The Complete Static Banking Awareness

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

![BANKING LAW Time : 1:30 Hours Maximum Marks-100 Tc Rd Dgk U Tk;] Bl Á’Uiqflrdk Dks U [Kksysa](https://docslib.b-cdn.net/cover/7622/banking-law-time-1-30-hours-maximum-marks-100-tc-rd-dgk-u-tk-bl-%C3%A1-uiqflrdk-dks-u-kksysa-147622.webp)

BANKING LAW Time : 1:30 Hours Maximum Marks-100 Tc Rd Dgk U Tk;] Bl Á’Uiqflrdk Dks U [Kksysa

Á’uiqfLrdk Øekad Roll No.-------------------- Question Booklet No. Á’uiqfLrdk fljht O.M.R. Serial No. Question Booklet Series A L.L.B (Fifth Semester) Examination, 2021 LLB504 BANKING LAW Time : 1:30 Hours Maximum Marks-100 tc rd dgk u tk;] bl Á’uiqfLrdk dks u [kksysa funsZ’k % & 1. ijh{kkFkhZ vius vuqØekad] fo”k; ,oa Á’uiqfLrdk dh fljht dk fooj.k ;FkkLFkku lgh& lgh Hkjsa] vU;Fkk ewY;akdu esa fdlh Hkh Ádkj dh folaxfr dh n’kk esa mldh ftEesnkjh Lo;a ijh{kkFkhZ dh gksxhA 2. bl Á’uiqfLrdk esa 100 Á’u gSa] ftues ls dsoy 75 Á’uksa ds mRrj ijh{kkfFkZ;ksa }kjk fn;s tkus gSA ÁR;sd Á’u ds pkj oSdfYid mRrj Á’u ds uhps fn;s x;s gSaA bu pkjksa esa ls dsoy ,d gh mRrj lgh gSA ftl mRrj dks vki lgh ;k lcls mfpr le>rs gSa] vius mRrj i=d (O.M.R. ANSWER SHEET) esa mlds v{kj okys o`Rr dks dkys ;k uhys cky IokabV isu ls iwjk Hkj nsaA ;fn fdlh ijh{kkFkhZ }kjk fu/kkZfjr Á’uksa ls vf/kd Á’uksa ds mRrj fn;s tkrs gSa rks mlds }kjk gy fd;s x;s ÁFker% ;Fkk fufnZ”V Á’uksRrjksa dk gh ewY;kadu fd;k tk;sxkA 3. ÁR;sd Á’u ds vad leku gSaA vki ds ftrus mRrj lgh gksaxs] mUgha ds vuqlkj vad Ánku fd;s tk;saxsA 776 4. lHkh mRrj dsoy vksŒ,eŒvkjŒ mRrj i=d (O.M.R. -

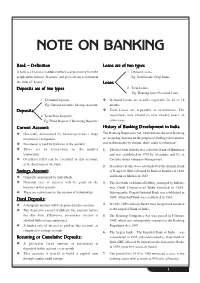

Note on Banking

NOTE ON BANKING Bank – Definition Loans are of two types A bank is a financial institution which accepts money from the 1. Demand Loans: people in the form of ‘Deposits’ and gives advances to them in Eg: Gold Loans, Crop loans. the form of “Loans”. Loans Deposits are of two types 2. Term Loans: Eg: Housing loan / Personal Loan. 1. Demand Deposits Y Demand Loans are usually repayable in 12 to 18 Eg: Current Account / Savings Account. months. Deposits Y Term Loans are repayable in instalments. The 2. Term/Time Deposits repayment may extend to over twenty years, in Eg: Fixed Deposits / Recurring Deposits. some cases. Current Account: History of Banking Development in India Y Generally maintained by businesspersons / large The Banking Regulation Act, 1949 defines the term Banking institutions / companies. as “accepting, deposits for the purpose of lending or investment, Y No interest is paid for balances in the account. and withdrawable by cheque, draft, order or otherwise”. Y There are no restrictions on the number 1. The first bank in India was called the Bank of Hindustan transactions. and was established in 1770 by Alexander and Co, at Y Overdraft (OD) can be extended in this account, Calcutta, under European Management. at the discretion of the bank. 2. Presidency Banks were established by the British: Bank Savings Account: of Bengal in 1806, followed by Bank of Bombay in 1840, Y Generally maintained by individuals. and Bank of Madras in 1843. Y Nominal rate of interest will be paid on the 3. The first bank with limited liability, managed by Indians, balances in this account. -

Unit 1. Evolution of Banking

DNYANSAGAR ARTS AND COMMERCE COLLEGE, BALEWADI, PUNE – 45 Subject – Banking And Finance - I (115 B) Class: FYB.COM (2019 Pattern) Unit 1. Evolution of Banking Introduction Money in the Economy is like blood in the human body”. The flow of money in the economy determines the characteristics of any economy. Robust money and capital markets are essentials for a developed economy. The short term and long term needs of money of individuals and institutions can be efficiently met by financial intermediaries. Pooling of scanty deposits into a large capital base and lending it to the desirable sectors is the core of banking business. In a developing economy like India, the role of banking sector becomes even more critical. In the initial years of economic development, when other sophisticated financial institutions were not present, banks were the only financial intermediaries which helped in bring about the change. The sense of confidence in the ethical functioning of financial intermediaries, in the minds of common man, was brought about by well-regulated commercial banks. The word ‘bank’ is of Germanic origin though some persons trace its origin to the French word ‘Banqui’ and the Italian word ‘Banca’. It referred to a bench for keeping, lending, and exchanging of money or coins in the market place by money lenders and money changers. According to Banking Regulation Act, 1949 of India, “Banking means the accepting for the purpose of lending or investment of deposits of money from the public, repayable on demand or otherwise and withdrawable by cheque, draft, and an order or otherwise”. A bank is a financial institution which deals with deposits and advances and other related services. -

GIPE-041303-Contents.Pdf

Date of J:elease for loan This book should be returned on or before the date last mentioned below. An overdue charge of 5 paise will be levied for each day the book .is kept beyond this date . ;188 1 2 Sf? 1921 I [ f -2. OCT 1991 2 9 AUG, '1991 . ~, 'APal\Q9S ~ -5 '·1l.Jlt995 . A.B.P.P. I j ____ -...J. ___ ~ A BANKER'S OFFICE INDIGENOUS BANKING IN INDIA ~~ ~.f.\A...~ .9 • MACMILLAN AND CO., Lnrrnm LONDON • BOMBAY • CALCUTTA • MADRAS MELBOURNE THE MACMILLAN· COMPANY NEW YORK • BOSTON • CmCAGO DALLAS • SAN PllANCISCO THE MACMILLAN COMPANY OF CANADA, LIMITED TORONTO INDIGENOUS BANKING IN INDIA BY L. C. JAIN M.A., LL.B., PH.D. (ECON.) LOND. LScruUJl, IN CORUNCV AND BANKING AT THB UNIVERSITY OF ALLAHABAD WITH AN INTRODUCTION BY DR. GILBERT SLATER, M.A., D.Se. (ECON.) LoND. LATE i>ROFasSOR OF INDIAN BCONOMICS, MADRAS UNIVERSITY MACMILLAN AND CO., LIMITED ST. MARTIN'S STREET, LONDON J9 2 9 COPYRIGHT (Thesis approved for 'he Degree of Doctor of Philosophy (Economics) in the Universitr of London) 41303 PRINTED IN. GREAT BRITAIN TO MY REVERED FATHER BALMUKAND JAIN, ESQ. B.A., C.T., A.C.P. (LoNDON) AN APOLOGY FOR TWO YEARS' ABSENCE FROM HOME PREFACE IN the following pages an attempt is made to describe the present indigenous banking system in India. Literature on the subject is almost non-existent. Such inform~tion as is given in works on the Indian money-market is incomplete, largely repetitive and in other ways unsatisfactory. There is som'etimes confusion of thought and consequent misre presentation of facts. -

General Knowledge Objective Quiz

Brilliant Public School , Sitamarhi General Knowledge Objective Quiz Session : 2012-13 Rajopatti,Dumra Road,Sitamarhi(Bihar),Pin-843301 Ph.06226-252314,Mobile:9431636758 BRILLIANT PUBLIC SCHOOL,SITAMARHI General Knowledge Objective Quiz SESSION:2012-13 Current Affairs Physics History Art and Culture Science and Technology Chemistry Indian Constitution Agriculture Games and Sports Biology Geography Marketing Aptitude Computer Commerce and Industries Political Science Miscellaneous Current Affairs Q. Out of the following artists, who has written the book "The Science of Bharat Natyam"? 1 Geeta Chandran 2 Raja Reddy 3 Saroja Vaidyanathan 4 Yamini Krishnamurthy Q. Cricket team of which of the following countries has not got the status of "Test" 1 Kenya 2 England 3 Bangladesh 4 Zimbabwe Q. The first Secretary General of the United Nation was 1 Dag Hammarskjoeld 2 U. Thant 3 Dr. Kurt Waldheim 4 Trygve Lie Q. Who has written "Two Lives"? 1 Kiran Desai 2 Khushwant Singh 3 Vikram Seth 4 Amitabh Gosh Q. The Headquarters of World Bank is situated at 1 New York 2 Manila 3 Washington D. C. 4 Geneva Q. Green Revolution in India is also known as 1 Seed, Fertiliser and irrigation revolution 2 Agricultural Revolution 3 Food Security Revolution 4 Multi Crop Revolution Q. The announcement by the Nuclear Power Corporation of India Limited Chairmen that India is ready to sell Pressurised 1 54th Conference 2 53rd Conference 3 51st Conference 4 50th Conference Q. A pension scheme for workers in the unorganized sector, launched recently by the Union Finance Ministry, has been named 1 Adhaar 2 Avalamb 3 Swavalamban 4 Prayas Q. -

Banking History

COMPILED BY : - GAUTAM SINGH STUDY MATERIAL – BANKING AWARENESS 0 7830294949 First in Banks- Banking History . o First bank in India- Bank of Hindustan (1770) o First Bank managed by Indians- Oudh Commercial Bank o First Bank with Indian capital- Punjab National Bank (Founder of the Bank is Lala Lajpat Rai) o First Foreign Bank in India – HSBC o First bank to get ISO certificate – Canara Bank o First Indian bank outside India –Bank of India o First Bank to introduce ATM – HSBC (1987, Mumbai) o First Bank to have joint stock public bank (Oldest) – Allahabad Bank o First Universal bank – ICICI (Industrial Credit and Investment Corporation of India) o First bank to introduce saving account – Presidency Bank (1833) o First Bank to introduce Cheque system – Bengal Bank (1833) o First bank to give internet banking facility – ICICI o First bank to sell mutual funds – State Bank of India THANKS FOR READING – VISIT OUR WEBSITE www.educatererindia.com COMPILED BY : - GAUTAM SINGH STUDY MATERIAL – BANKING AWARENESS 0 7830294949 o First bank to issue credit cards - Central Bank of India o First Rural Regional Bank (Grameen Bank) – Prathama Bank (sponsored by Syndicate Bank) o First bank to get ‘in principle’ banking license – IDFC and Bandhan Bank o First Bank to introduce merchant banking in India – Grind lays bank o First bank to introduce block chain technology – ICICI o First bank to introduce voice biometric – Citi Bank o First bank to introduce robot in banking service- HDFC Miscellaneous points: o Largest public sector bank in India – State Bank of India o Largest private sector bank in India – ICICI o Largest foreign bank in India – Standard Chartered Bank o Bank with more branches in India – State Bank of India Present 5 Associates of SBI : o Bank of Travancore o Bank of Patiala o Bank of Bikaner and Jaipur o Bank of Hyderabad o Bank of Mysuru THANKS FOR READING – VISIT OUR WEBSITE www.educatererindia.com . -

Pre-Independence Banking History Post-Independence

Banking history of India is divided into Two major categories – . Pre-Independence Banking History . Post-Independence Banking History Pre-Independence Banking :- . The origin of modern Banking in India dates back to the 18th century. Bank of Hindusthan was established in 1770 and it was the first bank at Calcutta underEuropean management. Banking Concept in India was brought by Europeans. In 1786 General Bank of India was set up. On June 2, 1806 the Bank of Calcutta established in Calcutta. It was the first Presidency Bank during the British Raj. Bank of Calcutta was established mainly to fund General Wellesley’s wars against Tipu Sultan and the Marathas. On January 2, 1809 the Bank of Calcutta renamed as the Bank of Bengal. In 1839, there was a fruitless effort by Indian merchants to establish a Bank called Union Bank but it failed within a decade. On 15th April, 1840 the second presidency Bank was established in Bombay – Bank of Bombay. On 1 July 1843 the Bank of Madras was established in Madras, now Chennai. It was the third Presidency Bank during the British Raj. Allahabad Bank which was established in 1865 and working even today. The oldest Public Sector Bank in India having branches all over India and serving the customers for the last 145 years is Allahabad Bank. Allahabad bank is also known as one of India’s Oldest Joint Stock Bank. These Presidency banks worked as quasi central banks in India for many years under British Rule. The Comptoire d’Escompte de Paris opened a branch in Calcutta in 1860. -

Download General Studies Notes PDF for IAS Prelims from This Link

These are few chapters extracted randomly from our General Studies Booklets for Civil Services Preliminary Exam. To read all these Booklets, kindly subscribe our course. We will send all these Booklets at your address by Courier/Post. BestCurrentAffairs.com BestCurrentAffairs.com PAGE NO.1 The Indian money market is classified into: the organised sector (comprising private, public and foreign owned commercial banks and cooperative banks, together known as scheduled banks); and the unorganised sector (comprising individual or family owned indigenous bankers or money lenders and non-banking financial companies (NBFCs)). The unorganised sector and microcredit are still preferred over traditional banks in rural and sub- urban areas, especially for non-productive purposes, like ceremonies and short duration loans. Banking in India, in the modern sense, originated in the last decades of the 18th century. Among the first banks were the Bank of Hindostan, which was established in 1770 and liquidated in 1829-32; and the General Bank of India, established in 1786 but failed in 1791. The largest bank, and the oldest still in existence, is the State Bank of India (S.B.I). It originated as the Bank of Calcutta in June 1806. In 1809, it was renamed as the Bank of Bengal. This was one of the three banks funded by a presidency government; the other two were the Bank of Bombay and the Bank of Madras. The three banks were merged in 1921 to form the Imperial Bank of India, which upon India's independence, became the State Bank of India in 1955. For many years the presidency banks had acted as quasi-central banks, as did their successors, until the Reserve Bank of India was established in 1935, under the Reserve Bank of India Act, 1934. -

Banks: Evolution, 1 Types & Functions

BANKS: EVOLUTION, 1 TYPES & FUNCTIONS BANK: DEFINITION The word bank is derived from Latin word ‘bancus’, French word ‘banque’, Italian word ‘banca’, meaning "table"; German word ‘banc’, meaning bench or counter. Benches were used as makeshift desks or exchange counters during the Renaissance by Jewish bankers, who used to make their transactions atop desks covered by green tablecloths. The Indian Banking Regulations Act, 1949 defines the term Banking as the accepting, for the purpose of lending or investment, of deposits of money from the public, repayable on demand or otherwise, and withdrawal by cheque, draft, order or otherwise. According to the Indian Banking Regulations Act, 1949 a Banking Company means any company which transacts the business of banking. Thus, a company which is engaged in the manufacture of goods or carries on any trade and which accepts deposits of money from the public merely for the purpose of financing its business as such manufacturer or trader shall not be deemed to transact the business of banking. The activities specified in the Act as banking activities are lending, borrowing, accepting and discounting of bills, dealing in foreign currency, deposit lockers, transfer of money etc. The Act prohibits a bank from buying and selling goods and also from holding immovable property. EVOLUTION OF BANKING There was no such word as ‘banking’ before 1640, although the practice of safe-keeping and savings flourished in the temple of Babylon as early as 2000 B.C. The first bank called the ‘Bank of Venice’ was established in Venice, Italy in 1157 to finance the monarch in his wars. -

Structure of Indian Banking System with Diagram

COMPILED BY : - GAUTAM SINGH STUDY MATERIAL – BANKING AWARENESS 0 7830294949 Structure of Indian Banking System with Diagram . Banking System in India or the Indian Banking System can be segregated into three distinct phases: A. Early Phase of Indian Banks, from 1786 to 1969 The first bank, namely Bank of Bombay was established in 1720 in Bombay. Later on, Bank of Hindustan was established in Calcutta in 1770. General Bank of India was established in 1786. Bank of Hindustan THANKS FOR READING – VISIT OUR WEBSITE www.educatererindia.com COMPILED BY : - GAUTAM SINGH STUDY MATERIAL – BANKING AWARENESS 0 7830294949 carried on the business till 1906. First Joint Stock Bank with limited liability established in India in 1881 was Oudh Commercial Bank Ltd. East India Company established the three independently functioning banks, also known by the name of “Three Presidency Banks” - The Bank of Bengal in 1806, The Bank of Bombay in 1840, and Bank of Madras in 1843. These three banks were amalgamated in 1921 and given a new name as Imperial Bank of India. After Independence, in 1955, the Imperial Bank of India was given the name "State Bank of India". It was established under State Bank of India Act, 1955. In the surcharged atmosphere of Swadeshi Movement, a number of private banks with Indian managements had been established by the businessmen from mid of the 19th century onwards, prominent among them being Punjab National Bank Ltd., Bank of India Ltd., Canara Bank Ltd, and Indian Bank Ltd. The first bank with fully Indian management was Punjab National Bank Ltd. established on 19 May 1894, in Lahore (now in Pakistan). -

Download a Mobile Wallet App on Our Phone NFC Contactless Payments

1 ACKNOWLEDGMENT The incredible activity of Team All India Legal Forum is to give a stage to the scholars from all through the country to get their unique work distributed in type of diaries is outstanding. This volume has been capably arranged by the group and has advanced vital and most most important aspects comes under Banking Law in India, Evolution of Banking Law, Structure of RBI, DRAT, Lok Adalats under legal services authority act, Securitization, Dishonour of cheques, Banking Regulation Act Amendment Bill 2020 and many more. At the very end of our publication it inludes the Multiple Choice Questions to quickly learn and revise along with some fun corners to not to get bored. We praise all the understudy benefactors for their superb piece of work and our all the best for all your future undertakings. We guarantee all the perusers that this will add a ton to the information subsequent to perusing this ideal assemblage of examination on the most recent consuming of the country. Truth be told its for the lawful clique as well as for any individual who has an interest in field of law and to know Banking System in India. With Best Wishes Ms Mahimashree Kaur ALL INDIA LEGAL FORUM 2 FOREWORD More has been aforesaid regarding the writing of lawyers and judges than of the other cluster, except, of course, poets and novelists. The distinction is that whereas the latter has sometimes been loved for their writing, the general public has nearly always damned lawyers and judges for theirs. If this state of affairs has modified in recent times, it's solely therein several lawyers and judges have currently joined the rest of the globe is repining regarding the standard of legal prose. -

All India Maha Mock : NPS Trust Officer Exam 2021

All India Maha Mock : NPS Trust Officer Exam 2021 Directions (1-7): Read the following passage carefully and answer the questions given below them. Certain words are given in bold to help you locate them while answering some of the questions. India’s ‘water crisis’ took over social media recently. That India’s cities are running out of water, coupled with Chennai’s drinking water woes, made the ‘crisis’ viral, raising questions about the quality of the discourse and choice of water governance strategies in India. If there is a water crisis, what is the nature of the crisis? Where is the crisis prevalent? And how do we deal with it? Usually, a delayed monsoon or a drought, combined with compelling images of parched lands and queues for water in urban areas raise an alarm in the minds of the public. Similarly, episodes of inter- State river water disputes catch public attention. However, this time, it was somewhat different. Videos and news reports claiming that Indian cities are running out of groundwater went viral. These news items could not have gained the traction but for the fact that they relied on a 2018 report of India’s own Niti Aayog, which was titled ‘Composite Water Management Index: A tool for water management.’ Later, thanks to yet another series of tweets by Joanna Slater of The Washington Post, the ‘crisis bogey’ lost some of its sheen. Ms. Slater investigated the “zombie statistics” in the Niti Aayog report, especially the piece of information that said: “21 major cities are expected to run out of groundwater as soon as 2020, affecting [nearly] 100 million people.” Her perseverance led to an eventual conclusion that there was no sure evidence for this assessment.