2012 Omni Channel Retailing State of the Union

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Completed Acquisition by Co-Operative Foodstores Limited of Eight My Local Grocery Stores from ML Convenience Limited and MLCG Limited

Completed acquisition by Co-operative Foodstores Limited of eight My Local grocery stores from ML Convenience Limited and MLCG Limited Decision on relevant merger situation and substantial lessening of competition ME/6625/16 The CMA’s decision on reference under section 22(1) of the Enterprise Act 2002 given on 19 October 2016. Full text of the decision published on 10 November 2016. Please note that [] indicates figures or text which have been deleted or replaced in ranges at the request of the parties for reasons of commercial confidentiality. CONTENTS Page SUMMARY ................................................................................................................. 2 ASSESSMENT ........................................................................................................... 3 Parties ................................................................................................................... 3 Transaction ........................................................................................................... 4 Jurisdiction ............................................................................................................ 4 Counterfactual....................................................................................................... 5 Frame of reference ............................................................................................... 7 Competitive assessment ..................................................................................... 11 Third party views ................................................................................................ -

Export Marketing Consultancy Project BA (Hons) International Business

Leeds Beckett University/BI Norwegian Business School Export Marketing Consultancy Project BA (Hons) International Business Tutor: Gareth Williams Authors: Kristina Linnea Johansson Brunvall Ole Johannes Gill Lunde Maiken Salmelid Sondre Larsson Richard Lindin Victoria Ekeli Date: 07th of May 2015 Plagiarism declaration “We certify with the signatures that this is our own work. Material from other sources has been properly acknowledge and referenced. The work has not, in whole or in part, been presented elsewhere for assessment. If this statement is untrue we acknowledge that we have committed an assessment offence. We also certify that we have taken a copy of this assignment, to make available upon request, which we will retain after the board of examiners has published results.” Researchers Kristina Linnea Johansson Brunvall Ole Johannes Gill Lunde Richard Lindin Victoria Ekeli: Maiken Salmelid Sondre Larsson 2015-Consultancy report 2 Introduction This report is a comprehensive study for the module Export Marketing at Leeds Beckett University. Through cooperation with the Norwegian grocery store company KIWI Mini Pris AS, the report will present the findings of a thorough market analysis of the UK grocery store market. It will include secondary findings through data collection and will be supported by primary research that the researchers have collected and analysed. Secondary data will be elements on what is currently happening in the market. Elements evaluated are current and future trends, customer needs and behaviour, external macro/micro environmental factors, competitors operating in the market and entry mode possibilities. Primary data methods include in-store and online observation, 3 expert interviews as well as semi-structured interviews conducted in the streets of Leeds to base findings found with customer’s opinions. -

May 4Th 2020 Written Evidence Submitted by Money Mail (COV0131)

May 4th 2020 Written evidence submitted by Money Mail (COV0131) Dear Sir/Madam, The Daily Mail’s personal finance section Money Mail has compiled a dossier of readers’ letters that we hope you will find useful to your inquiry into food supply in the Covid-19 pandemic. We first published a story on Wednesday, April 22, detailing the problems some classed as ‘clinically vulnerable’ were having securing a supermarket delivery in the lockdown. We then received hundreds of emails and letters from readers sharing their experiences. This was one of the biggest responses we have received to a story in recent memory. Money Mail then ran another story the following Wednesday (April 29th) sharing more reader stories and calling on supermarkets to do more to help. In this story, we told readers that their letters (with personal details removed) would be sent to the Efra inquiry. The pages that follow, we have included more 300 of the letters and emails we received in response to our coverage of the issue. Regards, The Money Mail team, Daily Mail 1. My husband and I are having to shield but unfortunately like most other people in similar circumstances, do not meet the very limited criteria set out by the Government for assistance with Food Deliveries. One has to ask why do so many able bodied people clap and cheer for the NHS Staff from their door steps on a Thursday evening yet a great many of them go online to do their Grocery Shopping booking a Home Delivery Slot? Do they not have the sense to see their selfishness and irresponsibility means that -

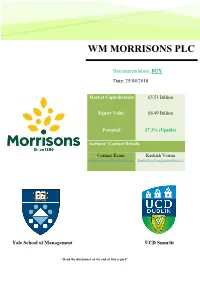

Wm Morrisons Plc

WM MORRISONS PLC Recommendation: BUY Date: 25/04/2018 Market Capitalization £5.53 Billion Equity Value £6.49 Billion Potential 17.3% (Upside) Authors’ Contact Details: Cormac Keane Kashish Verma [email protected] [email protected] Yale School of Management UCD Smurfit *Read the disclaimer at the end of this report* 01 HIGHLIGHTS • Morrisons’ divestment of their unprofitable convenience business has allowed them to turn to a strategy of capital light rebuilding of their core business. • Convenience business sold has since gone into administration. • Morrisons have successfully turned their business around after losses in 2014 and 2015 realizing increased like for like sales increases for the past two years. This growth is mainly due to their renovations of their core supermarket portfolio. • Underlying profit before tax: GBP 337 million (Up by 11.6%) • Control of the entire supply chain by vertical integration, • Very strong balance-sheet and cash flow with largely freehold estate and a low level of debt, • One of the lowest imported items ratios in the industry brings a strong position amidst weakening pound levels and BREXIT uncertainties, • Increase in their wholesale business by deals with Amazon and Ocado will increase their revenues further. • Discount stores remain a dominant force in the UK increasing their market share by roughly 5% y-o-y. This impact will result in Morrisons market share dropping from 10.53% at present to 10.19% by 2023, By Kashish Verma & Cormac Keane 02 TIMELINE •Egg and butter merchant William Morrison begins his business, set to become the 1899 company we know today. -

Press Release 25 July 2016

MONDAY 25 JULY 2016 NOT FOR BROADCAST OR PUBLICATION BEFORE 00.01 HRS MONDAY JULY 25TH 2016 Living near a supermarket can bag you a £22,000 bonus on your home • The ‘Waitrose Effect’ can boost the price of a home even further, by an average of almost £40,000 • Discount retailers also help to drive house prices in some areas New research from Lloyds Bank has found that living close to a well-known supermarket chain can add an average of £22,000 to the value of your home. The report also reveals that premium brands can add even more to nearby house prices, with properties close to a Waitrose store receiving an average boost of £38,666 (or 10%) higher than the wider town in which they are located (£425,428 v. £386,763) – the highest amongst the national supermarkets. In addition to Waitrose, properties near a Sainsbury’s, Marks and Spencer, Tesco or Iceland also command the highest house price premiums - Sainsbury’s (£27,939), Marks and Spencer (£27,182), Tesco (£22,072) and Iceland (£20,034). (See Table 1) The lowest house price premiums are in areas with an Asda (£5,026), Lidl (£3,926) or Aldi store (£1,333). Mike Songer, Lloyds Bank Mortgage Director, commented: "Our findings back-up the so-called ‘Waitrose effect’. There is definitely a correlation between the price of your home and whether it’s close to a major supermarket or not. Our figures show that the amount added to the value of your home can be even greater if located next to a brand which is perceived as upmarket. -

October US SUBS Cover

LETTER FROM HAVANA THIRTY DAYS AS A CUBAN Pinching pesos and dropping pounds in Havana By Patrick Symmes In the fi rst two decades of my life was 219 pounds, the most I’d ever off nine pounds in the two months I don’t believe I ever went more weighed in my life. before my departure. Time and than nine hours without eating. In Cuba the average salary is $20 a again, as I prepared for this trip, hor- Later on I was subjected to longer month. Doctors might make $30; rified friends speculated on what bouts—in China in the 1980s, trav- many people make only $10. I decid- food I was gorging on, what special eling with insurgents in remote ar- ed to award myself the salary of a items I was rushing to consume. eas of Colombia and Nepal, crossing Cuban journalist: $15 a month, the Their operating assumption was that South America by motorcycle, deep- wages of an offi cial intellectual. I’d being deprived of some cherished ly broke—but I always returned always wanted to be an intellectual, item for thirty days was an unbear- home, feasted, ate whatever, when- and $15 was a substantial kick above able test. They were worried about ever, and put back on what weight the proles building brick walls or cut- ice cream. In my experience, no one I’d lost—and more. I’d undergone ting cane for $12, and almost twice who is hungry craves the usual trajectory of American the $8 paid to many retirees. -

Issue 1 Download Report

ISSN 1744-6988 01 EXPERT 9 771744 698037 ADVICE GO FROM DEGREE TO FRANCHISEE What enterprising graduates need to know What THE PRICE OF SUCCESS Discover the true cost of franchise ownership BUYING A FRANCHISE Franchise Why you should let your head £3.99 | VOLUME 17 ISSUE 1 what-franchise.com rule your heart HOW TO STAY HEALTHY While taking care of business XCELERATE POWERBRANDS SPORT, FITNESS & OUTDOOR GYMS OPPORTUNITIES BUILT TO BE DIFFERENT -page special PAGE PAGE PAGE IN-HOUSE OR ON A MILLION- THE WORLD OF 13 OUTSOURCE? 14 POUND MISSION 70 WORK IS CHANGING Recruitment options for Join Fantastic Services’ And fl exible o ce ambitious franchisors seven-fi gure club franchisees can cash in CONTENts HIGHLIGHTS GO FROM SPORT FITNESS INVESTING IN DEGREE TO & OUTDOOR A FRANCHISE 34 FRANCHISEE 45 62 Our special Powerbrands You shouldn’t let your Graduates can broaden their career report highlights how opportunities heart rule your head, so here are our prospects by setting up their own in these sectors can help aspiring top tips for keeping your emotions business. We explore how a proven entrepreneurs get their careers in out of the decision making process franchise can help them do just that shape COVER STORIES 25 STEP UP TO THE CHALLENGE 74 HOODZ INTERNATIONAL’S Now’s the time to get into home care, GLOBAL EXPANSION Bluebird Care says Partner with the leading kitchen exhaust 13 IN-HOUSE OR OUTSOURCE? cleaning franchise Recruitment options for ambitious 30 TAKING THE PROVEN PATH franchisors Why investing in Guardian Angel Carers INSIGHT was -

Local Shop Report 2016

THE LOCAL SHOP REPORT 2016 A report by the Association of Convenience Stores #LocalShopReport CONTENTS ABOUT THE REPORT CONVENIENCE STORES - THE MODERN LOCAL SHOP About the report 2 The Local Shop Report 2016 marks the The value the convenience * About ACS 2 fifth edition of our report on the successful sector adds to the economy in That’s around of all UK RETAIL... ** The modern local shop 3 and diverse convenience sector in the Gross Value Added is just over...£5bn 6% Summary 4 UK. The report is the cornerstone of ACS’ Shops 6 research, providing detailed information The local shop is a long standing feature of UK communities, • Co-operatives – groups of stores that are owned by their Sales 8 about the stores that operate in the it is however constantly evolving and changing. customers, the biggest by far is The Co-operative Group, Investment 10 sector, the people they employ and the but there are a number of smaller co-operative societies The modern local shop has developed within the convenience operating convenience stores around the country; Features 12 communities that they serve. store format. It is typically characterised as follows: Jobs 14 • Multiples – chains of stores run from a head office • Open for long hours, usually seven days a week, and not (examples are McColl’s Retail Group, BP and Tesco Express); Entrepreneurs 16 In this year’s report, for the first time we subject to restrictions under the Sunday Trading Act. Communities 18 are exploring the investment decisions • Symbol groups – these are groups usually organised by a • Occupying a small store premises – usually smaller than wholesaler that are made up of independent businesses Customers 20 made by convenience store owners, 280 square metres or 3,000 square feet (see page 7). -

Registering for Priority Access to Online Supermarket Slots FAQ 19 November

The Scottish Government Covid-19 – Shielding Local Authority -Registering for priority access to online supermarket slots FAQ 19 November 1. Who is entitled to priority access to an online supermarket delivery slot? Anyone who has been placed on the shielding list by the Chief Medical Officer is entitled to register for priority access to an online supermarket delivery slot. If you have been placed on the shielding list, you will have received a letter from the Chief Medical Officer. 2. I signed up for priority access to an online supermarket delivery slot before 31 July 2020, do I need to sign up again? No. If you have already signed up for priority access you do not need to sign up again. The supermarket that you are registered with will continue to give you priority access to online delivery slots. 3. I signed up for priority access before 31 July. Can I now change to a different supermarket? The supermarkets are offering the opportunity for those on the shielding list who have not already done so, to sign up for priority access to online shopping slots. At this time, we are not able to offer anyone who has already been given priority access to one supermarket the opportunity to change to a different supermarket. If you are unhappy with any aspect of your online delivery you should contact the supermarket directly. See Appendix 1 for the contact details of individual supermarkets. 4. Will I be charged for an online delivery? Online deliveries are generally free for customers who spend a minimum amount on their groceries. -

Tesco Booker

Anticipated acquisition by Tesco plc of Booker Group plc Decision on relevant merger situation, substantial lessening of competition and reference ME/6677/17 The CMA’s decision on reference under section 33(1) of the Enterprise Act 2002 given on 12 July 2017. Full text of the decision published on 21 July 2017. Please note that [] indicates figures or text which have been deleted or replaced in ranges at the request of the parties for reasons of commercial confidentiality. Contents Page SUMMARY ...................................................................................................................... 2 ASSESSMENT ................................................................................................................ 4 Parties ........................................................................................................................ 4 Transaction ................................................................................................................ 5 Jurisdiction ................................................................................................................. 5 Procedure .................................................................................................................. 5 Background ................................................................................................................ 6 Counterfactual............................................................................................................ 9 Frame of reference ................................................................................................. -

Grocery Retail Structure 2016

Grocery Retail Structure 2016 Stores Change Store numbers Change Store numbers Change Co-operative Societies 2015 2016 Y-O-Y Multiple Retailers 2015 2016 Y-O-Y Specialist CTNs 2015 2016 Y-O-Y The Co-operative Group 1,836 1955 6.5% Tesco 504 504 0.0% Mccoll's Retail Group (Martins/RS McColl’s) 516 450 -12.8% Midcounties 181 159 -12.2% Tesco (attached) 485 485 0.0% JCR (Rippleglen) 85 86 1.2% Southern 188 185 -1.6% Tesco (standalone) 19 19 0.0% Aleef News 15 30 100.0% Scotmid 160 154 -3.8% Morrisons 333 334 0.3% Other CTNs 2,385 2301 -3.5% Central England 155 151 -2.6% Morrisons (attached) 317 318 0.3% Co-operatives Store numbers Change TOTAL 3,001 2,867 -4.5% SUPERMARKETS SUPERSTORES HYPERMARKETS East of England 82 84 2.4% Morrisons (standalone) 16 16 0.0% 2015 2016 2015 2016 2015 2016 2015 2016 Y-O-Y Lincolnshire 64 66 3.1% Sainsbury's 299 303 1.3% The Co-operative Group 726 679 – – – – 726 679 -6.5% Chelmsford Star 35 30 -14.3% Sainsbury's (attached) 281 278 -1.1% Central England 104 118 3 3 – – 107 121 13.1% Specialist Off-licences Heart of England 23 24 4.3% Sainsbury's (standalone) 18 25 38.9% Midcounties 63 64 – – – – 63 64 1.6% Bargain Booze (total) 463 465 0.4% Tamworth 12 11 -8.3% Asda 261 280 7.3% East of England 50 55 – – – – 50 55 10.0% Bargain Booze 223 223 0.0% Other Co-operatives 29 31 6.9% Asda (attached) 240 257 7.1% Scotmid 37 36 – – – – 37 36 -2.7% Bargain Booze Plus 214 214 0.0% TOTAL 2,765 2,850 3.1% Asda (standalone) 21 23 9.5% Southern 20 19 – – – – 20 19 -5.0% Wine Rack 26 28 7.7% Co-operative Societies 256 246 -3.9% Lincolnshire 15 16 – – – – 15 16 6.7% Majestic Wine Warehouse 211 216 2.4% 14 15 1 1 FORECOURTS The Co-operative Group (attached) 13 8 -38.5% Channel Islands – – 15 16 6.7% Whittalls (incl. -

Global Powers of Retailing 2021 Contents

Global Powers of Retailing 2021 Contents Top 250 quick statistics 4 Global economic outlook 5 Top 10 highlights 8 Impact of COVID-19 on leading global retailers 13 Global Powers of Retailing Top 250 17 Geographic analysis 25 Product sector analysis 32 New entrants 36 Fastest 50 38 Study methodology and data sources 43 Endnotes 47 Contacts 49 Acknowledgments 49 Welcome to the 24th edition of Global Powers of Retailing. The report identifies the 250 largest retailers around the world based on publicly available data for FY2019 (fiscal years ended through 30 June 2020), and analyzes their performance across geographies and product sectors. It also provides a global economic outlook, looks at the 50 fastest-growing retailers, and highlights new entrants to the Top 250. Top 250 quick statistics, FY2019 Minimum retail US$4.85 US$19.4 revenue required to be trillion billion among Top 250 Aggregate Average size US$4.0 retail revenue of Top 250 of Top 250 (retail revenue) billion 5-year retail Composite 4.4% revenue growth net profit margin 4.3% Composite (CAGR Composite year-over-year retail FY2014-2019) 3.1% return on assets revenue growth 5.0% Top 250 retailers with foreign 22.2% 11.1 operations Share of Top 250 Average number aggregate retail revenue of countries where 64.8% from foreign companies have operations retail operations Source: Deloitte Touche Tohmatsu Limited. Global Powers of Retailing 2021. Analysis of financial performance and operations for fiscal years ended through 30 June 2020 using company annual reports, press releases, Supermarket News, Forbes America’s largest private companies and other sources.