Doug Henwood

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Self-Study Report for Accreditation in Journalism and Mass Communications

Self-Study Report for Accreditation in Journalism and Mass Communications Undergraduate site visit during 2014-2015 Submitted to the Accrediting Council on Education in Journalism and Mass Communications Name of Institution: University of North Alabama Name of Journalism/Mass Communications Unit: Department of Communications Address: One Harrison Plaza, UNA Box 5007, Florence, AL 35632 Date of Scheduled Accrediting Visit: October 26-29, 2014 We hereby submit the following report as required by the Accrediting Council on Education in Journalism and Mass Communications for the purpose of an accreditation review. Journalism/mass communications administrator: Name: Dr. Greg Pitts Title: Chair, Department of Communications Signature: ______________________________________________ Administrator to whom journalism/mass communications administrator reports: Name: Dr. Carmen Burkhalter Title: Dean, College of Arts and Sciences Signature: ______________________________________________ UNA Self-Study Report Contents 2 Contents Part I: General Information ................................................................................................. 3 Part II: Supplementary Information .................................................................................. 11 Table 1. Students .......................................................................................................... 12 Table 2. Full-time faculty .............................................................................................. 13 Table 3. Part-time faculty............................................................................................. -

Democratic Citizenship in the Heart of Empire Dissertation Presented In

POLITICAL ECONOMY OF AMERICAN EDUCATION: Democratic Citizenship in the Heart of Empire Dissertation Presented in Partial Fulfillment of the Requirements for the Degree Doctor of Philosophy in the Graduate School of the Ohio State University Thomas Michael Falk B.A., M.A. Graduate Program in Education The Ohio State University Summer, 2012 Committee Members: Bryan Warnick (Chair), Phil Smith, Ann Allen Copyright by Thomas Michael Falk 2012 ABSTRACT Chief among the goals of American education is the cultivation of democratic citizens. Contrary to State catechism delivered through our schools, America was not born a democracy; rather it emerged as a republic with a distinct bias against democracy. Nonetheless we inherit a great demotic heritage. Abolition, the labor struggle, women’s suffrage, and Civil Rights, for example, struck mighty blows against the established political and economic power of the State. State political economies, whether capitalist, socialist, or communist, each express characteristics of a slave society. All feature oppression, exploitation, starvation, and destitution as constitutive elements. In order to survive in our capitalist society, the average person must sell the contents of her life in exchange for a wage. Fundamentally, I challenge the equation of State schooling with public and/or democratic education. Our schools have not historically belonged to a democratic public. Rather, they have been created, funded, and managed by an elite class wielding local, state, and federal government as its executive arms. Schools are economic institutions, serving a division of labor in the reproduction of the larger economy. Rather than the school, our workplaces are the chief educational institutions of our lives. -

Re:Imagining Change

WHERE IMAGINATION BUILDS POWER RE:IMAGINING CHANGE How to use story-based strategy to win campaigns, build movements, and change the world by Patrick Reinsborough & Doyle Canning 1ST EDITION Advance Praise for Re:Imagining Change “Re:Imagining Change is a one-of-a-kind essential resource for everyone who is thinking big, challenging the powers-that-be and working hard to make a better world from the ground up. is innovative book provides the tools, analysis, and inspiration to help activists everywhere be more effective, creative and strategic. is handbook is like rocket fuel for your social change imagination.” ~Antonia Juhasz, author of e Tyranny of Oil: e World’s Most Powerful Industry and What We Must Do To Stop It and e Bush Agenda: Invading the World, One Economy at a Time “We are surrounded and shaped by stories every day—sometimes for bet- ter, sometimes for worse. But what Doyle Canning and Patrick Reinsbor- ough point out is a beautiful and powerful truth: that we are all storytellers too. Armed with the right narrative tools, activists can not only open the world’s eyes to injustice, but feed the desire for a better world. Re:Imagining Change is a powerful weapon for a more democratic, creative and hopeful future.” ~Raj Patel, author of Stuffed & Starved and e Value of Nothing: How to Reshape Market Society and Redefine Democracy “Yo Organizers! Stop what you are doing for a couple hours and soak up this book! We know the importance of smart “issue framing.” But Re:Imagining Change will move our organizing further as we connect to the powerful narrative stories and memes of our culture.” ~ Chuck Collins, Institute for Policy Studies, author of e Economic Meltdown Funnies and other books on economic inequality “Politics is as much about who controls meanings as it is about who holds public office and sits in office suites. -

A Lexicon of Alchemy

A Lexicon of Alchemy by Martin Rulandus the Elder Translated by Arthur E. Waite John M. Watkins London 1893 / 1964 (250 Copies) A Lexicon of Alchemy or Alchemical Dictionary Containing a full and plain explanation of all obscure words, Hermetic subjects, and arcane phrases of Paracelsus. by Martin Rulandus Philosopher, Doctor, and Private Physician to the August Person of the Emperor. [With the Privilege of His majesty the Emperor for the space of ten years] By the care and expense of Zachariah Palthenus, Bookseller, in the Free Republic of Frankfurt. 1612 PREFACE To the Most Reverend and Most Serene Prince and Lord, The Lord Henry JULIUS, Bishop of Halberstadt, Duke of Brunswick, and Burgrave of Luna; His Lordship’s mos devout and humble servant wishes Health and Peace. In the deep considerations of the Hermetic and Paracelsian writings, that has well-nigh come to pass which of old overtook the Sons of Shem at the building of the Tower of Babel. For these, carried away by vainglory, with audacious foolhardiness to rear up a vast pile into heaven, so to secure unto themselves an immortal name, but, disordered by a confusion and multiplicity of barbarous tongues, were ingloriously forced. In like manner, the searchers of Hermetic works, deterred by the obscurity of the terms which are met with in so many places, and by the difficulty of interpreting the hieroglyphs, hold the most noble art in contempt; while others, desiring to penetrate by main force into the mysteries of the terms and subjects, endeavour to tear away the concealed truth from the folds of its coverings, but bestow all their trouble in vain, and have only the reward of the children of Shem for their incredible pain and labour. -

Now Available for Free As A

JARED CULTURAL STUDIES / AFRICANA STUDIES $14.95 | £11 In the proud tradition of Fanon, Cabral, Malcolm X, and Steve Biko, BALL Jared Ball speaks in the voice of the decolonial Other, ofering a much- needed mind transplant to anyone preferring to ignore the liberatory potential inhering in the hip-hop phenomenon of mixtape.—Ward Churchill / Author of A Little Matter of Genocide With this book, Jared Ball correctly and cogently posits hip-hop in its I rightful place—as the most important literary form to emerge from the MIX 20th century.—Boots Riley / Te Coup Te value of a committed, revolutionary Ph.D. with an ear for the WHAT truth and skills on the mic and turntable? Priceless.—Glen Ford / Executive Editor of BlackAgendaReport.com I In a moment of increasing corporate control in the music indus- LIKE try, where three major labels call the shots on which artists are heard and seen, Jared Ball analyzes the colonization and control ! of popular music and posits the homemade hip-hop mixtape as an emancipatory tool for community resistance. I Mix What I Like! is a revolutionary investigation of the cultural dimension of anti- JARED racist organizing in the Black community. A MIXTAPE BALL Blending together elements from internal colonialism theory, cul- tural studies, political science, and his own experience on the mic, Jared positions the so-called “hip-hop nation” as an extension of the internal colony that is modern African America, and suggests that the low-tech hip-hop mixtape may be one of the best weapons MANIFESTO we have against Empire. -

Killing Hope U.S

Killing Hope U.S. Military and CIA Interventions Since World War II – Part I William Blum Zed Books London Killing Hope was first published outside of North America by Zed Books Ltd, 7 Cynthia Street, London NI 9JF, UK in 2003. Second impression, 2004 Printed by Gopsons Papers Limited, Noida, India w w w.zedbooks .demon .co .uk Published in South Africa by Spearhead, a division of New Africa Books, PO Box 23408, Claremont 7735 This is a wholly revised, extended and updated edition of a book originally published under the title The CIA: A Forgotten History (Zed Books, 1986) Copyright © William Blum 2003 The right of William Blum to be identified as the author of this work has been asserted by him in accordance with the Copyright, Designs and Patents Act 1988. Cover design by Andrew Corbett ISBN 1 84277 368 2 hb ISBN 1 84277 369 0 pb Spearhead ISBN 0 86486 560 0 pb 2 Contents PART I Introduction 6 1. China 1945 to 1960s: Was Mao Tse-tung just paranoid? 20 2. Italy 1947-1948: Free elections, Hollywood style 27 3. Greece 1947 to early 1950s: From cradle of democracy to client state 33 4. The Philippines 1940s and 1950s: America's oldest colony 38 5. Korea 1945-1953: Was it all that it appeared to be? 44 6. Albania 1949-1953: The proper English spy 54 7. Eastern Europe 1948-1956: Operation Splinter Factor 56 8. Germany 1950s: Everything from juvenile delinquency to terrorism 60 9. Iran 1953: Making it safe for the King of Kings 63 10. -

Capitalism Has Failed — What Next?

The Jus Semper Global Alliance In Pursuit of the People and Planet Paradigm Sustainable Human Development November 2020 ESSAYS ON TRUE DEMOCRACY AND CAPITALISM Capitalism Has Failed — What Next? John Bellamy Foster ess than two decades into the twenty-first century, it is evident that capitalism has L failed as a social system. The world is mired in economic stagnation, financialisation, and the most extreme inequality in human history, accompanied by mass unemployment and underemployment, precariousness, poverty, hunger, wasted output and lives, and what at this point can only be called a planetary ecological “death spiral.”1 The digital revolution, the greatest technological advance of our time, has rapidly mutated from a promise of free communication and liberated production into new means of surveillance, control, and displacement of the working population. The institutions of liberal democracy are at the point of collapse, while fascism, the rear guard of the capitalist system, is again on the march, along with patriarchy, racism, imperialism, and war. To say that capitalism is a failed system is not, of course, to suggest that its breakdown and disintegration is imminent.2 It does, however, mean that it has passed from being a historically necessary and creative system at its inception to being a historically unnecessary and destructive one in the present century. Today, more than ever, the world is faced with the epochal choice between “the revolutionary reconstitution of society at large and the common ruin of the contending classes.”3 1 ↩ George Monbiot, “The Earth Is in a Death Spiral. It will Take Radical Action to Save Us,” Guardian, November 14, 2018; Leonid Bershidsky, “Underemployment is the New Unemployment,” Bloomberg, September 26, 2018. -

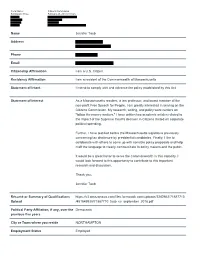

Citizens Commission Submission Time: February 28, 2019 9:19 Am

Form Name: Citizens Commission Submission Time: February 28, 2019 9:19 am Name Jennifer Taub Address Phone Email Citizenship Affirmation I am a U.S. Citizen Residency Affirmation I am a resident of the Commonwealth of Massachusetts Statement of Intent I intend to comply with and advance the policy established by this Act. Statement of Interest As a Massachusetts resident, a law professor, and board member of the non-profit Free Speech for People, I am greatly interested in serving on the Citizens Commission. My research, writing, and policy work centers on "follow the money matters." I have written two academic articles related to the impact of the Supreme Court's decision in Citizens United on corporate political spending. Further, I have testified before the Massachusetts legislature previously concerning tax disclosure by presidential candidates. Finally, I like to collaborate with others to come up with sensible policy proposals and help craft the language to clearly communicate to policy makers and the public. It would be a great honor to serve the Commonwealth in this capacity. I would look forward to this opportunity to contribute to this important research and discussion. Thank you, Jennifer Taub Résumé or Summary of Qualifications https://s3.amazonaws.com/files.formstack.com/uploads/3282862/71887710 Upload /481849938/71887710_taub_cv_september_2018.pdf Political Party Affiliation, if any, over the Democratic previous five years CIty or Town where you reside NORTHAMPTON Employment Status Employed Occupation Law Professor Employer Vermont Law School JENNIFER TAUB EDUCATION Harvard Law School, Cambridge, MA J.D. 1993, cum laude Recent Developments Editor of the Harvard Women’s Law Journal Yale University, New Haven, CT B.A. -

Energumen 3 Robert Kelly Bard College

Bard College Bard Digital Commons Robert Kelly Manuscripts Robert Kelly Archive 5-2008 enERGUMEN 3 Robert Kelly Bard College Follow this and additional works at: http://digitalcommons.bard.edu/rk_manuscripts Recommended Citation Kelly, Robert, "enERGUMEN 3" (2008). Robert Kelly Manuscripts. Paper 428. http://digitalcommons.bard.edu/rk_manuscripts/428 This Manuscript is brought to you for free and open access by the Robert Kelly Archive at Bard Digital Commons. It has been accepted for inclusion in Robert Kelly Manuscripts by an authorized administrator of Bard Digital Commons. For more information, please contact [email protected]. RK - Energumen as of 10 February 2008 – Page 1 ENERGUMEN 2 The great time for me is early morning, right after I've awakened. I go downstairs, onto the deck or in the cool dining room (with many windows), and open my bound notebook, usually an ordinary marbled school notebook, and write with a pen, fountain pen or gel or felt tip -- something flexible. Green tea or strong black tea or yerba mate, and I'll stay at that for an hour or two. Later in the morning, after meditation and breakfast, if I have time I'll get to type on the computer, editing and revising poems from the past few days, or from this morning (if I've caught up). So those are the two phases of a poem, the (usually) handwritten first draft and the later (hours or a few days) revision into typed form. As a typed page the poem will sit in my notebook for a long time, reviewed from time to time, revised, remade. -

Prophetic Dreams and Visions Concerning the Church, Israel, and the Nations

Prophetic Dreams and Visions concerning the Church, Israel, and the Nations Eric Michael Teitelman Pastor•Teacher•Worship Leader Scripture References Scripture sources: NASB and NKJV Italic text represents scripture, interpretation, or commentary on the dream or vision. Job 33:14-18 “For God may speak in one way, or in another, yet man does not perceive it. In a dream, in a vision of the night, when deep sleep falls upon men, while slumbering on their beds, Then He opens the ears of men, and seals their instruction. In order to turn man from his deed, and conceal pride from man, He keeps back his soul from the Pit, and his life from perishing by the sword.” Exe 12:23-25 “But tell them, The days draw near as well as the fulfillment of every vision. For there will no longer be any false vision or flattering divination within the house of Israel. For I the LORD will speak, and whatever word I speak will be performed. It will no longer be delayed, for in your days, O rebellious house, I will speak the word and perform it, declares the Lord GOD.” Num 12:6 “He said, Hear now My words: If there is a prophet among you, I, the LORD, shall make Myself known to him in a vision. I shall speak with him in a dream.” Dan 1:17 “As for these four young men, God gave them knowledge and skill in all literature and wisdom; and Daniel had understanding in all visions and dreams.” Joe 2:28 “It will come about after this That I will pour out My Spirit on all mankind; And your sons and daughters will prophesy, Your old men will dream dreams, Your young men will see visions.” The Church, Israel, and the Nations thehouseofdavid.org Table of Contents 2004 ............................................................................................................................................................. -

Scripture for His Purpose”: a Study of Robert Browning's Use of Biblical Allusions in the Ring and the Book

This dissertation has been microfilmed exactly as received 68-3016 LOUCKS, n, James Frederick, 1936- "SCRIPTURE FOR HIS PURPOSE”: A STUDY OF ROBERT BROWNING'S USE OF BIBLICAL ALLUSIONS IN THE RING AND THE BOOK. The Ohio State University, Ph.D., 1967 Language and Literature, modem University Microfilms, Inc.. Ann Arbor, Michigan "SCRIPTURE FOR HIS PURPOSE": A STUDY OF ROBERT BROWNING*S USE OF BIBLICAL ALLUSIONS IN THE RING AND THE BOOK DISSERTATION Presented in Partial Fulfillment of the Requirements for the Degree Doctor of Philosophy in the Graduate School of The Ohio State University er By James F.c Loucks, II, B.A. , M.A. ****#*• The Ohio State University 1967 Approved by Adviser Department of English Antonio: Mark you this, Bassanio, The dlvel can cite Scripture for his purpose, An evil soul producing holy witness, Is like a villain with a smiling cheek, A goodly apple rotten at the heart, O what a goodly outside falsehood hath. Merchant of Venice (1.3,97-102) ii PREFACE To Browning*s readers it is perhaps a commonplace that the poet makes extraordinarily frequent use of Scriptural allusion, even when considered in the context of his own Bible-quoting age. But few modern readers understand how Browning used these allusions for rhetorical effect; this lack has "been partially remedied by a few sketchy critical studies, presided over by Mrs, Minnie Machen*s The Bible in Browning» which shows commendable knowledge of the Bible, but little of the poet*s use thereof. It was my desire to elucidate some of the obscurer The Ring and the Book pas sages containing Biblical allusions that led me to the pre sent subject; but as I began to collect examples, I became aware that Browning*s manipulation of Scripture raised a larger question, that of the poet*s attitudes toward lan guage itself— its protean, elusive, impermanent and decep tive character. -

Spurgeon's Sermons Volume 9

Spurgeon©s Sermons Volume 9: 1863 by Charles Spurgeon About Spurgeon©s Sermons Volume 9: 1863 by Charles Spurgeon Title: Spurgeon©s Sermons Volume 9: 1863 URL: http://www.ccel.org/ccel/spurgeon/sermons09.html Author(s): Spurgeon, Charles Haddon (1834-1892) Publisher: Grand Rapids, MI: Christian Classics Ethereal Library Date Created: 2002-08-27 CCEL Subjects: All; Sermons; LC Call no: BV42 LC Subjects: Practical theology Worship (Public and Private) Including the church year, Christian symbols, liturgy, prayer, hymnology Times and Seasons. The church year Spurgeon©s Sermons Volume 9: 1863 Charles Spurgeon Table of Contents About This Book. p. ii Sermon 493. Gethsemane. p. 1 Sermon 494. The Betrayal. p. 11 Sermon 495. The Greatest Trial on Record. p. 21 Sermon 496. The New Song. p. 31 Sermon 497. The Procession of Sorrow. p. 40 Sermon 498. The Gladness of the Man of Sorrows. p. 49 Sermon 499. The Clean and the Unclean. p. 59 Sermon 500. Ebenezer!. p. 69 Sermon 501. Grace Abounding. p. 79 Sermon 502. A Jealous God. p. 89 Sermon 503. Death and Life in Christ. p. 99 Sermon 504. I Know That My Redeemer Liveth. p. 109 Sermon 531. The Warrant of Faith. p. 118 Indexes. p. 129 Index of Scripture References. p. 129 Index of Scripture Commentary. p. 129 iii Spurgeon©s Sermons Volume 9: 1863 Charles Spurgeon iv Spurgeon©s Sermons (V9) Charles Spurgeon Gethsemane A Sermon (No. 493) Delivered on Sunday Morning, February 8th, 1863, by the Rev. C. H. SPURGEON, At the Metropolitan Tabernacle, Newington ªAnd being in an agony he prayed more earnestly: and his sweat was as it were great drops of blood falling down to the ground.ºÐLuke 22:44.