CVS Pharmacy Price

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

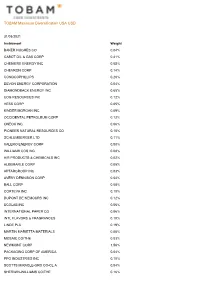

TOBAM Maximum Diversification USA USD

TOBAM Maximum Diversification USA USD 31/03/2021 Instrument Weight BAKER HUGHES CO 0.04% CABOT OIL & GAS CORP 0.41% CHENIERE ENERGY INC 0.05% CHEVRON CORP 0.14% CONOCOPHILLIPS 0.20% DEVON ENERGY CORPORATION 0.04% DIAMONDBACK ENERGY INC 0.65% EOG RESOURCES INC 0.12% HESS CORP 0.05% KINDER MORGAN INC 0.09% OCCIDENTAL PETROLEUM CORP 0.12% ONEOK INC 0.06% PIONEER NATURAL RESOURCES CO 0.10% SCHLUMBERGER LTD 0.11% VALERO ENERGY CORP 0.08% WILLIAMS COS INC 0.08% AIR PRODUCTS & CHEMICALS INC 0.02% ALBEMARLE CORP 0.05% APTARGROUP INC 0.03% AVERY DENNISON CORP 0.04% BALL CORP 0.08% CORTEVA INC 0.10% DUPONT DE NEMOURS INC 0.12% ECOLAB INC 0.06% INTERNATIONAL PAPER CO 0.06% INTL FLAVORS & FRAGRANCES 0.10% LINDE PLC 0.19% MARTIN MARIETTA MATERIALS 0.06% MOSAIC CO/THE 0.03% NEWMONT CORP 1.56% PACKAGING CORP OF AMERICA 0.04% PPG INDUSTRIES INC 0.10% SCOTTS MIRACLE-GRO CO-CL A 0.04% SHERWIN-WILLIAMS CO/THE 0.16% TOBAM Maximum Diversification USA USD 31/03/2021 Instrument Weight VULCAN MATERIALS CO 0.06% WESTROCK CO-WHEN ISSUED 0.03% 3M CO 0.31% ALLEGION PLC 0.03% AMERICAN AIRLINES GROUP INC 0.20% ARCONIC INC 0.04% AXON ENTERPRISE INC 0.03% C.H. ROBINSON WORLDWIDE INC 0.12% CARLISLE COS INC 0.02% CATERPILLAR INC 0.35% CLARIVATE ANALYTICS PLC 0.07% COPART INC 0.06% COSTAR GROUP INC 0.09% CUMMINS INC 0.11% DEERE & CO 0.11% DELTA AIR LINES INC 0.09% EMERSON ELECTRIC CO 0.15% EQUIFAX INC 0.06% EXPEDITORS INTL WASH INC 0.05% FASTENAL CO 0.08% FEDEX CORP 0.20% GENERAC HOLDINGS INC 0.06% GENERAL ELECTRIC CO 0.32% HEICO CORP-CLASS A 0.02% HUNT (JB) TRANSPRT SVCS -

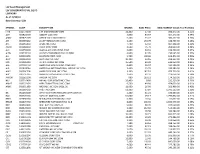

LSV Asset Management LSV CONSERVATIVE VAL EQ FD LSVFNDRV As Of: 9/30/19 Base Currency: USD

LSV Asset Management LSV CONSERVATIVE VAL EQ FD LSVFNDRV As of: 9/30/19 Base Currency: USD SYMBOL CUSIP DESCRIPTION SHARES BASE PRICE BASE MARKET VALUE% of Portfolio FITB 316773100 5TH 3RD BANCORP COM 14,400 27.38 394,272.00 0.51% ABT 002824100 ABBOTT LAB COM 3,600 83.67 301,212.00 0.39% ABBV 00287Y109 ABBVIE INC COM USD0.01 5,100 75.72 386,172.00 0.50% AYI 00508Y102 ACUITY BRANDS INC COM 1,400 134.79 188,706.00 0.24% AFL 001055102 AFLAC INC COM 7,400 52.32 387,168.00 0.50% AGCO 001084102 AGCO CORP COM 3,500 75.70 264,950.00 0.34% ALK 011659109 ALASKA AIR GROUP INC COM 3,000 64.91 194,730.00 0.25% ALSN 01973R101 ALLISON TRANSMISSION HOLDING 4,900 47.05 230,545.00 0.30% ALL 020002101 ALLSTATE CORP COM 5,700 108.68 619,476.00 0.80% ALLY 02005N100 ALLY FINL INC COM 10,200 33.16 338,232.00 0.44% MO 02209S103 ALTRIA GROUP INC COM 15,500 40.90 633,950.00 0.82% AAL 02376R102 AMERICAN AIRLINES INC COM USD1 6,800 26.97 183,396.00 0.24% AIG 026874784 AMERICAN INTERNATIONAL GROUP INC COM 3,400 55.70 189,380.00 0.24% AMP 03076C106 AMERIPRISE FINL INC COM 3,200 147.10 470,720.00 0.61% ABC 03073E105 AMERISOURCEBERGEN CORP COM 2,600 82.33 214,058.00 0.28% AMGN 031162100 AMGEN INC COM 900 193.51 174,159.00 0.22% NLY 035710409 ANNALY CAP MGMT INC COM 26,400 8.80 232,320.00 0.30% AMAT 038222105 APPLIED MATERIALS INC COM 9,500 49.90 474,050.00 0.61% ARNC 03965L100 ARCONIC INC COM USD1.00 11,900 26.00 309,400.00 0.40% T 00206R102 AT&T INC COM 51,300 37.84 1,941,192.00 2.50% BK 064058100 BANK NEW YORK MELLON CORP COM STK 4,300 45.21 194,403.00 0.25% BAC 060505104 -

United Airlines Holdings Annual Report 2021

United Airlines Holdings Annual Report 2021 Form 10-K (NASDAQ:UAL) Published: March 1st, 2021 PDF generated by stocklight.com UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, DC 20549 FORM 10-K ☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 31, 2020 OR ☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from to Commission Exact Name of Registrant as Specified in its Charter, State of I.R.S. Employer File Number Principal Executive Office Address and Telephone Incorporation Identification No. Number 001-06033 United Airlines Holdings, Inc. Delaware 36-2675207 233 South Wacker Chicago, Illinois Drive, 60606 (872) 825-4000 001-10323 United Airlines, Inc. Delaware 74-2099724 233 South Wacker Chicago, Illinois Drive, 60606 (872) 825-4000 Securities registered pursuant to Section 12(b) of the Act: Title of Each Class Trading Symbol Name of Each Exchange on Which Registered United Airlines Holdings, Inc. Common Stock, $0.01 par value UAL The Nasdaq Stock Market LLC Preferred Stock Purchase Rights The Nasdaq Stock Market LLC United Airlines, Inc. None None None Securities registered pursuant to Section 12(g) of the Act: United Airlines Holdings, Inc. None United Airlines, Inc. None Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act United Airlines Holdings, Inc. Yes ☒ No ☐ United Airlines, Inc. Yes ☒ No ☐ Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. -

Download All Holdings (PDF)

AMG GW&K High Income Fund - Portfolio Holdings as of February 28, 2021 Name Sector Asset Class Country Currency Par/Shares Price ($) Market Value ($) % of Fund Starwood Property Trust Inc Fixed 4.75% Mar 2025 Corporate Bond US USD 262,000 102.22 $267,810 2.52% HCA Inc Fixed 5.38% Feb 2025 Corporate Bond US USD 236,000 112.25 $264,910 2.49% Delta Air Lines Inc Fixed 7.38% Jan 2026 Corporate Bond US USD 225,000 116.57 $262,274 2.47% United Airlines Holdings Inc Fixed 5.00% Feb 2024 Corporate Bond US USD 254,000 102.63 $260,668 2.45% Apache Corp Fixed 4.63% Nov 2025 Corporate Bond US USD 251,000 103.63 $260,099 2.45% General Electric Co Floating Perpetual Corporate Bond US USD 271,000 94.56 $256,255 2.41% Howmet Aerospace Inc Fixed 6.88% May 2025 Corporate Bond US USD 220,000 115.75 $254,639 2.39% Hudbay Minerals Inc Fixed 4.50% Apr 2026 144A Corporate Bond CA USD 250,000 101.38 $253,445 2.38% Service Properties Trust Fixed 7.50% Sep 2025 Corporate Bond US USD 223,000 113.47 $253,033 2.38% American Axle & Manufacturing Inc Fixed 6.25% Apr 2025 Corporate Bond US USD 243,000 103.01 $250,314 2.35% JPMorgan Chase & Co Floating Perpetual Corporate Bond US USD 245,000 102.00 $249,900 2.35% Penske Automotive Group Inc Fixed 3.50% Sep 2025 Corporate Bond US USD 243,000 101.75 $247,253 2.32% Ford Motor Co Fixed 4.35% Dec 2026 Corporate Bond US USD 231,000 106.57 $246,186 2.31% Sprint Corp Fixed 7.13% Jun 2024 Corporate Bond US USD 211,000 115.14 $242,956 2.28% Ovintiv Exploration Inc Fixed 5.63% Jul 2024 Corporate Bond US USD 206,000 109.65 $225,881 -

AMERICAN CENTURY INVESTMENT TRUST Form NPORT-P Filed 2021

SECURITIES AND EXCHANGE COMMISSION FORM NPORT-P Filing Date: 2021-08-24 | Period of Report: 2021-06-30 SEC Accession No. 0001145549-21-048495 (HTML Version on secdatabase.com) FILER AMERICAN CENTURY INVESTMENT TRUST Mailing Address Business Address 4500 MAIN STREET 4500 MAIN STREET CIK:908406| IRS No.: 000000000 | State of Incorp.:MA | Fiscal Year End: 0331 KANSAS CITY MO 64111 KANSAS CITY MO 64111 Type: NPORT-P | Act: 40 | File No.: 811-07822 | Film No.: 211201694 816-531-5575 Copyright © 2021 www.secdatabase.com. All Rights Reserved. Please Consider the Environment Before Printing This Document American Century Investments® Quarterly Portfolio Holdings High-Yield Fund June 30, 2021 Copyright © 2021 www.secdatabase.com. All Rights Reserved. Please Consider the Environment Before Printing This Document High-Yield - Schedule of Investments JUNE 30, 2021 (UNAUDITED) Copyright © 2021 www.secdatabase.com. All Rights Reserved. Please Consider the Environment Before Printing This Document Shares/ Principal Amount ($) Value ($) CORPORATE BONDS — 86.4% Aerospace and Defense — 2.0% Bombardier, Inc., 6.00%, 10/15/22(1) 96,000 96,316 Bombardier, Inc., 7.50%, 3/15/25(1)(2) 305,000 314,341 Howmet Aerospace, Inc., 5.125%, 10/1/24 175,000 193,590 Rolls-Royce plc, 5.75%, 10/15/27(1) 250,000 275,695 TransDigm, Inc., 6.25%, 3/15/26(1) 1,000,000 1,056,250 TransDigm, Inc., 6.375%, 6/15/26 520,000 539,354 TransDigm, Inc., 4.625%, 1/15/29(1) 500,000 501,645 2,977,191 Airlines — 1.2% American Airlines, Inc. / AAdvantage Loyalty IP Ltd., 5.50%, 4/20/26(1) 504,000 534,240 United Airlines Holdings, Inc., 5.00%, 2/1/24(2) 555,000 577,930 United Airlines Pass Through Trust, 4.875%, 7/15/27 235,832 250,458 United Airlines, Inc., 4.625%, 4/15/29(1) 373,000 386,521 1,749,149 Auto Components — 0.7% Goodyear Tire & Rubber Co. -

List of CA100+ Non-Disclosers 142 of 167 CA100+ Target Companies (85%) Have Not Published a Review of Their Alignment with Industry Associations on Climate Change

List of CA100+ Non-Disclosers 142 of 167 CA100+ target companies (85%) have not published a review of their alignment with industry associations on climate change. A full list is below: • A.P. Moller - Maersk • CEZ, A.S. • Adbri Ltd • China National Offshore Oil Corporation (CNOOC) Limited • AES Corporation • China Petroleum & Chemical • Air France KLM S.A. Corporation (Sinopec) • Air Liquide • China Shenhua Energy • Airbus Group • China Steel Corporation • American Airlines Group Inc. • Coal India • American Electric Power Company, Inc. • Coca-Cola Company • Anhui Conch Cement • Colgate-Palmolive Company • ANTAM (Aneka Tambang) • CRH • Bayer AG • Cummins Inc. • Berkshire Hathaway • Daikin Industries, Ltd. • Bluescope Steel Limited • Daimler AG • BMW • Dangote Cement Plc • Boeing Company • Danone S.A. • Boral Limited • Delta Air Lines, Inc. • Bumi Resources • Devon Energy Corporation • Bunge Limited • Dominion Energy, Inc • Canadian Natural Resources Limited • Dow Inc • Caterpillar Inc. • E.ON SE • CEMEX S.A.B. De C.V. • Ecopetrol Sa • Centrica • EDF List of CA100+ Non-Disclosers 1 • Enbridge Inc. • LafargeHolcim Ltd • ENEL SpA • Lockheed Martin Corporation • ENEOS Holdings • Lukoil OAO • ENGIE • LyondellBasell Industries Cl A • Eni SpA • Marathon Petroleum • Eskom Holdings Soc Limited • Martin Marietta Materials, Inc. • Exelon Corporation • National Grid Plc • Fiat Chrysler Automobiles NV • Naturgy • FirstEnergy Corp. • Nestlé • Formosa Petrochemical • NextEra Energy, Inc. • Fortum Oyj • Nippon Steel Corporation • Gazprom • Nissan Motor Co., Ltd. • General Electric Company • Nornickel (MMC Norilsk Nickel OSJC) • General Motors Company • NRG Energy, Inc. • Grupo Argos • NTPC Ltd • Grupo Mexico • Occidental Petroleum Corporation • Hitachi, Ltd. • Oil & Natural Gas Corporation • Hon Hai Precision Industry • Oil Search • Honda Motor Company • Orica • Iberdrola, S.A. -

Ctpf Illinois Economic Opportunity Report

CTPF ILLINOIS ECONOMIC OPPORTUNITY REPORT As Required by Public Act 096-0753 for the period ending June 30, 2021 202 1 TABLE OF CONTENTS TABLE I 1 Illinois-based Investment Manager Firms Investing on Behalf of CTPF TABLE II Illinois-based Private Equity Partnerships, Portfolio Companies, 2 Infrastructure, and Real Estate Properties in the CTPF Portfolio TABLE III 14 Illinois-based Public Equity Market Value of Shares Held in CTPF’s Portfolio TABLE IV 18 Illinois-based Fixed Income Market Value of Shares Held in CTPF’s Portfolio TABLE V Domestic Equity Brokerage Commissions Paid to Illinois-based 19 Brokers/Dealers TABLE VI 20 International Equity Brokerage Commissions Paid to Illinois-based Brokers/Dealers TABLE VII Fixed Income Volume Traded through Illinois-based Brokers/Dealers 21 (par value) 2021 CTPF ILLINOIS ECONOMIC OPPORTUNITY REPORT REQUIRED BY PUBLIC ACT 096-0753 FOR THE PERIOD ENDING JUNE 30, 2021 TABLE I Illinois-based Investment Manager Firms Investing on Behalf of CTPF Table I identifies the economic opportunity investments made by CTPF with Illinois-based investment management companies. As of June 30, 2021, Total Market/Fair Value of Illinois-based investment managers was $3,121,157,662.18 (23.74%) of the total CTPF investment portfolio of $13,145,258,889.14. Market/Fair Value % of Total Fund Investment Manager Firms Location As of 6/30/2021 (reported in millions) Adams Street Chicago $ 319.69 2.43% Ariel Capital Management Chicago 83.44 0.63% Attucks Asset Management Chicago 274.06 2.08% Ativo Capital Management1 Chicago -

Quarterly Holdings

High-Yield - TF Schedule of Investments as of 2021-06-30 (Unaudited) Holding Interest Maturity Date Shares/Principal Market Value ($) Rate (%) Amount SPDR Bloomberg Barclays Short Term High Yield 133,100 3,670,898 Bond ETF SPDR Blackstone Senior Loan ETF 79,300 3,670,797 iShares Broad USD High Yield Corporate Bond 70,700 2,949,604 ETF CCO Holdings LLC / CCO Holdings Capital Corp 5.00 2028-02-01 2,020,000 2,121,000 5.00 02/01/2028 Occidental Petroleum Corp 6.38 09/01/2028 6.38 2028-09-01 1,200,000 1,402,692 Iron Mountain Inc 4.88 09/15/2029 4.88 2029-09-15 1,300,000 1,343,680 Altice Financing SA 7.50 05/15/2026 7.50 2026-05-15 1,205,000 1,256,273 Sirius XM Radio Inc 5.00 08/01/2027 5.00 2027-08-01 1,170,000 1,228,646 Caesars Resort Collection LLC / CRC Finco Inc 5.25 2025-10-15 1,200,000 1,216,500 5.25 10/15/2025 Ford Motor Co 8.50 04/21/2023 8.50 2023-04-21 1,080,000 1,206,576 International Game Technology PLC 5.25 5.25 2029-01-15 1,070,000 1,149,100 01/15/2029 T-Mobile USA Inc 4.75 02/01/2028 4.75 2028-02-01 1,067,000 1,144,358 Avolon Holdings Funding Ltd 4.25 04/15/2026 4.25 2026-04-15 1,035,000 1,122,484 1011778 BC ULC / New Red Finance Inc 4.38 4.38 2028-01-15 1,090,000 1,106,514 01/15/2028 Virgin Media Vendor Financing Notes IV DAC 5.00 5.00 2028-07-15 1,060,000 1,085,021 07/15/2028 TransDigm Inc 6.25 03/15/2026 6.25 2026-03-15 1,000,000 1,056,250 Magic Mergeco Inc 7.88 05/01/2029 7.88 2029-05-01 1,000,000 1,032,500 DISH DBS Corp 5.88 11/15/2024 5.88 2024-11-15 910,000 978,250 Scientific Games International Inc 7.25 11/15/2029 7.25 -

ACVR NT High Income

American Century Investments® Quarterly Portfolio Holdings NT High Income Fund June 30, 2021 NT High Income - Schedule of Investments JUNE 30, 2021 (UNAUDITED) Shares/ Principal Amount ($) Value ($) CORPORATE BONDS — 94.0% Aerospace and Defense — 1.9% Bombardier, Inc., 6.00%, 10/15/22(1) 1,287,000 1,291,240 Bombardier, Inc., 7.50%, 12/1/24(1) 1,450,000 1,517,070 Bombardier, Inc., 7.50%, 3/15/25(1) 676,000 696,702 Bombardier, Inc., 7.875%, 4/15/27(1) 1,100,000 1,142,636 BWX Technologies, Inc., 4.125%, 4/15/29(1) 525,000 535,521 F-Brasile SpA / F-Brasile US LLC, 7.375%, 8/15/26(1) 600,000 620,250 Howmet Aerospace, Inc., 5.125%, 10/1/24 1,925,000 2,129,493 Howmet Aerospace, Inc., 5.90%, 2/1/27 125,000 146,349 Howmet Aerospace, Inc., 5.95%, 2/1/37 1,975,000 2,392,574 Rolls-Royce plc, 5.75%, 10/15/27(1) 600,000 661,668 Spirit AeroSystems, Inc., 5.50%, 1/15/25(1) 400,000 426,220 Spirit AeroSystems, Inc., 7.50%, 4/15/25(1) 875,000 936,587 Spirit AeroSystems, Inc., 4.60%, 6/15/28 600,000 589,515 TransDigm, Inc., 7.50%, 3/15/27 675,000 718,942 TransDigm, Inc., 5.50%, 11/15/27 6,000,000 6,262,500 TransDigm, Inc., 4.625%, 1/15/29(1) 1,275,000 1,279,195 TransDigm, Inc., 4.875%, 5/1/29(1) 1,425,000 1,440,319 Triumph Group, Inc., 8.875%, 6/1/24(1) 315,000 350,833 Triumph Group, Inc., 6.25%, 9/15/24(1) 275,000 280,159 Triumph Group, Inc., 7.75%, 8/15/25 375,000 386,250 23,804,023 Air Freight and Logistics — 0.3% Cargo Aircraft Management, Inc., 4.75%, 2/1/28(1) 850,000 869,584 Western Global Airlines LLC, 10.375%, 8/15/25(1) 875,000 1,003,520 XPO Logistics, Inc., 6.125%, 9/1/23(1) 1,100,000 1,111,820 XPO Logistics, Inc., 6.75%, 8/15/24(1) 475,000 494,000 3,478,924 Airlines — 1.1% American Airlines Group, Inc., 5.00%, 6/1/22(1) 750,000 751,890 American Airlines, Inc., 11.75%, 7/15/25(1) 2,475,000 3,109,219 American Airlines, Inc. -

CORPORATE EQUALITY INDEX 2021 CEI 2021 Table of Contents

Rating Corporate Workplaces on Lesbian, Gay, Bisexual, Equality Transgender and Queer Index 2021 Equality NEWS CEI 2021 Corporate Equality Index © 2021 by the Human Rights Campaign Foundation. The Human Rights Campaign Foundation owns all right, title and interest in and to this publication and all derivative works thereof. Permission for reproduction and redistribution is granted if the publication is (1) reproduced in its entirety and (2) distributed free of charge. The Human Rights Campaign name and the Equality logo are trademarks of the Human Rights Campaign. The Human Rights Campaign Foundation and design incorporating the Equality logo are trademarks of the Human Rights Campaign Foundation. ISBN-13 978-1-934765-58-6 CORPORATE EQUALITY INDEX 2021 CEI 2021 Table of Contents Rating Workplaces Corporate on Lesbian, Gay, Bisexual, Equality Transgender and Queer Index 2021 Equality 2 Message from the HRC Foundation President NEWS 3 EXECUTIVE SUMMARY 5 Key Findings 7 Equality at the Fortune-Ranked Companies 8 Accelerating Global Equality 10 Spotlight: HRC’s Equidad Programs 13 FINDINGS 14 Criteria 1: Workforce Protections 16 Criteria 2: Inclusive Benefits 17 Continued Need for Partner Benefits 18 Understanding Transgender-Inclusive Healthcare Coverage 19 Criteria 3: Supporting an Inclusive Culture & Corporate Social Responsibility 19 Internal Education and Training Best Practices 20 LGBTQ Employee Resource Group or Diversity Council 22 Outreach or Engagement with the LGBTQ Community 24 Corporate Social Responsibility 25 Spotlight: Equality -

Pacer CFRA-Stovall Equal Weight Seasonal Rotation ETF Schedule of Investments January 31, 2021 (Unaudited)

Pacer CFRA-Stovall Equal Weight Seasonal Rotation ETF Schedule of Investments January 31, 2021 (Unaudited) Shares Value COMMON STOCKS - 99.4% Aerospace/Defense - 2.8% Boeing Co. 882 $ 171,276 General Dynamics Corp. 1,342 196,844 Howmet Aerospace, Inc. 7,684 188,873 L3Harris Technologies, Inc. 1,073 184,030 Lockheed Martin Corp. 561 180,541 Northrop Grumman Corp. 675 193,462 Raytheon Technologies Corp. 2,786 185,910 Teledyne Technologies, Inc. (a) 523 186,716 TransDigm Group, Inc. (a) 337 186,455 1,674,107 Airlines - 1.6% Alaska Air Group, Inc. 4,071 198,787 American Airlines Group, Inc. 11,911 204,512 Delta Air Lines, Inc. 4,865 184,675 Southwest Airlines Co. 4,426 194,479 United Airlines Holdings, Inc. (a) 4,199 167,918 950,371 Apparel - 2.8% Hanesbrands, Inc. 17,193 262,881 NIKE, Inc. - Class B 1,746 233,248 PVH Corp. 2,544 216,901 Ralph Lauren Corp. - Class A 2,368 239,286 Tapestry, Inc. 8,183 258,747 Under Armour, Inc. - Class A (a) 7,329 128,258 Under Armour, Inc. - Class C (a) 7,560 113,173 VF Corp. 2,769 212,853 1,665,347 Auto Manufacturers - 2.2% Cummins, Inc. 928 217,542 Ford Motor Co. 26,609 280,193 General Motors Co. 5,725 290,143 PACCAR, Inc. 2,376 216,738 Tesla Motors, Inc. (a) 389 308,683 1,313,299 Auto Parts & Equipment - 0.9% Aptiv PLC - ADR 1,963 262,257 BorgWarner, Inc. 6,571 275,916 538,173 Biotechnology - 0.9% Corteva, Inc. -

MM S&P 500® Index Fund

Fund Holdings As of 06/30/2021 MM S&P 500® Index Fund Northern Trust Fund Shares or Par Position Market Security Name Ticker CUSIP Weighting (%) Amount Value ($) Apple Inc AAPL 037833100 5.86 1,545,414 211,659,901 Microsoft Corp MSFT 594918104 5.56 741,943 200,992,359 Amazon.com Inc AMZN 023135106 4.02 42,230 145,277,957 Facebook Inc Class A FB 30303M102 2.27 236,043 82,074,512 Alphabet Inc Class A GOOGL 02079K305 2.00 29,618 72,320,936 Alphabet Inc Class C GOOG 02079K107 1.95 28,061 70,329,846 Berkshire Hathaway Inc Class B BRK.B 084670702 1.44 186,640 51,870,989 Tesla Inc TSLA 88160R101 1.43 75,913 51,598,066 NVIDIA Corp NVDA 67066G104 1.36 61,379 49,109,338 JPMorgan Chase & Co JPM 46625H100 1.28 298,119 46,369,429 Johnson & Johnson JNJ 478160104 1.18 259,471 42,745,253 Visa Inc Class A V 92826C839 1.08 166,736 38,986,212 UnitedHealth Group Inc UNH 91324P102 1.03 93,016 37,247,327 PayPal Holdings Inc PYPL 70450Y103 0.93 115,741 33,736,187 The Home Depot Inc HD 437076102 0.92 104,750 33,403,728 Procter & Gamble Co PG 742718109 0.90 241,368 32,567,784 The Walt Disney Co DIS 254687106 0.87 179,066 31,474,431 Mastercard Inc Class A MA 57636Q104 0.87 86,190 31,467,107 Bank of America Corp BAC 060505104 0.85 742,616 30,618,058 Adobe Inc ADBE 00724F101 0.76 47,127 27,599,456 Exxon Mobil Corp XOM 30231G102 0.73 416,660 26,282,913 Comcast Corp Class A CMCSA 20030N101 0.71 452,098 25,778,628 Netflix Inc NFLX 64110L106 0.64 43,685 23,074,854 Verizon Communications Inc VZ 92343V104 0.63 408,289 22,876,433 Intel Corp INTC 458140100 0.62 397,807 22,332,885