Market Express Vol.229

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Draft Po Toi Islands Outline Zoning Plan No. S/I-PTI/1

Islands District Council Paper No. IDC 28/2015 Draft Po Toi Islands Outline Zoning Plan No. S/I-PTI/1 1. Purpose The purpose of this paper is to seek Member’ views on the draft Po Toi Islands Outline Zoning Plan (OZP) No. S/I-PTI/1 together with its Notes and Explanatory Statement (ES) (Annexes I to III). 2. Background 2.1 Pursuant to section 20(5) of the Town Planning Ordinance (the Ordinance), the Po Toi Islands Development Permission Area (DPA) Plan is effective only for a period of 3 years until 2 March 2015. An OZP has to be prepared to replace the DPA Plan to maintain statutory planning control over the Po Toi Islands areas upon expiry of the DPA Plan. 2.2 The draft OZP was preliminarily considered and agreed by the Town Planning Board (the Board) on 5 December 2014. The draft OZP was submitted to the Lamma Island (South) Committee (LISRC) and the Islands District Council (IsDC) for consultation on 12 December 2014 and 15 December 2014 respectively. As suggested by Ms. YUE Lai-fun, Member of IsDC, another meeting with LISRC was held on 23.1.2015. In response to the local residents’ request, a meeting with the local residents of Po Toi was also held on 30.1.2015 to listen to their concerns on the draft OZP. Views of the LISRC and IsDC together with other public comments on the draft OZP were then submitted to the Board for further consideration on 13 February 2015. After considering all the views and comments received, the Board agreed to publish the draft OZP under section 5 of the Ordinance. -

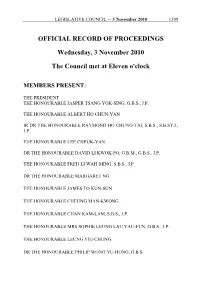

Official Record of Proceedings

LEGISLATIVE COUNCIL ─ 3 November 2010 1399 OFFICIAL RECORD OF PROCEEDINGS Wednesday, 3 November 2010 The Council met at Eleven o'clock MEMBERS PRESENT: THE PRESIDENT THE HONOURABLE JASPER TSANG YOK-SING, G.B.S., J.P. THE HONOURABLE ALBERT HO CHUN-YAN IR DR THE HONOURABLE RAYMOND HO CHUNG-TAI, S.B.S., S.B.ST.J., J.P. THE HONOURABLE LEE CHEUK-YAN DR THE HONOURABLE DAVID LI KWOK-PO, G.B.M., G.B.S., J.P. THE HONOURABLE FRED LI WAH-MING, S.B.S., J.P. DR THE HONOURABLE MARGARET NG THE HONOURABLE JAMES TO KUN-SUN THE HONOURABLE CHEUNG MAN-KWONG THE HONOURABLE CHAN KAM-LAM, S.B.S., J.P. THE HONOURABLE MRS SOPHIE LEUNG LAU YAU-FUN, G.B.S., J.P. THE HONOURABLE LEUNG YIU-CHUNG DR THE HONOURABLE PHILIP WONG YU-HONG, G.B.S. 1400 LEGISLATIVE COUNCIL ─ 3 November 2010 THE HONOURABLE WONG YUNG-KAN, S.B.S., J.P. THE HONOURABLE LAU KONG-WAH, J.P. THE HONOURABLE LAU WONG-FAT, G.B.M., G.B.S., J.P. THE HONOURABLE MIRIAM LAU KIN-YEE, G.B.S., J.P. THE HONOURABLE EMILY LAU WAI-HING, J.P. THE HONOURABLE ANDREW CHENG KAR-FOO THE HONOURABLE TIMOTHY FOK TSUN-TING, G.B.S., J.P. THE HONOURABLE TAM YIU-CHUNG, G.B.S., J.P. THE HONOURABLE ABRAHAM SHEK LAI-HIM, S.B.S., J.P. THE HONOURABLE LI FUNG-YING, S.B.S., J.P. THE HONOURABLE TOMMY CHEUNG YU-YAN, S.B.S., J.P. THE HONOURABLE FREDERICK FUNG KIN-KEE, S.B.S., J.P. -

A Magazine for the Women of Hong Kong • April 2017 the EXPERTS in INTERNATIONAL BACCALAUREATE OPENING SEPTEMBER 2017

A Magazine for the Women of Hong Kong • April 2017 THE EXPERTS IN INTERNATIONAL BACCALAUREATE OPENING SEPTEMBER 2017 DAILY OR BILINGUAL STANDARDIZED ACADEMIC STEMinn CHINESE MAP® TESTING PROGRAM MONTHLY OPEN HOUSE EVENTS & INFORMATION SESSIONS We are pleased to launch a new campus in Hong Kong, September 2017, following our huge success at Stamford American International School in Singapore, which today has over 3,000 students from 70 nationalities. We offer a rigorous standards-based curriculum for students from 5 to 18 years, graduating students with the International Baccalaureate Diploma* to 1st tier universities worldwide. Contact Us [email protected] +852 2500 8688 www.sais.edu.hk *Stamford American School Hong Kong will apply to the International Baccalaureate for program candidacy in December 2017. Individualized Learning Plans from Age 5 Secondary and readies them for their future careers as ST scientists, engineers and business leaders. PUTTING YOUR CHILD 1 Stamford’s Outstanding Results Our students at our Singapore campus consistently ACHIEVING MORE THAN THEY BELIEVE THEY CAN achieve above the U.S. benchmark in their MAP® assessments. In Elementary, our students’ scores in Reading and Math are greater than the benchmark by one year CAMPUS OPENING on average. Progressing to Secondary, Stamford students perform above the benchmark in Math and Reading by two SEPTEMBER 2017! or more years on average. In fact, the average Stamford Grade 6 student performs above the benchmark for Grade Every student at Stamford undergoes standardized 10 students in Reading, four grade levels above the norm. Measures of Academic Progress® (MAP®) assessments These outstanding MAP® results combined with the in Reading, Math and Science twice a year, allowing International Baccalaureate Diploma Program have led us to measure their academic growth throughout 90% of our graduates from Stamford’s Singapore campus to the school year and from year to year. -

Hong Kong Country Overview

HONG KONG COUNTRY OVERVIEW INTRODUCTION Electric, eclectic, energizing, nonstop, traditional, cosmopolitan, international; there are so many words to describe Hong Kong, one simply has to visit to experience it all. Hong Kong was a British colony from the mid-19th century until 1997 when China resumed sovereignty. The city now operates as a Special Administrative Region (SAR) under China’s ‘one country – two rule system.’ A haven for consumerists, Hong Kong offers some of the best shopping anywhere in the world. The infrastructure is modern and developed which makes getting around easy. On top of that, because of the city’s long history with the western world, English is spoken everywhere making Hong Kong a relatively easy destination to visit compared to other parts of China. 2 ABOUT HONG KONG LANDSCAPE Hong Kong is located at the delta of the Pearl River on China’s Southeast coast. The city is made up of Hong Kong island, and several areas on the mainland peninsula known as Kowloon and the New Territories. In total, the land area is over 1100 km2. CLIMATE Hong Kong enjoys a humid subtropical climate with hot, humid summers and relatively mild winters. It is most likely to rain during the summer months (June, July, August) and this is, therefore, the low travel season. The most popular seasons to visit are Spring with mild temperatures and only occasional rain and autumn which is usually sunny and dry. PEOPLE There are approximately 7.3 million people living in Hong Kong, 95% of whom are of Chinese descent (Mainly Canton people). -

List of Recognized Villages Under the New Territories Small House Policy

LIST OF RECOGNIZED VILLAGES UNDER THE NEW TERRITORIES SMALL HOUSE POLICY Islands North Sai Kung Sha Tin Tuen Mun Tai Po Tsuen Wan Kwai Tsing Yuen Long Village Improvement Section Lands Department September 2009 Edition 1 RECOGNIZED VILLAGES IN ISLANDS DISTRICT Village Name District 1 KO LONG LAMMA NORTH 2 LO TIK WAN LAMMA NORTH 3 PAK KOK KAU TSUEN LAMMA NORTH 4 PAK KOK SAN TSUEN LAMMA NORTH 5 SHA PO LAMMA NORTH 6 TAI PENG LAMMA NORTH 7 TAI WAN KAU TSUEN LAMMA NORTH 8 TAI WAN SAN TSUEN LAMMA NORTH 9 TAI YUEN LAMMA NORTH 10 WANG LONG LAMMA NORTH 11 YUNG SHUE LONG LAMMA NORTH 12 YUNG SHUE WAN LAMMA NORTH 13 LO SO SHING LAMMA SOUTH 14 LUK CHAU LAMMA SOUTH 15 MO TAT LAMMA SOUTH 16 MO TAT WAN LAMMA SOUTH 17 PO TOI LAMMA SOUTH 18 SOK KWU WAN LAMMA SOUTH 19 TUNG O LAMMA SOUTH 20 YUNG SHUE HA LAMMA SOUTH 21 CHUNG HAU MUI WO 2 22 LUK TEI TONG MUI WO 23 MAN KOK TSUI MUI WO 24 MANG TONG MUI WO 25 MUI WO KAU TSUEN MUI WO 26 NGAU KWU LONG MUI WO 27 PAK MONG MUI WO 28 PAK NGAN HEUNG MUI WO 29 TAI HO MUI WO 30 TAI TEI TONG MUI WO 31 TUNG WAN TAU MUI WO 32 WONG FUNG TIN MUI WO 33 CHEUNG SHA LOWER VILLAGE SOUTH LANTAU 34 CHEUNG SHA UPPER VILLAGE SOUTH LANTAU 35 HAM TIN SOUTH LANTAU 36 LO UK SOUTH LANTAU 37 MONG TUNG WAN SOUTH LANTAU 38 PUI O KAU TSUEN (LO WAI) SOUTH LANTAU 39 PUI O SAN TSUEN (SAN WAI) SOUTH LANTAU 40 SHAN SHEK WAN SOUTH LANTAU 41 SHAP LONG SOUTH LANTAU 42 SHUI HAU SOUTH LANTAU 43 SIU A CHAU SOUTH LANTAU 44 TAI A CHAU SOUTH LANTAU 3 45 TAI LONG SOUTH LANTAU 46 TONG FUK SOUTH LANTAU 47 FAN LAU TAI O 48 KEUNG SHAN, LOWER TAI O 49 KEUNG SHAN, -

District Profiles 地區概覽

Table 1: Selected Characteristics of District Council Districts, 2016 Highest Second Highest Third Highest Lowest 1. Population Sha Tin District Kwun Tong District Yuen Long District Islands District 659 794 648 541 614 178 156 801 2. Proportion of population of Chinese ethnicity (%) Wong Tai Sin District North District Kwun Tong District Wan Chai District 96.6 96.2 96.1 77.9 3. Proportion of never married population aged 15 and over (%) Central and Western Wan Chai District Wong Tai Sin District North District District 33.7 32.4 32.2 28.1 4. Median age Wan Chai District Wong Tai Sin District Sha Tin District Yuen Long District 44.9 44.6 44.2 42.1 5. Proportion of population aged 15 and over having attained post-secondary Central and Western Wan Chai District Eastern District Kwai Tsing District education (%) District 49.5 49.4 38.4 25.3 6. Proportion of persons attending full-time courses in educational Tuen Mun District Sham Shui Po District Tai Po District Yuen Long District institutions in Hong Kong with place of study in same district of residence 74.5 59.2 58.0 45.3 (1) (%) 7. Labour force participation rate (%) Wan Chai District Central and Western Sai Kung District North District District 67.4 65.5 62.8 58.1 8. Median monthly income from main employment of working population Central and Western Wan Chai District Sai Kung District Kwai Tsing District excluding unpaid family workers and foreign domestic helpers (HK$) District 20,800 20,000 18,000 14,000 9. -

Policy Address for the Fiscal Year 2013 of the Macao Special Administrative Region (MSAR) of the People’S Republic of China

Policy Address for the Fiscal Year 2013 of the Macao Special Administrative Region (MSAR) of the People’s Republic of China Contents Preface .......................................................................................................................1 Major Policies of the MSAR Government in 2013 Enhance the Well-being of Society and Prepare for Long-term Development ............................................................................................................7 I. Develop a long-term mechanism for effective administration, and share the fruits of development ........................................................4 (1) Enhance public investment and prioritise livelihood projects ....................................................................................................4 (2) Take appropriate measures and care for people’s livelihoods .............................................................................................11 II. Establish Macao as a world tourism and leisure centre and promote adequate diversification of the economy ............................13 (1) Implement the development blueprint and enhance underlying strengths ................................................................................................13 (2) Complement regional strengths and promote joint development ..........................................................................................15 (3) Improve urban environment and enjoy quality life together .................................................................................................17 -

Literature Review

Annex 9A Ecology – Literature Review LITERATURE REVIEW INTRODUCTION A literature review was conducted to review the baseline ecological characters of the Assessment Area, identify habitat resources and species of potential conservation importance, and identify information gaps to determine whether field surveys are required to provide sufficient information for the Ecological Impact Assessment. This Annex presents the findings of this literature review. LEGISLATIVE REQUIREMENTS AND EVALUATION CRITERIA 9A.1.2.1 Marine Parks Ordinance (Cap. 476) and its Subsidiary Legislation The Marine Parks Ordinance (Cap. 476) provides for the designation, control and management of marine parks and marine reserves. It also stipulates the Director of Agriculture, Fisheries and Conservation as the Country and Marine Parks Authority which is advised by the Country and Marine Parks Board. The Marine Parks and Marine Reserves Regulation was enacted in July 1996 to provide for the prohibition and control of certain activities in marine parks or marine reserves. 9A.1.2.2 Wild Animals Protection Ordinance (Cap. 170) Under the Wild Animals Protection Ordinance (Cap. 170), designated wild animals are protected from being hunted, whilst their nests and eggs are protected from destruction and removal. All birds and most mammals including all cetaceans are protected under this Ordinance, as well as certain reptiles (including all sea turtles), amphibians and invertebrates. The Second Schedule of the Ordinance that lists all the animals protected was last revised in June 1997. 9A.1.2.3 Protection of Endangered Species of Animals and Plants Ordinance (Cap. 586) The Protection of Endangered Species of Animals and Plants Ordinance (Cap. 586) was enacted to align Hong Kong’s control regime with the Convention on International Trade in Endangered Species of Wild Fauna and Flora (CITES). -

Table of Codes for Each Court of Each Level

Table of Codes for Each Court of Each Level Corresponding Type Chinese Court Region Court Name Administrative Name Code Code Area Supreme People’s Court 最高人民法院 最高法 Higher People's Court of 北京市高级人民 Beijing 京 110000 1 Beijing Municipality 法院 Municipality No. 1 Intermediate People's 北京市第一中级 京 01 2 Court of Beijing Municipality 人民法院 Shijingshan Shijingshan District People’s 北京市石景山区 京 0107 110107 District of Beijing 1 Court of Beijing Municipality 人民法院 Municipality Haidian District of Haidian District People’s 北京市海淀区人 京 0108 110108 Beijing 1 Court of Beijing Municipality 民法院 Municipality Mentougou Mentougou District People’s 北京市门头沟区 京 0109 110109 District of Beijing 1 Court of Beijing Municipality 人民法院 Municipality Changping Changping District People’s 北京市昌平区人 京 0114 110114 District of Beijing 1 Court of Beijing Municipality 民法院 Municipality Yanqing County People’s 延庆县人民法院 京 0229 110229 Yanqing County 1 Court No. 2 Intermediate People's 北京市第二中级 京 02 2 Court of Beijing Municipality 人民法院 Dongcheng Dongcheng District People’s 北京市东城区人 京 0101 110101 District of Beijing 1 Court of Beijing Municipality 民法院 Municipality Xicheng District Xicheng District People’s 北京市西城区人 京 0102 110102 of Beijing 1 Court of Beijing Municipality 民法院 Municipality Fengtai District of Fengtai District People’s 北京市丰台区人 京 0106 110106 Beijing 1 Court of Beijing Municipality 民法院 Municipality 1 Fangshan District Fangshan District People’s 北京市房山区人 京 0111 110111 of Beijing 1 Court of Beijing Municipality 民法院 Municipality Daxing District of Daxing District People’s 北京市大兴区人 京 0115 -

Jockey Club Age-Friendly City Project

Table of Content List of Tables .............................................................................................................................. i List of Figures .......................................................................................................................... iii Executive Summary ................................................................................................................. 1 1. Introduction ...................................................................................................................... 3 1.1 Overview and Trend of Hong Kong’s Ageing Population ................................ 3 1.2 Hong Kong’s Responses to Population Ageing .................................................. 4 1.3 History and Concepts of Active Ageing in Age-friendly City: Health, Participation and Security .............................................................................................. 5 1.4 Jockey Club Age-friendly City Project .............................................................. 6 2 Age-friendly City in Islands District .............................................................................. 7 2.1 Background and Characteristics of Islands District ......................................... 7 2.1.1 History and Development ........................................................................ 7 2.1.2 Characteristics of Islands District .......................................................... 8 2.2 Research Methods for Baseline Assessment ................................................... -

Islands Chapter 2

!"#$%&'()* !"#$%&'()* !"#$#%&'() !"#$!%&'()*+, - !"#$ !"#$%&'()*+,-. !"#$%&'( )*+,-. !"#$%&'()*+,-./ !"#$%&'()*+,-./ !"#$%&'()*+,-./ !"#$%&'()'*+,-. !"#$%&'()*+,-./ !"#$%&'()*+,-. !"#$%&'()*+,-. !"#$%&!'()*+,-.' !" ! !"#$%&' ! !"#$%&'() !"#$%&'() !"#$ ! !"#$%& !" !" !"#$%&'!( !"#$%&'() !"#$%&' NUP Section 2 Islands Chapter 2 he Islands District provides Hong Kong with a vast green space. In Tearly times people inhabited only a few islands. Among them the best-known are Cheung Chau and Tai O on Lantau Island; Mui Wo and Peng Chau are also important. Mr. Charles Mok, former CLP Organization Development Manager, and Mr. Cheng Ka Shing, former CLP Regional Manager, have been serving the people of the Islands District for many years. During the early years of the 1960s, Lord Lawrence Kadoorie initiated the expansion of the Rural Electrification Scheme to Lantau Island. At that time there were very few people (less !"# !"#$%&'() than 30 families) living in Ngong Ping and Ngong Ping, where the great Buddha Statue is situated, is the centre of Hong Kong’s Buddhism around Po Lin Monastery on Lantau Island. Ngong Ping got its electricity supply between 1964 and 1965, while the bungalows at Tai O had received electricity supply earlier. Since the bungalows were mainly built with iron sheets, the installation of electricity was very difficult. The people there used a kind of wood named “Kun Dian” as posts to hold the electric cables. NUQ !" ! Tai O was famous for its “bungalows” !"#$%&'()* !"#$%&'()* !"#$%&'()* -

Office Address of the Labour Relations Division

If you wish to make enquiries or complaints or lodge claims on matters related to the Employment Ordinance, the Minimum Wage Ordinance or contracts of employment with the Labour Department, please approach, according to your place of work, the nearby branch office of the Labour Relations Division for assistance. Office address Areas covered Labour Relations Division (Hong Kong East) (Eastern side of Arsenal Street), HK Arts Centre, Wan Chai, Causeway Bay, 12/F, 14 Taikoo Wan Road, Taikoo Shing, Happy Valley, Tin Hau, Fortress Hill, North Point, Taikoo Place, Quarry Bay, Hong Kong. Shau Ki Wan, Chai Wan, Tai Tam, Stanley, Repulse Bay, Chung Hum Kok, South Bay, Deep Water Bay (east), Shek O and Po Toi Island. Labour Relations Division (Hong Kong West) (Western side of Arsenal Street including Police Headquarters), HK Academy 3/F, Western Magistracy Building, of Performing Arts, Fenwick Pier, Admiralty, Central District, Sheung Wan, 2A Pok Fu Lam Road, The Peak, Sai Ying Pun, Kennedy Town, Cyberport, Residence Bel-air, Hong Kong. Aberdeen, Wong Chuk Hang, Deep Water Bay (west), Peng Chau, Cheung Chau, Lamma Island, Shek Kwu Chau, Hei Ling Chau, Siu A Chau, Tai A Chau, Tung Lung Chau, Discovery Bay and Mui Wo of Lantau Island. Labour Relations Division (Kowloon East) To Kwa Wan, Ma Tau Wai, Hung Hom, Ho Man Tin, Kowloon City, UGF, Trade and Industry Tower, Kowloon Tong (eastern side of Waterloo Road), Wang Tau Hom, San Po 3 Concorde Road, Kowloon. Kong, Wong Tai Sin, Tsz Wan Shan, Diamond Hill, Choi Hung Estate, Ngau Chi Wan and Kowloon Bay (including Telford Gardens and Richland Gardens).