Original and Extended Due Dates

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

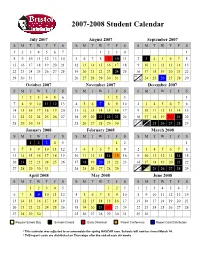

Approved Student Calendar

2007-2008 Student Calendar July 2007 August 2007 September 2007 SMTWT F S SMTWT F S SMTWT F S 1234567 1234 1 8910111213145678910 11 2 3 45678 15 16 17 18 19 20 21 12 13 14 15 16 17 18 9 10 11 12 13 14 15 22 23 24 25 26 27 28 19 20 21 22 23 24 25 16 17 18 19 20 21 22 23 29 30 31 26 27 28 29 30 31 30 24 25 26 27 28 29 October 2007 November 2007 December 2007 SMTWT F S SMTWT F S SMTWT F S 123456 123 1 7891011 12 134567 89102345678 14 15 16 17 18 19 20 11 12 13 14 15 16 17 9 10 11 12 13 14 15 21 22 23 24 25 26 27 18 19 20 21 22 23 24 16 17 18 19 20 21 22 23 24 28 29 30 31 25 26 27 28 29 30 30 31 25 26 27 28 29 January 2008 February 2008 March 2008 SMTWT F S SMTWT F S SMTWT F S 12345 12 1 67891011123456789 2345678 13 14 15 16 17 18 19 10 11 12 13 14 1516 9 1011121314 15 20 21 22 23 24 25 26 17 18 19 20 21 22 23 16 17 18 19 20 21 22 23 24 27 28 29 30 31 24 25 26 27 28 29 30 31 25 26 27 28 29 April 2008 May 2008 June 2008 SMTWT F S SMTWT F S SMTWT F S 12345 123 1234567 6789 10111245678910891011121314 13 14 15 16 17 18 19 11 12 13 14 15 16 17 15 16 17 18 19 20 21 20 21 22 23 24 25 26 18 19 20 21 22 23 24 22 23 24 25 26 27 28 27 28 29 30 25 26 27 28 29 30 31 29 30 Regular School Day Schools Closed Early Dismissal Parent Conference Report Card Distribution * This calendar was adjusted to accommodate the spring NASCAR race. -

Publication 509, Tax Calendars

Userid: CPM Schema: tipx Leadpct: 100% Pt. size: 8 Draft Ok to Print AH XSL/XML Fileid: … tions/P509/2021/A/XML/Cycle13/source (Init. & Date) _______ Page 1 of 13 10:55 - 31-Dec-2020 The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing. Publication 509 Cat. No. 15013X Contents Introduction .................. 2 Department of the Tax Calendars Background Information for Using Treasury the Tax Calendars ........... 2 Internal Revenue General Tax Calendar ............ 3 Service First Quarter ............... 3 For use in Second Quarter ............. 4 2021 Third Quarter ............... 4 Fourth Quarter .............. 5 Employer's Tax Calendar .......... 5 First Quarter ............... 6 Second Quarter ............. 7 Third Quarter ............... 7 Fourth Quarter .............. 8 Excise Tax Calendar ............. 8 First Quarter ............... 8 Second Quarter ............. 9 Third Quarter ............... 9 Fourth Quarter ............. 10 How To Get Tax Help ........... 12 Future Developments For the latest information about developments related to Pub. 509, such as legislation enacted after it was published, go to IRS.gov/Pub509. What’s New Payment of deferred employer share of so- cial security tax from 2020. If the employer deferred paying the employer share of social security tax in 2020, pay 50% of the employer share of social security tax by January 3, 2022 and the remainder by January 3, 2023. Any payments or deposits you make before January 3, 2022, are first applied against the first 50% of the deferred employer share of social security tax, and then applied against the remainder of your deferred payments. Payment of deferred employee share of so- cial security tax from 2020. -

Pricing*, Pool and Payment** Due Dates January - December 2021 Mideast Marketing Area Federal Order No

Pricing*, Pool and Payment** Due Dates January - December 2021 Mideast Marketing Area Federal Order No. 33 Class & Market Administrator Payment Dates for Producer Milk Component Final Pool Producer Advance Prices Payment Dates Final Payment Due Partial Payment Due Pool Month Prices Release Date Payrolls Due & Pricing Factors PSF, Admin., MS Cooperative Nonmember Cooperative Nonmember January February 3 * February 13 February 22 December 23, 2020 February 16 ** February 16 February 17 Janaury 25 January 26 February March 3 * March 13 March 22 January 21 * March 15 March 16 March 17 February 25 February 26 March March 31 * April 13 April 22 February 18 * April 15 April 16 April 19 ** March 25 March 26 April May 5 May 13 May 22 March 17 * May 17 ** May 17 ** May 17 April 26 ** April 26 May June 3 * June 13 June 22 April 21 * June 15 June 16 June 17 May 25 May 26 June June 30 * July 13 July 22 May 19 * July 15 July 16 July 19 ** June 25 June 28 ** July August 4 * August 13 August 22 June 23 August 16 ** August 16 August 17 July 26 ** July 26 August September 1 * September 13 September 22 July 21 * September 15 September 16 September 17 August 25 August 26 September September 29 * October 13 October 22 August 18 * October 15 October 18 ** October 18 ** September 27 ** September 27 ** October November 3 * November 13 November 22 September 22 * November 15 November 16 November 17 October 25 October 26 November December 1 * December 13 December 22 October 20 * December 15 December 16 December 17 November 26 ** November 26 December January 5, 2022 January 13, 2022 January 22, 2022 November 17 * January 18, 2022 ** January 18, 2022 ** January 18, 2022 ** December 27 ** December 27 ** * If the release date does not fall on the 5th (Class & Component Prices) or 23rd (Advance Prices & Pricing Factors), the most current release preceding will be used in the price calculation. -

2021 7 Day Working Days Calendar

2021 7 Day Working Days Calendar The Working Day Calendar is used to compute the estimated completion date of a contract. To use the calendar, find the start date of the contract, add the working days to the number of the calendar date (a number from 1 to 1000), and subtract 1, find that calculated number in the calendar and that will be the completion date of the contract Date Number of the Calendar Date Friday, January 1, 2021 133 Saturday, January 2, 2021 134 Sunday, January 3, 2021 135 Monday, January 4, 2021 136 Tuesday, January 5, 2021 137 Wednesday, January 6, 2021 138 Thursday, January 7, 2021 139 Friday, January 8, 2021 140 Saturday, January 9, 2021 141 Sunday, January 10, 2021 142 Monday, January 11, 2021 143 Tuesday, January 12, 2021 144 Wednesday, January 13, 2021 145 Thursday, January 14, 2021 146 Friday, January 15, 2021 147 Saturday, January 16, 2021 148 Sunday, January 17, 2021 149 Monday, January 18, 2021 150 Tuesday, January 19, 2021 151 Wednesday, January 20, 2021 152 Thursday, January 21, 2021 153 Friday, January 22, 2021 154 Saturday, January 23, 2021 155 Sunday, January 24, 2021 156 Monday, January 25, 2021 157 Tuesday, January 26, 2021 158 Wednesday, January 27, 2021 159 Thursday, January 28, 2021 160 Friday, January 29, 2021 161 Saturday, January 30, 2021 162 Sunday, January 31, 2021 163 Monday, February 1, 2021 164 Tuesday, February 2, 2021 165 Wednesday, February 3, 2021 166 Thursday, February 4, 2021 167 Date Number of the Calendar Date Friday, February 5, 2021 168 Saturday, February 6, 2021 169 Sunday, February -

September 15-October 15 2020

September 15-October 15 2020 National Hispanic Heritage Month Each year, Americans observe National Hispanic Heritage Month from September 15 to October 15, by celebrating the histories, cultures and contributions of American citizens whose ancestors came from Spain, Mexico, the Caribbean and Central and South America. The observation started in 1968 as Hispanic Heritage Week under President Lyndon Johnson and was expanded by President Ronald Reagan in 1988 to cover a 30-day period starting on September 15 and ending on October 15. It was enacted into law on August 17, 1988, on the approval of Public Law 100-402. The day of September 15 is significant because it is the anniversary of independence for Latin American countries Costa Rica, El Salvador, Guatemala, Honduras and Nicaragua. In addition, Mexico and Chile celebrate their independence days on September 16 and September 18, respectively. Around the World Fascinating Facts: Ecuador (video) Quick History: El Salvador (video) Nat Geo: Ecuador (video-elementary age) Mini Fantastic Facts Video: Chile Panama canal for kids (video) Mini Fantastic Facts Video: Honduras Mini Fantastic Facts Video: Puerto Rico Mini Fantastic Facts Video: Spain Mini Fantastic Facts Video: Mexico Kids Learning Tube: Guatemala (elementary age) Mini Fantastic Facts Video: Colombia Mini Fantastic Facts Video: Venezuela Mini Fantastic Facts Video: Peru Cuba History in 5 minutes (video) Mini Fantastic Facts Video: Dominican Republic Mini Fantastic Facts Video: Argentina Virtual Tours Grand Tours Museum Tours Canopy -

Public Comments, October 15-29, 2020

ZBA FY2020-39, Valley CDC, Comprehensive Permit Application for 132 Northampton Road ADDITIONAL PUBLIC COMMENTS: Additional Comments received from October 15, 2020 at 10:30AM until October 29, 2020 at 1:00PM 1. Francis Goyes Flor, Comments Submitted via Email, Dated October 15, 2020; 2. Anne Burton, Comments Submitted via Email, Dated October 21, 2020; 3. Anonymous, Comments Submitted via Town Website, Dated October 21, 2020; 4. Anonymous, Photographs Submitted via Town Website, Dated October 21, 2020; 5. Steve George, Comments Submitted via Town Website, Dated October 23, 2020; 6. Barbara Wilbur, Comments Submitted via Memo, Dated October 28, 2020; From: Francis Goyes Flor To: Pollock, Maureen Subject: In support of 132 Northampton Road Date: Thursday, October 15, 2020 5:36:30 PM To the members of the ZBA, I would like to express my support for the 132 Northampton Road development. Around the globe and across the country, too many people are unable to find a home that is adequate, safe, and affordable. Amherst is no exception. Recent estimates from the American Community Survey show that 60% of renters in Amherst are cost burdened, paying more than 30% of their income on rent. But we need to think of our neighbors outside of our city, too - in Hampshire County, more than 50% of renters are cost burdened. Housing is a basic need and has a direct and significant impact on every other part of our lives. It dictates who our neighbors are, the economic opportunities we have access to, the education we can take advantage of, and the natural resources available to us. -

School Site Council Meeting Notes October 15, 2015

School Site Council Meeting Notes October 15, 2015 Meeting held at Eastern Bank Community room in Jamaica Plain from 6:15 - • Welcome and Agenda Overview / Introductions / Ice Breaker o Members present; Bobby Bigby III, Allison Phillips, Christina Stevens, Deidra Eyma, Darcel Hunt, Craig Sweeney, Magda Zabala, Siobahn Mulligan, Annie Le, Jeff Cook, and Ivette Rivera. • Vote for Chair & Secretary / Overview of SSC By Laws / Establish Meeting Schedule o Chairs: Jeff Cook & Bobby Bigby o Secretary: Christina Stevens o Meeting Location: Eastern Bank Community Room on 687 Centre Street, Jamaica Plain, MA 02130 o Meeting Time: 6:00 PM – 7:30 PM o Meeting Dates: ! November 19, 2015 ! December 17, 2015 ! January 7, 2016 ! February 4, 2016 ! March 10, 2016 ! April 7, 2016 ! May 5, 2016 ! June 2, 2016 • Overview of School Wide Initiatives o New Bell Schedule ! Moved from a 5-block schedule to a 6-block schedule this year o Student Intervention Program (SIP) ! Serves approximately 100-125 students and offer an array of support components to support students who are experiencing the most struggle and/or significantly behind due to prior course failures. o Path Program or W3 Program ! A fully inclusive program for students in need of emotional support and counseling. Students in this program receive special education services in a co-taught inclusion setting with their general education peers as well as through a study skills class that will meet approximately 1 hour/day, 5 days/week. A social worker and an academic liaison are available throughout the day. o Updated Graduation Requirements o New Athletic Field Complex o Quality School Plan (EBA, Write Boston, & Data Inquiry) ! Review QSP. -

Pay Date Calendar

Pay Date Information Select the pay period start date that coincides with your first day of employment. Pay Period Pay Period Begins (Sunday) Pay Period Ends (Saturday) Official Pay Date (Thursday)* 1 January 10, 2016 January 23, 2016 February 4, 2016 2 January 24, 2016 February 6, 2016 February 18, 2016 3 February 7, 2016 February 20, 2016 March 3, 2016 4 February 21, 2016 March 5, 2016 March 17, 2016 5 March 6, 2016 March 19, 2016 March 31, 2016 6 March 20, 2016 April 2, 2016 April 14, 2016 7 April 3, 2016 April 16, 2016 April 28, 2016 8 April 17, 2016 April 30, 2016 May 12, 2016 9 May 1, 2016 May 14, 2016 May 26, 2016 10 May 15, 2016 May 28, 2016 June 9, 2016 11 May 29, 2016 June 11, 2016 June 23, 2016 12 June 12, 2016 June 25, 2016 July 7, 2016 13 June 26, 2016 July 9, 2016 July 21, 2016 14 July 10, 2016 July 23, 2016 August 4, 2016 15 July 24, 2016 August 6, 2016 August 18, 2016 16 August 7, 2016 August 20, 2016 September 1, 2016 17 August 21, 2016 September 3, 2016 September 15, 2016 18 September 4, 2016 September 17, 2016 September 29, 2016 19 September 18, 2016 October 1, 2016 October 13, 2016 20 October 2, 2016 October 15, 2016 October 27, 2016 21 October 16, 2016 October 29, 2016 November 10, 2016 22 October 30, 2016 November 12, 2016 November 24, 2016 23 November 13, 2016 November 26, 2016 December 8, 2016 24 November 27, 2016 December 10, 2016 December 22, 2016 25 December 11, 2016 December 24, 2016 January 5, 2017 26 December 25, 2016 January 7, 2017 January 19, 2017 1 January 8, 2017 January 21, 2017 February 2, 2017 2 January -

Due Date Chart 201803281304173331.Xlsx

Special Event Permit Application Due Date Chart for Events from January 1, 2019 - June 30, 2020 If due date lands on a Saturday or Sunday, the due date is moved to the next business day Event Date 30 Calendar days 90 Calendar Days Tuesday, January 01, 2019 Sunday, December 02, 2018 Wednesday, October 03, 2018 Wednesday, January 02, 2019 Monday, December 03, 2018 Thursday, October 04, 2018 Thursday, January 03, 2019 Tuesday, December 04, 2018 Friday, October 05, 2018 Friday, January 04, 2019 Wednesday, December 05, 2018 Saturday, October 06, 2018 Saturday, January 05, 2019 Thursday, December 06, 2018 Sunday, October 07, 2018 Sunday, January 06, 2019 Friday, December 07, 2018 Monday, October 08, 2018 Monday, January 07, 2019 Saturday, December 08, 2018 Tuesday, October 09, 2018 Tuesday, January 08, 2019 Sunday, December 09, 2018 Wednesday, October 10, 2018 Wednesday, January 09, 2019 Monday, December 10, 2018 Thursday, October 11, 2018 Thursday, January 10, 2019 Tuesday, December 11, 2018 Friday, October 12, 2018 Friday, January 11, 2019 Wednesday, December 12, 2018 Saturday, October 13, 2018 Saturday, January 12, 2019 Thursday, December 13, 2018 Sunday, October 14, 2018 Sunday, January 13, 2019 Friday, December 14, 2018 Monday, October 15, 2018 Monday, January 14, 2019 Saturday, December 15, 2018 Tuesday, October 16, 2018 2019 Tuesday, January 15, 2019 Sunday, December 16, 2018 Wednesday, October 17, 2018 Wednesday, January 16, 2019 Monday, December 17, 2018 Thursday, October 18, 2018 Thursday, January 17, 2019 Tuesday, December 18, 2018 -

BARBOUR COUNTY SCHOOLS 10 and 12-MONTH EMPLOYEES PAY SCHEDULE 2021 - 2022 Days in Period Period Payroll Report Due Check Dates/Release Dates Number Beginning Ending

Sheet1 AMH, 2/17/2021 BARBOUR COUNTY SCHOOLS 10 and 12-MONTH EMPLOYEES PAY SCHEDULE 2021 - 2022 Days in Period Period Payroll Report Due Check Dates/Release Dates Number Beginning Ending 1 Thursday, July 1, 2021 Sunday, July 4, 2021 2 Tuesday, July 6, 2021 Thursday, July 15, 2021 Monday, July 5, 2021 Sunday, July 11, 2021 5 Monday, July 12, 2021 2 Wednesday, July 28, 2021 Monday, July 12, 2021 Sunday, July 18, 2021 5 Monday, July 19, 2021 Monday, July 19, 2021 Sunday, July 25, 2021 5 Monday, July 26, 2021 3 Friday, August 13, 2021 Monday, July 26, 2021 Sunday, August 1, 2021 5 Monday, August 2, 2021 Monday, August 2, 2021 Sunday, August 8, 2021 5 Monday, August 9, 2021 4 Friday, August 27, 2021 Monday, August 9, 2021 Sunday, August 15, 2021 5 Monday, August 16, 2021 Monday, August 16, 2021 Sunday, August 22, 2021 5 Monday, August 23, 2021 5 Wednesday, September 15, 2021 Monday, August 23, 2021 Sunday, August 29, 2021 5 Monday, August 30, 2021 Monday, August 30, 2021 Sunday, September 5, 2021 5 Tuesday, September 7, 2021 6 Tuesday, September 28, 2021 Monday, September 6, 2021 Sunday, September 12, 2021 5 Monday, September 13, 2021 Monday, September 13, 2021 Sunday, September 19, 2021 5 Monday, September 20, 2021 7 Monday, September 20, 2021 Sunday, September 26, 2021 5 Monday, September 27, 2021 Friday, October 15, 2021 Monday, September 27, 2021 Sunday, October 3, 2021 5 Monday, October 4, 2021 Monday, October 4, 2021 Sunday, October 10, 2021 5 Monday, October 11, 2021 8 Thursday, October 28, 2021 Monday, October 11, 2021 Sunday, October -

Curriculum Committee Meeting Minutes October 15, 2020

Curriculum Committee Meeting Minutes October 15, 2020 COMMITTEE NAME: Curriculum Committee MEETING DATE: October 15, 2020 PERSON PRESIDING: Alana Baker (C) Faculty, English Members in Attendance: Celeste Allis Dean of Arts and Sciences/Professor, Mathematics Alana Baker (C) Faculty, English Chandra Caple Director, Educational Partnerships Benjamin Crouch Faculty, Music Anita Manning Program Director, Nursing Carla Moore Registrar/Director of Records Lori Murphy Department Chair, Math & Learning Support Services/Assistant Professor, Mathematics Gretchen Parrish Associate VP for Technology & Institutional Effectiveness Margaret Peele (S) Program Accountability Specialist (Credit) Carol Perry Director, Financial Aid & Veteran Affairs Beth Pulliam Director, Enterprise Resource Planning & Information Security Sheila Regan (CS) Vice President for Academic Affairs Anne Marie Ross Associate Professor, Psychology Deanna Saffold Professor, Mathematics Derick Satterfield Director, Enrollment Services Donata Worrell Department Chair, Humanities & Social Sciences/Associate Professor, Communication Members not in Attendance: Kris Brooks Dean, Workforce Development/Assistant Professor, Computer-Integrated Machining John Ayers Faculty, Agribusiness Technology Jon Cruise Faculty, Applied Technologies Vickie Chitwood Dean, Health Sciences and Public Service Technologies Others in Attendance: N/A Reminder: Approved Minutes Have Been Posted ACTIONS OF MEETING Agenda Item: 1) Credit for Prior Learning Sheila Regan, Vice President for Academic Affairs, reminded -

2021 Working Day Calendar-5 Day-Alternative Format

2021 Working Days Calendar – 5 day The Working Day Calendar is used to compute the estimated completion date of a contract. To use the calendar, find the start date of the contract, add the working days to the number of the calendar date (a number from 1 to 1000), and subtract 1, find that calculated number in the calendar and that will be the completion date of the contract Date Number of the Calendar Date Friday, January 1, 2021 Non-working Day Saturday, January 2, 2021 Non-working Day Sunday, January 3, 2021 Non-working Day Monday, January 4, 2021 938 Tuesday, January 5, 2021 939 Wednesday, January 6, 2021 940 Thursday, January 7, 2021 941 Friday, January 8, 2021 942 Saturday, January 9, 2021 Non-working Day Sunday, January 10, 2021 Non-working Day Monday, January 11, 2021 943 Tuesday, January 12, 2021 944 Wednesday, January 13, 2021 945 Thursday, January 14, 2021 946 Friday, January 15, 2021 947 Saturday, January 16, 2021 Non-working Day Sunday, January 17, 2021 Non-working Day Monday, January 18, 2021 Non-working Day Tuesday, January 19, 2021 948 Wednesday, January 20, 2021 949 Thursday, January 21, 2021 950 Friday, January 22, 2021 951 Saturday, January 23, 2021 Non-working Day Sunday, January 24, 2021 Non-working Day Monday, January 25, 2021 952 Tuesday, January 26, 2021 953 Wednesday, January 27, 2021 954 Thursday, January 28, 2021 955 Friday, January 29, 2021 956 Saturday, January 30, 2021 Non-working Day Sunday, January 31, 2021 Non-working Day Monday, February 1, 2021 957 Tuesday, February 2, 2021 958 Wednesday, February 3,