Delivering on Our Strategic Objectives

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Executive Summary

Executive summary For more information, visit: www.vodafone.com/investor Highlights Group highlights for the 2010 financial year Revenue Financial highlights ■ Total revenue of £44.5 billion, up 8.4%, with improving trends in most £44.5bn markets through the year. 8.4% growth ■ Adjusted operating profit of £11.5 billion, a 2.5% decrease in a recessionary environment. ■ Data revenue exceeded £4 billion for the first time and is now 10% Adjusted operating profit of service revenue. ■ £1 billion cost reduction programme delivered a year ahead of schedule; £11.5bn further £1 billion programme now underway. 2.5% decrease ■ Final dividend per share of 5.65 pence, resulting in a total for the year of 8.31 pence, up 7%. ■ Higher dividends supported by £7.2 billion of free cash flow, an increase Free cash flow of 26.5%. £7.2bn Operational highlights 26.5% growth ■ We are one of the world’s largest mobile communications companies by revenue with 341.1 million proportionate mobile customers, up 12.7% during the year. Proportionate mobile customers ■ Improved performance in emerging markets with increasing revenue market share in India, Turkey and South Africa during the year. ■ Expanded fixed broadband customer base to 5.6 million, up 1 million 341.1m during the year. 12.7% growth ■ Comprehensive smartphone range, including the iPhone, BlackBerry® Bold and Samsung H1. ■ Launch of Vodafone 360, a new internet service for the mobile and internet. ■ High speed mobile broadband network with peak speeds of up to 28.8 Mbps. Vodafone Group Plc Annual Report 2010 1 Sir John Bond Chairman Chairman’s statement Your Company continues to deliver strong cash generation, is well positioned to benefit from economic recovery and looks to the future with confidence. -

This Week's Stories

For the Week Ending April 2, 2010 This Week’s Stories______ However, although the work at the 3GPP will make it possible to deploy TD-LTE at 2.6GHz in the US, Clearwire is committed to WiMax for now. Clearwire Paves Way for LTE in US March 29, 2010 "Clearwire intends to maintain our 4G leadership position, which requires us to future-proof our network and stay Clearwire LLC is part of a group of operators and vendors abreast of emerging 4G technologies and evaluate their that has asked the 3rd Generation Partnership Project potential when and if standards are reached," a Clearwire (3GPP) standards body to start work on specs that would spokeswoman wrote in an emailed response to Light allow TD-LTE to be deployed in the US in the 2.6GHz Reading Mobile. spectrum -- which is now used for WiMax -- in a move that further exposes the operator's interest in the competing Another boost for TD-LTE? proto-4G standard. Beyond the implications for Clearwire's future network technology strategy, adding the US 2.6GHz band to the The proposal to adopt the 2496MHz-to-2690MHz 3GPP LTE specs could potentially broaden the market for frequency band in the US for TD-LTE, which was first TD-LTE. highlighted on the "LTE Watch" blog, was accepted at a 3GPP meeting earlier this month. The acceptance is TD-LTE is the flavor of LTE that China Mobile will use, significant because it will enable Clearwire and other although it will deploy the technology at 2.3GHz. The spectrum holders to deploy TD-LTE, which is the time operator is looking to gain support for TD-LTE outside division duplex (TDD) version of LTE, in the US. -

MEDIA RELEASE Vodafone Hutchison

Hutchison Telecommunications (Australia) Limited ABN 15 003 677 227 Level 7, 40 Mount Street North Sydney, NSW 2060 Tel: (02) 99644646 Fax: (02) 8904 0457 www.hutchison.com.au ASX Market Announcements Australian Securities Exchange Date 24 January 2014 Subject: VHA Announcement Please find attached a media release from Vodafone Hutchison Australia Pty Limited. Yours faithfully Louise Sexton Company Secretary For personal use only MEDIA RELEASE Vodafone Hutchison Australia appoints new CEO Friday, 24 January 2014 – Vodafone Hutchison Australia today announced the appointment of Inaki Berroeta as CEO Vodafone Hutchison Australia. Inaki is currently CEO in Romania and will succeed Bill Morrow on 1 March. Bill Morrow will remain with Vodafone Australia until the end of March. Inaki Berroeta has served as President and Chief Executive Officer since 2010 overseeing 3500-employees (total revenue was EUR 769 million with EBITDA of EUR 276 million for the fiscal year 2012-2013). Under Mr Berroeta’s leadership Vodafone Romania has delivered growth and improved profitability in a highly competitive market and tough economic conditions. He led Vodafone Romania’s successful bid to renew and acquire a 15-year spectrum license and established the company as the first mobile carrier to offer LTE services. Outgoing CEO of Vodafone Australia, Bill Morrow, said Mr Berroeta’s international experience and passion for the Vodafone family would ensure a smooth transition and a continued transformation of the company. “Inaki is a great fit for the local team and his diverse background places him well to take Vodafone through to the next phase of its 3 year turnaround. -

Vodafone Netherlands Calls on Clariba for BI Solutions

Clariba Customer Success Story Sending a clear signal to mobile customers Vodafone Netherlands calls on Clariba for BI solutions Connecting customers with the right product mix is a key objective for the Consumer Base Management (CBM) Team at Vodafone, a global leader in mobile telecommunications. By measuring the success of consumer focused marketing campaigns, understanding the customer lifecycle and identifying new prepaid and contract offerings, the CBM Team can target customers more effectively. However, this can only be achieved with timely and accurate information. The Company Vodafone Netherlands The Disconnect The CBM Team at Vodafone Netherlands recognized that their data collection Industry process made it difficult to access information due to the huge volume of customer Telecommunications data records (CDR). As a result of time-consuming report generation, the data presented to the management team was delivered too late and considered inac- Objectives curate, leaving decision-makers at Vodafone in the dark as to the success of their • Implement key reports within a marketing campaigns. maintainable BI solution Vodafone engaged Clariba to help them achieve the objective of centralizing and • Automate the report generation and automating their information gathering process. The CBM Team also identified distribution process the need for accurate information delivered cost-effectively and on time from one • Develop a management portal with trusted source to all relevant marketers and decision-makers. dashboard including key indicators The Clariba Difference Answering the Call • Customized BI solution based on Clariba collaborated with the CBM Team to implement a reliable BI solutionbased clear understanding of business requirements on the market leading BusinessObjects platform. -

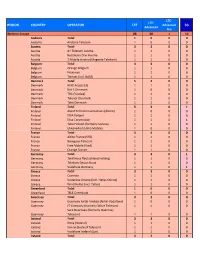

Mobile Data Consumption Continues to Grow – a Majority of Operators Now Rewarded with ARPU

Industry analysis #3 2019 Mobile data – first half 2019 Mobile data consumption continues to grow – a majority of operators now rewarded with ARPU Taiwan: Unlimited is so last year – Korea: 5G boosts usage Tefficient’s 24th public analysis on the development and drivers of mobile data ranks 115 operators based on average data usage per SIM, total data traffic and revenue per gigabyte in the first half of 2019. tefficient AB www.tefficient.com 5 September 2019 1 The data usage per SIM grew for all; everybody climbed our Christmas tree. More than half of the operators could turn that data usage growth into ARPU growth – for the first time a majority is in green. Read on to see who delivered on “more for more” – and who didn’t. Speaking of which, we take a closer look at the development of one of the unlimited powerhouses – Taiwan. Are people getting tired of mobile data? We also provide insight into South Korea – the world’s leading 5G market. Just how much effect did 5G have on the data usage? tefficient AB www.tefficient.com 5 September 2019 2 Fifteen operators now above 10 GB per SIM per month Figure 1 shows the average mobile data usage for 115 reporting or reported1 mobile operators globally with values for the first half of 2019 or for the full year of 2018. DNA, FI 3, AT Zain, KW Elisa, FI LMT, LV Taiwan Mobile, TW 1) FarEasTone, TW 1) Zain, BH Zain, SA Chunghwa, TW 1) *Telia, FI Jio, IN Nova, IS **Maxis, MY Tele2, LV 3, DK Celcom, MY **Digi, MY **LG Uplus, KR 1) Telenor, SE Zain, JO 3, SE Telia, DK China Unicom, CN (handset) Bite, -

Vodafone Greece Corporate Responsibility Report 2006-2007

Corporate Responsibility Report April 2006 - March 2007 Vodafone Greece Corporate Responsibility Report 2006-2007 Contents Letter from the Chairman of the Board of Directors and Chief Executive 3 Introductory Note 4 About Vodafone Greece and the Vodafone Group 6 Managing Corporate Responsibility 8 Environment 18 Mobile Phones - Masts - Health - Network Deployment 32 Access to Communications 38 Customers 44 Supply Chain 50 Employees 52 Social Investment 58 Odjectives - Results - New Commitments Table 66 Main Figures in Table Form 76 Website Index 77 Abbreviations 78 GRI Relevant Requirements Table 80 GRI Report Application Level 85 Vodafone Greece Corporate Responsibility Report 2006-2007 2 Vodafone Greece Corporate Responsibility Report 2006-2007 Letter from the Chairman of the Board of Directors and Chief Executive At Vodafone Greece we are taking consistent steps to reduce our impact on the environment, given that one of our business principles is a commitment to sustainable business practices and environmental protection. Energy savings, use of renewable energy sources and recycling are not just theory for us, but ongoing strategic investments and an everyday practice for our 2,600 employees, and are coupled with a specific methodology and measurable results. Since 1993, when Vodafone Greece began its operations, we have been systematically investing in cooling/heating and lighting energy saving programs, as well as photovoltaic systems to provide power to our base stations. Over the last three years, our energy program prevented the emission of 22,830 tons of carbon dioxide, a quantity that equals the annual energy consumption of approximately 4,000 Greek households. At the same time, we have been investing in recycling mobile phones, accessories, batteries and paper. -

Customer Insight Development in Vodafone Italy

Customer Insight development in Vodafone Italy Emanuele Baruffa – Vodafone Seugi - Vienna, 17-19 June 2003 Seugi 21_Vienna Pag. 1 ContentsContents:: 1. Introduction 2. Customer Base Management 3. Customer Insight 4. Data Environment 5. Conclusions Seugi 21_Vienna Pag. 2 1. Introduction 2. Customer Base Management 3. Customer Insight 4. Data Environment 5. Conclusions Seugi 21_Vienna Pag. 3 MobileMobile telephonytelephony isis oneone ofof thethe fastestfastest growinggrowing industriesindustries inin thethe worldworld Worldwide growth in subscribers (millions) ! 1 billion subscribers 1480 around the world 1321 ! Over 120 1152 countries have 958 mobile networks 727 ! Further acceleration 479 expected 206 87 14 34 Source: EITO 1991 1993 1995 1997 1999 2000 2001 2002 2003e 2004e Seugi 21_Vienna Pag. 4 Italy:Italy: Europe’sEurope’s secondsecond biggestbiggest mobilemobile marketmarket Country Subscribers Penetration Western European TLC market % growth by country (%) 10 9,1 9 Germany 60,300,000 84% 8 6,8 6,8 7 6,2 6,1 5,7 5,8 Italy 54,000,000 98% 6 5,6 5,6 5,4 5,0 5 UK 50,900,000 92% 4,0 4 France 39,000,000 77% 3 Spain 34,000,000 88% 2 1 0 Germany Italy UK France Spain Western Europe Sources: internal sources for Italy, Yankee Group for Source: EITO other European countries 2001/2002 2002/2003 Seugi 21_Vienna Pag. 5 PenetrationPenetration raterate inin thethe ItalianItalian marketmarket 60,000 96% 98% 100% 91% Subscribers (,000) 90% 50,000 Penetration Rate 80% 74% 70% 40,000 60% 53% 30,000 50% 36% 40% 20,000 30% 21% 20% 10,000 11% 10% 0 0% 1996 1997 1998 1999 2000 2001 2002 2003 Seugi 21_Vienna Pag. -

Before the FEDERAL COMMUNICATIONS COMMISSION Washington, D.C

Before the FEDERAL COMMUNICATIONS COMMISSION Washington, D.C. In the Matter of EDGE CABLE HOLDINGS USA, LLC, File No. SCL-LIC-2020-____________ AQUA COMMS (AMERICAS) INC., AQUA COMMS (IRELAND) LIMITED, CABLE & WIRELESS AMERICAS SYSTEMS, INC., AND MICROSOFT INFRASTRUCTURE GROUP, LLC, Application for a License to Land and Operate a Private Fiber-Optic Submarine Cable System Connecting the United States, the United Kingdom, and France, to Be Known as THE AMITIÉ CABLE SYSTEM JOINT APPLICATION FOR CABLE LANDING LICENSE— STREAMLINED PROCESSING REQUESTED Pursuant to 47 U.S.C. § 34, Executive Order No. 10,530, and 47 C.F.R. § 1.767, Edge Cable Holdings USA, LLC (“Edge USA”), Aqua Comms (Americas) Inc. (“Aqua Comms Americas”), Aqua Comms (Ireland) Limited (“Aqua Comms Ireland,” together with Aqua Comms Americas, “Aqua Comms”), Cable & Wireless Americas Systems, Inc. (“CWAS”), and Microsoft Infrastructure Group, LLC (“Microsoft Infrastructure”) (collectively, the “Applicants”) hereby apply for a license to land and operate within U.S. territory the Amitié system, a private fiber-optic submarine cable network connecting the United States, the United Kingdom, and France. The Applicants and their affiliates will operate the Amitié system on a non-common-carrier basis, either by providing bulk capacity to wholesale and enterprise customers on particularized terms and conditions pursuant to individualized negotiations or by using the Amitié cable system to serve their own internal business connectivity needs. The existence of robust competition on U.S.-U.K., U.S.-France, and (more broadly) U.S.-Western Europe routes obviates any need for common-carrier regulation of the system on public-interest grounds. -

International SMS - Supporting Destinations and Network Operators* 國際短訊服務 - 支援地方及網絡商*

International SMS - Supporting Destinations and Network Operators* 國際短訊服務 - 支援地方及網絡商* Destinations 地 方 Network Operator 網 絡 商 Afghanistan 阿富汗 MTN Afghanistan (Areeba) AWCC Roshan (TDCA) Aland 奧蘭島 (芬) Alands Telekommunikation Elisa Finland Sonera Albania 阿爾巴尼亞 AMC Eagle Mobile Vodafone Albania Algeria 亞爾及利亞 Djezzy Wataniya Algeria Andorra 安道爾 Andorra Telecom Angola 安哥拉 Unitel Angola Anguilla (West Indies) 安圭拉島 (西印度群島) C&W (West Indies) Digicel Antigua (West Indies) 安提瓜 (西印度群島) C&W (West Indies) Digicel Argentina 阿根廷 AMX (Claro Argentina) Movistar Argentina Telecom Personal Armenia 亞美尼亞 ArmenTel Vivacell-MTS Aruba 阿魯巴 SETAR Digicel Australia 澳洲 'yes' Optus Telstra Vodafone Australia Austria 奧地利 Orange Austria T-Mobile Austria A1 Telekom Austria AG (MobilKom) Azerbaijan 亞塞拜疆 Azercell Azerfon Bakcell Azores 亞速爾群島(葡) Vodafone Portugal TMN Bahamas 巴哈馬 BTC Bahrain 巴林 Batelco STC Bahrain (VIVA) zain BH (Vodafone Bahrain) Bangladesh 孟加拉 Robi (AKTel) Banglalink GrameenPhone Airtel (Warid Bangladesh) Barbados (West Indies) 巴巴多斯 (西印度群島) C&W (West Indies) Digicel Barbuda (West Indies) 巴布達 (西印度群島) C&W (West Indies) Digicel Belarus 白俄羅斯 MTS Belarus FE VELCOM (MDC) Belgium 比利時 Base NV/SA (KPN) MobiStar Belgacom Belize 伯利茲 BTL Benin 貝寧 Etisalat Benin S.A Spacetel Benin (MTN-Areeba) Bermuda 百慕達 Digicel Bhutan 不丹 B-Mobile Bhutan Bolivia 波利維亞 Entel Bornholm 波恩荷爾摩島 (丹) Telenor A/S Telia Danmark TDC A/S Bosnia and Herzegovina 波斯尼亞 HT Mobile Botswana 博茨瓦納 Orange Botswana Brazil 巴西 Brasil Telecom Celular (Oi Brazil) Claro Brasil TIM Brasil TNL PCS British Virgin -

News Release

news release 31 January 2007 VODAFONE REACHES 200 MILLION CUSTOMERS Vodafone Group Plc (“Vodafone”) today announces key performance indicators for the quarter ended 31 December 2006. The main highlights are: • Organic growth of 6.1% for the quarter in proportionate mobile revenue, with proportionate growth of 0.9% in Europe and 14.4% in EMAPA. Nine months year to date organic growth in proportionate mobile revenue of 6.1% • On a statutory basis, growth in total revenue for the quarter was 5.1%, with organic service revenue growth of 4.8% • 8.7 million proportionate organic net mobile additions for the quarter. Total proportionate mobile customer base at 198.6 million at the end of the quarter after a net reduction of 1.7 million mobile customers from other movements, principally business disposals • Total proportionate mobile customer base over 200 million by the end of January • 2.5 million 3G devices added, bringing total 3G device base to 13.6 million. 3G Broadband through HSDPA available across 21 of the Group’s markets and partner networks • Completed disposal of interests in Proximus and Swisscom Mobile with net proceeds of £3.1 billion • Continued execution on revenue stimulation and total communications objectives with Vodafone At Home now launched in seven markets, including five offering DSL services, and Vodafone Office available in 11 markets • Execution of core cost reduction programmes, including IT outsourcing, data centre consolidation, supply chain management and network sharing, all on track • Vodafone re-iterates its current year outlook with the financial performance for the quarter and year to date in line with expectations Arun Sarin, Chief Executive, commented: “These KPIs are very much in line with expectations and show that we are continuing to make progress in executing our strategy. -

Prepared for Upload GCD Wls Networks

LTE‐ LTE‐ REGION COUNTRY OPERATOR LTE Advanced 5G Advanced Pro Western Europe 88 68 1 10 Andorra Total 10 0 0 Andorra Andorra Telecom 10 0 0 Austria Total 33 0 0 Austria A1 Telekom Austria 11 0 0 Austria Hutchison Drei Austria 11 0 0 Austria T‐Mobile Austria (Magenta Telekom) 11 0 0 Belgium Total 33 0 0 Belgium Orange Belgium 11 0 0 Belgium Proximus 11 0 0 Belgium Telenet (incl. BASE) 11 0 0 Denmark Total 54 0 0 Denmark Hi3G Access (3) 11 0 0 Denmark Net 1 Denmark 10 0 0 Denmark TDC (YouSee) 11 0 0 Denmark Telenor Denmark 11 0 0 Denmark Telia Denmark 11 0 0 Finland Total 53 0 1 Finland Aland Telecommunications (Alcom) 10 0 0 Finland DNA Finland 11 0 0 Finland Elisa Corporation 11 0 1 Finland Telia Finland (formerly Sonera) 11 0 0 Finland Ukkoverkot (Ukko Mobile) 10 0 0 France Total 44 0 0 France Altice France (SFR) 11 0 0 France Bouygues Telecom 11 0 0 France Free Mobile (Iliad) 11 0 0 France Orange France 11 0 0 Germany Total 33 0 1 Germany Telefonica Deutschland Holding 11 0 0 Germany Telekom Deutschland 11 0 0 Germany Vodafone Germany 11 0 1 Greece Total 33 0 0 Greece Cosmote 11 0 0 Greece Vodafone Greece (incl. Hellas Online) 11 0 0 Greece Wind Hellas (incl. Tellas) 11 0 0 Greenland Total 10 0 0 Greenland TELE Greenland 10 0 0 Guernsey Total 32 0 0 Guernsey Guernsey Airtel Limited (Airtel‐Vodafone) 10 0 0 Guernsey JT Guernsey (formerly Wave Telecom) 11 0 0 Sure Guernsey (formerly Guernsey Guernsey Telecom) 11 0 0 Iceland Total 33 0 0 Iceland Nova (Iceland) 11 0 0 Iceland Siminn (Iceland Telecom) 11 0 0 Iceland Vodafone Iceland (Syn) -

Lists of Current Accreditations for Operators (Networks)

Rich Communications Services Interoperability and Testing / Accreditation Lists of current accreditations for Operators (networks) Lists of current accreditations for Operators (networks) Accreditation List of services/service # Company name Network brand name Country Accreditation level Accreditation status type clusters UP-Framework, UP- Approved (valid until 1 Evolve Cellular Inc. Evolve Cellular USA Provisional Messaging, UP- Universal Profile 1.0 4.12.2018) EnrichedCalling China Mobile Communication UP-Framework, UP- Approved (valid until 2 China Mobile China Provisional Universal Profile 1.0 Co. Ltd. Messaging 25.02.2019) UP-Framework, UP- Universal Profile Approved (valid until 3 Vodafone Group Vodafone-Spain Spain Provisional Messaging, UP- Transition – Phase 1 20.12.2018) EnrichedCalling UP-Framework, UP- Universal Profile Approved (valid until 4 Vodafone Group Vodafone-Deutschland Germany Provisional Messaging, UP- Transition – Phase 1 20.12.2018) EnrichedCalling UP-Framework, UP- Vodafone Albania Sh. Universal Profile Approved (valid until 5 Vodafone Group Albania Provisional Messaging, UP- A Transition – Phase 1 20.12.2018) EnrichedCalling 29 January 2018 Rich Communications Services Interoperability and Testing / Accreditation Lists of current accreditations for Operators (networks) Accreditation List of services/service # Company name Network brand name Country Accreditation level Accreditation status type clusters UP-Framework, UP- Vodafone Czech Czech Universal Profile Approved (valid until 6 Vodafone Group Provisional