Minister's Tax & Financial Guide – 2021 Edition

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

TAX REFORM and SMALL BUSINESS Eric J

REFERENCES TAX REFORM AND SMALL BUSINESS Eric J. Toder * Institute Fellow, Urban Institute and Co-Director, Urban-Brookings Tax Policy Center House Committee on Small Business April 15, 2015 Chairman Chabot, Ranking Member Velazquez, and Members of the Committee. Thank you for inviting me to appear today to discuss the effects of tax reform on small business. There is a growing consensus that the current system of taxing business income needs reform and bi-partisan agreement on some of the main directions of reform, although not the details. The main drivers for reform are concerns with a corporate tax system that discourages investment in the United States, encourages US multinational corporations to retain profits overseas, and places some US-based multinationals at a competitive disadvantage with foreign- based companies, while at the same time raising relatively little revenue, providing selected preferences to favored assets and industries, and allowing some US multinationals to pay very low tax rates by shifting reported profits to low tax countries. • The United States has the highest corporate tax rate in the Organization of Economic Cooperation and Development (OECD). This discourages investment in the United States by both US and foreign-based multinational corporations and encourages corporations to report income in other jurisdictions. • The US rules for taxing multinational corporations encourage US firms to earn and retain profits overseas and place some companies at a competitive disadvantage, encouraging *The views expressed are my own and should not be attributed to the Tax Policy Center or the Urban Institute, its board, or its funders. I thank Leonard Burman, Donald Marron, and George Plesko for helpful comments and Joseph Rosenberg, and John Wieselthier for assistance with the Tax Policy Center simulations. -

Taxation: State and Local Ronald H

Loyola University Chicago Law Journal Volume 18 Article 15 Issue 2 Winter 1986 1985-1986 Illinois Law Survey 1986 Taxation: State and Local Ronald H. Jacobson Follow this and additional works at: http://lawecommons.luc.edu/luclj Part of the Taxation-State and Local Commons Recommended Citation Ronald H. Jacobson, Taxation: State and Local, 18 Loy. U. Chi. L. J. 767 (1986). Available at: http://lawecommons.luc.edu/luclj/vol18/iss2/15 This Article is brought to you for free and open access by LAW eCommons. It has been accepted for inclusion in Loyola University Chicago Law Journal by an authorized administrator of LAW eCommons. For more information, please contact [email protected]. Taxation: State and Local Ronald H. Jacobson* TABLE OF CONTENTS I. INTRODUCTION .................................... 767 II. INCOME TAXATION ................................ 768 A. Unitary Taxation .............................. 768 B. Tax-Exempt Financing......................... 771 C. Interest on Federally GuaranteedBonds ........ 773 III. PROPERTY TAXATION .............................. 776 A. Charitableand EducationalExemptions ........ 776 B. Condominium Assessment Classifications ....... 778 IV. SALES TAXATION - USE TAX EXEMPTION ........ 780 V. TAX PROTESTING .................................. 782 A . Property Tax .................................. 782 B. Retaliatory Tax ................................ 784 VI. LOCAL GOVERNMENT TAXING POWERS ............ 786 A. County Tax Penalty Retention ................. 786 B. Taxation by Home Rule Units ................ -

Creating Market Incentives for Greener Products Policy Manual for Eastern Partnership Countries

Creating Market Incentives for Greener Products Policy Manual for Eastern Partnership Countries Creating Incentives for Greener Products Policy Manual for Eastern Partnership Countries 2014 About the OECD The OECD is a unique forum where governments work together to address the economic, social and environmental challenges of globalisation. The OECD is also at the forefront of efforts to understand and to help governments respond to new developments and concerns, such as corporate governance, the information economy and the challenges of an ageing population. The Organisation provides a setting where governments can compare policy experiences, seek answers to common problems, identify good practice and work to co-ordinate domestic and international policies. The OECD member countries are: Australia, Austria, Belgium, Canada, Chile, the Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Iceland, Ireland, Israel, Italy, Japan, Korea, Luxembourg, Mexico, the Netherlands, New Zealand, Norway, Poland, Portugal, the Slovak Republic, Slovenia, Spain, Sweden, Switzerland, Turkey, the United Kingdom and the United States. The European Union takes part in the work of the OECD. Since the 1990s, the OECD Task Force for the Implementation of the Environmental Action Programme (the EAP Task Force) has been supporting countries of Eastern Europe, Caucasus and Central Asia to reconcile their environment and economic goals. About the EaP GREEN programme The “Greening Economies in the European Union’s Eastern Neighbourhood” (EaP GREEN) programme aims to support the six Eastern Partnership countries to move towards green economy by decoupling economic growth from environmental degradation and resource depletion. The six EaP countries are: Armenia, Azerbaijan, Belarus, Georgia, Republic of Moldova and Ukraine. -

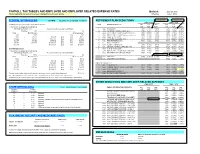

PAYROLL TAX TABLES and EMPLOYEE and EMPLOYER RELATED EXPENSE RATES Updated: June 27, 2012 *Items Highlighted in Yellow Have Been Changed Since the Last Update

PAYROLL TAX TABLES AND EMPLOYEE AND EMPLOYER RELATED EXPENSE RATES Updated: June 27, 2012 *items highlighted in yellow have been changed since the last update. Effective: July 1, 2012 FEDERAL WITHHOLDING 26 PAYS FEDERAL TAX ID NUMBER 86-6004791 RETIREMENT PLAN DEDUCTIONS 10.5% AT 50/50 10.5% AT 50/50 EMPLOYEE EMPLOYER (a) SINGLE person (including head of household) - CODE RETIREMENT PLAN DED OLD NEW DED OLD NEW If the amount of wages (after subtracting CODE RATE RATE CODE RATE RATE withholding allowances) is: The amount of income tax to withhold is: 1 ASRS PLAN-ASRS 7903 11.13% 10.90% 7904 9.87% 10.90% Not Over $83 ............................................................................................. $0 2 CORP JUVENILE CORRECTIONS (501) 7905 8.41% 8.41% 7906 9.92% 12.30% Over But not over - of excess over - 3 EORP ELECTED OFFICIALS & JUDGES (415) 7907 10.00% 11.50% 7908 17.96% 20.87% $83 - $417 10% $83 4 PSRS PUBLIC SAFETY (007) (ER pays 5% EE share) 7909 3.65% 4.55% 7910 38.30% 48.71% $417 - $1,442 $33.40 plus 15% $417 5 PSRS GAME & FISH (035) 7911 8.65% 9.55% 7912 43.35% 50.54% $1,442 - $3,377 $187.15 plus 25% $1,442 6 PSRS AG INVESTIGATORS (151) 7913 8.65% 9.55% 7914 90.08% 136.04% $3,377 - $6,954 $670.90 plus 28% $3,377 7 PSRS FIRE FIGHTERS (119) 7915 8.65% 9.55% 7916 17.76% 20.54% $6,954 - $15,019 $1,672.46 plus 33% $6,954 9 N/A NO RETIREMENT $15,019 ………………………………………………………$4,333.91 plus 35% $15,019 0 CORP CORRECTIONS (500) 7901 8.41% 8.41% 7902 9.15% 11.14% B PSRS LIQUOR CONTROL OFFICER (164) 7923 8.65% 9.55% 7924 38.77% 46.99% (b) MARRIED person F PSRS STATE PARKS (204) 7931 8.65% 9.55% 7932 18.50% 25.16% If the amount of wages (after subtracting G CORP PUBLIC SAFETY DISPATCHERS (563) 7933 7.96% 7.96% 7934 7.50% 7.90% withholding allowances) is: The amount of income tax to withhold is: H PSRS DEFERRED RET OPTION (DROP) 7957 8.65% 9.55% 0.24% AT 50/50 Not Over $312 ............................................................................................ -

Imports in GST Regime (Goods & Services Tax)

Imports in GST Regime (Goods & Services Tax) Introduction Under the GST regime, Article 269A constitutionally mandates that supply of goods, or of services, or both in the course of import into the territory of India shall be deemed to be supply of goods, or of services, or both in the course of inter-State trade or commerce. So import of goods or services will be treated as deemed inter-State supplies and would be subject to Integrated tax. While IGST on import of services would be leviable under the IGST Act, the levy of the IGST on import of goods would be levied under the Customs Act, 1962 read with the Custom Tariff Act, 1975. The importer of services will have to pay tax on reverse charge basis. However, in respect of import of online information and database access or retrieval services (OIDAR) by unregistered, non-taxable recipients, the supplier located outside India shall be responsible for payment of taxes (IGST). Either the supplier will have to take registration or will have to appoint a person in India for payment of taxes. Supply of goods or services or both to a Special Economic Zone developer or a unit shall be treated as inter-State supply and shall be subject to levy of integrated tax. Directorate General of Taxpayer Services CENTRAL BOARD OF EXCISE & CUSTOMS www.cbec.gov.in Imports in GST Regime (Goods & Services Tax) Importer Exporter Code (IEC): As per DGFT’s Trade Notice No. 09 The taxes will be calculated as under: dated 12.06.2017, the PAN of an entity would be used as the Import Particulars Duty Export code (IEC). -

Form W-4, Employee's Withholding Certificate

Employee’s Withholding Certificate OMB No. 1545-0074 Form W-4 ▶ (Rev. December 2020) Complete Form W-4 so that your employer can withhold the correct federal income tax from your pay. ▶ Department of the Treasury Give Form W-4 to your employer. 2021 Internal Revenue Service ▶ Your withholding is subject to review by the IRS. Step 1: (a) First name and middle initial Last name (b) Social security number Enter Address ▶ Does your name match the Personal name on your social security card? If not, to ensure you get Information City or town, state, and ZIP code credit for your earnings, contact SSA at 800-772-1213 or go to www.ssa.gov. (c) Single or Married filing separately Married filing jointly or Qualifying widow(er) Head of household (Check only if you’re unmarried and pay more than half the costs of keeping up a home for yourself and a qualifying individual.) Complete Steps 2–4 ONLY if they apply to you; otherwise, skip to Step 5. See page 2 for more information on each step, who can claim exemption from withholding, when to use the estimator at www.irs.gov/W4App, and privacy. Step 2: Complete this step if you (1) hold more than one job at a time, or (2) are married filing jointly and your spouse Multiple Jobs also works. The correct amount of withholding depends on income earned from all of these jobs. or Spouse Do only one of the following. Works (a) Use the estimator at www.irs.gov/W4App for most accurate withholding for this step (and Steps 3–4); or (b) Use the Multiple Jobs Worksheet on page 3 and enter the result in Step 4(c) below for roughly accurate withholding; or (c) If there are only two jobs total, you may check this box. -

Should EU Implement Its Present Proposal of a Financial Transaction Tax?

Should EU implement its present proposal of a financial transaction tax? Authors: Fredrik Hansson (890429-4033) Tutor: Thomas Ericson Degree of Bachelor of Science in Examiner: Dominique Anxo Business Administration and Subject: Economics Economics Level and semester: Bachelor´s Thesis, Spr 2012 Abstract: This paper study the possibility of implementing a financial transaction tax within the European Union, as a possibility to discourage future financial bubbles and force more fundamental values within the financial market. It is found, after reviewing current research; covering volatility, market volume and speculation, and empirical evidence, that a financial transaction tax fulfill the purpose of creating a more efficient financial system in the case of European Union. Table of Contents Introduction .......................................................................................................................................... 3 Theoretical framework .......................................................................................................................... 3 Empirical studies ................................................................................................................................ 10 United Kingdom ............................................................................................................................. 10 Sweden ........................................................................................................................................... 11 Hong Kong, Japan, -

European Parliament Resolution of 26 March 2019 on Financial Crimes, Tax Evasion and Tax Avoidance (2018/2121(INI)) (2021/C 108/02)

C 108/8 EN Official Journal of the European Union 26.3.2021 Tuesday 26 March 2019 P8_TA(2019)0240 Report on financial crimes, tax evasion and tax avoidance European Parliament resolution of 26 March 2019 on financial crimes, tax evasion and tax avoidance (2018/2121(INI)) (2021/C 108/02) The European Parliament, — having regard to Articles 4 and 13 of the Treaty on European Union (TEU), — having regard to Articles 107, 108, 113, 115 and 116 of the Treaty on the Functioning of the European Union (TFEU), — having regard to its decision of 1 March 2018 on setting up a special committee on financial crimes, tax evasion and tax avoidance (TAX3), and defining its responsibilities, numerical strength and term of office (1), — having regard to its TAXE committee resolution of 25 November 2015 (2) and its TAX2 committee resolution of 6 July 2016 (3) on tax rulings and other measures similar in nature or effect, — having regard to its resolution of 16 December 2015 with recommendations to the Commission on bringing transparency, coordination and convergence to corporate tax policies in the Union (4), — having regard to the results of the Committee of Inquiry into money laundering, tax avoidance and tax evasion, which were submitted to the Council and the Commission on 13 December 2017 (5), — having regard to the Commission’s follow-up to each of the above-mentioned Parliament resolutions (6), — having regard to the numerous revelations by investigative journalists, such as the LuxLeaks, the Panama Papers, the Paradise Papers and, more recently, the cum-ex scandals, as well as the money laundering cases involving, in particular, banks in Denmark, Estonia, Germany, Latvia, the Netherlands and the United Kingdom, — having regard to its resolution of 29 November 2018 on the cum-ex scandal: financial crime and loopholes in the current legal framework (7), (1) Decision of 1 March 2018 on setting up a special committee on financial crimes, tax evasion and tax avoidance (TAX3), and defining its responsibilities, numerical strength and term of office, Texts adopted, P8_TA(2018)0048. -

Publication 509, Tax Calendars

Userid: CPM Schema: tipx Leadpct: 100% Pt. size: 8 Draft Ok to Print AH XSL/XML Fileid: … tions/P509/2021/A/XML/Cycle13/source (Init. & Date) _______ Page 1 of 13 10:55 - 31-Dec-2020 The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing. Publication 509 Cat. No. 15013X Contents Introduction .................. 2 Department of the Tax Calendars Background Information for Using Treasury the Tax Calendars ........... 2 Internal Revenue General Tax Calendar ............ 3 Service First Quarter ............... 3 For use in Second Quarter ............. 4 2021 Third Quarter ............... 4 Fourth Quarter .............. 5 Employer's Tax Calendar .......... 5 First Quarter ............... 6 Second Quarter ............. 7 Third Quarter ............... 7 Fourth Quarter .............. 8 Excise Tax Calendar ............. 8 First Quarter ............... 8 Second Quarter ............. 9 Third Quarter ............... 9 Fourth Quarter ............. 10 How To Get Tax Help ........... 12 Future Developments For the latest information about developments related to Pub. 509, such as legislation enacted after it was published, go to IRS.gov/Pub509. What’s New Payment of deferred employer share of so- cial security tax from 2020. If the employer deferred paying the employer share of social security tax in 2020, pay 50% of the employer share of social security tax by January 3, 2022 and the remainder by January 3, 2023. Any payments or deposits you make before January 3, 2022, are first applied against the first 50% of the deferred employer share of social security tax, and then applied against the remainder of your deferred payments. Payment of deferred employee share of so- cial security tax from 2020. -

Tax Us If You Can 2012 FINAL.Pdf

City Research Online City, University of London Institutional Repository Citation: Murphy, R. and Christensen, J.F. (2012). Tax us if you can. Chesham, UK: Tax Justice Network. This is the published version of the paper. This version of the publication may differ from the final published version. Permanent repository link: https://openaccess.city.ac.uk/id/eprint/16543/ Link to published version: Copyright: City Research Online aims to make research outputs of City, University of London available to a wider audience. Copyright and Moral Rights remain with the author(s) and/or copyright holders. URLs from City Research Online may be freely distributed and linked to. Reuse: Copies of full items can be used for personal research or study, educational, or not-for-profit purposes without prior permission or charge. Provided that the authors, title and full bibliographic details are credited, a hyperlink and/or URL is given for the original metadata page and the content is not changed in any way. City Research Online: http://openaccess.city.ac.uk/ [email protected] tax us nd if you can 2Edition INTRODUCTION TO THE TAX JUSTICE NETWORK The Tax Justice Network (TJN) brings together charities, non-governmental organisations, trade unions, social movements, churches and individuals with common interest in working for international tax co-operation and against tax avoidance, tax evasion and tax competition. What we share is our commitment to reducing poverty and inequality and enhancing the well being of the least well off around the world. In an era of globalisation, TJN is committed to a socially just, democratic and progressive system of taxation. -

Ecotaxes: a Comparative Study of India and China

Ecotaxes: A Comparative Study of India and China Rajat Verma ISBN 978-81-7791-209-8 © 2016, Copyright Reserved The Institute for Social and Economic Change, Bangalore Institute for Social and Economic Change (ISEC) is engaged in interdisciplinary research in analytical and applied areas of the social sciences, encompassing diverse aspects of development. ISEC works with central, state and local governments as well as international agencies by undertaking systematic studies of resource potential, identifying factors influencing growth and examining measures for reducing poverty. The thrust areas of research include state and local economic policies, issues relating to sociological and demographic transition, environmental issues and fiscal, administrative and political decentralization and governance. It pursues fruitful contacts with other institutions and scholars devoted to social science research through collaborative research programmes, seminars, etc. The Working Paper Series provides an opportunity for ISEC faculty, visiting fellows and PhD scholars to discuss their ideas and research work before publication and to get feedback from their peer group. Papers selected for publication in the series present empirical analyses and generally deal with wider issues of public policy at a sectoral, regional or national level. These working papers undergo review but typically do not present final research results, and constitute works in progress. ECOTAXES: A COMPARATIVE STUDY OF INDIA AND CHINA1 Rajat Verma2 Abstract This paper attempts to compare various forms of ecotaxes adopted by India and China in order to reduce their carbon emissions by 2020 and to address other environmental issues. The study contributes to the literature by giving a comprehensive definition of ecotaxes and using it to analyse the status of these taxes in India and China. -

Personal Income Tax Changes | Policy Bulletin

POLICY BULLETIN PERSONAL INCOME TAX CHANGES 10 July 2019 IN BRIEF • Changes to income tax offsets and rates have received Royal Assent • The low and middle income tax offset (LMITO) changes apply to the 2018-19 year • The LMITO applies in a phased manner and is non-refundable • Changes to personal income tax rates apply from the 2022-23 year SUMMARY OF CHANGES The Treasury Laws Amendment (Tax Relief So Working Australians Keep More of Their Money) Act 2019 received Royal Assent on 5 July 2019. The Act: • increases the base and maximum amounts of the low and middle income tax offset (LMITO) to $255 and $1080, respectively, for the 2018-19, 2019-20, 2020-21 and 2021-22 financial years • increases the maximum amount of the low income tax offset from $645 to $700 from the 2022-23 financial year • reduces the tax payable by individuals from the 2022-23 financial year by increasing the top threshold of the 19 per cent income tax bracket from $41,000 to $45,000 • reduces the 32.5 per cent income tax rate to 30 per cent from the 2024-25 financial year. 1 LOW AND MIDDLE INCOME TAX OFFSET From the 2018-19 income year to the 2021-22 financial year, the LMITO for Australian resident taxpayers increases from a maximum amount of $530 to $1080 per annum and the base amount increases from $200 to $255 per annum. The LMITO will directly reduce the amount of tax payable but does not reduce the Medicare levy. As a non- refundable offset, any unused low and middle income tax offset cannot be refunded.