ORIX JREIT Announces the Acquisitions of 4 More Properties and the Issuance of Additional Investment Units

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Environmental and Social Report Year Ended March 31, 2002

Environmental and Social Report Year Ended March 31, 2002 2001 2002-10-2000 Printed in Japan Contents Vision Nissan: Enriching people’s lives 2 Vision & Mission Mission Corporate Profile Nissan provides unique and innovative automotive products and services that deliver superior measurable values to all stakeholders* in alliance with Renault. 4 Messages From Management *Our stakeholders include customers, shareholders, employees, dealers, suppliers, as well as the communities where we work and operate. 1 Environmental Management 6 Nissan’s Environmental Philosophy and Policies Guiding Principles 7 Assessment of the Environmental Impacts SUCCESS of the Vehicles and Business Activities Seeking Profitable Growth Unique and Innovative: “Bold and Thoughtful” 7 Approach to Sustainability Customer-Focused and Environmental Friendly 8 Environmental Management System Cross-Functional and Global Earnings and Profit Driven 10 Environmental Management Program Speed 13 Environmental Accounting Stretch 14 Environmental Risk Management 14 Environmental Education Corporate Profile (As of end of March 2002) NISSAN MOTOR CO., LTD. 15 Environmental Communication Established :December 26, 1933 Headquarters :2 Takaracho, Kanagawa-ku, Yokohama-shi, Kanagawa-ken 220-8623 2 Environmental Performance Head Office :6-17-1 Ginza, Chuo-ku, Tokyo 104-8023 Tel: +81-3-3545-5523 16 Product Development Paid-in Capital :604,556 million yen Number of Employees :Consolidated 125,099 (Unconsolidated 30,365 ) Manufacturing 24 Consolidated Subsidiaries:297 companies 30 Sales -

Corporate Mentors

GLOBIS University - Corporate Mentors Japanese Corporate Mentors AEON Co., Ltd. Japan Innovation Network Ricoh Company, Ltd. ASAHI MUTUAL LIFE INSURANCE CO. Japan Pallet Rental Corporation Sakurajyuji Co., Ltd. ASICS Corporation JTEKT CORPORATION SATO HOLDINGS CORPORATION BELLSYSTEM24, Inc. KAWADA INDUSTRIES, INC. Seino Holdings Co., Ltd. CAINZ CORPORATION Kouyuu K.K. SEPTENI HOLDINGS CO.,LTD. CCC PHOTO LIFE LAB Lawson, Inc. SHINKO DENSHI CO., LTD. Coca-Cola Bottlers Japan Inc. LIKE. Inc. Shizen Energy Inc. CyberAgent, Inc. LIXIL Corporation SoftBank Corp. Eisai Co., Ltd. MOBCAST HOLDINGS INC. Sony Corporation en World Japan K.K. Mynavi Corporation STANLEY ELECTRIC CO., LTD. Foster Electric Company, Limited NAGASE BROTHERS INC. Sumitomo Mitsui Banking Corporation GREE, Inc. NH Foods Ltd. Takashimaya Company, Limited Hitachi Automotive Systems, Ltd. NIKON-ESSILOR Co., Ltd Takeda Pharmaceutical Company Limited. Hitachi Metals, Ltd. NISSAN MOTOR CO., LTD. Tatsuno Corporation Hitachi Systems, Ltd. Oji Management Office Inc. Terilogy Co., Ltd. Hoshino Resorts Omron Corporation TOYOTA TSUSHO CORPORATION INVAST SECURITIES CO., LTD ORGANO CORPORATION Toshiba Corporation Isetan Mitsukoshi Holdings Ltd. ORIX Corporation Tsuneishi Holdings Corporation. istyle Inc. PARCO CO., LTD USHIO INC. Foreign Affiliated Corporate MentorsPersol Career Co., Ltd. Yokogawa Electric Corporation Abbott Vascular Japan Co., Ltd. Emerson Japan, Ltd. Neovia Logistics Services, LLC. AgroFresh Solutions Ernst & Young ShinNihon LLC Novartis Pharma K.K. Aon Benfield Japan, Ltd. Etsy Japan Pfizer AQUA Co., Ltd. Frost & Sullivan Japan K.K. Philip Morris Japan Limited ARDIAN JAPAN Co., Ltd GE Japan Corporation PwC Japan Tax Assurant Japan Genpact Japan K.K. Quintiles Transnational Japan K.K. Bayer Holding Ltd. Hewlett-Packard Japan Ltd. Richemont Japan Limited BMW Group Japan HP Japan Inc. -

Itraxx Japan Series 35 Final Membership List March 2021

iTraxx Japan Series 35 Final Membership List March 2021 Copyright © 2021 IHS Markit Ltd T180614 iTraxx Japan Series 35 Final Membership List 1 iTraxx Japan Series 35 Final Membership List...........................................3 2 iTraxx Japan Series 35 Final vs. Series 34................................................ 5 3 Further information .....................................................................................6 Copyright © 2021 IHS Markit Ltd | 2 T180614 iTraxx Japan Series 35 Final Membership List 1 iTraxx Japan Series 35 Final Membership List IHS Markit Ticker IHS Markit Long Name ACOM ACOM CO., LTD. JUSCO AEON CO., LTD. ANAHOL ANA HOLDINGS INC. FUJITS FUJITSU LIMITED HITACH HITACHI, LTD. HNDA HONDA MOTOR CO., LTD. CITOH ITOCHU CORPORATION JAPTOB JAPAN TOBACCO INC. JFEHLD JFE HOLDINGS, INC. KAWHI KAWASAKI HEAVY INDUSTRIES, LTD. KAWKIS KAWASAKI KISEN KAISHA, LTD. KINTGRO KINTETSU GROUP HOLDINGS CO., LTD. KOBSTL KOBE STEEL, LTD. KOMATS KOMATSU LTD. MARUB MARUBENI CORPORATION MITCO MITSUBISHI CORPORATION MITHI MITSUBISHI HEAVY INDUSTRIES, LTD. MITSCO MITSUI & CO., LTD. MITTOA MITSUI CHEMICALS, INC. MITSOL MITSUI O.S.K. LINES, LTD. NECORP NEC CORPORATION NPG-NPI NIPPON PAPER INDUSTRIES CO.,LTD. NIPPSTAA NIPPON STEEL CORPORATION NIPYU NIPPON YUSEN KABUSHIKI KAISHA NSANY NISSAN MOTOR CO., LTD. OJIHOL OJI HOLDINGS CORPORATION ORIX ORIX CORPORATION PC PANASONIC CORPORATION RAKUTE RAKUTEN, INC. RICOH RICOH COMPANY, LTD. SHIMIZ SHIMIZU CORPORATION SOFTGRO SOFTBANK GROUP CORP. SNE SONY CORPORATION Copyright © 2021 IHS Markit Ltd | 3 T180614 iTraxx Japan Series 35 Final Membership List SUMICH SUMITOMO CHEMICAL COMPANY, LIMITED SUMI SUMITOMO CORPORATION SUMIRD SUMITOMO REALTY & DEVELOPMENT CO., LTD. TFARMA TAKEDA PHARMACEUTICAL COMPANY LIMITED TOKYOEL TOKYO ELECTRIC POWER COMPANY HOLDINGS, INCORPORATED TOSH TOSHIBA CORPORATION TOYOTA TOYOTA MOTOR CORPORATION Copyright © 2021 IHS Markit Ltd | 4 T180614 iTraxx Japan Series 35 Final Membership List 2 iTraxx Japan Series 35 Final vs. -

The Demonstra#On of Smart City and Expansion to the Urban Disaster

1 The demonstraon of smart city and expansion to the urban disaster recovery promo-on area in Japan Toshiba corporaon Community Solu-on Div. Yoshimasa Kudo 2 Contents ! " Japanese Smart City Demonstraon ! " Toshiba’s success story - Miyako island smart grid system - Yokohama smart city project ! " Concept of Toshiba’s smart city ! " Urban disaster recovery area in Japan 3 Contents ! " Japanese Smart City Demonstraon ! " Toshiba’s success story - Miyako island smart grid system - Yokohama smart city project ! " Concept of Toshiba’s smart city ! " Urban disaster recovery area in Japan 4 Roadmap of smart city project 2009 2010 2011 2012 2013 2014 2015 - Miyako island smart grid project Energy stabilization Demand response project Effects & evaluaon of large PV/ many PV Distribution network system of next generations Energy management of Realiza<on of electric and thermal control smart city Energy conservaon project (BEMS/HEMS) Demonstration Smart EV project of basic technology (EV charging) New Mexico smart grid project (Overseas project) & others Demonstration The four-location smart city operational experiments (Japanese project) & others of smart city Business model project Earthquake (DR, Aggregator) 5 Contents ! " Japanese Smart City Demonstraon ! " Toshiba’s success story - Miyako island smart grid system - Yokohama smart city project ! " Concept of Toshiba’s smart city ! " Urban disaster recovery area in Japan 6 Miyako island smart grid system 7 Major smart city project in Japan 4 areas were selected as the smart city of first pilot -

Lazard Japanese Strategic Equity Fund Monthly Commentary

Lazard Japanese Strategic Equity Fund AUG Commentary 2021 Market Overview Markets were on the weak side for the rst few weeks of the month due to concerns that rapidly increasing delta variant cases around the world would side-track the current global economic recovery following pandemic period lows. However, the market made a strong recovery in the last week-and-a-half, with the TOPIX Total Return index nishing the month up a solid 3.2% in yen terms. Tokyo managed to host a reasonably successful Olympics and Japan even produced a strong showing in the medal count, particularly in gold medals. Portfolio Review During the month, the portfolio underperformed the TOPIX Total Return Index which returned 3.2% in yen terms. Being underweight and stock selection in consumer discretionary, and stock selection in the materials and utilities sectors were top contributors to performance. Being underweight and stock selection in health care, stock selection in communication services, and being underweight and stock selection in information technology sectors were negative. During the month, the top positive contributors to relative performance included: • Nippon Steel, Japan’s largest steel manufacturer, was strong after reporting better-than-expected rst-quarter earnings and raising its full-year guidance. • Mitsui O.S.K.Lines, a leading shipping company, continued to rise due to stronger-than-expected earnings and a better-than- expected dividend increase. • Makita, a leading global manufacturer of power tools, raised full-year guidance as its rst-quarter saw continued strong demand globally. • Dai-ichi Life Holdings, a leading life insurance company, rose as the yield on 10-year U.S. -

LF Ruffer Japanese Fund

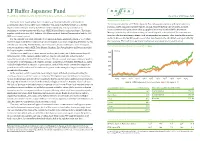

LF Ruffer Japanese Fund Providing capital growth by investing in a portfolio of Japanese equities December 2020 Issue 124 Investment objective During the three month period from 1 October to 31 December the price of the fund’s O accumulation shares increased by 12.0% while the FTSE Japan Total Return Index on a sterling The investment objective of LF Ruffer Japanese Fund is to provide capital growth by investing in a adjusted basis and in yen went up by 8.8% and 12.3% respectively. The top contributors to portfolio of predominantly Japanese equities, though Japanese fixed income securities and fixed performance over the quarter were M3, Sony, ORIX, Murata Manufacturing and Sumco. The largest income securities and equities from other geographical areas may be utilised if the Investment negative contributors were NEC, Rakuten, JCR Pharmaceutical, Santen Pharmaceutical and the JPY/ Manager believes they will assist in meeting the overall objective of the sub fund. The fund may also GBP forex forward contract. invest in collective investment schemes, cash, money market instruments, other transferable securities For the calendar year 2020, the fund’s O accumulation shares generated a return of 31.5% while and derivatives and forward transactions and other investments to the extent that each is permitted by the FTSE Japan Total Return returned 11.5% in sterling and 8.9% in yen. Regarding attribution for the the regulations. There will be no particular emphasis on any industrial or economic sector. calendar year 2020, M3, Daiichi Sankyo, Lifenet Insurance, Fujitsu and Keyence were the biggest Performance since launch on 14 May 2009 positive contributors while ORIX, Tokio Marine, Mandom, East Japan Railway and Recruit provided the largest negative contributions. -

LF Ruffer Japanese Fund

LF Ruffer Japanese Fund Providing capital growth by investing in a portfolio of Japanese equities March 2021 Issue 125 Investment objective During the three month period from 1 January to 31 March, the price of the fund’s O accumulation shares increased by 1.8%, while the FTSE Japan Total Return Index on a sterling adjusted basis and in The investment objective of LF Ruffer Japanese Fund is to provide capital growth by investing in a portfolio of predominantly Japanese equities, though Japanese fixed income securities and fixed yen went up by 1.5% and 9.3% respectively. The top contributors to performance over the quarter were income securities and equities from other geographical areas may be utilised if the Investment ORIX, Rakuten, Sony, NEC and Fuji Electric. The largest negative contributors were Lifenet, Keyence, M3, Daiichi Sankyo and Hoya. For the last twelve month period, the fund’s O accumulation shares Manager believes they will assist in meeting the overall objective of the sub fund. The fund may also invest in collective investment schemes, cash, money market instruments, other transferable securities generated a return of 42.7%, while the FTSE Japan Total Return returned 26.3% in sterling and 43.8% in yen. and derivatives and forward transactions and other investments to the extent that each is permitted by The Japanese stock market continued to rebound in the new year. Whilst Japan is lagging behind the regulations. There will be no particular emphasis on any industrial or economic sector. developed market peers in its vaccine rollout, the general direction of travel remains positive. -

Whither the Keiretsu, Japan's Business Networks? How Were They Structured? What Did They Do? Why Are They Gone?

UC Berkeley Working Paper Series Title Whither the Keiretsu, Japan's Business Networks? How Were They Structured? What Did They Do? Why Are They Gone? Permalink https://escholarship.org/uc/item/00m7d34g Authors Lincoln, James R. Shimotani, Masahiro Publication Date 2009-09-24 eScholarship.org Powered by the California Digital Library University of California WHITHER THE KEIRETSU, JAPAN’S BUSINESS NETWORKS? How were they structured? What did they do? Why are they gone? James R. Lincoln Walter A. Haas School of Business University of California, Berkeley Berkeley, CA 94720 USA ([email protected]) Masahiro Shimotani Faculty of Economics Fukui Prefectural University Fukui City, Japan ([email protected]) 1 INTRODUCTION The title of this volume and the papers that fill it concern business “groups,” a term suggesting an identifiable collection of actors (here, firms) within a clear-cut boundary. The Japanese keiretsu have been described in similar terms, yet compared to business groups in other countries the postwar keiretsu warrant the “group” label least. The prewar progenitor of the keiretsu, the zaibatsu, however, could fairly be described as groups, and, in their relatively sharp boundaries, hierarchical structure, family control, and close ties to the state were structurally similar to business groups elsewhere in the world. With the break-up by the U. S. Occupation of the largest member firms, the purging of their executives, and the outlawing of the holding company structure that held them together, the zaibatsu were transformed into quite different business entities, what we and other literature call “network forms” of organization (Podolny and Page, 1998; Miyajima, 1994). -

Presentation 6

Yokohama Smart City Project (Project cost: 13 billion USD) (Coordination between Yokohama City, 34 businesses, and 15 projects) Development of community‐based energy management covering a large area of existing urban districts and its feasibility project Installed/target (between FYs 2010 and 2014) HEMS 4,200 cases PV panels 37 MW, electrical vehicles 2,300 units Residential complexes Condominium equipped with HEMS (JX Nippoin Oil & Energy, Batteries for demand/supply control Battery SCADA equipped with HEMS (Tokyo Mitsui Fudosan Residential and Toshiba) (Toshiba, Hitachi, Meidensha and NEC) (Toshiba and TEPCO) Homes with HEMS Gas, (Panasonic) NTT‐F and NTT Docomo) Condominium with HEMS Customer batteries (Sony (Daikyo Astage) Energy Devices and Sharp) Homes with HEMS (Mitsui Data exchange system Fudosan Residential and Battery SCADA (Hitachi and Toshiba) Toshiba) FEMS (Meidensha and HEMS CEMS (Toshiba and Sumitomo Electric Recharging stations (JX Nippoin Oil & Energy Accenture) Industries) and Tokyo Institute of Technology) CARWINGS Data Center FEMS (Nissan Motor Corporation) CEMS Integrated BEMS (Toshiba) Smart BEMS (Toshiba and Taisei Corporation) EV Smart BEMS (JGC Corporation Chargeable and Dischargeable EVs (Nissan Motor BEMS for commercial buildings and JGC Information Systems Corporation, Hitachi, ORIX and (Toshiba, Marubeni, Mitsubishi Company) ORIX Auto Corporation) Estate and Smart BEMS (Meidensha Mitsui Fudosan) Smart BEMS (Shimizu and NEC) BEMS Corporation) 1 City to City Collaboration Country Bilateral Cooperation Japan JICA,JBIC,ADB,WB, etc Collaboration with aid and international agencies City City to City Collaboration Yokohama Technical Cooperation in Urban Development Private Sectors B to B and Academic Private And Academies Collaboration Sectors and Academies Support in Urban Development through PPP PPP dialogue to provide urban solutions 2 Goal 6. -

The Declaration of Startup Friendly Kansai

The Declaration of Startup Friendly Kansai 関西ベンチャーフレンドリー宣言 Under the Kansai Startup Backing Initiative, we aim to make the Kansai region a highly innovative area full of creativity and fully open to the world. To this end, now that a startup ecosystem is emerging in the Kansai region, we hereby announce that all supporting companies are quite positive in: inheriting a dynamic corporate culture typified by a unique way of thinking as well as a “Just try it” culture, both of which we have long fostered; and staying close beside next-generation entrepreneurs striving hard to launch new businesses, thereby providing them with necessary support. August 6, 2018 [Our Overview] (Dear startups) Given that the Kansai region has historically produced many entrepreneurs, we believe that the region has the potential ability to produce and raise entrepreneurs in modern society. In recent years especially, business enterprises, local governments, universities, etc. have taken a growing interest in nurturing startup companies, thereby intensifying support activities for startup companies. However, these efforts have only led to the region being dotted with startup companies that are not integrated into a single combined system of startup companies and start-up corporations. Among others, increased efforts for open innovation would be required from large companies and startup companies. To enable the Kansai region to achieve further growth, it is vital to break the status quo to revitalize Kansai’s startup ecosystem. This has prompted us to announce the Kansai Startup Backing Initiative, aimed at deepening cooperation between existing companies and new startups. Asked about big hurdles faced in opening up a business, many startup companies cited their being turned away at the door due to lack of past trade performance when they approached existing companies, as well as business- building and development of marketing networks, technical support, management of funds, etc. -

By Changing Our Earnings Structure We Will Create a More Robust Business

02 Daiwa Securities Group Integrated Report 2019 Message from the CEO By changing our earnings structure we will create a more robust business structure and, placing the SDGs in the foundation of management, aim to be an integrated securities group that is society’s first choice. Seiji Nakata President and CEO Daiwa Securities Group Inc. In a difficult business environment, steady execution of initiatives adopted in the Medium-Term Management Plan In FY2018, the market environment deteriorated particularly in the second half, but we recognize that economic growth, which had continued for 10 years since the global financial crisis, peaked at the beginning of 2018. In addition to the feeling that domestic business conditions had come full circle, there was an increasing sense of uncertainty about the direction of global business conditions brought about by the outbreak and widening of U.S.-China trade friction, and thus the securities markets, and the Japanese market in particular, lost momentum. As a result, activities related to securities transactions, especially for individual customers, slowed down significantly, and the Group was unable to escape from the impact. The Daiwa Securities Group reported consolidated net operating revenues of ¥441.2 billion, a decrease of 12.7% over the previous fiscal year, ordinary income of ¥83.1 billion (down 46.6%), and profit attributable to owners of parent of ¥63.8 billion, a decrease of 42.3% over the previous fiscal year, punishing results in what was the first year of the Medium-Term Management Plan (the Plan). With regard to shareholder returns, from FY2018 the dividend payout ratio has been increased from around 40% to 50% or higher. -

Stoxx True Exposure™ Japan 25% Index

STOXX TRUE EXPOSURE™ JAPAN 25% INDEX Components1 Company Supersector Country Weight (%) Toyota Motor Corp. Automobiles & Parts Japan 2.10 Softbank Group Corp. Telecommunications Japan 1.90 KDDI Corp. Telecommunications Japan 1.74 Nippon Telegraph & Telephone C Telecommunications Japan 1.53 Keyence Corp. Industrial Goods & Services Japan 1.51 RECRUIT HOLDINGS Industrial Goods & Services Japan 1.46 Daiichi Sankyo Co. Ltd. Health Care Japan 1.39 Oriental Land Co. Ltd. Travel & Leisure Japan 1.25 Central Japan Railway Co. Travel & Leisure Japan 1.20 Sony Corp. Personal & Household Goods Japan 1.15 NTT DoCoMo Inc. Telecommunications Japan 1.15 Itochu Corp. Industrial Goods & Services Japan 1.15 Mitsubishi UFJ Financial Group Banks Japan 1.08 Sumitomo Mitsui Financial Grou Banks Japan 1.05 Fast Retailing Co. Ltd. Retail Japan 0.99 East Japan Railway Co. Travel & Leisure Japan 0.94 Kao Corp. Personal & Household Goods Japan 0.89 Chugai Pharmaceutical Co. Ltd. Health Care Japan 0.85 Mitsubishi Estate Co. Ltd. Real Estate Japan 0.84 M3 Health Care Japan 0.82 Aeon Co. Ltd. Retail Japan 0.80 Tokio Marine Holdings Inc. Insurance Japan 0.80 Mitsubishi Corp. Industrial Goods & Services Japan 0.76 Mizuho Financial Group Inc. Banks Japan 0.76 Secom Co. Ltd. Industrial Goods & Services Japan 0.75 SOFTBANK Telecommunications Japan 0.73 Nitori Co. Ltd. Retail Japan 0.73 Mitsui Fudosan Co. Ltd. Real Estate Japan 0.72 Shiseido Co. Ltd. Personal & Household Goods Japan 0.71 Daiwa House Industry Co. Ltd. Personal & Household Goods Japan 0.71 Fujitsu Ltd. Technology Japan 0.69 Z HOLDINGS Technology Japan 0.67 Mitsui & Co.