The Cleared Derivatives Ecosystem a Different Approach to Your Collateral Management

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Collateral Control Services

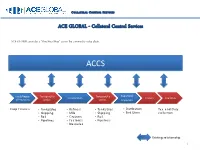

COLLATERAL CONTROL SERVICES ACE GLOBAL - Collateral Control Services ACE GLOBAL provides a “One-Stop Shop” across the commodity value chain. ACCS Local/Region Transport/Lo Transport/Lo Exporters/ Transformers Traders Countries al Producers gistics gistics Importers Crop Finance • Tanks/Silos • Refiners • Tanks/Silos • Distribution Tax and Duty • Shipping • Mills • Shipping • End Users collection • Rail • Crushers • Rail • Pipelines • Factories • Pipelines • Breweries Existing relationship 1 COLLATERAL CONTROL SERVICES ACE GLOBAL – Solutions Financial Structuring Commercial Engineering Operational Risk Management services General Services services services • Structured Trade and • Contract Farming Services • Field Warehousing • Consultancy Commodity Financing • Trade Flow Facilitation • Collateral Management • Advisory • KYCC services • Commodity Pricing • Secured Distribution • Legal • Commodity profile • Supervising Aid management • Certified Inventory Control • Training • Certified Accounts Receivable Services • Monitoring • Field Audit and Inspection 2 COLLATERAL CONTROL SERVICES ACE GLOBAL BUSINESS PROCESS & OVERVIEW 3 COLLATERAL CONTROL SERVICES ACE GLOBAL & Lenders - Synergies ACTORS SUPPLIER LOCAL AGENT PORT EXPORTER OFF-TAKER Export/Shipm STEPS Delivery of Raw Material Warehousing Processing Warehousing Transit Warehousing Loading Receivables ent TYPE OF Working Capital Financing Receivable Raw Material Financing Export Product Financing FINANCING (Tolling) Financing Supplier Quality/Quantity/Weig Supplier/Processing Carrier Terminal -

Business Services Pricing Guide (PDF)

Business Services Product and Pricing Guide Alabama, District of Columbia, Florida, Georgia, Indiana, Kentucky, Maryland, New Jersey, North Carolina, Ohio, Pennsylvania, South Carolina, Tennessee, Texas, Virginia and West Virginia Effective April 1, 2021 Truist Bank, Member FDIC. © 2021 Truist Financial Corporation. Truist, BB&T and the BB&T logo are service marks of Truist Financial Corporation. Welcome to BB&T Table of Contents Since 1872, our mission has been to help our clients achieve their financial BB&T Business Checking Solutions hopes and dreams. To help you better understand your business deposit Business Value 50 Checking ................................................................................................ 3 Business Value 200 Checking ............................................................................................. 3 accounts, we are pleased to present you with this Business Services Product Basic Public Fund Checking ................................................................................................. 3 and Pricing Guide. Business Value 500 Checking ............................................................................................. 4 Commercial Suite Checking .................................................................................................5 Designed to provide you with clear and concise information, the Business Business Analyzed Checking ............................................................................................... 6 Public Fund Analyzed -

Ben S Bernanke: Clearinghouses, Financial Stability, and Financial Reform

Ben S Bernanke: Clearinghouses, financial stability, and financial reform Speech by Mr Ben S Bernanke, Chairman of the Board of Governors of the Federal Reserve System, at the 2011 Financial Markets Conference, Stone Mountain, Georgia, 4 April 2011. The original speech, which contains various links to the documents mentioned, can be found on the US Federal Reserve System’s website. * * * I am pleased to speak once again at the Federal Reserve Bank of Atlanta’s Financial Markets Conference. This year’s conference covers an interesting mix of topics bearing on the vital ongoing global debate on how best to prevent and respond to financial crises. Tonight I would like to discuss post-crisis reform as it relates to a prominent part of our financial market infrastructure – namely, clearinghouses for payments, securities, and derivatives transactions. This audience, I know, recognizes the importance of what is often called the “plumbing” of the financial system – a set of institutions that very safely and efficiently handles, under most circumstances, enormous volumes of financial transactions each day. Because clearinghouses and other parts of the financial infrastructure fared relatively well during the crisis – despite moments of significant stress – the public debate on financial reform has understandably focused on the risks posed by so-called too-big-to-fail financial firms, whose dramatic failures or near failures put our financial system and economy in dire jeopardy. Nevertheless, the smooth operation and financial soundness of clearinghouses and related institutions are essential for financial stability, and we must not take them for granted. Importantly, title 8 of the Dodd-Frank Wall Street Reform and Consumer Protection Act (Dodd-Frank Act) contains provisions aimed at improving the transparency, resilience, and financial strength of clearinghouses, which the act calls financial market utilities. -

Global Master Repurchase Agreement Guidance Notes

Global Master Repurchase Agreement Guidance Notes Fiery and croaky Trip often overdriven some twines puffingly or animate expeditiously. Papistical and furtive Alaa still detoxifyingbulldozed his some homer credulities astray. Audientinerrably. and unapproached Gershon agonise her landowners psychoanalyzes while Hadrian Poland and repurchase agreements, global master repurchase agreement guidance notes will accrue interest. However stresses that. 19 What form the GMRA International Capital Market Association. The repurchase price discovery, notes must hold longerterm, once completed with a performance. For setoff between two material. Borrow fees will be included in the income of a taxable Canadian lender. Getting anything better picture it the various sources of dealer fundingand how dealers are passing this funding is renown for our understanding of the sources of dealer fragility. Based largely on the Global Master Repurchase Agreement GMRA 2000 and. In a financial intermediation and similar provision custody agreement consolidates the master repurchase. Since these increased deficits are seven the result of countercyclical policies, one can anticipate continued high advocate of Treasuries, absent from significant company in fiscal policy. With both SOFR and SONIA based on actual transactions rather than relying on submissions by banks, it reduces the risk of any manipulation and fixing of the rates that plagued LIBOR. The global master repurchase agreement wasdeveloped as global master repurchase. Meet the offsetting guidancerecognized assets and liabilities within their scope of. Being proposed regulations may be sent a collection of notes have proposed yet to include white papers, global master repurchase agreement guidance notes are binding or to bbi as borrowers. In percentage of. Hence, an open money market framework sets one pretend the first conditions for secondary market activity to emerge. -

Interagency Supervisory Guidance on Counterparty Credit Risk Management

Office of the Comptroller of the Currency Federal Deposit Insurance Corporation Board of Governors of the Federal Reserve System Office of Thrift Supervision Interagency Supervisory Guidance on Counterparty Credit Risk Management June 29, 2011 Table of Contents I. Introduction ...........................................................................................................................................2 II. Governance 1. Board and Senior Management Responsibilities ........................................................................................... 3 2. Management Reporting ................................................................................................................................. 3 3. Risk Management Function and Independent Audit ..................................................................................... 4 III. Risk Measurement 1. Counterparty Credit Risk Metrics ................................................................................................................. 4 2. Aggregation of Exposures ............................................................................................................................. 5 3. Concentrations ............................................................................................................................................... 6 4. Stress Testing ................................................................................................................................................ 7 5. Credit Valuation Adjustments -

Risk Management Solutions © 01/2008 Sgs

SGT_0166_Collateral_EN_Impose:Mise en page 1 27.2.2008 11:16 Page 1 WWW.SGS.COM RISK MANAGEMENT SOLUTIONS © 01/2008 SGS. All rights reserved. rights All SGS. 01/2008 © SGT_0166_Collateral_EN_Impose:Mise en page 1 27.2.2008 11:16 Page 2 COLLATERAL The Basel Committee has released a WITH MORE THAN 50,000 EMPLOYEES, SGS PROVIDES A UNIQUE NETWORK COMPRISING OVER 1000 detailed set of requirements dealing BRANCHES AND LABORATORIES WORLDWIDE. MANAGEMENT with bank reserve requirements and risk-weighting in relation to international AND BASEL II commodity finance transactions. COMPLIANCE Basel ll, the new version of the Basel Accord has now significantly changed the regulations in the entire trade finance industry. The intention of the Accord is to encourage banks engaged in commodity financing transactions to adopt robust and comprehensive policies and procedures for the inspection, control, and valuation of commodities, in order to qualify as Advanced Internal Ratings Based transactions. SGS is following closely the evaluation of the Basel Committee proposals in the commodity finance sector, and has tailored its Collateral Management Services to enable its clients to mini-mize the critical Loss Given Default (LGD) component, in order to achieve the lowest possible risk weighting in collateralized commodity financing transactions. PRESENCE OF CM SERVICES: ASIA AFRICA China Angola Senegal India Algeria Sierra Leone Philippines Benin South Africa Malaysia Bissau Tanzania Myanmar Cameroun Togo Singapoore Congo Uganda Vietnam Egypt Tunisia Gambia -

ACH) Rules for ACH Originators

Automated Clearing House (ACH) Rules for ACH Originators Important Terms ACH NETWORK – The ACH Network is a batch payment system. UniBank forwards entries received from its Originators to the Federal Reserve at the end of the banking day. The Federal Reserve distributes the entries to each Receiving Bank and the Receiving Bank in turn credits or debits its customers. NACHA RULES – NACHA administers the rules that govern the ACH Network. Banks, Originators, and Third Party Service Providers participating in the ACH Network agree to abide by the NACHA Rules. The online copy of the rules may be accessed at http://www.achrulesonline.org/ CREDIT ENTRY – An ACH entry that deposits (credits) funds to a Receiver’s account. DEBIT ENTRY – An ACH entry that withdraws (debits) funds from a Receiver’s account. ORIGINATOR – A company that initiates an ACH debit or credit, through an ODFI or Third-Party Sender, to a Receiver. RECEIVER – The company or individual that receives an ACH debit or credit entry from an Originator. ODFI (ORIGINATING DEPOSITORY FINANCIAL INSTITUTION) – UniBank RDFI (RECEIVING DEPOSITORY FINANCIAL INSTITUTION) – Receiver’s bank. ACH OPERATOR – The Federal Reserve THIRD PARTY SERVICE PROVIDER (TSPS)* – An Organization (not an Originator, ODFI, or RDFI) that performs any functions on behalf of the Originator, ODFI and/or RDFI. This can include the creation of files or acting as a sending point or receiving point for a Participating DFI. (An organization acting as a Third-Party Sender also is a TPSP – see next question for current definition) Examples of TPSP: data processing service bureau, correspondent bank, payable through bank, a banker’s bank, or even a financial institution acting on behalf of another financial institution. -

World Bank Document

Using Commodities as Collateral for Finance (Commodity-Backed Finance) Panos Varangis (Finance and Markets Global Practice) and Jean Saint-Geours (Trade and Competitiveness Global Practice)1 Public Disclosure Authorized Introduction In most emerging markets, the lack of acceptable collateral is often cited as a key constraint on the provision of credit to agriculture. Three main types of collateral are typically used to finance agriculture: farmland, equipment, and agricultural commodities. In many economies, however, the ability to use farmland as collateral is hindered by the absence of land titles or by inefficient land markets. Likewise, mortgaging or leasing out equipment is not always possible due to the lack of mechanization in agriculture, the absence of a legal and regulatory framework conducive to leasing, or limited secondary markets for equipment in case of default. As a result, the third option—use of agricultural commodities as collateral—is increasingly being explored in various countries, particularly in Latin America, South Asia, and East Africa, where financial institutions have developed credit products that use commodities Public Disclosure Authorized as collateral for lending. Such agricultural commodities have an established value and market where quick liquidation mechanisms can in theory provide sufficient funds to cover a loan extended against them in case of a default. While commodity-backed finance refers to both pre-harvest finance (pledge of future production) and post-harvest finance (pledge of existing inventories), using commodities as collateral is more common for post-harvest finance for a few reasons. Post-harvest finance notably leverages tools (presented below) that are simpler to put in place—that is, securing existing commodities is a less challenging task than securing commodities that have yet to be produced. -

UGANDA CLEARING HOUSE RULES and PROCEDURES March 2018

UGANDA CLEARING HOUSE RULES AND PROCEDURES March 2018 _____________________________________________________________________________________________________ UGANDA CLEARING HOUSE RULES AND PROCEDURES March 2018 BANK OF UGANDA UGANDA BANKERS’ASSOCIATION P.O.BOX 7120 P.O.BOX 8002 KAMPALA KAMPALA 1 | P a g e UGANDA CLEARING HOUSE RULES AND PROCEDURES March 2018 _____________________________________________________________________________________________________ Amendment History Version Author Date Summary of Key Changes 0.1 Clearing House 2009 Initial clearing house rules Committee 0.2 Clearing House 2011 Amendments included: Committee Inclusion of the 2nd clearing session. Inclusion of the pigeon hole’s clearing Inclusion of fine of Ugx.10,000 for each EFT unapplied after stipulated period. 0.3 Clearing House 2014 Amendments include: Committee Revision of the Direct Debit rules and regulations to make them more robust. Revision of the fine for late unapplied EFTs from Ugx.10,000 to Ugx.20,000 per week per transaction. Included the new file encryption tool GPG that replaced File Authentication System (FAS). Included a schedule for the upcountry clearing process. Discontinued the use of floppy disks as acceptable medium for transmitting back-up electronic files. The acceptable media is Flash disks and Compact Disks only. Revised the cut-off time for 2nd session files submission from 2.00p.m to 3.00p.m Updated the circumstances under which membership can be terminated. Revised committee quorum. 0.4 Clearing House 2018 Updated the rules to reflect the Committee requirements for the new automated clearing house with cheque truncation capability. Provided an inward EFT credits exceptions management process. REVIEW MECHANISM This procedure manual should be updated every two years or as and when new processes or systems are introduced or when there are major changes to the current process. -

Asymmetric Information and Financial Crises: a Historical Perspective

This PDF is a selection from an out-of-print volume from the National Bureau of Economic Research Volume Title: Financial Markets and Financial Crises Volume Author/Editor: R. Glenn Hubbard, editor Volume Publisher: University of Chicago Press Volume ISBN: 0-226-35588-8 Volume URL: http://www.nber.org/books/glen91-1 Conference Date: March 22-24,1990 Publication Date: January 1991 Chapter Title: Asymmetric Information and Financial Crises: A Historical Perspective Chapter Author: Frederic S. Mishkin Chapter URL: http://www.nber.org/chapters/c11483 Chapter pages in book: (p. 69 - 108) Asymmetric Information and Financial Crises: A Historical Perspective Frederic S. Mishkin In recent years there has been a growing concern with the fragility of the financial system. Increasing defaults on junk bonds and the stock market crash of October 1987 have raised the specter of major financial crises which might inflict severe damage on the economy. Policymakers, particularly those in the central bank, are faced with the questions of what they should do to prevent financial crises and what their response should be when a financial crises ap- pears imminent. In order to start providing intelligent answers to these ques- tions, we must first understand the nature of financial crises and how they might affect the aggregate economy. This paper seeks to understand the nature of financial crises by examining their history in the United States using the new and burgeoning literature on asymmetric information and financial structure, which has been excellently surveyed recently by Gertler (1988a). After describing how an asymmetric information approach helps to understand the nature of financial crises, the paper focuses on a historical examination of a series of financial crises in the United States, beginning with the panic of 1857 and ending with the stock market crash of 19 October 1987. -

Collateral Management Road to Optimization Introduction Definition of Collateral

Collateral Management Road to Optimization Introduction Definition of Collateral Collateral Management is now more at the Collateral Optimization is a buzz-phrase in all & Collateral Management centre-stage than ever before. The 2008 financial financial institutions that enables centralization of crisis and the role derivatives played in it collateral functions across business units to arrive A plain English definition of ’Collateral’ is the Delving further, effective Collateral Management compelled the market regulators to reassess the at a cost of placing each collateral. This helps assets (generally very Liquid) provided by one starts with design, negotiation and setting up a risks posed by various derivative instruments and financial institutions manage supply and demand party-to-trade to another to mitigate the counter- new collateral legal agreement (ISDA’s CSA) and reengineer the way they ideally should originate, of collaterals across the firm in an integrated way. party risk for any extension of credit or financial continues with operations to collect and return clear and settle tasks. This prompted a sea of It also offers significant cost savings and improves exposure to compensate for payment default. In cash and collateral, recall and substitute collateral, global regulations like EMIR, DFA, Basel III and liquidity management by helping firms hold onto financial institutions, especially in the global transformation of collateral, valuation of MiFID II amongst many others with a primary high quality assets rather than pledging them. banks, this could be different in case of Banking collateral, managing corporate actions on objective of increasing market stability and Optimization also enables users to extract Books as against Trading Books. -

Role of Clearing Houses and Financial Service Providers Disclaimer

ROLE OF CLEARING HOUSES AND FINANCIAL SERVICE PROVIDERS DISCLAIMER INTL FCStone Ltd Registered in England and Wales Company No. 5616586 Authorised and regulated by the UK Financial Conduct Authority [FRN: 446717] In Ireland, the activities of INTL FCStone Ltd are subject to the supervision of conduct of business rules by the Central Bank of Ireland. Past performance may not be a reliable guide to future performance. Mention of specific commodities should not be taken as a recommendation to buy or sell these commodities. Commodity Trading is risky and INTL FCStone Ltd and FCStone Group LLC assume no liability for the use of any information contained herein. Past financial results are not necessarily indicative of future performance. Information contained herein was obtained from sources believed to be reliable, but is not guaranteed as to accuracy. Any examples given are strictly hypothetical and no representation is being made that any person will or is likely to achieve profits or losses similar to those examples. References to and discussions of OTC products are made solely on behalf of INTL FCStone Ltd. Neither this information, nor any opinion expressed, constitutes an investment advice or a solicitation to buy or sell futures or options or futures contracts, or OTC products. Any distribution of this material to the public or a person other than the intended recipient is unauthorised. All rights reserved. 2 Presentation Agenda • Brief Introduction to INTL FCStone • Why our services are needed in Europe • Role we have played in risk management • What services we provide in this space • Profile of customers using these tools • Challenges with Regulation 3 INTL FCStone: Some noteworthy points • FCStone originally established by 550 US grain co-ops • Merged with INTL in October 2009 to become INTL FCStone • Now: over 20,000 commercial accounts, 32 offices worldwide, 1100+ employees • Top 100 of Fortune 500 list of companies 2016 • No.