What Would the Rockefellers Do?

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

2020 May June Newsletter

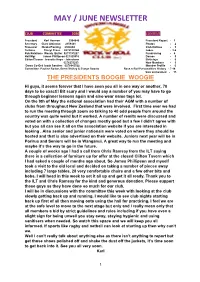

MAY / JUNE NEWSLETTER CLUB COMMITTEE 2020 CONTENT President Karl Herman 2304946 President Report - 1 Secretary Clare Atkinson 2159441 Photos - 2 Treasurer Nicola Fleming 2304604 Club Notices - 3 Tuitions Cheryl Cross 0275120144 Jokes - 3-4 Pub Relations Wendy Butler 0273797227 Fundraising - 4 Hall Mgr James Phillipson 021929916 Demos - 5 Editor/Cleaner Jeanette Hope - Johnstone Birthdays - 5 0276233253 New Members - 5 Demo Co-Ord Izaak Sanders 0278943522 Member Profile - 6 Committee: Pauline Rodan, Brent Shirley & Evelyn Sooalo Rock n Roll Personalities History - 7-14 Sale and wanted - 15 THE PRESIDENTS BOOGIE WOOGIE Hi guys, it seems forever that I have seen you all in one way or another, 70 days to be exact!! Bit scary and I would say a number of you may have to go through beginner lessons again and also wear name tags lol. On the 9th of May the national association had their AGM with a number of clubs from throughout New Zealand that were involved. First time ever we had to run the meeting through zoom so talking to 40 odd people from around the country was quite weird but it worked. A number of remits were discussed and voted on with a collection of changes mostly good but a few I didn’t agree with but you all can see it all on the association website if you are interested in looking . Also senior and junior nationals were voted on where they should be hosted and that is also advertised on their website. Juniors next year will be in Porirua and Seniors will be in Wanganui. -

WHAT IS YOUR DREAM? a Person Can’T Dream When He Is Busy Surviving

www.FaithMissionWF.org WINTER 2019 WHAT IS YOUR DREAM? A person can’t dream when he is busy surviving. INSIDE: From the CEO • Stories from our Ministries • Statistics FAITH MISSION FAITH REFUGE FAITH RESALE 940-723-5663 940-322-4673 940-766-0705 1300 Travis St. 710 E. Hatton Rd. 4502 Old Jacksboro Hwy. Wichita Falls, TX 76301 Wichita Falls, TX 76302 Wichita Falls, TX 76302 FROM THE CEO WHAT IS YOUR DREAM? Listening to people who Let me be clear, the staff at our homeless shelters stay at Faith Refuge and Faith Mission, one hears things don’t equate dreaming with positive thinking. We don’t like: “My dream is to have a car.” “I dream about my mom promote the pie-in-the-sky worldview that says, “If getting a good job.” “My dream is to have a place I can call you can imagine it, you can accomplish it.” What we my own.” “I dream that my relationship with my family is do believe is that God can give us a transformed life restored.” The truth is, many individuals at Faith Mission through a renewed mind (Romans 12:2). We see Him and Faith Refuge have given up on dreaming because they do it almost daily at our shelters. are busy surviving. A person can’t dream when he is You can help those who have lost hope to dream once busy surviving. again. The simplest thing you can do is pray. Please join Giving people a second chance to dream is a role we us in praying for the men, women, and children who cherish. -

Being a Family: Parents with Learning Disabilities in Wales

Acknowledgements I would like to thank the South Wales parent’s network who gave time at their meetings to comment on various aspects of the process of this study. Especially members from the Pembrokeshire Parent’s group and RCT People First, who gave specific advice on accessibility. All the parents who shared their stories with a great generosity. Sometimes the retelling of their stories was painful for them but they stayed with it as they want to improve things for all parents. The parents I met on my journeys who shared their stories with me, but didn’t want to be included in the study – they inspired me. The professionals I met who have given their time, thoughts and ideas. Supervisors Professor Kathy Lowe and Dr Stuart Todd who helped me through various mazes. Chris O’Connor for his support with the assessment tool. Jim Crowe, Simon Rose, Rebecca Watkins, Nicola Pepper, Kai Jones and Karen Warner at Learning Disability Wales for supporting, offering their perceptions and sometimes just listening to me trying to make sense of everything I was hearing. All at Torfaen People First, but especially Jean Francis, for giving me office space and putting up with me wandering round muttering darkly. And finally the Welsh Assembly Government for funding this work. Joyce Howarth (Researcher and Report Author) Learning Disability Wales would like to thank Joyce Howarth and all involved in this research and report. 2009 Learning Disability Wales 41 Lambourne Crescent Cardiff Business Park Llanishen Cardiff CF14 5GG 029 20681160 [email protected] www.learningdisabilitywales.org.uk Contents Chapter 1: The context ........................................................................................ -

Faqs About Cobra Premium Assistance Under the American Rescue Plan Act of 2021

FAQS ABOUT COBRA PREMIUM ASSISTANCE UNDER THE AMERICAN RESCUE PLAN ACT OF 2021 April 07, 2021 Set out below are Frequently Asked Questions (FAQs) regarding implementation of certain provisions of the American Rescue Plan Act of 2021 (ARP), as it app lies to the Consolidated Omnibus Budget Reconciliation Act of 1985, commonly called COBRA. These FAQs have been prepared by the Department of Labor (DOL). Like previously issued FAQs (available at https://www.dol.gov/agencies/ebsa/about-ebsa/our-activities/resource-center/faqs), these FAQs answer questions from stakeholders to help individuals un derstand the law and benefit from it, as intended. The Department of the Treasury and the I nternal Revenue Service (IRS) have reviewed these FAQs, and, concur in the application of the laws under their jurisdiction as set forth in these FAQs. COBRA Continuation Coverage COBRA continuation coverage provides certain group health plan continuation coverage rights for participants and beneficiaries covered by a group health plan. In general, under COBRA, an individual who was covered by a group health plan on the day before the occurrence of a qualifying event (such as a termination of employment or a reduction in hours that causes loss of coverage under the plan) may be able to elect COBRA continuation coverage upon that qualifying event.1 Individuals with such a right are referred to as qualified beneficiaries. Under COBRA, group health plans must provide covered employees and their families with cer tain notices explaining their COBRA rights. ARP COBRA Premium Assistance Section 9501 of the ARP provides for COBRA premium assistance to help Assistance Eligible Individuals (as defined below in Q3) continue their health benefits. -

Disability Benefits

Disability Benefits SSA.gov What’s inside Disability benefits 1 Who can get Social Security disability benefits? 1 How do I apply for disability benefits? 4 When should I apply and what information do I need? 4 Who decides if I am disabled? 5 How is the decision made? 6 What happens when my claim is approved? 9 Can my family get benefits? 10 How do other payments affect my benefits? 10 What do I need to tell Social Security? 11 When do I get Medicare? 12 What do I need to know about working? 12 The Ticket to Work program 13 Achieving a Better Life Experience (ABLE) Account 13 Contacting Social Security 14 Disability benefits Disability is something most people don’t like to think about. But the chances that you’ll become disabled are probably greater than you realize. Studies show that a 20-year-old worker has a 1-in-4 chance of becoming disabled before reaching full retirement age. This booklet provides basic information on Social Security disability benefits and isn’t meant to answer all questions. For specific information about your situation, you should speak with a Social Security representative. We pay disability benefits through two programs: the Social Security Disability Insurance (SSDI) program and the Supplemental Security Income (SSI) program. This booklet is about the Social Security disability program. For information about the SSI disability program for adults, see Supplemental Security Income (SSI) (Publication No. 05-11000). For information about disability programs for children, refer to Benefits For Children With Disabilities (Publication No. 05-10026). -

Wedding Ringer -FULL SCRIPT W GREEN REVISIONS.Pdf

THE WEDDING RINGER FKA BEST MAN, Inc. / THE GOLDEN TUX by Jeremy Garelick & Jay Lavender GREEN REVISED - 10.22.13 YELLOW REVISED - 10.11.13 PINK REVISED - 10.1.13 BLUE REVISED - 9.17.13 WHITE SHOOTING SCRIPT - 8.27.13 Screen Gems Productions, Inc. 10202 W. Washington Blvd. Stage 6 Suite 4100 Culver City, CA 90232 GREEN REVISED 10.22.13 1 OVER BLACK A DIAL TONE...numbers DIALED...phone RINGING. SETH (V.O.) Hello? DOUG (V.O.) Oh hi, uh, Seth? SETH (V.O.) Yeah? DOUG (V.O.) It’s Doug. SETH (V.O.) Doug? Doug who? OPEN TIGHT ON DOUG Doug Harris... 30ish, on the slightly dweebier side of average. 1 REVEAL: INT. DOUG’S OFFICE - DAY 1 Organized clutter, stacks of paper cover the desk. Vintage posters/jerseys of Los Angeles sports legends adorn the walls- -ERIC DICKERSON, JIM PLUNKETT, KURT RAMBIS, STEVE GARVEY- DOUG You know, Doug Harris...Persian Rug Doug? SETH (OVER PHONE) Doug Harris! Of course. What’s up? DOUG (relieved) I know it’s been awhile, but I was calling because, I uh, have some good news...I’m getting married. SETH (OVER PHONE) That’s great. Congratulations. DOUG And, well, I was wondering if you might be interested in perhaps being my best man. GREEN REVISED 10.22.13 2 Dead silence. SETH (OVER PHONE) I have to be honest, Doug. This is kind of awkward. I mean, we don’t really know each other that well. DOUG Well...what about that weekend in Carlsbad Caverns? SETH (OVER PHONE) That was a ninth grade field trip, the whole class went. -

Inivjo LU ME

1111~ ~~ ~~1 ~~~~if~l~l~l~lllllll ~iniVJO L U ME Sls- lV1ount . _. aure_ ' , ... i - ~~ .~ · .. .,~ - , ARCHIVES) LH I' 1 .M68 2002 c.2 ARCHIVES LHl .M68 2002c.2 Mountain Laurels IN GRATITUDE DR. B. J. ROBINSON The editors of Mountain Laurels wish to take this Opportunity to thank Dr. Robinson For her years of dedicated Service to the betterment Of our cultural Life. Her Joie de vivre, Unerring eye for art, Her hard and effective work, Humanity, love, and contagious laugh Are deeply missed. We dedicate this volume to her. Vol. 8 2002 Editors ........ ... .. ........... ..... .. .. ........ ...... .... ...... Jennifer Koch Judson Wright Managing Editor. ... ... ...... ... ... ... ......... ...... ......... Sarah Ballew Editorial Board ... .... ....... ... ........ .... ......... .. .. .... .. ... Sarah Ballew Brittany Tennant Carol Chester Gordon E. McNeer Brian Jay Corrigan Layout. ....... .. ... ............ .... ....... ... ............ Brian Jay Corrigan Faculty Sponsors and Advisors .... .. ................ Gordon E. McNeer Brian Jay Corrigan Founders... ....... ........ ...... ... ..... ... ................. .. Dr. Sally Allen Dr. Brian Jay Corrigan Front Cover Photo: Rekindled Memories by Debbie Martin Back Cover Photo: Troubled Bridge Over Water by Matthew Koch 1 TABLE OF CONTENTS California by Rachel Warner "Poetry First Place" . 3 Untitled by Rachel Warner "Poetry Second Place" . 4 Smoothed Over by Brandon Barton "Poetry Third Place" . 5 And Yet ... by Amanda L. Wood . 6 Sleepless by Crystal Corn. 7 Untitled by Brittany Tennant . 8 The Stage by Samantha Lovely . 9 James Corbin by Marcus Hawkins . 10 Autumn-tinted by Brittany Tennant. 11 Untitled by Brittany Tennant . 12 5 a.m. Girl by Brittany Tennant. 13 A Love Letter by Anonymous. 14 Why I Can 't Write Poetry by Lori Schink . 15 I Take a Thousand Grains of Sand by Shannon Wright . -

David Nguyen

Kính: A window into the life of a second generation Vietnamese American Davis Nguyen VIET 220 Spring 2014 1 Dedication: For my family, for all the struggles they went through and all the sacrifices they made so that my siblings, cousins, and I could have the lives we have today. Cám ơn. 2 Table of Contents Traditions ..................................................................................................................................... 4 Christmas ............................................................................................................................................................ 5 Wedding .............................................................................................................................................................. 7 In Memory of My Aunt Quyen .................................................................................................................... 9 Culture ....................................................................................................................................... 11 Wouldn’t you rather learn to cook? ......................................................................................................... 12 How to Find the Right Wife ...................................................................................................................... 13 My Birthday .................................................................................................................................................... 15 Values ........................................................................................................................................ -

The Studio Museum in Harlem Magazine Summer/Fall 2012 Studio Magazine Board of Trustees This Issue of Studio Is Underwritten, Editor-In-Chief Raymond J

The Studio Museum in Harlem Magazine Summer/Fall 2012 Studio Magazine Board Of Trustees This issue of Studio is underwritten, Editor-in-Chief Raymond J. McGuire, Chairman in part, with support from Bloomberg Elizabeth Gwinn Carol Sutton Lewis, Vice-Chair Creative Director Rodney M. Miller, Treasurer The Studio Museum in Harlem is supported, Thelma Golden in part, with public funds provided by Teri Trotter, Secretary Managing Editor the following government agencies and elected representatives: Dominic Hackley Jacqueline L. Bradley Valentino D. Carlotti Contributing Editors The New York City Department of Kathryn C. Chenault Lauren Haynes, Thomas J. Lax, Cultural A"airs; New York State Council Joan Davidson Naima J. Keith on the Arts, a state agency; National Gordon J. Davis Endowment for the Arts; Assemblyman Copy Editor Reginald E. Davis Keith L. T. Wright, 70th A.D. ; The City Samir Patel Susan Fales-Hill of New York; Council Member Inez E. Dr. Henry Louis Gates, Jr. Dickens, 9th Council District, Speaker Design Sandra Grymes Christine Quinn and the New York City Pentagram Joyce K. Haupt Council; and Manhattan Borough Printing Arthur J. Humphrey, Jr. President Scott M. Stringer. Finlay Printing George L. Knox !inlay.com Nancy L. Lane Dr. Michael L. Lomax The Studio Museum in Harlem is deeply Original Design Concept Tracy Maitland grateful to the following institutional 2X4, Inc. Dr. Amelia Ogunlesi donors for their leadership support: Corine Pettey Studio is published two times a year Bloomberg Philanthropies Ann Tenenbaum by The Studio Museum in Harlem, Doris Duke Charitable Foundation John T. Thompson 144 W. 125th St., New York, NY 10027. -

Turn Back Time: the Family

TURN BACK TIME: THE FAMILY In October 2011, my lovely wife, Naomi, responded to an advert from TV production company Wall to Wall. Their assistant producer, Caroline Miller, was looking for families willing to take part in a living history programme. They wanted families who were willing to live through five decades of British history. At the same time, they wanted to retrace the history of those families to understand what their predecessors would have been doing during each decade. Well, as you may have already guessed, Wall to Wall selected the Goldings as one of the five families to appear in the programme. Shown on BBC1 at 9pm from Tuesday 26th June 2012, we were honoured and privileged to film three of the five episodes. As the middle class family in the Edwardian, inter war and 1940s periods, we quite literally had the most amazing experience of our lives. This page of my blog is to share our experiences in more detail – from selection, to the return to normal life! I have done this in parts, starting with ‘the selection process’ and ending with the experience of another family. Much of what you will read was not shown on TV, and may answer some of your questions (those of you who watched it!!). I hope you enjoy reading our story. Of course, your comments are very welcome. PART 1 – THE SELECTION PROCESS I will never forget the moment when I got home from work to be told by Naomi that she had just applied for us to be part of a TV programme. -

Employer-Sponsored Insurance for You and Your Family

Your family deserves to be healthy Employer-sponsored Whether you are able to get your family health coverage through an employer-sponsored plan or by enrolling in a plan on the Health Insurance for You Insurance Marketplace, health insurance is an important part of making sure your family gets the medical care they need. Get them and Your Family insurance today! Employer-sponsored health insurance For American Indians and Alaska Natives Is paid for by a business on behalf of its employees May be offered only to the employee or to the employee and his or her family (spouse and children) Signing your family up through your employer How much will I pay for insurance? Options for when your employer doesn’t cover family Your employer may pay all of the cost or require you to share the cost Understanding what you will pay If your employer offers coverage for your family, you may have to pay a higher percentage of the cost than what you pay for your own insurance Your employer can provide information about how much you will pay for yourself and your family Have questions about your employer’s plan or signing your family up for insurance? Talk to your employer’s human resources department, Visit your Indian health program, Go online to healthcare.gov/tribal, or Call 1-800-318-2596 For more information: Visit go.cms.gov/AIAN @CMSGov #CMSNativeHealth CMS ICN No. 909342-N • August 2016 How can I get health insurance for I have insurance through my myself and my family? employer. -

The Mississippi Museum of Art and Tougaloo College Art and Civil Rights Initiative | 2017–2020

The Mississippi Museum of Art and Tougaloo College Art and Civil Rights Initiative | 2017–2020 The Mississippi Museum of Art and Tougaloo College Art and Civil Rights Initiative | 2017–2020 edited by Dr. Redell Hearn Mississippi Museum of Art Jackson in partnership with Tougaloo College Art Collections Turry M. Flucker, Director Tougaloo made possible by the Henry Luce Foundation The Art and Civil Rights Initiative is a partnership between the Mississippi Museum of Art and Tougaloo College, supported by the Henry Luce Foundation. The Mississippi Museum of Art and its programs are sponsored in part by the city of Jackson and Visit Jackson. Support is also provided in part by funding from the Mississippi Arts Commission, a state agency, and by the National Endowment for the Arts, a federal agency. Tougaloo College is a private, coeducational, historically black four-year liberal arts, church related, but not church-controlled institution. Copyright © 2020 Mississippi Museum of Art 380 South Lamar Street, Jackson, MS 39201 / www.msmuseumart.org and Tougaloo College 500 County Line Rd, Tougaloo, MS 39174 / https://www.tougaloo.edu/ All rights reserved. No part of this publication may be reproduced or transmitted in any form without written permission from the publisher. Artwork dimensions are given in inches; height precedes width precedes depth. MMA collection numbers 1966.001, 1966.018, 1972.006, and 2005.029 photographed by Gil Ford Photography; 2005.029 photographed by Roland L. Freeman. All other photography of artwork from MMA and Tougaloo collections is by Mark Geil. Creative director for the exhibitions A Tale of Two Collections and The Prize is Latrice Lawson.