Bertelsmann SE & Co. Kgaa

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

The Bertelsmann Divisions

The Bertelsmann Divisions RTL Group is a leader across broadcast, content and digital, With more than 250 imprints and brands on five continents, with interests in 60 television channels and 31 radio stations, more than 15,000 new titles and close to 800 million print, content production throughout the world and rapidly growing audio and e-books sold annually, Penguin Random House digital video businesses. RTL Group’s television portfolio is the world’s leading trade book publisher. Penguin Random includes RTL Television in Germany; M6 in France; the RTL House is committed to publishing adult and children’s fiction and channels in the Netherlands, Belgium, Luxembourg, Croatia nonfiction print editions and is a pioneer in digital publishing. Its and Hungary; and Antena 3 in Spain. The Group also operates book brands include storied imprints such as Doubleday, Viking the channels RTL CBS Entertainment and RTL CBS Extreme in and Alfred A. Knopf (United States); Ebury, Hamish Hamilton and Southeast Asia. Fremantle Media is one of the largest international Jonathan Cape (United Kingdom); Plaza & Janés and Alfaguara creators, producers and distributors of multigenre content (Spain); Sudamericana (Argentina); and the international imprint outside the United States. Combining the catch-up TV services DK. Its publishing lists include more than 60 Nobel Prize laureates of its broadcasters, the multichannel networks BroadbandTV, and hundreds of the world’s most widely read authors. Penguin StyleHaul and Divimove as well as Fremantle Media’s 260 Random House is dedicated to the mission of nourishing a YouTube channels, RTL Group has become the leading European universal passion for reading by connecting its authors and their media company in online video. -

London Book Fair 2019

London Book Fair 2019 Rights Catalogue: Frontlist Fiction FOR RIGHTS QUERIES CONTACT Nerrilee Weir, Senior Rights Manager TEL +61 2 8923 9892 FAX +61 2 9956 6487 EMAIL [email protected] penguin.com.au/rights Awards and Nominations 2019 & 2018 The Second Cure by Margaret Morgan Finalist: Aurealis Awards 2018 The Cage by Lloyd Jones Longlisted: Ockham New Zealand Book Awards 2019 The Man Who Would Not See by Rajorshi Chakraborti Longlisted: Ockham New Zealand Book Awards 2019 This Mortal Boy by FIona Kidman Longlisted: Ockham New Zealand Book Awards 2019 The Tea Gardens by Fiona McIntosh Longlisted: Australian Book Industry Awards 2018 The Girl in Kellers Way by Megan Goldin Shortlisted: Ned Kelly Awards 2018 Shortlisted: Davitt Awards 2018 Shortlisted: Australian Book Designers Awards 2018 All Day at the Movies by Fiona Kidman Longlisted: IMPAC International Dublin Literary Award 2018 Billy Bird by Emma Neale Longlisted: IMPAC International Dublin Literary Award 2018 2 LONDON 2019 FRONTLIST RIGHTS CATALOGUE RIGHTS SOLD 2018 & 2019 The Pearl Thief The Escape Room Fiona McIntosh Megan Goldin United Kingdom (Penguin North America (St Martin’s) Random House – Ebury) United Kingdom (Hachette) Italy (DeA Planeta) The Netherlands (Ambo Anthos) Audio (Penguin Random Germany (Piper Verlag) House Australia) Spain (Penguin Random House Groupo Editorial) Poland (Wydawnictwo Bukowy Las) Greenlight Benjamin Stevenson North America (Sourcebooks) This Mortal Boy United Kingdom (Hachette) Fiona Kidman United Kingdom (Gallic Books) Audio (Audible) Film Option (South Pacific Pictures) Audio (Bolinda) Potiki The Mannequin Makers Patrica Grace Craig Cliff United Kingdom (Penguin United Kingdom (Melville Random House – Penguin House) Press) Also licenced to: North America (Milkweed Editions) Romania (Editura Univers) The Yellow Villa Sixty Summers Amanda Hampson Amanda Hampson Italy (Newton Compton Editori) Audio (W. -

Book Publishing 2006

The research was funded by the Department of Arts and Culture (DAC) through the South African Book Development Council (SABDC) and by the Publishers’ Association of South Africa (PASA) PASA ANNUAL INDUSTRY SURVEY 2006 REPORT SEPTEMBER 2007 Research Team SCHOOL OF INFORMATION TECHNOLOGY Dr Francis Galloway DEPARTMENT OF INFORMATION SCIENCE Dr Rudi MR Venter PUBLISHING STUDIES Willem Struik CONTENTS EXECUTIVE SUMMARY 3 BACKGROUND 6 DATA COLLECTION PROCESS 6 Core list of targeted publishers 7 List of entities that participated in the 2005 and 2006 industry surveys 10 Producer profile of entities that participated in the 2006 survey 11 DATA CAPTURING 14 DATA ANALYSIS 15 TURNOVER PROFILE 16 Total Net Turnover 16 Total Net Turnover: Business Activities 17 Net Turnover: Sales of Local vs. Imported Product – According to Sub-sector 19 Educational Net Turnover per Province 26 Net Turnover of Local Books per Language 27 PRODUCTION PROFILE 32 Local Production of First Editions vs. Subsequent Editions & Reprints According to Sub-sector 32 Total Title Production (incl. New Editions, excl. Subsequent Editions & Reprints) per Language and Sub-sector 34 AUTHOR PROFILE 38 Total Number of Authors / Other Parties Receiving Royalties 38 Author Profile According to Population Group and Sub-sector 38 ROYALTY PROFILE 40 Average % Royalty on Net Turnover According to Sub-sector and Publishers’ Category 40 Rand Value of Royalty as % of Net Turnover of Sales of Local Product According to Publishers’ Category 41 FINAL REMARKS 42 © 2007 Francis Galloway, Rudi MR Venter & Willem Struik, Publishing Studies, University of Pretoria PASA ANNUAL INDUSTRY SURVEY REPORT 2006 2 EXECUTIVE SUMMARY Data collection process The core list for the 2006 survey contained 99 targeted entities. -

Annual Report 2016 at a Glance 2016

Annual Report 2016 At a Glance 2016 Key Figures (IFRS) in € millions 2016 2015 2014 2013 2012 Business Development Group revenues 16,950 17,141 16,675 16,179 16,065 Operating EBITDA 2,568 2,485 2,374 2,311 2,210 EBITDA margin in percent1) 15.1 14.5 14.2 14.3 13.8 Bertelsmann Value Added (BVA)2) 147 155 188 283 362 Group profit 1,137 1,108 572 885 612 Investments3) 1,240 1,259 1,578 1,312 655 Consolidated Balance Sheet Equity 9,895 9,434 8,380 8,761 6,083 Equity ratio in percent 41.6 41.2 38.9 40.9 32.2 Total assets 23,794 22,908 21,560 21,418 18,864 Net financial debt 2,625 2,765 1,689 681 1,218 Economic debt4) 5,913 5,609 6,039 4,216 4,773 Leverage factor 2.5 2.4 2.7 2.0 2.3 Dividends to Bertelsmann shareholders 180 180 180 180 180 Distribution on profit participation certificates 44 44 44 44 44 Employee profit sharing 105 95 85 101 92 Figures until 2015 are the most recently reported previous year’s figures. The figures shown in the table are, in some cases, so-called Alternative Performance Measures (APM), which are neither defined nor described in IFRS. Details are presented in the “Alternative Performance Measures” section in the Combined Management Report. Rounding may result in minor variations in the calculation of percentages. 1) Operating EBITDA as a percentage of revenues. 2) Bertelsmann uses BVA as a strictly defined key performance indicator to evaluate the profitability of the operating business and return on investment. -

Perumal Murugan, Rising Heat. Trans. Janani Kannan. Hamish Hamilton: Penguin Random House India, 2020

ASIATIC, VOLUME 14, NUMBER 2, DECEMBER 2020 Perumal Murugan, Rising Heat. Trans. Janani Kannan. Hamish Hamilton: Penguin Random House India, 2020. Pp. i-xiv+319. ISBN: 9780670093663. Perumal Murugan is a prominent voice in Tamil literature. His works started garnering national acclaim after some of his novels were translated into English. His novel Seasons of the Palm (translation of Koolla Madari, 2001) was shortlisted for the Kiriyama Prize in 2005. However, he was hounded by right-wing political groups for One Part Woman (2013), his most critically acclaimed novel and translation of Maadhorubaagan (2010). The novel depicts a religious festival where childless women were free to choose their mates from among the men in the crowd. Though this was a socio-cultural reality of the Konga Nadu region in Tamil Nadu which formed the backdrop of his novel, he was persecuted Asiatic, Vol. 14, No. 2, December 2020 137 Gargi Dutta relentlessly for portraying it. The international coverage of this incident brought Murugan to the limelight and English translations of his works became much in demand. Rising Heat (2020), the book under review, is the translation of Yeru Veyil (1991), Murugan’s first novel written in Tamil. It depicts the effects of relentless urbanisation of contemporary times. Narrated from the perspective of Selvan, a boy from a farming family and a tenth standard student, the novel narrates how his ancestral lands are acquired by the state government to make way for a housing colony against meagre compensation. It goes on to represent the family’s various vicissitudes after their displacement and depicts the various challenges posed by the unaccustomed surroundings and how they cope with these. -

Frankfurt Book Fair 2018

2018 Rights Catalogue: Fiction FRANKFURT BOOK FAIR 2018 FOR RIGHTS QUERIES CONTACT: Nerrilee Weir, Senior Rights Manager Tel: +61 2 8923 9892 Email: [email protected] www.penguin.com.au/rights Awards and Nominations 2018 & 2017 The Tea Gardens by Fiona McIntosh Longlisted: Australian Book Industry Awards 2018 The Girl in Kellers Way by Megan Goldin Shortlisted: Ned Kelly Awards 2018 Shortlisted: Davitt Awards 2018 Shortlisted: Australian Book Designers Awards 2018 All Day at the Movies by Fiona Kidman Longlisted: IMPAC International Dublin Literary Award 2018 Billy Bird by Emma Neale Longlisted: Longlisted: IMPAC International Dublin Literary Award 2018 Shortlisted: Ockham Awards 2017 Year of the Orphan by Daniel Findlay Shortlisted: Aurelis Awards 2017 Witi Ihimaera Awarded the prestigious New Zealand Prime Minister’s Award for Literary Achievement 2017 Appointed French Knight of the Order of Arts and Letters (Chevalier de l’ordre des Arts et des Lettres) 2017 Escaping Mr Right by Avril Tremayne Winner: The Ultimate Ruby – Best Romance of the Year, Romance Writers of Australia Awards 2017 The Grazier’s Wife by Barbara Hannay Shortlisted: Romance Writers of Australia Ruby Awards 2017 2 FRANKFURT 2018 RIGHTS CATALOGUE RIGHTS SOLD 2018 The Pearl Thief The Escape Room Fiona McIntosh Megan Goldin United Kingdom (Penguin North America (St. Martin’s) Random House - Ebury) The Netherlands (Ambo Anthos) Germany (Piper Verlag) Spain (Penguin Random House Groupo Editorial) Greenlight Benjamin Stevenson This Mortal Boy North America -

2019 2019 2019 2019 Agents & Scouts Agents & Scouts Agents

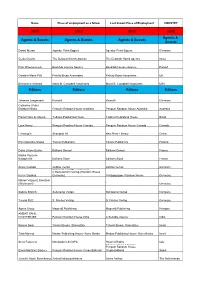

Name Place of employment as a fellow Last known Place of Employment COUNTRY 2019 2019 2019 2019 Agents & Agents & Scouts Agents & Scouts Agents & Scouts Scouts Daniel Mursa Agentur Petra Eggers Agentur Petra Eggers Germany Geula Geurts The Deborah Harris Agency The Deborah Harris Agency Israel Piotr Wawrzenczyk Book/lab Literary Agency Book/lab Literary Agency Poland Caroline Mann Plitt Felicity Bryan Associates Felicity Bryan Associates UK Beniamino Ambrosi Maria B. Campbell Associates Maria B. Campbell Associates USA Editors Editors Editors Editors Johanna Langmaack Rowohlt Rowohlt Germany Catherine (Cate) Elizabeth Blake Penguin Random House Australia Penguin Random House Australia Australia Flavio Rosa de Moura Todavia Publishing House Todavia Publishing House Brazil Lynn Henry Penguin Random House Canada Penguin Random House Canada Canada Li Kangqin Shanghai 99 New River Literary China Päivi Koivisto-Alanko Tammi Publishers Tammi Publishers Finland Dana Liliane Burlac Éditions Denoël Éditions Denoël France Maÿlis Vauterin- Bacqueville Editions Stock Editions Stock France Anvar Cukoski Aufbau Verlag Aufbau Verlag Germany Deutsche Verlags-Anstalt and C.Bertelsmann Verlag (Random House Karen Guddas Germany) Verlagsgruppe Random House Germany Marion Vazquez Boerzsei (Wichmann) ` ` Germany Sabine Erbrich Suhrkamp Verlag Suhrkamp Verlag Germany Teresa Pütz S. Fischer Verlag S. Fischer Verlag Germany Ágnes Orzóy Magvető Publishing Magvető Publishing Hungary AMBAR SAHIL CHATTERJEE Penguin Random House India A Suitable Agency India Ronnie -

A Holmes and Doyle Bibliography

A Holmes and Doyle Bibliography Volume 2 Monographs and Serials By Subject Compiled by Timothy J. Johnson Minneapolis High Coffee Press 2010 A Holmes & Doyle Bibliography Volume 2, Monographs & Serials, by Subject This bibliography is a work in progress. It attempts to update Ronald B. De Waal’s comprehensive bibliography, The Universal Sherlock Holmes, but does not claim to be exhaustive in content. New works are continually discovered and added to this bibliography. Readers and researchers are invited to suggest additional content. The first volume in this supplement focuses on monographic and serial titles, arranged alphabetically by author or main entry. This second volume presents the exact same information arranged by subject. The subject headings used below are, for the most part, taken from the original De Waal bibliography. Some headings have been modified. Please use the bookmark function in your PDF reader to navigate through the document by subject categories. De Waal's major subject categories are: 1. The Sacred Writings 2. The Apocrypha 3. Manuscripts 4. Foreign Language Editions 5. The Literary Agent (Sir Arthur Conan Doyle) 6. The Writings About the Writings 7. Sherlockians and The Societies 8. Memorials and Memorabilia 9. Games, Puzzles and Quizzes 10. Actors, Performances and Recordings 11. Parodies, Pastiches, Burlesques, Travesties and Satires 12. Cartoons, Comics and Jokes The compiler wishes to thank Peter E. Blau, Don Hobbs, Leslie S. Klinger, and Fred Levin for their assistance in providing additional entries for this bibliography. ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~ 01A SACRED WRITINGS -- INDIVIDUAL TALES -- A CASE OF IDENTITY (8) 1. Doyle, Arthur Conan. A Case of identity and other stories. -

Frankfurt Book Fair 2019

Frankfurt Book Fair 2019 Rights Catalogue: Frontlist Fiction FOR RIGHTS QUERIES CONTACT FOR RIGHTS QUERIES CONTACT Nerrilee Weir, Senior Rights Manager Alice Richardson, Rights Executive TEL +61 2 8923 9892 TEL +61 2 8923 9815 EMAIL [email protected] EMAIL [email protected] penguin.com.au/rights penguin.com.au/rights Awards and Nominations 2019 & 2018 Greenlight by Benjamin Stevenson Shortlisted: Ned Kelly Award 2019 Under Your Wings by Tiffany Tsao Longlisted: Ned Kelly Award 2019 The Second Cure by Margaret Morgan Finalist: Aurealis Awards 2018 The Man Who Would Not See by Rajorshi Chakraborti Longlisted: Ockham New Zealand Book Awards 2019 This Mortal Boy by Fiona Kidman Winner: Ockham New Zealand Book Awards 2019 Winner: New Zealand Booklovers Award 2019 Shortlisted: Ngaio Marsh Award for Best Crime Novel 2019 Winner: New Zealand Heritage Book Awards 2018 The Tea Gardens by Fiona McIntosh Longlisted: Australian Book Industry Awards 2018 The Girl in Kellers Way by Megan Goldin Shortlisted: Ned Kelly Awards 2018 Shortlisted: Davitt Awards 2018 Shortlisted: Australian Book Designers Awards 2018 All Day at the Movies by Fiona Kidman Longlisted: International Dublin Literary Award 2018 Billy Bird by Emma Neale Longlisted: International Dublin Literary Award 2018 2 FRANKFURT FRONTLIST RIGHTS CATALOGUE 2019 RIGHTS SOLD - Recent Highlights The Yield Jane in Love Tara June WInch Rachel Givney North America North America (HarperCollins) (HarperCollins) France (Actes Sud) Under Your Wings The Pearl Thief Tiffany -

Annual Report 2014 at a Glance

Building A New Bertelsmann Annual Report 2014 At a Glance Key Figures (IFRS) in € millions 2014 2013 2012 2011 2010 Business Development Group revenues 16,675 16,179 16,065 15,368 15,065 Operating EBITDA 2,374 2,311 2,210 2,243 2,355 EBITDA margin in percent 1) 14.2 14.3 13.8 14.6 15.6 Operating EBIT 1,769 1,763 1,732 1,755 1,825 Bertelsmann Value Added (BVA) 2) 188 283 362 359 378 Group profit 573 885 612 612 656 Investments 3) 1,578 1,312 655 956 753 Consolidated Balance Sheet Equity 8,381 8,761 6,083 6,149 6,486 Equity ratio in percent 38.9 40.9 32.2 33.9 34.7 Total assets 21,546 21,418 18,864 18,149 18,702 Net financial debt 1,689 681 1,218 1,809 1,913 Economic debt 4) 6,039 4,216 4,773 4,913 4,915 Leverage factor 2.7 2.0 2.3 2.4 2.3 Employees (in absolute numbers) Germany 40,846 38,611 38,434 37,519 36,462 Other countries 71,191 72,488 65,852 65,233 61,066 Total 112,037 111,099 104,286 102,752 97,528 Dividends to Bertelsmann shareholders 180 180 180 180 180 Distribution on profit participation certificates 44 44 44 44 44 Employee profit sharing 85 101 92 107 108 Figures adjusted for financial year 2013; figures before 2013 are the most recently reported previous year’s figures. 1) Operating EBITDA as a percentage of revenues. -

2014 Financial Statements for Bertelsmann SE & Co. Kgaa

Annual Financial Statements and Combined Management Report Bertelsmann SE & Co. KGaA, Gütersloh December 31, 2014 (Translation – the German text is authoritative) Annual financial statements 2014 Contents Balance sheet Income statement Notes “List of shareholdings” annex to the notes in accordance with HGB 285 (11) Combined management report Responsibility statement Auditor’s report 2 Annual financial statements 2014 Bertelsmann SE & Co. KGaA Balance sheet as of December 31, 2014 Assets 12/31/2014 Previous year Notes € € € millions Non-current assets Intangible assets (1) 1,244,865.15 1 Tangible assets (2) 318,645,994.96 291 Financial assets (3) 13,336,594,919.01 12,747 13,656,485,779.12 13,039 Current assets Receivables and other assets (4) 2,694,898,054.78 1,736 Securities 1.00 - Cash and cash equivalents (5) 246,221,247.42 1,425 2,941,119,303.20 3,161 Prepaid expenses and deferred charges (6) 12,925,617.58 13 16,610,530,699.90 16,213 Shareholders’ equity and liabilities 12/31/2014 Previous year Notes € € € millions Shareholders’ equity Subscribed capital (7) 1,000,000,000.00 1,000 Capital reserve 2,600,000,000.00 2,600 Retained earnings (8) 4,610,000,000.00 3,662 Unappropriated income 484,253,046.64 1,190 8,694,253,046.64 8,452 Provisions Pensions and similar obligations (9) 260,141,767.00 244 Other provisions (10) 102,097,953.10 117 362,239,720.10 361 Financial debt (11) 3,138,966,446.28 3,506 Other liabilities (12) 4,414,857,893.29 3,894 Deferred income (13) 213,593.59 - 16,610,530,699.90 16,213 3 Annual financial statements 2014 Bertelsmann SE & Co. -

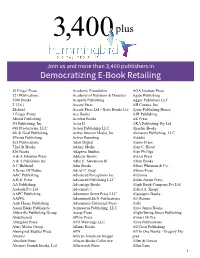

Democratizing E-Book Retailing

3,400 plus Join us and more than 3,400 publishers in Democratizing E-Book Retailing 10 Finger Press Academic Foundation AGA Institute Press 121 Publications Academy of Nutrition & Dietetics Agate Publishing 1500 Books Acapella Publishing Aggor Publishers LLC 2.13.61 Accent Press AH Comics, Inc. 2dcloud Accent Press Ltd - Xcite Books Ltd Ajour Publishing House 3 Finger Prints Ace Books AJR Publishing 3dtotal Publishing Acrobat Books AK Press 3G Publishing, Inc. Actar D AKA Publishing Pty Ltd 498 Productions, LLC Action Publishing LLC Akashic Books 4th & Goal Publishing Active Interest Media, Inc. Akmaeon Publishing, LLC 5Points Publishing Active Parenting Aladdin 5x5 Publications Adair Digital Alamo Press 72nd St Books Adams Media Alan C. Hood 826 Books Adaptive Studios Alan Phillips A & A Johnston Press Addicus Books Alazar Press A & A Publishers Inc Adlai E. Stevenson III Alban Books A C Hubbard Adm Books Albert Whitman & Co. A Sense Of Nature Adriel C. Gray Albion Press A&C Publishing Advanced Perceptions Inc. Alchimia A.R.E. Press Advanced Publishing LLC Alden-Swain Press AA Publishing Advantage Books Aleph Book Company Pvt.Ltd Aadarsh Pvt Ltd Adventure 1 Alfred A. Knopf AAPC Publishing Adventure Street Press LLC Algonquin Books AAPPL AdventureKEEN Publications Ali Warren Aark House Publishing Adventures Unlimited Press Alibi Aaron Blake Publishers Aepisaurus Publishing, LLC Alice James Books Abbeville Publishing Group Aesop Press Alight/Swing Street Publishing Abdelhamid Affirm Press Alinari 24 Ore Abingdon Press AFG Weavings LLC Alive Publications Abny Media Group Aflame Books All Clear Publishing Aboriginal Studies Press AFN All In One Books - Gregory Du- Abrams African American Images pree Absolute Press African Books Collective Allen & Unwin Abstract Sounds Books, Ltd.