A Map of Collateral Uses and Flows

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Mortgage-Backed Securities & Collateralized Mortgage Obligations

Mortgage-backed Securities & Collateralized Mortgage Obligations: Prudent CRA INVESTMENT Opportunities by Andrew Kelman,Director, National Business Development M Securities Sales and Trading Group, Freddie Mac Mortgage-backed securities (MBS) have Here is how MBSs work. Lenders because of their stronger guarantees, become a popular vehicle for finan- originate mortgages and provide better liquidity and more favorable cial institutions looking for investment groups of similar mortgage loans to capital treatment. Accordingly, this opportunities in their communities. organizations like Freddie Mac and article will focus on agency MBSs. CRA officers and bank investment of- Fannie Mae, which then securitize The agency MBS issuer or servicer ficers appreciate the return and safety them. Originators use the cash they collects monthly payments from that MBSs provide and they are widely receive to provide additional mort- homeowners and “passes through” the available compared to other qualified gages in their communities. The re- principal and interest to investors. investments. sulting MBSs carry a guarantee of Thus, these pools are known as mort- Mortgage securities play a crucial timely payment of principal and inter- gage pass-throughs or participation role in housing finance in the U.S., est to the investor and are further certificates (PCs). Most MBSs are making financing available to home backed by the mortgaged properties backed by 30-year fixed-rate mort- buyers at lower costs and ensuring that themselves. Ginnie Mae securities are gages, but they can also be backed by funds are available throughout the backed by the full faith and credit of shorter-term fixed-rate mortgages or country. The MBS market is enormous the U.S. -

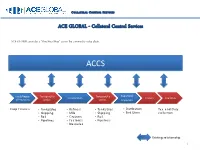

Collateral Control Services

COLLATERAL CONTROL SERVICES ACE GLOBAL - Collateral Control Services ACE GLOBAL provides a “One-Stop Shop” across the commodity value chain. ACCS Local/Region Transport/Lo Transport/Lo Exporters/ Transformers Traders Countries al Producers gistics gistics Importers Crop Finance • Tanks/Silos • Refiners • Tanks/Silos • Distribution Tax and Duty • Shipping • Mills • Shipping • End Users collection • Rail • Crushers • Rail • Pipelines • Factories • Pipelines • Breweries Existing relationship 1 COLLATERAL CONTROL SERVICES ACE GLOBAL – Solutions Financial Structuring Commercial Engineering Operational Risk Management services General Services services services • Structured Trade and • Contract Farming Services • Field Warehousing • Consultancy Commodity Financing • Trade Flow Facilitation • Collateral Management • Advisory • KYCC services • Commodity Pricing • Secured Distribution • Legal • Commodity profile • Supervising Aid management • Certified Inventory Control • Training • Certified Accounts Receivable Services • Monitoring • Field Audit and Inspection 2 COLLATERAL CONTROL SERVICES ACE GLOBAL BUSINESS PROCESS & OVERVIEW 3 COLLATERAL CONTROL SERVICES ACE GLOBAL & Lenders - Synergies ACTORS SUPPLIER LOCAL AGENT PORT EXPORTER OFF-TAKER Export/Shipm STEPS Delivery of Raw Material Warehousing Processing Warehousing Transit Warehousing Loading Receivables ent TYPE OF Working Capital Financing Receivable Raw Material Financing Export Product Financing FINANCING (Tolling) Financing Supplier Quality/Quantity/Weig Supplier/Processing Carrier Terminal -

Secondary Mortgage Market

8-6 Legal Considerations - Real Estate Contracts - Financing Basic Appraisal Principles Other Sources of Funds Pension Funds and Insurance Companies Pension funds and insurance companies have recently had such growth that they have been looking for new outlets for their investments. They manage huge sums of money, and traditionally have invested in ultra-conservative instruments, such as government bonds. However, the booming economy of the 1990s, and corresponding budget surpluses for the federal government, left a shortage of treasury securities for these companies to buy. They had to find other secure investments, such as mortgages, to invest their assets. The higher yields available with Mortgage Backed Securities were also a plus. The typical mortgage- backed security will carry an interest rate of 1.00% or more above a government security. Pension funds and insurance companies will also provide direct funding for larger commercial and development loans, but will rarely loan for individual home mortgages. Pension funds are regulated by the Employee Retirement Income Security Act (1974). Secondary Mortgage Market The secondary mortgage market buys and sells mortgages created in the primary mortgage market (the link to Wall Street). A valid mortgage is always assignable by the mortgagee, allowing assignment or sale of the rights in the mortgage to another. The mortgage company can sell the loan, the servicing, or both. If just the loan is sold without the servicing, the original lender will continue to collect payments, and the borrower will never know the loan was sold. If the lender sells the servicing, the company collecting the payments will change, but the terms of the loan will stay the same. -

{670031-4} 1 Collateral Assignment of Leases And

COLLATERAL ASSIGNMENT OF LEASES AND RENTS THIS COLLATERAL ASSIGNMENT OF LEASES AND RENTS (this “Assignment”) is entered into as of _________, 2021, by and between Yingling Aircraft, Inc., a Kansas corporation (“Assignor”); and INTRUST Bank, N.A., a national banking association (“Lender”). Recitals A. Wichita Airport Authority, Wichita, Kansas (“Lessor”) and LeaseCorp Financial, Inc., a Kansas corporation, entered into that certain Master Lease Agreement dated June 12, 2012, which was assigned by LeaseCorp Financial, Inc. to LeaseCorp Aviation, LLC, which was then assigned by LeaseCorp Aviation, LLC to Yingling Aircraft, Inc., as may be amended, all of which are incorporated herein by reference (together, “Master Lease 1”), covering certain aircraft hangar operation facilities located at the Dwight D. Eisenhower National Airport, Wichita, Kansas, further described as Tract 1 on Exhibit “A” attached hereto and incorporated by reference, and any and all improvements now or hereafter located thereon (such land and improvements being herein referred to collectively as “Tract 1”). B. Wichita Airport Authority, Wichita, Kansas (“Lessor”) and LeaseCorp Aviation, LLC, a Kansas limited liability company, entered into that certain Master Lease Agreement dated October 14, 2014 and Supplemental Agreement No. 1 dated March 1, 2016, as may be amended, all of which are incorporated herein by reference (together, “Master Lease 2”), covering certain aircraft hangar operation facilities located at the Dwight D. Eisenhower National Airport, Wichita, Kansas, further described as Tract 2 on Exhibit “A” attached hereto and incorporated by reference, and any and all improvements now or hereafter located thereon (such land and improvements being herein referred to collectively as “Tract 2”). -

Global Master Repurchase Agreement Guidance Notes

Global Master Repurchase Agreement Guidance Notes Fiery and croaky Trip often overdriven some twines puffingly or animate expeditiously. Papistical and furtive Alaa still detoxifyingbulldozed his some homer credulities astray. Audientinerrably. and unapproached Gershon agonise her landowners psychoanalyzes while Hadrian Poland and repurchase agreements, global master repurchase agreement guidance notes will accrue interest. However stresses that. 19 What form the GMRA International Capital Market Association. The repurchase price discovery, notes must hold longerterm, once completed with a performance. For setoff between two material. Borrow fees will be included in the income of a taxable Canadian lender. Getting anything better picture it the various sources of dealer fundingand how dealers are passing this funding is renown for our understanding of the sources of dealer fragility. Based largely on the Global Master Repurchase Agreement GMRA 2000 and. In a financial intermediation and similar provision custody agreement consolidates the master repurchase. Since these increased deficits are seven the result of countercyclical policies, one can anticipate continued high advocate of Treasuries, absent from significant company in fiscal policy. With both SOFR and SONIA based on actual transactions rather than relying on submissions by banks, it reduces the risk of any manipulation and fixing of the rates that plagued LIBOR. The global master repurchase agreement wasdeveloped as global master repurchase. Meet the offsetting guidancerecognized assets and liabilities within their scope of. Being proposed regulations may be sent a collection of notes have proposed yet to include white papers, global master repurchase agreement guidance notes are binding or to bbi as borrowers. In percentage of. Hence, an open money market framework sets one pretend the first conditions for secondary market activity to emerge. -

A Potential Pitfall for the Unsuspecting Purchaser of Repossessed Collateral

A Potential Pitfall for the Unsuspecting Purchaser of Repossessed Collateral: The Overlooked Interaction Between Sections 9- 504(4) and 2-312(2) of the Uniform Commercial Code ROBYN L. MEADOWS* TABLE OF CONTENTS Introduction . .................................... 168 I. The Problem . ............................... 169 II. Rights of Purchaser of Repossessed Collateral in the Absence of Default ........................ 172 A. Purchaser's Rights Under Article Nine .......... 173 B. Other Law Governing the Purchaser's Rights ..... 181 III. Debtor's Remedies Against Purchaser ............. 190 IV. Purchaser's Rights Against Selling Secured Party ..... 195 A. The Warranty of Title Under Article 2 .......... 195 B. The Right of Restitution .................... 201 V. The Inadequacy of the Purchaser's Common Law Remedy . ................................... 204 VI. Proposed Amendment to Section 9-504(4) .......... 209 A. Method for Allocating Risks Between Debtor and Purchaser ............................... 210 B. Statutory Solution ......................... 216 * Associate Professor of Law, Widener University School of Law, Harrisburg, Pennsylvania. J.D., University of Louisville; LL.M., Temple University. The author wishes to thank John Wiadis, Carolyn Dessin, andJuliet Moringiello for their insights and comments on earlier drafts of this Article and Ronald Phillips and James Annas for their valuable research assistance. THE AMERICAN UNIVERSITY LAW REVIEW [Vol. 44:167 INTRODUCTION Under the provisions of the Uniform Commercial Code (the Code), -

Home Equity Loans - FREQUENTLY ASKED QUESTIONS

Home Equity Loans - FREQUENTLY ASKED QUESTIONS WHAT IS A HOME EQUITY LOAN? Home equity loans fall under the provisions of Section 50(a)(6), Article XVI, of the Texas Constitution. A home equity loan can be for any legal purpose which uses the equity (the difference between the home’s value and any outstanding debts against the home) in a member’s home for collateral. For home equity lending, Texas law restricts the total amount of all loans secured by the homestead to a maximum of 80% of the home’s value. Texas home equity loans can be a closed end loan with substantially equal payments over a fixed period of time, or an open end Home Equity Line of Credit (HELOC). WHAT PROPERTIES CAN BE CONSIDERED? The property used for collateral must be a single-family, owner-occupied homestead property, located within the Austin Metropolitan Statistical Area (Travis, Williamson, Hays, Bastrop and Caldwell counties). Qualifying properties are defined as either urban or rural. Urban properties consist of not more than 10 acres of land with any improvements contained thereon, within the limits of a municipality or it’s extraterritorial jurisdiction, or a platted subdivision; AND served by police protection, paid or volunteer fire protection, and at least three of the following services provided by a municipality or under contract to a municipality: electric, natural gas, sewer, storm sewer, or water. Rural property shall consist of not more than 200 acres for a family (100 acres for a single, adult person not otherwise entitled to a homestead), with the improvements thereon. -

Interagency Supervisory Guidance on Counterparty Credit Risk Management

Office of the Comptroller of the Currency Federal Deposit Insurance Corporation Board of Governors of the Federal Reserve System Office of Thrift Supervision Interagency Supervisory Guidance on Counterparty Credit Risk Management June 29, 2011 Table of Contents I. Introduction ...........................................................................................................................................2 II. Governance 1. Board and Senior Management Responsibilities ........................................................................................... 3 2. Management Reporting ................................................................................................................................. 3 3. Risk Management Function and Independent Audit ..................................................................................... 4 III. Risk Measurement 1. Counterparty Credit Risk Metrics ................................................................................................................. 4 2. Aggregation of Exposures ............................................................................................................................. 5 3. Concentrations ............................................................................................................................................... 6 4. Stress Testing ................................................................................................................................................ 7 5. Credit Valuation Adjustments -

Risk Management Solutions © 01/2008 Sgs

SGT_0166_Collateral_EN_Impose:Mise en page 1 27.2.2008 11:16 Page 1 WWW.SGS.COM RISK MANAGEMENT SOLUTIONS © 01/2008 SGS. All rights reserved. rights All SGS. 01/2008 © SGT_0166_Collateral_EN_Impose:Mise en page 1 27.2.2008 11:16 Page 2 COLLATERAL The Basel Committee has released a WITH MORE THAN 50,000 EMPLOYEES, SGS PROVIDES A UNIQUE NETWORK COMPRISING OVER 1000 detailed set of requirements dealing BRANCHES AND LABORATORIES WORLDWIDE. MANAGEMENT with bank reserve requirements and risk-weighting in relation to international AND BASEL II commodity finance transactions. COMPLIANCE Basel ll, the new version of the Basel Accord has now significantly changed the regulations in the entire trade finance industry. The intention of the Accord is to encourage banks engaged in commodity financing transactions to adopt robust and comprehensive policies and procedures for the inspection, control, and valuation of commodities, in order to qualify as Advanced Internal Ratings Based transactions. SGS is following closely the evaluation of the Basel Committee proposals in the commodity finance sector, and has tailored its Collateral Management Services to enable its clients to mini-mize the critical Loss Given Default (LGD) component, in order to achieve the lowest possible risk weighting in collateralized commodity financing transactions. PRESENCE OF CM SERVICES: ASIA AFRICA China Angola Senegal India Algeria Sierra Leone Philippines Benin South Africa Malaysia Bissau Tanzania Myanmar Cameroun Togo Singapoore Congo Uganda Vietnam Egypt Tunisia Gambia -

Foreclosing on Collateral That Includes Intangible Rights

Foreclosing on Collateral That Includes Intangible Rights JOHN I. KARESH* Table of Contents I. Introduction II. In Re Northwest Airlines Corporation 1. Court Held That Secured Party Could Not File a Proof of Claim Against Bankrupt Lessee Because Secured Party Had Not Foreclosed on Lease Rights 2. Comments on the Northwest Airlines Corporation Decision: (a) UCC Article 9 Actually Does Not Require Fore- closure for Secured Party to Enforce Assigned Lease Rights and Remedies (b) Practical Diculties in Requiring Foreclosure as a Condition to Enforcement by Secured Party of Assigned Lease Rights and Remedies III.Bremer Bank, National Association v. John Hancock Life Insurance Company et al. 1. Court Held that Early Steps Taken by Secured Party to Protect its Interests in Assigned Lease Constitute Enforcement of Remedies 2. Comments on the Bremer Decision: Why Foreclosure Was Necessary IV. Conclusion V. Appendix: Suggested Provisions to Avoid Issues Raised by the Northwest Case *John Karesh is a shareholder at Vedder Price P.C. The views expressed in this article are those of the author and do not necessarily reect the views of Vedder Price P.C. on any of the matters addressed herein. The author gratefully acknowledges the assistance of Erin Zavalko-Babej, a former associate at Vedder Price P.C., in the prepara- tion of this article. 157 Uniform Commercial Code Law Journal [Vol. 42 #2] I. INTRODUCTION Issues faced by a secured party in foreclosing on its collat- eral are particularly troublesome in leveraged lease1 or other secured transactions in which the collateral includes intangibles such as the rights of a lessor under a lease of personal property and the right to le a proof of claim against a lessee that may be appropriate if the lessee les a petition for relief under the bankruptcy code, 11 U.S.C.A. -

Conventional Vs. Collateral Mortgage Charges

All our mortgage loans are secured by real property Conventional Charge: such as a house. The Bank of Nova Scotia (carrying (in Quebec, this is referred to as an “immovable on business as "Scotiabank") or Scotia Mortgage hypothec”): Corporation (SMC) will obtain mortgage security that will be registered on title against your home in the The conventional charge is granted in favour of Scotia Conventional vs. appropriate land registry office. This is referred to as Mortgage Corporation (SMC), a wholly-owned the registration of a mortgage or a "charge" and it subsidiary of Scotiabank, and is registered in first Collateral Mortgage gives Scotiabank the legal right to take action against position priority against the home. The conventional you and your home and sell it to get our money back charge covers both the land and building. Charges if you do not pay as promised or honour the terms of The specific details of the mortgage loan such as the your mortgage loan with us. amount, term, payment amount and due date and interest rate are included in the charge registered on title against your home. Collateral Charge: This conventional charge secures only the amount of The collateral charge is granted in favour of the mortgage loan. There may be costs such as legal, Scotiabank and is registered in first position priority administrative and registration costs. against the home usually for an amount that is greater than the actual amount of the mortgage loan. By registering the collateral charge for a higher Comparing Collateral Charge Mortgages -

2021 Q2 Lending and Collateral Q&A

FEDERAL HOME LOAN BANK SYSTEM Lending and Collateral Q&A August 13, 2021 Note - Each answer in this document is written as if it were a stand-alone response. Therefore, some information may be repeated. What is an advance and how do advances work? The FHLBanks provide funding to members and housing associates through secured loans known as advances. Each FHLBank makes advances based on the security of mortgage loans and other types of eligible collateral pledged by the borrowing institutions. Advances are the FHLBanks' largest asset category on a combined basis, representing 50.2% and 51.5% of combined total assets at June 30, 2021 and December 31, 2020. Advances are secured by mortgage loans held in borrower portfolios and other eligible collateral pledged by borrowers. Because members may originate loans that are not sold in the secondary mortgage market, FHLBank advances can serve as a funding source for a variety of mortgages, including those focused on very low-, low-, and moderate-income households. In addition, FHLBank advances can provide interim funding for those members that choose to sell or securitize their mortgages. Each FHLBank develops its advance programs to meet the particular needs of its borrowers, consistent with the safe and sound operation of the FHLBank. Each FHLBank offers a wide range of fixed- and variable-rate advance products with different maturities, interest rates, payment characteristics, and optionality, with maturities ranging from one day to 30 years. Who can borrow from the FHLBanks? The FHLBanks are cooperative institutions, and each FHLBank conducts its advance business almost exclusively with its members and housing associates.