View Presentation

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Xoom Rolls out Domestic Money Transfer Services in the U.S

Xoom Rolls Out Domestic Money Transfer Services in the U.S. November 12, 2019 PayPal's international money transfer service works with Walmart and Ria to offer cash pick-up in minutes at 4,700 Walmart and 175 Ria locations across the country SAN JOSE, Calif., Nov. 12, 2019 /PRNewswire/ -- Xoom, PayPal's international money transfer service, today rolled out the ability for customers to send money to recipients in the U.S. for the first time. Through strategic alliances with Walmart and Ria, Americans can now use Xoom to send money fast for cash pick-up typically in minutes at nearly 5,000 locations across the country*. Xoom's services potentially benefit more than 44 million foreign-born people in the U.S.1 who send remittances to family and friends in their home countries. With the introduction of domestic money transfer services, Xoom will now serve even more customers, including more than half of Americans who make domestic person-to-person (P2P) payments2. Using Xoom's mobile app or website, consumers will have the ability to send money quickly and securely for cash pick-up at any Walmart or Ria-owned store in the U.S. "Many of our customers in the U.S. already send money to loved ones in the country, and they usually prefer that the money is available right away," shared Julian King, Xoom's Vice President and General Manager. "This rollout reinforces our commitment to make money transfers fast, easy and affordable for everyone, whether they are at home or on-the-go." "At Ria, we are delighted to further consolidate our relationship with Xoom and Walmart," said Juan Bianchi, CEO of Euronet's Money Transfer Segment. -

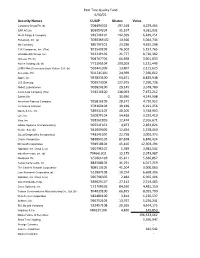

Pear Tree Quality Fund 6/30/21

Pear Tree Quality Fund 6/30/21 Security Names CUSIP Shares Value Compass Group Plc (b) '20449X302 197,348 4,229,464 SAP AG (b) '803054204 31,197 4,381,931 Wells Fargo & Company '949746101 142,399 6,449,251 Facebook, Inc. (a) '30303M102 14,566 5,064,744 3M Company '88579Y101 23,286 4,625,298 TJX Companies, Inc. (The) '872540109 76,502 5,157,765 UnitedHealth Group, Inc. '91324P102 21,777 8,720,382 Unilever Plc (b) '904767704 66,698 3,901,833 Roche Holding Ltd. (b) '771195104 109,203 5,131,449 LVMH Moët Hennessy-Louis Vuitton S.A. (b) '502441306 13,407 2,115,625 Accenture Plc 'G1151C101 24,969 7,360,612 Apple, Inc. '037833100 64,471 8,829,948 U.S. Bancorp '902973304 127,975 7,290,736 Abbott Laboratories '002824100 29,145 3,378,780 Coca-Cola Company (The) '191216100 138,093 7,472,212 Safran SA 0 30,650 4,249,998 American Express Company '025816109 28,572 4,720,952 Johnson & Johnson '478160104 38,189 6,291,256 Merck & Co., Inc. '589331107 48,205 3,748,903 Lyft, Inc. '55087P104 54,438 3,292,410 Visa, Inc. '92826C839 12,474 2,916,671 Adobe Systems Incorporated (a) '00724F101 4,873 2,853,824 Nestle, S.A. (b) '641069406 12,654 1,578,460 Quest Diagnostics Incorporated '74834L100 22,758 3,003,373 Oracle Corporation '68389X105 87,878 6,840,424 Microsoft Corporation '594918104 45,416 12,303,194 Alphabet, Inc. Class C (a) '02079K107 1,589 3,982,542 salesforce.com, inc. -

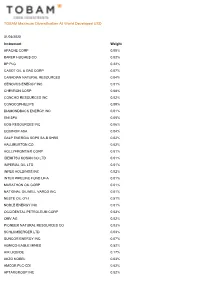

TOBAM Maximum Diversification All World Developed USD

TOBAM Maximum Diversification All World Developed USD 31/03/2020 Instrument Weight APACHE CORP 0.00% BAKER HUGHES CO 0.02% BP PLC 0.22% CABOT OIL & GAS CORP 0.07% CANADIAN NATURAL RESOURCES 0.04% CENOVUS ENERGY INC 0.01% CHEVRON CORP 0.08% CONCHO RESOURCES INC 0.02% CONOCOPHILLIPS 0.09% DIAMONDBACK ENERGY INC 0.01% ENI SPA 0.05% EOG RESOURCES INC 0.06% EQUINOR ASA 0.04% GALP ENERGIA SGPS SA-B SHRS 0.02% HALLIBURTON CO 0.02% HOLLYFRONTIER CORP 0.01% IDEMITSU KOSAN CO LTD 0.01% IMPERIAL OIL LTD 0.01% INPEX HOLDINGS INC 0.02% INTER PIPELINE FUND LP-A 0.01% MARATHON OIL CORP 0.01% NATIONAL OILWELL VARCO INC 0.01% NESTE OIL OYJ 0.51% NOBLE ENERGY INC 0.01% OCCIDENTAL PETROLEUM CORP 0.03% OMV AG 0.02% PIONEER NATURAL RESOURCES CO 0.03% SCHLUMBERGER LTD 0.03% SUNCOR ENERGY INC 0.07% AGNICO-EAGLE MINES 0.52% AIR LIQUIDE 0.17% AKZO NOBEL 0.03% AMCOR PLC-CDI 0.02% APTARGROUP INC 0.02% TOBAM Maximum Diversification All World Developed USD 31/03/2020 Instrument Weight AVON RESOURCES LTD 0.20% BALL CORP 0.06% CCL INDUSTRIES INC - CL B 0.01% CHR HANSEN HOLDING A/S 0.05% CLARIANT AG-REG 0.01% CORTEVA INC 0.04% CRODA INTERNATIONAL PLC 0.02% EMS-CHEMIE HOLDING AG-REG 0.01% FIRST QUANTUM MINERALS LTD 0.01% FORTESCUE METALS GROUP LTD 0.04% FRANCO-NEVADA CORP 1.01% GIVAUDAN-REG 0.07% INTL FLAVORS & FRAGRANCES 0.04% JAMES HARDIE INDUSTRIES-CDI 0.01% KANSAI PAINT CO LTD 0.01% KIRKLAND LAKE GOLD LTD 0.31% LINDE PLC 0.03% MARTIN MARIETTA MATERIALS 0.03% MOSAIC CO/THE 0.01% NEWCREST MINING LTD 0.60% NEWMONT CORP 1.89% NIPPON PAINT CO LTD 0.03% NORTHERN STAR RESOURCES -

Moving Forward. Driving Results. Euronet Worldwide Annual Report 2004 Report Annual Worldwide Euronet

MOVING FORWARD. DRIVING RESULTS. EURONET WORLDWIDE ANNUAL REPORT 2004 REPORT ANNUAL WORLDWIDE EURONET EURONET WORLDWIDE ANNUAL REPORT 2004 The Transaction Highway At Euronet Worldwide, Inc. secure electronic financial transactions are the driving force of our business. Our mission is to bring electronic payment convenience to millions who have not had it before. Every day, our operations centers in six countries connect consumers, banks, retailers and mobile operators around the world, and we process millions of transactions a day over this transaction highway. We are the world's largest processor of prepaid transactions, supporting more than 175,000 point-of-sale (POS) terminals at small and major retailers around the world. We operate the largest pan-European automated teller machine (ATM) network across 14 countries and the largest shared ATM network in India. Our comprehensive software powers not only our own international processing centers, but it also supports more than 46 million transactions per month for integrated ATM, POS, telephone, Internet and mobile banking solutions for our customers in more than 60 countries. Glossary ATM – Automated Teller Machine EMEA - Europe, Middle East and Africa An unattended electronic machine in a public Euronet has an EMEA regional business unit in place that dispenses cash and bank account the EFT Processing Segment. information when a personal coded card is EPS - Earnings per Share used. A company's profit divided by each fully-diluted Contents EBITDA - Earnings before interest, taxes, share of common stock. depreciation and amortization 3...Letter to Our Shareholders E-top-up – Electronic top up EBITDA is the result of operating profit plus The ability to add airtime to a prepaid mobile 5...2004 Company Highlights depreciation and amortization. -

ANNUAL REPORT June 30, 2021

JOB TITLE SA FUNDS AR REVISION 8 SERIAL <12345678> TIME Friday, August 27, 2021 JOB NUMBER 393837-1 TYPE PAGE NO. I ANNUAL REPORT June 30, 2021 PORTFOLIOS OF INVESTMENTS SA U.S. Fixed Income Fund SA Global Fixed Income Fund SA U.S. Core Market Fund SA U.S. Value Fund SA U.S. Small Company Fund SA International Value Fund SA International Small Company Fund SA Emerging Markets Value Fund SA Real Estate Securities Fund SA Worldwide Moderate Growth Fund Beginning on January 1, 2022, as permitted by regulations adopted by the Securities and Exchange Commission, we intend to no longer mail paper copies of each Fund’s shareholder reports, unless you specifically request paper copies of the reports from the SA Funds - Investment Trust (the “Trust”) or from your financial intermediary, such as a broker-dealer or bank. Instead, the reports will be made available on the Trust’s website (http://www.sa-funds.com), and you will be notified by mail each time a report is posted and provided with a website link to access the report. If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to continue to receive paper copies of all future reports free of charge. If you invest through a financial intermediary, you may contact your financial intermediary to request that you continue to receive paper copies of your shareholder reports. If you invest directly with the Trust, you may inform the Trust that you wish to continue receiving paper copies of your shareholder reports by contacting us at (844) 366-0905. -

November 2019

IssueIssue 228 390 | September | November 2004 2019 Banking Automation BULLETIN Banks reduce their footprint as branches get smarter Can the global cards market keep growing at its current rate? UnionPay retains largest share of global card expenditure Information sharing still seen as key to crime prevention Cash and ATM usage continue to decline in the UK Country profile: Singapore Published by RBR since 1979 www.rbrlondon.com/bulletin Issue 390 | November 2019 First published in December 1979 Banking Automation BULLETIN 2 ATM & CYBER SECURITY Information sharing still seen as key to crime prevention Can the global cards 4 GMV PERSPECTIVE And now Windows 10... Are you serious? market keep growing 6 BRANCH BANKING Banks reduce their footprint as branches get at its current rate? smarter 8 EURONET WORLDWIDE PERSPECTIVE Innovation for a changing payments landscape If you hear that $31 trillion was spent on purchases 10 DIEBOLD NIXDORF PERSPECTIVE globally in 2018 that sounds impressive. Exactly how Self-Service in the branch and as the branch impressive is hard to gauge – with an adult population of 4.6 billion, the world is a 12 GLOBAL CARDS AND PAYMENTS big place after all. UnionPay retains largest share of global card expenditure What is unambiguously impressive, however, is that the amount spent on payment UK CHARITIES cards grew 22% last year, having increased by 13% the year before. In other 13 UK charities adapt to an increasingly cashless words, the already large global payment cards market is not just growing fast, but society growth is accelerating. 15 CASH IN THE UK The results from RBR’s latest Global Payment Cards Data and Forecasts study allow Cash and ATM usage continue to decline in forensic analysis of a market which seemingly has multiple drivers simultaneously the UK pushing it to ever greater heights – economic growth, increased banked population, 16 NEWS BULLETIN penetration into new segments, changing customer behaviour, to name just a few. -

Diebold Nixdorf, Incorporated (Exact Name of Registrant As Specified in Its Charter)

Annual Report Transforming the Business Model to Generate Strong Free Cash Flow aanndd RReettuurrnn oonn IInnvveesstteedd CCapital1 The company is seeking to leverage its operating rigor and strong financial performance during 2020 to increase profitability, free cash flow generation and return on invested capital (ROIC) in 2021. $480 – $140 – $500 $170 ~18% 15% $453 $93 9% $401 $57 2019 2020 2021E 2019 2020 2021E 2019 2020 2021E Adjusted EBITDA1,2 Free Cash Flow 1,2 ROIC 1,2 Leveraging Competitive Differentiation for Growth Expecting 3% – 5% Revenue Growth in 2021 due to a strong product backlog and growth areas which include: $4,409 $4,000 – $4,100 $3,902 DN SeriesTM DN SeriesTM EASY DN AllConnectSM Data ATMs Self-Checkout Engine IoT-Enabled Solutions Service Model 2019 2020 2021E Revenue1 Managed Services Cloud-Native for Retailers and VynamicTM Payments Financial Institutions & Retail Software 1 All $ amounts are shown in millions. Company Outlook for 2021 provided on February 10, 2021. 2 Adjusted EBITDA, Free Cash Flow and ROIC are non-GAAP metrics. Please refer to “Notes for non-GAAP Measures,” following the “Exhibits” section of this report, for more information. Dear Shareholders Against the backdrop of a global pandemic, Diebold Nixdorf demonstrated the resiliency of its business model and a strong operating rigor in 2020. I am gratified by the many ways in which our employees adapted and responded to a dynamic and highly uncertain macro-environment. We cared for our employees, delivered for our customers, contributed to the well-being of our communities and generated strong financial results. Looking forward, we intend to build on this solid foundation in order to bring our DN Now transformation to a successful conclusion and evolve the business to deliver a balance of top-line growth, continuous operating improvements and significantly stronger free cash flow. -

Euronet and NTC Form Cashnet, an Electronic Funds Transfer Network

Euronet and NTC Form Cashnet, an Electronic Funds Transfer Network Partnership To Provide ATM Network Services For Banks and Card Issuers in Egypt LEAWOOD, KS USA & CAIRO, EGYPT (April 4, 2001) — Euronet Worldwide (Nasdaq: EEFT), a leading provider of secure electronic financial transaction solutions and National Telecommunications Company (NTC), a technology based holding company active in the communication and information technology fields in Egypt and the Middle East announced today the forming of Cashnet, a branded Electronic Fund Transfer (EFT) network. Cashnet is a joint venture between Euronet, NTC and Quantum Fund, a member of the George Soros group of funds, for developing and operating an Automated Teller Machine (ATM) network for banks and card issuers in Egypt. Cashnet will launch 50 ATMs by June of this year and the company’s business plan calls for the operation of 500 ATMs by 2004. The services Cashnet will provide to Egyptian financial institutions, include: ● Deploying an operating the Cashnet owned, Cashnet branded ATM network ● Operating bank owned, bank branded ATMs ● Operating POS terminals ● Providing connections or secure transaction gateway services between banks and international networks such as Visa and MasterCard. ● Providing authorization interfaces for the Internet and GSM mobile operators ● Providing debit and credit card issuance and related services At this time, Cashnet has entered into agreements to provide services to Citibank, Egyptian American Bank (EAB), Visa, MasterCard, American Express, and Diners Club International. As part of this agreement, Euronet Worldwide will provide Cashnet with day-to-day management services, and processing of Cashnet electronic transactions via the company’s Budapest, Hungary processing center. -

Multi-Lateral Mechanism of Cash Machines: Virtue Or Hassel

International Journal of Engineering Technology Science and Research IJETSR www.ijetsr.com ISSN 2394 – 3386 Volume 4, Issue 10 October 2017 Multi-Lateral Mechanism of Cash Machines: Virtue or Hassel Peeush Ranjan Agrawal1 and Sakshi Misra Shukla2 1 Professor, School of Management studies, MNNIT, Allahabad, Uttar Pradesh,India 2Assistant Professor, Department of MBA, S.P. Memorial Institute of Technology, Allahabad, India ABSTRACT Automated Teller Machines or Cash Machines became an organic constituent of the banking sector. The paper envisionsthe voyage that these cash machines have gone through since their initiation in the foreign banks operating in India. The study revolves around the indispensible factors in the foreign banking environment like availability, connectivity customer base, security, network gateways and clearing houses which were thoroughly reviewed and analyzed in the research paper. The methodology of the research paper includes literature review, derivation of variables, questionnaire formulation, pilot testing, data collectionand application of statistical tools with the help of SPSS software. The paper draws out findings related to the usage, congregation, multi-lateral functioning, security and growth of ATMs in the foreign banks operating in the country. The paper concludes by rendering recommendations to theforeign bankers to vanquish the stumbling blocks of the cash machines functioning. Keywords: ATMs, Cash Machines, Anywhere Banking, Foreign Banking, Online Banking 1. INTRODUCTION The Automated Teller Machine (ATM) has become an integral part of banking operations. Initially perceived as ‘cash machines’, which dispenses cash to depositors, ATMs can accept deposits, sell postage stamps, print statements and be used at institutions where the depositor does not have an account. -

Absa Bank (South Africa)

The Companies Listed under the Consortium for Next Gen ATMs ABA (American Bankers Association) Absa Bank (South Africa) Access Cash General Partnership (EZEE ATM) ACG ACI Worldwide ATEFI AIB (Allied Irish Banks) Akbank (Turkey) Altron Bytes Managed Solutions Aman (Palestine) ANZ Argotechno ATB Financial ATEFI ATM24 ATM CLUB Atima ATMIA ATM Security Association Auriga Australian Technology Management Pty Ltd Axis Communications AB 1 Bank of America Bank of Hawaii Bank of Montreal Bank of South Pacific Bank Permata BANTAS A.S Banktech (Australia) Barclays Bank BBVA Belfius Bank & Verzekeringen Bitstop Blanda Marketing & Public Relations BMO Financial Group BOSACH Technologies & Consulting Pvt. Ltd. BVK Capital One Cashflows Cashway Technology Co., Ltd. Capital One Bank Capitec Bank Cardtronics Cash and Card World Ltd Cash Connect® – ATM Solutions by WSFS Bank Cash Infrastructure Projects and Services GmbH Cashware Cecabank CIBC (Canadian Imperial Bank of Commerce) Citibank Citizens Bank CMS Analytics Coast Capital Savings Credit Union 2 Columbus Data Comerica Bank Commonwealth Bank of Australia Convergint Technologies CO-OP Financial Services CR2 Culiance Cummins Allison Cyttek Group Desjardins Dgiworks Technology (Turkey) Diebold-Nixdorf dormakaba USA Inc DPL Eastern Carolina ATM Eastman Credit Union EFTA Elan Financial Services Electronic Payment & Services (Pty) Ltd Embry Consulting, LLC Emirates NBD Euronet Worldwide EuroTechzam S.A. EVERTEC, Inc – US EVERI EVO Payments Faradis Alborz Corp First American Payment Systems First Data First National Bank of South Africa FISERV 3 FIS Global (Fidelity National Information Services) Fujitsu Ten España G4S GCB Bank (Ghana) General Dynamics Mission Systems Genmega GMR GMV Gorham Savings Bank GPT Great Southern Bank GRG Banking Gunnebo Gunnebo India Private Ltd Heritage Bank Hitachi Europe Hitachi-Omron Terminal Solutions, Corp. -

Descarca Bank Watch

SEPA • Sisteme de plãþi SWIFTNET • Outsourcing • Învãþãmânt bancar Nr. 4 / 15 iiuniie - 15 iiulliie 2009 www.marketwatch.ro intelligent management TRANSFONDTRANSFOND paginile 6-7 ªIªI „SEPA„SEPA PEPE LEI”LEI”:: UNUN PASPAS NECESAR,NECESAR, PENTRUPENTRU CINE?CINE? (II)(II) Infrastructuri de plãþi • Canale electronice de distribuþie • Sisteme informatice Ingenico - liderul mondial în soluþii de plãþi electronice securizate ºi cel mai mare producãtor de POS-uri bancare din lume. Terminalul Ingenico 5100 este avansat, puternic, sigur ºi flexibil ºi oferã o soluþie unicã pentru tranzacþii electronice destinate în special comercianþilor cu amãnuntul ºi restaurantelor. Acest terminal are PIN Pad integrat, perfect pentru comercianþii care au un numãr redus ºi mediu al tranzacþiilor. Are formã ergonomicã ºi poate fi utilizat cu uºurinþã de posesorii de carduri. În România, echipamentele Ingenico I5100 sunt folosite în prezent pentru reîncarcare electronicã (parteneriat Caracteristici de securitate remarcabile • sistem de securitate HSC integrat, dezvoltat de Ingenico dupã cu Euronet Worldwide, începând cu 2007), precum ºi în anii de experienþã acumulaþi ca lider mondial în securitatea POS-urilor. Acesta oferã niveluri diferite de securitate, care îndeplinesc cele mai exi- activitatea bancarã. gente cerinþe ale tranzactiilor de platã (PCI PED, ZKA ...). Deþine un procesor pe 32 de biþi, pentru a sprijini criptarea (RSA, DES, 3DES ...), asigurându-se astfel confidenþialitatea datelor; Cu peste 15 milioane de terminale de platã active în • Securitatea mai multor aplicaþii care sã ruleze independent pe acelaºi peste 125 de þãri – Ingenico deþine peste o treime din dispozitiv este asiguratã de tehnologia UNICAPTTM. valoarea totalã a pieþei. Calitate ºi performanþã • are disponibilã o gamã largã de opþiuni de comunicare internã: V22bis, V29, V34 (rapid), ISDN. -

Epay Partners with Zip Co to Tap Further Into Buy Now Pay Later Market

Monday, 31st August 2020 epay partners with Zip Co to tap further into Buy Now Pay Later market. Australian retailers provided with increased access to the growing Buy Now, Pay Later (BNPL) payment system market. Epay Australia Pty Ltd, Australia’s leading alternative payments provider with more than 23,000 locations Australia-wide, has announced a strategic partnership with Buy Now, Pay Later (BNPL) provider Zip Co to include Zip’s introduction at all epay POS terminals, apps and ecommerce platforms, giving customers access to interest-free payment plans for everyday spend with Zip Pay and interest-free terms for life’s bigger buys with Zip Money. The agreement creates a streamlined way for retailers to accept Zip payments instore and online, alongside Alipay, WeChat Pay and China Union Pay QR, with epay handling all integration, settlement and contracts on behalf of Zip. The partnership comes as Australian consumers continue their shift away from traditional credit cards to BNPL payment methods, with recent RBA data revealing a fall of 6.6 per cent in credit card use in the last financial year.[1] The rapid expansion and increasing popularity of BNPL payment platforms in the Australian market has also been reportedly fast-tracked by the rapid shift towards online shopping during the COVID-19 pandemic, with approximately 30 per cent of Australian adults (or about 5.8 million customers) now using BNPL services.[2] According to a recent report by IBISWorld, the BNPL market is expected to grow 9.1 per cent in 2020-21 to $741.5 million, a trend supported by a predicted 6.4 per cent surge in levels of online shopping over the same period.