Lionsgate Entertainment Corp

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

GLAAD Media Institute Began to Track LGBTQ Characters Who Have a Disability

Studio Responsibility IndexDeadline 2021 STUDIO RESPONSIBILITY INDEX 2021 From the desk of the President & CEO, Sarah Kate Ellis In 2013, GLAAD created the Studio Responsibility Index theatrical release windows and studios are testing different (SRI) to track lesbian, gay, bisexual, transgender, and release models and patterns. queer (LGBTQ) inclusion in major studio films and to drive We know for sure the immense power of the theatrical acceptance and meaningful LGBTQ inclusion. To date, experience. Data proves that audiences crave the return we’ve seen and felt the great impact our TV research has to theaters for that communal experience after more than had and its continued impact, driving creators and industry a year of isolation. Nielsen reports that 63 percent of executives to do more and better. After several years of Americans say they are “very or somewhat” eager to go issuing this study, progress presented itself with the release to a movie theater as soon as possible within three months of outstanding movies like Love, Simon, Blockers, and of COVID restrictions being lifted. May polling from movie Rocketman hitting big screens in recent years, and we remain ticket company Fandango found that 96% of 4,000 users hopeful with the announcements of upcoming queer-inclusive surveyed plan to see “multiple movies” in theaters this movies originally set for theatrical distribution in 2020 and summer with 87% listing “going to the movies” as the top beyond. But no one could have predicted the impact of the slot in their summer plans. And, an April poll from Morning COVID-19 global pandemic, and the ways it would uniquely Consult/The Hollywood Reporter found that over 50 percent disrupt and halt the theatrical distribution business these past of respondents would likely purchase a film ticket within a sixteen months. -

Netflix and Changes in the Hollywood Film Industry 넷플릭스와 할리우드

ISSN 2635-8875 / e-ISSN 2672-0124 산업융합연구 제18권 제5호 pp. 36-41, 2020 DOI : https://doi.org/10.22678/JIC.2020.18.5.036 Netflix and Changes in the Hollywood Film Industry Jeong-Suk Joo Associate Professor, Dept. of International Trade, Jungwon University 넷플릭스와 할리우드 영화산업의 변화 주정숙 중원대학교 국제통상학과 부교수 Abstract This paper aims to explore and shed light on how the rise of streaming services has been affecting the media landscape in the recent years by looking at the conflicts between the Hollywood film industry and Netflix. It especially examines Netflix’s disregard for the theatrical release, as it is the most portentous issue that could reshape the film industry, and Hollywood’s opposition to it as revealed through the 2019 Academy Awards where the issue was brought into sharp relief. At the same time, this paper also questions whether theatrical distribution makes a film any more cinematic by examining how Hollywood film production has been largely concentrated on tentpoles and franchises, while Netflix has been producing diverse films often shunned by the studios. In this light, it concludes the changes wrought by Netflix, including its bypassing of the theatrical release, are not likely to be reversed. Key Words : Netflix, Streaming service, Hollywood, Film industry, Netflix films 요 약 본 논문은 할리우드 영화산업과 넷플릭스 간 갈등의 고찰을 통해 스트리밍 서비스의 부상이 미디어 지형에 어떠한 영향을 미쳐왔는지 밝히고자 한다. 특히 영화산업의 재편을 가져올 수 있는 가장 중요한 문제로써 극장을 거치지 않고 자사 플랫폼에 영화를 공개하는 넷플릭스의 개봉방식을 살펴보고 이에 대한 반발이 크게 불거진 2019 년 아카데미 영화제를 중심으로 할리우드의 반대를 살펴본다. -

After Disney-Fox, Who's Next?

cc Wednesday, December 20, 2017 latimes.com/news After Disney-Fox, who’s next? Huge deal may force smaller media firms to grow or struggle By MEG JAMES AND RYAN FAUGHNDER TIMES STAFF WRITERS alt Disney Co.'s block- buster deal to buy W much of 21st Century Fox revealed Rupert Murdoch's fear that his media company was not strong enough to survive the digital onslaught — raising questions about how even smaller media com- panies will weather the storm. Since Disney clinched its $52.4- billion deal last week to buy some of Murdoch's most lucrative assets, many wonder which media compa- The entrance of the Metro-Goldwyn-Mayer offices in Santa Monica offices. nies might be next. MGM is among smaller media companies that are considered prime targets for The scramble to bulk up is likely acquisition. (Nick Ut / Associated Press) to force medium-sized players to strike their own deals out of con- nies to sell," predicted Ken Klein- "This is clearly an arms race and cern that they need to grow or get berg, a veteran Los Angeles enter- these companies need to step up left behind as tech giants like Net- tainment business lawyer. "If com- their game," said Lloyd Greif, a Los flix gain more power in Hollywood. panies like Fox are worried, what Angeles investment banker. "We are Sony Pictures Entertainment, are they waiting for?" going to see more creative, accretive CBS Corp., Viacom Inc., Liberty The Disney-Fox deal is just the strategic acquisitions — and acqui- Media Corp., Lionsgate and Metro- latest combination. -

Case #2020-11 IRB Netflix Studios

ALBUQUERQUE DEVELOPMENT COMMISSION November 23, 2020 Industrial Revenue Bond Hearing IRB 20-1: Netflix Studios LLC Project Case Number: IRB2020-11 REQUEST: Approval of $500,000,000 in City Industrial Revenue Bonds to be issued in two series is requested. PROJECT SUMMARY: Netflix Studios is planning to increase and expand their presence in Albuquerque by purchasing an additional 170 acres of land and investing more than $500 million in capital and another $1 billion in production spending, in addition to the company’s commitment of $1 billion in production spend under the 2018 local economic development transaction, to develop a major film and television production campus in Mesa Del Sol’s Planned Community Development. Netflix, Inc. is an American technology and media services provider and production company headquartered in Los Gatos, California. Netflix was founded in 1997 by Reed Hastings and Marc Randolph in Scotts Valley, California. The company's primary business is its subscription-based streaming service which offers online streaming of a library of films and television series, including those produced in-house. Netflix purchased Albuquerque Studios in 2018, and has undertaken significant production expenditures of approximately $150 million over two years (prior to the Covid pandemic that has limited film and television production worldwide). In 2020, Netflix began a competitive site selection process to determine where to focus its future production investment for the next decade and beyond. Netflix has three primary production facilities in North America other than Albuquerque, including Los Angeles, Atlanta, and Vancouver, Canada. The company sought a location with good business resiliency (not subject to shutdowns due to weather or other natural disasters), and selected the site at Mesa Del Sol in Albuquerque, New Mexico. -

Vodafone Idea and Starz Strike Strategic Alliance; Launch Lionsgate Play in India

VODAFONE IDEA AND STARZ STRIKE STRATEGIC ALLIANCE; LAUNCH LIONSGATE PLAY IN INDIA ~ VIL customers will have easy access to popular content from Lionsgate library ~ Portfolio includes movie premieres and blockbuster films across genres ~ A seamless viewing experience of customised and differentiated content Mumbai, Aug 19, 2019: Vodafone Idea Limited, India’s leading telecom operator and STARZPLAY, the international premium subscription platform from STARZ, a Lionsgate (NYSE: LGF.A, LGF.B) company, have joined hands to launch Lionsgate’s premium service Lionsgate Play in India. This partnership will enable Vodafone Idea customers’ access to a broad portfolio of celebrated blockbusters and award-winning feature films from the studio. Video is the new growth driver in the digital content consumption today. Vodafone Idea’s partnership with STARZPLAY is a step towards boosting the growth of the digital ecosystem in India. The partnership will capitalize on this huge potential by offering viewers with an array of premium content across genres. Lionsgate Play will be available to Vodafone Play and Idea Movies & TV subscribers as a part of this strategic collaboration between the two companies. The offering includes multibillion-dollar global blockbuster franchises The Hunger Games and The Twilight Saga, multiple Academy Award ® winner La La Land and the international breakout hit Wonder, with much of it available in four local languages. The content library will be spread across genres like horror, comedy, drama, action, thriller, documentaries to name a few. Following the launch, the offering will boast an illustrious line up of digital premieres of Lionsgate films coming to the service in the first year including Robin Hood, Crank, Sahara, Redcliff, Jersey Shore Attack, Killers, Grudge, Letters to Juliet, American Pyscho 2, Nerve, Facing Ali, Down A Dark Hall and American Assassin. -

Media Kit Final2

FILM EXPO GROUP MEDIA KIT FilmExpoGroup FILM EXPO GROUP - MEDIA KIT 2016 BRAND OVERVIEW Film Expo Group is the premier organizer of events in OUR MISSION the motion picture industry. The Film Expo Group Our mission is to produce events that reach the produces ShowEast, held in Miami; CineEurope, held motion picture industry members on a global in Barcelona; and CineAsia, held in Hong Kong. scale. The intent is to create networking opportunities for key decision makers to connect The events feature exclusive screenings of upcoming and unite with new ideas and endeavors. films, product presentations of films in production, educational seminars led by industry leaders, and a OUR VISION trade show with equipment and concessions suppliers Our vision is to remain progressive and keep to movie theatres. Each event also includes special audiences of all generations tapped into and informed events and an award ceremony honoring recent about the industry. trailblazers within the industry. OUR PURPOSE In addition to its events, The Film Expo Group also Our purpose is to embrace the ever-changing motion publishes Film Journal International, one of the picture industry and celebrate its advances through industry’s leading motion picture monthly trade interactive and collaborative events. publications. FILM EXPO GROUP - MEDIA KIT 2016 CINEEUROPE BARCELONA CineEurope is the longest-running and most successful AUDIENCE PROFILE European convention and trade show for Major, Regional, and Independent cinema professionals. Each year more than 3,000 industry leaders attend CineEurope. Those allied to the industry come to CineEurope each year to seek knowledge on the latest trends and issues; Company types include Cinema Exhibition, Film learn about new marketing ideas; network with industry Distribution, Film Production, Print or Broadcast Media peers; see Hollywood, international, and independent and Marketing/Advertising Agencies. -

Lionsgate Reports Results for First Quarter Fiscal 2022

LIONSGATE REPORTS RESULTS FOR FIRST QUARTER FISCAL 2022 First Quarter Revenue was $901.2 Million; Operating Income was $20.3 Million; Net Loss Attributable to Lionsgate Shareholders was $45.4 Million or $0.20 Diluted Net Loss per Share Adjusted OIBDA was $119.8 Million Global Media Networks Subscribers were 28.9 Million Global Streaming Subscribers were 16.7 Million, reflecting 58% Year-Over-Year Growth; STARZPLAY International Subscribers More than Doubled Year-Over-Year to 7.0 Million Film & Television Library Revenue was $740 Million for Trailing 12 Months SANTA MONICA, CA, and VANCOUVER, BC, August 5, 2021 – Lionsgate (NYSE: LGF.A, LGF.B) today reported first quarter (quarter ended June 30, 2021) revenue of $901.2 million, operating income of $20.3 million and net loss attributable to Lionsgate shareholders of $45.4 million or $0.20 diluted net loss per share on 221.8 million diluted weighted average common shares outstanding. Adjusted net income attributable to Lionsgate shareholders in the quarter was $42.4 million or adjusted diluted EPS of $0.18 on 229.2 million diluted weighted average common shares outstanding, with adjusted OIBDA of $119.8 million. “I’m pleased to report that we were able to lean into our resilient business model to drive strong financial results in the quarter,” said Lionsgate CEO Jon Feltheimer. “We filled our content pipelines with exciting new properties and added valuable new titles to our library. Like the rest of the industry, Starz subscriber growth was impacted by the decline in at home viewership and, importantly, a light content quarter due to COVID-driven production delays. -

The Plight of Our Planet the Relationship Between Wildlife Programming and Conservation Efforts

! THE PLIGHT OF OUR PLANET fi » = ˛ ≈ ! > M Photo: https://www.kmogallery.com/wildlife/2 = 018/10/5/ry0c9a1o37uwbqlwytiddkxoms8ji1 u f f ≈ f Page 1 The Plight of Our Planet The Relationship Between Wildlife Programming And Conservation Efforts: How Visual Storytelling Can Save The World By: Kelsey O’Connell - 20203259 In Fulfillment For: Film, Television and Screen Industries Project – CULT4035 Prepared For: Disneynature, BBC Earth, Netflix Originals, National Geographic, Discovery Channel, Animal Planet, Etc. Page 2 ACKNOWLEDGMENTS I cannot express enough gratitude to everyone who believed in me on this crazy and fantastic journey; everything you have done has molded me into the person I am today. To my family, who taught me to seek out my own purpose and pursue it wholeheartedly; without you, I would have never taken the chance and moved to England for my Masters. To my professors, who became my trusted resources and friends, your endless and caring teachings have supported me in more ways than I can put into words. To my friends who have never failed to make me smile, I am so lucky to have you in my life. Finally, a special thanks to David Attenborough, Steve Irwin, Terri Irwin, Jane Goodall, Peter Gros, Jim Fowler, and so many others for making me fall in love with wildlife and spark a fire in my heart for their welfare. I grew up on wildlife films and television shows like Planet Earth, Blue Planet, March of the Penguins, Crocodile Hunter, Mutual of Omaha’s Wild Kingdom, Shark Week, and others – it was because of those programs that I first fell in love with nature as a kid, and I’ve taken that passion with me, my whole life. -

Music and Sound Design Placements

Music and Sound Design Placements Listed from most recent TITLE STUDIO SD / MX Loki Disney SD Hitman’s Wife’s Bodyguard Lionsgate SD Snake Eyes Paramount SD Godzilla vs. Kong Warner Bros SD The Mosquito Coast Apple SD Raya and the Last Dragon Disney SD Army of the Dead Netflix SD Cruella Disney SD Cherry Apple SD Wrath of Man Miramax SD Without Remorse Paramount SD Nobody Universal SD Space Jam 2 Warner Bros SD WandaVision Disney SD Fast 9 NBC Universal SD Promising Young Woman Focus SD Monster Hunter Sony SD Tenet Warner Bros SD Welcome to the Blumhouse Amazon SD Embattled IFC (Rainbow Media) MX + SD The Craft Sony MX + SD Project Zenith (Black Adam) Warner Bros SD See (Season 1) Apple SD Dune Warner Bros SD Apple + Promo Apple SD Greyhound Apple / Sony SD Candyman NBC Universal SD Freaky NBC Universal SD Hala Apple SD You Should Have Left NBC Universal SD Unorthodox Netflix MX (Custom) Voyagers Lionsgate SD The Hunt NBC Universal MX (Custom) New Mutants Disney SD Amazing Stories (Trailer 1) Apple MX (Custom) Amazing Stories (30 spot) Apple MX Nobody NBC Universal SD The Invisible Man NBC Universal SD The Green Knight A24 SD Mythic Quest-Raven Apple SD Let Him Go Focus SD Rhythm Section Paramount MX + SD Bad Boys Sony SD Outsider HBO MX Black Widow Disney SD Ghostbusters Sony MX (Custom) + SD A Quiet Place 2 Paramount SD Fantasy Island Sony SD The Grudge Sony SD Harriet Focus MX + SD Uncut Gems A24 SD Free Guy Disney SD Underwater Disney SD Maleficent 2 Disney SD Midway Lionsgate SD Spiderman: Far from Home Sony SD Rambo: Last Blood -

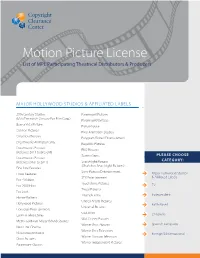

Motion Picture License List of MPL Participating Theatrical Distributors & Producers

Motion Picture License List of MPL Participating Theatrical Distributors & Producers MAJOR HOLLYWOOD STUDIOS & AFFILIATED LABELS 20th Century Studios Paramount Pictures (f/k/a Twentieth Century Fox Film Corp.) Paramount Vantage Buena Vista Pictures Picturehouse Cannon Pictures Pixar Animation Studios Columbia Pictures Polygram Filmed Entertainment Dreamworks Animation SKG Republic Pictures Dreamworks Pictures RKO Pictures (Releases 2011 to present) Screen Gems PLEASE CHOOSE Dreamworks Pictures CATEGORY: (Releases prior to 2011) Searchlight Pictures (f/ka/a Fox Searchlight Pictures) Fine Line Features Sony Pictures Entertainment Focus Features Major Hollywood Studios STX Entertainment & Affiliated Labels Fox - Walden Touchstone Pictures Fox 2000 Films TV Tristar Pictures Fox Look Triumph Films Independent Hanna-Barbera United Artists Pictures Hollywood Pictures Faith-Based Universal Pictures Lionsgate Entertainment USA Films Lorimar Telepictures Children’s Walt Disney Pictures Metro-Goldwyn-Mayer (MGM) Studios Warner Bros. Pictures Spanish Language New Line Cinema Warner Bros. Television Nickelodeon Movies Foreign & International Warner Horizon Television Orion Pictures Warner Independent Pictures Paramount Classics TV 41 Entertaiment LLC Ditial Lifestyle Studios A&E Networks Productions DIY Netowrk Productions Abso Lutely Productions East West Documentaries Ltd Agatha Christie Productions Elle Driver Al Dakheel Inc Emporium Productions Alcon Television Endor Productions All-In-Production Gmbh Fabrik Entertainment Ambi Exclusive Acquisitions -

Netflix and the Development of the Internet Television Network

Syracuse University SURFACE Dissertations - ALL SURFACE May 2016 Netflix and the Development of the Internet Television Network Laura Osur Syracuse University Follow this and additional works at: https://surface.syr.edu/etd Part of the Social and Behavioral Sciences Commons Recommended Citation Osur, Laura, "Netflix and the Development of the Internet Television Network" (2016). Dissertations - ALL. 448. https://surface.syr.edu/etd/448 This Dissertation is brought to you for free and open access by the SURFACE at SURFACE. It has been accepted for inclusion in Dissertations - ALL by an authorized administrator of SURFACE. For more information, please contact [email protected]. Abstract When Netflix launched in April 1998, Internet video was in its infancy. Eighteen years later, Netflix has developed into the first truly global Internet TV network. Many books have been written about the five broadcast networks – NBC, CBS, ABC, Fox, and the CW – and many about the major cable networks – HBO, CNN, MTV, Nickelodeon, just to name a few – and this is the fitting time to undertake a detailed analysis of how Netflix, as the preeminent Internet TV networks, has come to be. This book, then, combines historical, industrial, and textual analysis to investigate, contextualize, and historicize Netflix's development as an Internet TV network. The book is split into four chapters. The first explores the ways in which Netflix's development during its early years a DVD-by-mail company – 1998-2007, a period I am calling "Netflix as Rental Company" – lay the foundations for the company's future iterations and successes. During this period, Netflix adapted DVD distribution to the Internet, revolutionizing the way viewers receive, watch, and choose content, and built a brand reputation on consumer-centric innovation. -

Press Releases

Press Releases O’Melveny Guides ViacomCBS Through MIRAMAX Investment April 3, 2020 RELATED PROFESSIONALS FOR IMMEDIATE RELEASE Bruce Tobey CENTURY CITY—April 3, 2020—O’Melveny represented leading media and entertainment company Century City ViacomCBS (Nasdaq: VIACA; VIAC) in its acquisition of a 49percent stake in film and television studio D: +13102466764 MIRAMAX from beIN Media Group. The transaction, previously announced in December 2019, closed today. Amy Siegel ViacomCBS acquired 49 percent of MIRAMAX from beIN for a total committed investment of US$375 million. Century City Approximately US$150 million was paid at closing, while ViacomCBS has committed to invest US$225 million D: +13102466805 —comprised of US$45 million annually over the next five years—to be used for new film and television Silvia Vannini productions and working capital. Century City D: +13102466895 In addition, ViacomCBS’s historic film and television studio, Paramount Pictures, entered an exclusive, long term distribution agreement for MIRAMAX’s film library and an exclusive, longterm, firstlook agreement Eric Zabinski allowing Paramount Pictures to develop, produce, finance, and distribute new film and television projects Century City based on MIRAMAX’s IP. D: +13102468449 Rob Catmull ViacomCBS creates premium content and experiences for audiences worldwide, driven by a portfolio of Century City iconic consumer brands including CBS, Showtime Networks, Paramount Pictures, Nickelodeon, MTV, D: +13102468563 Comedy Central, BET, CBS All Access, Pluto TV, and Simon & Schuster. Eric H. Geffner beIN MEDIA GROUP is a leading independent global media group and one of the foremost sports and Century City entertainment networks in the world.