Pdf Annual Report 2009 Pdf 4.1 MB

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Pyatnits SC) EIJSC 39362474 Moscow

2008 ANNUAL REPORT Table of contents Address by the General Director ............................................4 Reinsurance ..........................................................................49 Position of Ingosstrakh in the Insurance Market .....................6 Investments ..........................................................................52 Quantitative and qualitative insurance Marketing .............................................................................54 market parameters ..............................................................9 Personnel .................................................................................56 Key Events and Trends in the Russian Insurance Market in 2008 ..............................13 Risk management ....................................................................62 Current Positioning of Ingosstrakh in the Market ...............16 Communications ......................................................................70 Deliverables in major areas of business ..................................20 Government relations ..........................................................73 Motor insurance ...................................................................23 Public relations .....................................................................74 Corporate property and liability insurance .........................27 Charity and sponsorship ......................................................76 Voluntary Medical insurance ................................................29 -

ZONE COUNTRIES OPERATOR TADIG CODE Calls

Calls made abroad SMS sent abroad Calls To Belgium SMS TADIG To zones SMS to SMS to SMS to ZONE COUNTRIES OPERATOR received Local and Europe received CODE 2,3 and 4 Belgium EUR ROW abroad (= zone1) abroad 3 AFGHANISTAN AFGHAN WIRELESS COMMUNICATION COMPANY 'AWCC' AFGAW 0,91 0,99 2,27 2,89 0,00 0,41 0,62 0,62 3 AFGHANISTAN AREEBA MTN AFGAR 0,91 0,99 2,27 2,89 0,00 0,41 0,62 0,62 3 AFGHANISTAN TDCA AFGTD 0,91 0,99 2,27 2,89 0,00 0,41 0,62 0,62 3 AFGHANISTAN ETISALAT AFGHANISTAN AFGEA 0,91 0,99 2,27 2,89 0,00 0,41 0,62 0,62 1 ALANDS ISLANDS (FINLAND) ALANDS MOBILTELEFON AB FINAM 0,08 0,29 0,29 2,07 0,00 0,09 0,09 0,54 2 ALBANIA AMC (ALBANIAN MOBILE COMMUNICATIONS) ALBAM 0,74 0,91 1,65 2,27 0,00 0,41 0,62 0,62 2 ALBANIA VODAFONE ALBVF 0,74 0,91 1,65 2,27 0,00 0,41 0,62 0,62 2 ALBANIA EAGLE MOBILE SH.A ALBEM 0,74 0,91 1,65 2,27 0,00 0,41 0,62 0,62 2 ALGERIA DJEZZY (ORASCOM) DZAOT 0,74 0,91 1,65 2,27 0,00 0,41 0,62 0,62 2 ALGERIA ATM (MOBILIS) (EX-PTT Algeria) DZAA1 0,74 0,91 1,65 2,27 0,00 0,41 0,62 0,62 2 ALGERIA WATANIYA TELECOM ALGERIE S.P.A. -

Annual Report 2012 Annual Report

Annual Report 2012 Annual Report Annual Report www.AR2012.megafon.ru/en Chief Executive Officer I.V. Tavrin (signature) Chief Accountant L.N. Strelkina (signature) Annual Report 2012 CONTENTS MEGAFON MegaFon’s business model and key 2012 results 4 Finanсial and operational highlights for 2012 2012 marked a new 8 Our business page in MegaFon’s history STRATEGY Management’s overview of the results p. 14 and vision for growth 14 Letter of the Chairman of the Board LETTER 18 Letter of the CEO OF THE CHAIRMAN 22 Strategy OF THE BOARD 24 The Russian market in 2012 РERFORMANCE MegaFon’s operating and financial results 30 Review of operations 48 Finanсial review GOVERNANCE Free cash flow reached RUB 70.8 billion Corporate governance and risk management systems 52 Risk management p. 48 56 Corporate governance 69 Shareholder’s equity FINANCIAL REVIEW SUSTAINABILITY Our mission is Responsibility to employees to bring Russia and community together through 74 Sustainable development communication technology APPENDICES 82 Management responsibility statement 82 US GAAP Consolidated Financial Statements p. 74 128 Appendices SUSTAINABLE 160 Contacts DEVELOPMENT generated at BeQRious.com This Annual Report focuses principally on our operations in the Russian Federation. While we have operating subsidiaries in the For more information Republics of Tajikistan (TT mobile), Abkhazia (AQUafon-GSM) about MegaFon, see and South Ossetia (OSTELEKOM), they generate only 1% of the company website. our total consolidated revenues. Unless otherwise specifically The report is also indicated, this Annual Report provides consolidated financial and available online operational data www.AR2012.megafon.ru/en Approved Annual General Shareholders Meeting OJSC “MegaFon” Minutes dated 28.06.2013 Preliminarily Approved Board of Directors OJSC “MegaFon” Minutes № 192 (256) dated 14.05.2013 NATIONWIDE 4G AGREEMENT WITH NEW CAPEX LICENCE YOTA ON 4G NETWORK FRAMEWORK P. -

2G 3G 4G 5G > 181,400

Annual report 2019 Operational Results Infrastructure Network expansion MegaFon is the unrivalled leader in Russia 1 by number of base stations, with We are committed to maximising the speed and reliability of communications services for our subscribers, and are continuously investing in infrastructure and innovative technology. > 181,400 stations 2G 3G 4G 5G 1990s 2000s 2010s 2016–2019 Voice and SMS Mobile data and high- Mobile broadband and full- Ultrafast mobile internet, quality voice services scale IP network full-scale support of IoT ecosystems, and ultra-reliability MegaFon was the first in Russia to • provide 2G services in all • roll out a full-scale • launch the first 4G • demonstrate a record Russian regions commercial 3G network network (2012); connection speed • launch a commercial of 2.46 Gbit/s VoLTE network (2016); on a smartphone • demonstrate a data on a 5G network (2019); rate in excess of 1 Gbit/s • launch a 5G on a commercial lab – in collaboration smartphone (2018) with Saint Petersburg State University’s Graduate School of Management (2019) 1 According to Roscomnadzor as of 19 March 2020. 48 About MegaFon 14–35 Strategic report 36–81 Sustainability 82–109 Corporate governance, securities, and risk management 110–147 Financial statements and appendix 148–226 MegaFon’s base stations, ‘000 4G/LTE coverage, % 2019 70.0 50.7 60.7 181.4 2019 82 2018 70.5 49.4 49.6 169.5 2018 79 2017 69.1 48.0 40.6 157.7 2017 74 2G 3G 4G/LTE MegaFon’s strong portfolio of unique high-speed data 4G/LTE networks spectrum assets is an important competitive advantage. -

Telenor 15 Years in Russia

Telenor 15 years in Russia Telenor ASA, the Norwegian Telecommunications group, is happy to announce the start of celebrations of its 15th anniversary on the Russian market. Telenor first invested into the Russian market by establishing modern and digital fixed line connections to Murmansk and the Kola Peninsula in Russia's north. In St. Petersburg, Telenor was an owner from 1994 of North-West GSM, a company that later became MegaFon. Two other acquisitions, in Stavropol and Kaliningrad, were later consolidated into VimpelCom, following Telenor's first investment in that company in 1998. In 2003, Telenor merged the earlier acquired Comincom into the integrated services provider Golden Telecom. Today, Telenor holds 29.9% of the voting shares in VimpelCom and 18.4% of the shares in Golden Telecom. During its 15 years in Russia, Telenor has seen its asset value rise to over $10 billion, thus becoming the largest investor into the Russian telecoms. The Norwegian Minister of Trade and Industry Dag Terje Andersen, who is currently in Moscow to celebrate Telenor Russia's anniversary, said: "Telenor has been a long-term investor in Russia - both during periods of prosperity and periods of periods recession. Telenor has contributed with capital, knowledge, technology and value creation in the Russian telecom sector." He added: "I want to wish Telenor success in Russia in the future and congratulate it with its 15th anniversary in Russia." Telenor's CEO and President Jon Fredrik Baksaas, also in Moscow for the anniversary, added: "This is a great day for our business in Russia. And this is part of a long-term industrial relationship. -

Reinsurance Market in Russia: 2015 Future Outlook

Reinsurance Market in Russia: Future Outlook Joint analytical report of ARIA and RNRC 1 Summary The reinsurance market in Russia needs a fresh start. The scope of internal reinsurance in Russia is declining progressively. The amount of reinsurance premiums on the internal market in 2015 was RUB 35.2 billion, which is RUB 8.9 billion (20%) less than in 2012. Over the 9 months of 2016, the amount of premiums for accepted risks was 28.8 billion. In 2012-2014, the reinsurance market in Russia was expanding: premiums during this period increased by RUB 23.6 billion (20.5%); but affected by the negative political and economic factors in 2015, the reinsurance market stopped growing and entered a recession phase. During 2011-2015, reinsurance premiums increased just by 2% in 2015, while the growth of prices for insurance services reached 58% according to the Federal State Statistics Service. The Russian reinsurance market is characterized by a low penetration rate. Refusal to cede risks is associated with a few factors: inability to cede risks, conscious refusal to cede risks by insurers and lack of insurers' trust in Russian companies operating on the incoming reinsurance market. Despite the sanctions, the share of reinsurance premiums flowing abroad is increasing. In 2012 to 2015, premiums ceded to foreign reinsurers grew from RUB 79.4 billion to 98.4 billion. The size of the reinsurance market in Russia for the 9 months of 2016 was RUB 28.8 billion, which is equivalent to 3.25% of premiums on the insurance market. According to 2015 data, this figure on the international reinsurance market was estimated at 5%. -

WT/TPR/S/345/Rev.1 6 December 2016 (16

WT/TPR/S/345/Rev.1 6 December 2016 (16-6657) Page: 1/173 Trade Policy Review Body TRADE POLICY REVIEW REPORT BY THE SECRETARIAT RUSSIAN FEDERATION Revision This report, prepared for the first Trade Policy Review of the Russian Federation, has been drawn up by the WTO Secretariat on its own responsibility. The Secretariat has, as required by the Agreement establishing the Trade Policy Review Mechanism (Annex 3 of the Marrakesh Agreement Establishing the World Trade Organization), sought clarification from the Russian Federation on its trade policies and practices. Any technical questions arising from this report may be addressed to Mr. John Finn (Tel: 022 739 5081), Mr. Ricardo Barba (Tel: 022 739 5088), Mr. Peter Milthorp (Tel: 022 739 5016) and Mr. Rosen Marinov (Tel: 022 739 6391). Document WT/TPR/G/345 contains the policy statement submitted by the Russian Federation. Note: This report was drafted in English. WT/TPR/S/345/Rev.1 • Russian Federation - 2 - CONTENTS SUMMARY ........................................................................................................................ 8 1 ECONOMIC ENVIRONMENT ........................................................................................ 13 1.1 Main Features of the Economy .....................................................................................13 1.2 Recent Economic Developments ...................................................................................14 1.3 Trade and Investment Performance ................................................................................18 -

Teliasonera Acquisition of MCT Corp. Coscom in Uzbekistan Indigo and Somoncom in Tajikistan Roshan in Afghanistan Strategic Acquisition Rationale

TeliaSonera Acquisition of MCT Corp. Coscom in Uzbekistan Indigo and Somoncom in Tajikistan Roshan in Afghanistan Strategic Acquisition Rationale • TeliaSonera will be the leading operator in Central Asian markets – Now: Uzbekistan, Tajikistan and Afghanistan – Existing via Fintur: Kazakhstan, Azerbaijan , Georgia and Moldova – Existing direct & unconsolidated: Turkey (incl. Ukraine indirectly) and Russia (incl. Tajikistan indirectly) • Attractive Growth Opportunity in terms of Addressable TeliaSonera MCT Market (Scandinavia, Baltics) – 10%-20% mobile penetration Fintur Turkcell – Less than 10% Fixed Line Penetration à wireless is attractive Megafon Yoigo • Natural Addition to TeliaSonera’s Eurasian Footprint – Uzbekistan, Tajikistan and Afghanistan complement current map in Central Asia – Significant economic/cultural ties between Kazakhstan, Azerbaijan, Tajikistan and Uzbekistan • Company and Shareholders Honoring International Business Practices – Company’s operations developed by international practices: audited, subject to US rules Acquisition Cost TeliaSonera Acquisition of 100% of MCT Corp for a 100% enterprise value of approximately SEK 2.0 Sonera billion (USD 300 million) holding interest in Holding BV four Eurasian mobile operators: 100% • 99.97% interest in Uzbek-American Joint Venture “Coscom” LLC (Coscom) in MCT Corp. Uzbekistan Delaware Corporation • 60% interest in CJSC “Indigo- Tajikistan” (Indigo-Tajikistan) in Tajikistan and Venture Holdings Local Ventures • 59.4% in CJSC Joint Venture Management and MCT Dev. Corp. “Somoncom” -

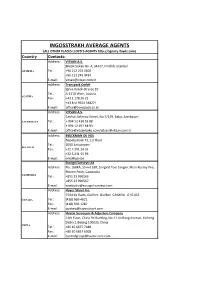

INGOSSTRAKH AVERAGE AGENTS (ALL OTHER PLACES LLOYD’S AGENTS Country Contacts: Address: VITSAN A.S

INGOSSTRAKH AVERAGE AGENTS (ALL OTHER PLACES LLOYD’S AGENTS http://agency.lloyds.com) Country Contacts: Address: VITSAN A.S. Bilezik Sokak No. 4, 34427, Findikli, Istanbul ARMENIA Tel.: +90 212 252 0600 +90 212 249 4434 E‐mail: [email protected] Address: Transpack GmbH Ignaz‐Koeck‐Strasse 10 Tel.: A‐1210 Wien, Austria AUSTRIA Fax: +43 1 278 26 22 +43 810 9554 338271 E‐mail: [email protected] Address: VITSAN A.S. Ceyhun Selimov Street, No:7/129, Baku, Azerbaijan AZERBAIJAN Tel.: + 994 12 430 53 88 + 994 12 497 68 93 E‐mail: [email protected]/[email protected] Address: BEECKMAN DE VOS Napelsstraat 73, 1st Floor Tel.: 2000 Antwerpen BELGIUM Fax: +32 3 201 24 33 +32 3 231 55 99 E‐mail: [email protected] Eurogal Surveys Ltd Address: No. 168KA, Street 598, Sangkat Toul Sangke, Khan Russey Keo, Phnom Penh, Cambodia CAMBODIA Tel.: +855 23 996566 +855 23 996567 E‐mail: cambodia@eurogal‐surveys.com Address: Hayes Stuart Inc. 7504 du Daim, Québec, Québec CANADA G1G 6S2 CANADA Tel.: (418) 660‐4621 Fax: (418) 660‐1287 E‐mail: [email protected] Address: Huatai Surveyors & Adjusters Company 14th Floor, China Re Building, No.11 Jin Rong Avenue, Xicheng District, Beijing 100033, China CHINA Tel.: +86 10 6657 7488 Fax: +86 10 6657 6508 E‐mail: controlgroup@huatai‐serv.com Address: Marinter SA Edificio "Playa", Calle 12, Nº 105, e/ 1ra y 3ra, 2do Piso, Miramar, Playa Ciudad de la Habana, Cuba CUBA Tel.: +53 7 2049742 Fax: +53 7 2049743 E‐mail: [email protected] Address: CRS Czech Republic Junacka 22, 169 00 Praha 6, Czech Republic CZECH -

The Insurance Market in Russia

The insurance market in Russia Vladimir Kalinin MAPFRE RE’s Commercial Adviser for Russia and the countries of the CIS Moscow – Russia 16 / 61 / 2012 661_trebol_ing.indd1_trebol_ing.indd 1616 117/07/127/07/12 112:182:18 Among the markets of the emerging countries, the Russian Federation’s insurance market is turning out to be the most important and to have the greatest potential in Central and Eastern Europe. In 2010, Russia, with a population of some 140 million and abundant natural resources, ranked ninth in the world in terms of gross domestic product (GDP), with USD 1,803 billion, placing it between Italy and Canada. [1] Russian insurance in the world market1 Russia’s share of the world insurance market is 0.96% of total premiums, put at USD 4.3 billion in 2010. In 2010, Russia ranked 19th in the world in terms of total premium income (USD 41,644 million), behind Ireland and ahead of Belgium. As regards Non-Life premium income, Russia ranks 12th in the world (USD 40,742 million), after Spain and ahead of Australia and Brazil. Its share of the world market is 2.24%. On the other hand, with per capita premium of USD 296.8, Russia comes behind Brazil, occupying 48th place in the world ranking. As regards insurance penetration, Russia drops to 55th place, with an insurance market accounting for 2.3% of its GDP in 2010. In 2010, total Russian premium accounted 1 Data from Swiss Re, for 47.4% of the total premium in Central Sigma No. 2/2011. -

Country Code City Code Country Name Rate Per Min 93 Afghanistan 1.575 93 7 Afghanistan-Mobile 1.2411 93 75 Afghanistan-Mobile AT

FirstLight Fiber International Calling Rates - effective April 1, 2017 *Rates are applicable to customers with standard rating voice products & services. Country Code City Code Country Name Rate per min 93 Afghanistan 1.575 93 7 Afghanistan-Mobile 1.2411 93 75 Afghanistan-Mobile AT 0.875 93 70 Afghanistan-Mobile AWCC 1.1634 93 78 Afghanistan-Mobile Etalis 1.12 93 77 Afghanistan-Mobile MTN 0.6496 93 79 Afghanistan-Mobile Roshan 1.1816 355 Albania 0.56 355 68 Albania-Mobile AMC 1.68 355 67 Albania-Mobile Eagle 1.7304 355 66 Albania-Mobile Plus 1.9243 355 69 Albania-Mobile Vodafone 1.47 355 4249 Albania-NGN 1.085 355 4250 Albania-NGN 1.085 355 4251 Albania-NGN 1.085 355 4252 Albania-NGN 1.085 355 422 Albania-Tirana 0.3864 355 423 Albania-Tirana 0.3864 355 424 Albania-Tirana 0.3864 213 Algeria 0.196 213 21 Algeria-Algiers 0.182 213 1 Algeria-CAT 0.196 213 6 Algeria-Mobile AMN 0.924 213 7 Algeria-Mobile Orascom 1.0251 213 5 Algeria-Mobile Wataniya 1.3629 1 684 American Samoa 0.1046 1 6842 American Samoa-Mobile 0.1046 376 Andorra 0.0654 376 3 Andorra-Mobile 0.5558 376 4 Andorra-Mobile 0.5558 376 6 Andorra-Mobile 0.5558 244 Angola 0.2859 244 9 Angola-Mobile 0.2891 1 264 Anguilla 0.3325 1 264235 Anguilla-Mobile CW 1.0955 Updated: April 2017 Page 1 of 236 1 264469 Anguilla-Mobile CW 1.0955 1 264476 Anguilla-Mobile CW 1.0955 1 264729 Anguilla-Mobile CW 1.0955 1 264772 Anguilla-Mobile CW 1.0955 1 26458 Anguilla-Mobile Digicel 1.225 1 264536 Anguilla-Mobile Weblinks 1.225 1 264537 Anguilla-Mobile Weblinks 1.225 1 264538 Anguilla-Mobile Weblinks 1.225 -

Annual Report 2016 About This Report

Annual Report 2016 About this Report This Annual Report was pre-approved by Rostelecom’s Board of Directors on 15 May 2017, Minutes No. 19 dated 15 May 2017. This Report has been prepared by PJSC Rostelecom (“Rostelecom” or the “Company”) and its subsidiaries (jointly, the “Group”), in line with Note 9 Subsidiaries to the Company’s consolidated financial statements prepared under the International Financial Reporting Standards (“IFRS”) for the year ended 31 December 2016. DISCLAIMER This Report contains certain “forward- » plans to improve the Company’s corporate » risks associated with changes in looking statements regarding future events”, governance practices; the political, economic and social as defined by the US federal securities laws, » the Company’s future position in environment in Russia and macroeconomic which are, therefore, regulated by these the telecommunications market and changes; laws, which provide for no liability for any act the outlook for the market segments in » risks associated with Russian laws, done or omitted in good faith. Such forward- which the Company operates; legislative reforms and taxation, including looking statements regarding future events » economic outlook and industry trends; laws, regulations, decrees and resolutions include (but are not limited to) the following: » potential regulatory changes and governing the Russian telecommunications assessments of the impact any laws or industry, activities related to placement » estimates of future operational and financial regulations may have on the