EVERGREEN MEDIA CORP (Form: 8-K, Filing Date: 07/02/1997)

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Living Side by Side with Terrorists Do Terrorists

A Special Report Sponsored by Voice of Russia and Russia House Associates World Terror Alert May 9, 2013 TERRORISM “EXTREMISM DOESN’T HAVE A HOMELAND” US-RUSSIA DIALOGUE “I SURVIVED A terror attack is the most grim occurrence which pulls people together. Be it a group of survivors meeting to share their feelings and reminisce about loved ones lost, a joint operation by DO THE TERROR international services working on its prevention, or even extremists themselves who have TERRORISTS become inspired by yet another attack seen on the news, these attacks create a strong ATTACK” connection of a special kind. The Boston marathon bombing has reminded society of HAVE By Margarita Bogatova the ongoing war against terrorism which started after 9/11. Each terror attack affects The Voice of Russia Staff Writer countless lives and each person has a story, proving that no one is A HOME? immune to terrorism. Olga Protas has celebrated two President Vladimir Putin called Rus- birthdays each year since October sia one of the earliest victims of inter- 2002. She was 15 when terrorists took national terrorism. “It’s not about na- her and 916 other people in the audi- tionality or religion, as we have said a ence of Russia’s Dubrovka Theater in thousand times – what is at issue here Moscow hostage. The event has be- is extremism”. come known worldwide as “the Nord- Putin called for an increase of joint Ost siege”. About 50 militants rushed anti-terrorism work between Moscow into the building during the middle and Washington. Real cooperation of the performance and held the au- should replace empty declarations that dience and staff at gunpoint for 57 terrorism is a common threat, he stated. -

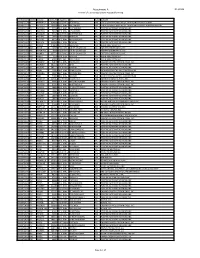

Attachment a DA 19-526 Renewal of License Applications Accepted for Filing

Attachment A DA 19-526 Renewal of License Applications Accepted for Filing File Number Service Callsign Facility ID Frequency City State Licensee 0000072254 FL WMVK-LP 124828 107.3 MHz PERRYVILLE MD STATE OF MARYLAND, MDOT, MARYLAND TRANSIT ADMN. 0000072255 FL WTTZ-LP 193908 93.5 MHz BALTIMORE MD STATE OF MARYLAND, MDOT, MARYLAND TRANSIT ADMINISTRATION 0000072258 FX W253BH 53096 98.5 MHz BLACKSBURG VA POSITIVE ALTERNATIVE RADIO, INC. 0000072259 FX W247CQ 79178 97.3 MHz LYNCHBURG VA POSITIVE ALTERNATIVE RADIO, INC. 0000072260 FX W264CM 93126 100.7 MHz MARTINSVILLE VA POSITIVE ALTERNATIVE RADIO, INC. 0000072261 FX W279AC 70360 103.7 MHz ROANOKE VA POSITIVE ALTERNATIVE RADIO, INC. 0000072262 FX W243BT 86730 96.5 MHz WAYNESBORO VA POSITIVE ALTERNATIVE RADIO, INC. 0000072263 FX W241AL 142568 96.1 MHz MARION VA POSITIVE ALTERNATIVE RADIO, INC. 0000072265 FM WVRW 170948 107.7 MHz GLENVILLE WV DELLA JANE WOOFTER 0000072267 AM WESR 18385 1330 kHz ONLEY-ONANCOCK VA EASTERN SHORE RADIO, INC. 0000072268 FM WESR-FM 18386 103.3 MHz ONLEY-ONANCOCK VA EASTERN SHORE RADIO, INC. 0000072270 FX W289CE 157774 105.7 MHz ONLEY-ONANCOCK VA EASTERN SHORE RADIO, INC. 0000072271 FM WOTR 1103 96.3 MHz WESTON WV DELLA JANE WOOFTER 0000072274 AM WHAW 63489 980 kHz LOST CREEK WV DELLA JANE WOOFTER 0000072285 FX W206AY 91849 89.1 MHz FRUITLAND MD CALVARY CHAPEL OF TWIN FALLS, INC. 0000072287 FX W284BB 141155 104.7 MHz WISE VA POSITIVE ALTERNATIVE RADIO, INC. 0000072288 FX W295AI 142575 106.9 MHz MARION VA POSITIVE ALTERNATIVE RADIO, INC. 0000072293 FM WXAF 39869 90.9 MHz CHARLESTON WV SHOFAR BROADCASTING CORPORATION 0000072294 FX W204BH 92374 88.7 MHz BOONES MILL VA CALVARY CHAPEL OF TWIN FALLS, INC. -

Maryland's Cigarette Restitution Fund Program

Maryland's Cigarette Restitution Fund Program Sustainable Minority Outreach and Technical Assistance Model. A Comprehensive Model For African-American And Other Minorities February 2001 Maryland Department of Health and Mental Hygiene Parris N. Glendening, Governor • Kathleen Kennedy Townsend, Lt. Governor • Georges C. Benjamin, MD, Secretary Carlessia A. Hussein, Dr.PH, Director CRFP Prepared by Naomi Booker & Associates Maryland Cigarette Restitution Fund Program ©Copyright 2001 Page i of 48 TABLE OF CONTENTS Introduction ....................................................................................................i Overview of the SMOTA Model .................................................................... iii Phase I .................................................................................................................................1 Prepare to Engage: Before Starting Work in a Community Component I.1: Formulate and Clarify Minority Outreach and Technical Assistance Goals.......................................................................................................................1 Component I.2: Seek to Understand Each Minority Community......................................................................5 Phase II For Outreach and Technical Assistance to Occur........................................... 13 Component II. 1: Establish and Develop Relationships In Each Minority Community...................................................................................................................... -

Where Learning Powers the Future

Where Learning Powers the Future 2021-2022 Table of Contents Welcome Letter .............................................................................................................. 4 Handbook Introduction ................................................................................................... 5 Equal Opportunity Employer........................................................................................... 5 Nondiscrimination Policy ................................................................................................. 6 Mission ........................................................................................................................... 6 Vision ............................................................................................................................. 6 Beliefs ............................................................................................................................ 6 Criminal History Background .......................................................................................... 7 School Board Members and Division Superintendent ..................................................... 8 Substitute Coordinators Contact Information .................................................................. 9 School Contact Information .......................................................................................... 10 Requirements ............................................................................................................... 11 Long-Term -

Chancellor /Evergreen

JULY 11, 1997 I N S I D E RESEARCH THEME ISSUE Sinclair To Buy Heritage? R &R's semi annual look at research Price tag could be as high as $675 million methodology and results offers these perspectives: BY HEATHER VAN SL(X7rEN tage media operations and keep R&R WASHINGTON BUREAU AC: Automated callout its in -store and direct-mail mar- Alternative: Perceptual interpretation Heritage Media's radio and keting businesses. CHR: Combing the diaries television stations are for sale. Heritage President/CEO Paul Country: Mining more from PI s That much, at least, is obvious. Fiddick told R &R that as of last NAC /Smooth Jazz: Vocals: How much The question now is, will the new Friday "there was no signed deal" is "not an is too much? owner be Sinclair Communica- He noted that Heritage but said it's Rock: Strengthening your image tions? Most indicators are point- active participant," of sad that people think a Urban: Frank Cody on format's ing precisely that way, and the "kind failure to categorically deny strengths rumored price is as high as $675 the 24 radio and six something is a confirmation:' Pages 39, 50, 59, 69, 76, 82, 88 million for TV stations. Still, Sinclair confirmed last The deal with Sinclair, if it hap- week it had recently submitted a OUT OF TIME pens, is contingent upon News $500 million bid for radio and TV Consultant John Lund gives us a five -point Corp.'s closing of its $1.3 billion stations. And sources hint that the plan that will help you manage your most buy of Heritage, expected late this actual bid was much, much high- precious commodity -time. -

Where Learning Powers the Future

Where Learning Powers the Future 2021-2022 Table of Contents Welcome Letter .............................................................................................................. 4 Handbook Introduction ................................................................................................... 5 Equal Opportunity Employer........................................................................................... 5 Nondiscrimination Policy ................................................................................................. 6 Mission ........................................................................................................................... 6 Vision ............................................................................................................................. 6 Beliefs ............................................................................................................................ 6 Criminal History Background .......................................................................................... 7 School Board Members and Division Superintendent ..................................................... 8 Substitute Coordinators Contact Information .................................................................. 9 School Contact Information .......................................................................................... 10 Requirements ............................................................................................................... 11 Long-Term -

Inside This Issue

News Serving DX’ers since 1933 Volume 83, No. 5 ● November 30, 2015 ● (ISSN 0737-1639) Inside this issue . 2 … AM Switch 13 … Musings of the Members 21 … Tower Calendar / DXtreme 5 … Domestic DX Digest West 14 … International DX Digest 22 … KC 2016 Call for Papers 9 … Domestic DX Digest East 17 … FCC CP Status Report 23 … Space Wx / FCC Silent List 2016 DXers Gathering: DXers in AM, FM, and Just FYI, as a nonprofit club run entirely by TV, including the NRC, IRCA, WTFDA, and uncompensated volunteers, NRC policy is not to DecaloMania will gather on September 9‐11, 2016 take advertising in DX News. However, we will in Kansas City, MO. It will be held at the Hyatt publish free announcements of commercial Place Kansas City Airport, 7600 NW 97th products that may be of interest to members – no Terrace. Information on registration will be made more than once a year, on a “space available” available starting in January. Rates are $99.00 per basis. Contact [email protected] for night for 1 to 3 persons per room, plus taxes and more info. fees. Plan to arrive on Thursday for 3 nights, and Membership Report we end Sunday at noon. Free airport transfers “Please renew my membership in the NRC for and breakfast each morning. Registration: $55 another year.” – Dave Bright. per person which includes a free Friday evening New Members: Welcome to Antoine Gamet, pizza party and Saturday evening banquet. Coatesville, PA; and Joseph Kremer, Bridgeport, Checks made payable to “National Radio Club” WV. and sent to Ernest J. -

530 CIAO BRAMPTON on ETHNIC AM 530 N43 35 20 W079 52 54 09-Feb

frequency callsign city format identification slogan latitude longitude last change in listing kHz d m s d m s (yy-mmm) 530 CIAO BRAMPTON ON ETHNIC AM 530 N43 35 20 W079 52 54 09-Feb 540 CBKO COAL HARBOUR BC VARIETY CBC RADIO ONE N50 36 4 W127 34 23 09-May 540 CBXQ # UCLUELET BC VARIETY CBC RADIO ONE N48 56 44 W125 33 7 16-Oct 540 CBYW WELLS BC VARIETY CBC RADIO ONE N53 6 25 W121 32 46 09-May 540 CBT GRAND FALLS NL VARIETY CBC RADIO ONE N48 57 3 W055 37 34 00-Jul 540 CBMM # SENNETERRE QC VARIETY CBC RADIO ONE N48 22 42 W077 13 28 18-Feb 540 CBK REGINA SK VARIETY CBC RADIO ONE N51 40 48 W105 26 49 00-Jul 540 WASG DAPHNE AL BLK GSPL/RELIGION N30 44 44 W088 5 40 17-Sep 540 KRXA CARMEL VALLEY CA SPANISH RELIGION EL SEMBRADOR RADIO N36 39 36 W121 32 29 14-Aug 540 KVIP REDDING CA RELIGION SRN VERY INSPIRING N40 37 25 W122 16 49 09-Dec 540 WFLF PINE HILLS FL TALK FOX NEWSRADIO 93.1 N28 22 52 W081 47 31 18-Oct 540 WDAK COLUMBUS GA NEWS/TALK FOX NEWSRADIO 540 N32 25 58 W084 57 2 13-Dec 540 KWMT FORT DODGE IA C&W FOX TRUE COUNTRY N42 29 45 W094 12 27 13-Dec 540 KMLB MONROE LA NEWS/TALK/SPORTS ABC NEWSTALK 105.7&540 N32 32 36 W092 10 45 19-Jan 540 WGOP POCOMOKE CITY MD EZL/OLDIES N38 3 11 W075 34 11 18-Oct 540 WXYG SAUK RAPIDS MN CLASSIC ROCK THE GOAT N45 36 18 W094 8 21 17-May 540 KNMX LAS VEGAS NM SPANISH VARIETY NBC K NEW MEXICO N35 34 25 W105 10 17 13-Nov 540 WBWD ISLIP NY SOUTH ASIAN BOLLY 540 N40 45 4 W073 12 52 18-Dec 540 WRGC SYLVA NC VARIETY NBC THE RIVER N35 23 35 W083 11 38 18-Jun 540 WETC # WENDELL-ZEBULON NC RELIGION EWTN DEVINE MERCY R. -

Jenny's Image on the Block

DAILY 05-21-05 MD SU C1 CMYK [ ABCDE] Inside 2 DeGeneres among Daytime Emmy winners C 3 Names & Faces: “Star Wars” sets records The Arts 5 Theater: Accokeek Creek’s “Matt & Ben” Television Comics 7 Weekend TV: Highlights and listings Style Saturday, May 21, 2005 S It’s E-Party Central After Video Games Expo, Sony, Microsoft and Nintendo Let ’Er Rip By Jose Antonio Vargas The global gaming industry ap- wise, it’s an all-out war. It feels Washington Post Staff Writer pears to have picked up where old like the late ’90s again. Hollywood, the anemic record in- Imagine the shouting match: LOS ANGELES — Here at E3, dustry and long-forgotten dot- Microsoft: We’ve got the Kill- the Vatican conclave of the video coms left off — throwing a week’s ers! The Chemical Brothers! game industry (only much loud- worth of mass shebangs that get We’re at the Shrine Auditorium! er), it’s Sony’s PlayStation 3 vs. bigger every year, bigger even Sony: Oh yeah? We’re way up Microsoft’s Xbox 360. The new than what Vanity Fair and Elton on a hill, overlooking Dodger Sta- Xbox made the rounds, and Sony John have done to Oscar night, dium, with a spectacular view of showed off dizzying specs for its minus designer gowns. E3 (short- Los Angeles! We’ve got Jimmy new baby, due next year. Pub- hand for the Electronic Entertain- Eat World! Steve Jones of the Sex licists are blowing smoke about ment Expo, the 11th annual L.A.- Pistols! Brandon Boyd of Incu- both, but really it comes down to based confab of all things video bus! Liz Phair! ZED INK this: Which giant throws the best game) could never just be anoth- Microsoft threw a megaparty at the Shrine Auditorium in Los Angeles for its new Xbox. -

National Association of Black Owned Broadcasters

NATIONAL ASSOCIATION OF BLACK OWNED BROADCASTERS 1201 Connecticut Avenue, N.W., Suite 200, Washington, D.C. 20036 (202) 463 -8970 • Fax: (202) 429-0657 • E-mail: [email protected] September 2, 2015 BOARD OF DIRECTORS JAMES L. Wlf'•STO'-: Pres idem MICHAEL L. CARTER Marlene H. Dortch, Secretary Vice President KAREi'- E. SLADE Federal Communications Commission Treasu1e1 445 12th Street NW LOIS E. WRIGHT Counsel 10 the Boa1d Washington, D. C. 20554 ARTHUR BENJAMIN CAROL MOORE CUTIING Re: Notice of Ex Parte Communication, MB Docket 13- ALFRED G. UGGll'S 249, Revitalization of the AM Radio Service JERRY LOPES ("Notice") OuJUAI' MCCOY STEVEN ROBERTS MELODY SPANN.COOPER Review of the Emergency Alert System (EB Docket JAM ES E. WOLFE. JR. No. 04-296); Recommendations of the Independent Panel Reviewing the Impact of Hurricane Katrina on Communications Networks (EB Docket 06-119) Dear Ms. Dortch: On August 31 , 2015, the undersigned President of the National Association of Black Owned Broadcasters, Inc. ("NABOB") along with Francisco Montero of Fletcher, Heald & Hildreth, PLC, and David Honig, President Emeritus and Senior Advisor, Multicultural Media, · Telecommunications and Internet Council ("MMTC") met with Commissioner Mignon Clyburn and Chanelle Hardy, Chief of Staff and \1edia Legal Advisor, to discuss the most important and effective proposal set forth in the AM Revitalization Notice: opening an application filing window for FM translators that would be limited to AM broadcast licensees. As the Commission recognized in the Notice, the best way to help the largest number of AM stations to quickly and efficiently improve their service is to open such an AM-only window. -

Substitute Handbook 2019-2020

Substitute Handbook 2019-2020 Table of Contents Welcome Letter .............................................................................................................. 4 Handbook Introduction ................................................................................................... 5 We are Equal Opportunity Employer .............................................................................. 5 Mission ........................................................................................................................... 6 Vision ............................................................................................................................. 6 Beliefs ............................................................................................................................ 6 School Board Members and Division Superintendent ..................................................... 7 Contact Information for Substitutes ................................................................................. 7 School Substitute Coordinators ...................................................................................... 8 School Contact Information ............................................................................................ 9 Requirements ............................................................................................................... 10 Criminal History Background ........................................................................................ 10 Long-Term Substitute Teacher -

TV Channel 5-6 Radio Proposal

Before the Federal Communications Commission Washington, D.C. 20554 In the Matter of ) ) Promoting Diversification of Ownership ) MB Docket No 07-294 in the Broadcasting Services ) ) 2006 Quadrennial Regulatory Review – Review of ) MB Docket No. 06-121 the Commission’s Broadcast Ownership Rules and ) Other Rules Adopted Pursuant to Section 202 of ) the Telecommunications Act of 1996 ) ) 2002 Biennial Regulatory Review – Review of ) MB Docket No. 02-277 the Commission’s Broadcast Ownership Rules and ) Other Rules Adopted Pursuant to Section 202 of ) the Telecommunications Act of 1996 ) ) Cross-Ownership of Broadcast Stations and ) MM Docket No. 01-235 Newspapers ) ) Rules and Policies Concerning Multiple Ownership ) MM Docket No. 01-317 of Radio Broadcast Stations in Local Markets ) ) Definition of Radio Markets ) MM Docket No. 00-244 ) Ways to Further Section 257 Mandate and To Build ) MB Docket No. 04-228 on Earlier Studies ) To: Office of the Secretary Attention: The Commission BROADCAST MAXIMIZATION COMMITTEE John J. Mullaney Mark Lipp Paul H. Reynolds Bert Goldman Joseph Davis, P.E. Clarence Beverage Laura Mizrahi Lee Reynolds Alex Welsh SUMMARY The Broadcast Maximization Committee (“BMC”), composed of primarily of several consulting engineers and other representatives of the broadcast industry, offers a comprehensive proposal for the use of Channels 5 and 6 in response to the Commission’s solicitation of such plans. BMC proposes to (1) relocate the LPFM service to a portion of this spectrum space; (2) expand the NCE service into the adjacent portion of this band; and (3) provide for the conversion and migration of all AM stations into the remaining portion of the band over an extended period of time and with digital transmissions only.