OFFICIAL REPORT (Hansard)

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Landmark Literature

JANUARY 2018 # 60 Upfront In My View Feature Business Monitoring big cat diets Catching the next wave Tracking down counterfeit PolyLC’s Andrew Alpert – by a whisker in IMS drugs with Minilab shares his lessons learned 13 18 34 – 43 44 – 48 Landmark Literature Ten experts select and reflect on standout papers that advanced analytical science in 2017. 22 – 33 www.theanalyticalscientist.com NORTH AMERICA SPP speed. USLC® resolution. A new species of column. • Drastically faster analysis times. • Substantially improved resolution. • Increased sample throughput with existing instrumentation. • Dependable reproducibility. Choose Raptor™ SPP LC columns for all of your valued assays to experience Selectivity Accelerated. www.restek.com/raptor www.restek.com/raptor Pure Chromatography Image of the Month Core Values Researchers at Scripps Institution of Oceanography have developed a new way to measure the average temperature of the world’s oceans over geological time. The scientists used a dual-inlet isotope ratio mass spectrometer to measure noble gases trapped in Antarctic ice caps, and showed that mean global ocean temperature increased by 2.57 ± 0.24 degrees Celsius over the last glacial transition (20,000 to 10,000 years ago). Seen here is an ice core from West Antarctica, drilled in 2012. Credit: Jay Johnson/IDDO. Reference: B Bereiter et al., “Mean global ocean temperatures during the last glacial transition”, Nature, 553, 39–44 (2018). Would you like your photo featured in Image of the Month? Send it to [email protected] -

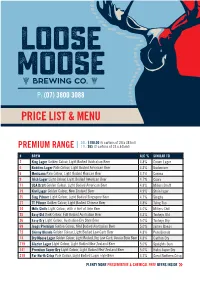

P: (07) 3800 3088 Price List & Menu

P: (07) 3800 3088 PRICE LIST & MENU 50L: $180.00 (6 cartons of 24 x 345ml) PREMIUM RANGE | 17L: $65 (2 cartons of 24 x 345ml) # BREW ALC % SIMILAR TO 2 King Lager Golden Colour, Light Bodied Australian Beer 4.8% Crown Lager 4 Buddies Lager Pale Colour, Light Bodied American Beer 4.3% Budweiser 6 Mexicana Pale Colour, Light Bodied Mexican Beer 4.7% Corona 9 Irish Lager Light Colour, Light Bodied American Beer 4.7% Coors 11 USA Draft Golden Colour, Light Bodied American Beer 4.8% Millers Draft 19 Kiwi Lager Golden Colour, New Zealand Beer 4.9% Stein lager 25 Sing Pilsner Light Colour, Light Bodied Singapore Beer 4.7% Singha 27 TT Pilsner Golden Colour, Light Bodied Chinese Beer 4.8% Tsing Tao 34 Mills Chills Light Colour, with a hint of lime Beer 4.0% Millers Chill 35 Easy Old Dark Colour, Full Bodied Australian Beer 4.3% Tooheys Old 36 Easy Dry Light Colour, Australian Dry Style Beer 5.0% Tooheys Dry 69 Joags Premium Golden Colour, Med Bodied Australian Beer 5.0% James Boags 72 Skinny Blonde Golden Colour, Light Bodied Low Carb Beer 4.8% Pure Blonde 73 Dry Moose Lager Golden Colour, Light Bodied, Dry, Low Carb, Aussie Style Beer 4.8% Carlton Dry 119 Glazier Lager Light Colour, Light Bodied New Zealand Beer 5.0% Speights Sum 141 Premium Super Dry Light Colour, Light Bodied New Zealand Beer 5.0% Hahn Super Dry 219 Far North Crisp Pale Colour, Light Bodied Lager style Beer 4.2% Great Northern Crisp PLENTY MORE PRESERVATIVE & CHEMICAL FREE BEERS INSIDE » 50L: $210.00 (6 cartons of 24 x 345ml) EXCLUSIVE RANGE | 17L: $75 (2cartons of 24 x 345ml) -

Wine - Glass & Bottle R L B

WINE - GLASS & BOTTLE R L B Mitchelton VS Cuvee Mitchelton 6.5 24 De Bortoli King Valley Prosecco King Valley 7.5 30 Clancy Cabernet Blend Barossa 7 11 26 St Hallet Rose Grenache Barossa 8 13 32 Sister’s Run Bethlehem Block Cabernet Sauvignon Barossa 7.5 12 30 Morgans Bay Chardonnay SE Australia 6.5 10 24 Hentley Farm Poppy Field Blend Chardonnay Dominant Barossa 7.5 12 30 Brown Brothers Moscato King Valley 7.5 12 30 Mandoletto Pinot Grigio Italy 7.5 12 30 Ara Single Estate Pinot Noir Marlborough, New Zealand 7.5 12 30 Oyster Bay Sauvignon Blanc New Zealand 8 13 32 Morgans Bay Sauvignon Blanc SE Australia 6.5 10 24 Wongary Shiraz Wrattonbully (Coonawarra) 7 11 26 Sister’s Run Epiphany Shiraz McLaren Vale 7.5 12 30 WINE - BOTTLE Taltarni T Series NV Multi Regional 27 Yarra Burn Sparkling Victoria 34 Brown Brothers Prosecco 200ml Piccolo King Valley 9.5 Yellowglen 200ml Piccolo SE Australia 9 Henkell Dealcoholised 200ml Piccolo Rhine Valley, Germany 7.5 Sam Miranda Ballerina Bianco Blend King Valley 30 Sister’s Run St Petri’s Riesling Eden Valley 27 Ara Single Estate Sauvignon Blanc Marlborough 30 Run Riot Sauvignon Blanc New Zealand 32 Shaw & Smith Sauvignon Blanc New Zealand 40 Taltarni T Series Sauvignon Blanc Pyrenees 27 Preece Pinot Grigio Mitchelton 30 Wongary Pinot Gris Wrattonbully (Coonawarra) 26 Knappstein Beaumont Chardonnay Barossa 27 Sister’s Run Sunday Slippers Chardonnay Barossa 30 Paul Conti Chardonnay Margaret River 32 Sam Miranda Ballerina Moscato King Valley 30 WINE - BOTTLE Bertaine Rose France 32 Sam Miranda Ballerina -

Pavilion Restaurant

Pavilion Restaurant WINE LIST PRICE ($) SPARKLING Glass Bottle TRENTHAM ESTATE NV BRUT | Trentham Cliffs, NSW ...................................................................N/A 7.5 (200ml) A delicate, light weight wine with persistent green apple and citrus flavours on a soft creamy palate. SAN MARTINO NV PROSECCO DOC Extra Dry | Veneto, Italy ........................................................6.5 24.5 A thread of sweetness, excellent fruit and clean, balance acidity. WHITE XANADU DJL SAUVIGNON BLANC SEMILLON | Margaret River, WA ................................................7 28.5 Blend of Sauvignon Blanc and Semillon is a crisp, refreshing style offering zesty citrus, herbs and passionfruit characters. Pa ROAD SAUVIGNON BLANC | Marlborough, NZ ..........................................................................6 21.5 2nd label of te Pa, classically Marlborough in style and flavour of citrus, tropical fruit and snow pea characters. TALISMAN RIESLING | Geographe, WA ..........................................................................................7 28.5 A light, dry and crisp wine with punchy aroma of rose petal, citrus blossom and lime, strong varietal flavour. ROSILY VINEYARD CHARDONNAY | Margaret River, WA .................................................................7.5 32.5 A classic stone fruit and white peach flavours as well as some mineral and flinty elements. RIVER RETREAT PINK MOSCATO | Trentham Cliffs, NSW ...............................................................5.5 15 Slightly fizzy with -

Introducing the Bushmills 4.5L Bottle

THE OFFICIAL VOICE OF THE NORTHERN IRELAND FEDERATION OF CLUBS Club ReviewVOLUME 32 - Issue 1, 2019 INTRODUCING THE BUSHMILLS 4.5L BOTTLE Due to popular demand, local favourite Bushmills Irish Whiskey is now available in a 4.5L bottle. With hints of honey, malt and spice a Bushmills Original Hot Whiskey is the perfect pour this season. Available now through all good wholesalers Optics and POS available while stocks last Contact Patrick Morgan: [email protected] +447734128048 Bushmills & Associated logos are trademarks® of “The Old Bushmills Distillery”, Bushmills, County Antrim. ©2019 Proximo Spirits. ENJOY BUSHMILLS RESPONSIBLY 050 Black bush Jan 2019 press ad A4 V5.indd 1 09/02/2019 15:24 Federation Update Minutes of the Executive Meeting Hosted by Philip Russell Limited, on Wednesday 9th January 2019 The Federation Executive in the UK have made remain unchanged, in that, in passed as a true record by Tommy Committee received a warm representation in respect to this all cases, the first port of call McMinn and Jim Hanna. welcome to the offices of Philip license, in view of which we are should be the club insurers, Russell Limited, by Michael happy for them to take the lead which, if your club insurance is The next Executive Committee Barnes, General Manager, and in this matter. with Rollins Club Insurance, meeting will be hosted by the Rhonda Simpson, Sales Manager. should be ‘DAS’. Our Federation Felons Club, Belfast. Details The Secretary provided details colleague Joe Patterson, who of the Federation AGM, to be Prior to commencing the of a meeting with a supplier in has experience in this field, is hosted by the RAOB Club In Philip Russell Limited has been supplying the licensed trade for over 40 years and within this time have meeting, the Chairman, John the annual process of renewing keen to underline this advice. -

Beer Knowledge – for the Love of Beer Section 1

Beer Knowledge – For the Love of Beer Beer Knowledge – For the Love of Beer Contents Section 1 - History of beer ................................................................................................................................................ 1 Section 2 – The Brewing Process ...................................................................................................................................... 4 Section 3 – Beer Styles .................................................................................................................................................... 14 Section 4 - Beer Tasting & Food Matching ...................................................................................................................... 19 Section 5 – Serving & Selling Beer .................................................................................................................................. 22 Section 6 - Cider .............................................................................................................................................................. 25 Section 1 - History of beer What is beer? - Simply put, beer is fermented; hop flavoured malt sugared, liquid. It is the staple product of nearly every pub, club, restaurant, hotel and many hospitality and tourism outlets. Beer is very versatile and comes in a variety of packs; cans, bottles and kegs. It is loved by people all over the world and this world wide affection has created some interesting styles that resonate within all countries -

Opening Times 181 Spring 2020

Opening ISSUE 181 Times SPRING 2020 Huntingdonshire branch of CAMRA hunts.camra.org.uk INSIDE FEATURES HUNTS PUB & BREWERY NEWS ST NEOTS ‘BOOZE ON THE OUSE’ 12-14 MARCH STYLE STORIES: GOLDEN ALES 2 OPENING TIMES ISSUE 181 @HuntsCAMRA EDITORIAL A warm welcome to the Opening Times, please email to news@ spring issue of Opening hunts.camra.org.uk (or forward them Times, the magazine from the to a member of the branch committee). Huntingdonshire branch of the The copy date for the next issue is 30 Campaign for Real Ale (CAMRA). April 2020. Thank you for picking up this magazine and reading it. Richard Harrison, Opening Times Editor on behalf of the Branch Committee, February 2020 This is a packed issue with lots of news regarding local pubs and breweries, details of the St Neots ‘Booze on the Ouse’ Beer and Cider Festival and articles including the association of beer and rugby, beer style stories featuring golden ales and a train trip to Grantham. A big thank you to all of CHAIRMAN Gareth Howell The main branch those who contributed and apologies [email protected] contacts listed. if anything you supplied has been Please visit our SECRETARY & BRANCH CONTACT website for a full omitted for space reasons. Chris Bee list of our branch [email protected] Committee members. The aim is for all news and articles to hunts.camra.org.uk TREASURER Graham Mulchinock be current and accurate. However, [email protected] errors may occasionally creep in, so if SOCIAL SECRETARY Juliet Ferris you do spot any errors please contact [email protected] us using the email address below. -

CRAFT BREWERS BASHED by OUR WINDS PRODUCE FOOD NI PRODUCERS 2016 GUIDE @Food NI

We Catch We EnjoyWe Craft We We Breed Grow The People Who Rear, Grow and Make Our Great Local Produce Local Our Great and Make Grow Who Rear, The People e We W Cook Catch HOOKED AND COOKED HERE BORN FOOD &BRED BAKERS BLENDERS &BREWERS Food NI Producers 2016 Guide NI Producers Food LOCALBUTCHERS LUSH PASTURES FARMERS GREAT GRASS ROOTS & SHOOTS Food NI Limited PEOPLE Belfast Mills Tel: +44 (0)28 9024 9449 GROWERS MAKING 71-75 Percy Street Email: [email protected] Belfast, BT13 2HW Web: www.nigoodfood.com LASHED BY OUR RAIN, GREAT @Food_NI CRAFT BREWERS BASHED BY OUR WINDS PRODUCE FOOD NI PRODUCERS 2016 GUIDE @Food_NI #nifood16 #nidrink16 #enjoyni16 #ourfoodsogood Supported by the NORTHERN IRELAND REGIONAL FOOD PROGRAMME 2016 Food NI Producers Guide Who we are Thanks for picking up this booklet. In case you’re wondering who’s behind it, let us tell you. We are Food NI/Taste of Ulster. We’re all about showcasing the finest food and drink from Northern Ireland. We promote the people who produce it and distribute it to shops and catering outlets. We believe we have world-class ingredients and chefs and we work tirelessly to get that message out near and far. Our producer members represent everyone from the small artisan to the large scale distributors. We have the full support of the Northern Ireland agri-food industry. Our board of directors include all the major stakeholders. We’re constantly in touch with the media, telling them about what are members are doing. Every week we are letting know about awards that have been won and new products that have hit the shelves. -

Northern Ireland

26/09/2021 Real Heritage Pubs Online Guide Using this guide The descriptions in this guide make clear the significance of each interior. The pubs fall into two distinct categories: On the National Inventory of Historic Pub Interiors for pubs that remain wholly or largely intact since before World War Two, or are exceptional examples of intact post-war schemes completed before 1970, or which retain particular rooms or other internal features of exceptional historic importance. On the Regional Inventory of Historic Pub Interiors for the Northern Ireland . Inclusion criteria are lower than for the National listings but the same principles apply, with the emphasis on the internal fabric and what is authentically old. In the section More to Try are pubs that are considered to be of 'some regional importance', meaning that the criteria for a full Regional Inventory entry is not satisfied in terms of the overall layout and fittings, but that specific features are of sufficient quality for the pub to be considered noteworthy. Contents Cead mille failte (a hundred thousand welcomes) Belfast & Lisburn Pubs - see under Belfast; Falls (Belfast); Lisburn; Ormeua (Belfast) County Antrim Pubs - see Ballycastle; Ballyeaston; Bushmills; Cushendall; Cushenden; Mallusk (near Belfast); Portrush; Randlestown. in More To Try section - see Ahoghill; Ballymena; Carncastle County Antrim Pubs - Closed Pubs More to Try Cead mille failte (a hundred thousand welcomes) ‘’The Irish Pub’ is a must-do attraction for any visitor to Northern Ireland. Here you will find a huge variety of them – big and small, town and country, the richly embellished and the very simple. -

On Tap Bottled Beer Bottled Cider

ON TAP Carlton Draught Lager 6 Lazy Yak Pale Ale Pale Ale 6.5 Wild Yak Pacific Ale Pacific Ale 6.5 Peroni Nastro Azzurro Lager 7 Great Northern Mid Strength Lager 5.5 Canadian Club & Dry Whisky 7.5 BOTTLED BEER Asahi Super Dry Lager 8 Carlton Dark Ale Dark Ale 6 Carlton Draught Lager 6 Carlton Dry Lager 6 Crown Lager Lager 7 Coopers Pale Ale Pale Ale 7 Corona Lager 8 Heineken Lager 8 Lord Nelson Dark Ale Dark Ale 9 Lord Nelson Pale Ale Pale Ale 9 Peroni Nastro Azzurro Lager 7 Pure Blonde Lager 6 Stella Artois Lager 7 Victoria Bitter Lager 6 BOTTLED CIDER Hills Cider Company Apple Cider 7 Hills Cider Company Pear Cider 7 Rekorderlig Passionfruit Cider 7.5 Rekorderlig Strawberry & Lime Cider 7.5 Rekorderlig Wild Berries Cider 7.5 BOTTLED LIGHT BEER Cascade Premium Light Lager 5 SOFT BEVERAGE Lentini Sparkling water 330ml 5 Lentini Sparkling water 750ml 8 East Coast Juices 4.5 Orange, Apple, Pineapple, Cranberry, Tomato Post Mix on tap 4.5 Coca-Cola, Coke Zero, Sprite, Lift, Fanta, Tonic TEA & COFFEE Di Manfredi Audacia Coffee Cup 4.5 Mug 5.5 Tea Drop Teas 4.5 English Breakfast, Earl Grey, Honeydew Green, Chai, Darjeeling, Ceylon, Lemongrass & Ginger, Camomile GIN Archie Rose Sydney, NSW 12 Blind Tiger Organic Renmark, SA 12 Bols Genever Amsterdam 10 Bombay Sapphire England 10 12The Botanist Scotland 12 Bulldog United Kingdom 10 Distillery Botanica Erina, Central Coast 10 Four Pillars Yarra Valley, VIC 11 Gin Mare Spain 13 Hendricks Scotland 12 Ink Northern Rivers, NSW 12 Moore’s Erina, Central Coast 10 Plymouth United Kingdom 10 Tanqueray United Kingdom 10 Tanqueray no. -

Case No COMP/M.2044 ΠINTERBREW / BASS REGULATION

EN Case No COMP/M.2044 – INTERBREW / BASS Only the English text is available and authentic. REGULATION (EEC) No 4064/89 MERGER PROCEDURE Article 9 Date: 22/08/2000 COMMISSION OF THE EUROPEAN COMMUNITIES Brussels, 22.08.2000 SG (2000) D/ 106331 In the published version of this decision, some information has been omitted pursuant to Article PUBLIC VERSION 17(2) of Council Regulation (EEC) No 4064/89 concerning non-disclosure of business secrets and other confidential information. The omissions are MERGER PROCEDURE shown thus […]. Where possible the information ARTICLE 9(4)(a) DECISION omitted has been replaced by ranges of figures or a general description. Decision relating to the referral of the case No COMP/M. 2044 Interbrew / Bass to the United Kingdom Competition Authorities, pursuant to Article 9 of Regulation 4064/89 THE COMMISSION OF THE EUROPEAN COMMUNITIES, Having regard to the Treaty establishing the European Community, Having regard to Council Regulation (EEC) No. 4064/89 of 21 December 1989, on the control of concentrations between undertakings1, as amended by Council Regulation (EC) No 1310/97 of 30 June 19972 (together, ‘the Merger Regulation’), and in particular article 9(3)(b) thereof, Having regard to the notification made by Interbrew SA on 6 July 2000, pursuant to article 4 of the Merger Regulation, Having regard to the request of the United Kingdom Competition Authorities of 1 August 2000, 1 OJ L 395, 30.12.1989, p.1; corrected version OJ L 257, 21.9.1990, p.13 2 OJ L 180, 9.7.1997, p.1; corrigendum OJ L 40, 13.12.1998, p.17 Rue de la Loi 200, B-1049 Bruxelles/Wetstraat 200, B-1049 Brussel - Belgium Telephone: exchange 299.11.11 Telex: COMEU B 21877. -

Domestic Beer Price List

3 DOMESTIC BEER PRICE LIST Case 30- Case 24- Case 18- Pack 12- Case 24- Case 20- Case 18- Pack 12- Pack 6- 12oz 12oz 12oz 12oz 12oz 12oz 12oz 12oz 12oz Beer Name Cans Cans Cans Cans Bottles Bottles Bottles Bottles Bottles Bud Ice 14.49 13.98 6.99 5.49 Bud Light 18.99 15.99 12.99 8.99 15.99 12.99 8.99 4.99 Bud Light Golden Wheat 21.98 10.99 6.49 Bud Light Lime 21.98 12.99 10.99 21.98 12.99 10.99 6.49 Budweiser 18.99 15.99 12.99 8.99 15.99 12.99 8.99 4.99 Budweiser Select 18.99 15.99 8.99 4.99 Budweiser Select 55 18.99 12.99 17.98 8.99 4.99 Busch 14.99 Busch Light 14.99 Coors 18.99 17.98 12.99 17.98 8.99 4.99 Coors Light 18.99 17.98 12.99 8.99 17.98 13.99 12.99 8.99 4.99 Genesee Beer 12.99 Genesee Cream Ale 12.99 Genesee Light 12.99 Icehouse 15.99 15.98 7.99 Iron City Beer 23.99 Iron City Light 23.99 Keystone Ice 14.99 Keystone Light 13.99 13.98 6.99 Michelob 13.99 19.98 9.99 5.99 Michelob Amber Bock 19.98 9.99 5.99 Michelob Light 13.99 19.98 9.99 5.99 Michelob Ultra 19.99 13.99 16.99 9.99 5.99 Michelob Ultra Amber 19.98 9.99 5.99 Miller Genuine Draft 18.99 17.98 12.99 8.99 15.99 12.99 8.99 4.79 Miller High Life 14.49 13.98 8.99 6.99 3.99 Miller High Life Light 14.49 13.98 6.99 Miller Lite 18.99 17.98 12.99 8.99 15.99 12.99 8.99 4.99 Milwaukee's Best, Ice, Light 13.99 11.98 5.99 National Bohemian 13.98 6.99 17.96 4.49 Natural Ice 13.99 Natural Light 13.99 12.98 6.49 Old Milwaukee 13.98 6.99 Pabst 15.99 10.99 17.96 4.49 Red Dog 17.99 Rolling Rock 17.99 14.99 17.99 9.99 4.99 Schaefer 15.99 Schaefer Light 15.99 Schlitz 21.98 10.99 Kegs Always In Stock We have cold kegs in stock, every day.