Disclosure Statement Has Been Approved by the Bankruptcy Court

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Cenovus Reports Second-Quarter 2020 Results Company Captures Value by Leveraging Flexibility of Its Operations Calgary, Alberta (July 23, 2020) – Cenovus Energy Inc

Cenovus reports second-quarter 2020 results Company captures value by leveraging flexibility of its operations Calgary, Alberta (July 23, 2020) – Cenovus Energy Inc. (TSX: CVE) (NYSE: CVE) remained focused on financial resilience in the second quarter of 2020 and used the flexibility of its assets and marketing strategy to adapt quickly to the changing external environment. This positioned the company to weather the sharp decline in benchmark crude oil prices in April by reducing volumes at its oil sands operations and storing the mobilized oil in its reservoirs for production in an improved price environment. While Cenovus’s financial results were impacted by the weak prices early in the quarter, the company captured value by quickly ramping up production when Western Canadian Select (WCS) prices increased almost tenfold from April to an average of C$46.03 per barrel (bbl) in June. As a result of this decision, Cenovus reached record volumes at its Christina Lake oil sands project in June and achieved free funds flow for the month of more than $290 million. “We view the second quarter as a period of transition, with April as the low point of the downturn and the first signs of recovery taking hold in May and June,” said Alex Pourbaix, Cenovus President & Chief Executive Officer. “That said, we expect the commodity price environment to remain volatile for some time. We believe the flexibility of our assets and our low cost structure position us to withstand a continued period of low prices if necessary. And we’re ready to play a significant -

New Book on Irving Oil Explores Business

New book on Irving Oil explores business Miramichi Leader (Print Edition)·Nathalie Sturgeon CA|September 25, 2020·08:00am Section: B·Page: B6 SAINT JOHN • New Brunswick scholar and author Donald J. Savoie has published a new book exploring the origins of the Irving Oil empire. Savoie, who is the Canada Research Chair in Public Administration and Governance at the Université de Moncton, has released Thanks for the Business: Arthur L. Irving, K.C. Irving and the Story of Irving Oil. It’s look at entrepreneurship through the story of this prominent Maritime business family. “New Brunswickers, and Maritimers more generally, should applaud business success,” said Savoie, who describes himself as a friend of Arthur Irving. “We haven’t had a strong record of applauding business success. I think K.C. Irving, Arthur Irving, and Irving Oil speak to business success.” Irving Oil is the David in a David and Goliath story of major oil refineries in the world, Savoie noted, adding it provides a valuable economic contribution to the province as a whole, having laid the in-roads within New Brunswick into a multi-country oil business. He wanted his book to serve as a reminder of that. In a statement, Candice MacLean, a spokeswoman for Irving Oil, said company employees are proud to read the story of K.C. Irving, the company’s founder, and Arthur Irving, the company’s current chairman. “(Arthur’s) passion and love for the business inspires all of us every day,” MacLean said. “Mr Savoie’s Thanks for the Business captures the story of the Irving Oil that we are proud to be a part of.” In his new book, Savoie, who has won the Donner Prize for public policy writing, details Irving Oil’s “success born in Bouctouche and grown from Saint John, New Brunswick.” The company now operates Canada’s largest refinery, along with more than 900 gas stations spanning eastern Canada and New England, according to Savoie. -

An Effects-Based Assessment of the Health of Fish in a Small Estuarine Stream Receiving Effluent from an Oil Refinery

An effects-based assessment of the health of fish in a small estuarine stream receiving effluent from an oil refinery by Geneviève Vallières B.Sc. Biology, Université de Sherbrooke, 1998 A THESIS SUBMITTED IN PARTIAL FULFILLMENT OF THE REQUIREMENTS FOR THE DEGREE OF Master of Science In the Graduate Academic Unit of Biology Supervisors: Kelly Munkittrick, Ph.D. Department of Biology Deborah MacLatchy, PhD. Department of Biology Examining Board: Kenneth Sollows, Ph.D., Department of Engineering, Chair Simon Courtenay, Ph. D. Department of Biology External Examiner: Kenneth Sollows, Ph.D., Department of Engineering This thesis is accepted by the Dean of Graduate studies. THE UNIVERSITY OF NEW BRUNSWICK May, 2005 © Geneviève Vallières, 2005 ABSTRACT A large oil refinery discharges its effluent into Little River, a small estuarine stream entering Saint John Harbour. An effects-based approach was used to assess the potential effects of the oil refinery effluent on fish and fish habitat. The study included a fish community survey, a sentinel species survey, a fish caging experiment, and a water quality survey. The study showed that the fish community and the sentinel species, the mummichog (Fundulus heteroclitus), were impacted in the stream receiving the oil refinery effluent. Lower abundance and species richness were found downstream of the effluent discharge whereas increased liversomatic index and MFO (females only) were measured in fish collected in Little River. Water quality surveys demonstrated that the receiving environment is subjected to extended periods of low dissolved oxygen levels downstream of the effluent discharge. The anoxic periods correlated with the discharge of ballast water through the waste treatment system. -

The Energy Sector an Investment in the People and Communities of Atlantic Canada

The Energy Sector An Investment in the People and Communities of Atlantic Canada January 2008 The Energy Sector An Investment in the People North America needs energy and Canada, and Communities of Atlantic the United States and Mexico want to find it closer to home. These twin needs of Canada increasing demand and increased security have created a unique opportunity for On the doorstep of a growing Atlantic Canada that could drive job market 2 creation, community development and Distance between Atlantic Canada’s investment in the region well into the next major centres and the ports decade and beyond. of Boston and New York (chart) 3 Oil, natural gas and electricity; Atlantic Atlantic Canada’s energy mix 3 Canada develops and delivers all three major forms of energy for its own communities Projects and players in Atlantic and for export around the continent to be Canada’s energy sector 5 used as heat, fuel and power in homes and New Brunswick 5 businesses. Over the last few decades, the Nova Scotia 6 Atlantic Canadian energy industry has laid Newfoundland and Labrador 8 the foundation for what has become one of Prince Edward Island 9 the most significant sectors in the regional economy, and, increasingly, one of the most Exporting energy resources; diverse with its mix of traditional thermal importing human resources 10 and hydroelectric generation with newer technology such as nuclear, wind, bioenergy and tidal. Matching people and skill sets 12 Occupations that will be required by the Atlantic Canadian On the doorstep of a growing energy sector over the next decade market (chart) 12 Energy accounts for just over half of all exports from Atlantic Canada and it now Engaging in all aspects of stands poised to significantly increase its community life 13 reach. -

Ms Catherine Sr PCS Fertilizer GA I Al Aithan Dh Ran H I Prefix First Name

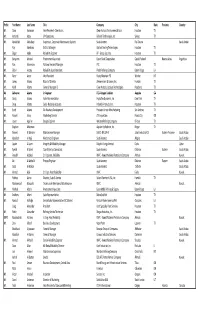

Prefix First Name Last Name Title Company City State Province Country Mr. Dana Aaronson Vice President ‐ Operations Clean Harbors Environmental Svcs Houston TX Mr. Armand Abay VP Operations Refined Technologies, Inc. Spring TX Mr. Abdulelah Abdulbaqi Supervisor, Corporate Maintenance Systems Saudi Aramco Ras Tanura Saudi Arabia Roy Abeldano District Manager Garlock Sealing Technologies Houston TX Mr. Edgar Ablan Reliability Engineer BP ‐ Group Security Houston TX Mr. Benjamin Achaval Procurement Associate Exxon Mobil Corporation Capital Federal Buenos Aires Argentina Mr. Ron Ackerman National Account Manager PSC Houston TX Mr. Eddie Acosta Reliability Superintendent Placid Refining Company Baton Rouge LA Mr. Terry Acree Vice President Rocky Mountain PSI Worden MT Mr. James Adams Board of Director Zimmermann & Jansen, Inc. Humble TX Mr. Keith Adams General Manager IS Clean Harbors Catalyst Technologies Pasadena TX Ms Catherine AdamsAdams Sr EnEngineergineer PCS NitroNitrogengen Fertilizer AuAugustagusta GA Ms. Cindy Adams Sales Representative HydroTex Dynamics, Inc. Deer Park TX Doug Adams Sales‐ National Accounts InduMar Products, Inc. Houston TX Mr. Scott Adams Dir. Business Development Precision Screen Manufactoring San Anotnio TX Mr. Russell Aday Marketing Director CFS Inspection Ponca City OK Mr. Javier Aguirre Design Engineer Western Refining Company El Paso TX Stephen Akkerman Aquilex Hydrochem, Inc Borger TX Mr. Ahmed Al Bahrani Maintenance Manager SABIC‐ IBN ZAHR Jubail Industrial City Eastern Province Saudi Arabia Mr. Abdullah Al Hajji Mechanical Engineer Saudi Aramco Abqaiq Saudi Arabia Mr. Jassim Al Jasmi Integrity & Reliability Manager Dolphin Energy Limited Doha Qatar Mr. Ayedh Al Saleh Coord Elec Sys Consultant Saudi Aramco Dhahran Eastern Saudi Arabia Mr. Reyadh Alabdali Sr. Engineer, Reliablity KNPC ‐ Kuwait National Petroleum Company Ahmadi Kuwait Ali Al‐Abdul'al Process Engineer Saudi Aramco Dhahran Eastern Saudi Arabia MrMr. -

ALUMNI NEWS Winter 2004

FORGING OUR FUTURES — CAMPAIGN UNB PAGE 6 UNB Vol. 12 No. 2 ALUMNI NEWS Winter 2004 MAKING A SIGNIFICANT DIFFERENCE OLD ARTS BUILDING UNB UNIVERSITY OF NEW BRUNSWICK TURNS 175 WWW.UNB.CA/UNBDIFFERENCE Be part of it! Welcome to the University of New Brunswick Alumni & Friends Travel Club. We are pleased to offer you this opportunity to preview our exciting line-up of travel programs, both domestic and abroad. Our goal is to offer enriching travel experiences along with the opportunity to connect with UNB alumni, their families and friends. Embark on an unforgettable journey! EXPLORER Don’t just dream of the exciting places you’d like to Discover South America visit . do it! See the world with us as we fly the April 15 — April 29, 2004 UNB flag around the globe. Embark on an unforgettable journey and discover the captivating BE PART OF IT! flavor of South America. Your adventure can be extended with optional 3-night pre-Machu Picchu and/or post-Amazon excursions. Highlights: Santiago • Folklore Show • Puerto Varas • The Lake Highlights: 4 rounds of golf with cart: The Lynx at Kingswood; District • Crossing of the Andes • Peulla • Bariloche • Buenos Aires • Royal Oaks; Crowbush; Mill River • Welcome reception • Deluxe Tango Show • Iguassu Falls • Rio de Janeiro motor coach • Farewell reception • On board escort & on-site coor- Cost: $6,675 CDN (per person/double occupancy) dination • 3 breakfasts • 3 dinners Explore his brilliance! Cost: $760 CDN (per person/double occupancy) EXPEDITIONS Best ski trails East of the Rockies! Mozart’s Imperial Cities — ADVENTURE Praque, Salzburg & Vienna Ski Mont Sainte-Anne April 30 — May 16, 2004 March 1 — March 6, 2004 Wolfgang Amadeus Mozart was born in It’s March Break, time to hit the slopes of Mont Saint-Anne! Mont Salzburg, Austria, in 1759. -

Saint John YMCA • Maritime Ontario • Bath Iron Works • 45 Stuart St. First

connections the biannual newsmagazine of the OSCO Construction Group fall & winter 2014 Saint John YMCA • Maritime Ontario • Bath Iron Works • 45 Stuart St. First 2000 NEBT Girders in Maritimes • Cabela’s • Floating Concrete the biannual newsmagazine of fall & winter 2014 connections the OSCO Construction Group what’s inside projects 4 .....Saint John YMCA 16 ...Cabela’s 22 ...Icon Bay Tower 6 .....Maritime Ontario 17.... Harbour Isle 22 ... Miscellaneous 8 .....Bath Iron Works Hazelton Metals Division 9 .....45 Stuart Street 17....Mr. Lube 23 ...Spryfield Bridge 18 ... Marine Terminal 24 ...Floating Concrete 10 ...Irving Oil Refinery 3 ..... Message from Projects 14 ... Fire Training 24 ...Scotia Wind Farms the President 20 ... Misc Rebar Projects Structure 25 ... The Bend Radio 52 ...Our Locations 14 ...Starfish Properties 20 ...Food Station 15 ... First 2000 NEBT 21 ...Bell Aliant 30 ... Wood Islands Girders in Maritimes 22 ...Varners Bridge Wharf profiles priorities 12 ... Product: Staggered Truss Framing (Summer House) 31 ... Safety: Safety Awards & Strescon Pipe Plant Milestone 26 ... Product: Precast Parking Garages 32 ... Technology: Summerside Plant Renovations 33 ...Technology: Best Nests 36 ... Environment: Restoring the landscape 37 ... Environment: e-waste people 41 ...Communication: Information Corner 42 ... OSCO Announces 41 ...Communication: Email sign up Promotions 44 ... Employee Appreciation Celebration 47 ... Employee Recognition Program public & 48 ...Retirement Lane community 49 ...Group Picnic 50 ...Group Golf Tournament 38 ...Saint John Touch a Truck 50 ... Strescon Golf 38 ...OSCO Bursary Winners Tournament 38 ...Steel Day 51 ...Fresh Faces 38 ...NSCC Foundation Bursary 51 ...Congratulations 39 ... Pte. David Greenslade Bursary & Park 39 ...Special Olympics 40...OSCO Group Career Fair OSCO 40...Employer of the Year construction group CONNECTIONS is the biannual magazine of the OSCO on our cover.. -

[email protected]

Our File Reference: 191620 Gavin S. Fitch, Q.C. <contact information removed> Radha Singh, Assistant <contact information removed> Fax: (403) 303-1668 September 21, 2020 PLEASE REPLY TO CALGARY OFFICE SENT VIA EMAIL – [email protected] Grassy Mountain Coal Project Joint Review Panel c/o Impact Assessment Agency of Canada 160 Elgin Street, 22nd Floor Place Bell Canada Ottawa, ON K1A 0H3 Attention: Tracy Utting, Acting Panel Manager Dear Madam: Re: Benga Mining Limited/Riversdale Resources - Grassy Mountain Coal Project Application Nos. 1844520 and 1902073 Pursuant to the Panel’s June 29, 2020 Notice of Hearing (Ref #365) and updates of September 4, 2020 (Ref #519) and September 14, 2020 (Ref #529), this is to advise of the evidence which the LLG intends to present at the public hearing. Attached hereto are four reports prepared by expert witnesses retained by LLG: 1. “Engineering review of the EIA design, operation, and reclamation plans for the proposed Grassy Mountain Project” by McKenna Geotechnical Inc., dated September 21, 2020; 2. “Comments on Air Quality and Meteorology concerning the Grassy Mountain Coal Project” by Jim Young Atmospheric Services Inc., dated September 21, 2020; 3. “Review of Human Health Risk Assessment, Benga Mining Grassy Mountain Coal Project” by John Dennis, PhD, SolAero Ltd., dated September 21, 2020; and 4. “Review of Grassy Mountain Coal Mine Economic Impact Assessment” by Chris Joseph MRM PhD, Swift Creek Consulting, dated September 21, 2020. Edmonton Office Calgary Office Yellowknife Office 600 McLennan Ross Building 1900 Eau Claire Tower 301 Nunasi Building 12220 Stony Plain Road 600 – 3rd Avenue SW 5109 – 48th Street Edmonton, AB T5N 3Y4 Calgary, AB T2P 0G5 Yellowknife, NT X1A 1N5 p. -

Provincial Outlook Summary: No Province Spared from Recession Alicia Macdonald

Provincial Outlook Summary No Province Spared From Recession Impact Paper May 27, 2020 For the exclusive use of Michelle Rozon, [email protected], The Conference Board of Canada. Contents 1 Key findings Ontario 10 Ontario suffers its first recession since 2009 2 National overview Manitoba 3 Provincial overview 12 Manitoba’s economy in a tailspin due to COVID-19 and trade Newfoundland and Labrador 4 Low oil prices combine with COVID-19 Saskatchewan to pummel Newfoundland economy 13 Tough times continue, but solid recovery is on the horizon Prince Edward Island 5 Economic hot streak ends abruptly Alberta 14 Province bracing for historic Nova Scotia 6 The coronavirus pandemic is wreaking havoc economic decline on Nova Scotia’s economy British Columbia 15 Province’s key industries hammered New Brunswick 8 New Brunswick’s economy set to weather by COVID-19 pandemic better than others Appendix A 17 Methodology Quebec 9 COVID-19 sickening the provincial economy © The Conference Board of Canada. All rights reserved. Please contact cboc.ca/ip with questions or concerns about the use of this material. Key findings • Canada is in the midst of its worst economic downturn in decades, with real GDP expected to decline by 4.3 per cent this year. • The arrival of the COVID-19 pandemic has devastated the economic outlook for all provinces, with significant declines in economic activity right across the country. • Alberta will be hardest hit this year as it contends with the combination of restrictions on activity to slow the spread of the virus and an unprecedented drop in the price and demand for oil. -

The Canadian Oil Transport Conundrum

STUDIES IN ENERGY TRANSPORTATION September 2013 The Canadian Oil Transport Conundrum by Gerry Angevine, with an Introduction by Kenneth P. Green Contents An Overview of Oil Transportation in Canada By Kenneth P. Green Introduction / 1 Overview / 3 Conclusion / 14 References / 15 About the author / 19 Challenges Posed by Pipeline Infrastructure Bottlenecks By Gerry Angevine Introduction / 20 Transportation bottlenecks faced by Canada’s oil producers / 21 Conclusion / 33 References / 34 About the author / 37 Publishing information / 38 Supporting the Fraser Institute / 40 Purpose, funding, & independence / 41 About the Fraser Institute / 42 Editorial board / 43 An Overview of Oil Transportation in Canada By Kenneth P. Green Introduction Recent events have elevated the importance of how we transport energy—spe- cifically oil—to high profile status. The long-stalled approval of the Keystone XL pipeline is probably the highest profile political event that has caused oil trans- port to surge to the fore in energy policy discussions today, but more prosaic economic issues also have played a role. Most importantly, because of limita- tions in the ability to ship oil to coastal refiners and overseas markets, Canada is forced to sell crude oil into the US market at a considerable discount relative to world oil price markers such as Brent.1 This is costing Canadians at least $15 billion each year (Beltrame, 2003, Apr. 13). Among other things, this shortfall has been blamed (wrongly, we believe) for problems with the balance sheet of Alberta’s government, bringing the issue to still greater prominence (Milke, 2013). Economic research has shown that eliminating bottlenecks (whether physical or political) can reduce oil price discounting similar to that which Canada currently endures (Bausell Jr. -

Outlook 2018: Industry Achievement Province’S Plan the Year Ahead Award Recipients Recognised to Grow the Oil & Gas Industry

NEWS Outlook 2018: Industry Achievement Province’s plan The Year Ahead award recipients recognised to grow the oil & gas industry Newfoundland & Labrador Oil & Gas Industries Association Volume 32, Number 1 2018 Quarter 1 Noia Board of Directors 2018 Chair Liam O’Shea Atlantic Offshore Medical Services Vice-Chair Mark Collett Crosbie Group of Companies Treasurer Mike Critch NSB Energy Contents Past-Chair Andrew Bell K&D Pratt INDUSTRY NEWS Directors Ian Arbuckle, Rothlochston Subsea 4 Outlook 2018: The year ahead David Billard, Aker Solutions Canada Jason Fudge, DF Barnes 10 Remembering the Ocean Ranger: Lessons learned Jason Muise, TechnipFMC 14 Canadian environmental assessment changes announced James Parmiter, Cahill Group of Companies Christian Somerton, Pennecon Energy Marine Base 16 Provincial government releases plan to grow the Hank Williams, Cougar Helicopters Inc. oil & gas industry Karen Winsor, Atlantic XL RESEARCH AND INNOVATION Noia News 18 C-CORE’s rapid iceberg profiling: Threat assessment in Editor-in-Chief: Jennifer Collingwood under an hour Editor: Marilyn Buckingham INSIDE NOIA Layout & Design: Steffanie Martin | NudgeDesigns.ca 21 Noia welcomes CEO Charlene Johnson Contributing Writers: Kristann Templeton, Geoff Meeker, 22 Noia presents 2018 Industry Achievement Awards Marilyn Buckingham 25 Prospectivity to prosperity for the province’s offshore 29 Noia’s 2018 Board of Directors Advertising: Alexia Williams 30 Meet Noia’s newest Board members Published by Noia | Printed by Bounty Print 32 Celebrating Puddister Trading Company’s 30-year membership The contents of this publication do not constitute professional advice. The publishers, editors and authors, as well as the authors’ firms or professional corporations, disclaim any liability which may arise as a 34 Stantec marks 30 years of Noia membership result of a reader relying upon contents of this publication. -

2015 Annual Report

Atlantic Pilotage Authority ANNUAL REPORT 2015 2015 EXECUTIVE & MANAGEMENT Mandate The mandate of the Atlantic Pilotage Authority is to establish, operate, maintain and administer, in the interest of safety, an efficient pilotage service in the Atlantic region. Mission The Authority will accomplish its mandate by providing the necessary expertise and Left to right: Peter MacArthur, Chief Financial Officer; Jennifer Holland, Human experience, associated with the appropriate Resources Manager; Brent Carroll, Pilot Boat Manager; Captain Sean Griffiths, Chief Executive Officer, Brian Bradley, Controller, Elaine Selig, Executive Assistant technology, to meet the needs of industry. The Authority is committed to maximizing the use of its resources/assets to meet 2015 BOARD OF DIRECTORS the goals in a safe and environmentally rinting: Cansel MDC P responsible manner. rvoine; O Vision To continue to provide an effective raductions F. T pilotage service throughout the Atlantic region. In doing so, the Authority would Captain Edward Anthony, Alisa Aymar, Public Sector L. Anne Galbraith, maximize opportunities and benefit the ranslation: T Pilotage Representative, Representative, Meteghan Chair & Public Sector St. John’s, NL River, NS Representative, various ports/districts and surrounding Dartmouth, NS communities. eill & Darrell Freeman; TABLE OF CONTENTS N Letter from the Chair and CEO . 1 Year in Review 2015, Strategic Direction . 2 Major Port Summaries . 6 Design: Dean Mc Captain Alexander MacIntyre, Patricia Mella, Brian Ritchie, Shipping Pilotage Representative, Vice-Chair & Public Industry Representative, Year in Review 2015, Financial Overview . .8 Head of St. Margaret’s Bay, NS Sector Representative, Shediac Cape, NB Compulsory Pilotage . 11 Stratford, PE On the Horizon: 2016 and Beyond .