Letters to Assessors 2006-010

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Disability Classification System

CLASSIFICATION SYSTEM FOR STUDENTS WITH A DISABILITY Track & Field (NB: also used for Cross Country where applicable) Current Previous Definition Classification Classification Deaf (Track & Field Events) T/F 01 HI 55db loss on the average at 500, 1000 and 2000Hz in the better Equivalent to Au2 ear Visually Impaired T/F 11 B1 From no light perception at all in either eye, up to and including the ability to perceive light; inability to recognise objects or contours in any direction and at any distance. T/F 12 B2 Ability to recognise objects up to a distance of 2 metres ie below 2/60 and/or visual field of less than five (5) degrees. T/F13 B3 Can recognise contours between 2 and 6 metres away ie 2/60- 6/60 and visual field of more than five (5) degrees and less than twenty (20) degrees. Intellectually Disabled T/F 20 ID Intellectually disabled. The athlete’s intellectual functioning is 75 or below. Limitations in two or more of the following adaptive skill areas; communication, self-care; home living, social skills, community use, self direction, health and safety, functional academics, leisure and work. They must have acquired their condition before age 18. Cerebral Palsy C2 Upper Severe to moderate quadriplegia. Upper extremity events are Wheelchair performed by pushing the wheelchair with one or two arms and the wheelchair propulsion is restricted due to poor control. Upper extremity athletes have limited control of movements, but are able to produce some semblance of throwing motion. T/F 33 C3 Wheelchair Moderate quadriplegia. Fair functional strength and moderate problems in upper extremities and torso. -

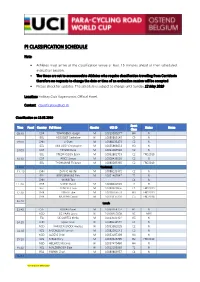

Pi Classification Schedule

PI CLASSIFICATION SCHEDULE Note: • Athletes must arrive at the classification venue at least 15 minutes ahead of their scheduled evaluation session. • The times are set to accommodate Athletes who require classification travelling from Corridonia therefore no requests to change the date or time of an evaluation session will be accepted. • Please check for updates. The schedule is subject to change until Sunday 12 May 2019 Location: Holiday Club Vayamundo, Official Hotel. Contact: [email protected] Classification on 13.05.2019 Sport Time Panel Country Full Name Gender UCI ID Status Notes Class 08:30 GBR TOWNSEND Joseph M 10019380277 H4 N BEL HOSSELET Catheline W 10089809149 C5 N 09:00 CHN LI Shan M 10088133473 C2 N BEL VAN LOOY Christophe M 10055886633 H3 N 10:00 GBR TAYLOR Ryan M 10093387540 C2 N BEL FREDRIKSSON Bjorn M 10062802733 C2 FRD2019 10:30 GBR PRICE Simon M 10008436556 C2 R BEL THOMANNE Thibaud M 10080285365 C2 FRD2019 11:00 Tea break 11 :10 CHN ZHANG Haofei M 10088133372 C2 N BEL KRIECKEMANS Dirk M 10091467647 T2 N CHN WANG Tao C4 N 11 :40 GBR STONE David M 10008440903 T2 R BEL CLINCKE Louis M 10080303856 C4 FRD2019 12:10 GBR JONES Luke M 10018766551 H3 FRD2019 GBR MURPHY David M 10019315310 C5 FRD2018 12:40 Lunch 13:40 CZE KOVAR Pavel M 10063464757 H1 N NED DE VAAN Laura W 10008465858 NE MRR ITA DE CORTES Mirko M 10013021424 H5 N 14:10 CHN QIAO Yuxin W 10088133574 C4 N NED VAN DEN BROEK Andrea W 10093581035 C2 N 14:40 NZL MCCALLUM Hamish M 10082591541 C3 N NED ALBERS Chiel M 10053197309 H4 N 15:10 NZL MEAD Rory M 10059646795 -

2018 Jessica Uniack Beach to Bay Race Long Beach Yacht Club

2018 Jessica Uniack Beach to Bay Race Long Beach Yacht Club Results for 2018 Jessica Uniack Beach to Bay Race CFJ Class Sailed: 1, Discards: 0, To count: 1, Entries: 25, Scoring system: Appendix A Class SailNo Club HelmName CrewName R1 Total Nett CFJ HHSF Jack Haliday Nicholas Ridout CFJ HHSF Trae Sanchez Ben Hagadorn CFJ LBYC 7 LBYC Nicky Lech Kai Bramble 1.0 1.0 1.0 CFJ 22 ABYC Nicholas Muller Ulises Lewis 2.0 2.0 2.0 CFJ LBYC 10 LBYC Preston Woodworth Alex Lech 3.0 3.0 3.0 CFJ 43 ABYC Summer Drake Paige Odell 4.0 4.0 4.0 CFJ 23 ABYC Nikhil Stewart Jamarcus Parker 5.0 5.0 5.0 CFJ 42 ABYC Sean colley Thomas Dobson 6.0 6.0 6.0 CFJ 44 ABYC Nicolas Sanchez Nicole Morikawa 7.0 7.0 7.0 CFJ 24 ?? 8.0 8.0 8.0 CFJ 0 HHSF Trae Sanchez Ben H 9.0 9.0 9.0 CFJ LBYC 2 LBYC Kyer Fox Isaure Chalandon 10.0 10.0 10.0 CFJ LBYC 9 LBYC Sawyer Bambam-Moak Katin Cathey 11.0 11.0 11.0 Class SailNo Club HelmName CrewName R1 Total Nett CFJ 46 ABYC Elisabeth Rossbach Troy Davidson 12.0 12.0 12.0 CFJ 00 HHSF Jack Haliday Nicholas 13.0 13.0 13.0 CFJ 41 ABYC Michael Colley Emilia Anctil 14.0 14.0 14.0 CFJ 6161 DPYC Riley Lenthall 15.0 15.0 15.0 CFJ 9PYSF HHYC Jack Busche Nolan Davis 16.0 16.0 16.0 CFJ 1510 DPYC Ryan Brown Colin Sekerka 17.0 17.0 17.0 CFJ 5151 DPYC Christopher Andersen Hunter Laws 18.0 18.0 18.0 CFJ LBYC 3 LBYC Luke Bramble Rio Dumont 19.0 19.0 19.0 CFJ LBYC 5 LBYC Jack Snow Reese Lapham 26.0 DSQ 26.0 26.0 CFJ 6161 DPYC Carsen Lenthall 26.0 DNC 26.0 26.0 CFJ 6161 DPYC Riley Lenthall 26.0 DNC 26.0 26.0 CFJ 5151 DPYC Hunter Laws Christopher Anderson -

Decision Tree Learning– Solution

Decision Tree Learning{ Solution 1) Assume that you have the following training examples available: F1 F2 F3 F4 F5 Class Example 1 t t f f f p Example 2 f f t t f p Example 3 t f f t f p Example 4 t f t f t p Example 5 f t f f f n Example 6 t t f t t n Example 7 f t t t t n Use all of the training examples to construct a decision tree. In case of ties between features, break ties in favor of features with smaller numbers (for ex- ample, favor F1 over F2, F2 over F3, and so on). How does the resulting decision tree classify the following example: F1 F2 F3 F4 F5 Class Example 8 f f f t t ? Answer: Let H(x; y) denote the entropy of a data set with x examples belonging to class p and y examples belonging to class n. That is, x x y y H(x; y) = − log − log : x + y 2 x + y x + y 2 x + y We precompute the values for some H(x; y), which will be useful when con- structing the decision tree. H(0; x) = H(x; 0) = −1 log2 1 − 0 log2 0 = 0 H(x; x) = −(1=2) log2 (1=2) − (1=2) log2 (1=2) = 1 H(1; 2) = H(2; 1) = −(1=3) log2 (1=3) − (2=3) log2 (2=3) = 0:918 H(1; 3) = H(3; 1) = −(1=4) log2 (1=4) − (3=4) log2 (3=4) = 0:811 First, we choose from f F1, F2, F3, F4, F5 g to become the root. -

Presenting the Paralympics: Affective Nationalism and the 'Able-Disabled'

View metadata, citation and similar papers at core.ac.uk brought to you by CORE provided by Bournemouth University Research Online (Re-)presenting the Paralympics: Affective Nationalism and the 'able-disabled' Emma Pullen, Daniel Jackson and Michael Silk Communication & Sport (2019, in press) *To cite this article: Pullen, E., Jackson, D., and Silk, M. (2019). (Re-)presenting the Paralympics: Affective Nationalism and the 'able-disabled'. Communication & Sport Corresponding author: [email protected] Abstract The relationship between media, sport, nations and nationalism is well established, yet, there is an absence of these discussions at the intersection of communication, Paralympics and disability studies. This omission is particularly significant considering the rapid commodification of the Paralympic spectacle, exacerbated by the entry of Channel 4 (C4) as the UK Paralympic rights holders, that has seen the games become an important site of disability (re-)presentation. In this article, we focus on the construction of national, normative, disabled bodies in Paralympic representation drawn from an analysis of three integrated datasets from Channel 4’s broadcasting of the Rio 2016 Paralympics: interviews with C4 production and editorial staff; quantitative content analysis, and qualitative moving image analysis. We highlight the strategic approach taken by C4 to focus on successful medal winning athletes; the implications this has on the sports and disability classifications given media coverage; and the role of affective high-value production practices. We also reveal the commercial tensions and editorial decisions that broadcasters face with respect to which disabilities / bodies are made hyper-visible - and thereby those which are marginalized - as national disability sport icons that inculcate preferred notions of disability and the (re)imagined nation. -

What Are We Doing with (Or To) the F-Scale?

5.6 What Are We Doing with (or to) the F-Scale? Daniel McCarthy, Joseph Schaefer and Roger Edwards NOAA/NWS Storm Prediction Center Norman, OK 1. Introduction Dr. T. Theodore Fujita developed the F- Scale, or Fujita Scale, in 1971 to provide a way to compare mesoscale windstorms by estimating the wind speed in hurricanes or tornadoes through an evaluation of the observed damage (Fujita 1971). Fujita grouped wind damage into six categories of increasing devastation (F0 through F5). Then for each damage class, he estimated the wind speed range capable of causing the damage. When deriving the scale, Fujita cunningly bridged the speeds between the Beaufort Scale (Huler 2005) used to estimate wind speeds through hurricane intensity and the Mach scale for near sonic speed winds. Fujita developed the following equation to estimate the wind speed associated with the damage produced by a tornado: Figure 1: Fujita's plot of how the F-Scale V = 14.1(F+2)3/2 connects with the Beaufort Scale and Mach number. From Fujita’s SMRP No. 91, 1971. where V is the speed in miles per hour, and F is the F-category of the damage. This Amazingly, the University of Oklahoma equation led to the graph devised by Fujita Doppler-On-Wheels measured up to 318 in Figure 1. mph flow some tens of meters above the ground in this tornado (Burgess et. al, 2002). Fujita and his staff used this scale to map out and analyze 148 tornadoes in the Super 2. Early Applications Tornado Outbreak of 3-4 April 1974. -

Reframing Sport Contexts: Labeling, Identities, and Social Justice

Reframing Sport Contexts: Labeling, Identities, and Social Justice Dr. Ted Fay and Eli Wolff Sport in Society Disability in Sport Initiative Northeastern University Critical Context • Marginalization (Current Status Quo) vs. • Legitimatization (New Inclusive Paradigm) Critical Context Naturalism vs. Trans-Humanism (Wolbring, G. (2009) How Do We Handle Our Differences related to Labeling Language and Cultural Identities? • Stereotyping? • Prejudice? • Discrimination? (Carr-Ruffino, 2003, p. 1) Ten Major Cultural Differences 1) Source of Control 2) Collectivism or Individualism 3) Homogeneous or Heterogeneous 4) Feminine or Masculine 5) Rank Status 6) Risk orientation 7) Time use 8) Space use 9) Communication Style 10) Economic System (Carr – Ruffino, 2003, p.27) Rationale for Inclusion • Divisioning by classification relative to “fair play” and equity principles • Sport model rather than “ism” segregated model (e.g., by race, gender, disability, socio-economic class, sexual orientation, look (body image), sect (religion), age) • Legitimacy • Human rights and equality Social Dynamics of Inequality Reinforce and reproduce Social Institutions Ideology Political (Patriarchy) Economic Educational Perpetuates Religious Prejudice & Are institutionalized by Discrimination Cultural Practices (ISM) Sport Music Art (Sage, 1998) Five Interlinking Conceptual Frameworks • Critical Change Factors Model (CCFM) • Organizational Continuum in Sport Governance (OCSG) • Criteria for Inclusion in Sport Organizations (CISO) • Individual Multiple Identity Sport Classifications Index (IMISCI) • Sport Opportunity Spectrum (SOS) Critical Change Factors Model (CCFM) F1) Change/occurrence of major societal event (s) affecting public opinion toward ID group. F2) Change in laws, government and court action in changing public policies toward ID group. F3) Change in level of influence of high profile ID group role models on public opinion. -

Marelli D6C & D5C ATEX Motor Technical Catalogue

Motors for This catalogue refers to ATEX Motors belonging to Group I Category M2 and Group II Category 2G, 2D, 2GD as described. STANDARDS ® BEARINGS Hazardous Areas The ATEX Motors described in this catalogue are manufactured in accordance with IEC 60034-1-5-6-7-8-9-12-14, IEC 60072-1, EN 50347, EN 60079- D5, D6 SERIES Frame Size (mm) D - end N - end Frame Size Poles B 3 V 1 MarelliMotori 0-1-7, EN 61241-0-1. 71* 6202-2Z 6202-2Z D - end N - end D - end N - end I M2, II 2G, II 2D EUROPEAN DIRECTIVES 355-400 2 6217-C3 6217-C3 6217-C3 7217 B 80* 6204-2Z 6204-2Z Ex d/de I, Ex d/de IIB, Ex tD A21 IP65 Title Directive 90* 6205-2Z 6205-2Z 355 4 NU222-C3 6217-C3 NU222-C3 6217-C3 + 7217 B Equipment and protective system intended for use in potentially explosive atmospheres (ATEX) 94/9/EC 100* 6206-2Z 6206-2Z 400 4 NU222-C3 6222-C3 NU222-C3 6222-C3 + 7222 B Electromagnetic Compatibility (EMC) 2004/108/IEC 112* 6206-2Z 6206-2Z Low Voltage Directive (LVD) 2006/95/EC 132* 6308-2Z 6308-2Z HEADQUARTERS ITALIAN OFFICES Machinery Directive (MD) 98/37/EC 160 - 180M 6310-Z-C3 6209-Z-C3 Marelli Motori S.p.A. Milan CERTIFICATES 180L 6310-Z-C3 6210-Z-C3 Via Sabbionara, 1 Via Cesare Cantù, 29 200 6312-Z-C3 6210-Z-C3 Frame size Number Temperature Limits 36071 Arzignano (VI) Italy 20092 Cinisello Balsamo (MI) Italy 225 6313-Z-C3 6213-Z-C3 71-132 BVI 08 ATEX 0001 -20°C +40°C* 160-315 CESI 02 ATEX 071 -20 C +40 C* 250 6314-Z-C3 6213-Z-C3 (T) +39.0444.479711 (T) +39.02.660.131.66 ° ° These tables describe the bearing types used in standard configurations. -

International Triathlon Union • ITU Competition Rules

ITU Competition Rules Approved by the ITU Executive Board, in November 2015 Green highlight – added as of November 2015 Red highlight – deleted as of November 2015 International Triathlon Union ITU Competition Rules 06-12-2015 1 The ITU Competition Rules is the master source document, found on ITU’s website at www.triathlon.org. The web based document acts as the official (authorised) reference document and is maintained based on authorised amendments in accordance with recommendations by the ITU Technical Committee and accepted by the ITU Executive Board. Contact International Triathlon Union (ITU) Maison du Sport International Av. de Rhodanie 54 Lausanne CH -1007, Switzerland Tel +41 21 614 60 30 Fax +41 21 614 60 39 Email: [email protected] For general information about ITU visit www.triathlon.org International Triathlon Union ITU Competition Rules 06-12-2015 2 TABLE OF CONTENTS 1. INTRODUCTION: _________________________________________________________________________ 4 2. CONDUCT OF ATHLETES: ___________________________________________________________________ 6 3. PENALTIES: _____________________________________________________________________________ 16 4. SWIMMING CONDUCT: ___________________________________________________________________ 20 5. CYCLING CONDUCT:______________________________________________________________________ 25 6. RUNNING CONDUCT: ____________________________________________________________________ 33 7. TRANSITION AREA CONDUCT: _____________________________________________________________ 34 8. COMPETITION -

A. Legal Permanent Resident Aliens

A. Classes Currently in Use - Legal Permanent Resident Aliens (continued) Symbol: *Arrival/ Statistical Document Adjust Section of Law Description FY AM1 AM-1 N Sec. 584(b)(1)(A) of Amerasian born in AM6 AM-6 A PL 100-202 Vietnam after (Dec. 22, 1987) Jan. 1, 1962 and before Jan. 1, 1976 who was fathered by a U.S. citizen. AM2 AM-2 N Sec. 584(b)(1)(B) of Spouse or child of an AM7 AM-7 A PL 100-202 alien classified as (Dec. 22, 1987) AM1 or AM6. AM3 AM-3 N Sec. 584(b)(1)(C) of Mother, guardian, or AM8 AM-8 A PL 100-202 next-of-kin of an (Dec. 22, 1987) alien classified as AM1 or AM6, and spouse or child of the mother, guardian, or next-of-kin. AR1 AR-1 N Sec. 201(b)(2)(A)(i) Amerasian child of a AR6 AR-6 A of the I&N Act and U.S. citizen born in 204(g) as added by Cambodia, Korea, PL 97-359 (Oct. 22, Laos, Thailand, or 1982) Vietnam (immediate relative child). AS6 AS-6 A Sec. 209(b) of the Asylee principal I&N Act as added by PL 96-212 (Mar. 17, 1980) AS7 AS-7 A Sec. 209(b) of the Spouse of an alien I&N Act as added by classified as AS6. PL 96-212 (Mar. 17, 1980) AS8 AS-8 A Sec. 209(b) of the Child of an alien I&N Act as added by classified as AS6. -

The Impact of Lower-Limb Prosthetic Limb Use in International C4 Track Para-Cycling

The impact of lower-limb prosthetic limb use in international C4 track para-cycling An investigation was undertaken to ascertain any impact or significance of athletes within the C4 paracycling classification between those who use a lower- limb prostheses and those who do not. A statistical evaluation of event completion time was undertaken to assess C4 cyclists when competing at the World Championships and the Paralympic Games in the 1km track time trial. The C4 athletes who utilise a prostheses consistently outperformed non-amputees in the C4 classification from 2011-2016 on a competition-to-competition basis. However, when the participations were grouped as a whole together and an identified outlier athlete was removed, it was then demonstrated that there was no statistical significance between those who required the use of a lower-limb prostheses to those that did not when either evaluated on a competition-by- competition or on an amputee and non-amputee group-by-group basis (P=>0.05). As a result, this study proposes that those requiring the use of lower-limb prostheses are neither advantaged nor disadvantaged in the C4 classification category when competing in the 1km time trial at this time. Implications for Rehabilitation • This analysis indicates that at this time, there is no evidence to suggest that use of such technology is advantageous in this category or should be seen as controversial. • The design of lower-limb prosthetic limb technology in cycling should continue to be developed and optimized unabated. • This study begins to address the cited lack of peer reviewed information regarding paracycling with limb absence available to practitioners. -

Before the Public Service Commission of the State of Missouri

Exhibit No.: Issues: Depreciation Witness: Brian C. Andrews Type of Exhibit: Direct Testimony Sponsoring Party: Missouri Industrial Energy Consumers Case No.: ER-2019-0335 Date Testimony Prepared: December 4, 2019 FILED March 19, 2020 Data Center BEFORE THE PUBLIC SERVICE COMMISSION Missouri Public OF THE STATE OF MISSOURI Service Commission ) In the Matter of Union Electric Company ) d/b/a Ameren Missouri's Tariffs to Decrease ) Case No. ER-2019-0335 Its Revenues for Electric Service. ) ------------) Direct Testimony and Schedules of Brian C. Andrews On behalf of Missouri Industrial Energy Consumers December 4, 2019 BRUIIAKr R & ASSOCIATES. INC. Project 10842 BEFORE THE PUBLIC SERVICE COMMISSION OF THE STATE OF MISSOURI ) In the Matter of Union Electric Company ) d/b/a Ameren Missouri's Tariffs to Decrease ) Case No. ER-2019-0335 Its Revenues for Electric Service. ) ) STATE OF MISSOURI ) ) ss COUNTY OF ST. LOUIS ) Affidavit of Brian C. Andrews Brian C. Andrews, being first duly sworn, on his oath states: 1. My name is Brian C. Andrews. I am a consultant with Brubaker & Associates, Inc., having its principal place of business at 16690 Swingley Ridge Road, Suite 140, Chesterfield, Missouri 63017. We have been retained by the Missouri Industrial Energy Consumers in this proceeding on their behalf. 2. Attached hereto and made a part hereof for all purposes are my direct testimony and schedules which were prepared in written form for introduction into evidence in Missouri Public Service Commission Case No. ER-2019-0335. 3. I hereby swear and affirm that the testimony and schedules are true and correct and that they show the matters and things that they purport to show.