Exhibitor Prospectus

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Hotel Koe, Tokyo

Best Urban Hotels 2018 OUR JUDGES Jasmi Bonnén Beauty entrepreneur, Copenhagen Aric Chen Design curator, Shanghai Natasha Jen Designer, New York Cherine Magrabi Creative director, Beirut Fernanda Marques Architect, São Paulo Makgati Molebatsi Art consultant, Johannesburg BEST OF THE REST Almanac, Barcelona Ace Hotel, Chicago Nobis, Copenhagen Mondrian Doha, Doha Bulgari Resort, Dubai Eden Locke, Edinburgh Puro, Gdańsk The Fontenay, Hamburg Macq 01, Hobart The Murray, Hong Kong Room Mate Emir, Istanbul Hallmark House Hotel, Johannesburg Verride Palácio Santa Catarina, Lisbon The Mandrake, London The Principal, London ban The NoMad, Los Angeles Ur Ho st t e e Hotel Monville, Montreal ls B 2 Roomers, Munich 0 1 8 Freehand, New York Winner Made, New York Moxy Times Square, New York Moxy Osaka Honmachi, Osaka Hôtel National des Arts et Métiers, Paris W Panama, Panama City The Hoxton, Paris Tribe Hotel, Perth Dream world Fera Palace Hotel, Salvador This year’s Best Urban Hotel, a fantastically furnished Sicilian palazzo, The Middle House, Shanghai plus three runners-up, as voted for by our jet-setting judging panel The Sukhothai, Shanghai Andaz, Singapore Six Senses Duxton, Singapore Asmundo di Gisira Paramount House Hotel, Sydney Catania The Vera, Tel Aviv The Broadview, Toronto Like many palazzi, Asmundo di Gisira, the public space celebrates the myth of FROM ABOVE LEFT, Hotel Indigo, Warsaw a converted 18th-century pile in Sicily’s Billonia, with a painting of the goddess by CEMENT TILES IN THE COVERED COURTYARD; second largest city, hides -

2018 Hotel Brand Reputation Rankings: USA & Canada

REPORT 2018 Hotel Brand Reputation Rankings: USA & Canada October 2018 INDEX Introduction 4 Methodology 6 The Importance of Brand Reputation 7 Key Data Points: All Chain Scales 8 Key Findings 9 Summary of Top Performers 10 ECONOMY BRANDS Overview 13 Top 25 Branded Economy Hotels 14 Economy Brand Ranking 15 Economy Brand Ranking by Improvement 16 Economy Brand Ranking by Service 17 Economy Brand Ranking by Value 18 Economy Brand Ranking by Rooms 19 Economy Brand Ranking by Cleanliness 20 Review Sources: Economy Brands 21 Country Indexes: Economy Brands 22 Response Rates: Economy Brands 22 Semantic Mentions: Economy Brands 23 MIDSCALE BRANDS Overview 24 Top 25 Branded Midscale Hotels 25 Midscale Brand Ranking 26 Midscale Brand Ranking by Improvement 27 Midscale Brand Ranking by Service 28 Midscale Brand Ranking by Value 29 Midscale Brand Ranking by Rooms 30 Midscale Brand Ranking by Cleanliness 31 Review Sources: Midscale Brands 32 Country Indexes: Midscale Brands 33 Response Rates: Midscale Brands 33 Semantic Mentions: Midscale Brands 34 UPPER MIDSCALE BRANDS Overview 35 Top 25 Branded Upper Midscale Hotels 36 Upper Midscale Brand Ranking 37 Upper Midscale Brand Ranking by Improvement 38 Upper Midscale Brand Ranking by Service 39 Upper Midscale Brand Ranking by Value 40 Upper Midscale Brand Ranking by Rooms 41 Upper Midscale Brand Ranking by Cleanliness 42 Review Sources: Upper Midscale Brands 43 Country Indexes: Upper Midscale Brands 44 Response Rates: Upper Midscale Brands 44 Semantic Mentions: Upper Midscale Brands 45 Index www.reviewpro.com -

The Serviced Apartment Sector in Europe Highlights and Trends in 2016

JULY 2016 THE SERVICED APARTMENT SECTOR IN EUROPE HIGHLIGHTS AND TRENDS IN 2016 Arlett Hoff, MRICS Director HVS.com HVS London | 7‐10 Chandos St, London W1G 9DQ Further growth in both demand and supply fuelled markets. Selected Short Stay Group locations the European serviced apartment industry in the will be repositioned under BridgeStreet’s own second half of 2015 and the beginning of 2016. brands (Aparthotels, Living, Place and Stüdyo). Furthermore, partners can benefit Transactions and M&A Activities from the BridgeStreet booking and distribution systems; The Staycity St Augustine Street in Dublin sold for €25 million from NAMA to an undisclosed buyer. The A collaboration with Airbnb to build up the Airbnb for Business product offerings and link investment shows a net initial yield of around 5% and reflects an average price of more than €227,000 for them to BridgeStreet’s client base. An each unit. Staycity remains as tenant on a long‐term interesting partnership that has been commented on as introducing shared lease. The St Augustine Street apartments are arranged in five blocks around a central courtyard and were economy services to a managed corporate developed in 2008 by Zoe Developments. programme. Accor has acquired Onefinestay, an online provider The future Go Native London Aldgate was subject to a forward funding transaction. The 178‐unit aparthotel that offers high‐end homes for rent similar to the AirBnB business model, combined with hotel‐like at 27 Commercial Road transacted between the Sharma family and Osprey at a price of £80 million. services for the proprietor and guest. -

Hotel Brand Reservation Contact List

www.ghla.net Corp Brand Website Toll-Free Number America's Best America's Best Inn & Suites americasbestinn.com 855.537.4573 Country Hearth Inn & Suites countryhearth.com 888.4HEARTH (443.2784) Best Western bestwestern.com 800-780-7234 Budget Host budgethost.com 800.BUDHOST (283.4678) Budget Suites budgetsuites.com 866.877.2000 Carlson Country Inns & Suites countryinns.com 800.830.5222 Park Inn parkinn.com 800.670.7275 Radisson radisson.com 800.967.9033 Choice Hotels choicehotels.com 877.424.6423 Ascend Collection ascendcollection.com 877.424.6423 Cambria Suites cambriasuites.com 877.424.6423 Clarion clarionhotel.com 877.424.6423 Comfort Inn comfortinn.com 877.424.6423 Comfort Suites comfortsuites.com 877.424.6423 EconoLodge econolodge.com 877.424.6423 MainStay Suites mainstaysuites.com 877.424.6423 Quality Inn qualityinn.com 877.424.6423 Rodeway Inn rodewayinn.com 877.424.6423 Sleep Inn sleepinn.com 877.424.6423 Suburban Extended Stay suburbanhotels.com 877.424.6423 Drury Hotels druryhotels.com 800.DRURYINN (378.7946) Extended Stay Hotels extendedstayhotels.com 800.804.3724 Crossland Economy Studio crosslandstudios.com 877.398.3633 Extended Stay America extendedstayamerica.com 800.804.3724 Extended Stay Deluxe extendedstaydeluxe.com 800.804.3724 Homestead Studio Suites homtesteadhotels.com 800.804.3724 StudioPLUS Deluxe Studios studioplus.com 800.804.3724 Four Seasons fourseasons.com 800.819.5053 www.ghla.net Hilton hilton.com 800.HILTONS (445.8667) // 800.368.1133 Doubletree 800.HILTONS (445.8667) // 800.368.1133 Embassy Suites 800.HILTONS -

Hotel News January 2015

Hotel News January 2015 Featured statistics and trends New hotel openings Development activity Union Hanover has opened its first Urban Villa extended stay Dominvs has bolstered management ahead of a period of property at Barratt's Great West Quarter scheme in significant expansion. The group is due to open two IHG fran- Brentford, West London. The 100-apartment property was chised hotels in Aberdeen this year, a Holiday Inn in Man- funded by EquityBridge Asset Management and Coutts and chester next year and will begin construction on another 500 will be operated by Noho Hospitality. branded 4-star rooms in London and Oxford in 2016. KSL Capital has opened the 4-star 120-bed Village Urban Chris Stewart Group has commenced work on a £30m Court- Resort Edinburgh. The £20M hotel, situated on the old Helix yard by Marriott in Edinburgh city centre. The 240-bed hotel, House site on Crewe Road to the North of the city, was de- which involves renovation of a row of townhouses, is sched- signed by 3DReid and constructed by Marshall Construction. uled to open in summer 2016. Development funding is being provided by RBS England & Wales / NatWest Scotland. CLS Holdings has opened the Staybridge Suites London - Vauxhall, IHG's second extended stay property in the Capital Whitbread has acquired two office buildings in London SW1 and second Vauxhall opening in the last 3 months. The 93- for £81M that it plans to convert into hub by Premier Inn bed property is managed by Cycas Hospitality, who also op- hotels. Subject to planning consent, the two properties on erate Staybridge Suites in Liverpool and Stratford City. -

Extended Stay America Appoints Bruce Haase As Chief Executive Officer

Extended Stay America Appoints Bruce Haase as Chief Executive Officer November 22, 2019 Kelly Poling Named EVP, Chief Commercial Officer Randy Fox Named EVP, Property Operations CHARLOTTE, N.C., Nov. 22, 2019 (GLOBE NEWSWIRE) -- Extended Stay America, Inc. and its paired-share REIT, ESH Hospitality, Inc. (together, the “Company”) (NASDAQ:STAY), the largest mid-priced extended stay hotel brand, today announced the appointment of Bruce Haase as President and Chief Executive Officer, effective immediately. Haase has been elected to serve as a director of Extended Stay America, Inc. and will continue to serve as a director of ESH Hospitality, Inc. He succeeds Jonathan Halkyard, who will continue to advise the Company through February 25, 2020. Haase has served as a director of ESH Hospitality since 2018. He has more than 20 years of lodging experience with particular expertise in the extended stay hotel segment. From 2014 to 2016, he served as Chief Executive Officer of WoodSpring Hotels, LLC, the nation’s largest and fastest growing economy extended stay hotel brand. Previously, Haase served in a series of executive positions with Choice Hotels International from 2000 through 2012, most recently as Executive Vice President, Global Brands, Marketing & Operations. The Company also announced today the appointment of Kelly Poling as Executive Vice President, Chief Commercial Officer, and Randy Fox, as Executive Vice President, Property Operations, filling two previously vacant key leadership positions and further strengthening the management team with executives deeply experienced in the extended stay hotel segment. Poling has a track record of success in the extended stay hotel segment, having led all central revenue generating functions at WoodSpring Suites. -

2021 Brochure

THE BUSINESS EVENT FOR THE HOTEL COMMUNITY PROSPECTIVE EXHIBITOR & PARTNER INFORMATION INDEPENDENTHOTELSHOW.NL @INDHOTELSHOWEU WELCOME TO THE INDEPENDENT HOTEL SHOW AMSTERDAM 2021 The Independent Hotel Show is the most comprehensive business event for the hotel community. With more than 2,300 hoteliers visiting the inaugural European edition in Amsterdam and 65% of exhibitors already booked into their stands for 2021, the value of the event to the industry is clear and we are thrilled to provide a means to support this exciting sector. With Covid-19 undoubtably presenting our industry with uncharted challenges, hoteliers are now, more than ever, trying to restore confidence with their guests and provide the best possible service experience. There is no quick fix, however we know that 2021 will be the perfect opportunity to reconnect and present your products and services to our audience of hotel owners, operators, and developers. Comprised of a curated exhibition of over 190 suppliers, a programme of educational seminars and multiple networking opportunities; the Independent Hotel Show brings thousands of hoteliers together to share ideas, do business and network. Join us 16–17 March 2021 at RAI Amsterdam to engage with an audience of high-quality hoteliers dedicated to the discovery of opportunities available to increase the profitability and efficiency of their hotel businesses. We look forward to welcoming you to the line-up. Mieke Berkers Event Manager Independent Hotel Show Amsterdam GUEST DEMOGRAPHICS TOTAL VISITORS 2300 COMPANY -

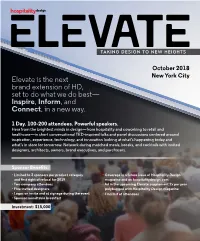

Elevate Is the Next Brand Extension of HD, Set to Do What We Do Best— Inspire, Inform, and Connect, in a New Way

TAKING DESIGN TO NEW HEIGHTS October 2018 New York City Elevate is the next brand extension of HD, set to do what we do best— Inspire, Inform, and Connect, in a new way. 1 Day. 100-200 attendees. Powerful speakers. Hear from the brightest minds in design—from hospitality and coworking to retail and healthcare—in short conversational TED-inspired talks and panel discussions centered around inspiration, experience, technology, and innovation looking at what’s happening today and what’s in store for tomorrow. Network during matched meals, breaks, and cocktails with invited designers, architects, owners, brand executives, and purchasers. Sponsor Benefits: • Limited to 3 sponsors per product category • Coverage in a future issue of Hospitality Design and first right of refusal for 2019 magazine and on hospitalitydesign.com • Two company attendees • Ad in the upcoming Elevate supplement 2x per year • Five invited designers polybagged with Hospitality Design magazine • Logos on invite and at signage during the event • Final list of attendees • Sponsor roundtable breakfast Investment: $15,000 Invited guests include HD’s Editorial Advisory Board Andrew Alford, chief creative officer, AJ Capital Julia Monk, senior vice president, director of David Ashen, principal, dash design hospitality design, HOK Jeffrey Beers, founder, Jeffrey Beers International Will Meyer, principal, Meyer Davis Malcolm Berg, principal/owner, EoA Alessandro Munge, principal, Munge Leung Mark Boekenheide, senior vice president, Barry Nidiffer, executive vice president – development -

The Serviced Apartment Sector in Europe No Longer the Underdog?

JULY 2017 THE SERVICED APARTMENT SECTOR IN EUROPE NO LONGER THE UNDERDOG? Nicole Perreten Senior Associate HVS.com HVS London | 7-10 Chandos St, London W1G 9DQ Another year has passed where the serviced apartment sector was able to consolidate its position in the lodging sector. This year’s article looks at the recent trends, discusses our analysis of the 2017 survey results and recent transaction evidence, and provides an outlook of the coming months in terms of pipeline. HIGHLIGHTS We conducted a new survey this year, which analysed a number of different operating characteristics and, while some show a clear commonality across the participants, many vary according to the brand and are therefore heavily driven by the operators’ strategy, were it to target the traditional long-stay market or, contrarily the short-stay market, bearing more characteristics with a hotel operation. Operators seem to get more creative with their product offering as they grow their portfolio. Recent additions to the sector showed that some have added more common spaces with communal dining areas at the expense of in-room kitchens, marketing them as a more affordable experience (or microapartments). The branded serviced apartment sector is getting more crowded. Almost every established hotel group now has an extended-stay product and new kids on the block are rapidly appearing such as Base in Switzerland and Cityden in Amsterdam. Other, more distribution-focused groups such as Saco and Bridgestreet are also rapidly increasing their portfolio of managed properties. Our analysis of Gross Operating Profit (GOP) margins revealed some impressive results. Nevertheless, the bandwith of GOP margins remains broad, confirming that some properties operate less profitably. -

Royal London House FINAL Report

ROYAL LONDON HOUSE, FINSBURY SQUARE, LONDON Demand Study On Behalf of Obidos Properties Limited 16 March 2012 CONTENTS 1. Executive Summary ................................................................... 3 2. Background & Method of Approach .......................................... 5 3. Site Appraisal ........................................................................... 7 4. Proposed Development Scheme .............................................. 11 5. Local Hotel Market .................................................................. 26 6. Envisaged Demand ................................................................. 46 7. Conclusion .............................................................................. 56 APPENDICES A. Glossary of Industry Terminology............................................ 61 B. London Hotel Market .............................................................. 63 CBRE HOTELS | ROYAL LONDON HOUSE, FINSBURY SQUARE, LONDON Executive Summary The subject property is situated in the London Borough of Islington on Finsbury Square, to the north of Finsbury Circus and Liverpool Street Station. It benefits from excellent visibility from Finsbury Square and City Road and is situated in close proximity to the City of London and popular areas such as Shoreditch High Street and Hoxton Square. There are numerous bars, eateries and entertainment facilities within immediate walking distance of the site. The proposed development and the Finsbury Square area is well served by road and rail. The site is -

Hotel Development NYC & Company

Sviluppo alberghiero a NYC Benvenuto a New York City. Lo sviluppo alberghiero a NYC, che include nuove aperture, ristrutturazioni e ampliamenti, continua a superare i livelli di crescita nazionali. Con un inventario attivo nei cinque distretti di oltre 117.300 camere d'albergo, la città è sempre di più un polo di attrazione per i nuovi brand, per le proprietà internazionali, per hotel indipendenti e boutique hotel, per strutture business, e per il target lusso. Questo report comprende più di 200 hotel e 40.000 nuove camere e include i nuovi progetti fino al 2020-2021. Nel 2018, da gennaio ad aprile, sono stati inaugurati sei nuovi hotel, per un totale di 1.685 nuove camere. Entro il 2020 sono in fase di sviluppo altri 121 progetti che porteranno la capacità alberghiera di NYC a oltre 138.000 camere disponibili. Tra gli sviluppi più interessanti previsti per la seconda metà del 2018, Times Square Edition, un nuovo citizen M Hotel, un AC Hotel in centro, due nuove proprietà targate Moxy (Chelsea e Downtown) e una nuova Ace Sister City affiliata all'hotel sulla Bowery. Brooklyn vedrà l'apertura di diversi brand indipendenti, tra cui Baltic Huis, The Hoxton Brooklyn e il Bond Hotel. Lo sviluppo alberghiero nel Queens si sta spostando oltre gli aeroporti, verso quartieri in crescita come Long Island City, Flushing, Giamaica e Fresh Meadows, con l'apertura di diverse proprietà tra cui un Hilton Garden Inn, l'Hotel Indigo, SpringHill Suites e un Courtyard by Marriott/Fairfield Inn & Suites. Meno noti, ma sicuramente da tenere in considerazione, i nuovi sviluppi sia nel Bronx che a Staten Island. -

Hotel Development in NYC Hotel Development In

Hotel Development in NYC Hotel Development in NYC Welcome to New York. From the Bronx to Brooklyn, across Queens to Staten Island’s new North Shore, new hotel properties are joining the dynamic developments in Manhattan, as the hotel pipeline in New York City continues to outpace the US growth picture. With a range of ground up new buildings, restorations of historic buildings, and expansions, the outlook for new inventory supports the city’s Welcome. Always. message to visitors offering accommodations to suit all traveler needs and preferences. Over the past decade the city has attracted new brands, international properties, authentic neighborhood independents, and a wide-ranging collection of select service brands, business class hotels, lifestyle and boutique properties, and new luxury destinations. This report covers almost 200 hotels and projects, including almost a dozen new entries, that represent an additional 20,000 rooms to the city’s already diverse inventory. At the current pace, the city is expected to reach almost 139,000 rooms in active inventory by the end of 2021. For calendar year 2018, 18 new hotels opened with a total of approximately 3,400 rooms added to the City’s supply. Among the new openings are the upscale Park Terrace across from Bryant Park in midtown, the Aliz Hotel Times Square, the City’s first TownePlace Suites by Marriott, the Insignia Hotel in Brooklyn, a member of the Ascend Collection, Mr. C Seaport, a Leading Hotels of the World member, and The Assemblage John Street, a co-working space with extended stay accommodations in Lower Manhattan.