Publication 509, Tax Calendars

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

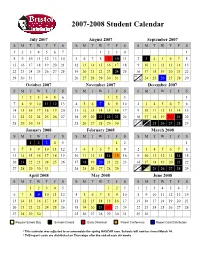

Approved Student Calendar

2007-2008 Student Calendar July 2007 August 2007 September 2007 SMTWT F S SMTWT F S SMTWT F S 1234567 1234 1 8910111213145678910 11 2 3 45678 15 16 17 18 19 20 21 12 13 14 15 16 17 18 9 10 11 12 13 14 15 22 23 24 25 26 27 28 19 20 21 22 23 24 25 16 17 18 19 20 21 22 23 29 30 31 26 27 28 29 30 31 30 24 25 26 27 28 29 October 2007 November 2007 December 2007 SMTWT F S SMTWT F S SMTWT F S 123456 123 1 7891011 12 134567 89102345678 14 15 16 17 18 19 20 11 12 13 14 15 16 17 9 10 11 12 13 14 15 21 22 23 24 25 26 27 18 19 20 21 22 23 24 16 17 18 19 20 21 22 23 24 28 29 30 31 25 26 27 28 29 30 30 31 25 26 27 28 29 January 2008 February 2008 March 2008 SMTWT F S SMTWT F S SMTWT F S 12345 12 1 67891011123456789 2345678 13 14 15 16 17 18 19 10 11 12 13 14 1516 9 1011121314 15 20 21 22 23 24 25 26 17 18 19 20 21 22 23 16 17 18 19 20 21 22 23 24 27 28 29 30 31 24 25 26 27 28 29 30 31 25 26 27 28 29 April 2008 May 2008 June 2008 SMTWT F S SMTWT F S SMTWT F S 12345 123 1234567 6789 10111245678910891011121314 13 14 15 16 17 18 19 11 12 13 14 15 16 17 15 16 17 18 19 20 21 20 21 22 23 24 25 26 18 19 20 21 22 23 24 22 23 24 25 26 27 28 27 28 29 30 25 26 27 28 29 30 31 29 30 Regular School Day Schools Closed Early Dismissal Parent Conference Report Card Distribution * This calendar was adjusted to accommodate the spring NASCAR race. -

Form W-4, Employee's Withholding Certificate

Employee’s Withholding Certificate OMB No. 1545-0074 Form W-4 ▶ (Rev. December 2020) Complete Form W-4 so that your employer can withhold the correct federal income tax from your pay. ▶ Department of the Treasury Give Form W-4 to your employer. 2021 Internal Revenue Service ▶ Your withholding is subject to review by the IRS. Step 1: (a) First name and middle initial Last name (b) Social security number Enter Address ▶ Does your name match the Personal name on your social security card? If not, to ensure you get Information City or town, state, and ZIP code credit for your earnings, contact SSA at 800-772-1213 or go to www.ssa.gov. (c) Single or Married filing separately Married filing jointly or Qualifying widow(er) Head of household (Check only if you’re unmarried and pay more than half the costs of keeping up a home for yourself and a qualifying individual.) Complete Steps 2–4 ONLY if they apply to you; otherwise, skip to Step 5. See page 2 for more information on each step, who can claim exemption from withholding, when to use the estimator at www.irs.gov/W4App, and privacy. Step 2: Complete this step if you (1) hold more than one job at a time, or (2) are married filing jointly and your spouse Multiple Jobs also works. The correct amount of withholding depends on income earned from all of these jobs. or Spouse Do only one of the following. Works (a) Use the estimator at www.irs.gov/W4App for most accurate withholding for this step (and Steps 3–4); or (b) Use the Multiple Jobs Worksheet on page 3 and enter the result in Step 4(c) below for roughly accurate withholding; or (c) If there are only two jobs total, you may check this box. -

Pricing*, Pool and Payment** Due Dates January - December 2021 Mideast Marketing Area Federal Order No

Pricing*, Pool and Payment** Due Dates January - December 2021 Mideast Marketing Area Federal Order No. 33 Class & Market Administrator Payment Dates for Producer Milk Component Final Pool Producer Advance Prices Payment Dates Final Payment Due Partial Payment Due Pool Month Prices Release Date Payrolls Due & Pricing Factors PSF, Admin., MS Cooperative Nonmember Cooperative Nonmember January February 3 * February 13 February 22 December 23, 2020 February 16 ** February 16 February 17 Janaury 25 January 26 February March 3 * March 13 March 22 January 21 * March 15 March 16 March 17 February 25 February 26 March March 31 * April 13 April 22 February 18 * April 15 April 16 April 19 ** March 25 March 26 April May 5 May 13 May 22 March 17 * May 17 ** May 17 ** May 17 April 26 ** April 26 May June 3 * June 13 June 22 April 21 * June 15 June 16 June 17 May 25 May 26 June June 30 * July 13 July 22 May 19 * July 15 July 16 July 19 ** June 25 June 28 ** July August 4 * August 13 August 22 June 23 August 16 ** August 16 August 17 July 26 ** July 26 August September 1 * September 13 September 22 July 21 * September 15 September 16 September 17 August 25 August 26 September September 29 * October 13 October 22 August 18 * October 15 October 18 ** October 18 ** September 27 ** September 27 ** October November 3 * November 13 November 22 September 22 * November 15 November 16 November 17 October 25 October 26 November December 1 * December 13 December 22 October 20 * December 15 December 16 December 17 November 26 ** November 26 December January 5, 2022 January 13, 2022 January 22, 2022 November 17 * January 18, 2022 ** January 18, 2022 ** January 18, 2022 ** December 27 ** December 27 ** * If the release date does not fall on the 5th (Class & Component Prices) or 23rd (Advance Prices & Pricing Factors), the most current release preceding will be used in the price calculation. -

2021-2022 Custom & Standard Information Due Dates

2021-2022 CUSTOM & STANDARD INFORMATION DUE DATES Desired Cover All Desired Cover All Delivery Date Info. Due Text Due Delivery Date Info. Due Text Due May 31 No Deliveries No Deliveries July 19 April 12 May 10 June 1 February 23 March 23 July 20 April 13 May 11 June 2 February 24 March 24 July 21 April 14 May 12 June 3 February 25 March 25 July 22 April 15 May 13 June 4 February 26 March 26 July 23 April 16 May 14 June 7 March 1 March 29 July 26 April 19 May 17 June 8 March 2 March 30 July 27 April 20 May 18 June 9 March 3 March 31 July 28 April 21 May 19 June 10 March 4 April 1 July 29 April 22 May 20 June 11 March 5 April 2 July 30 April 23 May 21 June 14 March 8 April 5 August 2 April 26 May 24 June 15 March 9 April 6 August 3 April 27 May 25 June 16 March 10 April 7 August 4 April 28 May 26 June 17 March 11 April 8 August 5 April 29 May 27 June 18 March 12 April 9 August 6 April 30 May 28 June 21 March 15 April 12 August 9 May 3 May 28 June 22 March 16 April 13 August 10 May 4 June 1 June 23 March 17 April 14 August 11 May 5 June 2 June 24 March 18 April 15 August 12 May 6 June 3 June 25 March 19 April 16 August 13 May 7 June 4 June 28 March 22 April 19 August 16 May 10 June 7 June 29 March 23 April 20 August 17 May 11 June 8 June 30 March 24 April 21 August 18 May 12 June 9 July 1 March 25 April 22 August 19 May 13 June 10 July 2 March 26 April 23 August 20 May 14 June 11 July 5 March 29 April 26 August 23 May 17 June 14 July 6 March 30 April 27 August 24 May 18 June 15 July 7 March 31 April 28 August 25 May 19 June 16 July 8 April 1 April 29 August 26 May 20 June 17 July 9 April 2 April 30 August 27 May 21 June 18 July 12 April 5 May 3 August 30 May 24 June 21 July 13 April 6 May 4 August 31 May 25 June 22 July 14 April 7 May 5 September 1 May 26 June 23 July 15 April 8 May 6 September 2 May 27 June 24 July 16 April 9 May 7 September 3 May 28 June 25. -

Publication 517, Social Security

Userid: CPM Schema: tipx Leadpct: 100% Pt. size: 8 Draft Ok to Print AH XSL/XML Fileid: … tions/P517/2020/A/XML/Cycle03/source (Init. & Date) _______ Page 1 of 18 11:42 - 2-Mar-2021 The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing. Publication 517 Cat. No. 15021X Contents Future Developments ............ 1 Department of the Social Security What's New .................. 1 Treasury Internal Reminders ................... 2 Revenue and Other Service Introduction .................. 2 Information for Social Security Coverage .......... 3 Members of the Ministerial Services ............. 4 Exemption From Self-Employment Clergy and (SE) Tax ................. 6 Self-Employment Tax: Figuring Net Religious Earnings ................. 7 Income Tax: Income and Expenses .... 9 Workers Filing Your Return ............. 11 Retirement Savings Arrangements ... 11 For use in preparing Earned Income Credit (EIC) ....... 12 Worksheets ................. 14 2020 Returns How To Get Tax Help ........... 15 Index ..................... 18 Future Developments For the latest information about developments related to Pub. 517, such as legislation enacted after this publication was published, go to IRS.gov/Pub517. What's New Tax relief legislation. Recent legislation pro- vided certain tax-related benefits, including the election to use your 2019 earned income to fig- ure your 2020 earned income credit. See Elec- tion to use prior-year earned income for more information. Credits for self-employed individuals. New refundable credits are available to certain self-employed individuals impacted by the coro- navirus. See the Instructions for Form 7202 for more information. Deferral of self-employment tax payments under the CARES Act. The CARES Act al- lows certain self-employed individuals who were affected by the coronavirus and file Schedule SE (Form 1040), to defer a portion of their 2020 self-employment tax payments until 2021 and 2022. -

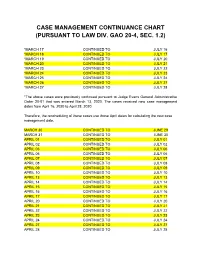

Case Management Continuance Chart (Pursuant to Law Div

CASE MANAGEMENT CONTINUANCE CHART (PURSUANT TO LAW DIV. GAO 20-4, SEC. 1.2) *MARCH 17 CONTINUED TO JULY 16 *MARCH 18 CONTINUED TO JULY 17 *MARCH 19 CONTINUED TO JULY 20 *MARCH 20 CONTINUED TO JULY 21 *MARCH 23 CONTINUED TO JULY 22 *MARCH 24 CONTINUED TO JULY 23 *MARCH 25 CONTINUED TO JULY 24 *MARCH 26 CONTINUED TO JULY 27 *MARCH 27 CONTINUED TO JULY 28 *The above cases were previously continued pursuant to Judge Evans General Administrative Order 20-01 that was entered March 13, 2020. The cases received new case management dates from April 16, 2020 to April 28, 2020. Therefore, the rescheduling of these cases use those April dates for calculating the new case management date. MARCH 30 CONTINUED TO JUNE 29 MARCH 31 CONTINUED TO JUNE 30 APRIL 01 CONTINUED TO JULY 01 APRIL 02 CONTINUED TO JULY 02 APRIL 03 CONTINUED TO JULY 06 APRIL 06 CONTINUED TO JULY 06 APRIL 07 CONTINUED TO JULY 07 APRIL 08 CONTINUED TO JULY 08 APRIL 09 CONTINUED TO JULY 09 APRIL 10 CONTINUED TO JULY 10 APRIL 13 CONTINUED TO JULY 13 APRIL 14 CONTINUED TO JULY 14 APRIL 15 CONTINUED TO JULY 15 APRIL 16 CONTINUED TO JULY 16 APRIL 17 CONTINUED TO JULY 17 APRIL 20 CONTINUED TO JULY 20 APRIL 21 CONTINUED TO JULY 21 APRIL 22 CONTINUED TO JULY 22 APRIL 23 CONTINUED TO JULY 23 APRIL 24 CONTINUED TO JULY 24 APRIL 27 CONTINUED TO JULY 27 APRIL 28 CONTINUED TO JULY 28 APRIL 29 CONTINUED TO JULY 29 APRIL 30 CONTINUED TO JULY 30 MAY 01 CONTINUED TO JULY 31 MAY 04 CONTINUED TO AUGUST 03 MAY 05 CONTINUED TO AUGUST 04 MAY 06 CONTINUED TO AUGUST 05 MAY 07 CONTINUED TO AUGUST 06 MAY 08 CONTINUED TO AUGUST 07 MAY 11 CONTINUED TO AUGUST 10 MAY 12 CONTINUED TO AUGUST 11 MAY 13 CONTINUED TO AUGUST 12 MAY 14 CONTINUED TO AUGUST 13 MAY 15 CONTINUED TO AUGUST 14 Please Note: Pursuant to Law Division General Administrative Order 20-4, all of the above cases, including those originally set for case management between March 17, 2020 and March 27, 2020, will have their case management date continued as detailed in the chart above. -

2021 7 Day Working Days Calendar

2021 7 Day Working Days Calendar The Working Day Calendar is used to compute the estimated completion date of a contract. To use the calendar, find the start date of the contract, add the working days to the number of the calendar date (a number from 1 to 1000), and subtract 1, find that calculated number in the calendar and that will be the completion date of the contract Date Number of the Calendar Date Friday, January 1, 2021 133 Saturday, January 2, 2021 134 Sunday, January 3, 2021 135 Monday, January 4, 2021 136 Tuesday, January 5, 2021 137 Wednesday, January 6, 2021 138 Thursday, January 7, 2021 139 Friday, January 8, 2021 140 Saturday, January 9, 2021 141 Sunday, January 10, 2021 142 Monday, January 11, 2021 143 Tuesday, January 12, 2021 144 Wednesday, January 13, 2021 145 Thursday, January 14, 2021 146 Friday, January 15, 2021 147 Saturday, January 16, 2021 148 Sunday, January 17, 2021 149 Monday, January 18, 2021 150 Tuesday, January 19, 2021 151 Wednesday, January 20, 2021 152 Thursday, January 21, 2021 153 Friday, January 22, 2021 154 Saturday, January 23, 2021 155 Sunday, January 24, 2021 156 Monday, January 25, 2021 157 Tuesday, January 26, 2021 158 Wednesday, January 27, 2021 159 Thursday, January 28, 2021 160 Friday, January 29, 2021 161 Saturday, January 30, 2021 162 Sunday, January 31, 2021 163 Monday, February 1, 2021 164 Tuesday, February 2, 2021 165 Wednesday, February 3, 2021 166 Thursday, February 4, 2021 167 Date Number of the Calendar Date Friday, February 5, 2021 168 Saturday, February 6, 2021 169 Sunday, February -

September 15-October 15 2020

September 15-October 15 2020 National Hispanic Heritage Month Each year, Americans observe National Hispanic Heritage Month from September 15 to October 15, by celebrating the histories, cultures and contributions of American citizens whose ancestors came from Spain, Mexico, the Caribbean and Central and South America. The observation started in 1968 as Hispanic Heritage Week under President Lyndon Johnson and was expanded by President Ronald Reagan in 1988 to cover a 30-day period starting on September 15 and ending on October 15. It was enacted into law on August 17, 1988, on the approval of Public Law 100-402. The day of September 15 is significant because it is the anniversary of independence for Latin American countries Costa Rica, El Salvador, Guatemala, Honduras and Nicaragua. In addition, Mexico and Chile celebrate their independence days on September 16 and September 18, respectively. Around the World Fascinating Facts: Ecuador (video) Quick History: El Salvador (video) Nat Geo: Ecuador (video-elementary age) Mini Fantastic Facts Video: Chile Panama canal for kids (video) Mini Fantastic Facts Video: Honduras Mini Fantastic Facts Video: Puerto Rico Mini Fantastic Facts Video: Spain Mini Fantastic Facts Video: Mexico Kids Learning Tube: Guatemala (elementary age) Mini Fantastic Facts Video: Colombia Mini Fantastic Facts Video: Venezuela Mini Fantastic Facts Video: Peru Cuba History in 5 minutes (video) Mini Fantastic Facts Video: Dominican Republic Mini Fantastic Facts Video: Argentina Virtual Tours Grand Tours Museum Tours Canopy -

PGD April-Aug 2021 Arrivals and Departures.Xlsx

DATE TIME DATE TIME Thursday, April 1, 2021 8:41 AM ARRIVE TIME Thursday, April 1, 2021 6:00 AM DEPART TIME Thursday, April 1, 2021 10:47 AM ARRIVE TIME Thursday, April 1, 2021 6:10 AM DEPART TIME Thursday, April 1, 2021 11:14 AM ARRIVE TIME Thursday, April 1, 2021 6:20 AM DEPART TIME Thursday, April 1, 2021 12:24 PM ARRIVE TIME Thursday, April 1, 2021 6:40 AM DEPART TIME Thursday, April 1, 2021 1:19 PM ARRIVE TIME Thursday, April 1, 2021 6:50 AM DEPART TIME Thursday, April 1, 2021 1:14 PM ARRIVE TIME Thursday, April 1, 2021 7:00 AM DEPART TIME Thursday, April 1, 2021 1:46 PM ARRIVE TIME Thursday, April 1, 2021 7:20 AM DEPART TIME Thursday, April 1, 2021 2:10 PM ARRIVE TIME Thursday, April 1, 2021 7:30 AM DEPART TIME Thursday, April 1, 2021 1:59 PM ARRIVE TIME Thursday, April 1, 2021 7:40 AM DEPART TIME Thursday, April 1, 2021 2:11 PM ARRIVE TIME Thursday, April 1, 2021 8:00 AM DEPART TIME Thursday, April 1, 2021 2:51 PM ARRIVE TIME Thursday, April 1, 2021 9:31 AM DEPART TIME Thursday, April 1, 2021 2:13 PM ARRIVE TIME Thursday, April 1, 2021 11:32 AM DEPART TIME Thursday, April 1, 2021 4:54 PM ARRIVE TIME Thursday, April 1, 2021 11:59 AM DEPART TIME Thursday, April 1, 2021 5:33 PM ARRIVE TIME Thursday, April 1, 2021 1:14 PM DEPART TIME Thursday, April 1, 2021 7:01 PM ARRIVE TIME Thursday, April 1, 2021 2:04 PM DEPART TIME Thursday, April 1, 2021 7:22 PM ARRIVE TIME Thursday, April 1, 2021 2:36 PM DEPART TIME Thursday, April 1, 2021 7:12 PM ARRIVE TIME Thursday, April 1, 2021 2:49 PM DEPART TIME Thursday, April 1, 2021 9:22 PM ARRIVE TIME -

Cross-Border Planning for Canadian Registered Retirement Plans

CROSS-BORDER PLANNING FOR CANADIAN REGISTERED RETIREMENT PLANS Elise M. Pulver, David J. Byun, Ryan M. Murphy and Amy P. Walters* Each year, many Canadians choose to move to the United States for various reasons, including, inter alia, employment opportunities, retirement destinations, and lower tax rates. Whatever the reason may be, there are several important planning questions to consider before making the move. The purpose of this paper is to address one such key consideration: the cross-border tax implications in respect of registered retirement plans. This paper is divided into three parts. The first part analyzes the Canadian taxation of distributions from Canadian registered retirement plans, upon the plan owner's death, to a beneficiary who is a non-resident of Canada. The second part discusses how a Canadian who moves south of the border and becomes a U.S. citizen or resident alien would be taxed by the U.S. tax system vis-aÁ-vis the distributions from his or her Canadian registered retirement plans. Conversely, the final part of the paper provides an overview of the U.S. taxation of a U.S. non-resident alien with respect to distributions from his or her U.S. retirement plans. I. CANADIAN TAXATION OF CANADIAN REGISTERED RETIREMENT PLANS UPON DEATH This part of the paper looks at the Canadian taxation of the payment from a registered retirement plan (namely, a Registered Retirement Savings Plan (ªRRSPº) and Registered Retirement Income Fund (ªRRIFº)) upon the plan owner's death, to a beneficiary who is a non-resident of Canada. In particular, it addresses whether a non-resident beneficiary of such registered plan would be subject to any withholding tax on such payment * Elise M. -

Publication 523 Reminders

Userid: CPM Schema: tipx Leadpct: 100% Pt. size: 10 Draft Ok to Print AH XSL/XML Fileid: … tions/P523/2020/A/XML/Cycle04/source (Init. & Date) _______ Page 1 of 22 12:06 - 1-Mar-2021 The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing. Department of the Treasury Contents Internal Revenue Service Future Developments ....................... 1 Publication 523 Reminders ............................... 1 Cat. No. 15044W Introduction .............................. 2 Does Your Home Sale Qualify for the Exclusion of Gain? .............................. 2 Selling Eligibility Test ........................... 3 Does Your Home Qualify for a Partial Your Home Exclusion of Gain? ...................... 6 Figuring Gain or Loss ....................... 7 For use in preparing Basis Adjustments—Details and Exceptions ..... 8 Business or Rental Use of Home ............ 11 Returns 2020 How Much Is Taxable? ..................... 14 Recapturing Depreciation ................. 15 Reporting Your Home Sale .................. 15 Reporting Gain or Loss on Your Home Sale .... 16 Reporting Deductions Related to Your Home Sale ............................... 17 Reporting Other Income Related to Your Home Sale .......................... 17 Paying Back Credits and Subsidies .......... 18 How To Get Tax Help ...................... 18 Index .................................. 22 Future Developments For the latest information about developments related to Pub. 523, such as legislation enacted after it was published, go to IRS.gov/Pub523. Reminders Photographs of missing children. The IRS is a proud partner with the National Center for Missing & Exploited Children® (NCMEC). Photographs of missing children se- lected by the Center may appear in this publication on pa- ges that would otherwise be blank. You can help bring these children home by looking at the photographs and calling 800-THE-LOST (800-843-5678) if you recognize a child. -

Public Comments, October 15-29, 2020

ZBA FY2020-39, Valley CDC, Comprehensive Permit Application for 132 Northampton Road ADDITIONAL PUBLIC COMMENTS: Additional Comments received from October 15, 2020 at 10:30AM until October 29, 2020 at 1:00PM 1. Francis Goyes Flor, Comments Submitted via Email, Dated October 15, 2020; 2. Anne Burton, Comments Submitted via Email, Dated October 21, 2020; 3. Anonymous, Comments Submitted via Town Website, Dated October 21, 2020; 4. Anonymous, Photographs Submitted via Town Website, Dated October 21, 2020; 5. Steve George, Comments Submitted via Town Website, Dated October 23, 2020; 6. Barbara Wilbur, Comments Submitted via Memo, Dated October 28, 2020; From: Francis Goyes Flor To: Pollock, Maureen Subject: In support of 132 Northampton Road Date: Thursday, October 15, 2020 5:36:30 PM To the members of the ZBA, I would like to express my support for the 132 Northampton Road development. Around the globe and across the country, too many people are unable to find a home that is adequate, safe, and affordable. Amherst is no exception. Recent estimates from the American Community Survey show that 60% of renters in Amherst are cost burdened, paying more than 30% of their income on rent. But we need to think of our neighbors outside of our city, too - in Hampshire County, more than 50% of renters are cost burdened. Housing is a basic need and has a direct and significant impact on every other part of our lives. It dictates who our neighbors are, the economic opportunities we have access to, the education we can take advantage of, and the natural resources available to us.