SKYSCRAPER INDEX Bubble Building

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Why We Worry Top-Down and Invest Bottom-Up

“Remember that there is nothing stable in human affairs; therefore avoid undue elation in prosperity or undue depression in adversity.” —Socrates, 399 B.C. “In the economy, an act, a habit, an institution, a law, gives birth not only to an effect, but to a series of effects. Of these effects, the first only is immediate; it manifests itself simultaneously with its cause— it is seen. The others unfold in succession— they are not seen: it is well for us if they are foreseen.” —Frederic Bastiat, That Which Is Seen, That Which Is Unseen , 1850 “Res nolunt diu male administrari . Things refuse to be mismanaged long. Though no checks to a new evil appear, the checks exist, and will appear.” —Ralph Waldo Emerson, 1844 “Men, it has been well said, think in herds; it will be seen that they go mad in herds, while they only recover their senses slowly, and one by one.”—Charles Mackay, Extraordinary Popular Delusions and the Madness of Crowds , 1912 2014 ANNUAL REPORT _______________________________________________________ For further information, contact Chris Ridenour at (574) 293-2077 or via email at [email protected] 1 Why We Worry Top-Down and Invest Bottom-Up “A rising tide lifts all ships” is bandied about in our profession like a shuttlecock at a garden party badminton game. It seems that whenever an analogy is that simple and quaint, there must be a catch. And there is: the waves. In their endless repetition they mask the invisible but prodigious ebb and flood tides. The daily headlines are almost always about the waves, particularly, even if unnoticed, when the tide is rising. -

Apartment Buildings in New Haven, 1890-1930

The Creation of Urban Homes: Apartment Buildings in New Haven, 1890-1930 Emily Liu For Professor Robert Ellickson Urban Legal History Fall 2006 I. Introduction ............................................................................................................................. 1 II. Defining and finding apartments ............................................................................................ 4 A. Terminology: “Apartments” ............................................................................................... 4 B. Methodology ....................................................................................................................... 9 III. Demand ............................................................................................................................. 11 A. Population: rise and fall .................................................................................................... 11 B. Small-scale alternatives to apartments .............................................................................. 14 C. Low-end alternatives to apartments: tenements ................................................................ 17 D. Student demand: the effect of Yale ................................................................................... 18 E. Streetcars ........................................................................................................................... 21 IV. Cultural acceptance and resistance .................................................................................. -

5 the Da Vinci Code Dan Brown

The Da Vinci Code By: Dan Brown ISBN: 0767905342 See detail of this book on Amazon.com Book served by AMAZON NOIR (www.amazon-noir.com) project by: PAOLO CIRIO paolocirio.net UBERMORGEN.COM ubermorgen.com ALESSANDRO LUDOVICO neural.it Page 1 CONTENTS Preface to the Paperback Edition vii Introduction xi PART I THE GREAT WAVES OF AMERICAN WEALTH ONE The Eighteenth and Nineteenth Centuries: From Privateersmen to Robber Barons TWO Serious Money: The Three Twentieth-Century Wealth Explosions THREE Millennial Plutographics: American Fortunes 3 47 and Misfortunes at the Turn of the Century zoART II THE ORIGINS, EVOLUTIONS, AND ENGINES OF WEALTH: Government, Global Leadership, and Technology FOUR The World Is Our Oyster: The Transformation of Leading World Economic Powers 171 FIVE Friends in High Places: Government, Political Influence, and Wealth 201 six Technology and the Uncertain Foundations of Anglo-American Wealth 249 0 ix Page 2 Page 3 CHAPTER ONE THE EIGHTEENTH AND NINETEENTH CENTURIES: FROM PRIVATEERSMEN TO ROBBER BARONS The people who own the country ought to govern it. John Jay, first chief justice of the United States, 1787 Many of our rich men have not been content with equal protection and equal benefits , but have besought us to make them richer by act of Congress. -Andrew Jackson, veto of Second Bank charter extension, 1832 Corruption dominates the ballot-box, the Legislatures, the Congress and touches even the ermine of the bench. The fruits of the toil of millions are boldly stolen to build up colossal fortunes for a few, unprecedented in the history of mankind; and the possessors of these, in turn, despise the Republic and endanger liberty. -

DOCUMENT RESUME INSTITUTION Borough of Manhattan Community

DOCUMENT RESUME ED 423 559 CS 509 903 TITLE New Media. INSTITUTION Borough of Manhattan Community Coll., New York, NY. Inst. for Business Trends Analysis. PUB DATE 1998-00-00 NOTE 65p. PUB TYPE Collected Works Serials (022) JOURNAL CIT Downtown Business Quarterly; vl n3 Sum 1998 EDRS PRICE MF01/PC03 Plus Postage. DESCRIPTORS *Community Colleges; Curriculum Development; *Employment Patterns; Employment Statistics; Mass Media; *Technological Advancement; Technology Education; Two Year Colleges; *World Wide Web IDENTIFIERS City University of New York Manhattan Comm Coll; *New Media; *New York (New York) ABSTRACT This theme issue explores lower Manhattan's burgeoning "New Media" industry, a growing source of jobs in lower Manhattan. The first article, "New Media Manpower Issues" (Rodney Alexander), addresses manpower, training, and workforce demands faced by new media companies in New York City. The second article, "Case Study: Hiring Dynamid" (John Montanez), examines the experience of new employees at a new media company that creates corporate websites. The third article, "New Media @ BMCC" (Alice Cohen, Alberto Errera, and MeteKok), describes the Borough of Manhattan Community College's developing new media curriculum, and includes an interview with John Gilbert, Executive Vice President and Chief Operating Officer of Rudin Management, the company that transformed 55 Broad Street into the New York Information Technology Center. The fourth section "Downtown Data" (Xenia Von Lilien-Waldau) presents data in seven categories: employment, services and utilities, construction, transportation, real estate, and hotels and tourism. The fifth article, "Streetscape" (Anne Eliet) examines Newspaper Row, where Joseph Pulitzer and William Randolph HearsL ran their empires. (RS) ******************************************************************************** Reproductions supplied by EDRS are the best that can be made from the original document. -

Isabel Amiano

isabel amiano www.isabelamiano.com.ar ARCHITECTURE NEW YORK New York in fact has three separately recognizable skylines: Midtown Manhattan, Downtown Manhattan (also known as Lower Manhattan), and Downtown Brooklyn. The largest of these skylines is in Midtown, which is the largest central business district in the world, and also home to such notable buildings as the Empire State Building, the Chrysler Building, and Rockefeller Center. The Downtown skyline comprises the third largest central business district in the United States (after Midtown and Chicago's Loop), and was once characterized by the presence of the Twin Towers of the World Trade Center. Today it is undergoing the rapid reconstruction of Lower Manhattan, and will include the new One World Trade Center Freedom Tower, which will rise to a height of 1776 ft. when completed in 2010. The Downtown skyline will also be getting notable additions soon from such architects as Santiago Calatrava and Frank Gehry. Also, Goldman Sachs is building a 225 meter (750 feet) tall, 43 floor building across the street from the World Trade Center site. New York City has a long history of tall buildings. It has been home to 10 buildings that have held the world's tallest fully inhabitable building title at some point in history, although half have since been demolished. The first building to bring the world's tallest title to New York was the New York World Building, in 1890. Later, New York City was home to the world's tallest building for 75 continuous years, starting with the Park Row Building in 1899 and ending with 1 World Trade Center upon completion of the Sears Tower in 1974. -

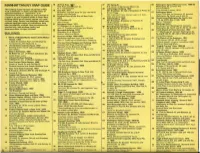

Manhattan N.V. Map Guide 18

18 38 Park Row. 113 37 101 Spring St. 56 Washington Square Memorial Arch. 1889·92 MANHATTAN N.V. MAP GUIDE Park Row and B kman St. N. E. corner of Spring and Mercer Sts. Washington Sq. at Fifth A ve. N. Y. Starkweather Stanford White The buildings listed represent ali periods of Nim 38 Little Singer Building. 1907 19 City Hall. 1811 561 Broadway. W side of Broadway at Prince St. First erected in wood, 1876. York architecture. In many casesthe notion of Broadway and Park Row (in City Hall Perk} 57 Washington Mews significant building or "monument" is an Ernest Flagg Mangin and McComb From Fifth Ave. to University PIobetween unfortunate format to adhere to, and a portion of Not a cast iron front. Cur.tain wall is of steel, 20 Criminal Court of the City of New York. Washington Sq. North and E. 8th St. a street or an area of severatblocks is listed. Many glass,and terra cotta. 1872 39 Cable Building. 1894 58 Housesalong Washington Sq. North, Nos. 'buildings which are of historic interest on/y have '52 Chambers St. 1-13. ea. )831. Nos. 21-26.1830 not been listed. Certain new buildings, which have 621 Broadway. Broadway at Houston Sto John Kellum (N.W. corner], Martin Thompson replaced significant works of architecture, have 59 Macdougal Alley been purposefully omitted. Also commissions for 21 Surrogates Court. 1911 McKim, Mead and White 31 Chembers St. at Centre St. Cu/-de-sac from Macdouga/ St. between interiorsonly, such as shops, banks, and 40 Bayard-Condict Building. -

WEST STREET BUILDING, 90 West Street and 140 Cedar Street (Aka 87-95 West Street, 21-25 Albany Street, and 136-140 Cedar Street), Borough of Manhattan

Landmarks Preservation Commission May 19, 1998, Designation List 293 LP-1984 WEST STREET BUILDING, 90 West Street and 140 Cedar Street (aka 87-95 West Street, 21-25 Albany Street, and 136-140 Cedar Street), Borough of Manhattan. Built 1905-07; architect, Cass Gilbert. Landmark Site: Borough of Manhattan Tax Map Block 56, Lot 4. On March 10, 1998, the Landmarks Preservation Commission held a public hearing on the proposed designation as a Landmark of the West Street Building, and the proposed designation of the related Landmark Site (Item No . 1) . The hearing had been duly advertised in accordance with the provisions of law. Five persons, including a representative of the owner and representatives of the New York Landmarks Conservancy and the Municipal Art Society, spoke in favor of designation. There were no speakers in opposition to designation. A statement supporting designation has been received from Council Member Kathryn Freed. Summary The West Street Building, one of three major Downtown office buildings designed by Cass Gilbert, was built in 1905-07 for the West Street Improvement Corporation, a partnership headed by Howard Carroll. Carroll was president of two asphalt companies and vice-president of his father-in-law's Starin Transportation Company, which had major river shipping interests. Although today separated from the Hudson River by the landfill supporting Battery Park City, the site of the West Street Building originally had a highly visible location facing the waterfront along West Street. Carroll conceived of his project as a first-class skyscraper office building for the shipping and railroad industries. In addition to Carroll's companies, the building soon filled up with tenants including major companies in the transportation industry. -

The Foundations of the Valuation of Insurance Liabilities

The foundations of the valuation of insurance liabilities Philipp Keller 14 April 2016 Audit. Tax. Consulting. Financial Advisory. Content • The importance and complexity of valuation • The basics of valuation • Valuation and risk • Market consistent valuation • The importance of consistency of market consistency • Financial repression and valuation under pressure • Hold-to-maturity • Conclusions and outlook 2 The foundations of the valuation of insurance liabilities The importance and complexity of valuation 3 The foundations of the valuation of insurance liabilities Valuation Making or breaking companies and nations Greece: Creative accounting and valuation and swaps allowed Greece to satisfy the Maastricht requirements for entering the EUR zone. Hungary: To satisfy the Maastricht requirements, Hungary forced private pension-holders to transfer their pensions to the public pension fund. Hungary then used this pension money to plug government debts. Of USD 15bn initially in 2011, less than 1 million remained at 2013. This approach worked because the public pension fund does not have to value its liabilities on an economic basis. Ireland: The Irish government issued a blanket state guarantee to Irish banks for 2 years for all retail and corporate accounts. Ireland then nationalized Anglo Irish and Anglo Irish Bank. The total bailout cost was 40% of GDP. US public pension debt: US public pension debt is underestimated by about USD 3.4 tn due to a valuation standard that grossly overestimates the expected future return on pension funds’ asset. (FT, 11 April 2016) European Life insurers: European life insurers used an amortized cost approach for the valuation of their life insurance liability, which allowed them to sell long-term guarantee products. -

New York: the Ultimate Skyscraper Laboratory

Tall Building Locations in New York City Tall Buildings in Numbers The recent skyscraper boom has been characterized by an increase in luxury residential construction, an increase in slenderness aspect ratios, and substantial construction in new locations away from Lower and Midtown Manhattan, in areas once considered “fringe,” such as Brooklyn, Queens and Jersey City. The research below examines the function and location of tall New York: The Ultimate Skyscraper Laboratory buildings over 100 meters, recently completed or under construction,3 in the New York City region4, with supertall buildings represented by larger dots. When construction of 111 West 3 4 57th Street (438 m) completes A timeline of skyscraper completions in New York uncannily Study of 100 m+ buildings in the New York City regionQueens – 20 in 2018, it will challenge the (2%) resembles the boom and bust cycles of the United States in QueensJersey – 20 City – 21 VIA 57 WEST (142 m), planned boundaries of engineering with Jersey City – 21 (2%) (3%) Bronx – 10 for completion in 2015, is a a width-to-height ratio of almost Upon completion in the 20th and early 21st centuries. The most active year was Hotel – 52 Other – 8 (3%) Brooklyn – 33 Bronx – 10 (1%) housing project designed as a 1:25, using 15,000 PSI concrete 2015, 432 Park Avenue hybrid between the European (426 m) will become the Hotel – 52 (6%)Other – 8 (1%) Brooklyn – 33 (4%) (1%) and a pendulum damper to 1931, when the fi nal excesses of the Roaring ‘20s were thrown perimeter block and a world’s tallest residential (6%) (1%) (4%) achieve this feat. -

Office Markets & Public Policy

REAL ESTATE ISSUES Office Markets REAL ESTATE ISSUES & Public Policy This is the first book that looks at how offices and office markets in cities have Also available in the series changed over the last 30 years. It analyses the long-term trends and processes Markets & Institutions in Real within office markets, and the interaction with the spatial economy and the Estate & Construction planning of cities. It draws on examples around the world, and looking forward Ball Policy Public & Markets Office at the future consequences of information communication technologies and the 9781405110990 sustainability agenda, it sets out the challenges that now face investors. The Right to Buy: Analysis & Evaluation of a Housing Policy The traditional business centres of cities are losing their dominance to the brash Jones & Murie new centres of the 1980s and 1990s, as the concept of the central business 9781405131971 district becomes more diffuse. Edge cities, business space and office parks have Housing Markets & Planning Policy entered the vocabulary as offices have also decentralised. The nature and pace of Jones & Watkins changes to office markets set within evolving spatial structures of cities has had 9781405175203 implications for tenants and led to a demand for shorter leases. The consequence is a rethink of the traditional perception of property investment as a secure long Challenges of the Housing Economy: An International Perspective term investment, and this is reflected in reduced investment holding periods by Jones, White & Dunse financial institutions. 9780470672334 Office Markets & Public Policy analyses these processes and policy issues from an Towers of Capital: Office Markets & international perspective and covers: International Financial Services Lizieri l A descriptive and theoretical base encompassing an historical context, 9781405156721 a review of the fundamentals of the demand for and supply of the office Office Markets market and offices as an investment. -

Mensa E-Mail 3/04

Volume 13 • Number 3 March 2004 SOUTHERN CONNECTICUT MENSA CHRONICLE If you or someone you know would like to be a speaker at our monthly dinner, please contact Activities Coordinator Nancy O’Neil at [email protected] or 203-791-1668. The dinner is held the third Saturday of the month. AMERICAN MENSA LTD. NEEDS YOUR HELP to correct a technical inconsistency in its Certificate of Incorporation. The Board of Directors of AML wants to change the Articles of Incorporation to permit elections and referenda to be conducted by mail. In order to do so, they need your proxy vote. So please take time NOW to give your proxy by visiting http://proxy.us.mensa.org. ARCHIVED COPIES OF THE CHRONICLE going back a year to July 2002 are available on the Internet at http://www.44ellen.com/mensa. You can download the latest e-mail version of the Chronicle there, as well as previous issues. All issues are in read-only Adobe Acrobat format so there is no chance of viruses accompanying the files. TABLE OF CONTENTS 2 Schedule of Southern Connecticut Mensa Events Schedule of Connecticut and Western Mass Mensa Events Happy Hours & Get Together’s 4 Regional Gatherings 5From The Vice Chairman 6 On the 20th Century 8 Kick Irrational Comic 9Word Origins 10 Poetry Corner 11 Noted and Quoted 12 Editing Ugly English 13 Good Wine Cheap 14 Puzzles and Questions Ruminations 15 Chapter Notes Member Advertisements Change of Address Form 16 List of Officers 1 Volume 13 • Number 3 MENSA CHRONICLE March 2004 SCHEDULE OF CHAPTER EVENTS FOR MARCH CONNECTICUT AND WESTERN MASSACHUSETTS Friday, March 12, 7:00 MENSA CHAPTER UPCOMING EVENTS Southern Connecticut and Connecticut/Western This is not a complete listing WE - Weekly Event, Massachusetts Joint Dinner ME - Monthly Event, YE - Yearly Event This is the new date for this monthly dinner at CT & W. -

Seattle Times Building Complex—Printing Plant 1930-31; Addition, 1947

Seattle Times Building Complex—Printing Plant 1930-31; Addition, 1947 1120 John Street 1986200525 see attached page D.T. Denny’s 5th Add. 110 7-12 Onni Group Vacant 300 - 550 Robson Street, Vancouver, BC V6B 2B7 The Blethen Corporation (C. B. Blethen) (The Seattle Times) Printing plant and offices Robert C. Reamer (Metropolitan Building Corporation) , William F. Fey, (Metro- politan Building Corporation) Teufel & Carlson Seattle Times Building Complex—Printing Plant Landmark Nomination, October 2014 LEGAL DESCRIPTION: LOTS 7 THROUGH 12 IN BLOCK 110, D.T. DENNY’S FIFTH ADDITION TO NORTH SEAT- TLE, AS PER PLAT RECORDED IN VOLUME 1 OF PLATS, PAGE 202, RECORDS OF KING COUNTY; AND TOGETHER WITH THOSE PORTIONS OF THE DONATION CLAIM OF D.T. DENNY AND LOUIS DENNY, HIS WIFE, AND GOVERNMENT LOT 7 IN THE SOUTH- EAST CORNER OF SECTION 30, TOWNSHIP 25, RANGE 4 EAST, W. M., LYING WEST- ERLY OF FAIRVIEW AVENUE NORTH, AS CONDEMNED IN KING COUNTY SUPERIOR COURT CAUSE NO. 204496, AS PROVIDE BY ORDINANCE NO. 51975, AND DESCRIBED AS THAT PORTION LYING SOUTHERLY OF THOMAS STREET AS CONVEYED BY DEED RECORDED UNDER RECORDING NO. 2103211, NORTHERLY OF JOHN STREET, AND EASTERLY OF THE ALLEY IN SAID BLOCK 110; AND TOGETHER WITH THE VACATED ALLEY IN BLOCK 110 OF SAID PLAT OF D.T. DENNY’S FIFTH ADDITION, VACATED UNDER SEATTLE ORDINANCE NO. 89750; SITUATED IN CITY OF SEATTLE, COUNTY OF KING, STATE OF WASHINGTON. Evan Lewis, ONNI GROUP 300 - 550 Robson Street, Vancouver, BC V6B 2B7 T: (604) 602-7711, [email protected] Seattle Times Building Complex-Printing Plant Landmark Nomination Report 1120 John Street, Seattle, WA October 2014 Prepared by: The Johnson Partnership 1212 NE 65th Street Seattle, WA 98115-6724 206-523-1618, www.tjp.us Seattle Times Building Complex—Printing Plant Landmark Nomination Report October 2014, page i TABLE OF CONTENTS 1.