January Monthly Money Savers

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

PRIVACY NOTICE Privacy Notice

PRIVACY NOTICE Privacy Notice Page 1. Who we are 3 2. The information we process 3 3. How we obtain information 4 4. Your rights 5 Table A – Your Rights 5 5. Changes to the way we use your information 6 6. How we use and share your information with other NatWest group companies 6 7. Sharing with third parties 6 8. Transferring information overseas 7 9. Marketing information 7 10. Communications about your account 7 11. Credit reference and fraud prevention agencies 7 12. How long we keep your information 8 13. Security 9 Schedule A – Schedule of Purposes of Processing A. Contractual necessity 10 B. Legal obligation 10 C. Legitimate interests of the bank 11 02 Privacy Notice 1. Who we are 1.1. This privacy notice (the ‘Privacy Notice’) applies to all personal information processing activities carried on by the businesses of the *Royal Bank of Scotland International Limited (RBS International). *RBS International also trades as NatWest International, Isle of Man Bank and Coutts Crown Dependencies. 1.2. RBS International is a data controller in respect of personal information that we process in connection with our business (including the products and services that we provide). In this notice, references to ‘we’, ‘us’ or ‘our’ are references to RBS International. 1.3. The Royal Bank of Scotland International Limited trades in Jersey, Guernsey and the Isle of Man as Coutts Crown Dependencies. The Royal Bank of Scotland International Limited Registered Office: P.O. BOX 64, Royal Bank House, 71 Bath Street, St. Helier, Jersey JE4 8PJ. Tel 00 44 1534 282345. -

Cross-Border Financial Institutions in the EU: Analysis of Total Assets and Ultimate Ownership

Directorate-General for Internal Policies Directorate A - Economic and Scientific Policy Policy Department A.: Economic and Scientific Policy and Quality of Life Unit Cross-Border Financial Institutions in the EU: Analysis of Total Assets and Ultimate Ownership Briefing Note IP/A/ECON/NT/2008-10 PE 408.550 Only published in English. Author: Josina KAMERLING Policy Department Economy and Science DG Internal Policies European Parliament Rue Wiertz 60 - ATR 00L046 B-1047 Brussels Tel: +32 (0)2 283 27 86 Fax: +32(0)2 284 69 29 E-mail: [email protected] Arttu MAKIPAA Policy Department Economy and Science DG Internal Policies European Parliament Rue Wiertz 60 - ATR 00L042 B-1047 Brussels Tel: +32 (0)2 283 26 20 Fax: +32(0)2 284 69 29 E-mail: [email protected] Manuscript completed in August 2008. The opinions expressed in this document do not necessarily represent the official position of the European Parliament. Reproduction and translation for non-commercial purposes are authorised provided the source is acknowledged and the publisher is given prior notice and receives a copy. Rue Wiertz – B-1047 Bruxelles - 32/2.284.43.74 Fax: 32/2.284.68.05 Palais de l‘Europe – F-67000 Strasbourg - 33/3.88.17.25.56 Fax: 33/3.88.36.92.14 E-mail: [email protected] IP/A/ECON/NT/2008-10 PE 408.550 Table of Contents 1. The Data on Financial Institutions in EU27 ......................................................................1 2. Largest Financial Institutions in Europe (Tables 1-5) .......................................................2 -

2020 Annual Report Adaptation Makes Things Work

2020 Annual Report Adaptation makes things work GUERNSEY - JERSEY - ISLE OF MAN CEO’s Statement WELCOME If ever there was a year for business to adapt to changing circumstances, it was 2020. At a time when we needed to adapt to the rapidly changing environment, we still saw excellent growth in our lending volume and a continuation of very low levels of bad debt. So, despite the pandemic and all the difficulties it caused, I am delighted to record that we achieved a 9% increase in our lending volume. Annual Report 2020 1 CEO’s Statement Continued I would like to thank our dedicated and very loyal staff who have worked extremely hard to make this happen, especially since we had to make rapid provision for our local teams to work remotely. This report provides the highlights º We have continued to apply the same º With Grant Thornton’s continued º Both our Jersey and Isle of Man of our business for the calendar year strict lending criteria that we have oversight as our Auditors, there have operations are continuing to grow ending December 2020. As always, always used, to ensure the quality been no issues raised in any of their in line with expectations. With our we will provide a further update on of our lending. We will not at any quarterly reports, which serves retail partner networks expanding our performance for the fiscal year, point be looking to grow the size to demonstrate the security of the considerably, we have seen ending June 2021, at our annual of our lending activity by taking Loan Notes. -

Company Registered Number: 2304 the ROYAL BANK of SCOTLAND

Company Registered Number: 2304 THE ROYAL BANK OF SCOTLAND INTERNATIONAL LIMITED ANNUAL REPORT AND ACCOUNTS 31 December 2020 Contents Page Board of directors and secretary 1 Report of the directors 2 Statement of directors’ responsibilities 6 Independent auditor’s report to the members of the Royal Bank of Scotland International Limited 7 Income statement for the year ended 31 December 2020 10 Statement of comprehensive income for the year ended 31 December 2020 11 Balance sheet as at 31 December 2020 12 Statement of changes in equity for the year ended 31 December 2020 13 Cash flow statement for the year ended 31 December 2020 14 Accounting policies 15 Notes to the accounts 21 The Royal Bank of Scotland International Limited Annual Report and Accounts 2020 Board of directors and secretary Chairman John Philip Ward Brewster Executive directors Andrew Martin McLaughlin Chief Executive Officer Lynn Ann Cleary Chief Financial Officer Non-executive directors Louis Philip Chetwynd Taylor (resigned 31 October 2020) Stuart Porteous Bruce Mark Cannon Gregory John Branch Christine Hilary Ashton (appointed 14 September 2020) Company Secretary Rachael Emma Pocklington (resigned 1 September 2020) Andrew Nicholson (appointed 1 September 2020) Auditor Ernst & Young LLP Castle Street St Helier Jersey JE1 1EY Registered office and Head office Royal Bank House 71 Bath Street St Helier Jersey JE4 8PJ The Royal Bank of Scotland International Limited Registered in Jersey, Channel Islands No. 2304 1 The Royal Bank of Scotland International Limited Annual Report and Accounts 2020 Report of the directors Presentation of information Business review The directors of The Royal Bank of Scotland International The Bank’s purpose, which is aligned with NatWest Group, is Limited (the “Company”/“RBS International”/”RBSI”/the “Bank”) to champion potential, helping people, families and businesses present their annual report, together with the audited financial to thrive. -

The Royal Bank of Scotland Group Plc 27 April 2018 Ring Fenced Structure

The Royal Bank of Scotland Group plc 27 April 2018 Ring Fenced Structure - Director Changes The Royal Bank of Scotland Group plc (together with its subsidiaries "RBS") today announces changes to the composition of boards of Directors in connection with the Ring- Fencing Transfer Scheme (the "Scheme") under Part VII of the Financial Services and Markets Act 2000 which is expected to be implemented on 30 April 2018. Implementation of the Scheme will be a significant step towards the restructuring of RBS to comply with the UK ring-fencing legislation that requires the separation of essential banking services from investment banking services from 1 January 2019. As previously announced, under the Scheme, The Royal Bank of Scotland plc (RBS plc) will: transfer its UK retail & commercial banking business to Adam & Company PLC (Adam); transfer its covered bonds in issue and Mentor business to National Westminster Bank Plc (NatWest); and transfer branches and other properties to either NatWest or Adam. At the same time, RBS plc will be renamed “NatWest Markets Plc”, Adam will be renamed “The Royal Bank of Scotland plc” and assume banknote-issuing responsibility. After the Scheme and subsequent restructuring is completed in 2018, NatWest Holdings Limited will have direct ownership of The Royal Bank of Scotland plc (formerly Adam & Company plc), National Westminster Bank Plc and Ulster Bank Ireland DAC. NatWest Holdings Limited will have indirect ownership of Coutts & Company and Ulster Bank Limited. The non-ring-fenced entities will be NatWest Markets Plc (formerly RBS plc) that will continue to undertake RBS’s finance, risk management and trading activities; and The Royal Bank of Scotland International Limited (RBSI), along with Isle of Man Bank Limited, which will continue to serve the markets and customers it serves today. -

A Jurisdictional Guide to Opening a Foreign Bank Account

A Jurisdictional Guide to Opening a Foreign Bank Account As companies expand their operations into different jurisdictions, they will need to set up local bank accounts but how difficult is it? IR Global members explain all. IR Global Guide - Opening a Foreign Bank Account IR Global - The Future of Professional Services IR Global was founded in 2010 and has since grown to Businesses today require more than just a traditional lawyer become the largest practice area exclusive network of advi- or accountant. IR Global is at the forefront of this transition, sors in the world. This incredible success story has seen the with members providing strategic support and working network awarded Band 1 status by Chamber & Partners, fea- closely alongside management teams to help realise their tured in Legal 500 and in publications such as The Financial vision. We believe the archaic ‘professional service firm’ Times, Lawyer 360 and Practical Law, among many others. model is dying due to it being insular, expensive and slow. In IR Global, forward-thinking clients now have a credible The group’s founding philosophy is based on bringing the alternative, which is open, cost effective and flexible. best of the advisory community into a sharing economy; a system that is ethical, sustainable and provides significant added value to the client. Our Founding Philosophies Multi-Disciplinary Co-Operative Leadership We work alongside legal, accountancy, financial, corporate In contrast to authoritarian or directive leadership, our group finance, transaction support and business intelligence firms, puts teamwork and self-organisation in the centre. The group ensuring we can offer complete solutions tailored to the cli- has steering committees for 12 practice area and regional ent’s requirements. -

PAF Corporate Licence Holders - Listed Alphabetically PDF Created: 03 09 2020

PAF Licensing Centre PAF ® Corporate Licensees: PAF Corporate Licence Holders - Listed Alphabetically PDF created: 03 09 2020 Company Name. Corporate Licence Holder AGF Holdings UK Ltd Allianz Management Services Ltd Allianz Business Services Allianz Management Services Ltd Allianz Cornhill Engineering Inspection Services Limited Allianz Management Services Ltd Allianz Cornhill Equity Investments Limited Allianz Management Services Ltd Allianz Cornhill Holdings Limited Allianz Management Services Ltd Allianz Cornhill Insurance Company Pension Fund Trustees Allianz Management Services Ltd Limited Allianz Cornhill Insurance Plc Allianz Management Services Ltd Allianz Cornhill Management Services Limited Allianz Management Services Ltd Allianz Engineering Inspection Services Limited Allianz Management Services Ltd Allianz Equity Investments Ltd Allianz Management Services Ltd Allianz Holdings Allianz Management Services Ltd Allianz Insurance Plc Allianz Management Services Ltd Allianz International Limited Allianz Management Services Ltd Allianz Pension Fund Trustees Limited Allianz Management Services Ltd Allianz Properties Limited Allianz Management Services Ltd Allianz UK Ltd Allianz Management Services Ltd British Reserve Insurance Company Limited Allianz Management Services Ltd Buddies Enterprises Limited Allianz Management Services Ltd Domestic Insurance Services Limited Allianz Management Services Ltd Fairmead Distribution Services Limited Allianz Management Services Ltd Fairmead Insurance Limited Allianz Management Services Ltd Fairmead -

RBS Resolution Plan

Logo RBS Public Section RBS Group pic Resolution Plan Pursuant to 12 C.F.R. Parts 217 & 381 and RBS Citizens, N.A. Resolution Plan Pursuant to 12 C.F.R. 360 July 1, 2013 Table of Contents III IntroductionRBS Group pageand RBS 1 Americas page 2 II.CII.BII.A MaterialGlobalPrincipal Operations Supervisory Officers of of RBS AuthoritiesRBS Group Group plcpage page page 4 2 5 IIIII.EII.D RBSCNA SummaryResolution IDI of PlanningPlan Financial and Corporate RBS Information, Citizens Governance, CapitalResolution and Structure PlanMajor page Funding and 10 Processes Sources pagepage 67 III.CIII.BIII.A CoreMaterialSummary Business Entities of Financial Lines page page 11Information, 12 Capital and Major Funding Sources page 13 III.FIII.EIII.D ForeignMembershipDerivative Operations and in HedgingMaterial page Payment,Activities 17 pageClearing 16 and Settlement Systems page 17 III.IIII.HIII.G RBS PrincipalMaterial Citizens' SupervisoryOfficers Resolution page Authorities 17 Planning page Corporate 17 Governance, Structure and III.KIII.JProcesses MaterialHigh-Level page Management Description 18 Information of RBS Citizens' Systems Resolution page 19 Strategy page 20 IV.BIV.AIV Markets CoreMaterial Business & EntitiesInternational Lines page page Banking22 23 Americas page 22 IV.EIV.DIV.C MembershipsDerivativeSummary ofand Financial in Hedging Material Information, Activities Payment, page CapitalClearing 24 and and Major Settlement Funding Systems Sources page page 24 24 IV.HIV.GIV.F ForeignPrincipalMaterial Operations SupervisoryOfficers page page Authorities 25 25 page 25 IV.JIV.I M&IBA'sMaterial ManagementResolution Planning Information Corporate Systems Governance, page 26 Structure and Processes page 25 StrategyIV.K High-Level page 26 Description of Markets & International Banking Americas' Resolution Chapter 1. -

Ring-Fencing Overview July 2020

Ring-fencing overview July 2020 Version 2 natwest.com/markets Contents What is ring-fencing What is ring-fencing? 2 UK ring-fencing legislation took effect on 1 January 2019. Our ring-fencing compliant structure 4 During 2018 RBS Group (now NatWest Group) reorganised its group legal entity structure and business model to operate with a ring-fenced Our offering 5 bank sub-group structure and multiple entities outside the ring-fence. In December 2016 we changed our brand from RBS Corporate & Institutional Banking (CIB) to NatWest Markets and on 30 April 2018, we renamed RBS plc to NatWest Markets Plc. NatWest Markets offers NatWest Group’s financing, risk management and trading solutions and operates outside of the ring-fence. Any transactions that you have with NatWest Markets Plc are therefore with a non ring-fenced bank. If you have questions or need more information on the changes that we made to meet ring-fencing legislation, you can email us at [email protected]. More information can also be found in the following Regulatory News Service (RNS) announcements, issued at the time: • RBS Announces Proposed Future Ring-Fenced Legal Entity Structure and Investment in Customer Brands • Ring-fencing Legal Entity Transfers • The Royal Bank of Scotland Group plc – Ring-Fencing Transfer Scheme Effective • Capital reduction: notice of petition and notice of completion • The Royal Bank of Scotland Group plc - update on ring-fencing plans: 31 July 2018 and 13 August 2018 • The Royal Bank of Scotland Group plc - changes to the UK intraGroup -

Press Release

PRESS RELEASE Under Embargo 0001: 31 JANUARY 2015 DL 020 3217 8441/ 8251/ 8316/ 8368 [email protected] @paymnow £26 MILLION ALREADY TRANSFERRED VIA PAYM IN 2014 • Nearly two million people now registered to receive payments through Paym • 85% of people who have used Paym would recommend it • Almost half of all Paym payments are sent on Friday, Saturday or Sunday More than £26million1 has been sent using Paym, the simple and secure way to pay using just a mobile number, since its launch on 29th April 2014. The research found that 85% of people who have used Paym would recommend it to others, and the benefits of being able to pay friends and family securely on a mobile phone are widely acknowledged amongst consumers. Nearly two million people2 have now registered with their participating bank or building society to receive payments into their bank account using just their mobile number. The figures are revealed in the first Paym statistical update, which includes a survey of consumer attitudes to mobile payments. Two thirds (66%) of the UK population are aware of mobile payments, with more than half (52%) of those with knowledge of mobile payments aware of Paym. Use of Paym peaks over the weekend. A snapshot of data from November 2014 reveals Friday, Saturday and Sunday account for 49% of Paym payments, with the three hours between 6-9pm being the most popular time for using the service. So far, Paym is most commonly used to pay back a close friend (21%), followed by a partner (19%), parents (19%), or child (13%). -

How to Get Access to Cash and Banking Services in a Changing World

How to get access to cash and banking services in a changing world Produced by the Community Access to Cash Project, 2021 CONTENTS WELCOME Contents Welcome Welcome . 3 The way many people bank and pay for things has changed in the 21st century . Nowadays many people use telephone and online banking, How to get cash from your bank account . 5 and there are fewer branches . New ways to pay – such as contactless cards – mean people carry less cash . Did you know that in 2018 only How to pay cash and cheques into your account . 8 one payment out of every three was in cash – that’s half what it was in 2008 . And Covid-19 has meant cash is being used less and less . Checking your balance . 10 But many people in the UK still rely on cash, and branch-based Making payments . 11 banking . As recently as 2018, one in six people in the UK said they couldn’t survive without cash . Opening a bank account . .. 13 In many communities, it has become harder to get hold of cash and How to arrange for someone to do your banking for you . 14 harder to use it too – as growing numbers of shops and restaurants have started only accepting payment by card . Getting support to set up online banking . 16 About us Online tools to help you make the most of your money . 18 The Community Access to Cash Project was set up to find solutions Banking with the Post Office . 21 for communities across the UK that are no longer having their banking and payment needs met . -

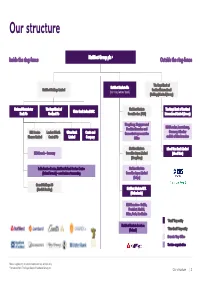

Our Structure

Our structure Inside the ring -fence NatWest Group plc 1 Outside the ring -fence The Royal Bank of NatWest Markets Plc NatWest Holdings Limited Scotland International (non ring-fenced bank) (Holdings) Limited (Jersey) National Westminster The Royal Bank of NatWest Markets The Royal Bank of Scotland Ulster Bank Ireland DAC Bank Plc Scotland Plc Securities Inc. (USA) International Limited (Jersey) Hong Kong, Singapore and Frankfurt Branches and RBSI London, Luxembourg, RBS Invoice Lombard North Ulster Bank Coutts and Connecticut representative Guernsey, Gibraltar Finance Limited Central Plc Limited Company Office and Isle of Man branches NatWest Markets Isle of Man Bank Limited EEA Branch – Germany Securities Japan Limited (Isle of Man) (Hong Kong) India Service Centre, NatWest Poland Service Centre NatWest Markets (Poland branch) – non -business transacting Securities Japan Limited (Tokyo) Strand Holdings AB (Nordisk Renting) NatWest Markets N.V. (Netherlands) EEA Branches – Dublin, Frankfurt, Madrid, Milan, Paris, Stockholm “Bank” key entity NatWest Markets Services (Poland) “Non -Bank” key entity Branch / Rep Office Service organisation Notes: Legal entity structure represents key entities only. 1 Renamed from The Royal Bank of Scotland Group plc. Our structure │ 1 This structure has been prepared for information purposes only and does not constitute a full Group structure chart or an analysis of all potentially material issues and is subject to change at any time without prior notice. NatWest Markets does not undertake to update you of such changes. NatWest Markets Plc is registered in Scotland No. 90312 with limited liability. Registered Office: 36 St Andrew Square, Edinburgh EH2 2YB. Authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority.