China's Healthcare System Uncovered

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

China Multi Asset Income Fund - 3-Year Class USD Fund Volatility

Principal China Multi Asset Income Fund - 3-year Class USD Fund Volatility 31 August 2021 10.83Low Lipper Analytics 15 Aug 2021 Fund Objective Fund Performance The Fund aims to provide income and 60% moderate capital growth through investments in one CIS, which invests 50% primarily in a diversified portfolio of securities related to China. 40% Currency: ISIN Code: 30% USD MYU1002GD004 20% Bloomberg Ticker: CIMCMUS MK 10% 0% Fund Information 7 7 8 8 8 8 8 8 9 9 9 9 9 9 0 0 0 0 0 0 1 1 1 1 1 -1 -1 -1 -1 -1 -1 -1 -1 -1 -1 -1 -1 -1 -1 -2 -2 -2 -2 -2 -2 -2 -2 -2 -2 -2 t c b r n g t c b r n l p v n r y l p v n b r n g c e e p u u c e e p u Ju e o a a a Ju e o a e p u u - 10% O D F A J A O D F A J S N J M M S N J F A J A Domicile Malaysia - 20% Base Currency US Dollar (USD) Fund Inception 3 July 2017 Fund Benchmark Benchmark The Fund adheres to the Past performance does not guarantee future results. Asset allocation and diversification do not ensure a profit or protect against a loss. benchmark of the Target Fund for performance Cumulative Performance (%) comparison. The Since YTD 1 Month 3 Months 6 Months 1-Year 3-Year 5-Year Inception benchmark of the Target Fund -8.70 -0.21 -9.33 -10.95 -1.42 17.94 N/A 19.79 Fund is 50% MSCI China Net + 50% Markit Benchmark/Target Return -4.47 0.22 -7.23 -7.95 2.29 22.31 N/A 33.59 iBoxx Asia Local Bond Index China Offshore for Calendar Year Returns (%) 2020 2019 2018 2017 2016 2015 comparison purpose. -

Bitter Pill to Swallow: China’S Flagrant Trade in Leopard Bone Products

Wildlife A Bitter Pill to Swallow: China’s flagrant trade in leopard bone products April 2020 Wildlife ©EIAimage We would like to thank ABOUT EIA EIA UK 62-63 Upper Street, Ximporae.EIA would Utlike aut to fugitisthank restithe ut atia We investigate and campaign against London N1 0NY UK nobitfollowing ium foralici their bla conesupport: consequam Network environmental crime and abuse. T: +44 (0) 20 7354 7960 cusfor Social aci oditaquates Change, Ernest dolorem Kleinwort volla Our undercover investigations E: [email protected] vendam,Charitable consequo Trust and molor The sinRufford net expose transnational wildlife crime, eia-international.org fugitatur,Foundation. qui int que nihic tem with a focus on elephants and asped quei oditaquates dolorem tigers, and forest crimes such as volla vendam, conseqci oditaquates EIA US illegal logging and deforestation for dolorem volla vendam, consequo PO Box 53343 cash crops like palm oil. We work to molor sin net fugitatur, qui int que Washington DC 20009 USA safeguard global marine ecosystems nihic tem asped quei oditaquates T: +1 202 483 6621 by addressing the threats posed dolorem volla vendam, consuo molor E: [email protected] by plastic pollution, bycatch sin net fugitatur, qui int que nihic eia-global.org and commercial exploitation of tem asped que n nes ape verrovid whales, dolphins and porpoises. maximolorera doles magni tet ea Environmental Investigation Agency Finally, we reduce the impact of voluptas enis as de evel ipsam (UK) Ltd. Company Number: 7752350 climate change by campaigning dolendit, voluptam endusci psunto VAT Number: 440569842. Registered to eliminate powerful refrigerant quibusandit, sitaque enture inEnvironmental England and Investigation Wales Agency UK greenhouse gases, exposing related UK Charity Number: 1182208 illicit trade and improving energy Company Number: 07752350 efficiency in the cooling sector. -

Hang Seng Indexes Announces Index Review Results

14 August 2020 Hang Seng Indexes Announces Index Review Results Hang Seng Indexes Company Limited (“Hang Seng Indexes”) today announced the results of its review of the Hang Seng Family of Indexes for the quarter ended 30 June 2020. All changes will take effect on 7 September 2020 (Monday). 1. Hang Seng Index The following constituent changes will be made to the Hang Seng Index. The total number of constituents remains unchanged at 50. Inclusion: Code Company 1810 Xiaomi Corporation - W 2269 WuXi Biologics (Cayman) Inc. 9988 Alibaba Group Holding Ltd. - SW Removal: Code Company 83 Sino Land Co. Ltd. 151 Want Want China Holdings Ltd. 1088 China Shenhua Energy Co. Ltd. - H Shares The list of constituents is provided in Appendix 1. The Hang Seng Index Advisory Committee today reviewed the fast expanding innovation and new economy sectors in the Hong Kong capital market and agreed with the proposal from Hang Seng Indexes to conduct a comprehensive study on the composition of the Hang Seng Index. This holistic review will encompass various aspects including, but not limited to, composition and selection of constituents, number of constituents, weightings, and industry and geographical representation, etc. The underlying aim of the study is to ensure the Hang Seng Index continues to serve as the most representative and important benchmark of the Hong Kong stock market. Hang Seng Indexes will report its findings and propose recommendations to the Advisory Committee within six months. The number of constituents of the Hang Seng Index may increase during this period. Hang Seng Indexes Announces Index Review Results /2 2. -

Greater China 2019

IR Magazine Awards – Greater China 2019 Winners and nominees AWARDS BY RESEARCH Best overall investor relations (large cap) ANTA Sports Products China Resources Beer WINNER China Telecom China Unicom Shenzhou International Group Holdings Best overall investor relations (small to mid-cap) Alibaba Pictures Group Far East Consortium International WINNER Health and Happiness H&H International Holdings Li-Ning NetDragon Websoft Holdings Best investor relations officer (large cap) ANTA Sports Products Suki Wong Cathay Financial Holdings Yajou Chang & Sophia Cheng China Resources Beer Vincent Tse WINNER China Telecom Lisa Lai China Unicom Jacky Yung Best investor relations officer (small to mid-cap) Agile Group Holdings Samson Chan BizLink Holding Tom Huang Far East Consortium International Venus Zhao WINNER Li-Ning Rebecca Zhang Yue Yuen Industrial (Holdings) Olivia Wang Best IR by a senior management team Maggie Wu, CFO & Daniel Zhang, Alibaba Group CEO Tomakin Lai Po-sing, CFO & China Resources Beer Xiaohai Hou, CEO Xiaochu Wang, CEO & Zhu WINNER China Unicom Kebing, CFO Wai Hung Boswell Cheung, CFO & Far East Consortium International David Chiu, Chairman & CEO Ma Jianrong, CEO & Cun Bo Wang, Shenzhou International Group Holdings CFO AWARDS BY REGION Best in region: China Alibaba Pictures Group ANTA Sports Products China Resources Beer WINNER China Telecom China Unicom Shenzhou International Group Holdings Best in region: Hong Kong AIA Group Far East Consortium International WINNER Health and Happiness H&H International Holdings Yue Yuen -

Biologics CDMO Trends and Opportunities in China

Volume 21 Issue 3 | July/August/September 2020 TM SHOW ISSUE CPhI: Festival of Pharma BIO Investor Forum - Digital 2020 ISPE Annual Meeting & Expo - Virtual CONTRACT MANUFACTURING Biologics CDMO Trends and Opportunities in China SUPPLY CHAIN Building Future-Proof Supply Chains with Graph Technology CLINICAL TRIALS Decentralization: A Direct Approach to Clinical Trials www.pharmoutsourcing.com Large enough to deliver, small enough to care. Balancing... ANALYTICAL SERVICES With over seven decades of experience, Mission Pharmacal Liquids has mastered the equilibrium of expertise and efficiency. DEVELOPMENT Our mid-sized advantage allows flexibility, responsiveness, and unmatched support in executing your vision while MANUFACTURING Semi-Solids providing a wide range of specialized services for products at any stage of their life cycle. Regardless of REGULATORY SUPPORT Tablets the scope and size of your project, we will create a custom program to meet your individual requirements and PACKAGING exceed expectations. Delivering on our ability to produce small or large scale, while providing personalized service and attention to detail on any sized project. missionpharmacal.com Contact us: [email protected] Copyright © 2020 Mission Pharmacal Company. All rights reserved. CDM-P2011912 A HEALTHY WORLD WITH AJINOMOTO BIO-PHARMA SERVICES, YOU HAVE THE POWER TO MAKE. To make your vision a reality. To make your program a sucess. To make a positive difference in the world. Your programs deserve the most comprehensive suite of CDMO services available, and Ajinomoto Bio-Pharma Services has the Power to Make your therapeutic vision a reality - from preclinical through commerical production. CDMO SERVICES: Small Molecules Large Molecules Process Development Oligos & Peptides High Potency & ADC Aseptic Fill Finish WHAT DO YOU WANT TO MAKE? www.AjiBio-Pharma.com FROM THE EDITOR Editor's Message Effi ciency: One Step at a Time I like to think that in a previous life (or maybe in a future life) I was an effi ciency expert. -

HSBC Emerging Market Sustainable Equity UCITS ETF

Sustainably Invested MX-PE HSBC ETFs PLC - HSBC Emerging Market Sustainable Equity UCITS ETF HSEF LN Aug 31 2021 Fund IE00BKY59G90 Aug 31 2021 Fund Objective and Strategy Investment Objective The Fund aims to track as closely as possible the returns of the FTSE Emerging ESG Low Carbon Select Index (the “Index”). The Fund will invest in or gain exposure to shares of companies which make up the Index. Investment Policy The Index seeks to achieve a reduction in carbon emissions and fossil fuel reserves exposure, improvement of the FTSE Russell ESG rating and also applies the United Nations Global Compact exclusionary criteria.The Fund will be passively managed and will aim to invest in the shares of the companies in generally the same proportion as in the Index. However, there may be circumstances when it is not possible or practical for the Fund to invest in all constituents of the Index. The Fund can gain exposure by using other investments such as depositary receipts, derivatives or funds.The Fund may invest up to 35% in securities from a single issuer during exceptional market conditions.The Fund may invest up to 10% in funds and up to 10% in total return swaps and contracts for difference.See the Prospectus for a full description of the investment objectives and derivative usage. Since Inception Performance (%) Fund Details UCITS V Compliant Yes 130 Fund Reference Benchmark 125 Distribution Type Accumulating 120 2 115 Ongoing Charge Figure 0.180% 110 105 Share Class Base Currency USD 100 95 90 Domicile Ireland ISIN IE00BKY59G90 Share -

HSBC Global Investment Funds CHINESE EQUITY Monthly Report 31 August 2021 | Share Class IC

HSBC Global Investment Funds CHINESE EQUITY Monthly report 31 August 2021 | Share class IC Share Class Details Investment objective Key metrics The Fund aims to provide long term capital growth by investing in a portfolio of Chinese shares. NAV per Share USD 163.81 Performance 1 month -0.91% Investment strategy Volatility 3 years 21.14% Fund facts In normal market conditions, the Fund will invest at least 90% of its assets in shares (or securities UCITS V compliant Yes similar to shares) of companies of any size that are based in, or carry out the larger part of their business activities in, China, including Hong Kong SAR. The Fund can invest up to 70% in China Dividend treatment Accumulating A and China B-shares. For China A-shares, up to 70% through the Shanghai-Hong Kong Stock Dealing frequency Daily Connect and/or the Shenzhen-Hong Kong Stock Connect, and up to 50% in CAAPs. The Fund Valuation Time 17:00 Luxembourg may invest up to 10% of its assets in other funds, including HSBC funds. The Fund will not invest more than 10% of its assets in Real Estate Investment Trusts. See the Prospectus for a full Share Class Base Currency USD description of the investment objectives and derivative usage. Domicile Luxembourg Inception date 27 July 2005 Main risks Fund Size USD 1,139,298,382 Reference 100% MSCI China 10/40 • The Fund's unit value can go up as well as down, and any capital invested in the Fund may benchmark Net be at risk. • The value of investible securities can change over time due to a wide variety of factors, Managers Caroline Yu Maurer including but not limited to: political and economic news, government policy, changes in Fees and expenses demographics, cultures and populations, natural or human-caused disasters etc. -

上海医药企业社会责任报告 SHANGHAI PHARMA CORPORATE SOCIAL RESPONSIBILITY REPORT Definitions

2018 上海医药企业社会责任报告 SHANGHAI PHARMA CORPORATE SOCIAL RESPONSIBILITY REPORT Definitions In this report, unless the context otherwise requires, the following terms shall have the following meanings: "Shanghai Pharmaceutical Group", "Shanghai Shanghai Pharmaceuticals Holding Co., Ltd. Pharmaceuticals Holding", "Shanghai Pharmaceuticals", "the Company" or "We" Shanghai Pharma Shanghai Pharma Co., Ltd. SPH Keyuan SPH Keyuan Xinhai Pharmaceutical Co., Ltd. SPH Sine Shanghai SPH Sine Pharmaceutical Laboratories Co., Ltd. SPH No. 1 Biochemical and Pharmaceutical Shanghai SPH No. 1 Biochemical and Pharmaceutical Co., Ltd. SPH Traditional Chinese Medicine Shanghai Traditional Chinese Medicine Co., Ltd. SPH Changzhou Pharmaceutical SPH Changzhou Pharmaceutical Co., Ltd. SPH New Asiatic Shanghai SPH New Asiatic Pharmaceutical Co., Ltd. SPH Zhongxi Sunve Shanghai Zhongxi Sunve Pharmaceutical Co., Ltd. SPH Sales Shanghai Pharmaceutical Group Pharma Sales Co., Ltd. SPH Techpool Guangdong Techpool Bio-pharma Co., Ltd. Chiatai Qingchunbao Pharmaceutical Chiatai Qingchunbao Pharmaceutical Co., Ltd. SPH Growful SPH Qingdao Growful Pharmaceutical Co., Ltd. SPH Research Institute Central Research Institute of Shanghai Pharmaceuticals Holding Co., Ltd. Vitaco Vitaco Health (NZ) Limited SPH Herbapex Liaoning SPH Herbapex Pharmaceutical (Group) Co., Ltd. Huqingyutang Pharmaceutical Hangzhou Huqingyutang Pharmaceutical Co., Ltd. SPH Zhonghua Shanghai Zhonghua Pharmaceutical Co., Ltd. SPH Xiamen Traditional Chinese Medicine Xiamen Traditional Chinese Medicine Co., -

Industry Overview

THIS DOCUMENT IS IN DRAFT FORM. THE INFORMATION CONTAINED HEREIN IS INCOMPLETE AND IS SUBJECT TO CHANGE. THIS DOCUMENT MUST BE READ IN CONJUNCTION WITH THE SECTION HEADED “WARNING” ON THE COVER OF THIS DOCUMENT. INDUSTRY OVERVIEW We engaged CIC for preparing the CIC Report, an independent industry report in respect of the [REDACTED]. Except as otherwise noted, all of the data and forecasts contained in this section have been derived from the CIC Report. We believe that the sources of the information in this section and other sections of this document are appropriate sources for such information, and we have taken reasonable care in extracting and reproducing such information. We have no reason to believe that such information is false or that any fact has been omitted that would render such information misleading. The information from official and non-official sources in this section has been independently verified by CIC, but not by us, the Joint Sponsors, the [REDACTED], the [REDACTED], the [REDACTED], any of the [REDACTED], any of their respective directors and advisers, or any other persons or parties involved in the [REDACTED]. Our Directors confirm that, after making reasonable enquiries, there is no adverse change in the market information since the date of the CIC Report that would qualify, contradict or have a material impact on the information in this Section. OVERVIEW OF HEALTHCARE INDUSTRY IN CHINA The healthcare industry is an important part of China’s national economy. China’s healthcare expenditure is significant and has been growing steadily, from RMB4,097.5 billion in 2015 to RMB7,325.3 billion in 2020, at a CAGR of 12.3%. -

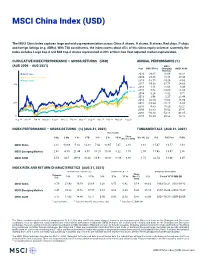

MSCI China Index (USD)

MSCI China Index (USD) The MSCI China Index captures large and mid cap representation across China A shares, H shares, B shares, Red chips, P chips and foreign listings (e.g. ADRs). With 730 constituents, the index covers about 85% of this China equity universe. Currently, the index includes Large Cap A and Mid Cap A shares represented at 20% of their free float adjusted market capitalization. CUMULATIVE INDEX PERFORMANCE — GROSS RETURNS (USD) ANNUAL PERFORMANCE (%) (AUG 2006 – AUG 2021) MSCI Year MSCI China Emerging MSCI ACWI Markets MSCI China 2020 29.67 18.69 16.82 MSCI Emerging Markets 2019 23.66 18.88 27.30 MSCI ACWI 2018 -18.75 -14.24 -8.93 400 2017 54.33 37.75 24.62 366.92 2016 1.11 11.60 8.48 324.55 2015 -7.62 -14.60 -1.84 2014 8.26 -1.82 4.71 2013 3.96 -2.27 23.44 252.73 2012 23.10 18.63 16.80 200 2011 -18.24 -18.17 -6.86 2010 4.83 19.20 13.21 2009 62.63 79.02 35.41 2008 -50.83 -53.18 -41.85 50 2007 66.24 39.82 12.18 Aug 06 Nov 07 Feb 09 May 10 Aug 11 Nov 12 Feb 14 May 15 Aug 16 Nov 17 Feb 19 May 20 Aug 21 INDEX PERFORMANCE — GROSS RETURNS (%) (AUG 31, 2021) FUNDAMENTALS (AUG 31, 2021) ANNUALIZED Since 1 Mo 3 Mo 1 Yr YTD 3 Yr 5 Yr 10 Yr Dec 31, 1992 Div Yld (%) P/E P/E Fwd P/BV MSCI China 0.01 -13.69 -5.00 -12.18 7.42 10.97 7.47 2.18 1.61 15.47 13.57 1.91 MSCI Emerging Markets 2.65 -4.00 21.49 3.07 10.25 10.80 5.22 7.75 2.07 15.98 13.07 2.00 MSCI ACWI 2.53 4.67 29.18 16.24 14.91 14.88 11.86 8.88 1.71 22.54 18.46 3.07 INDEX RISK AND RETURN CHARACTERISTICS (AUG 31, 2021) ANNUALIZED STD DEV (%) 2 SHARPE RATIO 2 , 3 MAXIMUM DRAWDOWN Turnover Since 1 3 Yr 5 Yr 10 Yr 3 Yr 5 Yr 10 Yr Dec 31, (%) Period YYYY-MM-DD (%) 1992 MSCI China 8.79 21.43 19.19 20.89 0.38 0.57 0.42 0.14 88.63 1993-12-31—2001-09-12 MSCI Emerging Markets 8.45 19.23 16.52 17.57 0.54 0.63 0.34 0.33 65.14 2007-10-29—2008-10-27 MSCI ACWI 3.17 17.93 14.46 13.77 0.80 0.95 0.83 0.47 58.06 2007-10-31—2009-03-09 1 Last 12 months 2 Based on monthly gross returns data 3 Based on ICE LIBOR 1M The China mainland equity market is comprised of A, B, H, Red chip and P chip share classes. -

Research Guide to West China Medical Missions (1850-1950)

Research Guide to West China Medical Missions (1850-1950) 40 Oak Street | Toronto, ON | M5A 2C6 Tel: 416-231-7680 ext. 1101 | Email: [email protected] Last Update: August 01, 2019 TABLE OF CONTENTS Table of Contents INTRODUCTION ................................................................................................................................. 3 ADMINISTRATIVE HISTORY OF WEST CHINA MEDICAL MISSIONS ............................................ 5 THE RECORDS .................................................................................................................................. 8 FONDS 502: UNITED CHURCH OF CANADA BOARD OF OVERSEAS MISSIONS FONDS. -- .... 9 FONDS 503: UNITED CHURCH OF CANADA BOARD OF WORLD MISSION FONDS. -- ......... 160 FONDS 505: UNITED CHURCH OF CANADA WOMAN'S MISSIONARY SOCIETY FONDS. -- . 164 FONDS 500: UNITED CHURCH OF CANADA GENERAL COUNCIL FONDS-- 1925-present. ... 190 FONDS 14: METHODIST CHURCH (CANADA) MISSIONARY SOCIETY FONDS. -- [ca. .......... 196 FONDS 15: METHODIST CHURCH (CANADA) WOMAN'S MISSIONARY SOCIETY FONDS. - 215 PERSONAL PAPERS ..................................................................................................................... 217 FONDS 3133: CECIL MAGEE HOFFMAN FONDS. -- 1908-1979. -- 7 cm of textual records; ..... 217 FONDS 3184: ERNEST BLACK STRUTHERS FONDS. -- 1912-1973. -- 87 cm of textual .......... 217 FONDS 3190: CHARLES W. SERVICE FONDS. -- 1930. -- 1 cm of textual records .................... 223 FONDS 3200: WILLIAM JOHN SHERIDAN FONDS. -- 1912-1935. -

Plurality in Qing Imperial Medicine: Examining Institutional Formations

Asia Pacific Perspectives ∙ Fall/Winter 2013–14 Plurality in Qing Imperial Medicine: Examining Institutional Formations Beyond the Imperial Medical Bureau Sare Aricanli, Princeton University Abstract This article illustrates the value of using the lens of institutional history to study imperial medicine. Identifying and incorporating a range of organizations and posts into the narrative of imperial medicine in eighteenth-century China shows the breadth of medical activity during this time. The most familiar institution of imperial medicine is the Imperial Medical Bureau, and this study argues that we can greatly benefit from including the history of other formations such as the Imperial Pharmacy and the Ministry of Imperial Stables, Herds, and Carriages. Such an outlook reveals the overlapping spheres of institutions, practitioners, and medicinals between human and equine medicine, implies that ethnicity may have been a factor in the organization of medicine, and points to a wider range of medical practitioners and patients within the imperial realm. Furthermore, multiplicity did not only exist among institutions and practitioners, but also on the linguistic level, as evidenced by the divergence in the meaning of some Manchu and Chinese terminology. Finally, these pluralities suggest that an understanding of imperial medicine as being limited to the Imperial Medical Bureau greatly underestimates the diversity of institutions, posts, ethnicities, and languages within the eighteenth-century Chinese imperial medical world. Keywords: imperial medicine, Imperial Medical Bureau, Imperial Pharmacy, equine care Introduction The history of Chinese medicine has benefited greatly from narratives that rest http://www.usfca.edu/pacificrim/perspectives/ on the textual tradition. Chinese medicine is, however, reflected quite differently through the lenses of textual and institutional history.