LONGFOR PROPERTIES CO. LTD. 龍湖地產有限公司 (Incorporated in the Cayman Islands with Limited Liability) (Stock Code:960)

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

WIC Template 13/9/16 11:52 Am Page IFC1

In a little over 35 years China’s economy has been transformed Week in China from an inefficient backwater to the second largest in the world. If you want to understand how that happened, you need to understand the people who helped reshape the Chinese business landscape. china’s tycoons China’s Tycoons is a book about highly successful Chinese profiles of entrepreneurs. In 150 easy-to- digest profiles, we tell their stories: where they came from, how they started, the big break that earned them their first millions, and why they came to dominate their industries and make billions. These are tales of entrepreneurship, risk-taking and hard work that differ greatly from anything you’ll top business have read before. 150 leaders fourth Edition Week in China “THIS IS STILL THE ASIAN CENTURY AND CHINA IS STILL THE KEY PLAYER.” Peter Wong – Deputy Chairman and Chief Executive, Asia-Pacific, HSBC Does your bank really understand China Growth? With over 150 years of on-the-ground experience, HSBC has the depth of knowledge and expertise to help your business realise the opportunity. Tap into China’s potential at www.hsbc.com/rmb Issued by HSBC Holdings plc. Cyan 611469_6006571 HSBC 280.00 x 170.00 mm Magenta Yellow HSBC RMB Press Ads 280.00 x 170.00 mm Black xpath_unresolved Tom Fryer 16/06/2016 18:41 [email protected] ${Market} ${Revision Number} 0 Title Page.qxp_Layout 1 13/9/16 6:36 pm Page 1 china’s tycoons profiles of 150top business leaders fourth Edition Week in China 0 Welcome Note.FIN.qxp_Layout 1 13/9/16 3:10 pm Page 2 Week in China China’s Tycoons Foreword By Stuart Gulliver, Group Chief Executive, HSBC Holdings alking around the streets of Chengdu on a balmy evening in the mid-1980s, it quickly became apparent that the people of this city had an energy and drive Wthat jarred with the West’s perception of work and life in China. -

Asia's Richest

Cover story ASIA’S RICHEST BUSINESSWOMEN The pace of economic change in Asia has been set in large part by the Chinese businesswomen who dominate in this year’s Asia Rich List. WORDS • HARNOOR CHANNI-TIWARY ZHANG XIN Net worth US$3.1 billion SOHO China If you visited Beijing or Shanghai a decade ago second-generation Burmese Chinese parents who worked as and went back now, there is a good chance translators at the Foreign Language Press. Unfortunately, this was you wouldn’t recognise the city; such is the also the same time that the cultural revolution was gaining steam and transformation that has occurred. And in many her family was shipped off to the countryside for Mao Tse-tung’s ways, a large part of this steep economic change ‘re-education’ program. This period was tough on her family and can be attributed to women, who now are not eventually her parents separated, with Zhang Xin remaining in her only making waves but are also finding mother’s care. unprecedented success in business circles. It is They both moved to Hong Kong when she was 14 in an attempt therefore no surprise that the Hurun Report of to pick up the pieces of their now-strewn life and livelihood. Her the richest self-made businesswomen in Asia mother got another job as a translator, which could only afford (March 2017) is dominated by the Chinese. them a room housing two tiny beds, and a bathroom shared with In fact, not a single name in the top 15 in this a dozen families. -

LONGFOR GROUP HOLDINGS LIMITED 龍湖集團控股有限公司 (Incorporated in the Cayman Islands with Limited Liability) (Stock Code: 960)

Hong Kong Exchanges and Clearing Limited and The Stock Exchange of Hong Kong Limited take no responsibility for the contents of this announcement, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this announcement. LONGFOR GROUP HOLDINGS LIMITED 龍湖集團控股有限公司 (incorporated in the Cayman Islands with limited liability) (Stock Code: 960) ANNOUNCEMENT OF ANNUAL RESULTS FOR THE YEAR ENDED DECEMBER 31, 2019 FINANCIAL SUMMARY • Contracted sales increased by 20.9% to RMB242.50 billion as compared with that of last year. • Revenue increased by 30.4% to RMB151.03 billion as compared with that of last year, of which the rental income from the property investment business increased by 41.5% to RMB5.79 billion. • Profit attributable to shareholders was RMB18.34 billion. Excluding effects, such as minority interests and valuation gains, core net profit increased by 21.0% to RMB15.55 billion as compared with that of last year. Gross profit increased by 28.5% year-on-year to RMB50.80 billion, gross profit margin was 33.6%. Core net profit margin was 15.5%, and core net profit margin attributable to shareholders was 10.3%. • The net debt to equity ratio (net debt divided by total equity) was 51.0%. Cash in hand was RMB60.95 billion. • Consolidated total borrowings was RMB146.00 billion and average cost of borrowing was 4.54% per annum. Average maturity period of loan was 6.04 years. • Basic earnings per share were RMB3.13. -

Wang Jianlin Wanda Group

10 Property.FIN.qxp_Layout 1 13/9/16 5:41 pm Page 113 Week in China China’s Tycoons Property Wang Jianlin Wanda Group the “football mayor” while Dalian Wanda became a household name in China thanks to its all-conquering football team which “My dominated the Chinese league in the 1990s. philosophy is always the Big break same: be close In 1991, Wanda was one of the state entities with the picked to become a ‘pilot’ joint stock firm. government, Wang got the controlling shareholder of and distance Wanda, which then began to expand beyond myself from Liaoning. politics” Wang came up with the idea of the Wanda Plaza: mega residential and commercial complexes. Local governments welcomed these huge projects with land and other incentives By late 2015 Wanda had 133 Wanda Plazas and 84 hotels nationwide with total leasable area of 26 million square metres. Going global At the apex of Chinese politics stands a group In 2012 Bo Xilai was arrested and lost out to Xi of elites known as the hongerdai, or children Jinping, another hongerdai, in the race to or grandchildren of the revolutionary leaders become China’s supreme leader. It didn’t seem who helped the Communist Party to seize to have affected Wang. power in 1949. Wang is among the blue bloods Indeed, it was after 2012 that Wang began to (“red bloods” may be politically more spend aggressively overseas. His trophy buys appropriate): his father had taken part in and include London properties, UK yacht maker survived the Red Army’s Long March. -

Entrepreneurship Propelling Economic Changes in China

Entrepreneurship Propelling Economic Changes in China by Gregory C. Chow, Princeton University CEPS Working Paper No. 202 March 2010 Entrepreneurship Propelling Economic Changes in China Gregory C. Chow The most important aspect of the Chinese economy today is its rapid changes. The changes are propelled by the Chinese entrepreneurs. This essay is an attempt to understand who the entrepreneurs are, the environment in which they work, whether the dynamic changes will continue and what policies can be proposed to improve the changes. For years the most important topic in the study of the Chinese economy is economic reform led by the Chinese government and the Communists Party of China. See Chow (2007) on China’s economic reform. Much of China’s economic reform has been completed. The government has provided an environment for the entrepreneurs to strive and to change the economy to the better. To study the economic changes is to study the behavior of this group of economic actors. I assume that they are rational economic agents motivated by the pursuit of economic gains. Their behavior can be understood in the framework of maximization subject to the constraint of the environment. Although economic thinking applies to the present study, the propositions are qualitative rather than quantitative. Economic growth can be measured by such important variables as real GDP, but economic changes in China have qualitative aspects that I cannot and do not wish to describe completely in quantitative terms. Yet economic thinking will be used for the explanation and prediction of the changes and for suggesting policies to improve them. -

LONGFOR GROUP HOLDINGS LIMITED 龍湖集團控股有限公司 (Formerly Known As Longfor Properties Co

Hong Kong Exchanges and Clearing Limited and The Stock Exchange of Hong Kong Limited take no responsibility for the contents of this announcement, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this announcement. LONGFOR GROUP HOLDINGS LIMITED 龍湖集團控股有限公司 (formerly known as Longfor Properties Co. Ltd. 龍湖地產有限公司) (incorporated in the Cayman Islands with limited liability) (Stock Code: 960) UNAUDITED INTERIM RESULTS ANNOUNCEMENT FOR THE SIX MONTHS ENDED JUNE 30, 2018 Financial Summary • Contracted sales increased by 4.8% to RMB97.10 billion over the same period last year. • Revenue increased by 45.9% to RMB27.12 billion over the same period last year, of which the rental income from the property investment business increased by 62.8% to RMB1.85 billion. • Profit attributable to shareholders was RMB5.43 billion. Excluding effects, such as minority interests and valuation gains, core net profit increased by 31.4% to RMB3.73 billion over the same period last year. Gross profit increased by 48.2% to RMB10.07 billion over the same period last year and gross profit margin was 37.1%. Core net profit margin was 17.7%, and core net profit margin attributable to shareholders was 13.8%. • The net debt to equity ratio (net debt divided by total equity) was 54.6%. Cash in hand was RMB42.13 billion. • Consolidated total borrowings was RMB107.93 billion and average cost of borrowing was 4.5% per annum. -

Bloomberg Xi Jinping Millionaire Relations Reveal Elite Chinese Fortunes by Bloomberg News

NEWSBloomberg Xi Jinping Millionaire Relations Reveal Elite Chinese Fortunes By Bloomberg News June 29, 2012 – Xi Jinping, the man in line to be China’s next president, warned officials on a 2004 anti-graft conference call: “Rein in your spouses, children, relatives, friends and staff, and vow not to use power for personal gain.” As Xi climbed the Communist Party ranks, his extended family expanded their business interests to include minerals, real estate and mobile-phone equipment, according to public documents compiled by Bloomberg. Those interests include investments in companies with total assets of $376 million; an 18 percent indirect stake in a rare- earths company with $1.73 billion in assets; and a $20.2 million holding in a Xi Jinping, vice president of China, visits the China Shipping terminal at the Port of Los Angeles in Los Angeles, California, U.S., on publicly traded technology company. The figures Thursday, Feb. 16, 2012. Source: Bloomberg don’t account for liabilities and thus don’t reflect the family’s net worth. No assets were traced to Xi, who turns 59 this provinces and joining the ruling Politburo Standing month; his wife Peng Liyuan, 49, a famous People’s Committee in 2007. Along the way, he built a Liberation Army singer; or their daughter, the reputation for clean government. documents show. There is no indication Xi intervened He led an anti-graft campaign in the rich coastal to advance his relatives’ business transactions, or of province of Zhejiang, where he issued the “rein in” any wrongdoing by Xi or his extended family. -

Longfor Group Holdings Target Price: HKD26.70 Price: HKD22.40 Our Favourite Long-Term Call Market Cap: USD16,923M Bloomberg Ticker: 960 HK

Results Review Hong Kong 1H18 results announced on 21 Aug 2018 are in line 23 August 2018 Property | Real Estate Buy (Maintained) Longfor Group Holdings Target Price: HKD26.70 Price: HKD22.40 Our Favourite Long-Term Call Market Cap: USD16,923m Bloomberg Ticker: 960 HK Maintain BUY with new HKD26.70 TP from HKD26.30, 19% upside – based Share Data on the same 25% discount to end-FY18F ENAV of HKD35.60, from Avg Daily Turnover (HKD/USD) 123m/15.3m HKD35.10. Longfor remains one of our picks for fundamentals, given high 52-wk Price low/high (HKD) 17.7 - 26.6 earnings quality and strong financial position. Other than its buoyant property development business outlook from strong sell-through rate and Free Float (%) 30 high cash collection ratio, we also like the leapfrogging investment Shares outstanding (m) 5,915 property business. Growing rental income would further safeguard its Estimated Return 19% status of being the only privately-owned developer in China with IG credit rating. We recommend Longfor and CR Land for long-term investors Shareholders (%) seeking solid fundamental plays. Wu Yajun 44.0 Cai Kui 26.0 Interim results met, positive surprise on margins. 1H18 core earnings were at CNY3.7bn, +31.2% YoY – which met. GPM and NPM were stronger-than- expected at 37.1% and 13.8%. Net gearing continued to hold steady at 54.6%. Share Performance (%) Interim dividend was announced at CNY0.30/share, +50% YoY. YTD 1m 3m 6m 12m Stable contracted sales outlook, on track of accomplishing sales targets. Absolute 14.4 9.0 (6.1) (7.8) 17.8 Management believes contracted sales are more skewed towards 2H this year, Relative 21.7 10.7 5.1 2.6 16.5 which is in line with our expectations. -

China's Securities Regula- Tors Intend to Issue Approvals with the Same Frequency Seen in Recent Years

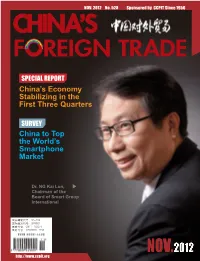

NOV. 2012 No. 528 Sponsored by CCPIT Since 1956 CHINA’S F REIGN TRADE SPECIAL REPORT China’s Economy Stabilizing in the First Three Quarters SURVEY China to Top the World’s Smartphone Market Dr. NG Kai Lun, Chairman of the Board of Smart Group International 国内邮发代号:80-799 国际邮发代号:SM1581 国内刊号:CN11-1020/F 国际刊号:ISSN0009-4498 http://www.ccpit.org 福田欧曼TL 世界标准 Foton Auman TL World standard Quality: Adopts European stan- dards as the design standards, so as to ensure the full-value chain and get fully aligned with the world standards in the aspects of R & D, supply chain, manufacturing, quality control, and service; as well as high vehicle, long service life, and high secondary-sale residual value. Safety: The car body can meet the European EEC safety regulations and standards, and has passed TÜV Rheinland safety certification, ensur- ing the safety of people, vehicles and cargoes. Fuel economy: Car body has gone through wind tunnel tests and aerodynamic design, with lower wind drag; the power system had been op- timized by the European technology with more efficiency; 3-5% more fuel- efficient than comparable vehicles, and lower operating costs. Intelligence: CAN-bus through- out the vehicle assembly, equipped with the smart power, with the world’s most advanced intelligent control and management systems, wireless net- work services and remote control sys- tems, intelligent navigation adopted, driving operability is more convenient and easier. Comfort: large driving space, hardwood floor throughout the ve- hicle, comfortable configuration in the car, adopting the Ramsis software de- sign, in line with ergonomic principles; equipped with four-point full-floating air bag body suspension system, the European tuning, smooth manipula- tion; newly-developed high-level auto body molding, manufactured in the global digital factory, good sealing, low noise; riding comfort with less fatigue. -

Longfor Properties (960 HK) Longfor Pr Operties

China Financials 11 April 2016 Longfor Properties (960 HK) Longfor Pr operties Target price: HKD13.29 Share price (8 Apr): HKD11.24 | Up/downside: +18.2% Initiation: ahead of the pack in strategy Reaping the rewards of its early return to China’s upper-tier cities Cynthia Chan (852) 2773 8243 Profitability and sales growth sustained in difficult environment [email protected] Initiating with Buy (1) rating and 12-month target price of HKD13.29 Investment case: We initiate coverage of Longfor Properties, a Beijing- Share price performance based company engaged in property development and investment in 24 (HKD) (%) cities in China, with a Buy (1) call. We see Longfor as well placed to reap 15 130 the benefits of its early return to the upper-tier cities, chiefly through the 13 120 11 110 reasonable cost of land it acquired in these cities. 10 100 8 90 In the face of housing oversupply in lower-tier cities, Longfor returned to Apr-15 Jul-15 Oct-15 Jan-16 Apr-16 China’s upper-tier cities before many of its peers, and we believe it remains Long Prop (LHS) Relative to HSI (RHS) ahead in terms of strategy. In our view, it has proven its sales execution ability in its 9 core cities (including Beijing, Shanghai, Chongqing, Chengdu, 12-month range 8.53-14.30 Hangzhou) in the past few years, which should enable sustained stable Market cap (USDbn) 8.43 contract sales growth of 13.9% YoY in 2016 (to CNY62.1bn) and 12.1% 3m avg daily turnover (USDm) 5.89 YoY in 2017 (to CNY69.6bn). -

Directors, Senior Management and Employees

THIS WEB PROOF INFORMATION PACK IS IN DRAFT FORM. The information contained herein is incomplete and subject to change and it must be read in conjunction with the section headed “Warning” on the cover of this Web Proof Information Pack. DIRECTORS, SENIOR MANAGEMENT AND EMPLOYEES Executive Directors App1A41(1) CO.3rd(6) Madam Wu Yajun (吳亞軍), aged 45, is our Chairperson and Chief Executive Officer. Madam Wu joined our Group since its inception in 1994. Madam Wu graduated from the Department of Navigation Engineering of the Northwestern Polytechnical University (西北工業大學) in 1984. Madam Wu serves as a member of the National Peoples’ Congress, Vice-Chairperson of the Federation of Industry & Commerce of Chongqing Municipality and Vice-Chairperson of the Real Estate Branch Chamber of the Chongqing General Chamber of Commerce. Between 1984 and 1988, Madam Wu worked at the Qianwei Meter Factory. From 1988 to 1993, Madam Wu worked as a journalist and editor with the China Shirong News Agency. Madam Wu held the posts of Chairperson and General Manager of Chongqing Jiachen Economic and Culture Development Co., Ltd. from 1994 to 1995. Between 1995 and 2000, she was the Managing Director of Chongqing Zhongjian Ke Real Estate Limited, after that she acted as Chairperson and General Manager of Chongqing Longhu Properties and Beijing Longhu Properties. In September 2005, Madam Wu resigned as General Manager of all regional companies, and took position as our Group’s Chairperson and CEO. Madam Wu was appointed as an executive director of the Company in December 2007. Mr. Lin Chu Chang (林鉅昌), aged 40, is our Chief Financial Officer. -

Xu Guanju of Transfar Becomes China's Most Generous

‘Logistics Tycoon’ Xu Guanju of Transfar becomes China’s Most Generous, donating US$430m last year Tencent co-founder Chen Yidan second (again!) with US$320m donation Education is preferred cause, especially alma maters Internet sensation Papi Jiang, 30, youngest on list ‘Real Estate Queen’ Wu Yajun most generous female philanthropist with US$14m donation Leading Authority on China’s wealthy publishes ranking of China’s 100 Most Generous Philanthropists for 14th Year and Hurun Global Chinese Philanthropy List for 4th Year China’s Most Generous Philanthropist Xu Guanju & family donated US$430m to Transfar Charity Foundation last October. The foundation focuses on relieving poverty, health, education and technology, green and ecology, agriculture and rural development, staff development and protection. Tencent co-founder Chen Yidan donated US$320m rank 2nd, setting up the Yidan Award, one of the world's largest education awards in Hong Kong. Real estate tycoon Xu Jiayin of Evergrande donated US$180m ranked 3th, mainly to an area within Guizhou Province, and US$1.5m to Harvard University for research. Total Donations down 45% yoy from last year. Rupert Hoogewerf, Chairman and Chief Researcher of Hurun Report said: “Last year Pony Ma's donation drove up the overall level.” Excluding Ma's donation, average donation this year is only 1% lower than last year. Cut-off to Top 100 US$2.1m, up 20% yoy. There are 31 philanthropists who have donated over CNY 100 million, 4 more than last year, the largest number of ‘supersize’ philanthropists in the history of this list. Education was the main cause.