The World's 200 Richest People

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

The Killing of William Browder

THE KILLING OF WILLIAM BROWDER THE KILLING OF WILLIAM BROWDER Bill Browder, the fa lse crusader for justice and human rights and the self - styled No. 1 enemy of Vladimir Putin has perpetrated a brazen and dangerous deception upon the Weste rn world. This book traces the anatomy of this deception, unmasking the powerful forces that are pushing the West ern world toward yet another great war with Russia. ALEX KRAINER EQUILIBRIUM MONACO First published in Monaco in 20 17 Copyright © 201 7 by Alex Krainer ISBN 978 - 2 - 9556923 - 2 - 5 Material contained in this book may be reproduced with permission from its author and/or publisher, except for attributed brief quotations Cover page design, content editing a nd copy editing by Alex Krainer. Set in Times New Roman, book title in Imprint MT shadow To the people of Russia and the United States wh o together, hold the keys to the future of humanity. Enlighten the people generally, and tyranny and oppressions of body and mind will vanish like the evil spirits at the dawn of day. Thomas Jefferson Table of Contents 1. Bill Browder and I ................................ ................................ ............... 1 Browder’s 2005 presentation in Monaco ................................ .............. 2 Harvard club presentation in 2010 ................................ ........................ 3 Ru ssophobia and Putin - bashing in the West ................................ ......... 4 Red notice ................................ ................................ ............................ 6 Reading -

2006 FIRST Annual Report

annual report For Inspiration & Recognition of Science & Technology 2006 F I R Dean Kamen, FIRST Founder John Abele, FIRST Chairman President, DEKA Research & Founder Chairman, Retired, Development Corporation Boston Scientific Corporation S Recently, we’ve noticed a shift in the national conversation about our People are beginning to take the science problem personally. society’s lack of support for science and technology. Part of the shift is in the amount of discussion — there is certainly an increase in media This shift is a strong signal for renewed commitment to the FIRST T coverage. There has also been a shift in the intensity of the vision. In the 17 years since FIRST was founded, nothing has been more conversation — there is clearly a heightened sense of urgency in the essential to our success than personal connection. The clearest example calls for solutions. Both these are positive developments. More is the personal commitment of you, our teams, mentors, teachers, parents, awareness and urgency around the “science problem” are central to sponsors, and volunteers. For you, this has been personal all along. As the FIRST vision, after all. However, we believe there is another shift more people make a personal connection, we will gain more energy, happening and it has enormous potential for FIRST. create more impact, and deliver more success in changing the way our culture views science and technology. If you listen closely, you can hear a shift in the nature of the conversation. People are not just talking about a science problem and how it affects This year’s Annual Report echoes the idea of personal connections and P02: FIRST Robotics Competition someone else; they are talking about a science problem that affects personal commitment. -

CRMA JUDGE BIOS 2014 Jeanne Abbott, Associate Professor

CRMA JUDGE BIOS 2014 Jeanne Abbott, Associate Professor, University of Missouri, worked for the Anchorage Daily News for nearly 15 years and covered the oil boom, native land claims issues and the exploding growth of a frontier city. After earning a Ph.D. in journalism from Missouri, Abbott also spent time at the Sacramento Bee and Des Moines Register before becoming a full‐‐time faculty member. Julie Vosburgh Agnone is Vice President of Editorial Operations for National Geographic Kids Publishing and Media. During her career at National Geographic, Julie has written, edited, and managed magazines and books for children, educational media for schools, and CD‐ROMs for beginning and ESL readers. She has worked on various special initiatives for National Geographic, including international editions, strategic partnerships, and electronic publishing. Danita Allen Wood is the co‐owner and editor‐in‐chief of Missouri Life magazine, which she and her husband purchased and revived in 1999. Danita learned the magazine business at Meredith Corporation, which publishes Better Homes & Gardens, Midwest Living, Successful Farming, and many other magazines. She returned to her home state of Missouri in 1995 to teach at the Missouri School of Journalism, holding the Meredith Chair until 2005, when she decided to devote her full time to Missouri Life. Dave Anderson is a photographer and filmmaker whose work can be found in the Museum of Fine Arts, Houston, the Ogden Museum of Southern Art, the Cocoran Gallery and in the pages of Esquire, Stern and ESPN the Magazine. In 2011 Anderson won a National Magazine Award for his “SoLost” video series created for the Oxford American. -

Honor Roll 2019

DONATION SPOTLIGHT HONOR ROLL OF DONORS ANONYMOUS CHILDREN’S HOSPITAL $25 MILLION LOS ANGELES DONATION SUPPORTS NEUROLOGICAL INSTITUTE Our history began in 1901, when a small group of caring individuals envisioned the benefits of a hospital for children. No one would have AND INTERVENTIONAL believed that the first children’s hospital in Southern California would RADIOLOGY evolve into one of the world’s leading pediatric health care facilities. More than a century later, the compassion of those founding members continues to thrive in our physicians, nurses, caregivers and researchers. The hospital’s international reputation is a testament to years of dedicated efforts from our team members and volunteers, as well as the philanthropic support from individuals, organizations, corporations and foundations. This generosity plays a pivotal role in our mission to create hope and build healthier futures. As a pediatric academic medical center, Children’s Hospital Los Angeles provides more than just the finest clinical care; we also remain at the forefront of novel research and professional education. Given the fundamental difference in the physiology of kids and adults, the best place In 2019, an anonymous donor made a $25 million to discover and develop the safest, most effective therapies and devices for gift to expand the Neurological Institute and children is at a hospital dedicated exclusively to their care. This work has increase the hospital’s capacity in interventional solidified Children’s L.A. as a global leader in the advancement of pediatric radiology (IR). This transformative gift will help treatment options, extending our commitment to caring—and the impact CHLA meet the rising demand for pediatric of donors’ philanthropic support—far beyond Los Angeles. -

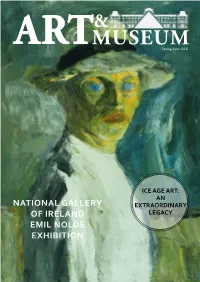

MUSEUM ART Spring Issue 2018

& MUSEUM ART Spring Issue 2018 ICE AGE ART: AN NATIONAL GALLERY EXTRAORDINARY OF IRELAND LEGACY EMIL NOLDE EXHIBITION CONTENTS 12 ANGELA ROSENGART 14 Interview with Madam Rosengarth about the Rosengarth Museum IVOR DAVIES Inner Voice of the Art World 04 18 NATIONAL GALLERY OF IRELAND SCULPTOR DAWN ROWLAND Sean Rainbird CEO & Editor Director National Gallery of Ireland Siruli Studio WELCOME Interviewed by Pandora Mather-Lees Interview with Derek Culley COVER IMAGE Emil Nolde (1867-1956) Self-portrait, 1917 ART & MUSEUM Magazine and will also appear at many of Selbstbild, 1917 Oil on plywood, 83.5 x 65 cm MAGAZINE the largest finance, banking and Family © Nolde Stiftung Seebüll Office Events around the World. Welcome to Art & Museum Magazine. This Media Kit. - www.ourmediakit.co.uk publication is a supplement for Family Office Magazine, the only publication in the world We recently formed several strategic dedicated to the Family Office space. We have partnerships with organisations including a readership of over 46,000 comprising of some The British Art Fair and Russian Art of the wealthiest people in the world and their Week. Prior to this we have attended and advisors. Many have a keen interest in the arts, covered many other international art fairs some are connoisseurs and other are investors. and exhibitions for our other publications. Many people do not understand the role of We are very receptive to new ideas for a Family Office. This is traditionally a private stories and editorials. We understand wealth management office that handles the that one person’s art is another person’s investments, governance and legal regulation poison, and this is one of the many ideas for a wealthy family, typically those with over we will explore in the upcoming issues of £100m + in assets. -

Mumbai Collector's Details of Leased Government Land In

FSI Rent at RR CRRNO L_RNT CSNO DIVISION HOLDER AREA COMM_DT PR_YR Rrrate Value 3 7% page no. 7602 130.90 2903 BHL MANJULABAI PRAGJI MAVJI 54.72 1/10/1964 50 57500 3146400 9439200 660744 62 7603 214.50 2909 BHL KESHAVRAM PITAMBARDAS PANCHAL & 1 ORS 55.18 1/1/1957 50 57500 3172850 9518550 666299 62 7604 65.25 2910-PT BHL THE MUNICIPAL CORPORATION OF THE CITY OF BOMBAY 108.88 1/1/1957 50 57500 6260600 18781800 1314726 62 7605 100.00 2911 BHL AJITKUMAR JAMNADAS & BORS 66.89 1/20/1963 50 57500 3846175 11538525 807697 62 7606 34.00 163 MZN PANDHARINATH MORESHWAR PATHARE 71.07 11/26/1957 50 40100 2849907 8549721 598480 75 7607 96.75 723 MZN SHIRINBAI FAKRUDDIN KARIMBHAI BOOTWALA 649.67 9/5/1914 99 42000 27286140 81858420 5730089 77 7608 379.70 719 + MZN GAJANAN RAMCHANDRA SAKHAL KAR & TWO ORS 4791.84 4/1/1913 99 42000 201257280 603771840 42264029 77 7609 175.74 717 MZN FIROZSHAH SHAVAKSHAH SHROFF 2171.51 4/1/1913 99 42000 91203420 273610260 19152718 77 7609A 164.90 718 MZN SMT.PADAMA ALISS PURNIMA W/F OF PARIMAL S.CHITALIA 2643.83 4/1/1913 99 42000 111040860 333122580 23318581 77 7616 111.00 80 CLB HIRABAI KAIKHORA JAMSHEDJI MODY & 3 ORS 1079.53 12/1/1928 999 7617 28.76 47 CLB RESERVE BANK OF INDIA 1768.40 12/1/1907 99 222800 393999520 1181998560 82739899 49 7618 85.11 46 CLB RUCHI PROPERTIES PVT.LTD. 1647.25 7/7/1914 999 7619 68.30 45 CLB RUCHI PROPERTIES PVT. -

WAL-MART At50

WAL-MART at50 FROM ARKANSAS TO THE WORLD a supplement to . VOL. 29, NO. 27 • JULY 2, 2012 ARKANSASBUSINESS.COM/WALMART50 Fifty years old, and healthy as ever Congratulations, Walmart! And thanks for letting us care for your associates and communities. From one proud Arkansas company to another CONGRATULATIONS TO A GREAT AMERICAN SUCCESS STORY It has been a privilege to travel with Walmart on its remarkable journey, including managing the company’s 1970 initial public offering. From one proud Arkansas company to another, best wishes to all Walmart associates everywhere. INVESTMENT BANKING • WEALTH MANAGEMENT INSURANCE • RESEARCH • SALES & TRADING CAPITAL MANAGEMENT • PUBLIC FINANCE • PRIVATE EQUITY STEPHENS INC. • MEMBER NYSE, SIPC • 1-800-643-9691 STEPHENS.COM WAL-MART at 50 • 3 Wal-Mart: INSIDE: A Homegrown 6 The World of Wal-Mart Mapping the growth of a retail giant Phenomenon 8 Timeline: A not-so-short history of Wal-Mart Stores Inc. Thousands of Arkansans have a Wal-Mart experience to share from the past 50 years that goes far beyond the routine trip to a Supercenter last week. 10 IPO Set the Stage for Global Expansion Wal-Mart is an exciting, homegrown phenomenon engineered by the late Sam Walton, a brilliant businessman who surrounded himself with smart people and proceeded to revolutionize 14 Influx of Workers Transforms retailing, logistics and, indeed, our state and the world. He created a heightened awareness of stock Northwest Arkansas investments as investors from Arkansas to Wall Street watched the meteoric rise in share prices and wondered when the next stock split would occur. -

George Soros

Click here for Full Issue of EIR Volume 23, Number 44, November 1, 1996 �ITffiInvestigation The secret financial network behind \vizard' George Soros by William Engdahl The dossier that follows is based upon a report released on . Following the crisis of the European Exchange Rate Oct. 1 by EIR's bureau 'in Wiesbaden, Germany, titled "A Mechanism of September 1992, when the Bank of England Profile of Mega-Speculator George Soros." Research was was forced to abandon efforts to stabilize the pound sterling, contributed by Mark Burdman, Elisabeth Hellenbroich, a little-known financial figure emerged from the shadows, to Paolo Raimondi, and Scott Thompson. boast that he had personally made over $1 billion in specula tion against the British pound. The speculator was the Hun Time magazine has characterized financier George Soros as garian-born George Soros, who spent the war in Hungary a "modem day Robin Hood," who robs from the rich to give under false papers working for the pro-Nazi government, to the poor countries of easternEurope and Russia. It claimed identifying and expropriating the property of wealthy fellow that Soros makes huge financial gains by speculating against Jews. Soros left Hungary afterthe war, and established Amer western central banks, in order to use his profits to help the ican citizenship after some years in London. Today, Soros is emerging post-communist economies of eastern Europe and based in New York, but that tells little, if anything, of who former Soviet Union, to assist them to create what he calls an and what he is. "Open Society." The Time statement is entirely accurate in Following his impressive claims to possession of a "Mi the first part, and entirely inaccurate in the second. -

Momentum Contents

REPORT OF GENEROSITY & VOLUNTEERISM, 2017– 18 166 Main Street Concord, MA 01742 MOMENTUM Together Together CONTENTS 2 SPIRITING US FORWARD Momentum: A Foreword Letter of Thanks 6 FURTHERING OUR MISSION The Concord Academy Mission Gathering Momentum: A Timeline 10 DELIVERING ON PROMISES The CA Annual Fund Strength in Numbers CA’s Annual Fund at Work 16 FUELING OUR FUTURE The Centennial Campaign for Concord Academy Campaign Milestones CA Houses Financial Aid CA Labs Advancing Faculty Leadership Boundless Campus 30 BUILDING OPPORTUNITY The CA Endowment 36 VOICING OUR GRATITUDE Our Generous Donors and Volunteer Leaders C REPORT OF GENEROSITY & VOLUNTEERISM 1 Momentum It livens your step as you cross the CA campus on a crisp fall afternoon, as students dash to class, or meet on the Moriarty Athletic Campus, or run to an audition at the Performing Arts Center. It’s the feeling that comes from an unexpected discovery in CA Labs, the chorus of friendly faces in the new house common rooms, or instructors from two disciplines working together to develop and teach a new course. It is the spark of encouragement that illuminates a new path, or a lifelong pursuit — a spark that, fanned by tremendous support over these past few years, is growing into a blaze. At Concord Academy we feel that momentum every day, in the power of students, teachers, and graduates to have a positive impact on their peers and to shape their world. It’s an irresistible energy that stems from the values we embrace as an institution, driven forward by the generosity of our benefactors. -

Donors 2015-2016 the Museum of Modern Art Moma PS1

Donors 2015-2016 The Museum of Modern Art MoMA PS1 1 Trustees of The Museum of Modern Art Jerry I. Speyer Glenn Dubin Joan Tisch Chairman John Elkann Edgar Wachenheim III Laurence Fink Leon D. Black Glenn Fuhrman Honorary Trustees Co-Chairman Kathleen Fuld Lin Arison Howard Gardner Mrs. Jan Cowles Marie-Josée Kravis Anne Dias Griffin Lewis B. Cullman President Mimi Haas H.R.H. Duke Franz of Bavaria Alexandra A. Herzan Maurice R. Greenberg Sid R. Bass Marlene Hess Wynton Marsalis Mimi Haas Ronnie Heyman Richard E. Oldenburg* Marlene Hess AC Hudgins Lord Rogers of Riverside Richard E. Salomon Jill Kraus Ted Sann Vice Chairmen Marie-Josée Kravis Gilbert Silverman Ronald S. Lauder Yoshio Taniguchi Glenn D. Lowry Thomas H. Lee Eugene V. Thaw Director Michael Lynne Khalil Gibran Muhammad *Director Emeritus Richard E. Salomon Philip S. Niarchos Treasurer James G. Niven Ex-Officio Peter Norton Glenn D. Lowry James Gara Daniel S. Och Director Assistant Treasurer Maja Oeri Michael S. Ovitz Agnes Gund Patty Lipshutz Ronald O. Perelman Chairman of the Board of MoMA PS1 Secretary David Rockefeller, Jr. Sharon Percy Rockefeller Sharon Percy Rockefeller David Rockefeller Richard E. Salomon President of the International Council Honorary Chairman Marcus Samuelsson Anna Deavere Smith Thomas R. Osborne Ronald S. Lauder Jerry I. Speyer Ann Schaffer Honorary Chairman Ricardo Steinbruch Co-Chairmen of The Contemporary Daniel Sundheim Arts Council Robert B. Menschel Alice M. Tisch Chairman Emeritus Gary Winnick Bill de Blasio Mayor of the City of New York Agnes Gund Life Trustees President Emerita Eli Broad Gabrielle Fialkoff Douglas S. -

Annual Report 2019/20 Contents

ANNUAL REPORT 2019/20 CONTENTS 02 GROUP 20 EXTRACT FROM THE MANAGEMENT REPORT CONSOLIDATED FINANCIAL STATEMENTS 03 Fundamental information about the group 07 Economic report 21 Consolidated income statement 17 Risk and opportunity report 22 Consolidated statement of comprehensive income 19 Forecast 23 Consolidated statement of financial position 25 Consolidated statement of cash flows 27 Consolidated statement of changes in equity Annual Report _ 2019 / 2020 GROUP MANAGEMENT REPORT 2019/20 2 03 FUNDAMENTAL INFORMATION ABOUT THE GROUP 03 PHOENIX 05 Strategy and group management 06 Processes and organisation 07 ECONOMIC REPORT 07 Economic environment 07 Business development at a glance 09 Financial performance 13 Assets and liabilities 14 Financial position 15 Employees 17 RISK AND OPPORTUNITY REPORT 17 Risk management 17 Risks 18 Opportunities 18 Management Board’s overall assessment of the risks and opportunities 19 FORECAST 19 Future economic environment 19 Future development of PHOENIX 19 Management Board’s assessment of the group’s future position PHOENIX Pharmahandel GmbH & Co KG Annual Report _ 2019 / 2020 Group management report Fundamental information about the Group FUNDAMENTAL INFORMATION ABOUT THE GROUP ° Leading market position in European pharmaceutical wholesale ° Corporate strategy builds upon three pillars ° Digitalisation brings direct communication with end customers ° Projects and initiatives aim to achieve process optimisation and cost efficiency PHOENIX NET TURNOVER PER REGION in % Leading European healthcare provider PHOENIX, with its headquarters in Mannheim, Germany, is FY 2018 / 19 a leading European healthcare provider and is one of the largest family businesses in both Germany and Europe. Its core Eastern Europe 16.3 34.5 Germany business is pharmaceutical wholesale and pharmacy retail. -

The 2013 USC Marshall International Case Competition. Each Year We

Welcome to the 2013 USC Marshall International Case Competition. Each year we invite students from schools around the world to participate in this competitive event. Of the thirty teams attending this year, 19 teams represent schools from outside the United States. We embrace all of you and hope you enjoy your brief visit to Los Angeles and the University of Southern California. This year’s case presents issues which are current and very real to this business and their competitors in this and related industries. Thus, do not feel that the only relevant and available information is found within the four corners of this document. While some of the information provided here was only made available on the day we went to press, this industry is changing so quickly that there is no doubt in our minds that additional relevant information will appear in the days running up the time you receive this document. Thus, you should feel free to look for, and use, additional information which you may find online in completing your analysis of this case. References to some additional sources of information may be found in the Appendix. In addition to testing your skills in strategic analysis this year’s case seeks to address a topic which is very relevant to each of you as consumers. Your own experience with this industry and with the companies covered in the case will no doubt influence your perspective. Give voice to your own insights. We are certain that the panel of judges and company representatives are willing and eager to listen to your recommendations for today and the future.