City of Chino Hills, California

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

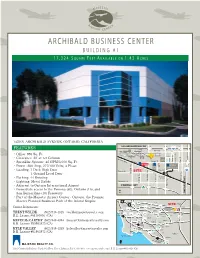

Archibald Business Center Building #1 1 7 , 3 2 4 S Q U a R E F E E T a Vailable on 1

ARCHIBALD BUSINESS CENTER BUILDING #1 1 7 , 3 2 4 S Q U A R E F E E T A VAILABLE ON 1 . 4 3 A CRES 1420 S. ARCHIBALD AVENUE, ONTARIO, CALIFORNIA SAN BERNARDINO FWY FEATURES 10 Ontario Airport Dr. International • Office: 993 Sq. Ft. Airport La Salle St. • Clearance: 22’ at 1st Column Mission U.P.R.R. UPS Carnegie Ave. Carnegie Dupont St. Dupont Commerce Pkwy. Commerce • Sprinkler System: .45 GPM/3,000 Sq. Ft. Blvd. Jurupa St. Fayette La . e ARCHIBALD UPS v CALIFORNIA • Power: 800 Amp, 277/480 Volts, 3 Phase A HOFER COMMERCE CENTER . RANCH • Loading: 1 Dock High Door Francis St. 15 Francis St. Ave Vineyard M e. 1 Ground Level Door v A Ave. Metrolink • Parking: 44 Existing Station Milliken Ave. Archibald Ave. Turner • Lighting: Metal Halide Philadelpia St. Hellman • Adjacent to Ontario International Airport POMONA FWY Haven 60 • Immediate access to the Pomona (60), Ontario (15), and San Bernardino (10) Freeways N ONTARIO FWY • Part of the Majestic Airport Center - Ontario, the Premier Master Planned Business Park of the Inland Empire 101 134 AZUSA RANCHO PASADENA CUCAMONGA LOS 101 5 ANGELES SAN DIMAS 210 FONTANA ContactFEATURES Information: 10 ONTARIO 10 INTERNATIONAL CITY OF AIRPORT INDUSTRY 57 TRENT WYLDE (562) 948-4315 [email protected] LOS ANGELES 60 ONTARIO INTL. 405 110 605 DIAMOND BAR MIRA 710 WHITTIER LOMA AIRPORT 71 CHINO R.E. License #01180856 (CA) 105 57 CHINO HILLS 15 SANTA FE BREA 5 SPRINGS YORBA LINDA KEVIN McCARTHY (562) 948-4394 [email protected] CORONA 91 FULLERTON PLACENTIA LONG 91 R.E. -

III. General Description of Environmental Setting Acres, Or Approximately 19 Percent of the City’S Area

III. GENERAL DESCRIPTION OF ENVIRONMENTAL SETTING A. Overview of Environmental Setting Section 15130 of the State CEQA Guidelines requires an EIR to include a discussion of the cumulative impacts of a proposed project when the incremental effects of a project are cumulatively considerable. Cumulative impacts are defined as impacts that result from the combination of the proposed project evaluated in the EIR combined with other projects causing related impacts. Cumulatively considerable means that the incremental effects of an individual project are considerable when viewed in connection with the effects of past projects, the effects of other current projects, and the effects of probable future projects. Section 15125 (c) of the State CEQA Guidelines requires an EIR to include a discussion on the regional setting that the project site is located within. Detailed environmental setting descriptions are contained in each respective section, as presented in Chapter IV of this Draft EIR. B. Project Location The City of Ontario (City) is in the southwestern corner of San Bernardino County and is surrounded by the Cities of Chino and Montclair, and unincorporated areas of San Bernardino County to the west; the Cities of Upland and Rancho Cucamonga to the north; the City of Fontana and unincorporated land in San Bernardino County to the east; the Cities of Eastvale and Jurupa Valley to the east and south. The City is in the central part of the Upper Santa Ana River Valley. This portion of the valley is bounded by the San Gabriel Mountains to the north; the Chino Hills, Puente Hills, and San Jose Hills to the west; the Santa Ana River to the south; and Lytle Creek Wash on the east. -

Chino Hills Historical Society Press Release

Chino Hills Historical Society Press Release Date: July 27, 2017 Contact: Denise Cattern, CHHS President (909) 597-6449 Chino Hills Historical Society Presents: “A Look Back at Antonio María Lugo and the Early Years of the Rancho Santa Ana del Chino” Monday, September 18th The Chino Hills Historical Society will host a presentation by Chino Hills resident and historian Paul R. Spitzzeri at 7:00 p.m. on Monday, September 18th at the Chino Hills Community Center, 14259 Peyton Drive. Spitzzeri will share the history of Antonio María Lugo and the early years of the Rancho Santa Ana del Chino. According to Spitzzeri, Antonio María Lugo (1775-1860), born near Monterey, Mexico just six years after the Spanish first settled California, was one of the most prominent and remarkable persons in greater Los Angeles during his lifetime. A soldier in the Spanish Army during his younger years, Lugo was granted the Rancho San Antonio, encompassing nearly 30,000 acres southeast of Los Angeles. Later, he and his family acquired the Rancho San Bernardino and Rancho Santa Ana del Chino, the latter including today’s cities of Chino and Chino Hills. “Lugo was torn by the loss of California to the Americans during a war that included the Battle of Chino, which was fought on what is now Boys Republic,” said Mr. Spitzzeri, “He was known for his forthright personality, hospitality, and strength of character.” Mr. Spitzzeri has lived in Chino Hills for 20 years. He is the Museum Director at the Workman and Temple Family Homestead Museum in the City of Industry, where he has worked since 1988. -

1. NEOGENE TECTONICS of SOUTHERN CALIFORNIA . the Focus of This Research Project Is to Investigate the Timing of Rotation of T

1. NEOGENE TECTONICS OF SOUTHERN CALIFORNIA. The focus of this research project is to investigate the timing of rotation of the Transverse Ranges and the evolution of the 3-D architecture of the Los Angeles basin. Objectives are to understand better the seismicity of the region and the relationships between petroleum accumulations and the structure and stratigraphic evolution of the basin. Figure 1 shows the main physiographic and structural features of the Los Angeles basin region, the epicenter of recent significant earthquakes and the our initial study area in the northeastern Los Angeles basin. Los Angeles basin tectonic model: Most tectonic models attribute the opening of the Los Angeles basin to lithospheric extension produced by breakaway of the Western Transverse Ranges from the Peninsular Ranges and 90 degrees or more of clockwise rotation from ca. 18 Ma to the present. Evidence of this extension includes crustal thinning on tomographic profiles between the Santa Ana Mountains and the Santa Monica Mountains and the presence in the Los Angeles basin of Middle Miocene volcanic rocks and proto-normal faults. Detailed evidence of the 3-D architecture of the rift created by the breakaway and the timing of the rift phase has remained elusive. The closing of the Los Angeles basin in response to N-S contraction began at ca. 8 Ma and continues today (Bjorklund, et al., 2002). A system of active faults has developed that pose significant seismic hazards for the greater Los Angeles region. Crustal heterogeneities that developed during the extension phase of basin development may have strongly influenced the location of these faults. -

Adjudicated Newspapers

Newspapers of General Circulation ~ Superior Court of San Bernardino County Name: City News Name: Adelanto Bulletin Name: Apple Valley News Address: 3200 E Guasti Road Ste 100 Address: PO Box 673 Address: PO Box 1147 City: Ontario, CA 91761 City: Adelanto, CA 92301 City: Apple Valley, CA 92307 Phone #: (909) 987-6397 Phone #: (760) 246-6822 Phone #: (760) 242-1930 Fax #: (909) 989-0425 Fax #: (760) 244-6609 Fax #: (760) 244-6609 E-Mail: [email protected] E-Mail: [email protected] E-Mail: [email protected] Case No. SCV-87903 Case No. VCV-006222 Case No. VCV-0011254 Date of Court Order 01-31-57 Date of Court Order 07-11-95 Date of Court Order 01-13-97 Day Published: Saturday Day Published: Thursday Day Published: Friday Area of Circulation: La Verne, Rancho Cucamonga, San Area of Circulation: City of Adelanto Area of Circulation: Apple Valley & Victor Valley Dimas, and Upland Name: Colton City News Name: The Alpine Mountaineer Name: Big Bear Grizzly Address: 22797 Barton Road Address: PO Box 4572 Address: 42007 Fox Farm Road, Suite 3B City: Grand Terrace, CA 92313 City: Crestline, CA 92325 PO Box 1789 Phone #: (909) 370-1200 Phone #: (909) 589-2140 City: Big Bear Lake, CA 92315 Fax #: (909) 825-1116 Fax #: Phone #: (909) 866-3456 E-Mail: [email protected] E-Mail: [email protected] Fax #: (909) 866-2302 Case No. SCV-13352 Case No. SCV-232612 E-Mail: [email protected] Date of Court Order December 20, 1994 Date of Court Order 09-25-86, Modified Case No. SCV-102161 Day Published: -

Transfer Tax Rates

California City Documentary and Property Transfer Tax Rates Governance: Per $1000 Rev&Tax Code Per $1000 General Law PropertyValue Sec 11911-11929 PropertyValue or Chartered City Rate County Rate Total ALAMEDA COUNTY $ 1.10 $ 1.10 ALAMEDA Chartered $ 12.00 $ 1.10 $ 13.10 ALBANY Chartered $ 11.50 $ 1.10 $ 12.60 1.5% for up to $ 1.10 $ 16.10 BERKELEY Chartered $1.5M value 2.5% properties $ 1.10 $ 26.10 over $2.5M DUBLIN General Law $ 0.55 $ 0.55 $ 1.10 EMERYVILLE Chartered $ 12.00 $ 1.10 $ 13.10 FREMONT General Law $ 0.55 $ 0.55 $ 1.10 HAYWARD Chartered $ 8.50 $ 1.10 $ 9.60 LIVERMORE General Law $ 0.55 $ 0.55 $ 1.10 NEWARK General Law $ 0.55 $ 0.55 $ 1.10 OAKLAND Chartered 1% up to $300k $ 1.10 $ 11.10 1.5% $300k-$2M $ 1.10 $ 16.10 1.75% $2M–$5M $ 1.10 $ 18.60 2.5% over $5M $ 1.10 $ 26.10 PIEDMONT Chartered $ 13.00 $ 1.10 $ 14.10 PLEASANTON General Law $ 0.55 $ 0.55 $ 1.10 SAN LEANDRO Chartered $ 6.00 $ 1.10 $ 7.10 UNION CITY General Law $ 0.55 $ 0.55 $ 1.10 ALPINE COUNTY $ 1.10 $ 1.10 AMADOR COUNTY $ 1.10 $ 1.10 AMADOR General Law $ 0.55 $ 0.55 $ 1.10 IONE General Law $ 0.55 $ 0.55 $ 1.10 JACKSON General Law $ 0.55 $ 0.55 $ 1.10 PLYMOUTH General Law $ 0.55 $ 0.55 $ 1.10 SUTTER CREEK General Law $ 0.55 $ 0.55 $ 1.10 BUTTE COUNTY $ 1.10 $ 1.10 BIGGS General Law $ 0.55 $ 0.55 $ 1.10 CHICO Chartered $ 0.55 $ 0.55 $ 1.10 GRIDLEY General Law $ 0.55 $ 0.55 $ 1.10 OROVILLE Chartered $ 0.55 $ 0.55 $ 1.10 PARADISE General Law $ 0.55 $ 0.55 $ 1.10 CALAVERAS COUNTY $ 1.10 $ 1.10 ANGELS CAMP General Law $ 0.55 $ 0.55 $ 1.10 COLUSA COUNTY $ 1.10 $ 1.10 -

Resident Resource Directory Resident Resource Directory

Resident Resource Directory Resident Resource Directory Chino Hills Police Department Table of Contents 14077 Peyton Drive City Hall, Police Department, Library & Fire Dist. Hours ...............1 Chino Hills, CA 91709 Animal Control ........................................................................2 Chino Hills Police Department ..............................................2 (909) 364-2000 Chino Valley Fire District ........................................................2 After Hours Dispatch: (909) 465-6837 Code Enforcement ..............................................................2-3 Hours of Operation Community Services - Sponsorships.......................................3 8:00 a.m. - 5:00 p.m. Mon.- Fri. Community Services - Facility & Gazebo Rentals ..................3 www.chinohills.org Community Services - Mobile Rec. & Youth Sports.................4 Demographics .........................................................................4 Emergency Information ......................................................4-5 Chino Valley Fire District Graffiti Removal .....................................................................5 Household Hazardous Waste.................................................5 14011 City Center Drive James S. Thalman Chino Hills Branch Library ......................5 Chino Hills, CA 91709 Municipal Code .......................................................................5 (909) 902-5260 Neighborhood Watch .............................................................6 Passports ................................................................................6 -

California Purple Heart Entities State

CALIFORNIA PURPLE HEART ENTITIES STATE California, USA 93637 California was designated as the Nation’s 1st Purple Heart State; April l6, 2012 CITIES/COMMUNITIES Adelanto, CA 92301 Anaheim, CA 92805 Anderson, CA 96007 Apple Valley, CA 92307 Arvin, CA 93203 Bakersfield, CA 93301 Banning, CA 92220 Barstow, CA 92311 Beaumont, CA 92223 Big Bear Lake, CA 92315 Blythe, CA 92225 Brea, CA 92821 Calimesa, CA 92320 Canyon Lake, CA 92587 Carlsbad, CA 92008 Cathedral City, CA 92234 Chino, CA 91710 Chino Hills, CA 91709 Coachella, CA 92236 Colton, CA 92324 Corona, CA 92882 Coronado, CA 92118 Cypress, CA 90630 Del Rey Oaks, CA 93940 Desert Hot Springs, CA 92240 Eastvale, CA 91752 El Cajon, CA 92020 Encinitas, CA 92024 Escondido, CA 92025 Fontana, CA 92335 Garden Grove, CA 92840 Gonzales, CA 93926 Grand Terrace, CA 92313 Greenfield, CA 93927 Healdsburg, CA 9548 Hemet, CA 92543 Hesperia, CA 92345 Highland, CA 92346 Imperial Beach, CA 91932 Indian Wells, CA 92210 Indio, CA 92201 Irvine, CA 92606 Jurupa Valley, CA 92509 King, CA 93930 La Quinta, CA 92253 Lake Elsinore, CA 92530 Lake Forest, CA 92630 Lemon Grove, CA 91945 Loma Linda, CA 92354 Los Alamitos, CA 90720 Los Angeles, CA 90001 Marina, CA 93933 McFarland, CA 93250 Menifee, CA 92586 Montclair, CA 91763 Monterey, CA 93940 Moreno Valley, CA 92552 Murrieta, CA 92562 Needles, CA 92363 Newport Beach, CA 92660 Norco, CA 92860 Oceanside, CA 92054 Ontario, CA 91764 Oxnard, CA 93030 Palm Desert, CA 92260 Palm Springs, CA 92262 Perris, CA 92570 Petaluma, CA 94952 Pomona, CA 91700 Port Hueneme, CA 93041 Poway. -

Connecting Californians with the Chaparral

Chapter 11 Connecting Californians with the Chaparral Richard W. Halsey, Victoria W. Halsey, and Rochelle Gaudette Abstract Chaparral is California’s most extensive, native ecosystem. We examined nature centers, publications, curricula, and volunteer naturalist programs in south- ern California to determine how the chaparral is being presented to the public. We found that a number of centers do an excellent job presenting accurate content. However, the majority need updates to reflect current science and the major contri- bution chaparral makes to the state’s biodiversity. Easily accessible publications and curricula with accurate information about the chaparral are lacking. More than half of the nature centers reviewed offer extensive naturalist training courses. Passion and enthusiasm of staff and volunteers are as important as content in creating and maintaining successful volunteer naturalist programs as well as the nature centers themselves. Utilizing active learning methodology versus lecturing can be a key factor in a program’s success. We offer an approach to nature education that com- bines active learning where students participate in the teaching process, and mean- ingful interpretation that establishes personal connections with nature. The greater understanding resulting from this approach can inspire a diverse, new generation of long-term nature advocates and help create an informed public, facilitating an appreciation for the value of the chaparral ecosystem. Keywords Active learning · California native plants · Chaparral · Naturalist · Nature center · Nature education R. W. Halsey (*) California Chaparral Institute, Escondido, CA, USA e-mail: [email protected] V. W. Halsey Ken Blanchard Companies, Escondido, CA, USA R. Gaudette Canyoneers, San Diego Natural History Museum, San Diego, CA, USA © Springer International Publishing AG, part of Springer Nature 2018 295 E. -

From Rock, Wind, & Water

FROM ROCK, WIND, & WATER: A N ATURAL H ISTORY OF THE P UENTE H ILLS Richard H. Ross Doctoral Student in History Claremont Graduate University Claremont, CA 91711 Photo: USGS National Elevation Dataset (SDDS). Cover Design: Tomomi Ishihara. TABLE OF CONTENTS List of Abbreviations .................................................................................................. 1 List of Illustrations ..................................................................................................... 2 From Rock, Wind, and Water: Introduction ............................................................ 3 Part 1: Of Rock Introduction: Geology ................................................................................................ 4 Plate Tectonics Overview .......................................................................................... 7 First Rocks and Farallon ............................................................................................. 9 Second Rocks and Rotation ..................................................................................... 11 Third Rocks and Uplift ............................................................................................. 13 Conclusion: Geology ................................................................................................ 17 Part 2: Of Wind and Water Introduction: Climate and Erosion ........................................................................... 18 Climate: Mediterranean ........................................................................................... -

Flood Control District Interim Director Brendon Biggs, M.S., P.E

825 East Third Street, San Bernardino, CA 92415-0835 | Phone: 909.387.7910 Fax: 909.387.7911 Luther Snoke Flood Control District Interim Director Brendon Biggs, M.S., P.E. Chief Flood Control Engineer NOTICE OF EXTENDED PUBLIC COMMENT PERIOD RE NOTICE OF AVAILABILITY (NOA)/ NOTICE OF INTENT (NOI) TO ADOPT A MITIGATED NEGATIVE DECLARATION SAN BERNARDINO COUNTY FLOOD CONTROL DISTRICT CARBON CANYON CHANNEL FLOOD CONTROL IMPROVEMENT PROJECT CHINO HILLS, CALIFORNIA The San Bernardino County Flood Control District (District) prepared a Draft Mitigated Negative Declaration (MND) in compliance with the California Environmental Quality Act (CEQA) for the construction and maintenance of flood control improvements to the Carbon Canyon Flood Control Channel in the City of Chino Hills, California from an existing interim channel to an ultimate condition channel (See attached Figure 1: Regional Location) (Project). The Project goal is to reduce the risk of flooding during a 100-year storm event by increasing the capacity and conveyance of the District-maintained facility. The site is generally located within an area characterized as urbanized, primarily with single family residences to the north and south of the channel. There is a large Southern California Edison (SCE) right-of-way (ROW) south of the channel, intersecting the channel in two locations. There is a church complex at the west end of the channel (Chino Valley Community Church) as well as a recreational field with irrigated grass and ornamental plants that borders Little Chino Creek. There are commercial uses at the east end near Pipeline Avenue. The Project area covers approximately 4,850 linear feet in length and 150 feet in width where the existing interim channel already exists. -

Chino Hills State Park Raptors

California Department of Parks and Recreation I. Introduction Birds of prey, also known as raptors, are important members of most terrestrial biological ecosystems. As carnivores, raptors generally exist at high trophic levels consuming other species that are either primary (herbivores) or secondary (omnivores or carnivores) producers. Because they occur at relatively high trophic levels, where toxic compounds are sometimes concentrated, raptors can be good indicators of system-wide pollution problems. Furthermore, presence or diversity of raptor species can be used to estimate whether or not habitat reserves or linkages are properly functioning (sustained high species diversity at many trophic levels). Conversion of native habitats to urban landscapes in southern California has placed increasing pressure on maintaining functional ecosystems within conserved habitats. Chino Hills State Park (CHSP) is important for conservation purposes because it provides a large habitat block, and remains as one of the few wildlife linkages between northeastern Orange, northwestern Riverside, and southwestern San Bernardino Counties. At Chino Hills State Park, raptors utilize many different habitats. They feed on small mammals, snakes, lizards, amphibians, invertebrates, and birds, hunting in open vegetation. Nest sites occur in diverse settings including rock ledges, riparian trees and vegetation, grasslands and human introduced features (e.g., Eucalyptus trees, utility poles). Understanding of the species composition, and abundances of raptor species and their reproductive success (from monitoring nesting locations), will support conservation management decisions at CHSP. Additionally, information regarding raptor populations at CHSP will support region-wide habitat conservation and management efforts. The purpose of this study was to identify the distribution and abundance of nesting birds of prey at CHSP, and to provide baseline data and a monitoring framework to observe changes in their distribution and abundance over time.