CUAM CSI Healthcare-AFS 2016

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

VANGUARD INTERNATIONAL EQUITY INDEX FUNDS Form N-Q

SECURITIES AND EXCHANGE COMMISSION FORM N-Q Quarterly schedule of portfolio holdings of registered management investment company filed on Form N-Q Filing Date: 2018-09-28 | Period of Report: 2018-07-31 SEC Accession No. 0000932471-18-007167 (HTML Version on secdatabase.com) FILER VANGUARD INTERNATIONAL EQUITY INDEX FUNDS Mailing Address Business Address PO BOX 2600 PO BOX 2600 CIK:857489| IRS No.: 000000000 | State of Incorp.:DE | Fiscal Year End: 1031 V26 V26 Type: N-Q | Act: 40 | File No.: 811-05972 | Film No.: 181093806 VALLEY FORGE PA 19482 VALLEY FORGE PA 19482 6106691000 Copyright © 2018 www.secdatabase.com. All Rights Reserved. Please Consider the Environment Before Printing This Document UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM N-Q QUARTERLY SCHEDULE OF PORTFOLIO HOLDINGS OF REGISTERED MANAGEMENT COMPANY Investment Company Act file number: 811-05972 Name of Registrant: VANGUARD INTERNATIONAL EQUITY FUNDS Address of Registrant: P.O. Box 2600 Valley Forge, PA 19482 Name and address of agent for service: Anne E. Robinson, Esquire P.O. Box 876 Valley Forge, PA 19482 Date of fiscal year end: October 31 Date of reporting period: July 31, 2018 Item 1: Schedule of Investments Vanguard Pacific Stock Index Fund Schedule of Investments (unaudited) As of July 31, 2018 Market Value Shares ($000) Common Stocks (99.6%)1 Australia (16.6%) Commonwealth Bank of Australia 1,856,264 103,370 BHP Billiton Ltd. 3,386,626 88,447 Westpac Banking Corp. 3,610,167 79,036 CSL Ltd. 475,901 69,628 Australia & New Zealand Banking Group Ltd. -

Etf Harvest Msci China a Index

HARVEST FUNDS (HONG KONG) ETF (AN UMBRELLA UNIT TRUST ESTABLISHED IN HONG KONG) HARVEST MSCI CHINA A INDEX ETF (A SUB-FUND OF THE HARVEST FUNDS (HONG KONG) ETF) UNAUDITED SEMI-ANNUAL REPORT 30 JUNE 2019 www.harvestglobal.com.hk Harvest Global Investments HARVEST FUNDS (HONG KONG) ETF (AN UMBRELLA UNIT TRUST ESTABLISHED IN HONG KONG) HARVEST MSCI CHINA A INDEX ETF (A SUB-FUND OF THE HARVEST FUNDS (HONG KONG) ETF) SEMI-ANNUAL REPORT 1ST JANUARY 2019 TO 30TH JUNE 2019 RESTRICTED HARVEST MSCI CHINA A INDEX ETF (A SUB-FUND OF THE HARVEST FUNDS (HONG KONG) ETF) CONTENTS PAGE Report of the Manager to the Unitholders 1 - 2 Statement of Financial Position (Unaudited) 3 Statement of Comprehensive Income (Unaudited) 4 Statement of Changes in Net Assets Attributable to Unitholders (Unaudited) 5 Statement of Cash Flows (Unaudited) 6 Investment Portfolio (Unaudited) 7 – 27 Statement of Movements in Investment Portfolio (Unaudited) 28 – 67 Performance Record (Unaudited) 68 Underlying Index Constituent Stocks Disclosure (Unaudited) 69 Report on Investment Overweight (Unaudited) 70 Management and Administration 71 - 73 RESTRICTED HARVEST MSCI CHINA A INDEX ETF (A SUB-FUND OF THE HARVEST FUNDS (HONG KONG) ETF) REPORT OF THE MANAGER TO THE UNITHOLDERS Fund Performance A summary of the performance of the Sub-Fund1 is given below (as at 30 June 2019): Harvest MSCI China A Index ETF 1H-2019 (without dividend reinvested) 2 MSCI China A Index 27.12% 3 Harvest MSCI China A Index ETF NAV-to-NAV (RMB Counter) 27.15% 4 Harvest MSCI China A Index ETF Market-to-Market (RMB Counter) 26.56% 3 Harvest MSCI China A Index ETF NAV-to-NAV (HKD Counter) 26.84% 4 Harvest MSCI China A Index ETF Market-to-Market (HKD Counter) 27.34% Source: Harvest Global Investments Limited, Bloomberg. -

Annual Report DBX ETF Trust

May 31, 2021 Annual Report DBX ETF Trust Xtrackers Harvest CSI 300 China A-Shares ETF (ASHR) Xtrackers Harvest CSI 500 China A-Shares Small Cap ETF (ASHS) Xtrackers MSCI All China Equity ETF (CN) Xtrackers MSCI China A Inclusion Equity ETF (ASHX) DBX ETF Trust Table of Contents Page Shareholder Letter ....................................................................... 1 Management’s Discussion of Fund Performance ............................................. 3 Performance Summary Xtrackers Harvest CSI 300 China A-Shares ETF ........................................... 6 Xtrackers Harvest CSI 500 China A-Shares Small Cap ETF .................................. 8 Xtrackers MSCI All China Equity ETF .................................................... 10 Xtrackers MSCI China A Inclusion Equity ETF ............................................ 12 Fees and Expenses ....................................................................... 14 Schedule of Investments Xtrackers Harvest CSI 300 China A-Shares ETF ........................................... 15 Xtrackers Harvest CSI 500 China A-Shares Small Cap ETF .................................. 20 Xtrackers MSCI All China Equity ETF .................................................... 28 Xtrackers MSCI China A Inclusion Equity ETF ............................................ 33 Statements of Assets and Liabilities ........................................................ 42 Statements of Operations ................................................................. 43 Statements of Changes in Net -

China Chemical Drug Sector Research Analysts INITIATION

19 January 2015 Asia Pacific/China Equity Research Major Pharmaceuticals (Healthcare CN (Asia)) China Chemical Drug Sector Research Analysts INITIATION Zen Zhou 852 2101 7640 [email protected] Big sheep run faster Iris Wang 852 2101 7646 Figure 1: Using three criteria to screen chemical drug companies [email protected] Strong Attractive Capable R&D commercialization Overall ranking valuation capability Hengrui Sihuan CSPC Huahai Salubris Dawnrays x Sino Biopharm Luye Humanwell CMS Fosun Pharma - Highest, - Lowest. Overall ranking is valued by weighted average of three criteria (Capable R&D:35%, Strong commercialization capability: 35%, Attractive valuation: 30%) Note: The four companies labelled with blue colour are initiated by us this time. Source: Credit Suisse ■ Stay on the sweet spot (Oncology and CNS). We forecast China’s chemical drug sector to deliver 15% CAGR in 2014–16, reaching about Rmb900 bn market size; however, the growth rate will vary among different therapeutic areas due to the higher morbidity rate for chronic diseases related to ageing population, urbanisation and lifestyle changes. We expect oncology drugs (17.5% CAGR in 2014–16) and CNS drugs (18.1% CAGR in 2014–16) to gain market share, while anti-infective drugs (9.5% CAGR in 2014–16) to lose market share. ■ Only the leader will win. China’s chemical drug market is fragmented compared to the global level (CR10: 15% vs 42%), but we see the domestic leading companies are gaining market share. We believe the trend of consolidation will stay stable, driven by: (1) higher barrier for R&D, (2) higher barrier for manufacturers, (3) favourable tender policy and (4) more M&A. -

FTSE Global All Cap Ex Canada China a Inclusion

FTSE PUBLICATIONS FTSE Global All Cap ex Canada 20 May 2017 China A Inclusion Indicative Index Weight Data as at Closing on 31 March 2017 Index Index Index Constituent Country Constituent Country Constituent Country weight (%) weight (%) weight (%) 13 Holdings <0.005 HONG KONG Acerinox <0.005 SPAIN Aeon Fantasy <0.005 JAPAN 1st Source <0.005 USA Aces Electronic Co. Ltd. <0.005 TAIWAN AEON Financial Service <0.005 JAPAN 2U <0.005 USA Achilles <0.005 JAPAN Aeon Mall <0.005 JAPAN 361 Degrees International (P Chip) <0.005 CHINA Achillion Pharmaceuticals <0.005 USA AerCap Holdings N.V. 0.02 USA 3-D Systems <0.005 USA ACI Worldwide 0.01 USA Aeroflot <0.005 RUSSIA 3i Group 0.02 UNITED Ackermans & Van Haaren 0.01 BELGIUM Aerojet Rocketdyne Holdings <0.005 USA KINGDOM Acom <0.005 JAPAN Aeroports de Paris 0.01 FRANCE 3M Company 0.26 USA Aconex <0.005 AUSTRALIA Aerospace Communications Holdings (A) <0.005 CHINA 3S Korea <0.005 KOREA Acorda Therapeutics <0.005 USA Aerospace Hi-Tech (A) <0.005 CHINA 3SBio (P Chip) <0.005 CHINA Acron JSC <0.005 RUSSIA Aerosun (A) <0.005 CHINA 77 Bank <0.005 JAPAN ACS Actividades Cons y Serv 0.01 SPAIN AeroVironment <0.005 USA 888 Holdings <0.005 UNITED Actelion Hldg N 0.06 SWITZERLAND AES Corp. 0.02 USA KINGDOM Activision Blizzard 0.08 USA AES Gener S.A. <0.005 CHILE 8x8 <0.005 USA Actuant Corp <0.005 USA AES Tiete Energia SA UNIT <0.005 BRAZIL A P Moller - Maersk A 0.02 DENMARK Acuity Brands Inc 0.02 USA Aetna 0.1 USA A P Moller - Maersk B 0.02 DENMARK Acxiom Corp <0.005 USA AF AB <0.005 SWEDEN A.G.V. -

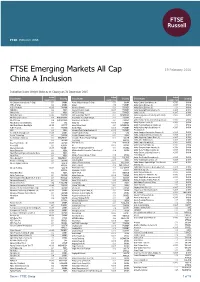

FTSE Emerging Markets All Cap China a Inclusion

FTSE PUBLICATIONS FTSE Emerging Markets All Cap 19 February 2016 China A Inclusion Indicative Index Weight Data as at Closing on 31 December 2015 Index Index Index Constituent Country Constituent Country Constituent Country weight (%) weight (%) weight (%) 361 Degrees International (P Chip) 0.01 CHINA Ajisen China Holdings (P Chip) 0.01 CHINA Anhui Golden Seed Winery (A) <0.005 CHINA 3SBio (P Chip) 0.03 CHINA Akbank 0.13 TURKEY Anhui Gujing Distillery (A) <0.005 CHINA A.G.V. Products <0.005 TAIWAN Akcansa Cimento 0.01 TURKEY Anhui Gujing Distillery (B) 0.01 CHINA ABB India 0.02 INDIA Akenerji Elektrik Uretim <0.005 TURKEY Anhui Guofeng Plastic Industry (A) <0.005 CHINA Abbott India 0.01 INDIA AKFEN Holding 0.01 TURKEY Anhui Heli (A) <0.005 CHINA Ability Enterprise <0.005 TAIWAN AKR Corporindo Tbk PT 0.02 INDONESIA Anhui Hengyuan Coal Industry & Electricity <0.005 CHINA Aboitiz Equity Ventures 0.08 PHILIPPINES Aksa Akrilik Ve Kimya Sanayii 0.01 TURKEY Power (A) Aboitiz Power 0.04 PHILIPPINES Aksa Enerji Uretim AS 0.01 TURKEY Anhui Honglu Steel Construction (group) (A) <0.005 CHINA Abu Dhabi Commercial Bank 0.09 UAE Aksigorta <0.005 TURKEY Anhui Huamao Textile (A) <0.005 CHINA Abu Dhabi Islamic Bank Egypt <0.005 EGYPT Alam Sutera Realty 0.01 INDONESIA Anhui Huaxing Chemical Industry (A) 0.01 CHINA AcBel Polytech 0.01 TAIWAN Alarko Hldgs <0.005 TURKEY Anhui Huilong Agricultural Means of <0.005 CHINA ACC 0.03 INDIA Albaraka Turk Katilim Bankasi AS <0.005 TURKEY Production (A) Accelink Technologies (A) <0.005 CHINA Aldar Properties PJSC 0.06 UAE Anhui Jianghuai Automotive Chassis (A) <0.005 CHINA Accton Technology 0.01 TAIWAN Alembic Pharmaceuticals 0.01 INDIA Anhui Jiangnan Chemical Industry (A) <0.005 CHINA Ace Hardware Indonesia 0.01 INDONESIA Alexander Forbes Equity Holdings 0.01 SOUTH Anhui Jingcheng Copper Share (A) <0.005 CHINA Acer 0.03 TAIWAN Proprietary AFRICA Anhui Jinhe Industrial (A) <0.005 CHINA Aces Electronic Co. -

China Universal International Etf Series – C-Shares Csi Healthcare Index Etf

Semi-Annual Report (Unaudited) CHINA UNIVERSAL INTERNATIONAL ETF SERIES – C-SHARES CSI HEALTHCARE INDEX ETF (A Sub-Fund of China Universal International ETF Series, an umbrella unit trust established under the laws of Hong Kong) For the period from 5 May 2014 (date of inception) to 30 June 2014 CHINA UNIVERSAL INTERNATIONAL ETF SERIES – C-SHARES CSI HEALTHCARE INDEX ETF (A Sub-Fund of China Universal International ETF Series) CONTENTS Pages MANAGEMENT AND ADMINISTRATION 1 - 2 STATEMENT OF FINANCIAL POSITION 3 STATEMENT OF COMPREHENSIVE INCOME 4 STATEMENT OF CHANGES IN NET ASSETS ATTRIBUTABLE TO UNIITHOLDERS 5 INVESTMENT PORTFOLIO (UNAUDITED) 6 - 7 MOVEMENTS IN INVESTMENT PORTFOLIO (UNAUDITED) 8 - 10 PERFORMANCE RECORD (UNAUDITED) 11 1 CHINA UNIVERSAL INTERNATIONAL ETF SERIES – C-SHARES CSI HEALTHCARE INDEX ETF (A Sub-Fund of China Universal International ETF Series) MANAGEMENT AND ADMINISTRATION MANAGER AND RQFII HOLDER China Universal Asset Management (Hong Kong) SERVICE AGENT OR CONVERSION AGENT Company Limited HK Conversion Agency Services Limited 3710-11, 37/F, Two IFC 2nd Floor, Infinitus Plaza 8 Finance Street 199 Des Voeux Road Central Central, Hong Kong Hong Kong DIRECTORS OF THE MANAGER AUDITORS LIN Li Jun Ernst & Young LI Wen 22/F, CITIC Tower ZHANG Hui 1 Tim Mei Avenue Central ADVISER Hong Kong China Universal Asset Management Company Limited 22/F, Aurora Plaza PARTICIPATING DEALERS No. 99 Fucheng Road BOCI Securities Limited Pudong District 20/F, Bank of China Tower, Shanghai 200120 1 Garden Road, China Hong Kong RQFII CUSTODIAN -

FTSE Publications

2 FTSE Russell Publications FTSE Global All Cap ex Canada 19 August 2019 China A Inclusion Indicative Index Weight Data as at Closing on 28 June 2019 Index Index Index Constituent Country Constituent Country Constituent Country weight (%) weight (%) weight (%) 1&1 Drillisch <0.005 GERMANY Accell Group <0.005 NETHERLANDS Advanced Wireless Semiconductor <0.005 TAIWAN 1st Source <0.005 USA Accent Group <0.005 AUSTRALIA AdvanSix <0.005 USA 21Vianet Group (ADS) (N Shares) <0.005 CHINA Accenture Cl A 0.23 USA Advantech 0.01 TAIWAN 2U <0.005 USA Acciona S.A. <0.005 SPAIN Advantest Corp 0.01 JAPAN 360 Security (A) <0.005 CHINA ACCO Brands <0.005 USA Advtech <0.005 SOUTH AFRICA 361 Degrees International (P Chip) <0.005 CHINA Accor 0.02 FRANCE Adyen 0.02 NETHERLANDS 3-D Systems <0.005 USA Accordia Golf Trust <0.005 SINGAPORE Aecc Aero Engine Control (A) <0.005 CHINA 3i Group 0.03 UNITED Accton Technology <0.005 TAIWAN Aecc Aero Science Technology (A) <0.005 CHINA KINGDOM Ace Hardware Indonesia <0.005 INDONESIA AECC Aviation Power (A) <0.005 CHINA 3M Company 0.19 USA Acea <0.005 ITALY AECI <0.005 SOUTH AFRICA 3M India <0.005 INDIA Acer <0.005 TAIWAN AECOM 0.01 USA 3SBio (P Chip) <0.005 CHINA Acerinox <0.005 SPAIN Aedas Homes <0.005 SPAIN 51job ADR (N Shares) <0.005 CHINA Achilles <0.005 JAPAN Aedifica <0.005 BELGIUM 58.com ADS (N Shares) 0.01 CHINA ACI Worldwide 0.01 USA Aegean Airlines SA <0.005 GREECE 5I5j Holding Group (A) <0.005 CHINA Ackermans & Van Haaren 0.01 BELGIUM Aegion Corp. -

2013 Outlook 10 December 2012 Health Care Industry Update

Deutsche Bank Markets Research Asia Industry Date China 2013 Outlook 10 December 2012 Health Care Industry Update Jack Hu, Ph.D Research Analyst Anticipate healthy revenue growth (+852) 2203 6208 [email protected] and modest margin pressure Healthy sector growth with modest margin pressure in 2013 Top picks We estimate 20-22% growth for the drug sector and 19% growth for the Sino Biopharmaceutical Buy medical device sector in 2013, driven primarily by healthy growth in medical (1177.HK),HKD3.72 reimbursement funding and completion of the infrastructure build-up cycle, China Shineway (2877.HK),HKD12.16 Buy respectively. We expect operating margin erosion to continue, due largely to Mindray Medical (MR.N),USD34.47 Buy rising sales and marketing expenses. We reiterate our top picks, namely Shineway (2877.HK), Sino Biopharm (1177.HK) and Mindray Medical (MR.N). Companies Featured Catalysts in 2013 We expect the following positive catalysts: 1) continuous demand growth, Sino Biopharmaceutical Buy (1177.HK),HKD3.72 demonstrated by growth acceleration of in-/out-patient visits to hospitals; 2) 2011A 2012E 2013E 2013 NRDL expansion, as more drugs should be reimbursed; and 3) new GMP P/E (x) 20.1 22.3 19.0 inspection for injectables by YE13, since sector consolidation is likely to ensue. EV/EBITDA (x) 8.9 9.7 8.2 We also anticipate the following uncertainties in 2013: 1) 2013 RDL tender, Price/book (x) 3.0 4.2 3.9 which could have a negative impact on drug pricing; and 2) hospital reform, which will affect prescription volumes, a larger risk compared with pricing. -

Portfolio Holdings Listing Fidelity Emerging Markets Index Fund As of October 31, 2018

DUMMY Portfolio Holdings Listing Fidelity Emerging Markets Index Fund as of October 31, 2018 The portfolio holdings listing (listing) provides information on a fund's investments as of the date indicated. Top 10 holdings information (top 10 holdings) is also provided for certain equity and high income funds. The listing and top 10 holdings are not part of a fund's annual/semiannual report or Form N-Q and have not been audited. The information provided in this listing and top 10 holdings may differ from a fund's holdings disclosed in its annual/semiannual report and Form N-Q as follows, where applicable: With certain exceptions, the listing and top 10 holdings provide information on the direct holdings of a fund as well as a fund's pro rata share of any securities and other investments held indirectly through investment in underlying non- money market Fidelity Central Funds. A fund's pro rata share of the underlying holdings of any investment in high income and floating rate central funds is provided at a fund's fiscal quarter end. For certain funds, direct holdings in high income or convertible securities are presented at a fund's fiscal quarter end and are presented collectively for other periods. For the annual/semiannual report, a fund's investments include trades executed through the end of the last business day of the period. This listing and the top 10 holdings include trades executed through the end of the prior business day. The listing includes any investment in derivative instruments, and excludes the value of any cash collateral held for securities on loan and a fund's net other assets. -

C-Shares CSI Healthcare Index ETF Semi-Annual Report 2016

Semi-Annual Report (Unaudited) CHINA UNIVERSAL INTERNATIONAL ETF SERIES – C-SHARES CSI HEALTHCARE INDEX ETF (A Sub-Fund of China Universal International ETF Series, an umbrella unit trust established under the laws of Hong Kong) For the period from 1 January 2016 to 30 June 2016 CHINA UNIVERSAL INTERNATIONAL ETF SERIES – C-SHARES CSI HEALTHCARE INDEX ETF (A Sub-Fund of China Universal International ETF Series) CONTENTS Pages MANAGEMENT AND ADMINISTRATION 1 STATEMENT OF FINANCIAL POSITION 2 STATEMENT OF COMPREHENSIVE INCOME 3 STATEMENT OF CHANGES IN NET ASSETS ATTRIBUTABLE TO UNITHOLDERS 4 INVESTMENT PORTFOLIO (UNAUDITED) 5 - 7 MOVEMENTS IN INVESTMENT PORTFOLIO (UNAUDITED) 8 - 10 PERFORMANCE RECORD (UNAUDITED) 11 0 CHINA UNIVERSAL INTERNATIONAL ETF SERIES – C-SHARES CSI HEALTHCARE INDEX ETF (A Sub-Fund of China Universal International ETF Series) MANAGEMENT AND ADMINISTRATION MANAGER AND RQFII HOLDER SERVICE AGENT OR CONVERSION AGENT China Universal Asset Management (Hong Kong) Company HK Conversion Agency Services Limited Limited 2nd Floor, Infinitus Plaza 3710-11, Two International Finance Centre 199 Des Voeux Road Central 8 Finance Street Hong Kong Central Hong Kong AUDITORS Ernst & Young DIRECTORS OF THE MANAGER 22/F, CITIC Tower LI Wen 1 Tim Mei Avenue WAN Qing Central ZHANG Hui Hong Kong ADVISER TRUSTEE China Universal Asset Management Company Limited BOCI-Prudential Trustee Limited 22/F, Aurora Plaza 12/F & 25/F, Citicorp Centre No. 99 Fucheng Road 18 Whitfield Road Pudong District Causeway Bay Shanghai 200120 Hong Kong China CUSTODIAN -

Vanguard Emerging Markets Stock Index Fund

Annual Report | October 31, 2020 Vanguard Emerging Markets Stock Index Fund See the inside front cover for important information about access to your fund’s annual and semiannual shareholder reports. Important information about access to shareholder reports Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of your fund’s annual and semiannual shareholder reports will no longer be sent to you by mail, unless you specifically request them. Instead, you will be notified by mail each time a report is posted on the website and will be provided with a link to access the report. If you have already elected to receive shareholder reports electronically, you will not be affected by this change and do not need to take any action. You may elect to receive shareholder reports and other communications from the fund electronically by contacting your financial intermediary (such as a broker-dealer or bank) or, if you invest directly with the fund, by calling Vanguard at one of the phone numbers on the back cover of this report or by logging on to vanguard.com. You may elect to receive paper copies of all future shareholder reports free of charge. If you invest through a financial intermediary, you can contact the intermediary to request that you continue to receive paper copies. If you invest directly with the fund, you can call Vanguard at one of the phone numbers on the back cover of this report or log on to vanguard.com. Your election to receive paper copies will apply to all the funds you hold through an intermediary or directly with Vanguard.