RCI Needs Assessment, Development Strategy, and Implementation Action Plan for Liaoning Province

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

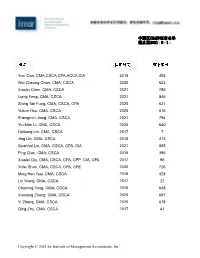

中国区cma持证者名单 截止至2021年9月1日

中国区CMA持证者名单 截止至2021年9月1日 Yixu Cao, CMA,CSCA,CPA,ACCA,CIA 2019 492 Wai Cheung Chan, CMA, CSCA 2020 622 Xiaolin Chen, CMA, CSCA 2021 785 Liang Feng, CMA, CSCA 2021 845 Shing Tak Fung, CMA, CSCA, CPA 2020 621 Yukun Hsu, CMA, CSCA 2020 676 Shengmin Jiang, CMA, CSCA 2021 794 Yiu Man Li, CMA, CSCA 2020 640 Huikang Lin, CMA, CSCA 2017 7 Jing Lin, CMA, CSCA 2018 415 Quanhui Liu, CMA, CSCA, CPA, CIA 2021 855 Ping Qian, CMA, CSCA 2018 396 Xiaolei Qiu, CMA, CSCA, CPA, CFP, CIA, CFA 2017 96 Yufei Shan, CMA, CSCA, CPA, CFE 2020 726 Ming Han Tsai, CMA, CSCA 2018 428 Lin Wang, CMA, CSCA 2017 22 Chunling Yang, CMA, CSCA 2020 648 Xiaolong Zhang, CMA, CSCA 2020 697 Yi Zhang, CMA, CSCA 2020 678 Qing Zhu, CMA, CSCA 2017 41 Copyright © 2021 by Institute of Management Accountants, Inc. 中国区CMA持证者名单 截止至2021年9月1日 Siha A, CMA 2020 81134 Bei Ai, CMA 2020 84918 Danlu Ai, CMA 2021 94445 Fengting Ai, CMA 2019 75078 Huaqin Ai, CMA 2019 67498 Jie Ai, CMA 2021 94013 Jinmei Ai, CMA 2020 79690 Qingqing Ai, CMA 2019 67514 Weiran Ai, CMA 2021 99010 Xia Ai, CMA 2021 97218 Xiaowei Ai, CMA, CIA 2019 75739 Yizhan Ai, CMA 2021 92785 Zi Ai, CMA 2021 93990 Guanfei An, CMA 2021 99952 Haifeng An, CMA 2021 92781 Haixia An, CMA 2016 51078 Haiying An, CMA 2021 98016 Jie An, CMA 2012 38197 Jujie An, CMA 2018 58081 Jun An, CMA 2019 70068 Juntong An, CMA 2021 94474 Kewei An, CMA 2021 93137 Lanying An, CMA, CPA 2021 90699 Copyright © 2021 by Institute of Management Accountants, Inc. -

Performing Masculinity in Peri-Urban China: Duty, Family, Society

The London School of Economics and Political Science Performing Masculinity in Peri-Urban China: Duty, Family, Society Magdalena Wong A thesis submitted to the Department of Anthropology of the London School of Economics for the degree of Doctor of Philosophy, London December 2016 1 DECLARATION I certify that the thesis I have presented for examination for the MPhil/ PhD degree of the London School of Economics and Political Science is solely my own work other than where I have clearly indicated that it is the work of others (in which case the extent of any work carried out jointly by me and any other person is clearly identified in it). The copyright of this thesis rests with the author. Quotation from it is permitted, provided that full acknowledgement is made. This thesis may not be reproduced without my prior written consent. I warrant that this authorisation does not, to the best of my belief, infringe the rights of any third party. I declare that my thesis consists of 97,927 words. Statement of use of third party for editorial help I confirm that different sections of my thesis were copy edited by Tiffany Wong, Emma Holland and Eona Bell for conventions of language, spelling and grammar. 2 ABSTRACT This thesis examines how a hegemonic ideal that I refer to as the ‘able-responsible man' dominates the discourse and performance of masculinity in the city of Nanchong in Southwest China. This ideal, which is at the core of the modern folk theory of masculinity in Nanchong, centres on notions of men's ability (nengli) and responsibility (zeren). -

Linking Drought Indices to Impacts to Support Drought Risk Assessment in Liaoning Province, China

1 Linking drought indices to impacts to support drought risk 2 assessment in Liaoning province, China 3 Yaxu Wang1,2,3, Juan Lv1,2, Jamie Hannaford 3,4, Yicheng Wang1,2, Hongquan Sun1,2, Lucy J. Barker3, 4 Miaomiao Ma1,2, Zhicheng Su1,2, Michael Eastman3 5 1China Institute of Water Resources and Hydropower Research, Beijing 100038, China 6 2Research Center on Flood and Drought Disaster Reduction of the Ministry of Water Resources, Beijing 100038, China 7 3The UK Centre for Ecology & Hydrology, Oxfordshire, OX10 8BB, UK 8 4Irish Climate Analysis and Research UnitS (ICARUS), Maynooth University, Dublin, W23 F2K8, Ireland 9 Correspondence to:Juan Lv ([email protected]) 10 Abstract. Drought is a ubiquitous and reoccurring hazard that has wide ranging impacts on society, agriculture and the 11 environment. Drought indices are vital for characterizing the nature and severity of drought hazards, and there have been 12 extensive efforts to identify the most suitable drought indices for drought monitoring and risk assessment. However, to date, 13 little effort has been made to explore which index(s) best represents drought impacts for various sectors in China. This is a 14 critical knowledge gap, as impacts provide important ‘ground truth’ information. The aim of this study is to explore the link 15 between drought indices and drought impacts, using Liaoning province (northeast China) as a case study due to its history of 16 drought occurrence. To achieve this we use independent, but complementary, methods (correlation and random forest analysis) 17 to identify which indices link best to the recorded drought impacts for cities in Liaoning. -

Mirror, Moon, and Memory in Eighth-Century China: from Dragon Pond to Lunar Palace

EUGENE Y. WANG Mirror, Moon, and Memory in Eighth-Century China: From Dragon Pond to Lunar Palace Why the Flight-to-the-Moon The Bard’s one-time felicitous phrasing of a shrewd observation has by now fossilized into a commonplace: that one may “hold, as ’twere, the mirror up to nature; to show virtue her own feature, scorn her own image, and the very age and body of the time his form and pressure.”1 Likewise deeply rooted in Chinese discourse, the same analogy has endured since antiquity.2 As a commonplace, it is true and does not merit renewed attention. When presented with a physical mirror from the past that does register its time, however, we realize that the mirroring or showing promised by such a wisdom is not something we can take for granted. The mirror does not show its time, at least not in a straightforward way. It in fact veils, disfi gures, and ultimately sublimates the historical reality it purports to refl ect. A case in point is the scene on an eighth-century Chinese mirror (fi g. 1). It shows, at the bottom, a dragon strutting or prancing over a pond. A pair of birds, each holding a knot of ribbon in its beak, fl ies toward a small sphere at the top. Inside the circle is a tree fl anked by a hare on the left and a toad on the right. So, what is the design all about? A quick iconographic exposition seems to be in order. To begin, the small sphere refers to the moon. -

2017 Annual Report 1 Definitions

* Bank of Jinzhou Co., Ltd. is not an authorized institution within the meaning of the Banking Ordinane (Chapter 155 of the Laws of Hong Kong), not subject to the supervision of the Hong Kong Monetary Authority, and not authorized to carry on banking and/or deposit-taking business in Hong Kong. Contents 2 Definitions 4 Chapter 1 Company Profile 7 Chapter 2 Financial Highlights 10 Chapter 3 Chairman ’s Statement 12 Chapter 4 President’s Statement 14 Chapter 5 Management Discussion and Analysis 71 Chapter 6 Changes in Ordinary Shares and Particulars of Shareholders 77 Chapter 7 Particulars of Preference Shares 79 Chapter 8 Directors, Supervisors, Senior Management, Employees and Organizations 98 Chapter 9 Corporate Governance Report 119 Chapter 10 Directors’ Report 127 Chapter 11 Supervisors’ Report 130 Chapter 12 Social Responsibility Report 132 Chapter 13 Internal Control and Internal Audit 136 Chapter 14 Important Events 139 Chapter 15 Independent Auditor’s Report 149 Chapter 16 Financial Statements 269 Chapter 17 Unaudited Supplementary Financial Information Bank of Jinzhou Co., Ltd. 2017 Annual Report 1 Definitions In this annual report, unless the context otherwise requires, the following terms shall have the meanings set out below: “A Share Offering” the Bank’s proposed initial public offering of not more than 1,927,000,000 A shares, which has been approved by the Shareholders on 29 June 2016 “Articles of Association” the articles of association of the Bank, as the same may be amended from time to time “the Bank”, “Bank of Jinzhou” -

Evaluation of City Sustainability from the Perspective of Behavioral Guidance

sustainability Article Evaluation of City Sustainability from the Perspective of Behavioral Guidance Ying Zhou 1,*, Weiwei Li 2 , Pingtao Yi 2 and Chengju Gong 3 1 School of Management, Shenyang Jianzhu University, Shenyang 110168, China 2 School of Business Administration, Northeastern University, Shenyang 110168, China; [email protected] (W.L.); [email protected] (P.Y.) 3 School of Economics and Management, Harbin Engineering University, Harbin 150001, China; [email protected] * Correspondence: [email protected] Received: 8 November 2019; Accepted: 28 November 2019; Published: 30 November 2019 Abstract: High-quality evaluation of city sustainability is an important part of city policy making and development. In this paper, we evaluated the sustainability of the 14 cities in Liaoning, China, from 2015 to 2017. Based on the comprehensive consideration of the interactions among the social, economic and environmental systems, the traditional evaluation indicator system is refined. We incorporate the attitude of decision makers into the evaluation model and propose an objective weighting method by considering data distribution to objectively guide the cities to develop towards the established goals. The empirical research results show that cities located in eastern Liaoning performed the best and in western Liaoning performed the worst. The performances of the 14 cities in Liaoning were not perfect. Both the evaluation values and growth rates of 7 cities (accounting for 50.00%) were lower than the overall average level. The evaluation values of the three systems of the 14 cities were not balanced. The evaluation values of the social, economic and environmental systems fluctuated within the range of [0.0159, 0.0346], [0.0151, 0.0677] and [0.0123, 0.0483], respectively. -

Announcement of Annual Results for the Year Ended 31 December 2020

Hong Kong Exchanges and Clearing Limited and The Stock Exchange of Hong Kong Limited take no responsibility for the contents of this announcement, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this announcement. COLOUR LIFE SERVICES GROUP CO., LIMITED 彩生活服務集團有限公(Incorporated in the Cayman Islands with limited liability司) (Stock Code: 1778) ANNOUNCEMENT OF ANNUAL RESULTS FOR THE YEAR ENDED 31 DECEMBER 2020 HIGHLIGHTS – For the year of 2020, the Group recorded total revenue of approximately RMB3,596 million, gross profit of approximately RMB1,208 million, net profit of approximately RMB542 million and the net profit attributable to the owners of the Company of approximately RMB502 million. – For the year ended 31 December 2020, the net cash flows generated from operating activities increased by 51.6% to RMB826 million. – Net profit margin increased by 1.2 percentage points to approximately 15.1% from approximately 13.9% for the same period in 2019. – The Board proposed the payment of a final dividend of RMB8.73 cents per share, representing about 25% dividend payout ratio, for the year ended 31 December 2020. Shareholders have the option of receiving their dividends in the form of new shares instead of cash. 1 The board (the “Board”) of directors (the “Directors”) of Colour Life Services Group Co., Limited (the “Company” or “Colour Life”) announces the 彩生活服務集團有限公司 audited financial results -

中國中車股份有限公司 CRRC CORPORATION LIMITED (A Joint Stock Limited Company Incorporated in the People’S Republic of China with Limited Liability) (Stock Code: 1766)

THIS CIRCULAR IS IMPORTANT AND REQUIRES YOUR IMMEDIATE ATTENTION If you are in any doubt as to any aspect of this circular or as to the action to be taken, you should consult your licensed dealer in securities, bank manager, solicitor, professional accountant or other professional adviser. If you have sold or transferred all your shares in CRRC Corporation Limited, you should at once hand this circular, the enclosed form of proxy and reply slip for attending the AGM and the 2015 annual report (if applicable) to the purchaser or the transferee or to the bank, licensed dealer in securities or other agent through whom the sale or transfer was effected for transmission to the purchaser or the transferee. Hong Kong Exchanges and Clearing Limited and The Stock Exchange of Hong Kong Limited take no responsibility for the contents of this document, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this document. 中國中車股份有限公司 CRRC CORPORATION LIMITED (a joint stock limited company incorporated in the People’s Republic of China with limited liability) (Stock code: 1766) ANNUAL GENERAL MEETING A notice convening the AGM of CRRC Corporation Limited to be held at Empark Grand Hotel, No. 69 Banjing Road, Haidian District, Beijing, the PRC at 2:00 p.m. (registration will begin at 1:30 p.m.) on Thursday, 16 June 2016 is set out on pages 7 to 11 of this circular. If you intend to attend the AGM in person or by proxy, you are required to complete and return the reply slip to the Company’s H Share Registrar, Computershare Hong Kong Investor Services Limited, on or before Thursday, 26 May 2016. -

Annual Report 2019 Mobility

(a joint stock limited company incorporated in the People’s Republic of China with limited liability) Stock Code: 1766 Annual Report Annual Report 2019 Mobility 2019 for Future Connection Important 1 The Board and the Supervisory Committee of the Company and its Directors, Supervisors and Senior Management warrant that there are no false representations, misleading statements contained in or material omissions from this annual report and they will assume joint and several legal liabilities for the truthfulness, accuracy and completeness of the contents disclosed herein. 2 This report has been considered and approved at the seventeenth meeting of the second session of the Board of the Company. All Directors attended the Board meeting. 3 Deloitte Touche Tohmatsu CPA LLP has issued standard unqualified audit report for the Company’s financial statements prepared under the China Accounting Standards for Business Enterprises in accordance with PRC Auditing Standards. 4 Liu Hualong, the Chairman of the Company, Li Zheng, the Chief Financial Officer and Wang Jian, the head of the Accounting Department (person in charge of accounting affairs) warrant the truthfulness, accuracy and completeness of the financial statements in this annual report. 5 Statement for the risks involved in the forward-looking statements: this report contains forward-looking statements that involve future plans and development strategies which do not constitute a substantive commitment by the Company to investors. Investors should be aware of the investment risks. 6 The Company has proposed to distribute a cash dividend of RMB0.15 (tax inclusive) per share to all Shareholders based on the total share capital of the Company of 28,698,864,088 shares as at 31 December 2019. -

Inclusive Mobility: Improving the Accessibility

Inclusive Mobility: Improving the Accessibility Public Disclosure Authorized of Road Infrastructure through Public Participation East Asia and Pacific Region Transport, This note describes a number of innovations taken by some Chinese cities, in particular Jinzhou, Liaoning Province, to ensure that urban transport systems are more accessible for the mobility-challenged. Public participation by disabled residents in Liaoning Province in northeast China has increased awareness and consideration for special needs in the design and implementation of road infrastructure. Jinzhou has convened a series of meetings inviting public participation on the issue of improving traffic infrastructure for use by disabled people. With the introduction of some low or no-cost features, the principle of “people first” for urban transport has Public Disclosure Authorized been put into practice. People with mobility impairments in cities around the world have long struggled to have their special needs accommodated in the design of urban infrastructure. The quality of life for citizens is reduced when they cannot take full advantage of roads, sidewalks and other transport facilities. Recently, significant progress has been made in the developed world to consider the needs of those with full or partial disabilities such as blindness and paralysis by implementing a number of features including textured pavements, curb cuts, safety islands, countdown and audible crossing signals. The World Bank has been working with various clients in China to identify ways to effectively introduce public participation in the infrastructure planning and implementation process. A structured Public Disclosure Authorized consultation process can help with particular needs, especially those of pedestrians, bicyclists, and other vulnerable road users that require special attention to detail and coordination between multiple agencies such as designers, builders, operators, maintenance, and law enforcement officials. -

Summary on Marine and Coastal Protected Areas in NOWPAP Region

Summary on Marine and Coastal Protected Areas in NOWPAP Region (NOWPAP DINRAC, March 2010) 1. Overview This summary is based on the Database on Coastal and Marine Nature Reserves in the Northwest Pacific Region (NowpapNatureReserve, http://dinrac.nowpap.org/NowpapNatureReserve.php) which is developed and maintained by NOWPAP DINRAC. The data was collected and provided by the National Focal Points of DINRAC started from 2006 and updated periodically. The WDPA (World database of protected areas, http://www.wdpa-marine.org), and the Ramsar Sites Database (http://ramsar.wetlands.org) were also taken as reference. The summary intends to give an overview and understanding on current situation of marine and coastal protected areas (MPAs) in NOWPAP region. The MPAs - marine and coastal protected areas comprise the nature reserves, national parks, wetland protected areas (Ramsar Sites) in NOWPAP Region. The sea area mainly covers the Yellow Sea and Eastern Area of NOWPAP region. Based on the existing data, there are total 87 MPAs in NOWPAP region covers an area of 4,090,046ha (Table 1 to Table 3). The earliest MPA was established in October 1916 and the latest was in August 2007 (Table 4). The smallest area is 10ha in Japan and largest area is 909,000ha in China (Table 5). Statistics tables and figures below are conducted on number, area, protected level, protected type and protected objectives (species) for MPAs in NOWPAP (Table 6 and Fig.1 to Fig.5). The list (List 1) and the location of the MPAs (Map 1) are listed individually. 2. Statistics Table 1. Number of MPAs in NOWPAP Region by Country Level Protected Type Country Total Wild Municipal/ Natural Nature Number National Provincial animal and County ecosystem heritage plant China 20 9 5 6 15 17 17 Japan 31 17 14 0 31 31 20 Korea 22 22 0 0 22 20 13 Russia 14 7 7 0 14 14 7 Region 87 55 26 6 82 82 57 1 Table 2. -

Chinacoalchem

ChinaCoalChem Monthly Report Issue May. 2019 Copyright 2019 All Rights Reserved. ChinaCoalChem Issue May. 2019 Table of Contents Insight China ................................................................................................................... 4 To analyze the competitive advantages of various material routes for fuel ethanol from six dimensions .............................................................................................................. 4 Could fuel ethanol meet the demand of 10MT in 2020? 6MTA total capacity is closely promoted ....................................................................................................................... 6 Development of China's polybutene industry ............................................................... 7 Policies & Markets ......................................................................................................... 9 Comprehensive Analysis of the Latest Policy Trends in Fuel Ethanol and Ethanol Gasoline ........................................................................................................................ 9 Companies & Projects ................................................................................................... 9 Baofeng Energy Succeeded in SEC A-Stock Listing ................................................... 9 BG Ordos Started Field Construction of 4bnm3/a SNG Project ................................ 10 Datang Duolun Project Created New Monthly Methanol Output Record in Apr ........ 10 Danhua to Acquire &