines Regional airlines Regional airlines provide service to provide the ONLY operated source of air service to 95% 64% 42% of U.S. airports of U.S. airports with scheduled with scheduled of scheduled passenger passenger passenger air service in 2016 air service in 2016 departures in 2016 6 Major Airlines Hiring Forecast 3x today’s RAA pilot workforce 5,000 50,000 4,000 Equal to today’s 40,000 RAA pilot YEARLY workforce CUMULATIVE 3,000 30,000 PILOTS PILOTS NEEDED 2,000 20,000 NEEDED 1,000 10,000 0 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025 2026 RETIREMENTS GROWTH ATTRITION CUMULATIVE Source: University of North Dakota Pilot Supply Forecast 2016 Shrinking Hireable Pilot Pool Estimated active pilot certificates held by category (Ages 20-59) 400,000 350,000 300,000 250,000 200,000 150,000 100,000 50,000 Source: FAA U.S. -

Use CTL/F to Search for INACTIVE Airlines on This Page - Airlinehistory.Co.Uk

The World's Airlines Use CTL/F to search for INACTIVE airlines on this page - airlinehistory.co.uk site search by freefind search Airline 1Time (1 Time) Dates Country A&A Holding 2004 - 2012 South_Africa A.T. & T (Aircraft Transport & Travel) 1981* - 1983 USA A.V. Roe 1919* - 1920 UK A/S Aero 1919 - 1920 UK A2B 1920 - 1920* Norway AAA Air Enterprises 2005 - 2006 UK AAC (African Air Carriers) 1979* - 1987 USA AAC (African Air Charter) 1983*- 1984 South_Africa AAI (Alaska Aeronautical Industries) 1976 - 1988 Zaire AAR Airlines 1954 - 1987 USA Aaron Airlines 1998* - 2005* Ukraine AAS (Atlantic Aviation Services) **** - **** Australia AB Airlines 2005* - 2006 Liberia ABA Air 1996 - 1999 UK AbaBeel Aviation 1996 - 2004 Czech_Republic Abaroa Airlines (Aerolineas Abaroa) 2004 - 2008 Sudan Abavia 1960^ - 1972 Bolivia Abbe Air Cargo 1996* - 2004 Georgia ABC Air Hungary 2001 - 2003 USA A-B-C Airlines 2005 - 2012 Hungary Aberdeen Airways 1965* - 1966 USA Aberdeen London Express 1989 - 1992 UK Aboriginal Air Services 1994 - 1995* UK Absaroka Airways 2000* - 2006 Australia ACA (Ancargo Air) 1994^ - 2012* USA AccessAir 2000 - 2000 Angola ACE (Aryan Cargo Express) 1999 - 2001 USA Ace Air Cargo Express 2010 - 2010 India Ace Air Cargo Express 1976 - 1982 USA ACE Freighters (Aviation Charter Enterprises) 1982 - 1989 USA ACE Scotland 1964 - 1966 UK ACE Transvalair (Air Charter Express & Air Executive) 1966 - 1966 UK ACEF Cargo 1984 - 1994 France ACES (Aerolineas Centrales de Colombia) 1998 - 2004* Portugal ACG (Air Cargo Germany) 1972 - 2003 Colombia ACI -

Court File No. CV-17-11827-00CL ONTARIO

Court File No. CV-17-11827-00CL ONTARIO SUPERIOR COURT OF JUSTICE BETWEEN : DUCA FINANCIAL SERVICES CREDIT LTD. Applicant - and - 2203824 ONTARIO INC. Respondent BRIEF OF AUTHORITIES OF THE RECEIVER, MSI SPERGEL INC. DEVRY SMITH FRANK LLP Lawyers & Mediators 95 Barber Greene Road, Suite 100 Toronto, ON M3C 3E9 LAWRENCE HANSEN LSUC No. 41098W SARA MOSADEQ LSUC No. 67864K Tel.: 416-449-1400 Fax: 416- 449-7071 Lawyers for the receiver msi Spergel Inc. Court File No. CV-17-11827-00CL ONTARIO SUPERIOR COURT OF JUSTICE BETWEEN : DUCA FINANCIAL SERVICES CREDIT LTD. Applicant - and - 2203824 ONTARIO INC. Respondent INDEX TAB AUTHORITY 1 Royal Bank of Canada v. Soundair Corp., 1991 Canlii 2727 (ON CA) 2 Sierra Club of Canada v. Canada (Minister of Finance), [2002] 2 SCR 522, 2002 SCC 41 (CanLii) 3 Delview Construction Ltd. v. Meringolo, 71 O.R (3d) 1, ONCA, 4 Thomas Gold Pettinghill LLP v. Ani-Wall Concrete Forming Inc., 2012 ONSC 2182 (CanLii) 5 Budinsky v. The Breakers East Inc., 1993 canlii 5442 (ONSC) 6 Royal Trust Co. v. Montex Apparel Industries Ltd. (1972), 17 C.B.R. (N.S) 45 (Ont. C.A) TAB 1 Royal Bank of Canada v. Soundair Corp., Canadian Pension Capital Ltd. and Canadian Insurers Capital Corp. Indexed as: Royal Bank of Canada v. Soundair Corp. (C.A.) 4 O.R. (3d) 1 [1991] O.J. No. 1137 Action No. 318/91 1991 CanLII 2727 (ON CA) ONTARIO Court of Appeal for Ontario Goodman, McKinlay and Galligan JJ.A. July 3, 1991 Debtor and creditor -- Receivers -- Court-appointed receiver accepting offer to purchase assets against wishes of secured creditors -- Receiver acting properly and prudently -- Wishes of creditors not determinative -- Court approval of sale confirmed on appeal.