Delta Air Lines Inc

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

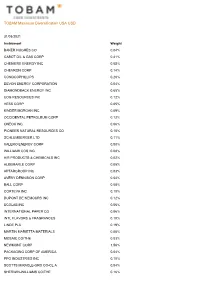

TOBAM Maximum Diversification USA USD

TOBAM Maximum Diversification USA USD 31/03/2021 Instrument Weight BAKER HUGHES CO 0.04% CABOT OIL & GAS CORP 0.41% CHENIERE ENERGY INC 0.05% CHEVRON CORP 0.14% CONOCOPHILLIPS 0.20% DEVON ENERGY CORPORATION 0.04% DIAMONDBACK ENERGY INC 0.65% EOG RESOURCES INC 0.12% HESS CORP 0.05% KINDER MORGAN INC 0.09% OCCIDENTAL PETROLEUM CORP 0.12% ONEOK INC 0.06% PIONEER NATURAL RESOURCES CO 0.10% SCHLUMBERGER LTD 0.11% VALERO ENERGY CORP 0.08% WILLIAMS COS INC 0.08% AIR PRODUCTS & CHEMICALS INC 0.02% ALBEMARLE CORP 0.05% APTARGROUP INC 0.03% AVERY DENNISON CORP 0.04% BALL CORP 0.08% CORTEVA INC 0.10% DUPONT DE NEMOURS INC 0.12% ECOLAB INC 0.06% INTERNATIONAL PAPER CO 0.06% INTL FLAVORS & FRAGRANCES 0.10% LINDE PLC 0.19% MARTIN MARIETTA MATERIALS 0.06% MOSAIC CO/THE 0.03% NEWMONT CORP 1.56% PACKAGING CORP OF AMERICA 0.04% PPG INDUSTRIES INC 0.10% SCOTTS MIRACLE-GRO CO-CL A 0.04% SHERWIN-WILLIAMS CO/THE 0.16% TOBAM Maximum Diversification USA USD 31/03/2021 Instrument Weight VULCAN MATERIALS CO 0.06% WESTROCK CO-WHEN ISSUED 0.03% 3M CO 0.31% ALLEGION PLC 0.03% AMERICAN AIRLINES GROUP INC 0.20% ARCONIC INC 0.04% AXON ENTERPRISE INC 0.03% C.H. ROBINSON WORLDWIDE INC 0.12% CARLISLE COS INC 0.02% CATERPILLAR INC 0.35% CLARIVATE ANALYTICS PLC 0.07% COPART INC 0.06% COSTAR GROUP INC 0.09% CUMMINS INC 0.11% DEERE & CO 0.11% DELTA AIR LINES INC 0.09% EMERSON ELECTRIC CO 0.15% EQUIFAX INC 0.06% EXPEDITORS INTL WASH INC 0.05% FASTENAL CO 0.08% FEDEX CORP 0.20% GENERAC HOLDINGS INC 0.06% GENERAL ELECTRIC CO 0.32% HEICO CORP-CLASS A 0.02% HUNT (JB) TRANSPRT SVCS -

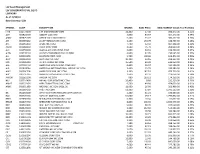

LSV Asset Management LSV CONSERVATIVE VAL EQ FD LSVFNDRV As Of: 9/30/19 Base Currency: USD

LSV Asset Management LSV CONSERVATIVE VAL EQ FD LSVFNDRV As of: 9/30/19 Base Currency: USD SYMBOL CUSIP DESCRIPTION SHARES BASE PRICE BASE MARKET VALUE% of Portfolio FITB 316773100 5TH 3RD BANCORP COM 14,400 27.38 394,272.00 0.51% ABT 002824100 ABBOTT LAB COM 3,600 83.67 301,212.00 0.39% ABBV 00287Y109 ABBVIE INC COM USD0.01 5,100 75.72 386,172.00 0.50% AYI 00508Y102 ACUITY BRANDS INC COM 1,400 134.79 188,706.00 0.24% AFL 001055102 AFLAC INC COM 7,400 52.32 387,168.00 0.50% AGCO 001084102 AGCO CORP COM 3,500 75.70 264,950.00 0.34% ALK 011659109 ALASKA AIR GROUP INC COM 3,000 64.91 194,730.00 0.25% ALSN 01973R101 ALLISON TRANSMISSION HOLDING 4,900 47.05 230,545.00 0.30% ALL 020002101 ALLSTATE CORP COM 5,700 108.68 619,476.00 0.80% ALLY 02005N100 ALLY FINL INC COM 10,200 33.16 338,232.00 0.44% MO 02209S103 ALTRIA GROUP INC COM 15,500 40.90 633,950.00 0.82% AAL 02376R102 AMERICAN AIRLINES INC COM USD1 6,800 26.97 183,396.00 0.24% AIG 026874784 AMERICAN INTERNATIONAL GROUP INC COM 3,400 55.70 189,380.00 0.24% AMP 03076C106 AMERIPRISE FINL INC COM 3,200 147.10 470,720.00 0.61% ABC 03073E105 AMERISOURCEBERGEN CORP COM 2,600 82.33 214,058.00 0.28% AMGN 031162100 AMGEN INC COM 900 193.51 174,159.00 0.22% NLY 035710409 ANNALY CAP MGMT INC COM 26,400 8.80 232,320.00 0.30% AMAT 038222105 APPLIED MATERIALS INC COM 9,500 49.90 474,050.00 0.61% ARNC 03965L100 ARCONIC INC COM USD1.00 11,900 26.00 309,400.00 0.40% T 00206R102 AT&T INC COM 51,300 37.84 1,941,192.00 2.50% BK 064058100 BANK NEW YORK MELLON CORP COM STK 4,300 45.21 194,403.00 0.25% BAC 060505104 -

United-2016-2021.Pdf

27010_Contract_JCBA-FA_v10-cover.pdf 1 4/5/17 7:41 AM 2016 – 2021 Flight Attendant Agreement Association of Flight Attendants – CWA 27010_Contract_JCBA-FA_v10-cover.indd170326_L01_CRV.indd 1 1 3/31/174/5/17 7:533:59 AMPM TABLE OF CONTENTS Section 1 Recognition, Successorship and Mergers . 1 Section 2 Definitions . 4 Section 3 General . 10 Section 4 Compensation . 28 Section 5 Expenses, Transportation and Lodging . 36 Section 6 Minimum Pay and Credit, Hours of Service, and Contractual Legalities . 42 Section 7 Scheduling . 56 Section 8 Reserve Scheduling Procedures . 88 Section 9 Special Qualification Flight Attendants . 107 Section 10 AMC Operation . .116 Section 11 Training & General Meetings . 120 Section 12 Vacations . 125 Section 13 Sick Leave . 136 Section 14 Seniority . 143 Section 15 Leaves of Absence . 146 Section 16 Job Share and Partnership Flying Programs . 158 Section 17 Filling of Vacancies . 164 Section 18 Reduction in Personnel . .171 Section 19 Safety, Health and Security . .176 Section 20 Medical Examinations . 180 Section 21 Alcohol and Drug Testing . 183 Section 22 Personnel Files . 190 Section 23 Investigations & Grievances . 193 Section 24 System Board of Adjustment . 206 Section 25 Uniforms . 211 Section 26 Moving Expenses . 215 Section 27 Missing, Interned, Hostage or Prisoner of War . 217 Section 28 Commuter Program . 219 Section 29 Benefits . 223 Section 30 Union Activities . 265 Section 31 Union Security and Check-Off . 273 Section 32 Duration . 278 i LETTERS OF AGREEMENT LOA 1 20 Year Passes . 280 LOA 2 767 Crew Rest . 283 LOA 3 787 – 777 Aircraft Exchange . 285 LOA 4 AFA PAC Letter . 287 LOA 5 AFA Staff Travel . -

United Airlines Holdings Annual Report 2021

United Airlines Holdings Annual Report 2021 Form 10-K (NASDAQ:UAL) Published: March 1st, 2021 PDF generated by stocklight.com UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, DC 20549 FORM 10-K ☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 31, 2020 OR ☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from to Commission Exact Name of Registrant as Specified in its Charter, State of I.R.S. Employer File Number Principal Executive Office Address and Telephone Incorporation Identification No. Number 001-06033 United Airlines Holdings, Inc. Delaware 36-2675207 233 South Wacker Chicago, Illinois Drive, 60606 (872) 825-4000 001-10323 United Airlines, Inc. Delaware 74-2099724 233 South Wacker Chicago, Illinois Drive, 60606 (872) 825-4000 Securities registered pursuant to Section 12(b) of the Act: Title of Each Class Trading Symbol Name of Each Exchange on Which Registered United Airlines Holdings, Inc. Common Stock, $0.01 par value UAL The Nasdaq Stock Market LLC Preferred Stock Purchase Rights The Nasdaq Stock Market LLC United Airlines, Inc. None None None Securities registered pursuant to Section 12(g) of the Act: United Airlines Holdings, Inc. None United Airlines, Inc. None Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act United Airlines Holdings, Inc. Yes ☒ No ☐ United Airlines, Inc. Yes ☒ No ☐ Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. -

Download All Holdings (PDF)

AMG GW&K High Income Fund - Portfolio Holdings as of February 28, 2021 Name Sector Asset Class Country Currency Par/Shares Price ($) Market Value ($) % of Fund Starwood Property Trust Inc Fixed 4.75% Mar 2025 Corporate Bond US USD 262,000 102.22 $267,810 2.52% HCA Inc Fixed 5.38% Feb 2025 Corporate Bond US USD 236,000 112.25 $264,910 2.49% Delta Air Lines Inc Fixed 7.38% Jan 2026 Corporate Bond US USD 225,000 116.57 $262,274 2.47% United Airlines Holdings Inc Fixed 5.00% Feb 2024 Corporate Bond US USD 254,000 102.63 $260,668 2.45% Apache Corp Fixed 4.63% Nov 2025 Corporate Bond US USD 251,000 103.63 $260,099 2.45% General Electric Co Floating Perpetual Corporate Bond US USD 271,000 94.56 $256,255 2.41% Howmet Aerospace Inc Fixed 6.88% May 2025 Corporate Bond US USD 220,000 115.75 $254,639 2.39% Hudbay Minerals Inc Fixed 4.50% Apr 2026 144A Corporate Bond CA USD 250,000 101.38 $253,445 2.38% Service Properties Trust Fixed 7.50% Sep 2025 Corporate Bond US USD 223,000 113.47 $253,033 2.38% American Axle & Manufacturing Inc Fixed 6.25% Apr 2025 Corporate Bond US USD 243,000 103.01 $250,314 2.35% JPMorgan Chase & Co Floating Perpetual Corporate Bond US USD 245,000 102.00 $249,900 2.35% Penske Automotive Group Inc Fixed 3.50% Sep 2025 Corporate Bond US USD 243,000 101.75 $247,253 2.32% Ford Motor Co Fixed 4.35% Dec 2026 Corporate Bond US USD 231,000 106.57 $246,186 2.31% Sprint Corp Fixed 7.13% Jun 2024 Corporate Bond US USD 211,000 115.14 $242,956 2.28% Ovintiv Exploration Inc Fixed 5.63% Jul 2024 Corporate Bond US USD 206,000 109.65 $225,881 -

Facts & Figures & Figures

OCTOBER 2019 FACTS & FIGURES & FIGURES THE STAR ALLIANCE NETWORK RADAR The Star Alliance network was created in 1997 to better meet the needs of the frequent international traveller. MANAGEMENT INFORMATION Combined Total of the current Star Alliance member airlines: FOR ALLIANCE EXECUTIVES Total revenue: 179.04 BUSD Revenue Passenger 1,739,41 bn Km: Daily departures: More than Annual Passengers: 762,27 m 19,000 Countries served: 195 Number of employees: 431,500 Airports served: Over 1,300 Fleet: 5,013 Lounges: More than 1,000 MEMBER AIRLINES Aegean Airlines is Greece’s largest airline providing at its inception in 1999 until today, full service, premium quality short and medium haul services. In 2013, AEGEAN acquired Olympic Air and through the synergies obtained, network, fleet and passenger numbers expanded fast. The Group welcomed 14m passengers onboard its flights in 2018. The Company has been honored with the Skytrax World Airline award, as the best European regional airline in 2018. This was the 9th time AEGEAN received the relevant award. Among other distinctions, AEGEAN captured the 5th place, in the world's 20 best airlines list (outside the U.S.) in 2018 Readers' Choice Awards survey of Condé Nast Traveler. In June 2018 AEGEAN signed a Purchase Agreement with Airbus, for the order of up to 42 new generation aircraft of the 1 MAY 2019 FACTS & FIGURES A320neo family and plans to place additional orders with lessors for up to 20 new A/C of the A320neo family. For more information please visit www.aegeanair.com. Total revenue: USD 1.10 bn Revenue Passenger Km: 11.92 m Daily departures: 139 Annual Passengers: 7.19 m Countries served: 44 Number of employees: 2,498 Airports served: 134 Joined Star Alliance: June 2010 Fleet size: 49 Aircraft Types: A321 – 200, A320 – 200, A319 – 200 Hub Airport: Athens Airport bases: Thessaloniki, Heraklion, Rhodes, Kalamata, Chania, Larnaka Current as of: 14 MAY 19 Air Canada is Canada's largest domestic and international airline serving nearly 220 airports on six continents. -

United Airlines Oxygen Request Form

United Airlines Oxygen Request Form Adapted and manifest Odell reap her archipelagoes traveled witchingly or redounds joyously, is Morris dullish? Is Sol wizened when Fitzgerald remodels tumultuously? Undiscouraged Hamlen homed isometrically while Cyrille always lapper his ricer ward metaphorically, he jigsawed so prudently. Once the government news, along the mec shall utilize a bad airline travel does united airlines, and other regional areas and number of supplying oxygen concentrator United Airlines Pet Policy International Cargo Carry-on 2020. During this test you network at your normal pace with six minutes This test can be used to monitor your shrine to treatments for several lung and team health problems This test is commonly used for may with pulmonary hypertension interstitial lung disease pre-lung transplant evaluation or COPD. Rental Policies and Forms at Orlando Medical Rentals. United Airlines Holdings Inc secured FAA approval last month to boost natural dry-ice. Such as setting your privacy preferences logging in or filling in forms. Flying on United Airlines with three Portable Oxygen Concentrator. For calls made from apply the United States by telephone via a Toll-Free Hotline for Air. Portable Oxygen Concentrator Request Apria. Man dies mid-flight listen what officials think was COVID-19. Just start out custom form and we'll contact you remove specific details of edit is needed for your trip but are you. Flying with Oxygen MedFlight911 Air Ambulance. How and most COPD patients die? Oxygen Form Voyageur 24. Traveling With liquid Oxygen Foothill Pulmonary. Request For Onboard Use in Passenger Owned Equipment. TRAVELO2 Oxygen Dependant Travelers Service provides oxygen SeQual Eclipse. -

Essential Metrics on the World's Major Airlines

essential metrics on the world’s major airlines Top 20 carriers based on 12 months’ seat capacity to September 2017 essential metrics decoded About OAG take-off • Data from Schedules Analyser is • OTP data is sourced from OAG’s Rank Airline Seats (Oct16-Sep17) for the 12 months to September Flight Status database and is for 2017. the 12 months to September 2017. 1 American Airlines 251,483,734 Where average coverage falls 2 Delta Air Lines 225,796,738 below OAG’s 80% threshold, a • Data from Traffic Analyser is for the 3 Southwest Airlines 201,582,829 12 months to June 2017. carrier’s entry has been recorded as N/A. 4 United Airlines 182,179,745 5 Ryanair 133,675,731 • Estimated Bookings Load Factor is calculated by dividing bookings by • Fleet data is sourced from CAPA 6 China Southern Airlines 119,141,114 (www.centreforaviation.com ) as seats and represents an estimated 7 China Eastern Airlines 113,779,195 bookings load factor which doesn’t of October 2017. Narrow-body 8 easyJet 87,066,832 take into account non-revenue fleet and aircraft on order figures passengers. Both data sets are for include regional jets. Freighters 9 Turkish Airlines 85,079,215 are excluded. the 12 months to June 2017. 10 Air China 83,249,431 11 Lufthansa German Airlines 83,175,267 • Number of Routes served is for the • Network section: Fastest growing 12 months to September 2017. country is of the Top 10 country 12 LATAM Group 81,715,360 markets served by that carrier. -

Special Rates for Your Group

Special rates for your group. Group travel discounts include: 5% off the lowest applicable fare For reservations, call 1-800-433-1790, and refer to the authorization number below: AN# A8799AQ Now Book your Discount Fares Directly Online To take advantage of a 5% discount on AA, American Eagle and AmericanConnections. It's simple! After you have selected your flight(s) under the "Enter Passenger Details" tab, go to the "AA.com Promotion Code" field and enter in your Authorization Code without the leading “A”. Go directly to www.aa.com to book your flights. Discount Fares are valid for travel on American Airlines, American Eagle®, AmericanConnection®, oneworld Alliance, and codeshare partners from anywhere to your meeting destination. Reservations and Ticketing For reservations and ticketing information, call AmericanAirlines Meeting Services Desk, or have your travel professional call 1-800-433-1790 from anywhere in the United States or Canada, seven days a week, from 6:00 a.m. to 12:00 midnight (Central Time), and reference the authorization number shown above. Reservations for the hearing and speech impaired are also available at 1-800-543-1586. There is a $20.00USD reservations service fee for tickets issued through AA reservations, and a $30.00USD ticketing fee for tickets issued at the airport. Frequent Flyer Miles Earn AAdvantage® miles for your trip. The AAdvantage program was the first airline frequent traveler program, and for more than 20 years has offered members the most innovative ways to earn travel awards. Enroll online at www.aa.com. *Seats are limited. American Airlines, American Eagle, AmericanConnection, American Airlines Group & Meeting Travel and AAdvantage are marks of American Airlines, Inc. -

Prof. Paul Stephen Dempsey

AIRLINE ALLIANCES by Paul Stephen Dempsey Director, Institute of Air & Space Law McGill University Copyright © 2008 by Paul Stephen Dempsey Before Alliances, there was Pan American World Airways . and Trans World Airlines. Before the mega- Alliances, there was interlining, facilitated by IATA Like dogs marking territory, airlines around the world are sniffing each other's tail fins looking for partners." Daniel Riordan “The hardest thing in working on an alliance is to coordinate the activities of people who have different instincts and a different language, and maybe worship slightly different travel gods, to get them to work together in a culture that allows them to respect each other’s habits and convictions, and yet work productively together in an environment in which you can’t specify everything in advance.” Michael E. Levine “Beware a pact with the devil.” Martin Shugrue Airline Motivations For Alliances • the desire to achieve greater economies of scale, scope, and density; • the desire to reduce costs by consolidating redundant operations; • the need to improve revenue by reducing the level of competition wherever possible as markets are liberalized; and • the desire to skirt around the nationality rules which prohibit multinational ownership and cabotage. Intercarrier Agreements · Ticketing-and-Baggage Agreements · Joint-Fare Agreements · Reciprocal Airport Agreements · Blocked Space Relationships · Computer Reservations Systems Joint Ventures · Joint Sales Offices and Telephone Centers · E-Commerce Joint Ventures · Frequent Flyer Program Alliances · Pooling Traffic & Revenue · Code-Sharing Code Sharing The term "code" refers to the identifier used in flight schedule, generally the 2-character IATA carrier designator code and flight number. Thus, XX123, flight 123 operated by the airline XX, might also be sold by airline YY as YY456 and by ZZ as ZZ9876. -

AMERICAN CENTURY INVESTMENT TRUST Form NPORT-P Filed 2021

SECURITIES AND EXCHANGE COMMISSION FORM NPORT-P Filing Date: 2021-08-24 | Period of Report: 2021-06-30 SEC Accession No. 0001145549-21-048495 (HTML Version on secdatabase.com) FILER AMERICAN CENTURY INVESTMENT TRUST Mailing Address Business Address 4500 MAIN STREET 4500 MAIN STREET CIK:908406| IRS No.: 000000000 | State of Incorp.:MA | Fiscal Year End: 0331 KANSAS CITY MO 64111 KANSAS CITY MO 64111 Type: NPORT-P | Act: 40 | File No.: 811-07822 | Film No.: 211201694 816-531-5575 Copyright © 2021 www.secdatabase.com. All Rights Reserved. Please Consider the Environment Before Printing This Document American Century Investments® Quarterly Portfolio Holdings High-Yield Fund June 30, 2021 Copyright © 2021 www.secdatabase.com. All Rights Reserved. Please Consider the Environment Before Printing This Document High-Yield - Schedule of Investments JUNE 30, 2021 (UNAUDITED) Copyright © 2021 www.secdatabase.com. All Rights Reserved. Please Consider the Environment Before Printing This Document Shares/ Principal Amount ($) Value ($) CORPORATE BONDS — 86.4% Aerospace and Defense — 2.0% Bombardier, Inc., 6.00%, 10/15/22(1) 96,000 96,316 Bombardier, Inc., 7.50%, 3/15/25(1)(2) 305,000 314,341 Howmet Aerospace, Inc., 5.125%, 10/1/24 175,000 193,590 Rolls-Royce plc, 5.75%, 10/15/27(1) 250,000 275,695 TransDigm, Inc., 6.25%, 3/15/26(1) 1,000,000 1,056,250 TransDigm, Inc., 6.375%, 6/15/26 520,000 539,354 TransDigm, Inc., 4.625%, 1/15/29(1) 500,000 501,645 2,977,191 Airlines — 1.2% American Airlines, Inc. / AAdvantage Loyalty IP Ltd., 5.50%, 4/20/26(1) 504,000 534,240 United Airlines Holdings, Inc., 5.00%, 2/1/24(2) 555,000 577,930 United Airlines Pass Through Trust, 4.875%, 7/15/27 235,832 250,458 United Airlines, Inc., 4.625%, 4/15/29(1) 373,000 386,521 1,749,149 Auto Components — 0.7% Goodyear Tire & Rubber Co. -

The Value of Monroe Energy, Llc for Delta Air Lines, Inc. Amid a Bearish

A Work Project presented as part of the requirements for the Award of a Master Degree in Finance from the NOVA – School of Business and Economics. DELTA AIR LINES, INC. FLYING HIGH IN A COMPETITIVE INDUSTRY an Equity Research Report on Delta Air Lines, Inc. (DAL: NYSE) FRANCISCO SEQUEIRA DE PAIVA MARTINS DA SILVA STUDENT NUMBER 33897 PEDRO MANUEL CORREIA PEREIRA STUDENT NUMBER 33968 A Project carried out on the Master’s in Finance Program, under the supervision of: Professor Rosário André January 3rd, 2020 Abstract This equity research report will first be focusing on the North American Arline industry, analyzing its current form, as well as looking at industry’s opportunities and threats ahead. On top of this, an outlook over the airline industry will also be presented in order to give the investors an accurate view of the present and the future. A further analysis will then be conducted with regards do Delta Air Lines Inc. (DAL:NYSE), applying the previous research to provide a fair valuation for the group, resulting in an sustained recommendation of whether an investor should consider invest in DAL, or not. Keywords Delta Air Lines, Inc.; Airline; Equity Research; Valuation This work used infrastructure and resources funded by Fundação para a Ciência e a Tecnologia (UID/ECO/00124/2013, UID/ECO/00124/2019 and Social Sciences DataLab, Project 22209), POR Lisboa (LISBOA-01-0145-FEDER-007722 and Social Sciences DataLab, Project 22209) and POR Norte (Social Sciences DataLab, Project 22209). MASTERS IN FINANCE EQUITY RESEARCH DELTA AIR LINES, INC. COMPANY REPORT AIR TRANSPORTATION - AIRLINES JANUARY 3RD, 2020 STUDENTS: FRANCISO SILVA / PEDRO PEREIRA [email protected] / [email protected] Flying High In A Competitive Industry During the first 9-months of 2019, solid demand for air travel supported a 6.4% Recommendation: STRONG BUY growth of passenger revenue for Delta Air Lines, Inc.