The Machinery Sector in China

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

2021 Yellow Table

YELLOW TABLE 2021 Yellow Table Construction Mini or Compact Equipment midi or skid- 2020/ sales (US$ Share of Backhoe Excavators steer Powered Telescopic 2021 Change Company Country million) total Loaders (0 - 13 t) loaders Access Handlers Cranes 1 1 Caterpillar US 24,824 13.0% 2 2 Komatsu JP 19,995 10.4% 3 4 1 XCMG CN 15,159 7.9% 4 5 1 Sany CN 14,418 7.5% 5 10 5 Zoomlion CN 9,449 4.9% 6 3 3 John Deere US 8,947 4.7% 7 6 1 Volvo Construction Equipment SE 8,846 4.6% 8 7 1 Hitachi Construction Machinery JP 8,549 4.5% 9 8 1 Liebherr DE 7,808 4.1% 10 9 1 Doosan Infracore KR 7,109 3.7% 11 11 Sandvik Mining and Rock Technology SE 5,823 3.0% 12 16 4 Metso Outotec FIN 4,443 2.3% 13 12 1 JCB** UK 4,000 2.1% 14 14 Epiroc SE 3,923 2.0% 15 19 4 Liugong CN 3,338 1.7% 16 17 1 Kobelco Construction Machinery JP 3,152 1.6% 17 13 4 Terex US 3,076 1.6% 18 18 Kubota JP 2,767 1.4% 19 21 2 Sumitomo Heavy Industries JP 2,518 1.3% 20 15 5 Oshkosh Access Equipment (JLG) US 2,515 1.3% 21 22 1 Hyundai Construction Equipment KR 2,345 1.2% 22 20 2 CNH Industrial IT 2,170 1.1% 23 28 5 Lonking CN 1,869 1.0% 24 24 Wacker Neuson DE 1,841 1.0% 25 23 2 Manitou FR 1,807 0.9% 26 25 1 Palfinger AT 1,748 0.9% 27 26 1 Tadano JP 1,704 0.9% 28 29 1 Fayat Group FR 1,596 0.8% 29 27 2 Manitowoc US 1,490 0.8% 30 30 Hiab FIN 1,311 0.7% 31 35 4 Sunward CN 1,195 0.6% 32 34 2 Shantui CN 1,147 0.6% 33 31 2 Astec Industries US 1,024 0.5% 34 33 1 Takeuchi JP 988 0.5% 35 32 3 Ammann** CH 966 0.5% 36 36 Skyjack** CA 751 -

Construction Machinery

2 November 2017 Manufacturing Construction Machinery Deutsche Bank Markets Research Asia Industry Date China 2 November 2017 Industrials Construction Manufacturing Machinery Recommendation Change Quality growth ahead instead of quantity Fei Sun, CFA Not too late in the cycle; expect quality growth in 2018 Construction machinery sales bottomed out in 3Q16 and have been growing Research Analyst rapidly, driven mainly by demand from infrastructure projects and replacement +852-2203 6130 orders. We identify the key drivers of construction machinery demand and our Vincent Ha, CFA top-down analysis suggests the industry will deliver moderate growth next year. Research Analyst Zoomlion would have relatively greater operating leverage as the sector continues +852-2203 6247 to recover, and we believe the valuation gap between Lonking and Zoomlion will narrow. We upgrade Zoomlion to Buy, as we expect an earnings rebound in Yuki Lu FY18-19 and asset quality to improve (less bad debt provision). We maintain a Research Associate Hold on Lonking as the positives, such as the ability to gain market share and +852-2203 5925 expand margins, are already factored into its share price. Key Changes Better-than-expected demand with balanced supply Company Target Price Rating According to China Construction Machinery Association (CCMA), excavator/ 1157.HK 3.89 to 4.80 Hold to Buy wheel loader/truck crane sales volume surged 100%/45%/122% in 9M17 amid 3339.HK 2.05 to 3.60 - robust replacement and infrastructure demand. Unlike the oversupply in the Source: Deutsche Bank previous down-cycle, construction machinery supply was balanced this time. This Top picks is because, unlike in 2011, fewer individual contractors have entered the industry, Zoomlion (1157.HK),HKD3.81 Buy allowing more rational market competition. -

1 1 China Petroleum & Chemical Corporation 1913182 70713

2011 Ranking 2010 Company Name Revenue (RMB, million) Net profit (RMB Million) Rankings (x,000,000) (x,000,000) 1 1 China Petroleum & Chemical Corporation 1913182 70713 2 2 China National Petroleum Corporation 1465415 139871 3 3 China Mobile Limited 485231 119640 China Mobile Revenue: 485,231,000,000 4 5 China Railway Group Limited 473663 7488 5 4 China Railway Construction Corporation Limited 470159 4246 6 6 China Life Insurance Co., Ltd. 388791 33626 7 7 Bank of China Ltd 380821 165156 8 9 China Construction Company Limited 370418 9237 9 8 China Construction Bank Corporation 323489 134844 10 17 Shanghai Automotive Group Co., Ltd. 313376 13698 11 . Agricultural Bank of China Co., Ltd. 290418 94873 12 10 China Bank 276817 104418 China Communications Construction Company 13 11 Limited 272734 9863 14 12 China Telecom Corporation Limited 219864 15759 China Telecom 15 13 China Metallurgical Co., Ltd. 206792 5321 16 15 Baoshan Iron & Steel Co., Ltd. 202413 12889 17 16 China Ping An Insurance (Group) Co., Ltd. 189439 17311 18 21 China National Offshore Oil Company Limited 183053 54410 19 14 China Unicom Co., Ltd. 176168 1228 China Unicom 20 19 China PICC 154307 5212 21 18 China Shenhua Energy Company Limited 152063 37187 22 20 Lenovo Group Limited 143252 1665 Lenovo 23 22 China Pacific Insurance (Group) Co., Ltd. 141662 8557 24 23 Minmetals Development Co., Ltd. 131466 385 25 24 Dongfeng Motor Group Co., Ltd. 122395 10981 26 29 Aluminum Corporation of China 120995 778 27 25 Hebei Iron and Steel Co., Ltd. 116919 1411 28 68 Great Wall Technology Co., Ltd. -

Marine Heavy-Lift Operations in China

CHINA FOCUS Marine heavy-lift operations in China Liang Jinyu Vice-general Manager, Safety Supervision Department, China Shipping Co Xie Jieying, Lecturer, Shanghai Maritime University Following the international financial crisis, as well as cargo operation practices and as large-scale industrial devices and large the global economic structure changed current heavy-lift fleets in the country. vehicles, has increased rapidly. Meanwhile, dramatically. The traditional global many large-scale projects were started market was subdivided into segments in Market for heavy-lift operations in China’s inland and coastal waters: the accordance with consumer requirements. in China Three Gorges project, West-East Natural Therefore, when conventional fleets such After China joined the World Trade Gas Transmission project, high speed rail, as tankers, bulk carriers and containers Organisation (WTO), its market share not to mention marine gas exploration, were struggling for survival, the heavy-lift for industrial products rose from 10% in nuclear power, petrochemical and civil transportation market developed rapidly. 2000 to 25% in 2008, accompanied by an aircraft manufacturing – all needed a large Heavy and bulky cargo items such explosive increase in export and processing quantity of large-scale devices and so as generators, locomotives, drilling rigs trades in European and American gave rise to the growth of exporting and and container cranes have brought about Markets. During the past decade, importing heavy-lift machinery via land revolutionary changes in cargo handling considering the changing government and sea transportation. and marine transportation. New methods strategies and the rapid development and tools have been introduced into the of equipment manufacturing in China, High-speed rail marine industry. -

The Material Handling Sector in South East Asia

Material Handling in South East Asia Prepared for Invest Northern Ireland July 2018 © 2018 Orissa International The Material Handling Sector Singapore | Malaysia | Indonesia | Thailand | Philippines Prepared for INVEST NORTHEN IRELAND July 2018 Orissa International Pte Ltd 1003 Bukit Merah Central #05-06 Inno Center, Singapore 159836 Tel: +65 6225 8667 | Fax: +65 6271 9791 [email protected] Disclaimer: All information contained in this publication has been researched and compiled from sources believed to be accurate and reliable at the time of publishing. Orissa International Pte Ltd accepts no liability whatsoever for any loss or damage resulting from errors, inaccuracies or omissions affecting any part of the publication. All information is provided without warranty, and Orissa International Pte Ltd makes no representation of warranty of any kind as to the accuracy or completeness of any information hereto contained. Copyright Notice: © 2018 Orissa International. All Rights Reserved. Permission to Reproduce is Required. Material Handling in South East Asia – July 2018 Table of Contents 1.0 KEY TRENDS IN THE MATERIAL HANDLING EQUIPMENT SECTOR .............................. 9 2.0 SINGAPORE .............................................................................................. 15 2.1 Singapore Country Profile ....................................................................................... 15 2.2 Overview of the Infrastructure / Building & Construction Sector .............................. 16 2.3 Overview of the -

Environmental Monitoring Report

Environmental Monitoring Report Quarterly Progress Report No. 10 June – August 2016 VIE: Central Mekong Delta Region Connectivity Project Part II/Annexes (pages 58-117) 'This environmental monitoring report is a document of the borrower. The views expressed herein do not necessarily represent those of ADB's Board of Directors, Management, or staff, and may be preliminary in nature. Your attention is directed to the “terms of use” section of this website. In preparing any country program or strategy, financing any project, or by making any designation of or reference to a particular territory or geographic area in this document, the Asian Development Bank does not intend to make any judgments as to the legal or other status of any territory or area Prepared by Detailed Design and Implementation Support: CDM Smith-WSP-Yoo-shin Consultant Joint Venture for the Socialist Republic of Viet Nam and the Asian Development Bank. QUARTERLY PROGRESS REPORT CW2B Rach Vuot Bridge Launching Voided slab girder Date: 14-08-2016 CW2B Rach Vuot Bridge Launching Voided slab girders Date: 14-08-2016 Quarterly Progress Report # 10 CMDRCP – August 2016 Page 58 QUARTERLY PROGRESS REPORT CW2B Rach Vuot Bridge Fabrication of Voided slab girders Date: 04-08-2016 CW2B Tan Binh Bridge Launching I Girder Date: 05-09-2016 Quarterly Progress Report # 10 CMDRCP – August 2016 Page 59 QUARTERLY PROGRESS REPORT CW2B Tan Binh Bridge Launching I Girder Date: 12-08-2016 CW2B Xang Muc Bridge Construction of Column P1 Date: 06-08-2016 Quarterly Progress Report # 10 CMDRCP – -

Reports Available the European Service

REPORTS AVAILABLE THE EUROPEAN SERVICE MARKET REPORTS: MONTHLY EQUIPMENT ANALYSES AGRICULTURAL DIESEL ENGINES MOTOR GRADERS TRACTORS France Germany France Germany Germany Italy ROUGH TERRAIN Italy UK LIFT TRUCKS UK France DUMP TRUCKS Germany ASPHALT FINISHERS France Italy Germany Germany UK Italy Italy UK UK SKID-STEER LOADERS BACKHOE LOADERS HYDRAULIC France Europe EXCAVATORS Germany France Italy COMPACTION Germany SUBSCRIPTIONUK SERVICES FOR FURTHER DETAILS, Available on an annual subscription basis and published PLEASE CONTACT: EQUIPMENT Italy monthly, they monitor, analyse and provide objective opinions on these key construction equipment markets. David C.A. Phillips Simon Battersby n WESTERN EUROPE Managing Director Sales Account Manager Off-Highway Research Limited Off-Highway Research Ltd. France UK n CHINA* WHEELED Southfields, Southview Road, Southfields, Southview Road, n INDIA Wadhurst, East Sussex, Wadhurst, East Sussex, * Also available in Chinese language version. TN5 6TP, United Kingdom TN5 6TP, United Kingdom Germany LOADERS T: +44 (0)1892 786 270 T: +44 (0)1892 786 232 Each service is made up of the following elements: F: +44 (0)1892 784 086 F: +44 (0)1892 784 086 Italy MINI EXCAVATORS n COMPANY PROFILESFrance E: [email protected] E: [email protected] n EQUIPMENT ANALYSES www.offhighway.co.uk www.offhighway.co.uk n COUNTRY ANALYSES (Europe only) UK France n MARKET REPORTSGermany CHINA INDIA n ENQUIRY PRIVILEGES SHI Yang Samir Bansal Off-Highway Research Ltd. Off-Highway Research India Germany DATABASEItaly -

Harvest Funds (Hong Kong) Etf (An Umbrella Unit Trust Established in Hong Kong)

HARVEST FUNDS (HONG KONG) ETF (AN UMBRELLA UNIT TRUST ESTABLISHED IN HONG KONG) HARVEST MSCI CHINA A INDEX ETF (A SUB-FUND OF THE HARVEST FUNDS (HONG KONG) ETF) SEMI-ANNUAL REPORT 1ST JANUARY 2016 TO 30TH JUNE 2016 www.harvestglobal.com.hk HARVEST MSCI CHINA A INDEX ETF (A SUB-FUND OF THE HARVEST FUNDS (HONG KONG) ETF) CONTENTS PAGE Report of the Manager to the Unitholders 1 - 2 Statement of Financial Position (Unaudited) 3 Statement of Comprehensive Income (Unaudited) 4 Statement of Changes in Net Assets Attributable to Unitholders (Unaudited) 5 Statement of Cash Flows (Unaudited) 6 Investment Portfolio (Unaudited) 7 – 29 Statement of Movements in Investment Portfolio (Unaudited) 30 – 75 Performance Record (Unaudited) 76 Underlying Index Constituent Stocks Disclosure (Unaudited) 77 Report on Investment Overweight (Unaudited) 78 Management and Administration 79 - 81 RESTRICTED HARVEST MSCI CHINA A INDEX ETF (A SUB-FUND OF THE HARVEST FUNDS (HONG KONG) ETF) REPORT OF THE MANAGER TO THE UNITHOLDERS Fund Performance A summary of the performance of the Sub-Fund1 is given below (as at 30 June 2016): Harvest MSCI China A Index ETF 1H-2016 (without dividend reinvested) MSCI China A Index2 -17.61% Harvest MSCI China A Index ETF NAV-to-NAV3 (RMB Counter) -17.60% Harvest MSCI China A Index ETF Market-to-Market4 (RMB Counter) -19.54% Harvest MSCI China A Index ETF NAV-to-NAV3 (HKD Counter) -18.51% Harvest MSCI China A Index ETF Market-to-Market4 (HKD Counter) -20.82% Source: Harvest Global Investments Limited, Bloomberg. 1 Past performance figures shown are not indicative of the future performance of the Sub-Fund. -

A New Stage for Overseas Expansion for China's Equipment

A New Stage for Overseas Expansion for China’s Equipment Manufacturing Industry Deloitte China Manufacturing Industry Group Deloitte China Research and Insight Centre Preface China's Equipment Manufacturing Industry is one of the country's most important sectors and has historically focused on manufacturing construction machinery, sophisticated machine tools and power equipment. However, China's high dependence on new core technologies as well as its internal lack of innovation capabilities are some of the main issues preventing the industry from reaching its goal of restructuring and upgrading, as well as enhancing its capacity for independent innovation, all of which have been called for under China's 12th Five-Year plan. Given this, equipment manufacturers have been exploring various approaches in order to encourage innovative reforms, such as investing heavily into research and development, improving innovation transformation capabilities, cultivating innovative ideas and establishing innovation mechanisms. In fact, as the global economy increasingly integrates, China’s Equipment Manufacturing sector has begun to play a crucial role in helping allocate global resources. On the one hand, this is the result of China upgrading its equipment manufacturing technologies; on the other hand, the industry itself has benefited from a booming domestic economy which has resulted in huge market demand for equipment manufacturing industry products. Furthermore, despite the recent slowdown in the Chinese economy, such demands are likely to remain. Since the break-out of the global financial crisis, developed economies across the world have taken a new look at their modes of economic development. At the same time, many of them have encouraged a return to manufacturing production as a way to revive previously-languid economies. -

Annual Report

2018 | Annual Report ® CORPORATE PROFILE Whether paving roads, mining essential commodities or extracting the fuels to satisfy global energy demand, Caterpillar products, services and solutions help improve the lives of people around the world. Customers use our products to build the basic infrastructure that enables higher standards of living so that people have access to water, electricity, roads, bridges, hospitals, schools and so much more. In short, our solutions help our customers build a better world. 104,000 Full-time employees 4 Million+ Products working around the world 168 Global Cat® dealers 19 Years Dow Jones Sustainability ~850,000 Index member Connected assets $27 Million Caterpillar Foundation investments $1.85 Billion in global communities in 2018 Research and development funding Our Strategy for Profitable Growth Services Operational Excellence Expanded Offerings Growing digital- Building upon core Enabling customer success enabled solutions and competencies – safety, through integrated and aftermarket offerings quality, Lean and cost differentiated solutions. to deliver unmatched discipline – to deliver strong value to customers. operational performance. “ The Caterpillar team extended our legacy of more than 90 years by introducing innovative products and services, executing our strategy to deliver long-term profitable growth and shareholder value, and – ultimately – making our customers more successful.” Jim Umpleby Chairman & CEO DEAR FELLOW SHAREHOLDERS Caterpillar’s outstanding performance in 2018 can be summed up by one number: 104,000. That’s the size of our dedicated global team who spent the year innovating and providing solutions that help our customers build a better world. In the process, our team is also building a better Caterpillar. -

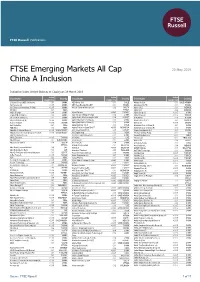

FTSE Emerging Markets All Cap China a Inclusion

FTSE Russell Publications FTSE Emerging Markets All Cap 20 May 2019 China A Inclusion Indicative Index Weight Data as at Closing on 29 March 2019 Index Index Index Constituent Country Constituent Country Constituent Country weight (%) weight (%) weight (%) 21Vianet Group (ADS) (N Shares) 0.01 CHINA AES Gener S.A. 0.01 CHILE Almarai Co Ltd 0.01 SAUDI ARABIA 360 Security (A) <0.005 CHINA AES Tiete Energia SA UNIT 0.01 BRAZIL Alpargatas SA PN 0.01 BRAZIL 361 Degrees International (P Chip) <0.005 CHINA African Rainbow Minerals Ltd 0.02 SOUTH Alpek S.A.B. 0.01 MEXICO 3M India 0.01 INDIA AFRICA Alpha Bank 0.04 GREECE 3SBio (P Chip) 0.04 CHINA Afyon Cimento <0.005 TURKEY Alpha Group (A) <0.005 CHINA 51job ADR (N Shares) 0.03 CHINA Agile Group Holdings (P Chip) 0.04 CHINA Alpha Networks <0.005 TAIWAN 58.com ADS (N Shares) 0.12 CHINA Agility Public Warehousing Co KSC 0.04 KUWAIT ALROSA ao 0.06 RUSSIA 5I5j Holding Group (A) <0.005 CHINA Agricultural Bank of China (A) 0.06 CHINA Alsea S.A.B. de C.V. 0.02 MEXICO A.G.V. Products <0.005 TAIWAN Agricultural Bank of China (H) 0.26 CHINA Altek Corp <0.005 TAIWAN Aarti Industries 0.01 INDIA Aguas Andinas S.A. A 0.03 CHILE Aluminum Corp of China (A) 0.01 CHINA ABB India 0.02 INDIA Agung Podomoro Land Tbk PT <0.005 INDONESIA Aluminum Corp of China (H) 0.03 CHINA Abdullah Al Othaim Markets <0.005 SAUDI ARABIA Ahli United Bank B.S.C. -

Caterpillar Annual Report 2021

Caterpillar Annual Report 2021 Form 10-K (NYSE:CAT) Published: February 17th, 2021 PDF generated by stocklight.com UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 cat-20201231_g1.jpg FORM 10-K (Mark One) ☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 31, 2020 OR ☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from to . Commission File No. 1-768 CATERPILLAR INC. (Exact name of Registrant as specified in its charter) Delaware 37-0602744 (State or other jurisdiction of incorporation) (IRS Employer I.D. No.) 510 Lake Cook Road, Suite 100, Deerfield, Illinois 60015 (Address of principal executive offices) (Zip Code) Registrant’s telephone number, including area code: (224) 551-4000 Securities registered pursuant to Section 12(b) of the Act: Title of each class Trading Symbol (s) Name of each exchange on which registered Common Stock ($1.00 par value) CAT New York Stock Exchange (1) 9 3/8% Debentures due March 15, 2021 CAT21 New York Stock Exchange 8% Debentures due February 15, 2023 CAT23 New York Stock Exchange 5.3% Debentures due September 15, 2035 CAT35 New York Stock Exchange (1) In addition to the New York Stock Exchange, Caterpillar common stock is also listed on stock exchanges in France and Switzerland. Securities registered pursuant to Section 12(g) of the Act: None Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.