Vijaya Bank and Dena Bank Into the Bank of Baroda (Bob) Has Come Into Effect and All Branches of the Former Two Will Function As Branches of Bob

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

![BANKING LAW Time : 1:30 Hours Maximum Marks-100 Tc Rd Dgk U Tk;] Bl Á’Uiqflrdk Dks U [Kksysa](https://docslib.b-cdn.net/cover/7622/banking-law-time-1-30-hours-maximum-marks-100-tc-rd-dgk-u-tk-bl-%C3%A1-uiqflrdk-dks-u-kksysa-147622.webp)

BANKING LAW Time : 1:30 Hours Maximum Marks-100 Tc Rd Dgk U Tk;] Bl Á’Uiqflrdk Dks U [Kksysa

Á’uiqfLrdk Øekad Roll No.-------------------- Question Booklet No. Á’uiqfLrdk fljht O.M.R. Serial No. Question Booklet Series A L.L.B (Fifth Semester) Examination, 2021 LLB504 BANKING LAW Time : 1:30 Hours Maximum Marks-100 tc rd dgk u tk;] bl Á’uiqfLrdk dks u [kksysa funsZ’k % & 1. ijh{kkFkhZ vius vuqØekad] fo”k; ,oa Á’uiqfLrdk dh fljht dk fooj.k ;FkkLFkku lgh& lgh Hkjsa] vU;Fkk ewY;akdu esa fdlh Hkh Ádkj dh folaxfr dh n’kk esa mldh ftEesnkjh Lo;a ijh{kkFkhZ dh gksxhA 2. bl Á’uiqfLrdk esa 100 Á’u gSa] ftues ls dsoy 75 Á’uksa ds mRrj ijh{kkfFkZ;ksa }kjk fn;s tkus gSA ÁR;sd Á’u ds pkj oSdfYid mRrj Á’u ds uhps fn;s x;s gSaA bu pkjksa esa ls dsoy ,d gh mRrj lgh gSA ftl mRrj dks vki lgh ;k lcls mfpr le>rs gSa] vius mRrj i=d (O.M.R. ANSWER SHEET) esa mlds v{kj okys o`Rr dks dkys ;k uhys cky IokabV isu ls iwjk Hkj nsaA ;fn fdlh ijh{kkFkhZ }kjk fu/kkZfjr Á’uksa ls vf/kd Á’uksa ds mRrj fn;s tkrs gSa rks mlds }kjk gy fd;s x;s ÁFker% ;Fkk fufnZ”V Á’uksRrjksa dk gh ewY;kadu fd;k tk;sxkA 3. ÁR;sd Á’u ds vad leku gSaA vki ds ftrus mRrj lgh gksaxs] mUgha ds vuqlkj vad Ánku fd;s tk;saxsA 776 4. lHkh mRrj dsoy vksŒ,eŒvkjŒ mRrj i=d (O.M.R. -

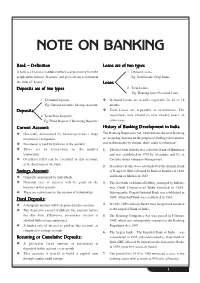

Note on Banking

NOTE ON BANKING Bank – Definition Loans are of two types A bank is a financial institution which accepts money from the 1. Demand Loans: people in the form of ‘Deposits’ and gives advances to them in Eg: Gold Loans, Crop loans. the form of “Loans”. Loans Deposits are of two types 2. Term Loans: Eg: Housing loan / Personal Loan. 1. Demand Deposits Y Demand Loans are usually repayable in 12 to 18 Eg: Current Account / Savings Account. months. Deposits Y Term Loans are repayable in instalments. The 2. Term/Time Deposits repayment may extend to over twenty years, in Eg: Fixed Deposits / Recurring Deposits. some cases. Current Account: History of Banking Development in India Y Generally maintained by businesspersons / large The Banking Regulation Act, 1949 defines the term Banking institutions / companies. as “accepting, deposits for the purpose of lending or investment, Y No interest is paid for balances in the account. and withdrawable by cheque, draft, order or otherwise”. Y There are no restrictions on the number 1. The first bank in India was called the Bank of Hindustan transactions. and was established in 1770 by Alexander and Co, at Y Overdraft (OD) can be extended in this account, Calcutta, under European Management. at the discretion of the bank. 2. Presidency Banks were established by the British: Bank Savings Account: of Bengal in 1806, followed by Bank of Bombay in 1840, Y Generally maintained by individuals. and Bank of Madras in 1843. Y Nominal rate of interest will be paid on the 3. The first bank with limited liability, managed by Indians, balances in this account. -

State Bank of India

State Bank of India State Bank of India Type Public Traded as NSE: SBIN BSE: 500112 LSE: SBID BSE SENSEX Constituent Industry Banking, financial services Founded 1 July 1955 Headquarters Mumbai, Maharashtra, India Area served Worldwide Key people Pratip Chaudhuri (Chairman) Products Credit cards, consumer banking, corporate banking,finance and insurance,investment banking, mortgage loans, private banking, wealth management Revenue US$ 36.950 billion (2011) Profit US$ 3.202 billion (2011) Total assets US$ 359.237 billion (2011 Total equity US$ 20.854 billion (2011) Owner(s) Government of India Employees 292,215 (2012)[1] Website www.sbi.co.in State Bank of India (SBI) is a multinational banking and financial services company based in India. It is a government-owned corporation with its headquarters in Mumbai, Maharashtra. As of December 2012, it had assets of US$501 billion and 15,003 branches, including 157 foreign offices, making it the largest banking and financial services company in India by assets.[2] The bank traces its ancestry to British India, through the Imperial Bank of India, to the founding in 1806 of the Bank of Calcutta, making it the oldest commercial bank in the Indian Subcontinent. Bank of Madras merged into the other two presidency banks—Bank of Calcutta and Bank of Bombay—to form the Imperial Bank of India, which in turn became the State Bank of India. Government of Indianationalised the Imperial Bank of India in 1955, with Reserve Bank of India taking a 60% stake, and renamed it the State Bank of India. In 2008, the government took over the stake held by the Reserve Bank of India. -

Customer Attitude on Service Quality of Private Banks in Tiruchirappalli

26326 R.Karthi et al./ Elixir Marketing Mgmt. 73 (2014) 26326-26329 Available online at www.elixirpublishers.com (Elixir International Journal) Marketing Management Elixir Marketing Mgmt. 73 (2014) 26326-26329 Customer Attitude on Service Quality of Private Banks in Tiruchirappalli R.Karthi *, B.Asha Daisy and M.Ganga E.G.S.Pillay Engineering College Nagapattinam, Tamilnadu, India. ARTICLE INFO ABSTRACT Article history: Marketing in today’s world is so difficult for existing players and the new entrants due to Received: 10 June 2014; the fast growing, changes in the customer preference and tastes, rapid growth of Received in revised form: technology, penetration of foreign players in the local market, price sensitiveness of 25 July 2014; customers and quality consciousness of government for attracting, acquiring, retaining Accepted: 9 August 2014; customers in the business. To identify the attitude of the customer in the banking sector, a study has been made in the Tiruchirappalli region among private bank. Keywords © 2014 Elixir All rights reserved. Customer Attitude, Service Quality, Private Banks. Introduction Reserve bank of India (RBI) came in picture in 1935 and Retail banking Industry is growing rapidly in a fast and study became the centre of every other bank taking away all the phase to acquire and retain the customers. To face the global responsibilities and functions of Imperial bank. Between 1969 competition the private banks are taking innumerable steps to and 1980 there was rapid increase in the number of branches of defend their business in order to maximize their potential the private banks. In April 1980, they accounted for nearly 17.5 business. -

List of Indian Public Sector Banks :- (Click to Visit the Website of the Bank)

List of Banks in India - 2014 Directory of Public Sector / Private Sector / Foreign Banks List of Indian Public Sector Banks :- (Click to visit the website of the Bank) Nationalized Banks, State Bank Group Banks have been included here as PS Banks : Allahabad Bank Andhra Bank Bank of Baroda Bank of India Bank of Maharashtra Canara Bank Central Bank of India Corporation Bank Dena Bank IDBI Bank Limited Indian Bank Indian Overseas Bank IDBI Bank Industrial Development Bank of India Oriental Bank of Commerce Punjab & Sind Bank Punjab National Bank State Bank of Bikaner and Jaipur State Bank of Hyderabad State Bank of India State Bank of Mysore State Bank of Patiala State Bank of Travancore Syndicate Bank UCO Bank Union Bank of India United Bank Of India Vijaya Bank (a) The following two State Bank Group Banks have since been merged with SBI) State Bank of Indore (since merged with SBI) State Bank of Saurashtra (since merged with SBI) ( b) New Bank of India (a nationalised bank) was merged with Punjab National Bank in 1993 List of Private Sector Banks in India Ads by Google Axis Bank Catholic Syrian Bank Ltd. IndusInd Bank Limited ICICI Bank ING Vysya Bank Kotak Mahindra Bank Limited Karnataka Bank Karur Vysya Bank Limited. Tamilnad Mercantile Bank Ltd. The Dhanalakshmi Bank Limited. The Federal Bank Ltd. The HDFC Bank Ltd. The Jammu & Kashmir Bank Ltd. The Nainital Bank Ltd. The Lakshmi Vilas Bank Ltd Yes Bank copied from www,allbankingsolutions.com List of Private Sector Banks Since Merged with other banks The Nedungadi Bank (merged with -

Unit 1. Evolution of Banking

DNYANSAGAR ARTS AND COMMERCE COLLEGE, BALEWADI, PUNE – 45 Subject – Banking And Finance - I (115 B) Class: FYB.COM (2019 Pattern) Unit 1. Evolution of Banking Introduction Money in the Economy is like blood in the human body”. The flow of money in the economy determines the characteristics of any economy. Robust money and capital markets are essentials for a developed economy. The short term and long term needs of money of individuals and institutions can be efficiently met by financial intermediaries. Pooling of scanty deposits into a large capital base and lending it to the desirable sectors is the core of banking business. In a developing economy like India, the role of banking sector becomes even more critical. In the initial years of economic development, when other sophisticated financial institutions were not present, banks were the only financial intermediaries which helped in bring about the change. The sense of confidence in the ethical functioning of financial intermediaries, in the minds of common man, was brought about by well-regulated commercial banks. The word ‘bank’ is of Germanic origin though some persons trace its origin to the French word ‘Banqui’ and the Italian word ‘Banca’. It referred to a bench for keeping, lending, and exchanging of money or coins in the market place by money lenders and money changers. According to Banking Regulation Act, 1949 of India, “Banking means the accepting for the purpose of lending or investment of deposits of money from the public, repayable on demand or otherwise and withdrawable by cheque, draft, and an order or otherwise”. A bank is a financial institution which deals with deposits and advances and other related services. -

Consolidation in Indian Banking Industry – Need of the Hour

Business Review Volume 3 Issue 2 July-December 2008 Article 8 7-1-2008 Consolidation in Indian banking industry – need of the hour Syed Ahsan Jamil Institute of Productivity and Management, Lucknow, India Bimal Jaiswal University of Lucknow, Lucknow, India Namita Nigam Institute of Environment and Management, Lucknow, India Follow this and additional works at: https://ir.iba.edu.pk/businessreview Part of the Finance and Financial Management Commons This work is licensed under a Creative Commons Attribution 4.0 License. iRepository Citation Jamil, S. A., Jaiswal, B., & Nigam, N. (2008). Consolidation in Indian banking industry – need of the hour. Business Review, 3(2), 1-16. Retrieved from https://ir.iba.edu.pk/businessreview/vol3/iss2/8 This article is brought to you by iRepository for open access under the Creative Commons Attribution 4.0 License. For more information, please contact [email protected]. https://ir.iba.edu.pk/businessreview/vol3/iss2/8 Business Review – Volume 3 Number 2 July – December 2008 DISCUSSION Consolidation in Indian Banking Industry- Need of the Hour Syed Ahsan Jamil Institute of Productivity and Management, Lucknow, India Bimal Jaiswal University of Lucknow, Lucknow, India Namita Nigam Institute of Environment and Management, Lucknow, India ABSTRACT his study is aimed at trying to unravel the fast and metamorphic changes been Tbrought about within the Indian banking industry. With the government in India clearly specifying that it will liberalize the entry of foreign banks in India by 2009 alarm bells have started ringing for underperforming banks who largely nurtured under government protection and lack of competition. It is now a fight for survival. -

GIPE-041303-Contents.Pdf

Date of J:elease for loan This book should be returned on or before the date last mentioned below. An overdue charge of 5 paise will be levied for each day the book .is kept beyond this date . ;188 1 2 Sf? 1921 I [ f -2. OCT 1991 2 9 AUG, '1991 . ~, 'APal\Q9S ~ -5 '·1l.Jlt995 . A.B.P.P. I j ____ -...J. ___ ~ A BANKER'S OFFICE INDIGENOUS BANKING IN INDIA ~~ ~.f.\A...~ .9 • MACMILLAN AND CO., Lnrrnm LONDON • BOMBAY • CALCUTTA • MADRAS MELBOURNE THE MACMILLAN· COMPANY NEW YORK • BOSTON • CmCAGO DALLAS • SAN PllANCISCO THE MACMILLAN COMPANY OF CANADA, LIMITED TORONTO INDIGENOUS BANKING IN INDIA BY L. C. JAIN M.A., LL.B., PH.D. (ECON.) LOND. LScruUJl, IN CORUNCV AND BANKING AT THB UNIVERSITY OF ALLAHABAD WITH AN INTRODUCTION BY DR. GILBERT SLATER, M.A., D.Se. (ECON.) LoND. LATE i>ROFasSOR OF INDIAN BCONOMICS, MADRAS UNIVERSITY MACMILLAN AND CO., LIMITED ST. MARTIN'S STREET, LONDON J9 2 9 COPYRIGHT (Thesis approved for 'he Degree of Doctor of Philosophy (Economics) in the Universitr of London) 41303 PRINTED IN. GREAT BRITAIN TO MY REVERED FATHER BALMUKAND JAIN, ESQ. B.A., C.T., A.C.P. (LoNDON) AN APOLOGY FOR TWO YEARS' ABSENCE FROM HOME PREFACE IN the following pages an attempt is made to describe the present indigenous banking system in India. Literature on the subject is almost non-existent. Such inform~tion as is given in works on the Indian money-market is incomplete, largely repetitive and in other ways unsatisfactory. There is som'etimes confusion of thought and consequent misre presentation of facts. -

(Subsidiary Banks) Act, 1959

THE STATE BANK OF INDIA (SUBSIDIARY BANKS) ACT, 1959 THE SUBSIDIARY BANKS GENERAL REGULATIONS, 1959 & THE STATE BANK OF HYDERABAD ACT, 1956 STATE BANK OF INDIA LAW DEPARTMENT CORPORATE CENTRE MUMBAI [As amended up to 27th June 2014] 1 © SBI, Law Department, Corporate Centre, Mumbai. (2014) [email protected] 2 THE STATE BANK OF INDIA (SUBSIDIARY BANKS) ACT, 1959 ………………………. 9 THE SUBSIDIARY BANKS GENERAL REGULATIONS, 1959 ……………..……………… 61 THE STATE BANK OF HYDERABAD ACT, 1956 ……………………………………..………. 83 Contents The State Bank of India (Subsidiary Banks) Act, 1959 .......................................................... 10 CHAPTER I ................................................................................................................................................. 10 PRELIMINARY ............................................................................................................................................... 10 1 Short title ..................................................................................................................................................... 10 2 Definitions ................................................................................................................................................... 10 CHAPTER II ................................................................................................................................................ 12 [CONSTITUTION OF NEW BANKS AND CHANGES OF NAME OF ANY SUBSIDIARY BANK] ............................................................................................................................................................................ -

State Bank of India Companyname

VISIT NOTE STATE BANK OF INDIA J uggernaut geared for the next cycle India Equity Research| Banking and Financial Services COMPANYNAME We met State Bank of India’s (SBI) top management team to assess the EDELWEISS 4D RATINGS bank’s business strategy and growth & asset quality outlook. Key Absolute Rating BUY takeaways: a) focus is on consistently delivering on earnings and Rating Relative to Sector Performer improving visibility while building on business momentum (10% loan Risk Rating Relative to Sector Low growth target); b) incremental stress is on expected lines with SBI Sector Relative to Market Overweight maintaining slippages & credit cost guidance of 2%; c) performance of subsidiaries has been impressive and potent value unlocking is imminent; MARKET DATA (R: SBI.BO, B: SBIN IN) and d) while consolidation of PSU banks is a pragmatic move, CMP : INR 265 management assuaged concerns of SBI being coerced into it. We believe, Target Price : INR 338 SBI is better positioned among peers—CET-1 at 9.8%, NNPLs at <5.3% and 52-week range (INR) : 352 / 232 CASA at ~45%. Maintain ‘BUY’ with TP of INR338. Share in issue (mn) : 8,924.6 M cap (INR bn/USD mn) : 2,365 / 32,620 Recent events largely one-off with restricted impact on SBI Avg. Daily Vol.BSE/NSE(‘000) : 24,517.5 Management perceives recent events as an off shoot of global factors; however, underlying macros of Indian economy continues on a strong footing. SBI has 6% stake SHARE HOLDING PATTERN (%) in IL&FS and debt exposure is at SPV level. -

Impact of Mergers & Acquisitions on Selected Banks

Conference Proceeding Published in International Journal of Trend in Research and Development (IJTRD), ISSN: 2394-9333, www.ijtrd.com Impact of Mergers & Acquisitions on Selected Banks Jyothi.L Asst. Professor, Kairalee Nikethan Golden Jubilee Degree College, Indiranagar, Bangalore, India Abstract: Banking sector plays very important role in every iii. To analysis the impact of Mergers & economy & is one of the fastest growing sectors in India. The Acquisitions on Selected Banks. competition is extreme & regardless of the challenge from the B. Research Tools global banks, domestic banks- both public & private sector. There are many indications that weak banks will merge will i. Secondary Data: Bank of Baroda’s, Vijaya Bank strong banks. Mergers & Acquisitions encourage banks to & Dena Bank past 5 financial year data gain global reach, better synergy, compete with global banks & collected, Debt Equity Ratio, Current Ratio, allow banks to acquire the Non-performing assets of weaker Asset Turnover Ratio, Net Profit Margin Ratio, banks. Through Mergers & Acquisitions, banks will get brand Net Operating Profit per share ratio, Non- names, new geographies, and correspondent product offerings performing assets. but also opportunities to cross sell to new accounts acquired by the other banks. The main objective of this paper is to assess C. Scope of the study the impact of merger & acquisition on the performance of i. The study is restricted to the impact of Bank of bank. This study is based on the secondary data collected from Baroda, Vijaya bank & Dena Bank. Magazines, Newspaper, journals etc. ii. The study is based on last four financial year data Keywords: Merger, Acquisitions, Banking sector, Growth of BOB, Vijaya Bank & Dena Bank. -

The State Bank of Saurashtra (Repeal) and the State Bank of India (Subsidiary Banks) Amendment Bill, 2009

1 AS INTRODUCED IN LOK SABHA Bill No. 113 of 2009 THE STATE BANK OF SAURASHTRA (REPEAL) AND THE STATE BANK OF INDIA (SUBSIDIARY BANKS) AMENDMENT BILL, 2009 A BILL to repeal the State Bank of Saurashtra Act, 1950 and further to amend the State Bank of India (Subsidiary Banks) Act, 1959. BE it enacted by Parliament in the Sixtieth Year of the Republic of India as follows:— CHAPTER I PRELIMINARY 1. (1) This Act may be called the State Bank of Saurashtra (Repeal) and the State Bank Short title and 5 of India (Subsidiary Banks) Amendment Act, 2009. commence- ment. (2) It shall come into force on such date as the Central Government may, by notification in the Official Gazette, appoint. CHAPTER II . REPEAL OF THE STATE BANK OF SAURASHTRA A CT, 1950 10 2. (1) The State Bank of Saurashtra Act, 1950 is hereby repealed. Repeal and savings. (2) Notwithstanding such repeal, anything done or any action taken, including any agreement entered into under the provisions of the State Bank of Saurashtra Act, 1950, by the State Bank of Saurashtra shall continue to be in force and have effect as if this Act has not been enacted. 15 (3) The mention of particulars in sub-section (2) shall not be held to prejudice or affect 10 of 1897. the general application of section 6 of the General Clauses Act, 1897, with regard to the effect of repeal. 2 CHAPTER III AMENDMENTS TO THE STATE BANK OF INDIA (SUBSIDIARY BANKS) ACT, 1959 Amendment 3. In section 2 of the State Bank of India (Subsidiary Banks) Act, 1959 (hereafter in this 38 of 1959.