Citic Resources Announces 2021 Interim Results

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Mineral Facilities of Asia and the Pacific," 2007 (Open-File Report 2010-1254)

Table1.—Attribute data for the map "Mineral Facilities of Asia and the Pacific," 2007 (Open-File Report 2010-1254). [The United States Geological Survey (USGS) surveys international mineral industries to generate statistics on the global production, distribution, and resources of industrial minerals. This directory highlights the economically significant mineral facilities of Asia and the Pacific. Distribution of these facilities is shown on the accompanying map. Each record represents one commodity and one facility type for a single location. Facility types include mines, oil and gas fields, and processing plants such as refineries, smelters, and mills. Facility identification numbers (“Position”) are ordered alphabetically by country, followed by commodity, and then by capacity (descending). The “Year” field establishes the year for which the data were reported in Minerals Yearbook, Volume III – Area Reports: Mineral Industries of Asia and the Pacific. In the “DMS Latitiude” and “DMS Longitude” fields, coordinates are provided in degree-minute-second (DMS) format; “DD Latitude” and “DD Longitude” provide coordinates in decimal degrees (DD). Data were converted from DMS to DD. Coordinates reflect the most precise data available. Where necessary, coordinates are estimated using the nearest city or other administrative district.“Status” indicates the most recent operating status of the facility. Closed facilities are excluded from this report. In the “Notes” field, combined annual capacity represents the total of more facilities, plus additional -

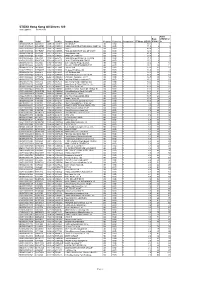

Environmental Information from the Listed Companies (Main Board) In

Environmental The reports published annually to report the Hang Seng Stock Information company 's environmental performance No. Company Industry Code published on the Previous Classification 2019 2018 2017 website Report(s) 1 0043 C.P. Pokphand Company Ltd. 20 N/A N/A N/A N/A N/A Year 2016 2 0341 Café de Coral Holdings Ltd. 30 EI N/A SR SR and / or before Year 2016 Canvest Environmental Protection Group 3 1381 40 N/A N/A SR SR and / or Company Limited before Year 2016 4 0510 CASH Financial Services Group Ltd. 50 EI N/A AR AR and / or before Year 2016 5 0293 Cathay Pacific Airways Ltd. 30 EI AR SR SR and / or before Year 2016 Celestial Asia Securities Holdings Ltd. 6 1049 80 EI AR AR AR and / or (Net2Gather (China) Holdings Ltd.) before Year 2016 CGN New Energy Holdings Co., Ltd 7 1811 40 N/A N/A ER ER and / or (CGN Meiya Power Holdings Co., Ltd.) before Environmental The reports published annually to report the Hang Seng Stock Information company 's environmental performance No. Company Industry Code published on the Previous Classification 2019 2018 2017 website Report(s) CK Hutchison Holdings Limited N/A N/A N/A N/A N/A (Cheung Kong (Holdings) Ltd.) Citybase Property Management Ltd 8 0001 80 N/A N/A N/A N/A N/A (member of Cheung Kong Property Group) Goodwell Property Management Ltd EI N/A N/A N/A N/A (member of Cheung Kong Property Group ) Year 2016 9 2778 Champion Real Estate Investment Trust 50 EI AR AR AR and / or before Year 2016 10 0092 Champion Technology Holdings Ltd. -

Stock Code Stock Name Margin Category HK 1 CK HUTCHISON HOLDINGS LTD

UOB KAY HIAN (SINGAPORE) PRIVATE LIMITED MARGIN STOCK LIST - HONG KONG MARKET 1 April 2021 Stock Code Stock Name Margin Category HK 1 CK HUTCHISON HOLDINGS LTD. SA HK 2 CLP HOLDINGS LTD. A HK 3 HONG KONG AND CHINA GAS CO. LTD. A HK 4 WHARF (HOLDINGS) LTD. A HK 5 HSBC HOLDINGS PLC SA HK 6 POWER ASSETS HOLDINGS LTD. SA HK 8 PCCW LTD. C HK 10 HANG LUNG GROUP LTD. A HK 11 HANG SENG BANK LTD. SA HK 12 HENDERSON LAND DEVELOPMENT CO. LTD. A HK 14 HYSAN DEVELOPMENT CO. LTD. B HK 16 SUN HUNG KAI PROPERTIES LTD. SA HK 17 NEW WORLD DEVELOPMENT CO. LTD. A HK 19 SWIRE PACIFIC LTD. 'A' A HK 23 BANK OF EAST ASIA, LTD. A HK 27 GALAXY ENTERTAINMENT GROUP LTD. A HK 38 FIRST TRACTOR CO LTD. - H SHARES D HK 41 GREAT EAGLE HOLDINGS LTD. C (Max Net Loan H$10M) HK 45 HONGKONG AND SHANGHAI HOTELS, LTD. B (Max Net Loan H$10M) HK 53 GUOCO GROUP LTD. B (Max Net Loan H$10M) HK 56 ALLIED PROPERTIES (HK) LTD. D HK 62 TRANSPORT INTERNATIONAL HOLDINGS LTD. D (Max Net Loan H$1M) HK 66 MTR CORPORATION LTD. SA HK 69 SHANGRI-LA ASIA LTD. A HK 81 CHINA OVERSEAS GRAND OCEANS GROUP LTD. C HK 83 SINO LAND CO. LTD. A HK 86 SUN HUNG KAI & CO. LTD. D HK 87 SWIRE PACIFIC LTD. 'B' A (Max Net Loan H$10m) HK 101 HANG LUNG PROPERTIES LTD. A HK 107 SICHUAN EXPRESSWAY CO. -

Negativliste. Fossil Energi

Bilag 6. Negativliste. Fossil energi Maj 2017 Læsevejledning til negativlisten: Moderselskab / øverste ejer vises med fed skrift til venstre. Med almindelig tekst, indrykket, er de underliggende selskaber, der udsteder aktier og erhvervsobligationer. Det er de underliggende, udstedende selskaber, der er omfattet af negativlisten. Rækkeetiketter Acergy SA SUBSEA 7 Inc Subsea 7 SA Adani Enterprises Ltd Adani Enterprises Ltd Adani Power Ltd Adani Power Ltd Adaro Energy Tbk PT Adaro Energy Tbk PT Adaro Indonesia PT Alam Tri Abadi PT Advantage Oil & Gas Ltd Advantage Oil & Gas Ltd Africa Oil Corp Africa Oil Corp Alpha Natural Resources Inc Alex Energy Inc Alliance Coal Corp Alpha Appalachia Holdings Inc Alpha Appalachia Services Inc Alpha Natural Resource Inc/Old Alpha Natural Resources Inc Alpha Natural Resources LLC Alpha Natural Resources LLC / Alpha Natural Resources Capital Corp Alpha NR Holding Inc Aracoma Coal Co Inc AT Massey Coal Co Inc Bandmill Coal Corp Bandytown Coal Co Belfry Coal Corp Belle Coal Co Inc Ben Creek Coal Co Big Bear Mining Co Big Laurel Mining Corp Black King Mine Development Co Black Mountain Resources LLC Bluff Spur Coal Corp Boone Energy Co Bull Mountain Mining Corp Central Penn Energy Co Inc Central West Virginia Energy Co Clear Fork Coal Co CoalSolv LLC Cobra Natural Resources LLC Crystal Fuels Co Cumberland Resources Corp Dehue Coal Co Delbarton Mining Co Douglas Pocahontas Coal Corp Duchess Coal Co Duncan Fork Coal Co Eagle Energy Inc/US Elk Run Coal Co Inc Exeter Coal Corp Foglesong Energy Co Foundation Coal -

中国の石油産業における 第2グループ(Second-Tiers)

JOGMEC K Y M C JOGMEC 調査部 竹原 美佳 アナリシス 中国の石油産業における 第2グループ(second-tiers) はじめに 中国の石油産業は長年3大国有石油企業CNPC、SINOPEC、CNOOC 3社の寡占状態にある。業界寡 占度は電力や石炭など他のエネルギー産業に比べ著しく高い。3社は原油生産の9割、天然ガス生産の8 割、精製処理量の7割を占めている(図1)。輸送、貯蔵・販売事業についても3社が過半を占める。 原油・天然ガス輸入パイプラインはCNPC/PetroChinaがほぼ一手に担い、国内の主要なLNG受入基 地は国有石油企業3社が地方政府と共同で建設。地方政府やその傘下のガス企業も出資しているが、上 海の受入基地を除き3社の出資比率が最も高い。また天然ガス(LNG)の輸入(長期売買契約)の9割以上 が3社によるものだ。 しかし、近年、習近平政権が推し進める「混合所有制(国有企業への国有〈異業種〉、集団、民間企業に よる資本参加)」(すなわち、国有石油企業の独占打破)政策や石油産業を対象とした汚職腐敗取り締ま りが追い風となり、国有石油企業の牙城で“第2グループ(second-tiers)”と呼ばれる企業の活動領域が 拡大しつつある。 国外ガスバリューチェーン展開の動きはまだ見られないが、今後、“第2グループ”の間で統合・再編 が行われ、国外探鉱開発事業と国内精製・販売を中核とした中堅石油企業が出現する可能性がある。 原油生産 天然ガス生産 精製処理量 陝西延長 6% 外資等 CNOOC 陝西延長 0% 18% その他 PetroChina 19% 28% 23% CNOOC PetroChina Sinopec 5% Sinopec PetroChina 52% 15% 62% 17% CNOOC Sinopec 6% 43% 外資等 6% 出所:各社年報、BP 統計等に基づき作成 図1 国有石油企業の原油・天然ガス生産、精製処理量の割合(2016年) 1.“第2グループ”企業の概要と石油・ガス産業での活動 “第2グループ(second-tiers)”企業は石油、電力・ガス、 中心に石油企業原油3社、電力・ガス9社、金融・その 金融他、政府系ファンドに大別することができる。本稿 他(国家ファンドを含む)7社計18社を抽出した。 では国外探鉱開発事業とLNG輸入事業に関わる活動を 企業別の概要と活動状況を以下に示す。 45 石油・天然ガスレビュー JOGMEC K Y M C アナリシス 表1 第2グループ企業の概要 LNG 売買 国内石油・ 国内 LNG 受入基 都市ガス販売・顧客数 契約 ガス生産 主な国外 地出資基地数 上段:販売量(億m3) (百万トン) 2016 年 油ガス田資産等 上段:操業中 下段:顧客 上段:契約 (万 boed) 下段:建設中 (万戸) 下段:合意 国有 中国中化 ブラジル Peregrino 油 未公表 Sinochem 田 石油 中国化工 ChemChina 地方政府 陝西延長 マダガスカル 23 Yanchang 国有 中国華電 複数計画あり 契約:1.0 販売:N.A Huadian 合意:3.0 顧客:N.A 地方政府 北京控股(北京燃気) ロシア 操業中 1:河北・ 販売:138 Beijing Enterprise/Beijing Verkhnechonsk 油田 唐山 顧客:660 Gas (2015 年) 申能 操業中 2:上海・ 販売:76 Shenergy 洋山、五号溝 顧客:660(LPG、 未公表 石炭ガス込み) (2016 年) 浙江能源 交渉中 操業中1:浙江・ 販売:65 -

Negativliste. Fossil Energi

Negativliste. Fossil energi Maj 2021 Udstedende selskab 1 ABJA Investment Co Pte Ltd 2 ABM Investama Tbk PT 3 Aboitiz Equity Ventures Inc 4 Aboitiz Power Corp 5 Abraxas Petroleum Corp 6 Abu Dhabi National Energy Co PJSC 7 AC Energy Finance International Ltd 8 Adams Resources & Energy Inc 9 Adani Electricity Mumbai Ltd 10 Adani Power Ltd 11 Adani Transmission Ltd 12 Adaro Energy Tbk PT 13 Adaro Indonesia PT 14 ADES International Holding PLC 15 Advantage Oil & Gas Ltd 16 Aegis Logistics Ltd 17 Aenza SAA 18 AEP Transmission Co LLC 19 AES Alicura SA 20 AES El Salvador Trust II 21 AES Gener SA 22 AEV International Pte Ltd 23 African Rainbow Minerals Ltd 24 AGL Energy Ltd 25 Agritrade Resources Ltd 26 AI Candelaria Spain SLU 27 Air Water Inc 28 Akastor ASA 29 Aker BP ASA 30 Aker Solutions ASA 31 Aksa Akrilik Kimya Sanayii AS 32 Aksa Enerji Uretim AS 33 Alabama Power Co 34 Alarko Holding AS 35 Albioma SA 36 Alexandria Mineral Oils Co 37 Alfa Energi Investama Tbk PT 38 ALLETE Inc 1 39 Alliance Holdings GP LP 40 Alliance Resource Operating Partners LP / Alliance Resource Finance Corp 41 Alliance Resource Partners LP 42 Alliant Energy Corp 43 Alpha Metallurgical Resources Inc 44 Alpha Natural Resources Inc 45 Alta Mesa Resources Inc 46 AltaGas Ltd 47 Altera Infrastructure LP 48 Altius Minerals Corp 49 Altus Midstream Co 50 Aluminum Corp of China Ltd 51 Ameren Corp 52 American Electric Power Co Inc 53 American Shipping Co ASA 54 American Tanker Inc 55 AmeriGas Partners LP / AmeriGas Finance Corp 56 Amplify Energy Corp 57 Amplify Energy Corp/TX 58 -

Steel Mills Move House China Commodities Watch

China Commodities Watch: Steel Mills Move House July 15, 2019 PRIMARY CREDIT ANALYSTS Key Takeaways Christine Li Hong Kong - China's steel-mill relocations should enhance industry clustering and logistics. (852) 2532-8005 Christine.Li - Large capex requirements will force some mills to sell out or merge, increasing market @spglobal.com concentration. Danny Huang - Relocations will focus more on upgrading output than reducing capacity. Hong Kong (852) 2532-8078 danny.huang @spglobal.com Ronald Cheng Chinese steel mills are relocating to reduce urban pollution and improve industrial clustering. S&P Hong Kong Global Ratings anticipates the process will help streamline the industry and boost efficiency. The (852) 2532-8015 ronald.cheng cost of moving house could put strain on some steel companies' financials, however this should @spglobal.com further the consolidation trend in the country's steel sector. SECONDARY CONTACT Led by China's top steel-producing provinces--Hebei, Shandong and Jiangsu--many regions have Lawrence Lu, CFA announced relocation plans for steel mills within their reign. Since late 2017, announced plans Hong Kong amount to at least 100 million tons per annum (mtpa) covering various cities in different provinces, (852) 2533-3517 or about 10% of national total capacity. lawrence.lu @spglobal.com Relocating steel mills will help but not complete reform guidelines set by state planners. Under a plan devised by the Ministry of Industry and Information Technology (MIIT), the overriding targets to be reached by 2025 are: (1) structural adjustments with reduced capacity; (2) increased market concentration led by several large groups; (3) improved efficiency and profitability. -

CITIC LIMITED Annual Report 2017 HTML

CITIC LI M IT ED Annual Report 2017 CITIC LIMITED ANNUAL REPORT 2017 CITIC Limited Registered Office 32nd Floor, CITIC Tower, 1 Tim Mei Avenue, Central, Hong Kong Tel +852 2820 2111 HTML Fax +852 2877 2771 www.citic.com Stock code : 00267 OUR COMPANY CITIC Limited (SEHK: 00267) is China’s largest conglomerate and a constituent of the Hang Seng Index. Among our diverse global businesses, we focus primarily on financial services, resources and energy, manufacturing, engineering contracting and real estate. As China’s economy matures and is increasingly weighted towards consumption and services, CITIC is building upon its existing consumer platform, expanding into complementary businesses that reflect these trends and opportunities. Tracing our roots to the beginning of China’s opening and reform, we are driven today by the same values on which we were founded: a pioneering spirit, a commitment to innovation and a focus on the long term. We embrace world- class technologies and aim for international best practice. We are guided by a strategy that is consumer-centric, commercially-driven, and far-sighted in the allocation of capital and resources. Our platform is unique in its diversity and scale, allowing CITIC to capture emerging opportunities in China and around the world. Guiding us as we grow is our fundamental commitment to create long-term value for all of our shareholders. OUR BUSINESSES Financial Services Resources & Energy CITIC Bank (65.97%) CITIC Resources (59.50%) CITIC Trust (100%) CITIC Mining International (100%) CITIC-Prudential -

The Emergence of China: New Frontiers in Outbound M&A

The emergence of China: New frontiers in outbound M&A November 2009 New frontiers in outbound M&A Introduction 4 Executive summary 6 Methodology 7 China outbound M&A overview 8 China outbound M&A activity into Australia 17 China outbound M&A activity into the US 23 Sector focus Automotive 29 Oil and Gas 34 Financial Services 40 Mining 45 Deloitte Global Chinese Services Group Overview 50 Deloitte contacts 52 The emergence of China: New frontiers in outbound M&A 3 Foreword: New frontiers in outbound M&A China has truly stepped onto the world the China Development Bank recently loaning stage following the turmoil that afflicted the the state-owned China National Petroleum global financial system in the second half Corporation US$30bn in order to swell its of last year. Nowhere is this more prevalent outbound M&A war-chest. than in the Chinese outbound M&A market, where activity remained solid over the first Looking forward, Chinese outbound M&A three quarters of 2009, despite dire market activity looks likely to continue to move conditions. Indeed, outbound deal volumes from strength to strength over 2010, over Q1-Q3 2009 accounted for 10% of driven by a largely-unchanged appetite for overall Chinese M&A activity, as well as close deal-making in China, as well as relatively to one-quarter of M&A investment – in attractive valuations for overseas assets. comparison, foreign acquisitions in 2007 At the same time, Chinese acquirers are comprised just 8.5% over all M&A volumes increasingly examining assets in Europe and 21% of values. -

白重恩BAI Chong-En

白重恩 清华大学经济管理学院院长 BAI Chong-En Dean of Tsinghua University School of Economics and Management 白重恩是清华大学经济管理学院院长、弗里曼经济学讲席教授,清华大学中国财政税收研究所所 长。美国哈佛大学经济学博士。研究领域为制度经济学、经济增长和发展、公共经济学、金融、公司 治理以及中国经济。 目前担任全国政协委员、“十四五”国家发展规划专家委员会专家委员、中国经济 50 人论坛学术 委员、亚洲开发银行研究院顾问委员会委员、国务院学位委员会第七届学科评议组成员、中国民主建 国会中央常委,经济委员会主任、国家税务总局特邀税收评论员、中国金融 40 人论坛成员、中国信息 百人会成员以及国际经济学会执行委员会成员。曾挂任北京市国有资产经营有限责任公司副总裁。曾 任中国人民银行货币政策委员会成员、布鲁金斯学会 non-resident 高级研究员。 主要研究项目:国家自然科学基金委中英 NSFC-ESRC 项目《中国的国际金融一体化--对金融发 展和稳定的影响》,负责人。2017 - 2019。农业部办公厅《三农问题中的财政体制和政府激励机制》, 负责人。2016.1 - 2016.12。中国金融四十人论坛课题《中国经济增长潜力研究》,负责人。2015.1 - 2016.5。世界银行:由世界银行行长任命的“世界银行营商环境报告的独立评审专家组 ”2012 - 2013。 Professor BAI Chong-En is Dean of the School of Economics and Management, Mansfield Freeman Chair Professor of Tsinghua University. He is also the director of the National Institute for Fiscal Studies of Tsinghua University. He earned his Ph.D. degrees in Mathematics and Economics from UCSD and Harvard University, respectively. His research interests include Institutional Economics, Economic Growth and Development, Public Economics, Finance, Corporate Governance and Chinese Economy. Professor BAI is a member of the National Committee of the Chinese People’s Political Consultative Conference, expert member of the Committee of experts on National Development Planning in the 14th five- year Plan, Academic member of the Chinese Economists 50 Forum, Member of the Advisory Board of the Asian Development Bank Research Institute, the 7th Discipline Evaluation Group of the State Council Academic Degrees Committee, member of Central Committee and director of economic committee, China National Democratic Construction Association, specially invited tax commentator of State Administration Taxation, member of China Finance 40 Forum, China Info100, and the executive committee of International Economic Association. He served as Adjunct Vice-President of Beijing State-Owned Assets Management Co., the monetary policy committee of the People’s Bank of China and was a non-resident Senior Fellow of the Brookings Institution. -

STOXX Hong Kong All Shares 180 Last Updated: 03.04.2018

STOXX Hong Kong All Shares 180 Last Updated: 03.04.2018 Rank Rank (PREVIOU ISIN Sedol RIC Int.Key Company Name Country Currency Component FF Mcap (BEUR) (FINAL) S) HK0000069689 B4TX8S1 1299.HK HK1013 AIA GROUP HK HKD Y 83.1 1 1 CNE1000002H1 B0LMTQ3 0939.HK CN0010 CHINA CONSTRUCTION BANK CORP H CN HKD Y 71.5 2 2 CNE1000003G1 B1G1QD8 1398.HK CN0021 ICBC H CN HKD Y 49.4 3 3 CNE1000003X6 B01FLR7 2318.HK CN0076 PING AN INSUR GP CO. OF CN 'H' CN HKD Y 42.9 4 4 HK0941009539 6073556 0941.HK 607355 China Mobile Ltd. CN HKD Y 41.6 5 5 CNE1000001Z5 B154564 3988.HK CN0032 BANK OF CHINA 'H' CN HKD Y 33.3 6 7 HK0388045442 6267359 0388.HK 626735 Hong Kong Exchanges & Clearing HK HKD Y 31.0 7 6 KYG217651051 BW9P816 0001.HK 619027 CK HUTCHISON HOLDINGS HK HKD Y 27.1 8 8 HK0016000132 6859927 0016.HK 685992 Sun Hung Kai Properties Ltd. HK HKD Y 20.2 9 10 HK0027032686 6465874 0027.HK 646587 GALAXY ENTERTAINMENT GP. HK HKD Y 20.1 10 11 HK0883013259 B00G0S5 0883.HK 617994 CNOOC Ltd. CN HKD Y 19.0 11 12 KYG2177B1014 BYZQ077 1113.HK HK50CI CK Asset Holdings Ltd HK HKD Y 18.8 12 9 HK0002007356 6097017 0002.HK 619091 CLP Holdings Ltd. HK HKD Y 18.3 13 13 CNE1000002Q2 6291819 0386.HK CN0098 China Petroleum & Chemical 'H' CN HKD Y 18.2 14 15 CNE1000002L3 6718976 2628.HK CN0043 China Life Insurance Co 'H' CN HKD Y 16.7 15 14 HK0823032773 B0PB4M7 0823.HK B0PB4M Link Real Estate Investment Tr HK HKD Y 15.1 16 16 HK2388011192 6536112 2388.HK 653611 BOC Hong Kong (Holdings) Ltd. -

Interim Report 2019 中期報告 Manganese

INTERIM REPORT 2019 中期報告 MANGANESE Single largest shareholder of CITIC Dameng Holdings Limited (SEHK: 1091), one of the largest vertically integrated manganese OIL producers in the world. Major income driver with steady production and development in oilfields located in Kazakhstan, China and Indonesia. ALUMINIUM (1) a 22.5% participating interest in the Portland Aluminium Smelter joint venture, one of the largest and most efficient aluminium smelting operations in the world; and (2) a 9.6846% equity interest in Alumina Limited (ASX: AWC), one of IMPORT AND Australia’s leading companies with significant EXPORT OF global interests in bauxite COMMODITIES mining, alumina refining COAL and selected aluminium smelting operations. An import and export of commodities business, A 14% participating based on strong expertise interest in the Coppabella and established marketing and Moorvale coal mines networks, with a focus on joint venture (a major international trade. producer of low volatile pulverized coal injection coal in the international seaborne market) and interests in a number of coal exploration operations in Australia with significant resource potential. MANGANESE Single largest shareholder of CITIC Dameng Holdings Contents Limited (SEHK: 1091), one 目錄 of the largest vertically integrated manganese Corporate Information 公司資料 OIL producers in the world. Financial Results 財務業績 Major income driver with Condensed Consolidated Income Statement 01 簡明綜合利潤表 steady production and development in oilfields Condensed Consolidated Statement of Comprehensive