Macrovision and Lionsgate Announce Agreement for Lionsgate to Acquire TV Guide Network and Tvguide.Com

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

FCC-06-11A1.Pdf

Federal Communications Commission FCC 06-11 Before the FEDERAL COMMUNICATIONS COMMISSION WASHINGTON, D.C. 20554 In the Matter of ) ) Annual Assessment of the Status of Competition ) MB Docket No. 05-255 in the Market for the Delivery of Video ) Programming ) TWELFTH ANNUAL REPORT Adopted: February 10, 2006 Released: March 3, 2006 Comment Date: April 3, 2006 Reply Comment Date: April 18, 2006 By the Commission: Chairman Martin, Commissioners Copps, Adelstein, and Tate issuing separate statements. TABLE OF CONTENTS Heading Paragraph # I. INTRODUCTION.................................................................................................................................. 1 A. Scope of this Report......................................................................................................................... 2 B. Summary.......................................................................................................................................... 4 1. The Current State of Competition: 2005 ................................................................................... 4 2. General Findings ....................................................................................................................... 6 3. Specific Findings....................................................................................................................... 8 II. COMPETITORS IN THE MARKET FOR THE DELIVERY OF VIDEO PROGRAMMING ......... 27 A. Cable Television Service .............................................................................................................. -

Annex 2: Providers Required to Respond (Red Indicates Those Who Did Not Respond Within the Required Timeframe)

Video on demand access services report 2016 Annex 2: Providers required to respond (red indicates those who did not respond within the required timeframe) Provider Service(s) AETN UK A&E Networks UK Channel 4 Television Corp All4 Amazon Instant Video Amazon Instant Video AMC Networks Programme AMC Channel Services Ltd AMC Networks International AMC/MGM/Extreme Sports Channels Broadcasting Ltd AXN Northern Europe Ltd ANIMAX (Germany) Arsenal Broadband Ltd Arsenal Player Tinizine Ltd Azoomee Barcroft TV (Barcroft Media) Barcroft TV Bay TV Liverpool Ltd Bay TV Liverpool BBC Worldwide Ltd BBC Worldwide British Film Institute BFI Player Blinkbox Entertainment Ltd BlinkBox British Sign Language Broadcasting BSL Zone Player Trust BT PLC BT TV (BT Vision, BT Sport) Cambridge TV Productions Ltd Cambridge TV Turner Broadcasting System Cartoon Network, Boomerang, Cartoonito, CNN, Europe Ltd Adult Swim, TNT, Boing, TCM Cinema CBS AMC Networks EMEA CBS Reality, CBS Drama, CBS Action, Channels Partnership CBS Europe CBS AMC Networks UK CBS Reality, CBS Drama, CBS Action, Channels Partnership Horror Channel Estuary TV CIC Ltd Channel 7 Chelsea Football Club Chelsea TV Online LocalBuzz Media Networks chizwickbuzz.net Chrominance Television Chrominance Television Cirkus Ltd Cirkus Classical TV Ltd Classical TV Paramount UK Partnership Comedy Central Community Channel Community Channel Curzon Cinemas Ltd Curzon Home Cinema Channel 5 Broadcasting Ltd Demand5 Digitaltheatre.com Ltd www.digitaltheatre.com Discovery Corporate Services Discovery Services Play -

Lionsgate Reports Results for First Quarter Fiscal 2022

LIONSGATE REPORTS RESULTS FOR FIRST QUARTER FISCAL 2022 First Quarter Revenue was $901.2 Million; Operating Income was $20.3 Million; Net Loss Attributable to Lionsgate Shareholders was $45.4 Million or $0.20 Diluted Net Loss per Share Adjusted OIBDA was $119.8 Million Global Media Networks Subscribers were 28.9 Million Global Streaming Subscribers were 16.7 Million, reflecting 58% Year-Over-Year Growth; STARZPLAY International Subscribers More than Doubled Year-Over-Year to 7.0 Million Film & Television Library Revenue was $740 Million for Trailing 12 Months SANTA MONICA, CA, and VANCOUVER, BC, August 5, 2021 – Lionsgate (NYSE: LGF.A, LGF.B) today reported first quarter (quarter ended June 30, 2021) revenue of $901.2 million, operating income of $20.3 million and net loss attributable to Lionsgate shareholders of $45.4 million or $0.20 diluted net loss per share on 221.8 million diluted weighted average common shares outstanding. Adjusted net income attributable to Lionsgate shareholders in the quarter was $42.4 million or adjusted diluted EPS of $0.18 on 229.2 million diluted weighted average common shares outstanding, with adjusted OIBDA of $119.8 million. “I’m pleased to report that we were able to lean into our resilient business model to drive strong financial results in the quarter,” said Lionsgate CEO Jon Feltheimer. “We filled our content pipelines with exciting new properties and added valuable new titles to our library. Like the rest of the industry, Starz subscriber growth was impacted by the decline in at home viewership and, importantly, a light content quarter due to COVID-driven production delays. -

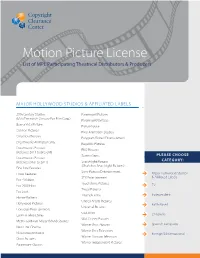

Motion Picture License List of MPL Participating Theatrical Distributors & Producers

Motion Picture License List of MPL Participating Theatrical Distributors & Producers MAJOR HOLLYWOOD STUDIOS & AFFILIATED LABELS 20th Century Studios Paramount Pictures (f/k/a Twentieth Century Fox Film Corp.) Paramount Vantage Buena Vista Pictures Picturehouse Cannon Pictures Pixar Animation Studios Columbia Pictures Polygram Filmed Entertainment Dreamworks Animation SKG Republic Pictures Dreamworks Pictures RKO Pictures (Releases 2011 to present) Screen Gems PLEASE CHOOSE Dreamworks Pictures CATEGORY: (Releases prior to 2011) Searchlight Pictures (f/ka/a Fox Searchlight Pictures) Fine Line Features Sony Pictures Entertainment Focus Features Major Hollywood Studios STX Entertainment & Affiliated Labels Fox - Walden Touchstone Pictures Fox 2000 Films TV Tristar Pictures Fox Look Triumph Films Independent Hanna-Barbera United Artists Pictures Hollywood Pictures Faith-Based Universal Pictures Lionsgate Entertainment USA Films Lorimar Telepictures Children’s Walt Disney Pictures Metro-Goldwyn-Mayer (MGM) Studios Warner Bros. Pictures Spanish Language New Line Cinema Warner Bros. Television Nickelodeon Movies Foreign & International Warner Horizon Television Orion Pictures Warner Independent Pictures Paramount Classics TV 41 Entertaiment LLC Ditial Lifestyle Studios A&E Networks Productions DIY Netowrk Productions Abso Lutely Productions East West Documentaries Ltd Agatha Christie Productions Elle Driver Al Dakheel Inc Emporium Productions Alcon Television Endor Productions All-In-Production Gmbh Fabrik Entertainment Ambi Exclusive Acquisitions -

Channel Guide August 2018

CHANNEL GUIDE AUGUST 2018 KEY HOW TO FIND WHICH CHANNELS YOU HAVE 1 PLAYER PREMIUM CHANNELS 1. Match your ENTERTAINMENT package 1 2 3 4 5 6 2 MORE to the column 100 Virgin Media Previews 3 M+ 101 BBC One If there’s a tick 4 MIX 2. 102 BBC Two in your column, 103 ITV 5 FUN you get that 104 Channel 4 6 FULL HOUSE channel ENTERTAINMENT SPORT 1 2 3 4 5 6 1 2 3 4 5 6 100 Virgin Media Previews 501 Sky Sports Main Event 101 BBC One HD 102 BBC Two 502 Sky Sports Premier 103 ITV League HD 104 Channel 4 503 Sky Sports Football HD 105 Channel 5 504 Sky Sports Cricket HD 106 E4 505 Sky Sports Golf HD 107 BBC Four 506 Sky Sports F1® HD 108 BBC One HD 507 Sky Sports Action HD 109 Sky One HD 508 Sky Sports Arena HD 110 Sky One 509 Sky Sports News HD 111 Sky Living HD 510 Sky Sports Mix HD 112 Sky Living 511 Sky Sports Main Event 113 ITV HD 512 Sky Sports Premier 114 ITV +1 League 115 ITV2 513 Sky Sports Football 116 ITV2 +1 514 Sky Sports Cricket 117 ITV3 515 Sky Sports Golf 118 ITV4 516 Sky Sports F1® 119 ITVBe 517 Sky Sports Action 120 ITVBe +1 518 Sky Sports Arena 121 Sky Two 519 Sky Sports News 122 Sky Arts 520 Sky Sports Mix 123 Pick 521 Eurosport 1 HD 132 Comedy Central 522 Eurosport 2 HD 133 Comedy Central +1 523 Eurosport 1 134 MTV 524 Eurosport 2 135 SYFY 526 MUTV 136 SYFY +1 527 BT Sport 1 HD 137 Universal TV 528 BT Sport 2 HD 138 Universal -

GOLD Package Channel & VOD List

GOLD Package Channel & VOD List: incl Entertainment & Video Club (VOD), Music Club, Sports, Adult Note: This list is accurate up to 1st Aug 2018, but each week we add more new Movies & TV Series to our Video Club, and often add additional channels, so if there’s a channel missing you really wanted, please ask as it may already have been added. Note2: This list does NOT include our PLEX Club, which you get FREE with GOLD and PLATINUM Packages. PLEX Club adds another 500+ Movies & Box Sets, and you can ‘request’ something to be added to PLEX Club, and if we can source it, your wish will be granted. ♫: Music Choice ♫: Music Choice ♫: Music Choice ALTERNATIVE ♫: Music Choice ALTERNATIVE ♫: Music Choice DANCE EDM ♫: Music Choice DANCE EDM ♫: Music Choice Dance HD ♫: Music Choice Dance HD ♫: Music Choice HIP HOP R&B ♫: Music Choice HIP HOP R&B ♫: Music Choice Hip-Hop And R&B HD ♫: Music Choice Hip-Hop And R&B HD ♫: Music Choice Hit HD ♫: Music Choice Hit HD ♫: Music Choice HIT LIST ♫: Music Choice HIT LIST ♫: Music Choice LATINO POP ♫: Music Choice LATINO POP ♫: Music Choice MC PLAY ♫: Music Choice MC PLAY ♫: Music Choice MEXICANA ♫: Music Choice MEXICANA ♫: Music Choice Pop & Country HD ♫: Music Choice Pop & Country HD ♫: Music Choice Pop Hits HD ♫: Music Choice Pop Hits HD ♫: Music Choice Pop Latino HD ♫: Music Choice Pop Latino HD ♫: Music Choice R&B SOUL ♫: Music Choice R&B SOUL ♫: Music Choice RAP ♫: Music Choice RAP ♫: Music Choice Rap 2K HD ♫: Music Choice Rap 2K HD ♫: Music Choice Rock HD ♫: Music Choice -

Lions Gate Entertainment Corp. Fiscal 2018 Fourth Quarter Year End

Lions Gate Entertainment Corp. Fiscal 2018 Fourth Quarter Year End Earnings Call Thursday, May 24, 2018, 5:00 PM Eastern CORPORATE PARTICIPANTS Jon Feltheimer - Chief Executive Officer Jimmy Barge - Chief Financial Officer Michael Burns - Vice Chairman Chris Albrecht - President, Chief Executive Officer, Starz Jeff Hirsch - Chief Operating Officer, Starz Brian Goldsmith - Chief Operating Officer, Lionsgate Joe Drake - Chairman, Motion Picture Group Kevin Beggs - Chairman, Television Group Laura Kennedy - Chief Operating Officer, TV Group Rick Prell - Chief Accounting Officer James Marsh - Senior Vice President, Head of Investor Relations 1 PRESENTATION Operator Ladies and gentlemen, thank you for standing by. Welcome to the Lionsgate Fiscal 2018 Fourth Quarter Year End Earnings Call. At this time, all participants are in a listen-only mode. Later, we will conduct a question and answer session and instructions will be given at that time. If you should require assistance on today’s call, please press star then zero. And as a reminder, this conference is being recorded. I would now like to turn the conference over to Senior Vice President and Head of Investor Relations, James Marsh. Please go ahead. James Marsh Thanks, Noah. Good afternoon, everyone. Thanks for joining us today for the Lionsgate’s fiscal 2018 fourth quarter call and year-end earnings conference call. We’ll begin with opening remarks from our CEO, Jon Feltheimer; followed by remarks from our CFO, Jimmy Barge. After their remarks, we’ll open the call up for questions. Also, joining us on the call today are Vice Chairman, Michael Burns, Starz’ President and CEO, Chris Albrecht, Starz’ Chief Operating Officer, Jeff Hirsch, Lionsgate’s Chief Operating Officer, Brian Goldsmith, Chairman of the Motion Picture Group, Joe Drake, Chairman of Television Group, Kevin Beggs, Chief Operating Officer of the TV Group, Laura Kennedy, and Chief Accounting Officer, Rick Prell. -

Lionsgate Entertainment Corporation

Lionsgate Entertainment Corporation Q1 2021 Earnings Conference Call Thursday, August 6, 2020, 5:00 PM Eastern CORPORATE PARTICIPANTS Jon Feltheimer - Chief Executive Officer Jimmy Barge - Chief Financial Officer Michael Burns - Vice Chairman Brian Goldsmith - Chief Operating Officer Kevin Beggs - Chairman, TV Group Joe Drake - Chairman, Motion Picture Group Jeff Hirsch - President, Chief Executive Officer, Starz Scott Macdonald - Chief Financial Officer, Starz Superna Kalle - Executive Vice President, International James Marsh - Executive Vice President and Head of Investor Relations 1 PRESENTATION Operator Ladies and gentlemen, thank you for standing by. Welcome to the Lionsgate Entertainment First Quarter 2021 Earnings Call. At this time, all participants are in a listen-only mode. Later, we will conduct a question and answer session; instructions will be given at that time. If you should require assistance during the call, please press "*" then "0." As a reminder, this conference is being recorded. I will now turn the conference over to our host, Executive Vice President and Head of Investor Relations, James Marsh. Please go ahead. James Marsh Good afternoon. Thank you for joining us for the Lion Gate’s Fiscal 2021 First Quarter Conference Call. We’ll begin with opening remarks from our CEO, Jon Feltheimer, followed by remarks from our CFO, Jimmy Barge. After their remarks, we’ll open the call for questions. Also joining us on the call today are Vice Chairman, Michael Burns, COO, Brian Goldsmith, Chairman of the TV Group, Kevin Beggs, and Chairman of the Motion Picture Group, Joe Drake. And from Starz, we have President and CEO, Jeff Hirsch, CFO, Scott Macdonald and EVP of International, Superna Kalle. -

CHANNEL GUIDE AUGUST 2020 2 Mix 5 Mixit + PERSONAL PICK 3 Fun 6 Maxit

KEY 1 Player 4 Full House PREMIUM CHANNELS CHANNEL GUIDE AUGUST 2020 2 Mix 5 Mixit + PERSONAL PICK 3 Fun 6 Maxit + 266 National Geographic 506 Sky Sports F1® HD 748 Create and Craft 933 BBC Radio Foyle HOW TO FIND WHICH CHANNELS YOU CAN GET + 267 National Geographic +1 507 Sky Sports Action HD 755 Gems TV 934 BBC Radio NanGaidheal + 268 National Geographic HD 508 Sky Sports Arena HD 756 Jewellery Maker 936 BBC Radio Cymru 1. Match your package to the column 1 2 3 4 5 6 269 Together 509 Sky Sports News HD 757 TJC 937 BBC London 101 BBC One/HD* + 270 Sky HISTORY HD 510 Sky Sports Mix HD 951 Absolute 80s 2. If there’s a tick in your column, you get that channel Sky One + 110 + 271 Sky HISTORY +1 511 Sky Sports Main Event INTERNATIONAL 952 Absolute Classic Rock 3. If there’s a plus sign, it’s available as + 272 Sky HISTORY2 HD 512 Sky Sports Premier League 1 2 3 4 5 6 958 Capital part of a Personal Pick collection 273 PBS America 513 Sky Sports Football 800 Desi App Pack 959 Capital XTRA 274 Forces TV 514 Sky Sports Cricket 801 Star Gold HD 960 Radio X + 275 Love Nature HD 515 Sky Sports Golf 802 Star Bharat 963 Kiss FM 516 Sky Sports F1® 803 Star Plus HD + 167 TLC HD 276 Smithsonian Channel HD ENTERTAINMENT 517 Sky Sports Action 805 SONY TV ASIA HD ADULT 168 Investigation Discovery 277 Sky Documentaries HD 1 2 3 4 5 6 + 518 Sky Sports Arena 806 SONY MAX HD 100 Virgin Media Previews HD 169 Quest -

Lionsgate Entertainment Corp

Lionsgate Entertainment Corp. 2020 Q1 Earnings Call Thursday, August 8, 2019, 5:00 PM Eastern CORPORATE PARTICIPANTS Jon Feltheimer - Chief Executive Officer Jimmy Barge - Chief Financial Officer Michael Burns - Vice Chairman Brian Goldsmith – Lionsgate Chief Operating Officer Kevin Beggs - Chairman, Lionsgate TV Group Joe Drake - Chairman, Lionsgate Motion Picture Group Jeff Hirsch - Chief Operating Officer, Starz Scott Macdonald - Chief Financial Officer, Starz Superna Kalle - Executive Vice President, International Digital Networks, Starz James Marsh - Head, Investor Relations 1 PRESENTATION Operator Ladies and gentlemen, thank you for standing by, and welcome to the Lions Gate 2020 First Quarter Earnings Call. At this time all participants are in a listen-only mode. Later, we will conduct a question-and-answer session. Instructions will be given at that time. Should you require assistance during the call, please press "*", then "0." And as a reminder, this conference is being recorded. I would now like to turn the conference over to our host, Mr. James Marsh, Head of Investor Relations. Please go ahead sir. James Marsh Good afternoon. Thank you for joining us for the Lionsgate Fiscal '20 first quarter conference call. We'll begin with opening remarks from our CEO, Jon Feltheimer followed by remarks from our CFO, Jimmy Barge. After their remarks, we'll open the call for questions. Also joining us on the call today are: Vice Chairman, Michael Burns; COO, Brian Goldsmith; Chairman of the TV Group, Kevin Beggs; and Chairman of the Motion Picture Group, Joe Drake. And from Starz, we have COO, Jeff Hirsch; CFO, Scott Macdonald; and EVP of International, Superna Kalle. -

LEASK-DISSERTATION-2020.Pdf (1.565Mb)

WRAITHS AND WHITE MEN: THE IMPACT OF PRIVILEGE ON PARANORMAL REALITY TELEVISION by ANTARES RUSSELL LEASK DISSERTATION Submitted in partial fulfillment of the requirements for the degree of Doctor of Philosophy at The University of Texas at Arlington August, 2020 Arlington, Texas Supervising Committee: Timothy Morris, Supervising Professor Neill Matheson Timothy Richardson Copyright by Antares Russell Leask 2020 Leask iii ACKNOWLEDGEMENTS • I thank my Supervising Committee for being patient on this journey which took much more time than expected. • I thank Dr. Tim Morris, my Supervising Professor, for always answering my emails, no matter how many years apart, with kindness and understanding. I would also like to thank his demon kitten for providing the proper haunted atmosphere at my defense. • I thank Dr. Neill Matheson for the ghostly inspiration of his Gothic Literature class and for helping me return to the program. • I thank Dr. Tim Richardson for using his class to teach us how to write a conference proposal and deliver a conference paper – knowledge I have put to good use! • I thank my high school senior English teacher, Dr. Nancy Myers. It’s probably an urban legend of my own creating that you told us “when you have a Ph.D. in English you can talk to me,” but it has been a lifetime motivating force. • I thank Dr. Susan Hekman, who told me my talent was being able to use pop culture to explain philosophy. It continues to be my superpower. • I thank Rebecca Stone Gordon for the many motivating and inspiring conversations and collaborations. • I thank Tiffany A. -

Keeping the Score the Impact of Recapturing North American Film and Television Sound Recording Work

Keeping the Score The impact of recapturing North American film and television sound recording work December 2014 [This page is intentionally left blank.] Keeping the Score Table of Contents Acknowledgments 2 Executive Summary 3 Introduction 5 Precarious work in a shifting industry 7 From full-time to freelance 7 A dignified standard set by decades of organizing 9 Musicians in a Twenty-First Century studio system 12 What is a “major studio” anyhow? 12 Composers squeezed in the middle: the rise of the “package deal” 15 Chasing tax credits 17 A profitable industry 19 The “last actors” feel the pain 21 Recording employment slipping away 21 Where has recording gone? 24 Recording the score as “an afterthought” 25 Hollywood provides quality employment – for most 26 Bringing work back: the debate thus far 28 A community weakened by the loss of music 33 Case Study: Impact on the Los Angeles regional economy 33 Impact on the cultural fabric 35 Breaking the social compact 36 Federal subsidies 36 Local subsidies 37 Cheating on employment 38 Lionsgate: a new major roars 39 Reliance on tax incentives 41 Wealth – and work – not shared 41 Taking the high road: what it could mean 43 Conclusion and Recommendations 44 Recommendations to policy makers 44 Recommendations to the industry 46 Endnotes 47 laane: a new economy for all 1 Keeping the Score Acknowledgments Lead author: Jon Zerolnick This report owes much to many organizations and individuals who gave generously of their time and insights. Thanks, first and foremost, to the staff and members of the American Federation of Musicians, including especially Local 47 as well as the player conference the Recording Musicians Association.