Lions Gate Entertainment Corp

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Co-Optation of the American Dream: a History of the Failed Independent Experiment

Cinesthesia Volume 10 Issue 1 Dynamics of Power: Corruption, Co- Article 3 optation, and the Collective December 2019 Co-optation of the American Dream: A History of the Failed Independent Experiment Kyle Macciomei Grand Valley State University, [email protected] Follow this and additional works at: https://scholarworks.gvsu.edu/cine Recommended Citation Macciomei, Kyle (2019) "Co-optation of the American Dream: A History of the Failed Independent Experiment," Cinesthesia: Vol. 10 : Iss. 1 , Article 3. Available at: https://scholarworks.gvsu.edu/cine/vol10/iss1/3 This Article is brought to you for free and open access by ScholarWorks@GVSU. It has been accepted for inclusion in Cinesthesia by an authorized editor of ScholarWorks@GVSU. For more information, please contact [email protected]. Macciomei: Co-optation of the American Dream Independent cinema has been an aspect of the American film industry since the inception of the art form itself. The aspects and perceptions of independent film have altered drastically over the years, but in general it can be used to describe American films produced and distributed outside of the Hollywood major studio system. But as American film history has revealed time and time again, independent studios always struggle to maintain their freedom from the Hollywood industrial complex. American independent cinema has been heavily integrated with major Hollywood studios who have attempted to tap into the niche markets present in filmgoers searching for theatrical experiences outside of the mainstream. From this, we can say that the American independent film industry has a long history of co-optation, acquisition, and the stifling of competition from the major film studios present in Hollywood, all of whom pose a threat to the autonomy that is sought after in these markets by filmmakers and film audiences. -

2013 Movie Catalog © Warner Bros

1-800-876-5577 www.swank.com Swank Motion Pictures,Inc. Swank Motion 2013 Movie Catalog 2013 Movie © Warner Bros. © 2013 Disney © TriStar Pictures © Warner Bros. © NBC Universal © Columbia Pictures Industries, ©Inc. Summit Entertainment 2013 Movie Catalog Movie 2013 Inc. Pictures, Motion Swank 1-800-876-5577 www.swank.com MOVIES Swank Motion Pictures,Inc. Swank Motion 2013 Movie Catalog 2013 Movie © New Line Cinema © 2013 Disney © Columbia Pictures Industries, Inc. © Warner Bros. © 2013 Disney/Pixar © Summit Entertainment Promote Your movie event! Ask about FREE promotional materials to help make your next movie event a success! 2013 Movie Catalog 2013 Movie Catalog TABLE OF CONTENTS New Releases ......................................................... 1-34 Swank has rights to the largest collection of movies from the top Coming Soon .............................................................35 Hollywood & independent studios. Whether it’s blockbuster movies, All Time Favorites .............................................36-39 action and suspense, comedies or classic films,Swank has them all! Event Calendar .........................................................40 Sat., June 16th - 8:00pm Classics ...................................................................41-42 Disney 2012 © Date Night ........................................................... 43-44 TABLE TENT Sat., June 16th - 8:00pm TM & © Marvel & Subs 1-800-876-5577 | www.swank.com Environmental Films .............................................. 45 FLYER Faith-Based -

Donahue V. Artisan Entertainment 2002 U.S

Donahue v. Artisan Entertainment 2002 U.S. Dist. LEXIS 5930 United States District Court for the Southern District of New York April 5, 2002 HEATHER DONAHUE, MICHAEL C. WILLIAMS, JOSHUA G. LEONARD, Plaintiffs, against ARTISAN ENTERTAINMENT, INC., ARTISAN PICTURES INC, Defendants. 00 Civ. 8326 (JGK). 2002 U.S. Dist. LEXIS 5930. April 3, 2002, Decided. April 5, 2002, Filed. Counsel: For plaintiffs: Philip R. Hoffman, Pryor, Cashman, Sherman & Flynn, New York, New York. For defendants: Andrew J. Frack-man, O’Melveny & Myers, New York, New York. Before John G. Koeltl, United States District Judge. JOHN G. KOELTL, District Judge. Plaintiffs Heather Donahue, Michael C. Williams, and Joshua G. Leonard bring this action against defendants Artisan Entertainment, Inc., and Artisan Pictures Inc. (collectively, “Artisan”) for breach of contract and violations of New York Civil Rights Law § 51, § 43(a) of the Lanham Act, 15 U.S.C. § 1125(a), and New York common law regarding unfair competition. The plaintiffs, who played the three central characters in the film “The Blair Witch Project” (“Blair Witch 1”), complain that their names and likenesses from that film, or other images of them, have been used without their approval in a sequel called “Blair Witch 2: Book of Shadows” (“Blair Witch 2”), as well as in promotions for that sequel and in other unauthorized ways. The defendants claim that each of the plaintiffs authorized these uses in their original acting contracts. The defendants now move for summary judgment on all claims. I The standard for granting summary judgment is well established. Summary judgment may not be granted unless “the pleadings, depositions, answers to interrogatories, and admissions on file, together with the affidavits, if any, show that there is no genuine issue as to any material fact and that the moving party is entitled to a judgment as a matter of law.”~ II There is no dispute as to the following facts except where specifically noted. -

Lionsgate Reports Results for First Quarter Fiscal 2022

LIONSGATE REPORTS RESULTS FOR FIRST QUARTER FISCAL 2022 First Quarter Revenue was $901.2 Million; Operating Income was $20.3 Million; Net Loss Attributable to Lionsgate Shareholders was $45.4 Million or $0.20 Diluted Net Loss per Share Adjusted OIBDA was $119.8 Million Global Media Networks Subscribers were 28.9 Million Global Streaming Subscribers were 16.7 Million, reflecting 58% Year-Over-Year Growth; STARZPLAY International Subscribers More than Doubled Year-Over-Year to 7.0 Million Film & Television Library Revenue was $740 Million for Trailing 12 Months SANTA MONICA, CA, and VANCOUVER, BC, August 5, 2021 – Lionsgate (NYSE: LGF.A, LGF.B) today reported first quarter (quarter ended June 30, 2021) revenue of $901.2 million, operating income of $20.3 million and net loss attributable to Lionsgate shareholders of $45.4 million or $0.20 diluted net loss per share on 221.8 million diluted weighted average common shares outstanding. Adjusted net income attributable to Lionsgate shareholders in the quarter was $42.4 million or adjusted diluted EPS of $0.18 on 229.2 million diluted weighted average common shares outstanding, with adjusted OIBDA of $119.8 million. “I’m pleased to report that we were able to lean into our resilient business model to drive strong financial results in the quarter,” said Lionsgate CEO Jon Feltheimer. “We filled our content pipelines with exciting new properties and added valuable new titles to our library. Like the rest of the industry, Starz subscriber growth was impacted by the decline in at home viewership and, importantly, a light content quarter due to COVID-driven production delays. -

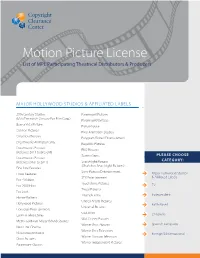

Motion Picture License List of MPL Participating Theatrical Distributors & Producers

Motion Picture License List of MPL Participating Theatrical Distributors & Producers MAJOR HOLLYWOOD STUDIOS & AFFILIATED LABELS 20th Century Studios Paramount Pictures (f/k/a Twentieth Century Fox Film Corp.) Paramount Vantage Buena Vista Pictures Picturehouse Cannon Pictures Pixar Animation Studios Columbia Pictures Polygram Filmed Entertainment Dreamworks Animation SKG Republic Pictures Dreamworks Pictures RKO Pictures (Releases 2011 to present) Screen Gems PLEASE CHOOSE Dreamworks Pictures CATEGORY: (Releases prior to 2011) Searchlight Pictures (f/ka/a Fox Searchlight Pictures) Fine Line Features Sony Pictures Entertainment Focus Features Major Hollywood Studios STX Entertainment & Affiliated Labels Fox - Walden Touchstone Pictures Fox 2000 Films TV Tristar Pictures Fox Look Triumph Films Independent Hanna-Barbera United Artists Pictures Hollywood Pictures Faith-Based Universal Pictures Lionsgate Entertainment USA Films Lorimar Telepictures Children’s Walt Disney Pictures Metro-Goldwyn-Mayer (MGM) Studios Warner Bros. Pictures Spanish Language New Line Cinema Warner Bros. Television Nickelodeon Movies Foreign & International Warner Horizon Television Orion Pictures Warner Independent Pictures Paramount Classics TV 41 Entertaiment LLC Ditial Lifestyle Studios A&E Networks Productions DIY Netowrk Productions Abso Lutely Productions East West Documentaries Ltd Agatha Christie Productions Elle Driver Al Dakheel Inc Emporium Productions Alcon Television Endor Productions All-In-Production Gmbh Fabrik Entertainment Ambi Exclusive Acquisitions -

PDF of Credits

ALANA DA FONSECA EXECUTIVE MUSIC PRODUCER – SONGWRITER MOTION PICTURES EUROVISION (Music Producer, Vocal Arranger) David Dobkin, dir. Netflix THE ADDAMS FAMILY (Music Producer) Greg Tiernan, Conrad Vernon, dirs. MGM GOOD BOYS (Executive Music Producer) Gene Stupnitsky, dir. Universal Pictures PITCH PERFECT 3 (Executive Music Producer) Trish Sie, dir. Universal Pictures POMS (Executive Music Producer) Zara Hayes, dir. STX ISN’T IT ROMANTIC (Music Producer) Todd Strauss-Schulson, dir. Warner Bros. THE SECRET LIFE OF PETS (Producer “We Go Together”) Chris Renaud, dir. Universal Pictures PITCH PERFECT 2 (Arranger/Vocal Arranger) Elizabeth Banks, dir. Universal Pictures ALVIN AND THE CHIPMUNKS: THE ROAD CHIP (Executive Music Producer) Walt Becker, dir. Fox 2000 PITCH PERFECT (Additional Vocal Arranger) Jason Moore, dir. Universal Pictures HANNAH MONTANA: THE MOVIE (Producer “Let’s Do This”) Peter Chelsom dir. Walt Disney Studios 3349 Cahuenga Blvd. West Los Angeles, California 90068 Tel. 818-380-1918 Fax 818-380-2609 ALANA DA FONSECA EXECUTIVE MUSIC PRODUCER – SONGWRITER TELEVISION JULIE AND THE PHANTOMS (Vocal Arranger/Vocal Producer, Songwriter) Kenny Ortega, dir. Netflix TROLLS: THE BEAT GOES ON (Executive Music Producer, Songwriter) Hannah Friedman, creator Netflix DWA UNNANOUNCED SHOW (Executive Music Producer, Songwriter) DreamWorks Animation ALVINNN!!! AND THE CHIPMUNKS (Executive Music Producer, Songwriter) Janice Karman, creator Nickelodeon LIVE SHOW TROLLS LIVE TOURING SHOW (Music Producer) SONGWRITER NAKED (Writer “Nobody But You”) Michael Tiddes, dir. Netflix STAR (TV) (Writer “Honeysuckle”) Lee Daniels, Tom Donaghy, creators Fox ALVIN AND THE CHIPMUNKS: THE ROAD CHIP (Writer “Home”) Walt Becker, dir. Fox 2000 POWER (TV) (Writer “Old Flame”) Courtney A. Kemp, creator Starz FIFTY SHADES OF GREY (Writer “Awakening”) Sam Taylor-Johnson, dir. -

Films Winning 4 Or More Awards Without Winning Best Picture

FILMS WINNING 4 OR MORE AWARDS WITHOUT WINNING BEST PICTURE Best Picture winner indicated by brackets Highlighted film titles were not nominated in the Best Picture category [Updated thru 88th Awards (2/16)] 8 AWARDS Cabaret, Allied Artists, 1972. [The Godfather] 7 AWARDS Gravity, Warner Bros., 2013. [12 Years a Slave] 6 AWARDS A Place in the Sun, Paramount, 1951. [An American in Paris] Star Wars, 20th Century-Fox, 1977 (plus 1 Special Achievement Award). [Annie Hall] Mad Max: Fury Road, Warner Bros., 2015 [Spotlight] 5 AWARDS Wilson, 20th Century-Fox, 1944. [Going My Way] The Bad and the Beautiful, Metro-Goldwyn-Mayer, 1952. [The Greatest Show on Earth] The King and I, 20th Century-Fox, 1956. [Around the World in 80 Days] Mary Poppins, Buena Vista Distribution Company, 1964. [My Fair Lady] Doctor Zhivago, Metro-Goldwyn-Mayer, 1965. [The Sound of Music] Who's Afraid of Virginia Woolf?, Warner Bros., 1966. [A Man for All Seasons] Saving Private Ryan, DreamWorks, 1998. [Shakespeare in Love] The Aviator, Miramax, Initial Entertainment Group and Warner Bros., 2004. [Million Dollar Baby] Hugo, Paramount, 2011. [The Artist] 4 AWARDS The Informer, RKO Radio, 1935. [Mutiny on the Bounty] Anthony Adverse, Warner Bros., 1936. [The Great Ziegfeld] The Song of Bernadette, 20th Century-Fox, 1943. [Casablanca] The Heiress, Paramount, 1949. [All the King’s Men] A Streetcar Named Desire, Warner Bros., 1951. [An American in Paris] High Noon, United Artists, 1952. [The Greatest Show on Earth] Sayonara, Warner Bros., 1957. [The Bridge on the River Kwai] Spartacus, Universal-International, 1960. [The Apartment] Cleopatra, 20th Century-Fox, 1963. -

ELIZABETH MARTUCCI Costume Designer

! ELIZABETH MARTUCCI Costume Designer www.ElizabethMartucci.com Television PROJECT DIRECTOR STUDIO / PRODUCTION CO. SIDE HUSTLE Various Nickelodeon seasons 1-2 Prod: David Malkoff, Chris Phillips, John Beck, Ron Hart DAD, STOP EMBARRASSING ME Various Netflix season 1 Prod: Jamie Foxx, Jaime Rucker King, Chris Arrington PRIDE OF TEXAS Andy Fickman Disney Channel pilot Prod: Betsy Sullenger, Greg Hampson THE RANCH Various Netflix seasons 1-4 Prod: Melanie Patterson, Don Reo, Jim Patterson LIV & MADDIE Various Disney Channel seasons 2-4 Prod: Andy Fickman, Betsy Sullenger Emmy Nomination: Outstanding Costume Design in a Daytime Series GLEE Various Fox seasons 3-4 Prod: Ryan Murphy, Dante Di Loreto, Ian Brennan season 2 (Assistant Designer) SLAMBALL J.D. Hansen Spike TV seasons 3-4 Prod: Michael Tollin, Pat Croce TRUE BLOOD Various HBO season 5 (Costumer) Prod: Alan Ball, Gregg Fienberg SUBURGATORY Various ABC season 1 (Costumer) Prod: Emily Kapnek WORKAHOLICS Various Comedy Central season 1 (Costumer) Prod: Kevin Etten, Kyle Newacheck THE PINK HOUSE Michael Lembeck Universal Media Studios / NBC tv movie (Costumer) Prod: Kenny Schwartz NIP TUCK Various FX seasons 3-5 (Costumer) Prod: Ryan Murphy, Michael Robin CRIMINAL MINDS Various Touchstone season 4 (Costumer) Prod: Edward Bernero VALENTINE Various Media Rights Capital season 1 (Costumer) Prod: Kevin Murphy IN JUSTICE Various Touchstone season 1 (Costumer) Prod: Richard Heus, Terri Kopp SAMANTHA WHO? Various ABC season 1 (Costumer) Prod: Donald Todd, Peter Traugott Film PROJECT DIRECTOR -

Lions Gate Entertainment Corp. Fiscal 2018 Fourth Quarter Year End

Lions Gate Entertainment Corp. Fiscal 2018 Fourth Quarter Year End Earnings Call Thursday, May 24, 2018, 5:00 PM Eastern CORPORATE PARTICIPANTS Jon Feltheimer - Chief Executive Officer Jimmy Barge - Chief Financial Officer Michael Burns - Vice Chairman Chris Albrecht - President, Chief Executive Officer, Starz Jeff Hirsch - Chief Operating Officer, Starz Brian Goldsmith - Chief Operating Officer, Lionsgate Joe Drake - Chairman, Motion Picture Group Kevin Beggs - Chairman, Television Group Laura Kennedy - Chief Operating Officer, TV Group Rick Prell - Chief Accounting Officer James Marsh - Senior Vice President, Head of Investor Relations 1 PRESENTATION Operator Ladies and gentlemen, thank you for standing by. Welcome to the Lionsgate Fiscal 2018 Fourth Quarter Year End Earnings Call. At this time, all participants are in a listen-only mode. Later, we will conduct a question and answer session and instructions will be given at that time. If you should require assistance on today’s call, please press star then zero. And as a reminder, this conference is being recorded. I would now like to turn the conference over to Senior Vice President and Head of Investor Relations, James Marsh. Please go ahead. James Marsh Thanks, Noah. Good afternoon, everyone. Thanks for joining us today for the Lionsgate’s fiscal 2018 fourth quarter call and year-end earnings conference call. We’ll begin with opening remarks from our CEO, Jon Feltheimer; followed by remarks from our CFO, Jimmy Barge. After their remarks, we’ll open the call up for questions. Also, joining us on the call today are Vice Chairman, Michael Burns, Starz’ President and CEO, Chris Albrecht, Starz’ Chief Operating Officer, Jeff Hirsch, Lionsgate’s Chief Operating Officer, Brian Goldsmith, Chairman of the Motion Picture Group, Joe Drake, Chairman of Television Group, Kevin Beggs, Chief Operating Officer of the TV Group, Laura Kennedy, and Chief Accounting Officer, Rick Prell. -

Lionsgate Entertainment Corporation

Lionsgate Entertainment Corporation Q1 2021 Earnings Conference Call Thursday, August 6, 2020, 5:00 PM Eastern CORPORATE PARTICIPANTS Jon Feltheimer - Chief Executive Officer Jimmy Barge - Chief Financial Officer Michael Burns - Vice Chairman Brian Goldsmith - Chief Operating Officer Kevin Beggs - Chairman, TV Group Joe Drake - Chairman, Motion Picture Group Jeff Hirsch - President, Chief Executive Officer, Starz Scott Macdonald - Chief Financial Officer, Starz Superna Kalle - Executive Vice President, International James Marsh - Executive Vice President and Head of Investor Relations 1 PRESENTATION Operator Ladies and gentlemen, thank you for standing by. Welcome to the Lionsgate Entertainment First Quarter 2021 Earnings Call. At this time, all participants are in a listen-only mode. Later, we will conduct a question and answer session; instructions will be given at that time. If you should require assistance during the call, please press "*" then "0." As a reminder, this conference is being recorded. I will now turn the conference over to our host, Executive Vice President and Head of Investor Relations, James Marsh. Please go ahead. James Marsh Good afternoon. Thank you for joining us for the Lion Gate’s Fiscal 2021 First Quarter Conference Call. We’ll begin with opening remarks from our CEO, Jon Feltheimer, followed by remarks from our CFO, Jimmy Barge. After their remarks, we’ll open the call for questions. Also joining us on the call today are Vice Chairman, Michael Burns, COO, Brian Goldsmith, Chairman of the TV Group, Kevin Beggs, and Chairman of the Motion Picture Group, Joe Drake. And from Starz, we have President and CEO, Jeff Hirsch, CFO, Scott Macdonald and EVP of International, Superna Kalle. -

Lionsgate Entertainment Corp

Lionsgate Entertainment Corp. 2020 Q1 Earnings Call Thursday, August 8, 2019, 5:00 PM Eastern CORPORATE PARTICIPANTS Jon Feltheimer - Chief Executive Officer Jimmy Barge - Chief Financial Officer Michael Burns - Vice Chairman Brian Goldsmith – Lionsgate Chief Operating Officer Kevin Beggs - Chairman, Lionsgate TV Group Joe Drake - Chairman, Lionsgate Motion Picture Group Jeff Hirsch - Chief Operating Officer, Starz Scott Macdonald - Chief Financial Officer, Starz Superna Kalle - Executive Vice President, International Digital Networks, Starz James Marsh - Head, Investor Relations 1 PRESENTATION Operator Ladies and gentlemen, thank you for standing by, and welcome to the Lions Gate 2020 First Quarter Earnings Call. At this time all participants are in a listen-only mode. Later, we will conduct a question-and-answer session. Instructions will be given at that time. Should you require assistance during the call, please press "*", then "0." And as a reminder, this conference is being recorded. I would now like to turn the conference over to our host, Mr. James Marsh, Head of Investor Relations. Please go ahead sir. James Marsh Good afternoon. Thank you for joining us for the Lionsgate Fiscal '20 first quarter conference call. We'll begin with opening remarks from our CEO, Jon Feltheimer followed by remarks from our CFO, Jimmy Barge. After their remarks, we'll open the call for questions. Also joining us on the call today are: Vice Chairman, Michael Burns; COO, Brian Goldsmith; Chairman of the TV Group, Kevin Beggs; and Chairman of the Motion Picture Group, Joe Drake. And from Starz, we have COO, Jeff Hirsch; CFO, Scott Macdonald; and EVP of International, Superna Kalle. -

Keeping the Score the Impact of Recapturing North American Film and Television Sound Recording Work

Keeping the Score The impact of recapturing North American film and television sound recording work December 2014 [This page is intentionally left blank.] Keeping the Score Table of Contents Acknowledgments 2 Executive Summary 3 Introduction 5 Precarious work in a shifting industry 7 From full-time to freelance 7 A dignified standard set by decades of organizing 9 Musicians in a Twenty-First Century studio system 12 What is a “major studio” anyhow? 12 Composers squeezed in the middle: the rise of the “package deal” 15 Chasing tax credits 17 A profitable industry 19 The “last actors” feel the pain 21 Recording employment slipping away 21 Where has recording gone? 24 Recording the score as “an afterthought” 25 Hollywood provides quality employment – for most 26 Bringing work back: the debate thus far 28 A community weakened by the loss of music 33 Case Study: Impact on the Los Angeles regional economy 33 Impact on the cultural fabric 35 Breaking the social compact 36 Federal subsidies 36 Local subsidies 37 Cheating on employment 38 Lionsgate: a new major roars 39 Reliance on tax incentives 41 Wealth – and work – not shared 41 Taking the high road: what it could mean 43 Conclusion and Recommendations 44 Recommendations to policy makers 44 Recommendations to the industry 46 Endnotes 47 laane: a new economy for all 1 Keeping the Score Acknowledgments Lead author: Jon Zerolnick This report owes much to many organizations and individuals who gave generously of their time and insights. Thanks, first and foremost, to the staff and members of the American Federation of Musicians, including especially Local 47 as well as the player conference the Recording Musicians Association.