FTSE Emerging Markets All Cap China a Inclusion

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

SAIC MOTOR CORPORATION LIMITED Annual Report 2016

SAIC MOTOR ANNUAL REPORT 2016 Company Code:600104 Abbreviation of Company: SAIC SAIC MOTOR CORPORATION LIMITED Annual Report 2016 Important Note 1. Board of directors (the "Board"), board of supervisors, directors, supervisors and senior management of the Company certify that this report does not contain any false or misleading statements or material omissions and are jointly and severally liable for the authenticity, accuracy and integrity of the content. 2. All directors attended Board meetings. 3. Deloitte Touche Tohmatsu Certified Public Accountants LLP issued standard unqualified audit report for the Company. 4. Mr. Chen Hong, Chairman of the Board, Mr. Wei Yong, the chief financial officer, and Ms. Gu Xiao Qiong. Head of Accounting Department, certify the authenticity, accuracy and integrity of the financial statements contained in the annual report of the current year. 5. Plan of profit distribution or capital reserve capitalization approved by the Board The Company plans to distribute cash dividends of RMB 16.50 (inclusive of tax) per 10 shares, amounting to RMB 19,277,711,252.25 in total based on total shares of 11,683,461,365. The Company has no plan of capitalization of capital reserve this year. The cash dividend distribution for the recent three years accumulates to RMB48,605,718,485.39 in total (including the year of 2016). 6. Risk statement of forward-looking description √Applicable □N/A The forward-looking description on future plan and development strategy in this report does not constitute substantive commitment to investors. Please note the investment risk. 7. Does the situation exist where the controlling shareholders and their related parties occupy the funds of the Company for non-operational use? No. -

1 1 China Petroleum & Chemical Corporation 1913182 70713

2011 Ranking 2010 Company Name Revenue (RMB, million) Net profit (RMB Million) Rankings (x,000,000) (x,000,000) 1 1 China Petroleum & Chemical Corporation 1913182 70713 2 2 China National Petroleum Corporation 1465415 139871 3 3 China Mobile Limited 485231 119640 China Mobile Revenue: 485,231,000,000 4 5 China Railway Group Limited 473663 7488 5 4 China Railway Construction Corporation Limited 470159 4246 6 6 China Life Insurance Co., Ltd. 388791 33626 7 7 Bank of China Ltd 380821 165156 8 9 China Construction Company Limited 370418 9237 9 8 China Construction Bank Corporation 323489 134844 10 17 Shanghai Automotive Group Co., Ltd. 313376 13698 11 . Agricultural Bank of China Co., Ltd. 290418 94873 12 10 China Bank 276817 104418 China Communications Construction Company 13 11 Limited 272734 9863 14 12 China Telecom Corporation Limited 219864 15759 China Telecom 15 13 China Metallurgical Co., Ltd. 206792 5321 16 15 Baoshan Iron & Steel Co., Ltd. 202413 12889 17 16 China Ping An Insurance (Group) Co., Ltd. 189439 17311 18 21 China National Offshore Oil Company Limited 183053 54410 19 14 China Unicom Co., Ltd. 176168 1228 China Unicom 20 19 China PICC 154307 5212 21 18 China Shenhua Energy Company Limited 152063 37187 22 20 Lenovo Group Limited 143252 1665 Lenovo 23 22 China Pacific Insurance (Group) Co., Ltd. 141662 8557 24 23 Minmetals Development Co., Ltd. 131466 385 25 24 Dongfeng Motor Group Co., Ltd. 122395 10981 26 29 Aluminum Corporation of China 120995 778 27 25 Hebei Iron and Steel Co., Ltd. 116919 1411 28 68 Great Wall Technology Co., Ltd. -

VANGUARD INTERNATIONAL EQUITY INDEX FUNDS Form N-Q

SECURITIES AND EXCHANGE COMMISSION FORM N-Q Quarterly schedule of portfolio holdings of registered management investment company filed on Form N-Q Filing Date: 2018-09-28 | Period of Report: 2018-07-31 SEC Accession No. 0000932471-18-007167 (HTML Version on secdatabase.com) FILER VANGUARD INTERNATIONAL EQUITY INDEX FUNDS Mailing Address Business Address PO BOX 2600 PO BOX 2600 CIK:857489| IRS No.: 000000000 | State of Incorp.:DE | Fiscal Year End: 1031 V26 V26 Type: N-Q | Act: 40 | File No.: 811-05972 | Film No.: 181093806 VALLEY FORGE PA 19482 VALLEY FORGE PA 19482 6106691000 Copyright © 2018 www.secdatabase.com. All Rights Reserved. Please Consider the Environment Before Printing This Document UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM N-Q QUARTERLY SCHEDULE OF PORTFOLIO HOLDINGS OF REGISTERED MANAGEMENT COMPANY Investment Company Act file number: 811-05972 Name of Registrant: VANGUARD INTERNATIONAL EQUITY FUNDS Address of Registrant: P.O. Box 2600 Valley Forge, PA 19482 Name and address of agent for service: Anne E. Robinson, Esquire P.O. Box 876 Valley Forge, PA 19482 Date of fiscal year end: October 31 Date of reporting period: July 31, 2018 Item 1: Schedule of Investments Vanguard Pacific Stock Index Fund Schedule of Investments (unaudited) As of July 31, 2018 Market Value Shares ($000) Common Stocks (99.6%)1 Australia (16.6%) Commonwealth Bank of Australia 1,856,264 103,370 BHP Billiton Ltd. 3,386,626 88,447 Westpac Banking Corp. 3,610,167 79,036 CSL Ltd. 475,901 69,628 Australia & New Zealand Banking Group Ltd. -

Etf Harvest Msci China a Index

HARVEST FUNDS (HONG KONG) ETF (AN UMBRELLA UNIT TRUST ESTABLISHED IN HONG KONG) HARVEST MSCI CHINA A INDEX ETF (A SUB-FUND OF THE HARVEST FUNDS (HONG KONG) ETF) UNAUDITED SEMI-ANNUAL REPORT 30 JUNE 2019 www.harvestglobal.com.hk Harvest Global Investments HARVEST FUNDS (HONG KONG) ETF (AN UMBRELLA UNIT TRUST ESTABLISHED IN HONG KONG) HARVEST MSCI CHINA A INDEX ETF (A SUB-FUND OF THE HARVEST FUNDS (HONG KONG) ETF) SEMI-ANNUAL REPORT 1ST JANUARY 2019 TO 30TH JUNE 2019 RESTRICTED HARVEST MSCI CHINA A INDEX ETF (A SUB-FUND OF THE HARVEST FUNDS (HONG KONG) ETF) CONTENTS PAGE Report of the Manager to the Unitholders 1 - 2 Statement of Financial Position (Unaudited) 3 Statement of Comprehensive Income (Unaudited) 4 Statement of Changes in Net Assets Attributable to Unitholders (Unaudited) 5 Statement of Cash Flows (Unaudited) 6 Investment Portfolio (Unaudited) 7 – 27 Statement of Movements in Investment Portfolio (Unaudited) 28 – 67 Performance Record (Unaudited) 68 Underlying Index Constituent Stocks Disclosure (Unaudited) 69 Report on Investment Overweight (Unaudited) 70 Management and Administration 71 - 73 RESTRICTED HARVEST MSCI CHINA A INDEX ETF (A SUB-FUND OF THE HARVEST FUNDS (HONG KONG) ETF) REPORT OF THE MANAGER TO THE UNITHOLDERS Fund Performance A summary of the performance of the Sub-Fund1 is given below (as at 30 June 2019): Harvest MSCI China A Index ETF 1H-2019 (without dividend reinvested) 2 MSCI China A Index 27.12% 3 Harvest MSCI China A Index ETF NAV-to-NAV (RMB Counter) 27.15% 4 Harvest MSCI China A Index ETF Market-to-Market (RMB Counter) 26.56% 3 Harvest MSCI China A Index ETF NAV-to-NAV (HKD Counter) 26.84% 4 Harvest MSCI China A Index ETF Market-to-Market (HKD Counter) 27.34% Source: Harvest Global Investments Limited, Bloomberg. -

43Gdy6nm9dgg55.Pdf

Investment Manager: AMP Capital Investors Limited ABN 59 001 777 591 | AFSL 232497 Issuer and Responsible Entity: BetaShares Capital Ltd ABN 78 139 566 868 | AFSL 341181 28 February 2017 Market Announcements Office ASX Limited AMP CAPITAL DYNAMIC MARKETS FUND (HEDGE FUND) (ASX CODE: DMKT) QUARTERLY PORTFOLIO DISCLOSURE We advise that the Fund’s portfolio as at 30 December 2016 comprised the following holdings: Security Weighting (%) Security Weighting (%) ETFs* SPDR S&P/ASX200 Fund 9.82 Vanguard Value ETF 2.09 Vanguard FTSE Emgerging Markets ETF 8.75 Vanguard Materials ETF 1.95 BetaShares FTSE RAFI AU 200 5.18 iShares Global Materials ETF 1.93 iShares Global Financials ETF 3.21 Topix-17 Banks ETF 1.70 Vaneck Vectors Russia ETF 2.74 Lyxor ETF STOXX Europe 600 Banks 1.61 SPDR Bank ETF 2.67 Vanguard Energy ETF 1.61 *Please note underlying ETF exposures are provided below on a weighted consolidated look through basis. AMP Capital Investors Limited 50 Bridge Street Sydney NSW 2000 Australia Client Services 1800 658 404 8.30am-5.30pm | [email protected] ampcapital.com.au For personal use only Important information: This information has been prepared by BetaShares Capital Ltd (ACN 139 566 868 AFS Licence 341181) ("BetaShares") the Responsible Entity and Issuer of the Fund. AMP Capital Investors Limited (“AMP Capital”) (ABN 59 001 777 591, and AFSL 232497) is the investment manager of the Fund and has been appointed by the Responsible Entity to provide investment management and associated services in respect of the Fund. It is general information only and does not take into account any person’s objectives, financial situation or needs. -

Annual Report DBX ETF Trust

May 31, 2021 Annual Report DBX ETF Trust Xtrackers Harvest CSI 300 China A-Shares ETF (ASHR) Xtrackers Harvest CSI 500 China A-Shares Small Cap ETF (ASHS) Xtrackers MSCI All China Equity ETF (CN) Xtrackers MSCI China A Inclusion Equity ETF (ASHX) DBX ETF Trust Table of Contents Page Shareholder Letter ....................................................................... 1 Management’s Discussion of Fund Performance ............................................. 3 Performance Summary Xtrackers Harvest CSI 300 China A-Shares ETF ........................................... 6 Xtrackers Harvest CSI 500 China A-Shares Small Cap ETF .................................. 8 Xtrackers MSCI All China Equity ETF .................................................... 10 Xtrackers MSCI China A Inclusion Equity ETF ............................................ 12 Fees and Expenses ....................................................................... 14 Schedule of Investments Xtrackers Harvest CSI 300 China A-Shares ETF ........................................... 15 Xtrackers Harvest CSI 500 China A-Shares Small Cap ETF .................................. 20 Xtrackers MSCI All China Equity ETF .................................................... 28 Xtrackers MSCI China A Inclusion Equity ETF ............................................ 33 Statements of Assets and Liabilities ........................................................ 42 Statements of Operations ................................................................. 43 Statements of Changes in Net -

China Chemical Drug Sector Research Analysts INITIATION

19 January 2015 Asia Pacific/China Equity Research Major Pharmaceuticals (Healthcare CN (Asia)) China Chemical Drug Sector Research Analysts INITIATION Zen Zhou 852 2101 7640 [email protected] Big sheep run faster Iris Wang 852 2101 7646 Figure 1: Using three criteria to screen chemical drug companies [email protected] Strong Attractive Capable R&D commercialization Overall ranking valuation capability Hengrui Sihuan CSPC Huahai Salubris Dawnrays x Sino Biopharm Luye Humanwell CMS Fosun Pharma - Highest, - Lowest. Overall ranking is valued by weighted average of three criteria (Capable R&D:35%, Strong commercialization capability: 35%, Attractive valuation: 30%) Note: The four companies labelled with blue colour are initiated by us this time. Source: Credit Suisse ■ Stay on the sweet spot (Oncology and CNS). We forecast China’s chemical drug sector to deliver 15% CAGR in 2014–16, reaching about Rmb900 bn market size; however, the growth rate will vary among different therapeutic areas due to the higher morbidity rate for chronic diseases related to ageing population, urbanisation and lifestyle changes. We expect oncology drugs (17.5% CAGR in 2014–16) and CNS drugs (18.1% CAGR in 2014–16) to gain market share, while anti-infective drugs (9.5% CAGR in 2014–16) to lose market share. ■ Only the leader will win. China’s chemical drug market is fragmented compared to the global level (CR10: 15% vs 42%), but we see the domestic leading companies are gaining market share. We believe the trend of consolidation will stay stable, driven by: (1) higher barrier for R&D, (2) higher barrier for manufacturers, (3) favourable tender policy and (4) more M&A. -

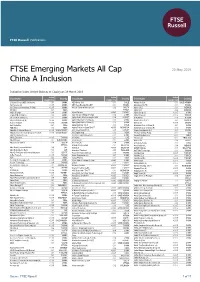

FTSE Emerging Markets All Cap China a Inclusion

FTSE Russell Publications FTSE Emerging Markets All Cap 20 May 2019 China A Inclusion Indicative Index Weight Data as at Closing on 29 March 2019 Index Index Index Constituent Country Constituent Country Constituent Country weight (%) weight (%) weight (%) 21Vianet Group (ADS) (N Shares) 0.01 CHINA AES Gener S.A. 0.01 CHILE Almarai Co Ltd 0.01 SAUDI ARABIA 360 Security (A) <0.005 CHINA AES Tiete Energia SA UNIT 0.01 BRAZIL Alpargatas SA PN 0.01 BRAZIL 361 Degrees International (P Chip) <0.005 CHINA African Rainbow Minerals Ltd 0.02 SOUTH Alpek S.A.B. 0.01 MEXICO 3M India 0.01 INDIA AFRICA Alpha Bank 0.04 GREECE 3SBio (P Chip) 0.04 CHINA Afyon Cimento <0.005 TURKEY Alpha Group (A) <0.005 CHINA 51job ADR (N Shares) 0.03 CHINA Agile Group Holdings (P Chip) 0.04 CHINA Alpha Networks <0.005 TAIWAN 58.com ADS (N Shares) 0.12 CHINA Agility Public Warehousing Co KSC 0.04 KUWAIT ALROSA ao 0.06 RUSSIA 5I5j Holding Group (A) <0.005 CHINA Agricultural Bank of China (A) 0.06 CHINA Alsea S.A.B. de C.V. 0.02 MEXICO A.G.V. Products <0.005 TAIWAN Agricultural Bank of China (H) 0.26 CHINA Altek Corp <0.005 TAIWAN Aarti Industries 0.01 INDIA Aguas Andinas S.A. A 0.03 CHILE Aluminum Corp of China (A) 0.01 CHINA ABB India 0.02 INDIA Agung Podomoro Land Tbk PT <0.005 INDONESIA Aluminum Corp of China (H) 0.03 CHINA Abdullah Al Othaim Markets <0.005 SAUDI ARABIA Ahli United Bank B.S.C. -

Main Chinese Importers of Brazilian Products

MAIN BRAZILIAN PRODUCTS IMPORTED BY CHINA (YEAR: 2005, SOURCE: CHINA CUSTOMS) HS CODE PRODUCT NAME IMPORTER Beijing Mandelin kickshaw Co., Ltd. Nanjing Yuanheng Foods Co., Ltd. Puer Yuhe Tea Co., Ltd. Qingdao Kaiyuan Products Co., Ltd. Shanghai Dachang Jiangnanfeng Co., Ltd. 02071421 Wings of fowls Shanghai Dajiang (Group) Co., Ltd. Shanghai Food Stuffs Imp/Exp. Co., Ltd. Shanghai Hormel Foods Co., Ltd. Shanghai Shenteng Livestock Co., Ltd. Shanghai ST Food Industries Co., Ltd. Foshan Huafa Foods Co.,Ltd Nanjing Yuanheng Foods Co., Ltd. Qingdao Kaiyuan Products Co., Ltd. Shanghai Dachang Jiangnanfeng Co., Ltd. Shanghai Dajiang (Group) Co., Ltd. 02071429 Other fowls cuts Shanghai Food Group Co., Ltd. Shanghai Food Stuffs Imp/Exp. Co., Ltd. Shanghai Shenteng Livestock Co., Ltd. Shanghai ST Food Industries Co., Ltd. Zhongjia Shanghai Frozen Food Co., Ltd. China Textiles Grain and Oil Import & Export Co., Ltd. Dahai Grain and Oil Industry Fangcheng Co.,Ltd. Dalian Huanong Bean Group Limited East Sea Grain and Oil Zhangjiagang Co., Ltd Fujian Jinshi Oil Co.,Ltd. Henan Cereals,Oils & Foodstuffs Imp. & Exp. Group Co., Ltd. 12010091 Yellow soybeans Heze Ruifeng Grain & Oil Co., Ltd Huanghai Grain and Oil Industrial Co.,Ltd.(Shandong) Import & Export Inc. of Jilin Grain Group Qinhuangdao Jinhai Grain and Oil Industrial Co.,Ltd. Yihai (Lianyungang) Grain and Oil Co., Ltd. Yihai (Yantai) Grain and Oil Co., Ltd. Beijing Oriental Huaken Oil Trading Co.,Ltd. China Grains and Oils Group Corporation China plant Oil Co.,Ltd. Huanghai Grain and Oil Industrial Co.,Ltd.(Shandong) Crude soybean oil whether or not Shanghai MINMETALS Import & Export Corporation 15071000 degummed Shanghai Yihai Enterprise Development Co,. -

FTSE Global All Cap Ex Canada China a Inclusion

FTSE PUBLICATIONS FTSE Global All Cap ex Canada 20 May 2017 China A Inclusion Indicative Index Weight Data as at Closing on 31 March 2017 Index Index Index Constituent Country Constituent Country Constituent Country weight (%) weight (%) weight (%) 13 Holdings <0.005 HONG KONG Acerinox <0.005 SPAIN Aeon Fantasy <0.005 JAPAN 1st Source <0.005 USA Aces Electronic Co. Ltd. <0.005 TAIWAN AEON Financial Service <0.005 JAPAN 2U <0.005 USA Achilles <0.005 JAPAN Aeon Mall <0.005 JAPAN 361 Degrees International (P Chip) <0.005 CHINA Achillion Pharmaceuticals <0.005 USA AerCap Holdings N.V. 0.02 USA 3-D Systems <0.005 USA ACI Worldwide 0.01 USA Aeroflot <0.005 RUSSIA 3i Group 0.02 UNITED Ackermans & Van Haaren 0.01 BELGIUM Aerojet Rocketdyne Holdings <0.005 USA KINGDOM Acom <0.005 JAPAN Aeroports de Paris 0.01 FRANCE 3M Company 0.26 USA Aconex <0.005 AUSTRALIA Aerospace Communications Holdings (A) <0.005 CHINA 3S Korea <0.005 KOREA Acorda Therapeutics <0.005 USA Aerospace Hi-Tech (A) <0.005 CHINA 3SBio (P Chip) <0.005 CHINA Acron JSC <0.005 RUSSIA Aerosun (A) <0.005 CHINA 77 Bank <0.005 JAPAN ACS Actividades Cons y Serv 0.01 SPAIN AeroVironment <0.005 USA 888 Holdings <0.005 UNITED Actelion Hldg N 0.06 SWITZERLAND AES Corp. 0.02 USA KINGDOM Activision Blizzard 0.08 USA AES Gener S.A. <0.005 CHILE 8x8 <0.005 USA Actuant Corp <0.005 USA AES Tiete Energia SA UNIT <0.005 BRAZIL A P Moller - Maersk A 0.02 DENMARK Acuity Brands Inc 0.02 USA Aetna 0.1 USA A P Moller - Maersk B 0.02 DENMARK Acxiom Corp <0.005 USA AF AB <0.005 SWEDEN A.G.V. -

Preliminary Programme

27th CIMAC World Congress on Combustion Engine Technology for Ship Propulsion Power Generation Rail Traction PRELIMINARY PROGRAMME 1 Contents 2 Welcome Message 4 Introduction to CIMAC 5 General Information 6 Time Schedule Overview 8 Conference Venue 9 Layout for Congress and Exhibition 13 Preliminary Programme Monday, 13th May 2013 15 Preliminary Programme Tuesday, 14th May 2013 19 Poster Session Tuesday, 14th May 2013 21 Preliminary Programme Wednesday, 15th May 2013 25 Poster Session Wednesday, 15th May 2013 27 Preliminary Programme Thursday, 16th May 2013 29 Poster Session Thursday, 16th May 2013 31 The Technical Programme Committee 33 Exhibition 34 Optional Tours Tuesday 14th May 2013 35 Optional Tours Wednesday 15th May 2013 36 Technical Tours Friday 17th May 2013 39 Optional Pre and Post Congress Tours 40 CHINA 41 Shanghai 43 Accommodation 44 Hotel Overview 45 Hotel Reservation 47 Registration information 50 Members of CIMAC 1 Welcome Message The Chinese Society for Internal Combustion Engines, as the National Member of CIMAC, has the pleasure of organizing the 27th CIMAC World Congress on Combustion Engines, scheduled for 13th – 16th May 2013 in Shanghai, China. CIMAC is a vigorous and attractive organization, which brings together manufacturers, users, suppliers, oil companies, classification societies and scientists in the field of engine. With more than 60 years of diligent, effective and valuable work, CIMAC has become one of the major forums in which engine builders and users can consult with each other and share concerns and ideas. The Congress will be devoted to the presentation of papers in the fields of marine, power generation and locomotive engine research and development covering state-of-the art technologies as well as the application of such engines. -

CUAM CSI Healthcare-AFS 2016

ANNUAL REPORT CHINA UNIVERSAL INTERNATIONAL ETF SERIES – C-SHARES CSI HEALTHCARE INDEX ETF (A Sub-Fund of China Universal International ETF Series, an umbrella unit trust established under the laws of Hong Kong) 31 December 2016 CHINA UNIVERSAL INTERNATIONAL ETF SERIES – C-SHARES CSI HEALTHCARE INDEX ETF (A Sub-Fund of China Universal International ETF Series) CONTENTS Pages MANAGEMENT AND ADMINISTRATION 1 REPORT OF THE MANAGER TO THE UNITHOLDERS 2 - 3 REPORT OF THE TRUSTEE TO THE UNITHOLDERS 4 STATEMENT OF RESPONSIBILITIES OF THE MANAGER AND THE TRUSTEE 5 INDEPENDENT AUDITOR'S REPORT 6 - 10 AUDITED FINANCIAL STATEMENTS Statement of profit or loss and other comprehensive income 11 Statement of financial position 12 Statement of changes in net assets attributable to unitholders 13 Statement of cash flows 14 Notes to financial statements 15 - 42 INVESTMENT PORTFOLIO 43 - 44 MOVEMENTS IN INVESTMENT PORTFOLIO 45 - 48 PERFORMANCE RECORD 49 IMPORTANT: Any opinion expressed herein reflects the Manager's view only and is subject to change. For more information about the Sub-Fund, please refer to the prospectus of the Sub-Fund which is available at our website: http://www.99fund.com.hk Investors should not rely on the information contained in this report for their investment decisions. CHINA UNIVERSAL INTERNATIONAL ETF SERIES – C-SHARES CSI HEALTHCARE INDEX ETF (A Sub-Fund of China Universal International ETF Series) MANAGEMENT AND ADMINISTRATION MANAGER AND RQFII HOLDER SERVICE AGENT OR CONVERSION AGENT China Universal Asset Management (Hong Kong) Company HK Conversion Agency Services Limited Limited 1/F One & Two Exchange Square 3710-11, Two International Finance Centre 8 Connaught Place 8 Finance Street Central, Hong Kong Central Hong Kong AUDITOR Ernst & Young DIRECTORS OF THE MANAGER 22/F, CITIC Tower LI Wen 1 Tim Mei Avenue WAN Qing Central ZHANG Hui Hong Kong ADVISER PARTICIPATING DEALERS China Universal Asset Management Company Limited BOCI Securities Limited 22/F, Aurora Plaza 20/F, Bank of China Tower, No.