Global Members List November 2019

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

SAIC MOTOR CORPORATION LIMITED Annual Report 2016

SAIC MOTOR ANNUAL REPORT 2016 Company Code:600104 Abbreviation of Company: SAIC SAIC MOTOR CORPORATION LIMITED Annual Report 2016 Important Note 1. Board of directors (the "Board"), board of supervisors, directors, supervisors and senior management of the Company certify that this report does not contain any false or misleading statements or material omissions and are jointly and severally liable for the authenticity, accuracy and integrity of the content. 2. All directors attended Board meetings. 3. Deloitte Touche Tohmatsu Certified Public Accountants LLP issued standard unqualified audit report for the Company. 4. Mr. Chen Hong, Chairman of the Board, Mr. Wei Yong, the chief financial officer, and Ms. Gu Xiao Qiong. Head of Accounting Department, certify the authenticity, accuracy and integrity of the financial statements contained in the annual report of the current year. 5. Plan of profit distribution or capital reserve capitalization approved by the Board The Company plans to distribute cash dividends of RMB 16.50 (inclusive of tax) per 10 shares, amounting to RMB 19,277,711,252.25 in total based on total shares of 11,683,461,365. The Company has no plan of capitalization of capital reserve this year. The cash dividend distribution for the recent three years accumulates to RMB48,605,718,485.39 in total (including the year of 2016). 6. Risk statement of forward-looking description √Applicable □N/A The forward-looking description on future plan and development strategy in this report does not constitute substantive commitment to investors. Please note the investment risk. 7. Does the situation exist where the controlling shareholders and their related parties occupy the funds of the Company for non-operational use? No. -

中國中車股份有限公司 CRRC CORPORATION LIMITED (A Joint Stock Limited Company Incorporated in the People’S Republic of China with Limited Liability) (Stock Code: 1766)

THIS CIRCULAR IS IMPORTANT AND REQUIRES YOUR IMMEDIATE ATTENTION If you are in any doubt as to any aspect of this circular or as to the action to be taken, you should consult your licensed dealer in securities, bank manager, solicitor, professional accountant or other professional adviser. If you have sold or transferred all your shares in CRRC Corporation Limited, you should at once hand this circular, the enclosed form of proxy and reply slip for attending the AGM and the 2015 annual report (if applicable) to the purchaser or the transferee or to the bank, licensed dealer in securities or other agent through whom the sale or transfer was effected for transmission to the purchaser or the transferee. Hong Kong Exchanges and Clearing Limited and The Stock Exchange of Hong Kong Limited take no responsibility for the contents of this document, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this document. 中國中車股份有限公司 CRRC CORPORATION LIMITED (a joint stock limited company incorporated in the People’s Republic of China with limited liability) (Stock code: 1766) ANNUAL GENERAL MEETING A notice convening the AGM of CRRC Corporation Limited to be held at Empark Grand Hotel, No. 69 Banjing Road, Haidian District, Beijing, the PRC at 2:00 p.m. (registration will begin at 1:30 p.m.) on Thursday, 16 June 2016 is set out on pages 7 to 11 of this circular. If you intend to attend the AGM in person or by proxy, you are required to complete and return the reply slip to the Company’s H Share Registrar, Computershare Hong Kong Investor Services Limited, on or before Thursday, 26 May 2016. -

Annual Report 2019 Mobility

(a joint stock limited company incorporated in the People’s Republic of China with limited liability) Stock Code: 1766 Annual Report Annual Report 2019 Mobility 2019 for Future Connection Important 1 The Board and the Supervisory Committee of the Company and its Directors, Supervisors and Senior Management warrant that there are no false representations, misleading statements contained in or material omissions from this annual report and they will assume joint and several legal liabilities for the truthfulness, accuracy and completeness of the contents disclosed herein. 2 This report has been considered and approved at the seventeenth meeting of the second session of the Board of the Company. All Directors attended the Board meeting. 3 Deloitte Touche Tohmatsu CPA LLP has issued standard unqualified audit report for the Company’s financial statements prepared under the China Accounting Standards for Business Enterprises in accordance with PRC Auditing Standards. 4 Liu Hualong, the Chairman of the Company, Li Zheng, the Chief Financial Officer and Wang Jian, the head of the Accounting Department (person in charge of accounting affairs) warrant the truthfulness, accuracy and completeness of the financial statements in this annual report. 5 Statement for the risks involved in the forward-looking statements: this report contains forward-looking statements that involve future plans and development strategies which do not constitute a substantive commitment by the Company to investors. Investors should be aware of the investment risks. 6 The Company has proposed to distribute a cash dividend of RMB0.15 (tax inclusive) per share to all Shareholders based on the total share capital of the Company of 28,698,864,088 shares as at 31 December 2019. -

1 1 China Petroleum & Chemical Corporation 1913182 70713

2011 Ranking 2010 Company Name Revenue (RMB, million) Net profit (RMB Million) Rankings (x,000,000) (x,000,000) 1 1 China Petroleum & Chemical Corporation 1913182 70713 2 2 China National Petroleum Corporation 1465415 139871 3 3 China Mobile Limited 485231 119640 China Mobile Revenue: 485,231,000,000 4 5 China Railway Group Limited 473663 7488 5 4 China Railway Construction Corporation Limited 470159 4246 6 6 China Life Insurance Co., Ltd. 388791 33626 7 7 Bank of China Ltd 380821 165156 8 9 China Construction Company Limited 370418 9237 9 8 China Construction Bank Corporation 323489 134844 10 17 Shanghai Automotive Group Co., Ltd. 313376 13698 11 . Agricultural Bank of China Co., Ltd. 290418 94873 12 10 China Bank 276817 104418 China Communications Construction Company 13 11 Limited 272734 9863 14 12 China Telecom Corporation Limited 219864 15759 China Telecom 15 13 China Metallurgical Co., Ltd. 206792 5321 16 15 Baoshan Iron & Steel Co., Ltd. 202413 12889 17 16 China Ping An Insurance (Group) Co., Ltd. 189439 17311 18 21 China National Offshore Oil Company Limited 183053 54410 19 14 China Unicom Co., Ltd. 176168 1228 China Unicom 20 19 China PICC 154307 5212 21 18 China Shenhua Energy Company Limited 152063 37187 22 20 Lenovo Group Limited 143252 1665 Lenovo 23 22 China Pacific Insurance (Group) Co., Ltd. 141662 8557 24 23 Minmetals Development Co., Ltd. 131466 385 25 24 Dongfeng Motor Group Co., Ltd. 122395 10981 26 29 Aluminum Corporation of China 120995 778 27 25 Hebei Iron and Steel Co., Ltd. 116919 1411 28 68 Great Wall Technology Co., Ltd. -

中國中車股份有限公司crrc Corporation Limited

Hong Kong Exchanges and Clearing Limited and The Stock Exchange of Hong Kong Limited take no responsibility for the contents of this announcement, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this announcement. 中國中車股份有限公司 CRRC CORPORATION LIMITED (a joint stock limited company incorporated in the People’s Republic of China with limited liability) (Stock Code: 1766) OVERSEAS REGULATORY ANNOUNCEMENT ANNOUNCEMENT IN RELATION TO SIGNING CONTRACTS This overseas regulatory announcement is made pursuant to Rule 13.10B of the Rules Governing the Listing of Securities on The Stock Exchange of Hong Kong Limited. CRRC Corporation Limited (the “Company”) has entered into certain contracts for the period from December 2019 to January 2020 with an aggregate value of approximately RMB28.48 billion. Details of such contracts are set out below: 1. The consortium formed by CRRC Zhuzhou Locomotive Co., Ltd. (中車株洲電力機 車有限公司) (a wholly-owned subsidiary of the Company) and CRRC Dalian Co., Ltd. (中車大連機車車輛有限公司) (a wholly-owned subsidiary of the Company) has entered into contracts with Guangzhou Metro Group Co., Ltd. (廣州地鐵集 團有限公司) in relation to the equipment operation and maintenance service of metro depot and the sales of metro cars with an aggregate value of approximately RMB18.31 billion. 2. Jiangsu CRRC Electric Co., Ltd (江蘇中車電機有限公司) (a wholly-owned subsidiary of the Company) and CRRC Xi’an Yongdian Jieli Wind Energy Co., Ltd. (西安中車永電捷力風能有限公司) (a wholly-owned subsidiary of the Company), have entered into contracts with Xinjiang Goldwind Science & Technology Co., Ltd. -

VANGUARD INTERNATIONAL EQUITY INDEX FUNDS Form N-Q

SECURITIES AND EXCHANGE COMMISSION FORM N-Q Quarterly schedule of portfolio holdings of registered management investment company filed on Form N-Q Filing Date: 2018-09-28 | Period of Report: 2018-07-31 SEC Accession No. 0000932471-18-007167 (HTML Version on secdatabase.com) FILER VANGUARD INTERNATIONAL EQUITY INDEX FUNDS Mailing Address Business Address PO BOX 2600 PO BOX 2600 CIK:857489| IRS No.: 000000000 | State of Incorp.:DE | Fiscal Year End: 1031 V26 V26 Type: N-Q | Act: 40 | File No.: 811-05972 | Film No.: 181093806 VALLEY FORGE PA 19482 VALLEY FORGE PA 19482 6106691000 Copyright © 2018 www.secdatabase.com. All Rights Reserved. Please Consider the Environment Before Printing This Document UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM N-Q QUARTERLY SCHEDULE OF PORTFOLIO HOLDINGS OF REGISTERED MANAGEMENT COMPANY Investment Company Act file number: 811-05972 Name of Registrant: VANGUARD INTERNATIONAL EQUITY FUNDS Address of Registrant: P.O. Box 2600 Valley Forge, PA 19482 Name and address of agent for service: Anne E. Robinson, Esquire P.O. Box 876 Valley Forge, PA 19482 Date of fiscal year end: October 31 Date of reporting period: July 31, 2018 Item 1: Schedule of Investments Vanguard Pacific Stock Index Fund Schedule of Investments (unaudited) As of July 31, 2018 Market Value Shares ($000) Common Stocks (99.6%)1 Australia (16.6%) Commonwealth Bank of Australia 1,856,264 103,370 BHP Billiton Ltd. 3,386,626 88,447 Westpac Banking Corp. 3,610,167 79,036 CSL Ltd. 475,901 69,628 Australia & New Zealand Banking Group Ltd. -

43Gdy6nm9dgg55.Pdf

Investment Manager: AMP Capital Investors Limited ABN 59 001 777 591 | AFSL 232497 Issuer and Responsible Entity: BetaShares Capital Ltd ABN 78 139 566 868 | AFSL 341181 28 February 2017 Market Announcements Office ASX Limited AMP CAPITAL DYNAMIC MARKETS FUND (HEDGE FUND) (ASX CODE: DMKT) QUARTERLY PORTFOLIO DISCLOSURE We advise that the Fund’s portfolio as at 30 December 2016 comprised the following holdings: Security Weighting (%) Security Weighting (%) ETFs* SPDR S&P/ASX200 Fund 9.82 Vanguard Value ETF 2.09 Vanguard FTSE Emgerging Markets ETF 8.75 Vanguard Materials ETF 1.95 BetaShares FTSE RAFI AU 200 5.18 iShares Global Materials ETF 1.93 iShares Global Financials ETF 3.21 Topix-17 Banks ETF 1.70 Vaneck Vectors Russia ETF 2.74 Lyxor ETF STOXX Europe 600 Banks 1.61 SPDR Bank ETF 2.67 Vanguard Energy ETF 1.61 *Please note underlying ETF exposures are provided below on a weighted consolidated look through basis. AMP Capital Investors Limited 50 Bridge Street Sydney NSW 2000 Australia Client Services 1800 658 404 8.30am-5.30pm | [email protected] ampcapital.com.au For personal use only Important information: This information has been prepared by BetaShares Capital Ltd (ACN 139 566 868 AFS Licence 341181) ("BetaShares") the Responsible Entity and Issuer of the Fund. AMP Capital Investors Limited (“AMP Capital”) (ABN 59 001 777 591, and AFSL 232497) is the investment manager of the Fund and has been appointed by the Responsible Entity to provide investment management and associated services in respect of the Fund. It is general information only and does not take into account any person’s objectives, financial situation or needs. -

2019 Annual Results Announcement

B_table indent_3.5 mm N_table indent_3 mm Hong Kong Exchanges and Clearing Limited and The Stock Exchange of Hong Kong Limited take no responsibility for the contents of this document, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this announcement. (a joint stock company incorporated in the People’s Republic of China with limited liability) (Stock Code: 3898) 2019 ANNUAL RESULTS ANNOUNCEMENT The board of directors (the “Board”) of Zhuzhou CRRC Times Electric Co., Ltd. (the “Company” together with its subsidiaries, the “Group”) is pleased to announce the audited results of the Group for the year ended 31 December 2019. This announcement, containing the main text of the 2019 annual report of the Company, complies with the relevant requirements of the Rules Governing the Listing of Securities on The Stock Exchange of Hong Kong Limited (the “Stock Exchange”) in relation to information to accompany preliminary announcements of annual results. The 2019 annual report of the Company will be despatched to the H-Share holders of the Company and will also available for viewing on the website of the Stock Exchange at http://www.hkex.com.hk and on the website of the Company at http://www.tec.crrczic.cc on or before 30 April 2020. By order of the Board Zhuzhou CRRC Times Electric Co., Ltd. Li Donglin Chairman Zhuzhou, China, 27 March 2020 As at the date of this announcement, our chairman of the Board and executive director is Li Donglin, our vice chairman of the Board and executive director is Yang Shouyi, our other executive directors are Liu Ke’an and Yan Wu, our non-executive director is Zhang Xinning, and our independent non-executive directors are Chan Kam Wing, Clement, Pao Ping Wing, Liu Chunru, Chen Xiaoming and Gao Feng. -

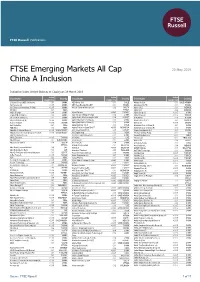

FTSE Emerging Markets All Cap China a Inclusion

FTSE Russell Publications FTSE Emerging Markets All Cap 20 May 2019 China A Inclusion Indicative Index Weight Data as at Closing on 29 March 2019 Index Index Index Constituent Country Constituent Country Constituent Country weight (%) weight (%) weight (%) 21Vianet Group (ADS) (N Shares) 0.01 CHINA AES Gener S.A. 0.01 CHILE Almarai Co Ltd 0.01 SAUDI ARABIA 360 Security (A) <0.005 CHINA AES Tiete Energia SA UNIT 0.01 BRAZIL Alpargatas SA PN 0.01 BRAZIL 361 Degrees International (P Chip) <0.005 CHINA African Rainbow Minerals Ltd 0.02 SOUTH Alpek S.A.B. 0.01 MEXICO 3M India 0.01 INDIA AFRICA Alpha Bank 0.04 GREECE 3SBio (P Chip) 0.04 CHINA Afyon Cimento <0.005 TURKEY Alpha Group (A) <0.005 CHINA 51job ADR (N Shares) 0.03 CHINA Agile Group Holdings (P Chip) 0.04 CHINA Alpha Networks <0.005 TAIWAN 58.com ADS (N Shares) 0.12 CHINA Agility Public Warehousing Co KSC 0.04 KUWAIT ALROSA ao 0.06 RUSSIA 5I5j Holding Group (A) <0.005 CHINA Agricultural Bank of China (A) 0.06 CHINA Alsea S.A.B. de C.V. 0.02 MEXICO A.G.V. Products <0.005 TAIWAN Agricultural Bank of China (H) 0.26 CHINA Altek Corp <0.005 TAIWAN Aarti Industries 0.01 INDIA Aguas Andinas S.A. A 0.03 CHILE Aluminum Corp of China (A) 0.01 CHINA ABB India 0.02 INDIA Agung Podomoro Land Tbk PT <0.005 INDONESIA Aluminum Corp of China (H) 0.03 CHINA Abdullah Al Othaim Markets <0.005 SAUDI ARABIA Ahli United Bank B.S.C. -

RCI Needs Assessment, Development Strategy, and Implementation Action Plan for Liaoning Province

ADB Project Document TA–1234: Strategy for Liaoning North Yellow Sea Regional Cooperation and Development RCI Needs Assessment, Development Strategy, and Implementation Action Plan for Liaoning Province February L2MN This report was prepared by David Roland-Holst, under the direction of Ying Qian and Philip Chang. Primary contributors to the report were Jean Francois Gautrin, LI Shantong, WANG Weiguang, and YANG Song. We are grateful to Wang Jin and Zhang Bingnan for implementation support. Special thanks to Edith Joan Nacpil and Zhuang Jian, for comments and insights. Dahlia Peterson, Wang Shan, Wang Zhifeng provided indispensable research assistance. Asian Development Bank 4 ADB Avenue, Mandaluyong City MPP2 Metro Manila, Philippines www.adb.org © L2MP by Asian Development Bank April L2MP ISSN L3M3-4P3U (Print), L3M3-4PXP (e-ISSN) Publication Stock No. WPSXXXXXX-X The views expressed in this paper are those of the authors and do not necessarily reflect the views and policies of the Asian Development Bank (ADB) or its Board of Governors or the governments they represent. ADB does not guarantee the accuracy of the data included in this publication and accepts no responsibility for any consequence of their use. By making any designation of or reference to a particular territory or geographic area, or by using the term “country” in this document, ADB does not intend to make any judgments as to the legal or other status of any territory or area. Note: In this publication, the symbol “$” refers to US dollars. Printed on recycled paper 2 CONTENTS Executive Summary ......................................................................................................... 10 I. Introduction ............................................................................................................... 1 II. Baseline Assessment .................................................................................................. 3 A. -

Main Chinese Importers of Brazilian Products

MAIN BRAZILIAN PRODUCTS IMPORTED BY CHINA (YEAR: 2005, SOURCE: CHINA CUSTOMS) HS CODE PRODUCT NAME IMPORTER Beijing Mandelin kickshaw Co., Ltd. Nanjing Yuanheng Foods Co., Ltd. Puer Yuhe Tea Co., Ltd. Qingdao Kaiyuan Products Co., Ltd. Shanghai Dachang Jiangnanfeng Co., Ltd. 02071421 Wings of fowls Shanghai Dajiang (Group) Co., Ltd. Shanghai Food Stuffs Imp/Exp. Co., Ltd. Shanghai Hormel Foods Co., Ltd. Shanghai Shenteng Livestock Co., Ltd. Shanghai ST Food Industries Co., Ltd. Foshan Huafa Foods Co.,Ltd Nanjing Yuanheng Foods Co., Ltd. Qingdao Kaiyuan Products Co., Ltd. Shanghai Dachang Jiangnanfeng Co., Ltd. Shanghai Dajiang (Group) Co., Ltd. 02071429 Other fowls cuts Shanghai Food Group Co., Ltd. Shanghai Food Stuffs Imp/Exp. Co., Ltd. Shanghai Shenteng Livestock Co., Ltd. Shanghai ST Food Industries Co., Ltd. Zhongjia Shanghai Frozen Food Co., Ltd. China Textiles Grain and Oil Import & Export Co., Ltd. Dahai Grain and Oil Industry Fangcheng Co.,Ltd. Dalian Huanong Bean Group Limited East Sea Grain and Oil Zhangjiagang Co., Ltd Fujian Jinshi Oil Co.,Ltd. Henan Cereals,Oils & Foodstuffs Imp. & Exp. Group Co., Ltd. 12010091 Yellow soybeans Heze Ruifeng Grain & Oil Co., Ltd Huanghai Grain and Oil Industrial Co.,Ltd.(Shandong) Import & Export Inc. of Jilin Grain Group Qinhuangdao Jinhai Grain and Oil Industrial Co.,Ltd. Yihai (Lianyungang) Grain and Oil Co., Ltd. Yihai (Yantai) Grain and Oil Co., Ltd. Beijing Oriental Huaken Oil Trading Co.,Ltd. China Grains and Oils Group Corporation China plant Oil Co.,Ltd. Huanghai Grain and Oil Industrial Co.,Ltd.(Shandong) Crude soybean oil whether or not Shanghai MINMETALS Import & Export Corporation 15071000 degummed Shanghai Yihai Enterprise Development Co,. -

Annual Report 2018 IMPORTANT

(a joint stock limited company incorporated in the People’s Republic of China with limited liability) Stock Code: 1766 Driving Value For You Annual Report 2018 IMPORTANT 1. The Board and the Supervisory Committee of the Company and its Directors, Supervisors and Senior Management warrant that there are no false representations, misleading statements contained in or material omissions from this annual report and they will assume joint and several legal liabilities for the truthfulness, accuracy and completeness of the contents disclosed herein. 2. This report has been considered and approved at the ninth meeting of the second session of the Board of the Company. All Directors attended the Board meeting. 3. Deloitte Touche Tohmatsu CPA LLP has issued standard unqualified audit report for the Company’s financial statements prepared under the PRC GAAP in accordance with PRC Auditing Standards. Deloitte Touche Tohmatsu has issued standard unqualified audit report for the financial statements prepared under the International Financial Reporting Standards (“IFRSs”) in accordance with Hong Kong Standards on Auditing. 4. Liu Hualong, the Chairman of the Company, Zhan Yanjing, the Chief Financial Officer and Wang Jian, the head of the Accounting Department (person in charge of accounting affairs) warrant the truthfulness, accuracy and completeness of the financial statements in this annual report. http://www.crrcgc.cc/ 5. Statement for the risks involved in the forward-looking statements: this report contains forward-looking statements that involve future plans and development strategies which do not constitute a substantive commitment by the Company to investors. Investors should be aware of the investment risks. 6.