Decarbonisation Options for the Dutch Ceramic Industry

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Compuclub Verenigingsprogramma

Afstandenkaart voor Morlincourt/Noyon Lat: +493339,0 Long: +030234,0 Lidnummer Naam Plaats Afstand 0404.0000 De Snelvliegers Genemuiden Ongeldige Latitude liefhebber 0404.0055 G. Timmerman Genemuiden Ongeldige Latitude liefhebber 0404.0063 H. van Dalfzen Genemuiden 399,966342 0404.0080 D. Altena Genemuiden 400,100386 0404.0110 Cor Heutink Genemuiden 400,347056 0404.0128 Klaas de Lange Genemuiden 400,102582 0404.0152 K. de Lange Hjzn Genemuiden Ongeldige Latitude liefhebber 0404.0195 H. Bos Genemuiden 395,351660 0404.0217 G. Visscher Genemuiden Ongeldige Latitude liefhebber 0404.0233 H. Bruintjes Genemuiden 399,685384 0404.0241 G. Heutink Genemuiden Ongeldige Latitude liefhebber 0404.0306 P. Bastiaan Genemuiden 400,165508 0404.0373 H. van der Sluis Genemuiden Ongeldige Latitude liefhebber 0404.0381 R. van der Sluis Genemuiden Ongeldige Latitude liefhebber 0404.0403 H. Bergman Genemuiden 400,349026 0404.0417 JoA«l Kuijper Genemuiden 400,110185 0404.0437 Michel Eenkhoorn Genemuiden Ongeldige Latitude liefhebber 0404.0489 Ricardo de Groot Genemuiden Ongeldige Latitude liefhebber 0404.0551 Henri Bakker Genemuiden Ongeldige Latitude liefhebber 0404.0578 A. van Riesen Genemuiden 400,032914 0404.0608 T. Bruintjes Genemuiden 400,270948 0404.0624 J.C. Heutink Genemuiden Ongeldige Latitude liefhebber 0404.0667 Arjan Beens Genemuiden 400,222457 0404.0675 G.J. Beens Genemuiden 399,982252 0404.0691 Reind Breman Genemuiden 399,955916 0404.0721 P. Breman Genemuiden 400,203567 0404.0772 J. ten Hoeve Genemuiden 399,698030 0404.0829 E. Eenkhoorn Genemuiden Ongeldige Latitude liefhebber 0404.0837 J. van Dijk Genemuiden 400,156946 0404.0853 A. van der Haar Genemuiden 400,186533 0404.0861 H. van der Haar Genemuiden 399,676148 0404.0870 J. -

Waterschap Rijn En Ijssel GGOR Rijnstrangen Eindrapport

Waterschap Rijn en IJssel GGOR Rijnstrangen Eindrapport Witteveen+Bos van Twickelostraat 2 postbus 233 7400 AE Deventer telefoon 0570 69 79 11 telefax 0570 69 73 44 INHOUDSOPGAVE blz. 1. INLEIDING 1 1.1. Aanleiding 1 1.2. GGOR-methodiek 1 1.3. Leeswijzer 2 2. KADERS EN UITGANGSPUNTEN 3 2.1. Beleidsmatige kaders 3 2.2. Natura 2000 / Vogel- en Habitatrichtlijn 3 2.3. Waterhuishoudingsplan provincie Gelderland 3 2.4. Waterbeheerplan waterschap Rijn en IJssel 4 2.5. Afbakening 4 3. BESCHRIJVING WATERSYSTEEM RIJNSTRANGEN 6 3.1. Algemeen 6 3.2. Topografische beschrijving 6 3.3. Landgebruik 7 3.4. Bodemkundige situatie 7 3.5. Geohydrologische situatie 7 3.6. Watersysteemanalyse projectgebied 10 3.6.1. Oppervlaktewatersysteem 10 3.6.2. Grondwatersysteem en kwel en infiltratie 11 3.6.3. Waterkwaliteit 13 3.6.4. Ecologie 14 3.6.5. SED-functie Oude Rijn 15 3.6.6. Ontwikkelingen Netterdensch Kanal 16 4. ACTUEEL GROND- EN OPPERVLAKTEWATER REGIME (AGOR) 17 4.1. Algemeen 17 4.2. Actueel oppervlaktewaterregime 17 4.3. Actueel grondwaterregime: GHG, GLG en GVG 17 5. SCENARIOBEREKENINGEN 18 5.1. Algemeen 18 5.2. Toetsingscriteria 18 5.2.1. Beschouwde grondgebruiksfuncties 18 5.2.2. OGOR en toetsingscriteria landbouw 19 5.2.3. OGOR en toetsingscriteria natuur 20 5.2.4. Toetsingscriterium bebouwing 21 5.2.5. Kosten 21 5.2.6. Samenvatting toetsingscriteria 22 5.3. Beschrijving scenario’s 22 5.3.1. Algemeen 22 5.3.2. Hoofdknop peilbeheer 23 5.3.3. AGOR 23 5.3.4. Landbouw 24 5.3.5. Rietmoeras 24 5.3.6. -

[email protected] W

Wilhelminastraat 2 6687BA Angeren 026-3252725 E: [email protected] W: www.marang.nl Basisschool Marang MARANGFLITS 12 27 februari 2019 Redactie: Sylvia Stevens: [email protected] Marjonel de Wit: [email protected] Kalender 1 maart Carnavalsviering 4 t/m 10 maart Carnavalsvakantie Even bijpraten Carnaval! Hoedjes, gezelligheid en stralende ogen! Gisteren was het gekke hoedjesdag op ons IKC. Wat hebben we een mooie creaties gezien. Iedere klas heeft de mooiste hoed beloond met een oorkonde. Vrijdag vieren we dan ‘echt’ carnaval op school. Ik wens iedereen veel plezier. U komt toch ook naar de optocht kijken?! Lentekriebels. We mogen deze week al genieten van prachtig lenteweer. Bij de eerste zonnestralen gaan we graag naar buiten. Via Lingewaard doet hebben we al een mooi bedrag binnen voor het groene en uitdagende schoolplein. Rob Roelofs heeft hier een mooi initiatief bij georganiseerd. Tijdens de Lentekriebels gaat de opbrengst vanuit het eten en drinken naar onze speelplaats. Een super initiatief! Voor meer informatie kunt u kijken op de facebookpagina van Werkkans! Hartelijke groet, Marjonel de Wit Nieuws uit de groepen Peutergroep en kinderopvang Pinkeltje Wilhelminastraat 2 6687 BA Angeren Telefoon: 06-8186001 Stichting Kinderopvang De Linge Polseweg 13 Postbus 42 6852 AA HUISSEN Tel. 026-3179933 ma t/m vr 8.30-12.30 uur [email protected] Nieuwsbrief februari 2019 Openingstijden peutergroep Van 8.30 uur tot 11.30 uur. Vanaf 15 minuten voor aanvang kunt met uw peuter naar binnen in het peuterlokaal! Ziekmelding Ziekmelding peuters vanaf een kwartier voor aanvang! Telefoonnummer: 06-81860001 Telefoonnummer servicebureau Het servicebureau van Kinderopvang De Linge is telefonisch rechtstreeks bereikbaar op telefoonnummer 026-3179933. -

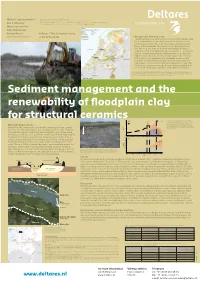

Embanked Floodplains Along the Rivers Rhine and Meuse, Areas That Are Flooded During High-Discharge Conditions (Fig

Michiel J. van der Meulen1,2* 1 Deltares, PO box 85467, 3508 AL Utrecht, Netherlands 2 TNO – Geological Survey of the Netherlands, PO box 80015, NL-3508 TA Utrecht, Netherlands Ane P. Wiersma1,2 3 Utrecht University, Faculty of Geosciences, Department of Physical Geography, PO box 80115, NL-3508 TC Utrecht, Netherlands 4 Alterra, Wageningen University and Research Centre, PO box 47, NL-6700 AA Wageningen, Netherlands Marcel van der Perk3 Hans Middelkoop3 Noortje Hobo3,4 Deltares / TNO Geological Survey *[email protected] of the Netherlands Background, Aim and scope The Netherlands has vast resources of clay that are exploited for the fabrication of structural-ceramic products such as bricks and roof tiles (Fig. 1, 2). Most clay is extracted from the so-called embanked floodplains along the rivers Rhine and Meuse, areas that are flooded during high-discharge conditions (Fig. 3, 4). Riverside clay extraction is – at least in theory – compensated by deposition. Based on a sediment balance (deposition vs. extraction), we explore the extent to which clay can be regarded as a renewable resource, with potential for sustainable use. Beyond that, we discuss the implications for river and sediment management, especially for the large engineering works that are to be undertaken to increase the discharge capacities of the Rhine and Meuse. Fig. 1: Occurrences of clay in the Netherlands that are extractable, i.e., having (1) a thickness ≥ 1 m without intercalations, and (2) < 25% chance of encountering particulate organic material or shells. For details of the underlying resource assessment see Van der Meulen et al. (2005, 2007). -

Report No. 173

REPORT NO. 173 HISTORICAL OFFICER CANADIAN MILITARY HEADQUARTERS 25 Mar 47 THE WATCH ON THE MAAS 9 NOV 44 - 8 FEB 45 CONTENTS PAGE ALLIED AND ENEMY DISPOSITIONS ....................... 1 FIRST CDN ARMY AREA ........................... 4 REGROUPING AND FUTURE PLANS ........................ 8 1 BRIT CORPS FRONT ............................15 CHANGES IN ENEMY DISPOSITIONS, 9-30 NOV 44 ................18 "OFFENSIVE DEFENCE" ............................25 FOUNDATIONS FOR OPERATION "VERITABLE" ..................29 THE ENEMY HITS BACK ...........................46 THE FIRST CDN ARMY FRONT, 1-7 JAN 45 ...................46 THE LEFT FLANK: 2 CDN CORPS, 8-14 JAN ..................52 THE RIGHT FLANK: 2 CDN CORPS, 8-14 JAN .................54 THE LARGER PICTURE ............................56 INTENSIVE PATROLLING AND SMALL-SCALE ACTION, 15-21 JAN ..........59 APPRECIATION AND PLANS ..........................62 THE ATTACK ON KAPELSCHEVEER .......................67 1 Report No. 173 ACTIVITIES OF 2 CDN CORPS, 22 JAN - 4 FEB ................71 "VERITABLE" ON THE WAY ..........................72 APPENDICES "A" 2 CDN CORPS OPERATION ORDER, 22 NOV 44 "B" MAP - ALLIED AND ENEMY DISPOSITIONS (NORTHERN SECTOR) 0600 HRS 9 NOV 44 "C" MAP - DISPOSITIONS OF FIRST CDN ARMY, 0600 HRS 1 JAN 45 "D" MAP - THE BATTLE FOR KAPELSCHEVEER, 26-31 JAN 45 "E" MAP - DISPOSITIONS OF FIRST CDN ARMY, 1200 HRS 1 FEB 45 2 Report No. 173 REPORT NO. 173 HISTORICAL OFFICER CANADIAN MILITARY HEADQUARTERS 25 Mar 47 THE WATCH ON THE MAAS 9 NOV 44 - 8 FEB 45 1. The present report is a detailed account of the operations of Canadian Forces in North-West Europe from 9 Nov 44 to 8 Feb 45. During this period First Cdn Army, deployed on the left flank of 21 Army Group, was charged with the responsibility for the security of two vitally important sectors of the Allied Front: the NIJMEGEN bridgehead and the long line of the River Maas from Middelaar to the sea. -

Betuwe 2 November 2020 RWS INFORMATIE - | Vragen En Antwoorden Online Informatiebijeenkomst Betuwe D.D

RWS INFORMATIE - Vragen en antwoorden online informatiebijeenkomst ViA15 – Betuwe 2 november 2020 RWS INFORMATIE - | Vragen en Antwoorden online informatiebijeenkomst Betuwe d.d. 2 november 2020 Inhoud Inleiding 7 1 Vraag & antwoord: Raad van State 8 1. Wat zijn de specifieke maatregelen waarom dit project wel door kan gaan? 8 2. Zijn wijzigingen aangebracht na bezwaren en wat waren enkele van deze dergelijke bezwaren die van invloed waren op het ontwerp 8 3. Waar gaat de uitspraak van de raad van state precies over? Wat kan daardoor worden beïnvloed? 8 4. Is het niet vreemd dat al begonnen is met uitvoerende werkzaamheden, terwijl Raad van State nog een uitspraak moet doen? 8 2 Vraag & antwoord: Planning 9 1. Wanneer gaat de daadwerkelijke bouw beginnen? 9 2. Wat zijn de tijdspaden ongeveer? Wanneer gaat bijvoorbeeld met de fietstunnel begonnen worden? 9 3. Wanneer is de opening gepland? 9 4. Wat is de totale doorlooptijd van het project na toestemming door de Raad van State? 9 5. Als de RvS goedkeuring verleent, wanneer gaat men dan starten? 9 6. Wordt aan beide zijden, dus oost en west, tegelijk begonnen? 9 7. Met welke planning houden jullie rekening? En wat is de geschatte doorlooptijd van de verschillende trajecten? 9 8. Hoelang duurt de gehele bouwperiode? 9 9. Is het mogelijk om een schatting te geven van de tijdsspanne tussen begin project en einde project? 9 10. Tijdtraject voor de realisatie; tijdlijn voor de verschillende deel projecten. 9 11. Wanneer is het totale project gerealiseerd? 10 3 Vraag & antwoord: Verbreden A15 11 1. Kunnen de populieren langs de A15 tussen Knooppunt Ressen en de Karstraat/Van Elkweg in Bemmel blijven staan? 11 2. -

4516192 Kallirroi Tarouda ... Ort P5.Pdf

DYNAMIC RIVERSCAPES A vision for inhabitable, sustainable floodplains. The case of Huissensche Waard. Kallirroi Taroudaki MSc graduation thesis DYNAMIC RIVERSCAPES A vision for inhabitable, sustainable floodplains. The case of Huissensche Waard. Kallirroi Taroudaki MSc graduation thesis 4 TU Delft Faculty of Architecture Department of Urbanism - Chair of Landscape Architecture MSc Graduation Thesis Graduation Studio Flowscapes Author Kallirroi Taroudaki First mentor ir. Frits van Loon Second mentor ir. Teake Bouma Delegate board of examiners ir. Filip Geerts June 2017 5 Acknowledgements I would like to sincerely thank all the people that contributed to the com- pletion of this fruitful academic and personal journey. First of all, my mentors Frits and Teake for their guidance, advice and support through all the stages of the project. They provided me with knowledge but most importantly with motivation to dive more into the uncertainty and move forward. My parents and sisters for their unlimited love and encouragement, not only through this year but through my whole life, helping me to achieve my goals and follow my dreams. My patient supporter Giorgos, for following this journey next to me, de- spite the distance. Last but not least, I would like to thank the amazing landscape family and all my greek and international friends for making these two years in Delft an incredible experience and a huge life lesson. 6 Floodplains, Westervoort (Source: Author) 7 Being a Greek student of landscape architecture in the Netherlands I was from the beginning fasci- nated by the Dutch landscape and the differences that it presented, compared to the type of land- scapes I was used to. -

Gemeente Lingewaard.Indd

Municipality Designs New Storage Strategy and Eliminates Tape, Chooses ExaGrid for Its Integration with Veeam CUSTOMER SUCCESS STORY Customer Overview Gemeente Lingewaard is a municipality in the eastern Netherlands made up of eight villages, including Angeren, Bemmel, Doornenburg, Gendt, Haalderen, Huissen, Loo, and Ressen. Lingewaard lies within the Gelderse Poort National Landscape, a popular area for hiking and cycling known for its beautiful river scenery, and is well known for its greenhouse horticulture district. “My assigned customer support engineer has a high level of Lengthy Wait Time with Tape knowledge about my system and Marc de Ruiter, the system engineer at environment, so when I speak Gemeente Lingewaard, had been backing to him, he doesn’t act as if I am up user data (which has longer retention speaking in riddles, which I have requirements) to tape disk-to-disk-to-tape experienced with other vendors.” (D2D2T) strategy using NetApp NDMP. He was frustrated with the overall maintenance Marc de Ruiter involved with tape, as well as the amount of System Engineer time the tape library was in use for backup. Sometimes, it took more than three days to comply with a restore request. “I had to Key Benefi ts: wait until the backup to tape had run. Then, fi nally, I could make the restore to satisfy the Disk-based storage eliminates customer,” remarked de Ruiter. storage strategy to put the various devices the manual maintenance of tape and software to use. ExaGrid’s customer ExaGrid customer support helps In Search of the Right Solution support staff reviewed the strategy and optimize backup process Switching from NetApp to Atlantis USX as a recommended a change that seemed Integration of ExaGrid with storage solution proved cost eff ective. -

Blois/Orleans

NOORDELIJKE UNIE ZONE 1 Blois MET 13898 DUIVEN OP 26/06/11 OM 07.17 UUR NP-E25-BLAD 1 APL ZPL NAAM WOONPLAATS LIDNUMMER AFSTAND AD GT JR-RINGNR ZUIV.TYD MET/MIN POELE PUNTEN BEDRAG 3 1 1 Comb R.A.Bakker & Zn Veenendaal 1057.9141 578.968 37 04 0.1461551 15.09.55 1224.250 ......1000.0 6 2 1 D. Hendriksen Amersfoort 1102.0604 586.511 15 02 0.1379978 15.17.11 1221.430 ...... 999.7 8 3 1 C.J. Steinmann Utrecht 1043.0271 568.482 36 06 8.1291279 15.02.32 1221.139 ...... 999.4 11 4 1 P.J. v.d. Berg & Zn. Benschop 1020.9125 557.743 20 06 9.2007754 14.54.22 1219.466 ...... 999.1 15 5 1 Comb A & J Broekhuiz Lopik 1020.9187 554.377 25 09 9.2006001 14.53.04 1215.563 ...... 998.8 16 6 1 Henri Diks 't-Goy 1750.0849 565.272 30 07 8.1301906 15.02.05 1215.422 ...... 998.6 18 7 1 D. van Oort Zaltbommel 2164.0215 547.684 54 38 0.1882202 14.48.01 1214.323 ...... 998.3 19 8 1 J. & B. Geerenstein Scherpenzeel 1057.9168 582.815 14 14 0.1462901 15.16.58 1214.242 ...... 998.0 22 9 1 D. van Oort Zaltbommel 2164.0215 02 54 02 0.1882377 14.48.24 1213.292 ...... 997.7 25 10 1 Mario Bambacht Hellouw 1018.0143 547.140 08 01 9.2005220 14.48.47 1211.069 ...... 997.4 26 11 1 Comb G. -

Eindstand Vitesse Kring 2 Regio 4 Eindstand Vitesse

EINDSTAND VITESSE KRING 2 REGIO 4 KAMPIOENSCHAP ONAANGEWEZEN KAMPIOENSCHAP AANGEWEZEN PC Lidnummer Naam Woonplaats Totpnt PC Lidnummer Naam Woonplaats Totpnt 1 0844.0651 K. Derksen Emmerich-El 5725.7 1 0815.9128 W. Geurtz en Zn. Haalderen 5445.4 2 0837.0181 Bart Jansen Westervoort 5672.9 2 0815.0072 C.H.R. Graven Bemmel 4741.5 3 0837.9016 Klomp&Bouwman Westervoort 5586.2 3 0844.0651 K. Derksen Emmerich-El 4600.2 4 0837.0389 M Brundel Duiven 5472.8 4 0814.9078 Nissen & Vermaas Doornenburg 4384.3 5 0837.0238 N.J. Koenders Westervoort 5439.3 5 0876.9112 J.W.Jansen en Zn Zevenaar 4330.7 6 0837.0327 P.J.H Pennekamp Westervoort 5429.0 6 0837.0238 N.J. Koenders Westervoort 4328.9 7 0844.9102 Comb. Loef Herwen 5345.9 7 0844.9137 Comb. Roos-v/d Kamp Elten 4117.1 8 0849.0730 C. Vermeulen Huissen 5310.1 8 0876.0431 Coen Polman Zevenaar 4102.1 9 0837.0131 E. Erdhuisen Westervoort 5184.5 9 0837.0131 E. Erdhuisen Westervoort 4006.5 10 0815.9128 W. Geurtz en Zn. Haalderen 5175.3 10 0837.0389 M Brundel Duiven 3863.1 11 0844.0766 H. Kroes Elten 4999.6 11 0844.0766 H. Kroes Elten 3844.1 12 0844.9137 Comb. Roos-v/d Kamp Elten 4959.4 12 0837.9016 Klomp&Bouwman Westervoort 3693.1 13 0814.9078 Nissen & Vermaas Doornenburg 4950.1 13 0837.0181 Bart Jansen Westervoort 3679.1 14 0814.0796 H. Gertsen Angeren 4937.8 14 0837.0327 P.J.H Pennekamp Westervoort 3667.1 15 0875.0691 J. -

CONCEPT VERSION First Version, June 12, 2009 the Research in Concept

Traditional Values in a Contemporary World CONCEPT VERSION First version, June 12, 2009 The research in concept Maarten den Teuling student number: 1368095 Technische Univiersiteit Delft (TU-Delft) Faculty of Architecture, Explorelab 8 With help from Andrea Peresthu For more info please contact: Maarten den Teuling www.mrtn.nu [email protected] 2 REBIRTH OF THE MALACCA SHOPHOUSE, A TYPOLOGICAL RESEARCH SHOPHOUSES Maarten den Teuling 03 Rebirth of the Malacca shophouse A typological research. Traditional Values in a Contemporary World 06 Introduction 08 Explorelab 10 Thesis 11 The issue 16 The goal modern needs generic and specific 21 Malaysia and Malacca 22 Facts and data Malaysia and Malacca 24 Little history Malaysia and Malacca 28 UNESCO world herritage 30 Typological research 31 Strategy 32 The shophouse 40 Symbols 41 The typologies 42 Dutch style (rowhouse) 44 Southern China Style 48 Early shophouse 50 Early transitional 52 Early straits eclectic 54 Late straits eclectic 58 Neo-classical 60 Art-Deco 62 Early Modern 63 Results 64 Conclusions 66 Genealogy 68 Key elements checked 69 Key elements for design 70 Design 71 Concept 72 In detail 86 Conceptual drawings 90 Last word 92 Bibliography 4 INTRODUCTION The title of this research might lead to some misunderstandings, as we all know, words can be a serious obstacle to process. When starting a research focused on architecture it is always hard to describe it in words. Architects communicate with drawings, or models, and when this is communicated properly words don’t have to be used. The words as ‘rebirth’ ‘shophouse’ ‘small scale’ etc. might refer to other words as ‘heritage’, ‘preservation’, soon the attention of the reader can be distracted, and he or she stops reading. -

De Flora Van De Gelderse Poort Trends Van Indicatieve Soorten Tussen 1970 En 2008 En Actuele Ontwikkelingen Van Beschermde En Bedreigde Soorten (Vanaf 2004)

De Floraa van de Gelderseelderse Poort TrendsTrends van indicatieveindicatieve soorten tussen 1970 en 2008 en actueactuelele ontwiontwikkelingenkkelingen van bbeschermdeeschermde en bedreibedreigdegde soorten (vanaf 2004) FloraFlora &FaunaFauna Werkgroep Gelderse Poort De Flora van de Gelderse Poort Trends van indicatieve soorten tussen 1970 en 2008 en actuele ontwikkelingen van beschermde en bedreigde soorten (vanaf 2004) Iris Niemeijer Bart Beekers Gijs Kurstjens Peter van Beers Pepijn Calle Margriet Louwen Kim Lotterman Marcel Bolten Emiel Brouwer Nico Dam Martien van Bergen Met fi nanciële ondersteuning van Provincie Gelderland, Staatsbosbeheer en ARK Natuurontwikkeling FloraFlora Colofon &FaunaFauna Uitgave van de Stichting Flora- en Faunawerkgroep Gelderse Poort. Met fi nanciële ondersteuning van de Provincie Gelderland, Werkgroep Gelderse Poort Staatsbosbeheer en ARK Natuurontwikkeling De inhoud van dit rapport kwam mede tot stand door gegevens van: FLORON, Provincie Gelderland, Staatsbosbeheer, Waarneming.nl, NABU en Rijkswaterstaat-Waterdienst Bronnen: FLORBASE-2N (1975-2006) en het Meetnet Oevers Zoete Rijkswateren van Rijkswaterstaat Waterdienst, hetgeen onderdeel uitmaakt van het Monitoring-programma Waterstaatkundige toestand van het Land (MWTL). Rijkswaterstaat Waterdienst neemt geen verantwoordelijkheid voor de in deze rapportage vermelde conclusies op basis van het door haar aangeleverde materiaal. Kaartmateriaal: Provincie Gelderland/Kees Nuijten. Auteurs hoofdstuk 1 t/m 3: Iris Niemeijer, Gijs Kurstjens Auteurs hoofdstuk