Market Wrap July 15, 2020

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

18 December 2020 Reliance and Bp Announce First Gas from Asia's

18 December 2020 Reliance and bp announce first gas from Asia’s deepest project • Commissioned India's first ultra-deepwater gas project • First in trio of projects that is expected to meet ~15% of India’s gas demand and account for ~25% of domestic production Reliance Industries Limited (RIL) and bp today announced the start of production from the R Cluster, ultra-deep-water gas field in block KG D6 off the east coast of India. RIL and bp are developing three deepwater gas projects in block KG D6 – R Cluster, Satellites Cluster and MJ – which together are expected to meet ~15% of India’s gas demand by 2023. These projects will utilise the existing hub infrastructure in KG D6 block. RIL is the operator of KG D6 with a 66.67% participating interest and bp holds a 33.33% participating interest. R Cluster is the first of the three projects to come onstream. The field is located about 60 kilometers from the existing KG D6 Control & Riser Platform (CRP) off the Kakinada coast and comprises a subsea production system tied back to CRP via a subsea pipeline. Located at a water depth of greater than 2000 meters, it is the deepest offshore gas field in Asia. The field is expected to reach plateau gas production of about 12.9 million standard cubic meters per day (mmscmd) in 2021. Mukesh Ambani, chairman and managing director of Reliance Industries Limited added: “We are proud of our partnership with bp that combines our expertise in commissioning gas projects expeditiously, under some of the most challenging geographical and weather conditions. -

Quarterly Shareholder Update Q 1 January - 31 March 2020 1

Pacific Assets Trust plc Quarterly Shareholder Update Q 1 January - 31 March 2020 1 Image location: Mumbai This document is a financial promotion for Pacific Assets Trust plc (the “Trust”) only for those people resident in the UK for tax and investment purposes. Investing involves certain risks including: • The value of investments and any income from them may go down as well as up and are not guaranteed. Investors may get back significantly less than the original amount invested. • Emerging market risk: emerging markets may not provide the same level of investor protection as a developed market; they may involve a higher risk than investing in developed markets. • Currency risk: the Trust invests in assets which are denominated in currencies other than pound sterling; changes in exchange rates will affect the value of the Trust. • The Trust’s share price may not fully reflect net asset value. Reference to specific securities (if any) is included for the purpose of illustration only and should not be construed as a recommendation to buy or sell. Reference to the names of any company is merely to explain the investment strategy and should not be construed as investment advice or a recommendation to invest in any of those companies. For an overview of the terms of investment, risks, returns and costs and charges please refer to the Key Information Document which can be found on the Trust’s website: www.pacific-assets.co.uk. If you are in any doubt as to the suitability of the Trust for your investment needs, please seek investment advice. -

Press Release Reliance Industries Limited

Press Release Reliance Industries LImited March 30, 2020 Ratings Amount Facilities Rating1 Rating Action (Rs. crore) CARE AAA; Non-Convertible Debentures 10,386 Stable(Triple A; Assigned Outlook: Stable) Details of instruments/facilities in Annexure-1 Other Ratings Instruments Amount (Rs.Crore) Ratings Non-Convertible Debenture 40,000 CARE AAA; Stable Commercial Paper 34,500 CARE A1+ Detailed Rationale& Key Rating Drivers On March 18, 2020, the company announced that the Hon’ble National Company Law Tribunal (NCLT), Ahmedabad Bench has approved the Scheme, for transfer of certain identified liabilities from Reliance Jio Infocomm Limited (RJIL; rated CARE AAA; Stable/ CARE A1+, CARE AAA (CE); Stable) to Reliance Industries Limited (RIL). Pursuant to the Scheme of Arrangement amongst RJIL and certain classes of its creditors (the “Scheme”) as sanctioned by the Hon’ble National Company Law Tribunal, Ahmedabad Bench, vide its order dated March 13, 2020, RIL has assumed the NCDs issued by RJIL. The rating continues to factor in the immensely experienced and resourceful promoter group, highly integrated nature of operations with presence across the entire energy value chain, diversified revenue streams, massive scale of downstream business with one of the most complex refineries, established leadership position in the petrochemical segment as well as strong financial risk profile characterized by robust capital structure, stable cash flows and healthy liquidity position. The rating also factors in the increasing wireless subscriber base which has led its digital services business to attain a leadership position in the industry as well as the various steps announced by the management to reduce the debt on a consolidated level. -

Digital Payments Take Off in India December 9, 2016

DIGITAL PAYMENTS TAKE OFF IN INDIA DECEMBER 9, 2016 SUMMARY ABOUT ASG On November 8, Prime Minister Narendra Modi announced that at the stroke of Albright Stonebridge Group midnight, currency notes of Rs. 500 and Rs. 1,000 denominations would cease to be (ASG) is a leading global legal tender. business strategy firm. We help clients understand and Following the announcement, digital payments through credit and debit cards as well successfully navigate the as digital wallets have accelerated, and the government is continuing its push to economic, political, and decrease cash payments in the economy. social landscape in international markets. The government has announced incentives including waiving service taxes on ASG’s worldwide team of digital payments, discounts on purchases (petrol, railway tickets, highway tolls), commercial diplomats has and more. served clients in more than 110 countries. Over 12.6 trillion rupees ($185 billion) have been deposited into bank accounts since the government’s announcement on November 8. ALBRIGHTSTONEBRIDGE.COM GDP growth is expected to suffer in the short-run, according to S&P and Moody’s. Shortage of card-reading machines has been a boon for mobile payments companies. The Reserve Bank of India has waived off two-factor authentication requirements to transactions valued under Rs. 2,000. The Finance Ministry has announced plans to make all payments above Rs. 5,000 by government departments to contracts via electronic payments. A high-level committee of chief ministers has been formed to develop a roadmap for increased use of digital payments in the economy. The government is working on an upgraded Unified Payments Interface for banks to increase ease of use and security across the network. -

Morning Note Market Snapshot

Morning Note Market Snapshot October 12, 2020 Market Snapshot (Updated at 8AM)* Key Contents Indian Indices Close Net Chng. Chng. (%) Market Outlook/Recommendation Sensex 40509.49 326.82 0.81 Today’s Highlights Nifty 11914.20 79.60 0.67 Global News, Views and Updates Global Indices Close Net Chng. Chng. (%) Links to important News highlight DOW JONES 28586.90 161.39 0.57 Top News for Today NASDAQ COM. 11579.94 158.96 1.39 FTSE 100 6016.65 38.62 0.65 Vedanta: The company on Saturday said that the delisting offer is deemed to have failed as per terms of the delisting regulations. The post offer public CAC 40 4946.81 34.87 0.71 announcement by the company said that 125.47 crore shares were validly DAX 13051.23 9.02 0.07 tendered by public shareholders. NIKKEI 225 23573.55 41.51 0.18 Federal-Mogul Goetze (India): Promoter IEH FMGI Holdings to sell up to 1.21 SHANGHAI 3314.68 43.00 1.31 crore shares or 21.83% stake through an Offer for Sale (OFS). The floor price of Rs 342 per share is a 21.1% discount to Friday's closing price. HANG SENG 24496.08 357.47 1.48 Glenmark: The company said that addition of Umifenovir did not demonstrate any additional benefit over Favipiravir alone in moderate Covid-19 patients. Currency Close Net Chng. Chng. (%) Indiabulls Housing Finance: Has sold further portion of its stake in OakNorth USD / INR 73.13 0.11 0.15 Holding - the wholly-owning parent company of OakNorth Bank to Riva Capital USD / EUR 1.18 0.00 0.06 Partners for approximately Rs 441 crore. -

Reliance Industries

25 July 2021 1QFY22 Results Update | Sector: Oil & Gas Reliance Industries Estimate change CMP: INR2,105 TP: INR2,485 (+18%) Buy TP change Rating change O2C and Telecom deliver; Retail is recovering gradually EBITDA for the consolidated/standalone business rose 38%/61% YoY in Motilal Oswal values your support in the 1QFY22 on a low base of last year (2% beat). On a QoQ basis, consolidated Asiamoney Brokers Poll 2021 for India Research, Sales, Corporate Access and revenue/EBITDA is up -6%/1%. RJio’s EBITDA was in line (up 23% YoY), while Trading team. We request your ballot. the same for Retail grew 79% YoY (6% beat) on a low base. Despite the impact of the second COVID wave, RJio held its ground after the push from the Jio Phone launch in 4QFY21. Revenue/EBITDA grew 4% QoQ (in line) on a steady 14.4m net subscriber additions, along with flattish ARPU. EBITDA margin expanded 10bp QoQ to 47.9%. Bloomberg RIL IN Reliance Retail’s revenue/EBITDA grew 19%/79% YoY (6% EBITDA beat) as Equity Shares (m) 6,339 the second COVID wave had a lesser impact v/s that in 1QFY21, cushioned M.Cap.(INRb)/(USDb) 13793.7 / 185.4 by the e-commerce business, swift recovery, and lesser intensity of the 52-Week Range (INR) 2369 / 1830 lockdown. Compared to pre-COVID levels (1QFY20), EBITDA was flat. 1, 6, 12 Rel. Per (%) -6/-6/-37 The company reported an O2C EBITDA that was 6% higher than our estimate 12M Avg Val (INR M) 28673 at INR114.6b (+61% YoY, +12% QoQ). -

Statutory Reports

CORPORATE MANAGEMENT GOVERNANCE FINANCIAL NOTICE Corporate Governance Report OVERVIEW REVIEW STATEMENTS highest standards of ethics. It has before exceptional items 23.7%. The of the Board while nurturing a culture thus become crucial to foster and financial markets have endorsed our where the Board works harmoniously sustain a culture that integrates all sterling performance and the market for the long-term benefit of the “Between my past, the present and the future, there is one common factor: components of good governance by capitalisation has increased by CAGR Company and all its stakeholders. The carefully balancing the inter-relationship of 31.5% during the same period. In Chairman guides the Board for effective Relationship and Trust. This is the foundation of our growth.” among the Board of Directors, Board terms of distributing wealth to our governance in the Company. Committees, Finance, Compliance & shareholders, apart from having a Shri Dhirubhai H. Ambani The Chairman takes a lead role in Assurance teams, Auditors and the track record of uninterrupted dividend Founder Chairman managing the Board and facilitating Senior Management. Our employee payout, we have also delivered effective communication among satisfaction is reflected in the stability consistent unmatched shareholder Directors. The Chairman actively works of our senior management, low attrition returns since listing. The result of our with the Human Resources, Nomination across various levels and substantially initiative is our ever widening reach and Remuneration Committee to higher productivity. Above all, we feel and recall. Our shareholder base has plan the Board and Committees’ honoured to be integral to India’s social grown from 52,000 after the IPO composition, induction of directors to development. -

Reliance Industries and Reliance Communications Sign Telecom Tower Pact

Reliance Industries and Reliance Communications Sign Telecom Tower Pact The Ambani brothers have signed a mega deal to share mobile telecom towers. The agreement would permit Reliance Jio Infocomm, a subsidiary of Mukesh Ambani's, Reliance Industries Limited to rent 45000 telecom towers of Anil's Reliance Communications for a period of 15 years. Reliance Jio Infocomm will pay Rs. 12000 crores to Reliance Communication for this lease, which translates to around Rs. 14000-15000 per tower per month. The deal is a win-win for both the companies as it provides a regular income stream for Reliance Comunications and a quicker and economical network capability to Reliance Jio Infocomm when it rolls out its 4G services. Reliance Jio Infocomm could commence occupying some of the towers in the next six months. As per the market sources, Reliance Jio Infocomm did a hard bargain as the prevailing market rental value for a telecom tower ranges around Rs. 25000 - 30000 per month. Reliance Communication will use a large part of the proceeds to retire debt. It has an outstanding debt of around Rs 39,000 crores. This is the second telecom business deal between the two Ambani brothers. Earlier, in April this year these two companies had signed a Rs. 1200 crore pact to share the optic fibre network for carrying call traffic across the country. According to Gurdeep Singh - chief executive (mobility), Reliance Communications, it is possible that these two firms will sign more deals that are mutually beneficial. Synergies in telecom operations appear to have brought the two family factions together. -

Pan India Tie up with Dr Lal Pathlabs for Pathology Services and Delhi Ncr

HUMAN RESOURCES MANAGEMENT DIVISION, HOSPITALISATION CELL CORPORATE OFFICE- DWARKA-NEW DELHI (PHONE [email protected]) Date: 03.05.2014 TO ALL OFFICES: HRMD CIRCULAR NO. 409 REG: PAN INDIA TIE UP WITH DR.LAL PATHLABS FOR PATHOLOGY SERVICES AND DELHI NCR NETWORK FOR RADIOLOGY SERVICES The Bank has been making efforts to have tie up arrangement with reputed hospitals/Diagnostic Centers for charging rates for OPD Consultation, lab charges and General/Executive Health Check-up of employees and Indoor facilities on reimbursement basis. Dr Lal Path Labs runs Asia’s biggest National Reference Lab testing more than 10,000 patients’ samples every day at New Delhi and runs another 100 state-of- the-art satellite laboratories, 75 Patient Service Centers and about 1500 collection centers all over India and overseas, carry out sophisticated tests and has a highly qualified dedicated team. We are pleased to inform that Bank has taken up with Dr LAL Path lab for discounts to PNB staff including retirees and in context after detailed discussion they have agreed to provide following services to PNB employees and retirees on PAN India basis:- 20% Cash Rate discount for all serving and retired employees of PNB and their dependents on PAN India network of Dr. Lal Path Lab for pathology services and on Delhi NCR network for Radiology services Checkups can be done at our Pan India Company owned Satellite Lab’s and PSC’s as per list attached. Employee can avail home collection service by paying Rs.100 extra/per visit (DNCR Only). Payment: Payment shall be made by employee at the time registration. -

Reliance Industries

1 November 2020 2QFY21 Results Update | Sector: Oil & Gas Reliance Industries Estimate change CMP: INR2,054 TP: INR2,240 (+8%) Buy TP change Rating change Consumer biz cushions sharp fall in Oil and Gas biz Reliance Industries (RIL)’s 2QFY21 consolidated/standalone business EBITDA was Bloomberg RIL IN down 14%/44% YoY. This was weighed by sharp decline in refining Equity Shares (m) 6,339 throughput/margin and a weak Retail biz (hurt by the lockdown), but partly offset M.Cap.(INRb)/(USDb) 13524.8 / 180 by the growing Digital business. 52-Week Range (INR) 2369 / 867 RJio’s revenue/EBITDA growth slowed to 6%/7% QoQ (in-line) due to the 1, 6, 12 Rel. Per (%) -12/24/41 combination of 3% ARPU and subscriber growth each, coupled with 60bp margin 12M Avg Val (INR M) 29721 expansion to 42.6%. Reliance Retail’s net revenues were flat YoY at INR366b (in-line). This is Financials & Valuations (INR b) commendable despite the lockdown and lack of footfall at stores in 2QFY21. Y/E March FY21E FY22E FY23E Net Sales 5,438 7,191 7,845 During the quarter, RIL operated its refining and petrochemical units at >90% EBITDA 823 1,217 1,397 despite the much lower utilization rates of its Indian peers – the company is Net Profit 418 677 809 enjoying the benefits of its integrated Oils-to-Chemicals (O2C) business model. Adj. EPS (INR) 64.8 105.1 125.6 Despite a poor SG GRM benchmark, RIL reported a GRM of USD5.7/bbl. RIL EPS Gr. -

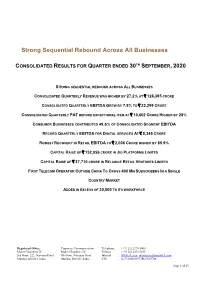

Strong Sequential Rebound Across All Businesses

Strong Sequential Rebound Across All Businesses CONSOLIDATED RESULTS FOR QUARTER ENDED 30TH SEPTEMBER, 2020 STRONG SEQUENTIAL REBOUND ACROSS ALL BUSINESSES CONSOLIDATED QUARTERLY REVENUE WAS HIGHER BY 27.2% AT ` 128,385 CRORE CONSOLIDATED QUARTERLY EBITDA GREW BY 7.9% TO ` 23,299 CRORE CONSOLIDATED QUARTERLY PAT BEFORE EXCEPTIONAL ITEM AT ` 10,602 CRORE HIGHER BY 28% CONSUMER BUSINESSES CONTRIBUTED 49.6% OF CONSOLIDATED SEGMENT EBITDA RECORD QUARTERLY EBITDA FOR DIGITAL SERVICES AT ` 8,345 CRORE ROBUST RECOVERY IN RETAIL EBITDA TO ` 2,006 CRORE HIGHER BY 85.9% CAPITAL RAISE OF ` 152,056 CRORE IN JIO PLATFORMS LIMITED CAPITAL RAISE OF ` 37,710 CRORE IN RELIANCE RETAIL VENTURES LIMITED FIRST TELECOM OPERATOR OUTSIDE CHINA TO CROSS 400 MN SUBSCRIBERS IN A SINGLE COUNTRY MARKET ADDED IN EXCESS OF 30,000 TO ITS WORKFORCE Registered Office: Corporate Communications Telephone : (+91 22) 2278 5000 Maker Chambers IV Maker Chambers IV Telefax : (+91 22) 2278 5185 3rd Floor, 222, Nariman Point 9th Floor, Nariman Point Internet : www.ril.com; [email protected] Mumbai 400 021, India Mumbai 400 021, India CIN : L17110MH1973PLC019786 Page 1 of 19 STRATEGIC UPDATES • Jio Platforms Limited, a wholly owned subsidiary of Reliance Industries Limited, raised ₹ 152,056 crore from leading global investors including Facebook, Google, Silver Lake, Vista Equity Partners, General Atlantic, KKR, Mubadala, ADIA, TPG, L Catterton, PIF, Intel Capital and Qualcomm Ventures. • Reliance Retail Ventures Limited (RRVL), a wholly owned subsidiary of Reliance Industries Limited, raised ` 37,710 crore of investments from leading global investors including Silver Lake, KKR, General Atlantic, Mubadala, GIC, TPG and ADIA. -

Final Placement Report 2016-2018

INDIAN INSTITUTE OF Final Placement Report MANAGEMENT 2016-2018 INDORE OVERVIEW It gives me immense pleasure overseeing a successful placement season with a tremendous increase in the average CTC as well as the highest CTC. Leveraging upon the largest batch across all IIMs -including PGP, PGP Mumbai and IPM programmes, an advent of new relationships were developed. This is a testament to the confidence and trust shown by the industry in the rigor and excellence of IIM Indore and further reaffirms our position among the top business schools in the country. On behalf of the entire IIM Indore Community, I would like to thank all our recruitment partners for continuous support and for recognizing IIM Indore as a preferred campus for recruitment. - Prof. Rishikesha T. Krishnan, Director IIM Indore has once again proven its eminence among the premier business schools of the country with the recently concluded final placements for 2016-18 batch that comprised of 624 participants (443 PGP, 68 PGP- Mumbai & 113 IPM). The multitude of offers granted by industry giants reaffirms their trust in the institute and its legacy. The season witnessed a highly commendable increase in the number of recruiters across multiple sectors. More than 200 recruiters participated in the process. The highest international package offered this year was 63.45 LPA while the highest domestic package stood at 33.04 LPA. The average CTC for the batch was 18.17 LPA, which is a 12% increase from the previous year. Also, owing to the excellent performance of students during their summer internships, the number of Pre-Placement Offers (PPOs) extended by companies this year increased by an astonishing 40% to 147.