Conscience: Taxes for Peace Not

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Black Anarchism, Pedro Riberio

TABLE OF CONTENTS 1. Introduction.....................................................................................................................2 2. The Principles of Anarchism, Lucy Parsons....................................................................3 3. Anarchism and the Black Revolution, Lorenzo Komboa’Ervin......................................10 4. Beyond Nationalism, But not Without it, Ashanti Alston...............................................72 5. Anarchy Can’t Fight Alone, Kuwasi Balagoon...............................................................76 6. Anarchism’s Future in Africa, Sam Mbah......................................................................80 7. Domingo Passos: The Brazilian Bakunin.......................................................................86 8. Where Do We Go From Here, Michael Kimble..............................................................89 9. Senzala or Quilombo: Reflections on APOC and the fate of Black Anarchism, Pedro Riberio...........................................................................................................................91 10. Interview: Afro-Colombian Anarchist David López Rodríguez, Lisa Manzanilla & Bran- don King........................................................................................................................96 11. 1996: Ballot or the Bullet: The Strengths and Weaknesses of the Electoral Process in the U.S. and its relation to Black political power today, Greg Jackson......................100 12. The Incomprehensible -

Selected Chronology of Political Protests and Events in Lawrence

SELECTED CHRONOLOGY OF POLITICAL PROTESTS AND EVENTS IN LAWRENCE 1960-1973 By Clark H. Coan January 1, 2001 LAV1tRE ~\JCE~ ~')lJ~3lj(~ ~~JGR§~~Frlt 707 Vf~ f·1~J1()NT .STFie~:T LA1JVi~f:NCE! i(At.. lSAG GG044 INTRODUCTION Civil Rights & Black Power Movements. Lawrence, the Free State or anti-slavery capital of Kansas during Bleeding Kansas, was dubbed the "Cradle of Liberty" by Abraham Lincoln. Partly due to this reputation, a vibrant Black community developed in the town in the years following the Civil War. White Lawrencians were fairly tolerant of Black people during this period, though three Black men were lynched from the Kaw River Bridge in 1882 during an economic depression in Lawrence. When the U.S. Supreme Court ruled in 1894 that "separate but equal" was constitutional, racial attitudes hardened. Gradually Jim Crow segregation was instituted in the former bastion of freedom with many facilities becoming segregated around the time Black Poet Laureate Langston Hughes lived in the dty-asa child. Then in the 1920s a Ku Klux Klan rally with a burning cross was attended by 2,000 hooded participants near Centennial Park. Racial discrimination subsequently became rampant and segregation solidified. Change was in the air after World "vV ar II. The Lawrence League for the Practice of Democracy (LLPD) formed in 1945 and was in the vanguard of Post-war efforts to end racial segregation and discrimination. This was a bi-racial group composed of many KU faculty and Lawrence residents. A chapter of Congress on Racial Equality (CORE) formed in Lawrence in 1947 and on April 15 of the following year, 25 members held a sit-in at Brick's Cafe to force it to serve everyone equally. -

Ch 4, Launching the Peace Movement, and Skim Through Ch

-----------------~-----~------- ---- TkE u. s. CENT'R.A.L A.MERIC.A. PE.A.CE MOVEMENT' CHRISTIAN SMITH The University of Chicago Press Chicago and London List of Tables and Figures ix Acknowledgments xi Acronyms xiii Introduction xv portone Setting the Context 1. THE SOURCES OF CENTRAL AMERICAN UNREST 3 :Z. UNITED STATES INTERVENTION 18 J. Low-INTENSITY WARFARE 33 porttwo The Movement Emerges -'. LAUNCHING THE PEACE MOVEMENT 5 9 5. GRASPING THE BIG PICTURE 87 '. THE SOCIAL STRUCTURE OF MORAL OUTRAGE 13 3 '1'. THE INDIVIDUAL ACTIVISTS 169 porlthreeMaintaining the Struggle 8, NEGOTIATING STRATEGIES AND COLLECTIVE IDENTITY 211 1'. FIGHTING BATTLES OF PUBLIC DISCOURSE 231 1 O. FACING HARASSMENT AND REPRESSION 280 11. PROBLEMS FOR PROTESTERS CLOSER TO HOME 325 1%. THE MOVEMENT'S DEMISE 348 portfour Assessing the Movement 1J. WHAT DID THE MOVEMENT ACHIEVE? 365 1-'. LESSONS FOR SOCIAL-MOVEMENT THEORY 378 ii CONTENTS Appendix: The Distribution and Activities of Central America Peace Movement Organizations 387 Notes 393 Bibliography 419 ,igures Index 453 Illustrations follow page 208. lobles 1.1 Per Capita Basic Food Cropland (Hectares) 10 1.2 Malnutrition in Central America 10 7.1 Comparison of Central America Peace Activists and All Adult Ameri cans, 1985 171 7.2 Occupational Ratio of Central America Peace Movement Activist to All Americans, 1985 173 7.3 Prior Social Movement Involvement by Central American Peace Activists (%) 175 7.4 Central America Peace Activists' Prior Protest Experience (%) 175 7.5 Personal and Organizational vs. Impersonal -

Introduction

Introduction Introduction In this book I have gathered documents that show how war tax resistance devel- oped in the Society of Friends in America and how Quaker war tax resistance was seen by other Americans. These documents highlight the search for truth within the Society of Friends as well as the interest, concern, and occasional aggravation of those outside of the Society who found themselves trying to understand or nav- igate the Quaker point of view. Here, I’ll introduce some of the common themes found in these documents. The bounds to Quaker taxpaying were marked by two Biblical instructions in particular, found in Romans 13 and Acts 5. The first says: Let every soul be subject unto the higher powers. For there is no power but of God: the powers that be are ordained of God. Whosoever therefore resists the power, resists the ordinance of God.... ye must needs be subject, not only for wrath, but also for conscience sake. For for this cause pay ye tribute also... The second provides an exception to the rule: We ought to obey God rather than men. Much of the debate about Quaker war tax resistance, both inside the Society of Friends and with its critics, centered on how liberally this exception was to be interpreted. Does providing funds to help the government make war violate God’s commands in a way that triggers this exception, or are today’s higher powers no less deserving of tribute than was Cæsar in his day? A typical Quaker war tax resistance position went something like this: We must cheerfully pay taxes for the support of civil government even when that gov- ernment uses the tax money to fund a budget that includes military spending, but we must refuse to pay any tax that is levied expressly for the purpose of conduct- ing a war or supporting the military. -

Bedau’S Introduction Sets out the Issues and Shows How the Various Authors Shed Light on Each Aspect of Them

CIVIL DISOBEDIENCE in focus How can civil disobedience be defined and distinguished from revolution or lawful protest? What, if anything, justifies civil disobedience? Can nonviolent civil disobedience ever be effective? The issues surrounding civil disobedience have been discussed since at least 399 BC and, in the wake of such recent events as the protest at Tiananmen Square, are still of great relevance. By presenting classic and current philosophical reflections on the issues, this book presents all the basic materials needed for a philosophical assessment of the nature and justification of civil disobedience. The pieces included range from classic statements by Plato, Thoreau, and Martin Luther King, to essays by leading contemporary thinkers such as Rawls, Raz, and Singer. Hugo Adam Bedau’s introduction sets out the issues and shows how the various authors shed light on each aspect of them. Hugo Adam Bedau is Austin Fletcher Professor of Philosophy at Tufts University. ROUTLEDGE PHILOSOPHERS IN FOCUS SERIES General Editor: Stanley Tweyman York University, Toronto GÖDEL’S THEOREM IN FOCUS Edited by S. G. Shanker J. S. MILL: ON LIBERTY IN FOCUS Edited by John Gray and G. W. Smith DAVID HUME: DIALOGUES CONCERNING NATURAL RELIGION IN FOCUS Edited by Stanley Tweyman RENÉ DESCARTES’ MEDITATIONS IN FOCUS Edited by Stanley Tweyman PLATO’S MENO IN FOCUS Edited by Jane M. Day GEORGE BERKELEY: ALCIPHRON IN FOCUS Edited by David Berman ARISTOTLE’S DE ANIMA IN FOCUS Edited by Michael Durrant WILLIAM JAMES: PRAGMATISM IN FOCUS Edited by Doris Olin JOHN LOCKE’S LETTER ON TOLERATION IN FOCUS Edited by John Horton and Susan Mendus CIVIL DISOBEDIENCE in focus Edited by Hugo Adam Bedau London and New York First published 1991 by Routledge 11 New Fetter Lane, London EC4P 4EE This edition published in the Taylor & Francis e-Library, 2002. -

ISSN: 2320-5407 Int. J. Adv. Res. 8(05), 471-476

ISSN: 2320-5407 Int. J. Adv. Res. 8(05), 471-476 Journal Homepage: - www.journalijar.com Article DOI: 10.21474/IJAR01/10950 DOI URL: http://dx.doi.org/10.21474/IJAR01/10950 RESEARCH ARTICLE THOREAU’S CIVIL DISOBEDIENCE: A VOICE OF NON-VIOLENT RESISTANCE TO DISSENT AN UNJUST POLITICAL CONTEXT Dr. C. Masilamani Asst. Professor of English Kristu Jayanti College Bangalore, India-560077. …………………………………………………………………………………………………….... Manuscript Info Abstract ……………………. ……………………………………………………………… Manuscript History This article reviews Henry David Thoreau‟s social and political Received: 12 March 2020 philosophy of Civil Disobedience, which rebels against government‟s Final Accepted: 14 April 2020 brutality and it suggests fighting against tyranny to get freedom, Published: May 2020 breaking with conventional customs, rejecting the social traditions and values and unjust law and policies affecting the democrats. This study Key words:- Civil Disobedience, Political also reviews some of the writings of political situations which display Philosophy, Transcendentalism, Slavery, the political meanings and aspirations. The purpose of the article is to Literature of Politics, Mass of Men, explore the power and importance of individual over groups, especially Rebellion, Rationalism, and Non-Violent government through Thoreau‟s Civil Disobedience. In addition, it also Resistance tries to discuss how people‟s taxes are misused by the government for an unnecessary war and dispute with other countries instead of taking good care their own citizens. Therefore, this article seeks to discuss and eventually justify the relevance of civil disobedience as a catalyst of positive change for the stability and sustainability of the democratic process and system of government in a state. It also evaluates his open call for every citizen to sacrifice oneself for the nation‟s cause not to pay taxes and avoid colluding with government by refusing to play an active role. -

The Peace Tax Seven Are

conscience issue 125 summer 2004 update newsletter of conscience THE PEACE TAX CAMPAIGN The Peace Tax Seven are Go! The Peace Tax Seven, a group of conscientious objectors and war tax resisters, have sent their “Letter before Action” to Gordon Brown; the first step on the long road to a Judicial Review. The Seven are seeking a Judicial Review of current tax law, which makes them complicit in killing if they carry out their civic duty and pay their taxes or makes them criminals if they follow their conscience and refuse to pay taxes conscience for war and war preparations. The “Letter before Action” informs the government of their intention to seek a Judicial Review and sets out their reasons for doing so. The government has 28 days to respond to photos | Oliver Haslam/ the letter. Once they have this response The conscience “Peace Tax Collectors” set up their office at the Glastonbury festival this year the Peace Tax Seven can move on to (see page 2 for the full story). the next step of the process, which is to seek a pre-emptive costs order. If the in the public interest that the legal case Judicial Review goes against the Peace against the war be heard and that the Tax Seven, they would be liable for groups taking the case should not have the government’s costs as well as their to risk bankruptcy for this to happen. own; if they are granted a pre-emptive If the Seven are also successful conscience costs order this will place a cap on their in persuading a judge that their case is campaigns for the liability for the government’s costs. -

Juanita Nelson

The Library of America • Story of the Week From War No More: Three Centuries of American Antiwar & Peace Writing (The Library of America, 2016), pages 334–47. Headnote by Lawrence Rosenwald. Originally published in the September 1960 issue of Liberation. Reprinted by permission of the Estate of Juanita Nelson. JUANITA NELSON It is impossible for me to write about Juanita Nelson (1923–2015) with- out memories of her surfacing in my mind. She was sixty-six when I got to know her, in connection with the IRS seizure of houses owned by war tax resisters Bob Bady, Betsy Corner, and Randy Kehler. She was already an eminence in the war tax resistance movement, but not a laurels-sitting eminence; she was gracious and fierce and courtly and funny. (She was implacable on the question of lending money at inter- est, which she opposed.) Her home on Woolman Hill, near Deerfield, Massachusetts, was a place of hospitality and radical simplicity (no electricity, no running water, an outhouse), with neither getting in the way of the other. Over the years she became still more eminent, almost legendary, but never stopped having those other traits as well. She was born in Cleveland, enrolled in Howard University in 1941, was the secretary to that university’s NAACP chapter, and was first arrested in 1943 for a protest against lunch counter segregation. (For her as for many, opposing war and opposing segregation were not separate issues.) She was working as a journalist when she met Wally Nelson in 1943; they got married and stayed married till Wally’s death in 2002. -

U Nuni C a Ti

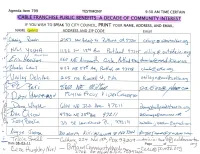

Agenda ltem 799 TEST|MONY 9:30 AM T|ME CERTATN CABLE FRANCHISE PUBLIC BENEFITS: A DECADE OF COIvIIUUT¡ry IuruRTsT lF YOU WISH TO SPEAK TO CITY COUNCIL, PRINT yOUR NAME, ADDRESS, AND EMA¡L. NAME ADDRESS AND ZIP CODE Email C¿ol. ?rr.x ¿-1ç-l ¡^, (^faù (.r Cyã.t c ø c.,\bq\wtka.u'q, \J b\\L\ \ o (ftA l\z t 5\^r \3+d å^ P*[ {^^! 11zo -t û nu4r)h in e?a ^i\ì f - Õ /r,-- l/),;^'r:i: tt6t( ÅE Å;^rr".J( Cr.lo P,,ff^l rro dnorrl ron@-t"eú, kl 2. or.u, L¿-;ç r+.r& C[r*í.t 1rZ+ l,/E çTl ) ?"*+{a/, ofL 17219 CA,/^eed<*.ok5 U^i l"{ Ü¿jr^ tl'¿ ?aÇ y\ø ?-*dt d, p& f,r-.7*r, {eø t{tr ø;/1,/ r-?<-ã*us,Q- lrb cd' I 'Í) tH h+"rs-nt ¡ ftl(ú- ft.vç l/ t D€zGrr*rtr, (rloq t t ( /Þ,1 D *^ Ull.,.lu-- rJÉ 3z"N Nno- 9 7¿ åo^^^L.rl l*¡0,*!+\,o* L, a rot f +f :òwö*oN, -r- ¿./ { 4-t1t xt€, Z*q/ror* 172 // 2Sl on <.q q,@â,-r^' c^rgz .^û FJ yt ltLlßøe\,n h , 3b aü t err s(h^.rst R , \?Z t '| 4r,rd*t^- c+ c.^>t t*l ,. /oo ,¡orrq {,7t r'ì4f ,.- t,trftf ç Pil lTzt¿ þZSxrfa.-*<PS, â.cp' tô :- fffdaG¡'daSnoQ! S^.e-Q-t ---;J8'¿.a, zz+z7 rvwfvu/ l LBn,Et( Pox'rl\-= rC\q, çn.{l€ p¡\ c*[J"no...{=,GT " ,/ i "!ao1 -.{i.ù,page of "*tJ or7 -Date0S-03-ll ?a@gfayy"2ftyy,V*tux u Q;îE^rlrtey N u, ¡ - or;yrÏ.oi,ao n') miÌ ltrl ."-f.l * i' \ *.:1 * " , \'¡e 'Zl.tl " ryi'+wÅlt Ð J,L çfJ 1'¿. -

Chapter 4: Tactics That Support Tax Resisters

Tactics that Support CHAPTER 4 Tax Resisters The heart of any tax resistance campaign is the resisters themselves. A successful campaign does what it can to encourage, support, and sustain these resisters and to facilitate their resis- tance. This chapter discusses some of the techniques campaigns have relied on for this. Tactics in this category can also be opportunities for people who are sympathetic to the campaign, but who are nonetheless unable to resist paying taxes themselves. People who can- not resist the tax directly can help support those who can and do. form mutual insurance pacts People will be more willing to risk the wrath of the government in a tax resistance campaign if they know that the weight of that wrath will not fall wholly on them. One way your campaign can provide this sort of reassurance is to form a mutual insurance plan, so that if the govern- ment takes legal action against a resister, or retaliates against them in some other way, that resister won’t have to bear these consequences alone. DUBLIN WATER CHARGE STRIKE. For example, during the 1994–96 water charge strike in Dublin—a mass refusal to pay new government fees, ostensibly for water and other utilities, that the resisters felt were a regressive “double tax” on households—the government tried to defeat the campaign by harshly targeting a few individual resisters in the hopes that this would discourage the rest. One strike leader noted: 99 Tactics of Successful Tax Resistance Campaigns 23 The campaign immediately took a decision that when any individual was summonsed to court, we would turn up and contest every case—and that we would turn up in force... -

Thoreau's Civil Disobedience: a Reassessment

University of the Pacific Scholarly Commons University of the Pacific Theses and Dissertations Graduate School 1975 Thoreau's Civil Disobedience: A Reassessment Thomas Aquinas Murawski University of the Pacific Follow this and additional works at: https://scholarlycommons.pacific.edu/uop_etds Part of the English Language and Literature Commons Recommended Citation Murawski, Thomas Aquinas. (1975). Thoreau's Civil Disobedience: A Reassessment. University of the Pacific, Dissertation. https://scholarlycommons.pacific.edu/uop_etds/3146 This Dissertation is brought to you for free and open access by the Graduate School at Scholarly Commons. It has been accepted for inclusion in University of the Pacific Theses and Dissertations by an authorized administrator of Scholarly Commons. For more information, please contact [email protected]. THOREAU'S .Ql!I.kJ2J99]E.]1ENCE: A REASSESSMENT An. essay presented to the faculty o.f the Department of English University of the Pacific \ . In partial fulfillment of the requirements for the degree .Doctor of Arts by Thomas A. Murawski July 9, 1975 This essay, written and submitted by ~- THOMAS A. MURAH'SKI is approved for recommendation to the Graduate Council, University of the Pacific. Department Chairman or Dean: Essay Committee: b __ i- "Animals are ei.ther social or isolate. !-!an is a social isolate, and from this duality have come ages o:f pain." --Jacob Bronowski Although civil disobedierice is as old as Socrates and Antigone, i.n the twentieth century it is to Thoreau's essay that advocates have returned for inspiration and .jnsti.fication. The extraordinary appeal of Thoreau's --------ci~?-:i1-TJi.so-o€m-n:tr:::-eiE: demonst:rated in the diversity of --""--~.-.......·-:-------- political philosophies to v;hich it speaks. -

CW Refuses Tax Exemption

We Go On Record: CW Refuses Tax Exemption Dorothy Day The Catholic Worker, May 1972, 1,3,5. Summary: Explains CW finances and why the CW refuses to apply for tax exempt status. Cites Ammon Hennacy and Karl Meyer’s tax resistance as nonviolent protest against war. Upholds the principle that governments should never do what small bodies can accomplish. (DDLW #191). The Catholic Worker has received a letter from the Internal Revenue Service stating that we owe them $296,359 in fines, penalties, and unpaid income tax for the last six years. As the matter stands right now, there might be a legal battle with delays and postponements which may remind us of Dickens’ Bleak House. Or, since we will not set up a defense committee to campaign for funds, it may terminate swiftly in the confiscation of our property and our bank account (never very large). Our farm at Tivoli and the First Street house could be put up for sale by government agents and our C.W. family evicted. Perhaps no one here at St. Joseph’s House realizes the situation we are in right now as keenly as I do, having seen so many evictions in the Depression - furniture, clothes, kitchen utensils piled up on the streets by landlords’ marshals. The Communists used to demonstrate and forcibly move the belongings of the unfortunate people back into the tenements, but our Catholic Worker staff, a handful of us, begged money and rented other apartments for eight to fifteen dollars a month and moved the evicted families there.