Exempel På Rubrik

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Annual Report 2016 About This Report

Annual Report 2016 About this Report This Annual Report was pre-approved by Rostelecom’s Board of Directors on 15 May 2017, Minutes No. 19 dated 15 May 2017. This Report has been prepared by PJSC Rostelecom (“Rostelecom” or the “Company”) and its subsidiaries (jointly, the “Group”), in line with Note 9 Subsidiaries to the Company’s consolidated financial statements prepared under the International Financial Reporting Standards (“IFRS”) for the year ended 31 December 2016. DISCLAIMER This Report contains certain “forward- » plans to improve the Company’s corporate » risks associated with changes in looking statements regarding future events”, governance practices; the political, economic and social as defined by the US federal securities laws, » the Company’s future position in environment in Russia and macroeconomic which are, therefore, regulated by these the telecommunications market and changes; laws, which provide for no liability for any act the outlook for the market segments in » risks associated with Russian laws, done or omitted in good faith. Such forward- which the Company operates; legislative reforms and taxation, including looking statements regarding future events » economic outlook and industry trends; laws, regulations, decrees and resolutions include (but are not limited to) the following: » potential regulatory changes and governing the Russian telecommunications assessments of the impact any laws or industry, activities related to placement » estimates of future operational and financial regulations may have on the -

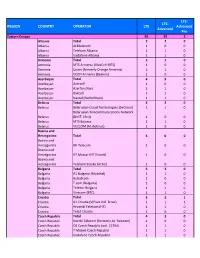

Ready for Upload GCD Wls Networks

LTE‐ LTE‐ REGION COUNTRY OPERATOR LTE Advanced Advanced Pro Eastern Europe 92 55 2 Albania Total 320 Albania ALBtelecom 100 Albania Telekom Albania 110 Albania Vodafone Albania 110 Armenia Total 310 Armenia MTS Armenia (VivaCell‐MTS) 100 Armenia Ucom (formerly Orange Armenia) 110 Armenia VEON Armenia (Beeline) 100 Azerbaijan Total 430 Azerbaijan Azercell 100 Azerbaijan Azerfon (Nar) 110 Azerbaijan Bakcell 110 Azerbaijan Naxtel (Nakhchivan) 110 Belarus Total 420 Belarus Belarusian Cloud Technologies (beCloud) 110 Belarusian Telecommunications Network Belarus (BeST, life:)) 100 Belarus MTS Belarus 110 Belarus VELCOM (A1 Belarus) 100 Bosnia and Herzegovina Total 300 Bosnia and Herzegovina BH Telecom 100 Bosnia and Herzegovina HT Mostar (HT Eronet) 100 Bosnia and Herzegovina Telekom Srpske (m:tel) 100 Bulgaria Total 530 Bulgaria A1 Bulgaria (Mobiltel) 110 Bulgaria Bulsatcom 100 Bulgaria T.com (Bulgaria) 100 Bulgaria Telenor Bulgaria 110 Bulgaria Vivacom (BTC) 110 Croatia Total 321 Croatia A1 Croatia (VIPnet incl. B.net) 111 Croatia Hrvatski Telekom (HT) 110 Croatia Tele2 Croatia 100 Czech Republic Total 430 Czech Republic Nordic Telecom (formerly Air Telecom) 100 Czech Republic O2 Czech Republic (incl. CETIN) 110 Czech Republic T‐Mobile Czech Republic 110 Czech Republic Vodafone Czech Republic 110 Estonia Total 330 Estonia Elisa Eesti (incl. Starman) 110 Estonia Tele2 Eesti 110 Telia Eesti (formerly Eesti Telekom, EMT, Estonia Elion) 110 Georgia Total 630 Georgia A‐Mobile (Abkhazia) 100 Georgia Aquafon GSM (Abkhazia) 110 Georgia MagtiCom -

Printmgr File

UNITED STATES SECURITIES AND EXCHANGE COMMISSION WASHINGTON, D.C. 20549 FORM 20-F ‘ Registration Statement Pursuant to Section 12(b) or (g) of the Securities Exchange Act of 1934 OR È Annual Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 for the fiscal year ended December 31, 2015 OR ‘ Transition Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 OR ‘ Shell Company Report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 Commission File Number: 1-34694 VIMPELCOM LTD. (Exact name of registrant as specified in its charter) Bermuda (Jurisdiction of incorporation or organization) Claude Debussylaan 88, 1082 MD, Amsterdam, the Netherlands (Address of principal executive offices) Scott Dresser Group General Counsel Claude Debussylaan 88, 1082 MD, Amsterdam, the Netherlands Tel: +31 20 797 7200 Fax: +31 20 797 7201 (Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person) Securities registered or to be registered pursuant to Section 12(b) of the Act: Title of Each Class Name of Each Exchange on Which Registered American Depositary Shares, or ADSs, each representing one common share NASDAQ Global Select Market Common shares, US$0.001 nominal value NASDAQ Global Select Market* * Listed, not for trading or quotation purposes, but only in connection with the registration of ADSs pursuant to the requirements of the Securities and Exchange Commission. Securities registered or to be registered pursuant to Section 12(g) of the Act: None. Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None. -

Transparency in Corporate Reporting

TRANSPARENCY IN CORPORATE REPORTING Assessing Russia’s Largest Companies “Transparency International-Russia” Report ASSESSING RUSSIA’S LARGEST COMPANIES “TRANSPARENCY INTERNATIONAL— RUSSIA” REPORT This report was produced by Transparency International Russia as part of a project led by the Transparency International Secretariat with fund- ing from the Siemens Integrity Initiative. The Transparency in Corporate Reporting assessment conducted in Russia uses the same methodol- ogy as the Transparency in Corporate Reporting: Assessing the World’s Largest Companies which is produced periodically by the Transparency International Secretariat. The latest edition of the global report, pub- lished in 2014, included Siemens as one of the 124 companies that were assessed. Project coordinator Anastasiya Ivolga Project team Anton Pominov, Ekaterina Sukhareva, Ilya Shumanov, Maria Maria Shigreva Project interns Alisa Velmiskina and Svetlana Ivanova © Bureau Verstak, design, 2017 Printed in Tara-Tut print shop (Moscow) TABLE OF CONTENTS Introduction 9 The Overall Results 10 Recommendations 12 Methodology 20 1. Anti-corruption documents 26 2. Organizational Transparency 38 3. Country-by-country reporting 44 Annexes 1. List of evaluated information 50 2. Data per companies 52 — 2 CENTER “TRANSPARENCY INTERNATIONAL R” TRANSPARENCY ACP — ANTI-CORRUPTION PROGRAMS SCALE FROM 0–10, WHERE 0 IS THE LEAST TRANSPARENT, OT — ORGANIZATIONAL TRANSPARENCY 10 IS THE MOST TRANSPARENT. THE INDEX IS BASED ON THE IN CORPORATE REPORTING СВС — COUNTRY-BY-COUNTRY REPORTING -

Send Free Sms Beeline Russia

Send free sms beeline russia Возможность бесплатно написать и отправить SMS-сообщение абоненту «Билайн» с нашего сайта! Unlimited free sms text message to Russia is sent in real time and is read immediately. Enter your Russia mobile number and sms text message and click send. Free sms to Kuban; Free sms to MegaFon (North-WestJSCSonic Duo); Free. Send Unlimited FREE SMS to Russia. No signup needed to send free text messages to Russia. Contact Beeline (), + (7 digits) (Area code is ). allow you to free sms to almost anywhere in Russia. You don't need to send sms from your phone anymore; do it online. Using our cell phone recharge center you can add airtime and send free SMS / text to any cell phone in Russia: Beeline, Megafon, MTS, Skylink, SMARTS. Send SMS to Russia(Beeline, Global Star, Megafon, MTS, Skylink, Tele2, Yota VimpelCom is offering free access to the mobile version of the Wikipedia. Сервис бесплатной отправки SMS. Отправить смс сообщение на мобильный телефон МТС, Beeline, Мегафон, Tele2, Utel. twinSMS is the website where you can send SMS to any mobile phone in Russia send free sms to Taif-Telecom, Megafon, Codotel, Delta Telecom, MTS. Phone No, *. Mensaxe. *. Send Free SMS Beeline,Russia. Facebook SMS Copyright Open Merchant Account Ltd. Send unlimited Free SMS to any network in Russia. Verizon does not support text messaging to Russia. Does anyone To send free SMS messages to a Moscow Beeline customer: Beeline SMS. twinSMS is the website where you can send SMS to any mobile phone in Russia send free sms to Taif-Telecom, Megafon, Codotel, Delta Telecom, MTS. -

Country / Network NETWORK-CODE STANDARD TOP

Country / Network NETWORK-CODE STANDARD TOP Afghanistan (+93) Areeba 412 40 AVAILABLE AVAILABLE Awcc 412 01 AVAILABLE AVAILABLE Etisalat Afghanistan 412 30 AVAILABLE AVAILABLE Roshan 412 20 AVAILABLE AVAILABLE Albania (+355) A MC Mobil 276 01 AVAILABLE AVAILABLE Vodafone 276 02 AVAILABLE AVAILABLE Algeria (+213) Djezzy 603 02 AVAILABLE AVAILABLE Andorra (+376) Mobiland 213 03 AVAILABLE AVAILABLE Antigua And Barbuda (+1268) Apua Pcs 344 030 AVAILABLE AVAILABLE Cable & Wireless 344 920 AVAILABLE AVAILABLE Argentina (+54) Cti Movil 722 310 AVAILABLE AVAILABLE Nextel Argentina Srl (Iden) 722 020 AVAILABLE AVAILABLE Personal 722 341 AVAILABLE AVAILABLE Telefonica Moviles 722 070 AVAILABLE AVAILABLE Armenia (+374) Armgsm 283 01 AVAILABLE AVAILABLE K-Telecom 283 05 AVAILABLE AVAILABLE Aruba (+297) Digicel 363 02 AVAILABLE AVAILABLE Australia (+61) Telstra Mobilenet 505 01 AVAILABLE AVAILABLE Vodafone 505 03 AVAILABLE AVAILABLE 1 Vodafone Hutchison Australia 505 06 AVAILABLE AVAILABLE Yes Optus 505 02 AVAILABLE AVAILABLE Austria (+43) 3 At 232 10 AVAILABLE AVAILABLE A1 232 01 AVAILABLE AVAILABLE Orange Austria 232 05 AVAILABLE AVAILABLE Tele.Ring 232 07 AVAILABLE AVAILABLE T-Mobile A 232 03 AVAILABLE AVAILABLE Azerbaijan (+994) Azercell Gsm 400 01 AVAILABLE AVAILABLE Azerfon Llc (Nar Mobile) 400 04 AVAILABLE AVAILABLE Bakcell Gsm 2000 400 02 AVAILABLE AVAILABLE Bahamas (+1242) The Bahamas Telecommunications Company 364 39 AVAILABLE AVAILABLE Bahrain (+973) Batelco 426 01 AVAILABLE AVAILABLE Zain BH 426 02 AVAILABLE AVAILABLE Bangladesh (+880) -

Broadband & Satellite Russia Newsletter

Broadband Russia World at a different angle Broadband & Satellite Russia Newsletter № 74 May 16-30, 2014 | MOSCOW | RUSSIA | Contents Broadband Russia Changes On The Western Front . 3 Broadband Speeds Quadrupled . 3 Space Saboteurs . 4 LTE Roaming For Fans . 4 Mobile Frequency Auctions. 5 Wi-Fi In Train Stations . 5 LTE Dreams Coming True . 6 Crimean Frequencies Allocated To The Unknown . 6 RDIF Will Pay For Pan-Russian Broadband . 7 4G Lags Behind xDSL . 7 ER-Telecom Head To Crimea . 8 Fourth Operator For 4G . 8 About Us. Contacts . 9 Sources: ComNews.ru, Interfax, Kommersant, Izvestiya, Vedomosti.ru, Lenta.ru, ITAR-TASS World at a Broadband Russia different angle ◊◊ Changes On The Western Front Since the beginning of the year, TransTeleCom Company (TTK), The highest penetration of Internet access services from TTK in the one of Russia’s largest telcos, has increased technical coverage of its region (more than 50%) was registered in Baltiysk. In Kaliningrad broadband network in the most western region of the country – the (formerly called Königsberg in Prussia) penetration of broadband service Kaliningrad by 10%. As of the end of April 2014, technical coverage of in technical network coverage reached 20%. local broadband network spanned 67,000 households in 910 “We plan to connect another 190 apartment blocks in Moskovsky and apartment blocks. Leningradsky districts of Kaliningrad in the near future”, commented Gennady Schukin, director general of TTK-Kaliningrad. ◊◊ ◊◊ Broadband Speeds Quadrupled Average speed of broadband connections in Russia has more than more than quadrupled, and also mentioned that the retailer markets quadrupled over the past 2 years, while the price for such services services from about 50 providers. -

Express-Evaluation As Tool of Investment Solution in Telecommunication Industry

Advances in Economics, Business and Management Research, volume 38 Trends of Technologies and Innovations in Economic and Social Studies (TTIESS 2017) Express-evaluation as tool of investment solution in telecommunication industry Larisa Zubkova Sergey Dyachkov Department of Finance, money and credit Department of Finance, money and credit Tyumen state University Tyumen state University Tyumen, Russia Tyumen, Russia [email protected] Abstract— Currently, one of the key global trends in subsequent automation and computerization of the business the world of progress is the intensive development of the processes permits solution of many complex problems. information and communication technologies, ensuring Wide spreading and rapid development of information stable economic growth, raising living standards and technologies become a global driving force of the world creating a knowledge economy. The rapid growth of the progress in recent decades. Nowadays, information and Telecom industry and development of methodology of computing technologies (ICT) influence the economic investment analysis in this industry has led to the progress. ICT promotes investment attraction, creates new advanced contribution and development of this article. jobs, introduces progressive technologies in the production The paper proposes a scheme of the part of investment and management, and ultimately creates innovative economy, analysis that includes two important, complementary provides stable economic growth and rises standards of living. components of macroeconomic and microeconomic. It Formation of neo-industrial society with its features of provides the calculation of the indicator for the assessment knowledge economy, intellectual labor, the automation and of companies within the telecommunications industry. The computerization of production, brought Russian article presents a comparative analysis by the calculation telecommunication industry to the growth. -

Fourth Quarter 2010

FOURTH QUARTER 2010 Februaryy, 8, 2011 Agenda About Q4 2011 Financial review GidGuidance an dCd Conc ldiluding remar ks 2 2010-10-20 Higgghlights Q4 • Group – Total customer base amounting to almost 31 million customers. Net customer intake for the group 803,000 – Net sales grew by 2 percent. Currency-adjusted net sales grew by 8 percent, driven by mobile sales – EBITDA grew by 10 percent. Currency-adjusted EBITDA grew by 18 percent. EBITDA margin amounted to 25 (23) percent • Russia • Nordic • Central Europe & Eurasia • Western Europe 3 2010-10-20 Higgghlights Tele2 Russia • 755,000 (1,149,000) new customers in Q4 2010 • Revenue grew by 24 percent in Q4 2010 4 2010-10-20 Tele2 Russia: Mobile market overview Penetration repaid share repaid bers (million) PP Mobile subscri NET ADDITIONS QUARTERLY CHURN Share of adds (%) MTS Vimpelcom MegaFon Tele2 PERCENT Tele2 100% 13% 80% 60% 10% Net additions 40% churn uarterly QQ 7% 20% 0% 4% ‐20% 3Q09 4Q09 1Q10 2Q10 3Q10 4Q10 Source: AC&M – 3Q10 Report, Mayson Analysis – Voice Quarterly Metrics, Nov 8th 2010 5 2010-10-20 Tele2 Russia: Mobile market overview MOBILE MARKET SHARES MOBILE MARKET SHARES PERCENT OF ACTIVE SUBSCRIBERS PERCENT OF RETAIL REVENUES 40% 35,0% 35% 30,0% 30% arket shares arket shares 25,0% mm 25% mm Mobile TeleSystems 20,0% Mobile TeleSystems 20% Mobile VimpelCom Mobile VimpelCom 15,0% 15% MegaFon MegaFon TlTele 2 10, 0% TlTele 2 10% 5% 5,0% 0% 0,0% 2006 2007 2008 2009 1Q10 2Q10 3Q10 2006 2007 2008 2009 1Q10 2Q10 3Q10 Average TELE2 share (old regions) – 38.5% Average TELE2 share -

Pdf Annual Report 2009 Pdf 4.1 MB

... Route to Victory ...09 Annual Report 2009 Approved Annual General Shareholders Meeting OJSC “MegaFon” Minutes dated 02.06.2010 Preliminarily Approved Board of Directors OJSC “MegaFon” Minutes № 127 (191) dated 28.04.2010 MEGAFON ANNUAL REPORT ...................... Route to Victory ...09 Contents 01. Company Overview 4 02. Network Coverage Area 5 03. Address by the Chairman of The Board 6 06. Key Events of 2009 04. Address by the Chief Executive Officer 12 8 10 05. Highlights of 2009 13. Consolidated Financial Statements 09. Risk Management 65 35 10. Corporate Governance 39 29 08. Review of Financial 11. Sustainable Results Development 49 52 15 12. Annexes 07. Report by the Board of Directors 4 COMPANY OVERVIEW 01: Company Overview MegaFon has firmly established itself as over 50 million people in 83 Russian frastructure in the country, and is also the a leading name in Russia’s telecommu- regions, as well as Tajikistan, Abkhazia leader in terms of revenue from mobile nications industry, having become one and South Ossetia. data transfer services. of the “Big Three” mobile communica- tions operators in the country. It was the MegaFon was also the first Russian opera- In 2009, MegaFon was named a General first, and remains the only, player in the tor to commercially launch a third-gener- Partner of the XXII Winter Olympic Games sector to offer a full spectrum of mobile ation network, based on the IMT-2000/ and XI Winter Paralympic Games in Sochi communication services nationwide. The UMTS (3G) standard. It offers the widest in 2014. Company’s subscriber base comprises coverage and the most developed 3G in- Mission ..................................................... -

2. VTB Market Position

World Without Barriers. VTB Group Content Mission and values 4 5.3. The General Shareholders Meeting of JSC VTB Bank 80 5.4. The Supervisory Council of JSC VTB Bank 82 Statement of the Chairman of the Supervisory Council 6 5.5. The Management Board of JSC VTB Bank 98 Statement of the President and Chairman of the Management Board 8 5.6. Remuneration of the members of the Supervisory Council 1. Financial highlights 10 and the Management Board of JSC VTB Bank 103 5.7. Internal control and audit 103 2. VTB’s market position 14 5.8. Investor relations 110 3. The economy and banking sector 17 5.9. VTB Group governance system 115 4. Management report 22 6. Corporate social responsibility 118 4.1. Key events in 2013 22 6.1. Personnel 118 4.2. VTB Group strategy 23 6.2. Responsible resource management 122 4.3. Review of operating performance 30 6.3. Social programmes 123 4.3.1. Corporate and investment banking 30 7. Management responsibility statement 126 4.3.2. Retail banking 39 4.3.3. Other businesses 52 8. Summary consolidated financial statements in accordance with IFRS 127 4.3.4. Business outside of Russia 54 9. Other information 138 4.4. Review of financial performance 58 9.1. Details of JSC VTB Bank 138 4.5. Risk management 66 9.2. Contact information 139 5. Corporate governance 78 10. Shareholders information 142 5.1. Overview of the corporate governance system 78 5.2. Development of the corporate governance system in 2013 79 Mission and values Mission Versatility. -

Russian M&A Review

Russian M&A Review 2014 March 2015 Contents Russian M&A ■ Foreword ___3 ■ Headlines ___4 ■ Executive Summary ___5 ■ Looking back over the last decade ___6 ■ 2014 Review ___8 Domestic M&A __12 Inbound M&A __13 Outbound M&A __14 Private equity __15 ■ 2015 Outlook ___16 Buy Right ■ Road map for successful acquisitions ___19 Sector analysis ■ Methodology ___31 ■ Agriculture ___32 ■ Automotive ___33 ■ Banking and insurance ___34 ■ Chemicals ___35 ■ Communications and media ___36 ■ Consumer markets ___37 ■ Healthcare and pharmaceuticals ___38 ■ Innovation and technology ___39 ■ Metals and mining ___40 ■ Oil and gas ___41 ■ Power and utilities ___42 ■ Real estate and construction __43 ■ Transport and infrastructure __44 Russian M&A Review 2014 | 3 Foreword Welcome to the 10 th edition of KPMG’s annual Russian M&A Review. The last decade has seen substantial changes in the landscape of Russian M&A, and although 2014 saw the second successive year of decline in value terms, significant opportunities exist for the market to grow and further mature in the years to come. In this edition of the Review we also reflect on the relevance of our key findings from 2005 on today’s Russian M&A market. Political and economic turbulence took their toll on Russian M&A in 2014. Sanctions over the Ukraine crisis led to a sharp decline in inbound M&A from March onwards, while domestic M&A collapsed in the usually strong fourth quarter in the wake of the falling oil price and devaluation of the rouble. We expect Russian M&A to further contract in 2015, particularly in the absence of the larger transactions which have driven the market in recent years.