Role of Postal Savings in Financial Inclusion

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

List of Lacs with Local Body Segments (PDF

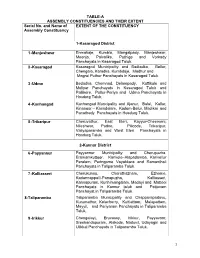

TABLE-A ASSEMBLY CONSTITUENCIES AND THEIR EXTENT Serial No. and Name of EXTENT OF THE CONSTITUENCY Assembly Constituency 1-Kasaragod District 1 -Manjeshwar Enmakaje, Kumbla, Mangalpady, Manjeshwar, Meenja, Paivalike, Puthige and Vorkady Panchayats in Kasaragod Taluk. 2 -Kasaragod Kasaragod Municipality and Badiadka, Bellur, Chengala, Karadka, Kumbdaje, Madhur and Mogral Puthur Panchayats in Kasaragod Taluk. 3 -Udma Bedadka, Chemnad, Delampady, Kuttikole and Muliyar Panchayats in Kasaragod Taluk and Pallikere, Pullur-Periya and Udma Panchayats in Hosdurg Taluk. 4 -Kanhangad Kanhangad Muncipality and Ajanur, Balal, Kallar, Kinanoor – Karindalam, Kodom-Belur, Madikai and Panathady Panchayats in Hosdurg Taluk. 5 -Trikaripur Cheruvathur, East Eleri, Kayyur-Cheemeni, Nileshwar, Padne, Pilicode, Trikaripur, Valiyaparamba and West Eleri Panchayats in Hosdurg Taluk. 2-Kannur District 6 -Payyannur Payyannur Municipality and Cherupuzha, Eramamkuttoor, Kankole–Alapadamba, Karivellur Peralam, Peringome Vayakkara and Ramanthali Panchayats in Taliparamba Taluk. 7 -Kalliasseri Cherukunnu, Cheruthazham, Ezhome, Kadannappalli-Panapuzha, Kalliasseri, Kannapuram, Kunhimangalam, Madayi and Mattool Panchayats in Kannur taluk and Pattuvam Panchayat in Taliparamba Taluk. 8-Taliparamba Taliparamba Municipality and Chapparapadavu, Kurumathur, Kolacherry, Kuttiattoor, Malapattam, Mayyil, and Pariyaram Panchayats in Taliparamba Taluk. 9 -Irikkur Chengalayi, Eruvassy, Irikkur, Payyavoor, Sreekandapuram, Alakode, Naduvil, Udayagiri and Ulikkal Panchayats in Taliparamba -

World Bank Document

KERALA RURAL WATER SUPPLY AND SANITATION PROJECT (WORLD BANK ASSISTED – PROJECT ID-P121774) DEPARTMENT OF WATER RESOURCES GOVERNMENT OF KERALA Public Disclosure Authorized PHASE-II Public Disclosure Authorized Public Disclosure Authorized MONTHLY PROGRESS REPORT FOR THE PERIOD ENDING February’16,STATUS AS ON 28.02.16 Public Disclosure Authorized Kerala Rural Water Supply & Sanitation Agency 3rd Floor P.T.C Towers, S.S Kovil Road, Thampanoor Thiruvananthapuram 0 CONTENTS Page No 1. Thumbnail Sketch of the Project - - - - - - - 2 2. Executive Summary - - - - - - - 3 3. Project Status – Summery table - - - - - - 5 4. Implementation Progress- - - - - - - - 6 Water Supply - - - - - - - - 7 Sanitation - - - - - - - - 11 5. Status of key agreed actions of previous mission - - - - 13 6. Status of PDO indictors - - - - - - - - 15 1 KERALA RURAL WATER SUPPLY AND SANITATION AGENCY Project Details Name of the Project : Kerala Rural Water Supply and Sanitation Project (Jalanidhi-II) Project ID : P121774 Project Implementation : Period: January 2012 -June 2017 Area of Operation : Batch I- 12 Districts of Kerala (Alapuzha and Ernakulam districts not included) Batch II- Onwards Nine selected districts of Kerala Kasargode, Kannur, Wayanad, Kozhikode, Malappuram, Palakkad, Thrissur,Kottayam and Idukki Project Finance Data Project Outlay : US $ 241.2 Million (Rs.1022.3 Cr.) Source : Total Amount Total Project Cost : US $ Million Indian Rupees World Bank US $ 155.3 Million 658.22 Cr. 64% Beneficiary Groups : US $ 11.5 Million 48.74 Cr. 5% GramaPanchayath -

Janakeeya Hotel Updation 02.11.2020

LUNCH LUNCH Parcel LUNCH Home Sponsored by No. of By Unit Delivery Sl. No. District Name of the LSGD (CDS) Kitchen Name Kitchen Place Rural / Urban No Of Members Initiative LSGI's units (November (November 2 (November 2 2nd) nd) nd) 1 Alappuzha Ala JANATHA Near CSI church, Kodukulanji Rural 5 Janakeeya Hotel 2 Alappuzha Alappuzha North Ruchikoottu Janakiya Bhakshanasala Coir Machine Manufacturing Company Urban 4 Janakeeya Hotel 3 Alappuzha Alappuzha South Samrudhi janakeeya bhakshanashala Pazhaveedu Urban 5 Janakeeya Hotel 4 Alappuzha Ambalppuzha North Swaruma Neerkkunnam Rural 10 Janakeeya Hotel 5 Alappuzha Ambalappuzha South Patheyam Amayida Rural 5 Janakeeya Hotel 6 Alappuzha Arattupuzha Hanna catering unit JMS hall,arattupuzha Rural 6 Janakeeya Hotel 7 Alappuzha Arookutty Ruchi Kombanamuri Rural 5 Janakeeya Hotel 8 Alappuzha Aroor Navaruchi Vyasa charitable trust Rural 5 Janakeeya Hotel 9 Alappuzha Bharanikavu Sasneham Janakeeya Hotel Koyickal chantha Rural 5 Janakeeya Hotel 10 Alappuzha Budhanoor sampoorna mooshari parampil building Rural 5 Janakeeya Hotel 11 Alappuzha Chambakulam Jyothis Near party office Rural 4 Janakeeya Hotel 12 Alappuzha Chenganoor SRAMADANAM chengannur market building complex Urban 5 Janakeeya Hotel 13 Alappuzha Chennam Pallippuram Friends Chennam pallipuram panchayath Rural 3 Janakeeya Hotel 14 Alappuzha Chennithala Bhakshana sree canteen Chennithala Town Rural 4 Janakeeya Hotel 15 Alappuzha Cheppad Sreebhadra catering unit Choondupalaka junction Rural 3 Janakeeya Hotel 16 Alappuzha Cheriyanad DARSANA Near -

New Media List 2012

Thrissur Press Club KUWJ Thrissur Unit Round North, Thrissur, Kerala. Phone: 0487 2335576, 2330224 Web: www.thrissurpressclub.in, [email protected], [email protected] Phone Mobile Phone Mobile Chandrika 2424988/Fax Subin 9847813847 Sudheesh Kumar 9446114105 Unni Kottakkal 9846061196 Diamond Paul. M 9995343362 Jeejo John 9495568560 Fahad Muneer 9946104864 Deccan Chronicle Nidhin. T. R 9495538200 Malayalam News 2446227 Anoop. K. Venu 9747430375 Rajesh Padiyath 9447233084 Deepika&Rashtra 2421596/3012222-6 Mangalam 2445472 Franco Louis 2212895 9745108206 Jinesh Poonath 9847505078 Paul Mathew 9388820426 K. Krishnakumar 9895183730 M. V. Vasanth 9846880537 Renjith Balan 9446058435 Ajil Narayanan 8606646391 Gasoongi 9349599179 Mathrubhumi 2423284 - 2442007-Fax E. Salahudeen 9447407070 Deshabhimani 2325180, 2386881-4/ 2386887-Fax Babu.M.B 94472 61711 K. Remathambai 9446141772 G. Rajesh Kumar 9388886600 K. Prabath 9447087755 Dhanya. T. S 9539483354 C.A. Premachandran 9846033667 Maneesh Chemmenchery 9447356673 K. K. Rudrakshan 9447186883 J. Philip 9847189502 Sidhikul Akber 8907225143 General 2421439 Unnikrishnan Koodoth 9387311012 MetroVartha 3049890,3049888 Indian Express 2424778 Siraj 2446446 / 2426251-Fax Gopika Varrier 8547356930 Sudheer. V. U 9809577322 Noushad 9847986336 Janmabhoomi 3105221 Neelambaran. T. S 9446503527 Suprabatham 2446786 Shaji. M. A 9961607348 Shihab 8589984472 Jimon. K. Paul 9961482083 C.B. Pradeepkumar 9846068657 Janayugam 2429705 Swathanthramandapam 2384127 Surendran Kuthanoor 9446450440 A. Muhammad 2384558 8547384127 Risiya 8547841299 Rajan Elavathoor 9745561241 Kiran. G. B 9605766737 Telagraph 2420680 Kerala Kaumudi/Flash 2386651,61-2386681-Fax Sanoop. K 9495358757 Rajeevan.K.P 9447161027 Riyas Annamanada 9447524885 Bhasi Pangil 9946108601 Krishnakumar Amalath 9446994528 The Hindu 2321411-2320711- Fax Raphi M Devasi 9946108349 Mini Muringatheri 9446320452 Najeeb. K. K 9447020787 Kerala Bhooshanam Vani Vincent 9746651098 The Times Of India T. -

Service Electoral Roll - 2017

SERVICE ELECTORAL ROLL - 2017 DIST_NO & NAME: 7 Thrissur AC_NO & NAME:- 64 64-MANALUR ECI CODE NAME SEX TYPE HOUSE ADDRESS REGIMENTAL ADDRESS 428860 ABEJITH P ASHOK M M PERUMBULLY Army MEG Records KANIPAYYUR THALAPPILY MEG Records, PIN - 900 493, c/o 56 APO CHONDAL 680502 1303281 PRASEENA RAJIN F W ITHIKKATE HOUSE INDIAN AIR FORCE DPS VADANAPPILLY DPS AIR HQ NEW DELHI THRITHALLUR 1357201 SAJEESH ES M M Army ASC Records (South) VENKITANGU CHAVAKKAO Agaram Post, Bangalore-07 PADOOR 688524 1366632 NEELESH P B M M Army ASC Records (South) MULLASSERY CHAVAKKAD Agaram Post, Bangalore-07 MULLASHERY 1368108 SALEESH K V M M NIL Army NIL ASC Records (South) MANALUR THRISSUR Agaram Post, Bangalore-07 MANALUR 0 1320301 RATHEESH B M M Army Armd Corps Records BRAHMAKULAM CHAVAKKAD Armd Corps Records, PIN - 900 476, c/o 56 A BRAHMAKULAM 1244670 SANTHOSH P A M M Army Armd Corps Records ELAUALLY CHAUAKKAD Armd Corps Records, PIN - 900 476, c/o 56 A 680511 263251 FAISAL RJ M M RAYAMARAKKAR Army PAVARATTY AMC Records ELAVALLY CHAVAKKAD AMC Records, PIN - 900 450, c/o 56 APO ELAVALLY NORTH 680511 7410 REGHU K S M M KALIYAM VEETTIL Army Arty Records ERANELLUR KUNNAMKULAM Arty Records, PIN - 908 802, c/o 56 APO ERANELLUR 43876 ASWIN TP M M THOTTUNGAL Army Arty Records ELAVALLY CHAVAKKAD Arty Records, PIN - 908 802, c/o 56 APO PUVATHOOR 680508 119885 REJISH VR M M Vilakka Thala Army Arty Records Elavally Chavakkad Arty Records, PIN - 908 802, c/o 56 APO Chittattukara 680511 718096 M M CHEAVU HOUSE Army Records The MADRAS Regt PARAKKAD THRISSUR Records The MADRAS -

Accused Persons Arrested in Thrissur City District from 14.06.2020To20.06.2020

Accused Persons arrested in Thrissur City district from 14.06.2020to20.06.2020 Name of Name of the Name of the Place at Date & Arresting Court at Sl. Name of the Age & Cr. No & Sec Police father of Address of Accused which Time of Officer, which No. Accused Sex of Law Station Accused Arrested Arrest Rank & accused Designation produced 1 2 3 4 5 6 7 8 9 10 11 579/2020 U/s 188, 269 IPC & 118(e) of PUTHENKADU JAYAPRADE KP Act & Sec. PAZHAYA COLONY , 20-06-2020 EP K G, SI OF JINEESH 27, 4(2)(d) r/w 5 NNUR BAILED BY 1 VASU ELANAD DESOM, ELANAD at 20:05 POLICE VASU Male of Kerala (Thrissur POLICE PAZHAYANNUR Hrs PAZHAYAN Epidemic City) VILLAGE NUR PS Diseases Ordinance 2020 579/2020 U/s 188, 269 IPC MALAMBATHY & 118(e) of JAYAPRADE HOUSE, KP Act & Sec. PAZHAYA 20-06-2020 EP K G, SI OF RADHAKRI 20, THIRUMANI , 4(2)(d) r/w 5 NNUR BAILED BY 2 REJU ELANAD at 20:05 POLICE SHNAN Male ELANAD DESOM, of Kerala (Thrissur POLICE Hrs PAZHAYAN PAZHAYANNUR Epidemic City) NUR PS VILLAGE Diseases Ordinance 2020 579/2020 U/s 188, 269 IPC & 118(e) of THEKKINKADU JAYAPRADE KP Act & Sec. PAZHAYA SANEESH COLONY, 20-06-2020 EP K G, SI OF CHANDRA 31, 4(2)(d) r/w 5 NNUR BAILED BY 3 CHANDRA ELANAD DESOM, ELANAD at 20:05 POLICE N Male of Kerala (Thrissur POLICE N PAZHAYANNUR Hrs PAZHAYAN Epidemic City) VILLAGE NUR PS Diseases Ordinance 2020 677/2020 U/s 269 IPC & JAYACHAN 118(e) of KP DRAN.K.M, Act & Sec. -

Accused Persons Arrested in Thrissur City District from 15.07.2018 to 21.07.2018

Accused Persons arrested in Thrissur City district from 15.07.2018 to 21.07.2018 Name of Name of the Name of the Place at Date & Arresting Court at Sl. Name of the Age & Cr. No & Sec Police father of Address of Accused which Time of Officer, which No. Accused Sex of Law Station Accused Arrested Arrest Rank & accused Designation produced 1 2 3 4 5 6 7 8 9 10 11 SATHEESH NEDUPUZ MALAYATH 21-07-2018 KUMAR, SI PARAMESW 45, SAKTHAN 450/2018 U/s HA 1 SUNDARAN (H),OORAKKAD,K at 23:20 OF POLICE, ARRESTED ARAN NAIR Male NAGAR 151 CrPC (THRISSUR UNDUKKAD Hrs NEDUPUZH CITY) A PS SATHEESH NELLISSERY NEDUPUZ 21-07-2018 KUMAR, SI 39, (H),PANNITHADA SAKTHAN 450/2018 U/s HA 2 LINSAN WILSON at 23:20 OF POLICE, ARRESTED Male M,KUNNAMKULA NAGAR 151 CrPC (THRISSUR Hrs NEDUPUZH M CITY) A PS VAKAYIL HOUSE,PO SATHEESH NEDUPUZ NEDUPUZHA,PAN 21-07-2018 449/2018 U/s KUMAR, SI 33, KOORKKEN HA BAILED BY 3 SANDEEP VENU AMUKKU,NEAR at 22:00 279 IPC & 185 OF POLICE, Male CHERY (THRISSUR POLICE THRITHAMARASS Hrs MV ACT NEDUPUZH CITY) ERY A PS TEMBLE,THRISSUR PADINJARE ANTHOOR HOUSE, WADAKKA 21-07-2018 401/2018 U/s MURALEED RAMANKU 49, VITHANASSERY PUNNAMPA NCHERRY K C BAILED BY 4 at 20:20 118(a) of KP HARAN TTY NAIR Male DESOM, RAMBU (THRISSUR RATHEESH POLICE Hrs Act VALLANGY CITY) VILLAGE, PALAKKAD ANGADIPARAMBI GURUVAY L HOUSE 21-07-2018 520/2018 U/s 34, UR ANUDAS K, BAILED BY 5 SREEJESH KRISHNAN P.O.KAKKASSERY THAIKKAD at 20:00 279 IPC & 185 Male (THRISSUR SI OF PLOCE POLICE ELAVALLY Hrs MV ACT CITY) VILLAGE CHAKKENDAN 21-07-2018 TRAFFIC NANDAKU SUDHAKAR 41, MATHRUBH -

Lions Clubs International Club Membership Register Summary 132 130 4 10-2018 318 D 026687 2 0 0 0 2 4186 98 98 4 06-2018 318

LIONS CLUBS INTERNATIONAL CLUB MEMBERSHIP REGISTER SUMMARY THE CLUBS AND MEMBERSHIP FIGURES REFLECT CHANGES AS OF NOVEMBER 2018 MEMBERSHI P CHANGES CLUB CLUB LAST MMR FCL YR TOTAL IDENT CLUB NAME DIST NBR COUNTRY STATUS RPT DATE OB NEW RENST TRANS DROPS NETCG MEMBERS 4186 026687 CHALAKUDY INDIA 318 D 4 10-2018 130 2 0 0 0 2 132 4186 026693 KODUNGALLUR INDIA 318 D 4 06-2018 98 0 0 0 0 0 98 4186 026696 IRINJALAKUDA INDIA 318 D 4 11-2018 108 0 0 0 -8 -8 100 4186 026703 KUNNAMKULAM INDIA 318 D 4 10-2018 63 1 0 0 0 1 64 4186 026712 NILAMBUR INDIA 318 D 4 11-2018 42 0 0 0 0 0 42 4186 026713 OLLUR INDIA 318 D 4 09-2018 124 12 0 0 -6 6 130 4186 026715 PALGHAT INDIA 318 D 4 11-2018 86 0 0 0 -2 -2 84 4186 026720 PERINTALMANNA INDIA 318 D 4 10-2018 33 5 0 0 0 5 38 4186 026732 TIRUR INDIA 318 D 4 10-2018 22 11 0 0 -4 7 29 4186 026734 TRICHUR INDIA 318 D 4 11-2018 126 9 0 0 -3 6 132 4186 026739 VADAKKANCHERRY INDIA 318 D 4 10-2018 63 2 0 0 0 2 65 4186 029335 MALA INDIA 318 D 4 11-2018 64 1 0 0 0 1 65 4186 033286 TRIPRAYAR INDIA 318 D 4 11-2018 146 2 0 0 -1 1 147 4186 039659 VADAKKANCHRY MALABAR INDIA 318 D 4 08-2018 41 0 0 0 -2 -2 39 4186 040966 SHORNUR INDIA 318 D 4 10-2018 29 8 0 0 0 8 37 4186 041424 TRICHUR AYYANTHOLE INDIA 318 D 4 11-2018 91 5 0 0 0 5 96 4186 042625 MANNUTHY INDIA 318 D 4 11-2018 38 2 0 0 0 2 40 4186 042913 CHAVAKKAD INDIA 318 D 4 11-2018 28 0 0 0 -7 -7 21 4186 044147 KOZHINJAMPARA INDIA 318 D 4 11-2018 70 0 0 0 0 0 70 4186 046943 KODAKARA INDIA 318 D 4 09-2018 40 10 0 0 0 10 50 4186 047201 TRICHUR NEHRU NAGAR INDIA 318 D 7 11-2018 -

Accused Persons Arrested in Thrissur City District from 17.11.2019To23.11.2019

Accused Persons arrested in Thrissur City district from 17.11.2019to23.11.2019 Name of Name of the Name of the Place at Date & Arresting Court at Sl. Name of the Age & Cr. No & Sec Police father of Address of Accused which Time of Officer, which No. Accused Sex of Law Station Accused Arrested Arrest Rank & accused Designation produced 1 2 3 4 5 6 7 8 9 10 11 EDAKALATHUR HOUSE, Thrissur 23-11-2019 834/2019 U/s KURIAKKO 45, VAILATHUR West UMESH SI OF BAILED BY 1 XAVIAR OLARI at 21:55 279 IPC & 185 SE Male VILLAGE, (Thrissur PLOCE POLICE Hrs MV ACT NJAMANAMKAD, City) VADAKKEKKAD, 1291/2019 Thrissur THALIYATH 23-11-2019 VARGHEES 33, SAKTHAN U/s 15(c) r/w East BAILED BY 2 VIPIN HOUSE at 21:45 JOSEPH K T E Male MARKET 63 of Abkari (Thrissur POLICE PULLAZHY Hrs Act City) KIDANGUKARAN 1291/2019 Thrissur 23-11-2019 33, HOUSE EASTFORT SAKTHAN U/s 15(c) r/w East BAILED BY 3 DITO PAUL at 21:45 JOSEPH K T Male P O MARKET 63 of Abkari (Thrissur POLICE Hrs CHEMBUKAVU Act City) THARAYIL 23-11-2019 516/2019 U/s Pavaratty SHARAFUD 46, MULLASSER BAILED BY 4 HAMSA HOUSE, at 21:05 118(e) of KP (Thrissur SI REMIN EEN Male Y POLICE POOVATHUR Hrs Act City) 1290/2019 Thrissur THALADAN 23-11-2019 28, SAKTHAN U/s 15(c) r/w East BIBIN C V, SI BAILED BY 5 NIDHIN MOHANAN HOUSE at 21:45 Male MARKET 63 of Abkari (Thrissur OF POLICE POLICE CHIYYARAM Hrs Act City) 1290/2019 Thrissur CHIRIYANKANDA 23-11-2019 33, SAKTHAN U/s 15(c) r/w East BIBIN, SI OF BAILED BY 6 ELVIN THIMOTHI TH HOUSE at 21:45 Male MARKET 63 of Abkari (Thrissur POLICE POLICE CHEMBUKAVU Hrs Act City) -

Accused Persons Arrested in Thrissur City District from 22.03.2020To28.03.2020

Accused Persons arrested in Thrissur City district from 22.03.2020to28.03.2020 Name of Name of the Name of the Place at Date & Arresting Court at Sl. Name of the Age & Cr. No & Sec Police father of Address of Accused which Time of Officer, which No. Accused Sex of Law Station Accused Arrested Arrest Rank & accused Designation produced 1 2 3 4 5 6 7 8 9 10 11 144/2020 U/s Puzhangaraillath 28-03-2020 Guruvayur 20, 188 IPC & Fakrudheen BAILED BY 1 Al ameen Jamal house , elavally p.o, Kandanassery at 20:25 (Thrissur Male 118(e) of KP SI of police POLICE elavally villege Hrs City) Act 144/2020 U/s Puzhangaraillath 28-03-2020 Guruvayur 21, 188 IPC & Fakrudheen BAILED BY 2 Abbas Haneefa house, elavally po, Kandanassery at 20:25 (Thrissur Male 118(e) of KP SI of police POLICE elavally villege Hrs City) Act 144/2020 U/s Pulattveetil house, 28-03-2020 Guruvayur 24, 188 IPC & Fakrudheen BAILED BY 3 Shajeer Ali elavally po, elavally Kandanassery at 20:25 (Thrissur Male 118(e) of KP SI of police POLICE villege Hrs City) Act 143/2020 U/s Mekkanam 28-03-2020 Guruvayur 28, Kottapadi,sav 188 IPC & Fakrudheen BAILED BY 4 Shyam Sivan house,puthanpally( at 19:20 (Thrissur Male akotta 118(e) of KP SI of police POLICE p.o)iringapuram Hrs City) Act 143/2020 U/s Sreeshyalam, 28-03-2020 Guruvayur 26, Kottapadi,sav 188 IPC & Fakrudheen BAILED BY 5 Sonu Chandran puthanpally (po) at 19:20 (Thrissur Male akotta 118(e) of KP SI of police POLICE iringapuram Hrs City) Act CHERUTH 28-03-2020 35, Veluthedath house, Desamangala 126/2020 U/s URUTHI Si of police, BAILED -

Club Health Assessment MBR0087

Club Health Assessment for District 318 D through February 2020 Status Membership Reports Finance LCIF Current YTD YTD YTD YTD Member Avg. length Months Yrs. Since Months Donations Member Members Members Net Net Count 12 of service Since Last President Vice Since Last for current Club Club Charter Count Added Dropped Growth Growth% Months for dropped Last Officer Rotation President Activity Account Fiscal Number Name Date Ago members MMR *** Report Reported Report *** Balance Year **** Number of times If below If net loss If no report When Number Notes the If no report on status quo 15 is greater in 3 more than of officers that in 12 within last members than 20% months one year repeat do not have months two years appears appears appears in appears in terms an active appears in in brackets in red in red red red indicated Email red Clubs less than two years old 135051 Angadippuram 06/06/2018 Active 26 5 2 3 13.04% 20 2 1 3 $98.66 Exc Award (,06/30/19) 138578 Anthikad 06/18/2019 Active 24 4 0 4 20.00% 0 0 2 M,MC,SC 2 $100.07 140451 Calicut University 12/11/2019 Newly 21 21 0 21 100.00% 0 0 M N/R Chartered 136057 Elanad 08/01/2018 Active 34 1 0 1 3.03% 29 0 T,VP,SC 4 $101.48 Exc Award (,06/30/19) 136087 Elavally 08/07/2018 Active 36 0 0 0 0.00% 36 14 1 None P,S,T,M,VP 14 MC,SC Exc Award (,06/30/19) 136988 Guruvayur Lioness 12/14/2018 Cancelled(8*) 0 0 22 -22 -100.00% 22 1 2 None P,S,T,M,VP N/R 90+ Days MC,SC 137527 Guruvayur Players 06/17/2019 Active(1) 12 2 35 -33 -73.33% 0 0 2 S,T,M,MC,SC 4 136062 Karukaputhoor 08/07/2018 Active(1) 21 0 -

Thrissur District Office of the Department, Headed by Smt

DISTRICT SPATIAL PLAN THRISSUR DEPARTMENT OF TOWN AND COUNTRY PLANNING - GOVERNMENT OF KERALA January 2011 PREFACE Planning is a prerequisite for effective development. Development becomes comprehensive when growth centres are identified considering physical, social and economic variables of an area in an integrated manner. This indicates that planning of villages and towns are to be complementary. Second Administrative Reforms Commission (ARC) while interpreting the article 243 ZD of the Constitution of India states as follows. “This, in other words, means that the development needs of the rural and urban areas should be dealt with in an integrated manner and, therefore, the district plan, which is a plan for a large area consisting of villages and towns, should take into account such factors as ‘spatial planning’, sharing of ‘physical and natural resources’, integrated development of infrastructure’ and ‘environmental conservation’. All these are important, because the relationship between villages and towns is complementary. One needs the other. Many functions that the towns perform as seats of industry, trade and business and as providers of various services, including higher education, specialized health care services, communication etc have an impact on the development and welfare of rural people. Similarly, the orderly growth of the urban centre is dependent on the kind of organic linkage it establishes with its rural hinterland”. Therefore a move of harmonizing urban and rural centres of an area can be said as a move of planned urbanisation of the area. In this context, it is relevant to mention the 74th Amendment Act of the Constitution of India, which mandated the District Planning Committee to prepare a draft development plan for the district.