The Role of Rating Agencies in Determining the Activities of Banks

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Halyk Finance” Has Been Named “The Best Investment Bank in Kazakhstan” for the 6Th Consecutive Year by a Renowned International Financial Magazine, EMEA Finance

Almaty, 11 April 2016 Press release JSC Subsidiary Organization of Halyk Bank of Kazakhstan “Halyk Finance” has been named “The Best Investment Bank in Kazakhstan” for the 6th consecutive year by a renowned international financial magazine, EMEA Finance. Upon its annual rigorous selection of the world’s leading investment banks – “Europe Banking Awards 2015” – EMEA Finance (www.emeafinance.com), a renowned international financial magazine, has named Halyk Finance “The Best Investment Bank in Kazakhstan 2015”. Halyk Finance has for the 6th consecutive year become the winner of this highly prestigious award where voting is made by the leading industry experts from all over the world, which cements Halyk Finance’s multi-year leading position in Kazakhstan’s investment banking market. Earlier in March 2016, Halyk Finance had also won “EMEA Finance Achievement Awards” for the record 6th consecutive year in the following two prestigious nominations: 1. “The Best Sovereign Bond in EMEA” for the Ministry of Finance of the Republic of Kazakhstan’s USD 4 billion 10- and 30-year dual-tranche Eurobond in which Halyk Finance has acted as the Joint Lead Manager in July 2015; and 2. “The Best Financial Institution Bond” for JSC Halyk Bank’s KZT 132 billion 10-year bond in which Halyk Finance has acted as the Sole Financial Advisor and Bookrunner. “This acknowledgement of Halyk Finance – the investment banking arm of Halyk Group – as the best investment bank in Kazakhstan for the record 6th consecutive year is an extraordinary achievement not only for Kazakhstan and our entire region, but also for the Emerging and Frontier Markets as a whole. -

JSC Halyk Bank

JSC Halyk Bank Consolidated Financial Statements and Independent Auditors’ Report For the Years Ended 31 December 2016, 2015 and 2014 JSC Halyk Bank Table of contents Page STATEMENT OF MANAGEMENT’S RESPONSIBILITIES FOR THE PREPARATION AND APPROVAL OF THE CONSOLIDATED FINANCIAL STATEMENTS FOR THE YEARS ENDED 31 DECEMBER 2016, 2015 AND 2014 1 INDEPENDENT AUDITORS’ REPORT 2-6 CONSOLIDATED FINANCIAL STATEMENTS FOR THE YEARS ENDED 31 DECEMBER 2016, 2015 AND 2014: Consolidated statements of financial position 7 Consolidated statements of profit or loss 8 Consolidated statements of other comprehensive income 9 Consolidated statements of changes in equity 10-12 Consolidated statements of cash flows 13-14 Notes to the consolidated financial statements 15-113 Why the matter was determined to be a How the matter was addressed in the key audit matter audit Revenue recognition and calculation of the We tested automated controls over the effective interest rate on individually calculation of the effective interest rate in assessed impaired loans the banking system with the involvement As disclosed in Note 27 to the consolidated of IT specialists. financial statements, interest income on We tested the arithmetical accuracy of individually assessed impaired loans for the interest income accrual in accordance the year ended 31 December 2016 with the effective interest rate amounted to KZT 33,437 million. requirements in IAS 39 Financial The recognition of interest income using Instruments: Recognition and the effective interest rate method on Measurement (“IAS 39”) by re- individually assessed impaired loans, which performing a sample of calculations and is calculated through the banking system, comparing these to accounting records. -

Georgian Banking Sector Overview

Georgian Banking Sector Overview 2016 3rd Quarter Results December, 2016 Contents Page 3 Basis of Preparation At a Glance 4 General Highlights 5 Sector Highlights 6 Bank Profiles 7 Appendix 1: Shareholding Structure & General Information 24 Appendix 2: Sector Insights 27 Appendix 3: Key Financial Indicators 28 Appendix 4: Bank Contact Details 32 Glossary of Terms 34 © 2016 KPMG Georgia LLC, a company incorporated under the Laws of Georgia, a member firm of the KPMG network of 2 independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved. Basis of Preparation This report summarizes and analyzes the financial results of the 17 commercial banks of Georgia for the 3rd quarter of 2016, as well as provides some insights into the recent developments in the sector. The financial information has been obtained from the published interim reports for the 3rd quarter of 2016. The banks are listed in the alphabetical order throughout the publication. We have used simple headline numbers in our analysis unless stated otherwise; each bank has its own way of reporting performance and this has proved to be the most consistent method of presenting their results. All the key ratios are calculated based on the obtained data unless stated otherwise. The general information, such as the number of branches, employee headcount, etc, are mainly taken from the Notes to the Financial Statements prepared by the banks. The official websites of the banks serve as the only alternative source, however they are not always properly updated. Due to this, the figures presented may not necessarily be as of 30th September 2016. -

Halyk Group Financial Results Presentation 1Q 2020

October 2020 Disclaimer Certain information contained in this presentation may include forward-looking statements. Such forward-looking statements are not guarantees of future performance. These statements are based on management’s current expectations or beliefs as of the date of this presentation and are subject to a number of factors and uncertainties that could cause actual results to differ materially from those described in the forward-looking statements. The Bank disclaims any intention or obligation to publicly update or revise any forward- looking statements. The alternative performance measures (“APMs”) disclosed in this presentation are unaudited supplementary measures of the Halyk Group’s performance and liquidity that are not required by, or presented in accordance with, IFRS. These measures are not defined by IFRS and the Halyk Group’s use and definition of these metrics may not be comparable to similarly titled APMs used by other companies in the financial industry due to differences in accounting policies or differences in the calculation methodology. These APMs have limitations and should not be considered in isolation, or as substitutes for financial information as reported under IFRS. Accordingly, undue reliance should not be placed on the APMs presented in this presentation. The Halyk Group has included these measures because it believes that they enhance an investor’s understanding of the Halyk Group’s financial performance. The Halyk Group also believes that these APMs are commonly used by investors in comparing the performance of businesses. The management of the Halyk Group uses these measures to monitor and analyse Halyk Group’s performance. Basis of calculation: - all figures in this presentation are based on IFRS audited financial statements or financial statements reviewed by auditors, unless stated otherwise; - the figures shown in this presentation for the 7, 8 and 9 months of 2020 and any monthly figures has been extracted from unaudited management accounts and financials statements. -

Halyk Bank, Named the Best Bank in Kazakhstan by International Finance

Halyk Bank, named the Best Bank in Kazakhstan by International Finance 29 January 2020, Almaty – International Finance, a premium business and finance magazine has crowned Halyk Bank as the Best Managed Bank – Kazakhstan 2019, in the edition of its flagship International Finance Awards 2019. The win was awarded based on the findings of the world’s best experts on banking and financial industry, asset management, brokerage activity, insurance. “It's a comfort to know that management potential of the Halyk Group has been highly highlighted by the established financial publication. An unbiased opinion of international experts once again confirms the ample opportunities of the Group, which, thanks to its careful strategy, keeps showing good growth rates, being a reliable business partner in the financial market of Kazakhstan and in the countries of operation,” said Umut Shayakhmetova, CEO of Halyk Bank. The International Finance Awards reflect innovative strategies, processes, trends, qualitative changes and groundbreaking achievements in the global financial community. The International Finance publication has launched the awards with the aim of recognizing those companies that have best demonstrated and proved themselves in certain areas of the world of finance: banking, insurance, brokerage, etc. *** International Finance is a premium business and finance magazine published by UK’s International Finance Publications Limited. The publication publishes news, analytical materials, as well as comments and interviews of leading industry experts and market participants on the history of banking, finance and Islamic finance, asset management, capital, hedge funds, pension and sovereign wealth funds, real estate, fintech, currencies, and also niche financing and investment opportunities. The magazine and website have a growing readership in Europe and the Middle East. -

Financial Statements and Management Report for the Year Ended December 31, 2020

JOINT STOCK COMPANY HALYK BANK GEORGIA Financial Statements and Management Report For the Year Ended December 31, 2020 JOINT STOCK COMPANY HALYK BANK GEORGIA TABLE OF CONTENTS Page STATEMENT OF MANAGEMENT’S RESPONSIBILITIES FOR THE PREPARATION AND APPROVAL OF THE FINANCIAL STATEMENTS AND MANAGEMENT REPORT FOR THE YEAR ENDED DECEMBER 31, 2020 1 MANAGEMENT REPORT FOR THE YEAR ENDED DECEMBER 31, 2020: Overview 2 Financial performance review 3 Risk management 4-6 Principal risks and uncertainties 7-9 Human resource management 10 Corporate responsibility 11 INDEPENDENT AUDITOR’S REPORT 12-14 FINANCIAL STATEMENTS FOR THE YEAR ENDED DECEMBER 31, 2020: Statement of financial position 15 Statement of profit or loss and other comprehensive income 16 Statement of changes in equity 17 Statement of cash flows 18 NOTES TO THE FINANCIAL STATEMENTS: 1. Organisation 19 2. Basis of preparation 19 3. Application of new and revised international financial reporting standards (ifrss) 21 4. Significant accounting policies 22 5. Critical accounting judgements and key sources of estimation uncertainty 38 6. Cash and cash equivalents 40 7. Mandatory cash balance with the national bank of georgia 40 8. Loans to customers 41 9. Investments in debt instruments 44 10. Property and equipment 44 11. Other assets 46 12. Due to financial institutions 46 13. Deposits by customers 47 14. Lease liability 48 15. Subordinated debt 48 16. Other liabilities 49 17. Share capital 49 18. Net interest income before impairment losses 50 19. Impairment losses on interest bearing and non-interest bearing assets / provision for other operations 50 20. Fee and commission income and expense 51 21. -

Annual Report Contents

2019 annual report Contents: 1. GLOSSARY 3 2. AT A GLANCE 5 3. BUSINESS MODEL 8 4. CHAIRMAN OF THE BOARD’S STATEMENT 10 5. CHAIRPERSON OF THE MANAGEMENT BOARD’S REVIEW 14 6. BOARD OF DIRECTORS 18 7. MANAGEMENT BOARD 23 8. KEY EVENTS 29 9. AWARDS 32 10. MACROECONOMIC AND BANKING REVIEW 34 11. FINANCIAL REVIEW 38 12. BUSINESS REVIEW 42 13. RISK MANAGEMENT 51 14. CORPORATE GOVERNANCE 58 15. SOCIAL REPORT 67 16. RESPONSIBILITY STATEMENT 75 17. OUTLOOK 77 18. AUDITED CONSOLIDATED FINANCIAL STATEMENTS FOR 2019 79 (iNCLUDING INDEPENDENT AUDITORS’ REPORT), NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS FOR 2019 19. INFORMATION FOR SHAREHOLDERS 174 HALYK BANK ANNUAL REPORT 2019 1 glossary 4 Glossary Glossary 1 Altyn Bank Altyn Bank JSC (SB of China Citic Bank Corporation Ltd) 2 AML/CTF Anti-Money Laundering and Countering Financing of Terrorism 3 BCC Branch credit committee 4 BNCC Branch network credit committee 5 Business Roadmap – 2020 The “Road Map for Business 2020” Unified Programme for Supporting Entrepreneurship and Business Development 6 CITIC Bank China CITIC Bank Corporation Limited 7 GDR Global Depositary Receipt 8 Halyk Bank, the Bank Halyk Bank of Kazakhstan 9 Halyk Group, the Group Halyk Bank Group of Companies 10 IS Information security 11 IT Information technology 12 KASE Kazakhstan Stock Exchange 13 KKB Kazkommertsbank 14 Retail Credit Committee Retail Credit Committee of the Head Bank 15 RK Republic of Kazakhstan 16 SCC Small credit committee of the regional branch 17 SME Small and medium enterprises 18 SPV Special purpose vehicle -

5Ea57a68f19ad.Pdf

A N N U A L R E P O R T 2 0 1 8 CONTENTS 1. GLOSSARY 3 2. AT A GLANCE 5 3. BUSINESS MODEL 11 4. CHAIRMAN OF THE BOARD'S STATEMENT 13 5. CHAIRPERSON OF THE MANAGEMENT BOARD'S REVIEW 16 6. BOARD OF DIRECTORS 18 7. MANAGEMENT BOARD 22 8. KEY EVENTS 27 9. AWARDS 31 10. MACROECONOMIC AND BANKING REVIEW 33 11. FINANCIAL REVIEW 37 12. BUSINESS REVIEW 42 13. RISK MANAGEMENT 53 14. CORPORATE GOVERNANCE 61 15. SOCIAL REPORT 75 16. RESPONSIBILITY STATEMENT 85 17. OUTLOOK 87 18. AUDITED CONSOLIDATED FINANCIAL STATEMENTS FOR 2018 (INCLUDING INDEPENDENT 90 AUDITORS' REPORT), NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS FOR 2018 19. INFORMATION FOR SHAREHOLDERS 326 2 GLOSSARY GLOSSARY Altyn Bank Altyn Bank JSC (SB of China Citic Bank Corporation Ltd) UAPF Unified Accumulative Pension Fund Halyk Group, the Group Halyk Bank Group of Companies Road Map for Business 2020 The “Road Map for Business 2020” Unified Programme for Supporting Entrepreneurship and Business Development IT Information technology IS Information security SME Small and medium-sized enterprise Halyk Bank, the Bank Halyk Bank of Kazakhstan NBK National Bank of Kazakhstan Halyk Project Halyk Bank's subsidiary for doubtful and bad asset management AML/CFT Anti-Money Laundering and Countering Financing of Terrorism Damu fund Damu Entrepreneurship Development Fund CITIC Bank China CITIC Bank Corporation Limited GDR Global Depositary Receipt KASE Kazakhstan Stock Exchange 4 2 AT A GLANCE AT A GLANCE FINANCIAL HIGHLIGHTS (CONSOLIDATED BASIS) Key figures 01.01.2019 01.01.2018 Key figures 2018 20172 -

Georgian Banking Sector Overview Q1 2021

Georgian Banking Sector Overview 2021 1st Quarter Results June 2021 Contents Page Basis of Preparation 3 At a Glance 4 General Highlights 5 Sector Highlights 6 Bank Profiles 7 Appendix 1: Shareholding Structure & General Information 22 Appendix 2: Sector Insights 24 Appendix 3: Key Financial Indicators 26 Appendix 4: Bank Contact Details 30 Glossary of Terms 32 © 2021 KPMG Georgia LLC, a company incorporated under the Laws of Georgia and a member firm of the KPMG global 2 organization of independent member firms affiliated with KPMG International Limited, a private English company limited by guarantee. All rights reserved. Basis of Preparation This report summarizes and analyzes the financial results of the 15 commercial banks of Georgia for the 1st quarter of 2021, as well as provides some insights into the recent developments in the sector. The financial information has been obtained from the published quarterly reports for the 1st quarter of 2021. The banks are listed in the alphabetical order throughout the publication. We have used simple headline numbers in our analysis unless stated otherwise; each bank has its own way of reporting performance and this has proved to be the most consistent method of presenting their results. All the key ratios are calculated based on the obtained data unless stated otherwise. The general information, such as the number of branches are mainly taken from the Notes to the Financial Statements prepared by the banks. The official websites of the banks serve as the only alternative source, however they are not always properly updated. Due to this, the figures presented may not necessarily be as of 31 March 2021. -

Changes to the Management Board of JSC Halyk Bank As Per The

Changes to the Management Board of JSC Halyk Bank As per the resolution of the Board of Directors of JSC Halyk Bank (hereinafter - the 'Bank') Mr. Nurlan Zhagiparov, Deputy Chairman of the Bank's Management Board, and Mr. Aslan Talpakov, Deputy Chairman of the Bank's Management Board, have stepped down from their positions as of 2 May 2019 and transferred to a new role as Advisors to the Office of the Management Board. Starting from 2 May 2019, Mr. Askar Smagulov was appointed as the Deputy Chairman of the Management Board of the Bank in charge of Digital banking and Transactional business. Mr. Smagulov started his career at ABN AMRO Bank Kazakhstan in 1998 and served as a Treasury Dealer, Chief Dealer, Head of the Trade Division of Treasury and Head of Treasury. From February 2005 to May 2018, he held various positions in the Bank: Deputy Chairman of the Management Board, Member of the Bank's Management Board, Advisor to the Office of the Board of Directors and the Management Board of the Bank, Head of Treasury. From November 2014 to June 2018, Mr. Smagulov was the Chairman of the Management Board, member of the Board of Directors of JSC Altyn Bank. From February 2010 to May 2015, he was the Chairman of the Board of Directors of JSC Kazteleport, from July 2017 to June 2018 – the Chairman of the Board of Directors in CB "Moskommertsbank". Mr. Smagulov has a degree in economics with honours from Al-Farabi Kazakh National University and an MBA from the William Simon School of Business, University of Rochester (US). -

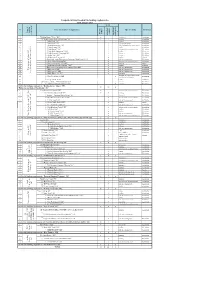

Composite Information About the Banking Conglomerates on 01

Composite information about the banking conglomerates on 01 january 2021 Status № Name of a member of conglomerate Type of activity Residency n banking Nameof holding banking company conglomerate significant subsidiary participatio 1 "Holding Group "Almex" JSC + investment Kazakhstan 2 └ "Halyk Savings Bank of Kazakhstan" JSC + + banking Kazakhstan 3 ├ "Altyn Bank" JSC + banking Kazakhstan 4 ├ "Kazteleport" JSC + telecommunications Kazakhstan 5 ├ «Halyk Inkassatsiya» LLP + cash & valuables-in-transit services Kazakhstan 6 ├ "Halyk Leasing" JSC + leasing Kazakhstan 7 ├ "Halyk Finance" JSC + activities in the securities market Kazakhstan 8 ├ "Halyk Bank Kyrgyzstan" OJSC + banking Kyrgyzstan 9 ├ "Halyk" Insurance Company" JSC + insurance Kazakhstan 10 ├ «Halyk - Life» JSC + insurance Kazakhstan 11 ├ «Halyk Bank Georgia» JSC + banking Georgia 12 ├ Distressed Assets Management Company "Halyk-Project" LLP + bad assets management Kazakhstan 13 ├ «Halyk Global Markets» JSC + activities in the securities market Kazakhstan 14 ├ "Moscommertsbank" CB (JSC) + banking Russia 15 ├ "Kazkommertsbank Tajikistan" CJSC + banking Tajikistan 16 ├ Distressed assets management company Halyk LLP + bad assets management Kazakhstan 17 "HoldingGroup "Almex" JSC ├ "Halyk Asset" LLP + bad assets management Kazakhstan 18 ├ "Halyk Asset 1" LLP + bad assets management Kazakhstan 19 "HalykSavings Bankof Kazakhstan" JSC ├ "Halyk Finservice" JSC + processing Kazakhstan formation of credit histories and the 20 ├ "First Credit Bureau" LLP + Kazakhstan providing of credit -

ANNUAL REPORT Contents

’18 ANNUAL REPORT Contents List of abbreviations Message from the Chairman I. About KDIF 6 1.1. Key Principles of Operation 7 1.2. Corporate Governance 8 1.3. Advisory Council 9 2018 in Facts and Figures 10 II. Development Trends of the Deposit Market in 2018 11 2.1. Deposit Market 12 2.2. Dedollarization of Deposit Base 13 2.3. Formation of Stable Funding Base 14 III. KDIF Performance in 2018 16 3.1. Effectiveness of Deposit Insurance System 17 3.2. Formation of Special Reserve 18 3.3. Liquidation of Banks and Payout Process 20 3.4. Public Relations 21 3.5. International Cooperation 23 I V. Prospective Lines of Development for 2019 25 4.1. Enhancing of KDIF Powers 26 4.2. Improvement of the Payout Mechanism 26 4.3. Automation of the Payout Process 26 4.4. Improvement of the Risk Profile Assessment of Deposit Insurance System Member Banks 27 4.5. Optimization of the Collection Process of Member Banks’ Reports 27 V. Financial Statements 28 2 List of abbreviations Agent Bank – A deposit insurance system member bank commissioned to process payouts to depositors Bank, Member Bank – A member bank of the deposit insurance system Deposit Insurance Law – Law of the Republic of Kazakhstan dated 7 July 2006 “On compulsory insurance of deposits placed with second-tier banks in the Republic of Kazakhstan” National Bank, NBK – National Bank of the Republic of Kazakhstan DIS – Deposit insurance system Fund, KDIF – Kazakhstan Deposit Insurance Fund IADI – International Association of Deposit Insurers 3 Message from the Chairman Dear Colleagues, Friends and Partners! The year 2018 has been very eventful and interesting for KDIF, and it can be described as a “make-or-break” year, when, against the backdrop of simultaneously forced liquidation of several banks, the gaps in the current operational procedures for working with depositors and, at the same time, the opportunities for improving the Fund’s activities have become visible.